21% Growth in LTM Enterprise Subscription

Revenue

$126 Million in LTM Operating Cash Flow

Five9, Inc. (NASDAQ:FIVN), the Intelligent CX Platform provider,

today reported results for the second quarter ended June 30,

2024.

Second Quarter 2024 Financial Results

- Revenue for the second quarter of 2024 increased 13% to a

record $252.1 million, compared to $222.9 million for the second

quarter of 2023.

- GAAP gross margin was 53.0% for the second quarter of 2024,

compared to 53.2% for the second quarter of 2023.

- Adjusted gross margin was 60.5% for the second quarter of 2024,

compared to 61.8% for the second quarter of 2023.

- GAAP net loss for the second quarter of 2024 was $(12.8)

million, or $(0.17) per basic share, and (5.1)% of revenue,

compared to GAAP net loss of $(21.7) million, or $(0.30) per basic

share, and (9.8)% of revenue, for the second quarter of 2023.

- Non-GAAP net income for the second quarter of 2024 was $38.9

million, or $0.52 per diluted share, and 15.4% of revenue, compared

to non-GAAP net income of $37.4 million, or $0.52 per diluted

share, and 16.8% of revenue, for the second quarter of 2023.

- Adjusted EBITDA for the second quarter of 2024 was $41.8

million, or 16.6% of revenue, compared to $41.5 million, or 18.6%

of revenue, for the second quarter of 2023.

- GAAP operating cash flow for the second quarter of 2024 was

$19.9 million, compared to GAAP operating cash flow of $21.9

million for the second quarter of 2023.

“We are pleased to report strong second quarter results,

achieving a key milestone with annual revenue run rate exceeding $1

billion, primarily driven by LTM enterprise subscription revenue

growing 21% year-over-year. Adjusted EBITDA margin reached 17%,

helping drive robust LTM operating cash flow of $126 million. As we

look to the remainder of the year, we are reducing our annual

revenue guidance by 3.8%, reflecting recent bookings trends and the

uncertain economic conditions. We remain confident in our massive

market opportunity and are committed to driving balanced growth and

profitability.

Additionally, we are excited to announce our agreement to

acquire Acqueon, which we believe will be a significant step in

advancing our AI-powered CX platform and market reach. Also, our

latest innovations to our Five9 Genius AI suite, including GenAI

Studio and AI Knowledge, further demonstrate our leadership in AI.

Our AI solutions are driving tangible business outcomes, enabling

some of the world’s largest brands to elevate their customer

experiences.”

- Mike Burkland, Chairman and CEO, Five9

Business Outlook

Five9 provides guidance based on current market conditions and

expectations. Five9 emphasizes that the guidance is subject to

various important cautionary factors referenced in the section

entitled "Forward-Looking Statements" below, including risks and

uncertainties associated with the ongoing macroeconomic

conditions.

- For the full year 2024, Five9 now expects to report:

- Revenue in the range of $1.013 to $1.017 billion.

- GAAP net loss per share in the range of $(0.29) to $(0.19),

assuming basic shares outstanding of approximately 74.5

million.

- Non-GAAP net income per share in the range of $2.25 to $2.29,

assuming diluted shares outstanding of approximately 75.2

million.

- For the third quarter of 2024, Five9 expects to report:

- Revenue in the range of $254.5 to $255.5 million.

- GAAP net loss per share in the range of $(0.06) to $(0.01),

assuming basic shares outstanding of approximately 74.9

million.

- Non-GAAP net income per share in the range of $0.57 to $0.59,

assuming diluted shares outstanding of approximately 75.5

million.

With respect to Five9’s guidance as provided above, please refer

to the “Reconciliation of GAAP Net Loss to Non-GAAP net income -

Guidance” table for more details, including important assumptions

upon which such guidance is based.

Conference Call Details

Five9 will discuss its second quarter 2024 results today, August

8, 2024, via Zoom webinar at 4:30 p.m. Eastern Time. To access the

webinar, please register by clicking here. A copy of this press

release will be furnished to the Securities and Exchange Commission

on a Current Report on Form 8-K and will be posted to our website,

prior to the conference call.

A live webcast and a replay will be available on the Investor

Relations section of the Company’s web-site at

http://investors.five9.com/.

Non-GAAP Financial Measures

In addition to disclosing financial measures prepared in

accordance with U.S. generally accepted accounting principles

(GAAP), this press release and the accompanying tables contain

certain non-GAAP financial measures. We calculate adjusted gross

profit and adjusted gross margin by adding back the following items

to gross profit: depreciation, intangibles amortization,

stock-based compensation, exit costs related to the closure and

relocation of our Russian operations, acquisition and related

transaction costs and one-time integration costs, and lease

amortization for finance leases. We calculate adjusted EBITDA by

adding back or removing the following items to or from GAAP net

loss: depreciation and amortization, stock-based compensation,

interest expense, gain on early extinguishment of debt, interest

income and other, exit costs related to closure and relocation of

our Russian operations, acquisition and related transaction costs

and one-time integration costs, lease amortization for finance

leases and provision for income taxes. We calculate non-GAAP

operating income by adding back or removing the following items to

or from GAAP loss from operations: stock-based compensation,

intangibles amortization, exit costs related to the closure and

relocation of our Russian operations, and acquisition and related

transaction costs and one-time integration costs. We calculate

non-GAAP net income by adding back or removing the following items

to or from GAAP net loss: stock-based compensation, intangibles

amortization, amortization of discount and issuance costs on

convertible senior notes, exit costs related to the closure and

relocation of our Russian operations, acquisition and related

transaction costs and one-time integration costs, and gain on early

extinguishment of debt. For the periods presented, these

adjustments from GAAP net loss to non-GAAP net income do not

include any presentation of the net tax effect of such adjustments

given our significant net operating loss carryforwards. Non-GAAP

financial measures do not have any standardized meaning and are

therefore unlikely to be comparable to similarly titled measures

presented by other companies. The Company considers these non-GAAP

financial measures to be important because they provide useful

measures of the operating performance of the Company, exclusive of

factors that do not directly affect what we consider to be our core

operating performance, as well as unusual events. The Company’s

management uses these measures to (i) illustrate underlying trends

in the Company’s business that could otherwise be masked by the

effect of income or expenses that are excluded from non-GAAP

measures, and (ii) establish budgets and operational goals for

managing the Company’s business and evaluating its performance. In

addition, investors often use similar measures to evaluate the

operating performance of a company. Non-GAAP financial measures are

presented only as supplemental information for purposes of

understanding the Company’s operating results. The non-GAAP

financial measures should not be considered a substitute for

financial information presented in accordance with GAAP. Please see

the reconciliation of non-GAAP financial measures set forth in this

release.

Forward-Looking Statements

This news release contains certain forward-looking statements

within the meaning of the Private Securities Litigation Reform Act

of 1995, including the statements in the quote from our Chairman

and Chief Executive Officer, including statements regarding Five9’s

market opportunity and size and ability to capitalize on that

opportunity, the Company’s commitment to drive balanced growth and

profitability, the Company’s agreement to acquire Acqueon and, if

the transaction closes, the anticipated benefits thereof,

innovations in Five9’s GenAI solutions and the anticipated benefits

thereof, Five9’s AI market position, and the third quarter and full

year 2024 financial projections set forth under the caption

“Business Outlook,” that are based on our current expectations and

involve numerous risks and uncertainties that may cause these

forward-looking statements to be inaccurate. Risks that may cause

these forward-looking statements to be inaccurate include, among

others: (i) the impact of adverse economic conditions, including

the impact of macroeconomic deterioration, including continued

inflation, increased interest rates, supply chain disruptions,

decreased economic output and fluctuations in currency rates, the

impact of the Russia-Ukraine conflict, the impact of the conflict

in Israel, and other factors, may continue to harm our business;

(ii) if we are unable to attract new clients or sell additional

services and functionality to our existing clients, our revenue and

revenue growth will be harmed; (iii) if our existing clients

terminate their subscriptions or reduce their subscriptions and

related usage, or fail to grow subscriptions at the rate they have

in the past or that we might expect, our revenues and gross margins

will be harmed and we will be required to spend more money to grow

our client base; (iv) because a significant percentage of our

revenue is derived from existing clients, downturns or upturns in

new sales will not be immediately reflected in our operating

results and may be difficult to discern; (v) if we fail to manage

our technical operations infrastructure, our existing clients may

experience service outages, our new clients may experience delays

in the deployment of our solution and we could be subject to, among

other things, claims for credits or damages; (vi) we have

established, and are continuing to increase, our network of

technology solution distributors and resellers to sell our

solution; our failure to effectively develop, manage, and maintain

this network could materially harm our revenues; (vii) our

quarterly and annual results may fluctuate significantly, including

as a result of the timing and success of new product and feature

introductions by us, may not fully reflect the underlying

performance of our business and may result in decreases in the

price of our common stock; (viii) if we are unable to attract and

retain highly skilled leaders and other employees, our business and

results of operations may be adversely affected; (ix) our

historical growth may not be indicative of our future growth, and

even if we continue to grow rapidly, we may fail to manage our

growth effectively; (x) failure to adequately retain and expand our

sales force will impede our growth; (xi) further development of our

AI solutions may not be successful and may result in reputational

harm and our future operating results could be materially harmed;

(xii) the AI technology and features incorporated into our solution

include new and evolving technologies that may present both legal

and business risks, may not be accepted by our customers, and may

not result in sales that exceed lost revenue opportunities due to

any decline in agent seats due to the use of AI solutions; (xiii)

the use of AI by our workforce may present risks to our business;

(xiv) the contact center software solutions market is subject to

rapid technological change, and we must develop and sell

incremental and new cloud contact center solutions, which we refer

to as our solution, in order to maintain and grow our business;

(xv) our growth depends in part on the success of our strategic

relationships with third parties and our failure to successfully

maintain, grow and manage these relationships could harm our

business; (xvi) the markets in which we participate involve a high

number of competitors that is continuing to increase, and if we do

not compete effectively, our operating results could be harmed;

(xvii) we continue to expand our international operations, which

exposes us to significant macroeconomic and other risks; (xviii)

security breaches and improper access to, use of, or disclosure of

our data or our clients’ data, or other cyber attacks on our

systems, could result in litigation and regulatory risk, harm our

reputation, our business or financial results; (xix) we may acquire

other companies, or technologies, or be the target of strategic

transactions, or be impacted by transactions by other companies,

which could divert our management’s attention, result in additional

dilution to our stockholders or use a significant amount of our

cash resources and otherwise disrupt our operations and harm our

operating results; (xx) our proposed acquisition of Acqueon may not

close, including if we are unable to obtain regulatory clearance in

the U.S., (xxi) we sell our solution to larger organizations that

require longer sales and implementation cycles and often demand

more configuration and integration services or customized features

and functions that we may not offer, any of which could delay or

prevent these sales and harm our growth rates, business and

operating results; (xxii) we rely on third-party telecommunications

and internet service providers to provide our clients and their

customers with telecommunication services and connectivity to our

cloud contact center software and any failure by these service

providers to provide reliable services could cause us to lose

clients and subject us to claims for credits or damages, among

other things; (xxiii) we have a history of losses and we may be

unable to achieve or sustain profitability; (xxiv) our stock price

has been volatile, may continue to be volatile and may decline,

including due to factors beyond our control; (xxv) we may not be

able to secure additional financing on favorable terms, or at all,

to meet our future capital needs; (xxvi) failure to comply with

laws and regulations could harm our business and our reputation;

(xxvii) we may not have sufficient cash to service our convertible

senior notes and repay such notes, if required, and other risks

attendant to our convertible senior notes and increased debt

levels; and (xxviii) the other risks detailed from time-to-time

under the caption “Risk Factors” and elsewhere in our Securities

and Exchange Commission filings and reports, including, but not

limited to, our most recent annual report on Form 10-K and

quarterly reports on Form 10-Q. Such forward-looking statements

speak only as of the date hereof and readers should not unduly rely

on such statements. We undertake no obligation to update the

information contained in this press release, including in any

forward-looking statements.

About Five9

The Five9 Intelligent CX Platform provides a comprehensive suite

of solutions for orchestrating fluid customer experiences. Our

cloud-native, multi-tenant, scalable, reliable, and secure platform

includes contact center; omni-channel engagement; Workforce

Engagement Management; extensibility through more than 1,000

partners; and innovative, practical AI, automation and journey

analytics that are embedded as part of the platform. Five9 brings

the power of people, technology, and partners to more than 3,000

organizations worldwide. For more information, visit

www.five9.com.

FIVE9, INC. CONDENSED

CONSOLIDATED BALANCE SHEETS (In thousands) (Unaudited)

June 30, 2024

December 31, 2023

ASSETS

Current assets:

Cash and cash equivalents

$

175,699

$

143,201

Marketable investments

930,639

587,096

Accounts receivable, net

104,382

97,424

Prepaid expenses and other current

assets

41,760

34,622

Deferred contract acquisition costs,

net

69,622

61,711

Total current assets

1,322,102

924,054

Property and equipment, net

124,600

108,572

Operating lease right-of-use assets

34,107

38,873

Finance lease right-of-use assets

3,653

4,564

Intangible assets, net

33,027

38,323

Goodwill

227,269

227,412

Other assets

17,755

16,199

Deferred contract acquisition costs, net —

less current portion

147,867

136,571

Total assets

$

1,910,380

$

1,494,568

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities:

Accounts payable

$

29,405

$

24,399

Accrued and other current liabilities

76,320

62,131

Operating lease liabilities

9,509

10,731

Finance lease liabilities

1,819

1,767

Deferred revenue

65,286

68,187

Convertible senior notes

432,364

—

Total current liabilities

614,703

167,215

Convertible senior notes — less current

portion

730,012

742,125

Operating lease liabilities — less current

portion

32,177

36,378

Finance lease liabilities — less current

portion

1,949

2,877

Other long-term liabilities

5,661

7,888

Total liabilities

1,384,502

956,483

Stockholders’ equity:

Common stock

75

73

Additional paid-in capital

951,048

942,280

Accumulated other comprehensive (loss)

income

(502

)

582

Accumulated deficit

(424,743

)

(404,850

)

Total stockholders’ equity

525,878

538,085

Total liabilities and stockholders’

equity

$

1,910,380

$

1,494,568

FIVE9, INC. CONDENSED

CONSOLIDATED STATEMENTS OF OPERATIONS (In thousands, except per

share data) (Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Revenue

$

252,086

$

222,882

$

499,096

$

441,321

Cost of revenue

118,414

104,361

232,944

209,117

Gross profit

133,672

118,521

266,152

232,204

Operating expenses:

Research and development

40,717

39,210

82,235

77,318

Sales and marketing

78,332

74,077

159,441

150,391

General and administrative

33,988

30,477

64,536

58,735

Total operating expenses

153,037

143,764

306,212

286,444

Loss from operations

(19,365

)

(25,243

)

(40,060

)

(54,240

)

Other income (expense), net:

Interest expense

(3,906

)

(1,866

)

(6,473

)

(3,711

)

Gain on early extinguishment of debt

—

—

6,615

—

Interest income and other

13,800

6,123

24,359

10,244

Total other income (expense), net

9,894

4,257

24,501

6,533

Loss before income taxes

(9,471

)

(20,986

)

(15,559

)

(47,707

)

Provision for income taxes

3,345

753

4,334

1,280

Net loss

$

(12,816

)

$

(21,739

)

$

(19,893

)

$

(48,987

)

Net loss per share:

Basic and diluted

$

(0.17

)

$

(0.30

)

$

(0.27

)

$

(0.69

)

Shares used in computing net loss per

share:

Basic and diluted

74,203

71,627

73,845

71,444

FIVE9, INC. CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS (In thousands)

(Unaudited)

Six Months Ended

June 30, 2024

June 30, 2023

Cash flows from operating

activities:

Net loss

$

(19,893

)

$

(48,987

)

Adjustments to reconcile net loss to net

cash provided by operating activities:

Depreciation and amortization

25,121

23,071

Amortization of operating lease

right-of-use assets

6,312

5,838

Amortization of deferred contract

acquisition costs

33,825

25,710

Accretion of discount on marketable

investments

(11,217

)

(4,315

)

Provision for credit losses

677

528

Stock-based compensation

88,316

104,110

Amortization of discount and issuance

costs on convertible senior notes

2,509

1,839

Gain on early extinguishment of debt

(6,615

)

—

Deferred taxes

356

250

Other

(64

)

622

Changes in operating assets and

liabilities:

Accounts receivable

(7,635

)

(1,494

)

Prepaid expenses and other current

assets

(7,137

)

(8,764

)

Deferred contract acquisition costs

(53,032

)

(44,606

)

Other assets

(1,868

)

(5,344

)

Accounts payable

3,931

2,316

Accrued and other current liabilities

3,934

4,453

Deferred revenue

(3,484

)

(680

)

Other liabilities

(1,805

)

717

Net cash provided by operating

activities

52,231

55,264

Cash flows from investing

activities:

Purchases of marketable investments

(816,492

)

(337,595

)

Proceeds from sales of marketable

investments

12,517

245

Proceeds from maturities of marketable

investments

470,755

227,836

Purchases of property and equipment

(18,722

)

(16,642

)

Capitalization of software development

costs

(8,260

)

(3,565

)

Cash paid to acquire Aceyus

99

—

Net cash used in investing activities

(360,103

)

(129,721

)

Cash flows from financing

activities:

Proceeds from issuance of 2029 convertible

senior notes, net of issuance costs

728,843

—

Payments for capped call transactions

associated with the 2029 convertible senior notes

(93,438

)

—

Repurchase of a portion of 2025

convertible senior notes, net of costs

(304,485

)

—

Repayment of outstanding 2023 convertible

senior notes at maturity

—

(169

)

Cash received from the settlement at

maturity of the outstanding capped calls associated with the 2023

convertible senior notes

—

74,453

Cash received from partial termination of

capped calls associated with the 2025 convertible senior notes

539

—

Proceeds from exercise of common stock

options

397

6,981

Proceeds from sale of common stock under

ESPP

9,522

9,444

Payment of finance lease liabilities

(966

)

—

Net cash provided by financing

activities

340,412

90,709

Net increase in cash, cash equivalents and

restricted cash

32,540

16,252

Cash, cash equivalents and restricted

cash:

Beginning of period

144,842

180,987

End of period

$

177,382

$

197,239

FIVE9, INC. RECONCILIATION OF

GAAP GROSS PROFIT TO ADJUSTED GROSS PROFIT (In thousands,

except percentages) (Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

GAAP gross profit

$

133,672

$

118,521

$

266,152

$

232,204

GAAP gross margin

53.0

%

53.2

%

53.3

%

52.6

%

Non-GAAP adjustments:

Depreciation

7,773

6,424

14,738

12,485

Intangibles amortization

2,648

2,845

5,296

5,691

Stock-based compensation

7,789

9,888

15,392

19,221

Exit costs related to closure and

relocation of Russian operations

—

51

—

75

Acquisition and related transaction costs

and one-time integration costs

72

—

125

34

Lease amortization for finance leases

455

—

912

—

Adjusted gross profit

$

152,409

$

137,729

$

302,615

$

269,710

Adjusted gross margin

60.5

%

61.8

%

60.6

%

61.1

%

FIVE9, INC. RECONCILIATION OF

GAAP NET LOSS TO ADJUSTED EBITDA (In thousands, except

percentages) (Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

GAAP net loss

$

(12,816

)

$

(21,739

)

$

(19,893

)

$

(48,987

)

Non-GAAP adjustments:

Depreciation and amortization

12,938

11,724

25,121

23,071

Stock-based compensation

43,632

53,367

88,316

104,110

Interest expense

3,906

1,866

6,473

3,711

Gain on early extinguishment of debt

—

—

(6,615

)

—

Interest income and other

(13,800

)

(6,123

)

(24,359

)

(10,244

)

Exit costs related to closure and

relocation of Russian operations (1)

32

815

57

1,411

Acquisition and related transaction costs

and one-time integration costs

4,089

877

5,020

2,332

Lease amortization for finance leases

455

—

912

—

Provision for income taxes

3,345

753

4,334

1,280

Adjusted EBITDA

$

41,781

$

41,540

$

79,366

$

76,684

Adjusted EBITDA as % of revenue

16.6

%

18.6

%

15.9

%

17.4

%

(1)

Exit costs related to the closure and

relocation of our Russian operations was $(0.1) million and $0.0

million during the three and six months ended June 30, 2024. The

$0.0 million and $0.1 million adjustments presented above were net

of $(0.1) million and $(0.1) million included in “Interest income

and other.” Exit costs related to the closure and relocation of our

Russian operations was $1.1 million and $1.8 million during the

three and six months ended June 30, 2023. The $0.8 million and $1.4

million adjustments presented above were net of $0.3 million and

$0.4 million included in “Interest income and other.”

FIVE9, INC. RECONCILIATION OF

GAAP OPERATING LOSS TO NON-GAAP OPERATING INCOME (In thousands)

(Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Loss from operations

$

(19,365

)

$

(25,243

)

$

(40,060

)

$

(54,240

)

Non-GAAP adjustments:

Stock-based compensation

43,632

53,367

88,316

104,110

Intangibles amortization

2,648

2,845

5,296

5,691

Exit costs related to closure and

relocation of Russian operations

32

815

57

1,411

Acquisition and related transaction costs

and one-time integration costs

4,089

877

5,020

2,332

Non-GAAP operating income

$

31,036

$

32,661

$

58,629

$

59,304

FIVE9, INC. RECONCILIATION OF

GAAP NET LOSS TO NON-GAAP NET INCOME (In thousands, except per

share data) (Unaudited)

Three Months Ended

Six Months Ended

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

GAAP net loss

$

(12,816

)

$

(21,739

)

$

(19,893

)

$

(48,987

)

Non-GAAP adjustments:

Stock-based compensation

43,632

53,367

88,316

104,110

Intangibles amortization

2,648

2,845

5,296

5,691

Amortization of discount and issuance

costs on convertible senior notes

1,435

931

2,509

1,839

Gain on early extinguishment of debt

—

—

(6,615

)

—

Exit costs related to closure and

relocation of Russian operations

(114

)

1,110

(20

)

1,851

Acquisition and related transaction costs

and one-time integration costs

4,089

877

5,020

2,332

Income tax expense effects (1)

—

—

—

—

Non-GAAP net income

$

38,874

$

37,391

$

74,613

$

66,836

GAAP net loss per share:

Basic and diluted

$

(0.17

)

$

(0.30

)

$

(0.27

)

$

(0.69

)

Non-GAAP net income per share:

Basic

$

0.52

$

0.52

$

1.01

$

0.94

Diluted

$

0.52

$

0.52

$

1.00

$

0.92

Shares used in computing GAAP net loss per

share:

Basic and diluted

74,203

71,627

73,845

71,444

Shares used in computing non-GAAP net

income per share:

Basic

74,203

71,627

73,845

71,444

Diluted

74,647

72,600

74,415

72,474

(1)

Non-GAAP adjustments do not have a

material impact on our worldwide income tax provision due to

available tax loss and credit attributes.

FIVE9, INC. SUMMARY OF

STOCK-BASED COMPENSATION, DEPRECIATION AND INTANGIBLES

AMORTIZATION (In thousands) (Unaudited)

Three Months Ended

June 30, 2024

June 30, 2023

Stock-Based

Compensation

Depreciation

Intangibles

Amortization

Stock-Based

Compensation

Depreciation

Intangibles

Amortization

Cost of revenue

$

7,789

$

7,773

$

2,648

$

9,888

$

6,424

$

2,845

Research and development

9,827

741

—

13,013

868

—

Sales and marketing

13,824

26

—

17,391

1

—

General and administrative

12,192

1,750

—

13,075

1,586

—

Total

$

43,632

$

10,290

$

2,648

$

53,367

$

8,879

$

2,845

Six Months Ended

June 30, 2024

June 30, 2023

Stock-Based

Compensation

Depreciation

Intangibles

Amortization

Stock-Based

Compensation

Depreciation

Intangibles

Amortization

Cost of revenue

$

15,392

$

14,738

$

5,296

$

19,221

$

12,485

$

5,691

Research and development

20,757

1,631

—

25,395

1,740

—

Sales and marketing

27,844

53

—

34,436

2

—

General and administrative

24,323

3,403

—

25,058

3,153

—

Total

$

88,316

$

19,825

$

5,296

$

104,110

$

17,380

$

5,691

FIVE9, INC. RECONCILIATION OF

GAAP NET LOSS TO NON-GAAP NET INCOME – GUIDANCE(1) (In

thousands, except per share data) (Unaudited)

Three Months Ending

Year Ending

September 30, 2024

December 31, 2024

Low

High

Low

High

GAAP net loss

$

(4,608

)

$

(1,098

)

$

(21,511

)

$

(14,503

)

Non-GAAP adjustments:

Stock-based compensation(2)

42,053

40,053

173,848

169,848

Intangibles amortization

2,643

2,643

10,580

10,580

Amortization of discount and issuance

costs on convertible senior notes

1,480

1,480

5,397

5,397

Exit costs related to closure and

relocation of Russian operations

—

—

94

94

Acquisition and related transaction costs

and one-time integration costs(3)

1,467

1,467

7,680

7,680

Gain on early extinguishment of debt

—

—

(6,615

)

(6,615

)

Income tax expense effects(4)

—

—

—

—

Non-GAAP net income

$

43,035

$

44,545

$

169,473

$

172,481

GAAP net loss per share, basic and

diluted

$

(0.06

)

$

(0.01

)

$

(0.29

)

$

(0.19

)

Non-GAAP net income per share:

Basic

$

0.57

$

0.59

$

2.27

$

2.32

Diluted

$

0.57

$

0.59

$

2.25

$

2.29

Shares used in computing GAAP net loss per

share and non-GAAP net income per share:

Basic

74,900

74,900

74,500

74,500

Diluted

75,500

75,500

75,200

75,200

(1)

Represents guidance discussed on

August 8, 2024. Reader shall not construe presentation

of this information after August 8, 2024 as an update or

reaffirmation of such guidance.

(2)

Stock-based compensation expenses are

based on a range of probable significance, assuming market price

for our common stock that is approximately consistent with current

levels.

(3)

Acquisition and related transaction costs

and one-time integration costs are based on a range of probable

significance for completed acquisitions, and no new acquisitions

assumed.

(4)

Non-GAAP adjustments do not have a

material impact on our worldwide income tax provision due to

available tax loss and credit attributes.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240808347199/en/

Investor Relations Contacts:

Five9, Inc. Barry Zwarenstein Chief Financial Officer

925-201-2000 ext. 5959 IR@five9.com

The Blueshirt Group for Five9, Inc. Lisa Laukkanen 415-217-4967

Lisa@blueshirtgroup.com

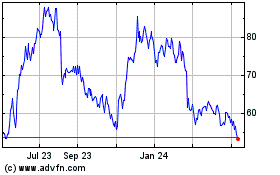

Five9 (NASDAQ:FIVN)

Historical Stock Chart

From Dec 2024 to Jan 2025

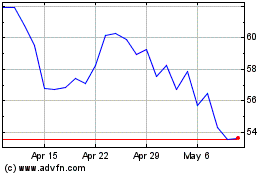

Five9 (NASDAQ:FIVN)

Historical Stock Chart

From Jan 2024 to Jan 2025