As filed with the Securities and Exchange Commission

on July 26, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

ENTERO THERAPEUTICS, INC.

(Exact name of registrant as specified in its charter)

| Delaware |

|

2834 |

|

46-4993860 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

777 Yamato Road, Suite 502

Boca Raton, Florida 33431

(561) 589-7020

(Address, including zip code, and telephone number,

including area code, of registrant’s principal

executive offices)

James Sapirstein, Chief Executive Officer and

Chairman

Entero Therapeutics, Inc.

777 Yamato Road, Suite 502

Boca Raton, Florida 33431

(561) 589-7020

(Name, address, including zip code, and telephone

number,

including area code, of agent for service)

Copies to

Barry I. Grossman, Esq.

Jessica Yuan, Esq.

Ellenoff Grossman & Schole LLP

1345 Avenue of the Americas

New York, New York 10105

Telephone: (212) 370-1300

Approximate date of commencement

of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If the only securities being

registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ¨

If any of the securities

being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. x

If this Form is filed to

register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ¨

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement

number of the earlier effective registration statement for the same offering. ¨

If this Form is a registration

statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the

Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ¨

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ¨

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging

growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

¨ |

Accelerated filer |

¨ |

| Non-accelerated filer |

x |

Smaller reporting company |

x |

| |

|

Emerging growth company |

¨ |

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

The Registrant hereby

amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the registrant shall file

a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section

8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective on such date as the Commission,

acting pursuant to said Section 8(a), may determine.

The information in this preliminary

prospectus is not complete and may be changed. The selling stockholders may not resell these securities until the registration statement

filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an offer to sell these securities,

nor is it a solicitation of offers to buy these securities, in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION |

DATED JULY 26, 2024 |

3,525,348 Shares of Common Stock

This prospectus relates to

the offer and resale of up to an aggregate of 3,525,348 shares of common stock, par value $0.0001 per share (the “Common Stock”)

of Entero Therapeutics, Inc., formerly known as First Wave BioPharma, Inc. (the “Company,” “we,” “our”

or “us”), held by the selling stockholders listed in this prospectus or their permitted transferees (the “Selling Stockholders”).

The shares of Common Stock registered for resale pursuant to this prospectus include 3,525,348 shares of Common Stock (the “Warrant

Shares”) issuable upon exercise of common warrants (the “Warrants”) issued to selling stockholders in a warrant inducement

transaction (the “Private Placement”) which closed on July 12, 2024. For additional information about the Private Placement,

see “Private Placement.”

We are registering the Warrant

Shares on behalf of the Selling Stockholders to be offered and sold by them from time to time. We are not selling any securities under

this prospectus and will not receive any proceeds from the sale of our Common Stock by the Selling Stockholders in the offering described

in this prospectus. The Selling Stockholders may sell any, all or none of the Warrant Shares offered by this prospectus. The Warrants

have an exercise price per share of $1.09. For more information, see “Use of Proceeds.”

The Selling Stockholders,

or their respective transferees, pledgees, donees or other successors-in-interest, may offer or sell the Warrant Shares from time to time

in a number of different ways and at varying prices, including through public or private transactions at prevailing market prices, at

prices related to prevailing market prices or at privately negotiated prices. See “Plan of Distribution” on page 13 of this

prospectus for more information about how the Selling Stockholders may sell or dispose of the shares of Common Stock being registered

pursuant to this prospectus.

This prospectus describes

the general manner in which the Warrant Shares may be offered and sold. When the Selling Stockholders sell shares of Common Stock under

this prospectus, we may, if necessary and required by law, provide a prospectus supplement that will contain specific information about

the terms of that offering. Any prospectus supplement may also add to, update, modify or replace information contained in this prospectus.

We urge you to read carefully this prospectus, any accompanying prospectus supplement and any documents we incorporate by reference into

this prospectus and any accompanying prospectus supplement before you make your investment decision.

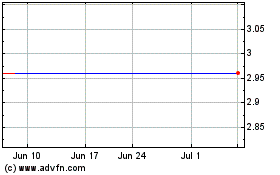

Our Common Stock is

currently listed on The Nasdaq Capital Market under the symbol “ENTO” (and prior to our name change from First Wave

BioPharma, Inc. to our current name of Entero Therapeutics, Inc., effective on May 17, 2024, our Common Stock was listed under the

symbol “FWBI”). On July 24, 2024, the last reported sale price of our Common Stock on The Nasdaq Capital Market was

$1.00. As of December 18, 2023, we effected a one-for-twenty reverse stock split of our issued and outstanding shares of Common

Stock (the “Reverse Stock Split”). Unless otherwise indicated, all share and per share prices in this prospectus have

been adjusted to reflect the Reverse Stock Split. However, Common Stock share and per share amounts in certain of the documents

incorporated by reference herein have not been adjusted to give effect to the Reverse Stock Split.

Investing in our securities

involves risks. See “Risk Factors” beginning on page 3 of this prospectus for a discussion of the risks that you should consider

in connection with an investment in our securities.

Neither the Securities

and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

The date of this prospectus is , 2024

TABLE OF CONTENTS

You should rely only on the

information provided in this prospectus, as well as the information incorporated by reference into this prospectus and any applicable

prospectus supplement. We have not authorized anyone to provide you with different information. We are not making an offer of these securities

in any jurisdiction where the offer is not permitted. You should not assume that the information in this prospectus, any applicable prospectus

supplement or any documents incorporated by reference is accurate as of any date other than the date of the applicable document. Since

the respective dates of this prospectus and the documents incorporated by reference into this prospectus, our business, financial condition,

results of operations and prospects may have changed.

PROSPECTUS SUMMARY

This summary highlights

information contained elsewhere in this prospectus. This summary does not contain all of the information that you should consider before

deciding to invest in our securities. You should read this entire prospectus carefully, including all documents incorporated by reference.

In particular, attention should be directed to our “Risk Factors” section in this prospectus and under similar captions in

the documents incorporated by reference into this prospectus, including any prospectus supplement incorporated by reference hereto, and

the financial statements and related notes thereto contained herein or otherwise incorporated by reference hereto. In this prospectus,

unless otherwise stated or the context otherwise requires, references to “Entero”, “Company”, “we”,

“us”, “our” or similar references mean Entero Therapeutics, Inc. and its subsidiaries on a consolidated basis,

and any references to “First Wave BioPharma” mean Entero prior our name change effective May 17, 2024. References to “First

Wave Bio” refer to First Wave Bio, Inc., and to “ImmunogenX” or “IMGX” refer to ImmunogenX, LLC, each of

which is a wholly-owned subsidiary of Entero.

Overview

We are engaged in the research

and development of targeted, non-systemic therapies for the treatment of patients with gastrointestinal (“GI”) diseases. Non-systemic

therapies are non-absorbable drugs that act locally, i.e., in the intestinal lumen, skin or mucosa, without reaching an individual’s

systemic circulation.

We are currently focused on

developing a therapeutic pipeline with multiple late-stage clinical programs built around four proprietary technologies: our lead product

candidate, Latiglutenase, a targeted oral biotherapeutic for celiac disease designed to breakdown gluten into non-immunogenic peptides;

the biologic Adrulipase, a recombinant lipase enzyme designed to enable the digestion of fats and other nutrients in cystic fibrosis and

chronic pancreatitis patients with exocrine pancreatic insufficiency; Capeserod, a selective 5-HT4 receptor partial agonist which we are

developing as a gastroparesis therapeutic; and Niclosamide, an oral small molecule with anti-inflammatory properties for patients with

inflammatory bowel diseases such as ulcerative colitis and Crohn’s disease.

In March 2024, we announced

the closing of an acquisition, referred to as a merger (the “IMGX Merger”) with ImmunogenX, Inc., a private, clinical-stage

biopharmaceutical company founded in 2013, which is developing the biologic, Latiglutenase, for celiac disease. IMGX is also developing

CypCel, a metabolic marker compound that can measure the state of small-intestinal recovery of celiac patients undergoing gluten-free

diets.

Corporate Information

We were incorporated on January

30, 2014 in the State of Delaware. In June 2014, we acquired 100% of the issued and outstanding capital stock of AzurRx SAS. In September

2021, we acquired First Wave Bio through a merger transaction, and changed our name to First Wave BioPharma, Inc. In March 2024, we acquired

ImmunogenX, Inc. through a merger transaction. On May 15, 2024, we filed an amendment to our amended and restated certificate of incorporation

with the Secretary of State of Delaware to change our corporate name from “First Wave BioPharma, Inc.” to “Entero Therapeutics,

Inc.,” effective as of May 17, 2024.

Our principal executive offices

are located at 777 Yamato Road, Suite 502, Boca Raton, Florida 33431. Our telephone number is (561) 589-7020. We maintain a website at

www.enterothera.com. The information contained on our website is not, and should not be interpreted to be, a part of this prospectus.

The Offering

Shares of Common

Stock offered by the

Selling Stockholders |

|

3,525,348 shares of Common Stock consisting of 3,525,348 Warrant Shares. |

| |

|

|

| Use of proceeds |

|

We are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of the shares of Common Stock covered hereby by the Selling Stockholders. To the extent any Warrants are exercised for cash, we intend to use such proceeds for working capital or general corporate purposes. See “Use of Proceeds.” |

| |

|

|

| Terms of this offering; Determination of offering price |

|

The Selling Stockholders, including their transferees,

donees, pledgees, assignees and successors-in-interest, may sell, transfer or otherwise dispose of any or all of the shares of Common

Stock offered by this prospectus from time to time on The Nasdaq Capital Market or any other stock exchange, market or trading facility

on which the shares are traded or in private transactions. The Selling Stockholders may offer or sell the shares of Common Stock offered

by this prospectus at market prices prevailing at the time of sale, at prices related to prevailing market price or at privately negotiated

prices.

The offering price of our Common Stock does not

necessarily bear any relationship to our book value, assets, past operating results, financial condition or any other established criteria

of value. Our Common Stock might not trade at market prices in excess of the offering price as prices for our Common Stock in any public

market will be determined in the marketplace and may be influenced by many factors, including the depth and liquidity. See “Determination

of Offering Price” and “Plan of Distribution” for more information. |

| |

|

|

| Nasdaq symbol |

|

Our Common Stock is listed on The Nasdaq Capital Market under the symbol “ENTO”. |

| |

|

|

| Risk Factors |

|

Investing in our securities involves significant risks. Before making a decision whether to invest in our securities, please read the information contained in or incorporated by reference under the heading “Risk Factors” in this prospectus, the documents we have incorporated by reference herein, including any prospectus supplement incorporated herein, and under similar headings in other documents filed after the date hereof and incorporated by reference into this prospectus. See “Incorporation of Certain Information by Reference” and “Where You Can Find More Information”. |

RISK FACTORS

An investment in our securities

involves a high degree of risk. Before deciding whether to purchase our securities, including the shares of Common Stock offered by this

prospectus, you should read and carefully consider the risks and uncertainties described under “Risk Factors” described below,

in any applicable prospectus supplement, in our most recent Annual Report on Form 10-K and our subsequent Quarterly Reports on Form 10-Q

and Current Reports on Form 8-K, and in our other filings with the Securities and Exchange Commission (“SEC”), which are incorporated

by reference herein. If any of these risks actually occur, our business, financial condition, results of operations and prospects could

be materially and adversely affected and we may not be able to achieve our goals, the value of our securities could decline and you could

lose some or all of your investment. Much of the business information, as well as the financial and operational data contained in our

risk factors, are updated by our periodic reports filed with the SEC pursuant to the Securities Exchange Act of 1934, as amended (the

“Exchange Act”), which are also incorporated by reference into this prospectus as described elsewhere in this prospectus.

Additional risks not presently known to us or that we currently believe are immaterial may also significantly impair our business operations

or our Company. See also “Cautionary Note about Forward-Looking Statements.” If any of these risks occur, our business, results

of operations, financial condition or prospects could be harmed. In that event, the market price of our Common Stock and the value of

our warrants could decline, and you could lose all or part of your investment.

Risks Related to This Offering

A substantial number

of shares of Common Stock may be sold in the market following this offering, which may depress the market price for our Common Stock.

Following

this offering, a large number of shares of Common Stock may be sold in the market, which may depress the market price of our Common Stock.

Sales of a substantial number of shares of our Common Stock in the public market following this offering could cause the market price

of our Common Stock to decline. A substantial majority of the outstanding shares of our Common Stock are, and the shares of Common Stock

issuable upon exercise of the Warrants will be, freely tradable without restriction or further registration under the Securities Act of

1933, as amended (the “Securities Act”), unless owned or purchased by our “affiliates” as that term is defined

in Rule 144 under the Securities Act.

Our failure to maintain compliance with

applicable Nasdaq listing requirements could result in the delisting of our Common Stock.

Our Common Stock is currently

listed for trading on The Nasdaq Stock Market LLC. We must satisfy applicable listing requirements of Nasdaq, to maintain the listing

of our Common Stock on The Nasdaq Stock Market LLC.

On August 17, 2023, we

received notice from the Listing Qualifications Staff (the “Staff”) of The Nasdaq Stock Market LLC

(“Nasdaq”) indicating that we were not in compliance with the $2.5 million minimum stockholders’ equity

requirement for continued listing of the Common Stock on Nasdaq, as set forth in Nasdaq Listing Rule 5550(b)(1) (the “Minimum

Stockholders’ Equity Rule”). In that regard, we reported a stockholders’ deficit of $(881,960) in our Quarterly

Report on Form 10-Q for the period ended June 30, 2023 (we did not then, and do not now, meet the alternative compliance standards

relating to the market value of listed securities of $35 million or net income from continuing operations of $500,000 in the most

recently completed fiscal year or in two of the last three most recently completed fiscal years). On October 2, 2023, we submitted a

plan to the Staff to regain compliance with the Minimum Stockholders’ Equity Rule. On November 13, 2023, we filed our

Quarterly Report on Form 10-Q for the period ended September 30, 2023, reporting total stockholders’ equity of $3,278,805 as

of September 30, 2023. On March 29, 2024, we filed our Annual Report on Form 10-K for the year ended December 31, 2023, reporting

total stockholders’ equity of $3,602,929 as of December 31, 2023. On April 1, 2024, we received a letter from Nasdaq Staff

stating that, based on our Annual Report on Form 10-K for the fiscal year ended December 31, 2023, which evidenced

stockholders’ equity of $3,602,929, the Staff had determined that we were in compliance with the Minimum Stockholders’

Equity Rule and that the matter was now closed.

As we have previously reported,

on August 24, 2023, we received a notice (the “Minimum Bid Price Notice”) from the Staff indicating that, based upon the closing

bid price of our Common Stock for the last 30 consecutive business days, we were not in compliance with the requirement to maintain a

minimum bid price of $1.00 per share for continued listing on The Nasdaq Capital Market, as set forth in Nasdaq Listing Rule 5550(a)(2)

(the “Minimum Bid Price Rule”). We were provided a compliance period of 180 calendar days from the date of the Notice, or

until February 20, 2024, to regain compliance with the Minimum Bid Price Rule, pursuant to Nasdaq Listing Rule 5810(c)(3)(A). If at any

time before February 20, 2024, the closing bid price of the Common Stock closes at or above $1.00 per share for a minimum of 10 consecutive

business days, subject to Nasdaq’s discretion to extend this period pursuant to Nasdaq Listing Rule 5810(c)(3)(G) to 20 consecutive

business days, Nasdaq will provide written notification that we have achieved compliance with the minimum bid price requirement, and the

matter would be resolved. On January 4, 2024, we received notice from Nasdaq Listing Qualifications stating that the Staff had determined

that for the prior eleven consecutive business days, from December 18, 2023, to January 3, 2024, the closing bid price of our Common Stock

had been at $1.00 per share or greater, and accordingly, we had regained compliance with the Bid Price Rule.

On October 26, 2023, we received

notice from the Staff of Nasdaq indicating that, in connection with our July 2023 Offering, we were not in compliance with Nasdaq’s

shareholder approval requirements set forth in Listing Rule 5635(d), which requires prior shareholder approval for transactions, other

than public offerings, involving the issuance of 20% or more of the pre-transaction shares outstanding at less than the Minimum Price,

defined as a price that is the lower of: (i) the Nasdaq official closing Price (as reflected on Nasdaq.com) immediately preceding the

signing of the binding agreement; or (ii) the average Nasdaq official Closing Price of the common stock (as reflected on Nasdaq.com) for

the five trading days immediately preceding the signing of the binding agreement. On December 12, 2023, during the Special Meeting, our

stockholders ratified our entry into the Offering as we received the affirmative vote of the majority of the votes cast by shares of our

Common Stock present or represented by proxy and entitled to vote at the Special Meeting. On March 19, 2024, we received the Letter of

Reprimand from the Nasdaq Listing Qualifications Staff stating that, while we failed to comply with Nasdaq’s continued listing requirements,

our violation of listing rule 5635(d) does not appear to have been the result of a deliberate intent to avoid compliance, and as such,

the Staff does not believe that delisting our securities is an appropriate sanction and that it is appropriate to close these matters

by issuing the Letter of Reprimand.

There can be no assurance

that we will be able to ultimately sustain compliance with all applicable requirements for continued listing on The Nasdaq Stock Market

LLC. In 2020, the SEC approved a previously proposed Nasdaq rule change to expedite delisting of securities with a closing bid price at

or below $0.10 for 10 consecutive trading days during any bid price compliance period and that have had one or more reverse stock splits

with a cumulative ratio of one for 250 or more shares over the prior two-year period. In addition, if a company falls out of compliance

with the $1.00 minimum bid price after completing reverse stock splits over the immediately preceding two years that cumulatively result

in a ratio one for 250 shares, the company will not be able to avail itself of any bid price compliance periods under Rule 5810(c)(3)(A),

and Nasdaq will instead require the issuance of a Staff delisting determination. We could appeal the determination to a hearings panel,

which could grant us a 180-day exception to remain listed if it believes we would be able to achieve and maintain compliance with the

bid price requirement. Following the exception, the company would be subject to the procedures applicable to a company with recurring

deficiencies (Nasdaq Rule 5815(d)(4)(B)).

Additionally, on March 28,

2024, we received a letter from the Nasdaq Listing Qualifications Department (the “Staff”) stating that the Staff had determined

First Wave’s acquisition of ImmunogenX, Inc. constitutes a business combination that results in a “Change of Control”

pursuant to Nasdaq Listing Rule 5110(a), and that, as a result, we will be required to satisfy all of Nasdaq’s initial listing criteria

and to complete Nasdaq’s initial listing process prior to shareholder approval of the conversion of the Series G Preferred Stock,

or other material changes triggering a change of control.

In the event that we are unable

to sustain compliance with all applicable requirements to remain listed on Nasdaq, our Common Stock may be delisted from Nasdaq. If our

Common Stock were delisted from Nasdaq, trading of our Common Stock would most likely take place on an over-the-counter market established

for unlisted securities, such as the OTCQB or the Pink Market maintained by OTC Markets Group Inc. An investor would likely find it less

convenient to sell, or to obtain accurate quotations in seeking to buy, our Common Stock on an over-the-counter market, and many investors

would likely not buy or sell our Common Stock due to difficulty in accessing over-the-counter markets, policies preventing them from trading

in securities not listed on a national exchange or other reasons. In addition, as a delisted security, our Common Stock would be subject

to SEC rules as a “penny stock,” which impose additional disclosure requirements on broker-dealers. The regulations relating

to penny stocks, coupled with the typically higher cost per trade to the investor of penny stocks due to factors such as broker commissions

generally representing a higher percentage of the price of a penny stock than of a higher-priced stock, would further limit the ability

of investors to trade in our Common Stock. In addition, delisting would materially and adversely affect our ability to raise capital on

terms acceptable to us, or at all, and may result in the potential loss of confidence by investors, suppliers, customers and employees

and fewer business development opportunities. For these reasons and others, delisting would adversely affect the liquidity, trading volume

and price of our Common Stock, causing the value of an investment in us to decrease and having an adverse effect on our business, financial

condition and results of operations, including our ability to attract and retain qualified employees and to raise capital.

Risks Related to Our Business, Financial Position

and Capital Requirements

There is substantial doubt about our ability to continue as a

“going concern,” and we will require substantial additional funding to finance our long-term operations. If we are unable

to raise additional capital when needed, we could be forced to delay, reduce or terminate certain of our products or other operations.

We have incurred substantial

operating losses since inception and expect to continue to incur significant operating losses for the foreseeable future. As of March

31, 2024, we had cash and cash equivalents of approximately $3.4 million, and had sustained cumulative losses attributable to common stockholders

of approximately $178.8 million. As of December 31, 2023, we had cash and cash equivalents of approximately $3.7 million, working capital

of approximately $1.8 million, and had sustained cumulative losses attributable to stockholders of approximately $184.3 million.

Based on our cash on hand

at July 23, 2024, we anticipate having sufficient cash to fund planned operations into September 2024, however, the acceleration or reduction

of cash outflows by management can significantly impact the timing for the need to raise additional capital to complete development of

our products. We believe that we will need to raise substantial additional capital to fund our continuing operations, satisfy existing

and future obligations and liabilities, and otherwise support our working capital needs and business activities, including the development

of Latiglutenase and Capeserod. In order to manage our operating costs, we have paused development activities for Adrulipase, and we are

exploring strategic alternatives for Niclosamide.

We have not yet achieved profitability

and anticipate that we will continue to incur net losses for the foreseeable future. We expect that our expenses will continue to grow

and, as a result, we will need to generate significant product revenues to achieve profitability. We may never achieve profitability.

Therefore, we are dependent on obtaining, and are continuing to pursue, the necessary funding from outside sources, including obtaining

additional funding from the sale of securities in order to continue our operations. We are actively working to obtain additional funding.

However, there are currently no commitments in place for further financing nor is there any assurance that such financing will be available

to us on favorable terms, if at all. We believe these conditions may raise substantial doubt about our ability to continue as a going

concern. If we are unable to secure additional capital, we may be required to delay or curtail any future development of products, and

we may take additional measures to reduce expenses in order to conserve our cash in amounts sufficient to sustain operations and meet

our obligations. This would negatively impact our business and operations, which would likely cause the price of our Common Stock

to decline or ultimately force us to cease our operations.

Risks Related to Clinical Development, Regulatory

Approval and Commercialization

Due to the significant resources required

for the development of our product candidates, we must prioritize development of certain product candidates and/or certain disease indications.

We may expend our limited resources on candidates or indications that do not yield a successful product and fail to capitalize on product

candidates or indications that may be more profitable or for which there is a greater likelihood of success.

We intend to develop a pipeline

of product candidates to treat GI and other diseases. Due to the significant resources required for the development of product candidates,

we must focus our attention and resources on specific diseases and/or indications and decide which product candidates to pursue and the

amount of resources to allocate to each. We are currently focusing our resources on the development of our lead product candidate, Latiglutenase.

Our decisions concerning the

allocation of research, development, collaboration, management and financial resources toward particular product candidates or therapeutic

areas may not lead to the development of any viable commercial product and may divert resources away from better opportunities. Similarly,

any decision to delay, terminate or collaborate with third parties in respect of certain programs or product candidates may subsequently

prove to be suboptimal and could cause us to miss valuable opportunities. If we make incorrect determinations regarding the viability

or market potential of any of our programs or product candidates or misread trends in the GI, CF, CP, COVID-19, ICI-AC or biotechnology

industry, our business, financial condition and results of operations could be materially adversely affected. As a result, we may fail

to capitalize on viable commercial products or profitable market opportunities, be required to forego or delay pursuit of opportunities

with other product candidates or other diseases and indications that may later prove to have greater commercial potential than those we

choose to pursue, or relinquish valuable rights to such product candidates through collaboration, licensing or other royalty arrangements

in cases in which it would have been advantageous for us to invest additional resources to retain development and commercialization rights.

We will need to grow the size of our organization,

and we may experience difficulties in managing this growth.

As of December 31, 2023, we

had 9 employees, which increased to 15 employees in March 2024 following the IMGX Merger. In connection with certain cost reduction measures

we have taken, on July 16, 2024, we reduced our headcount to 11 employees. As our development and commercialization plans and strategies

develop, we may further expand or contract our personnel base, depending on our needs and available resources for additional managerial,

operational, research and development, sales, marketing, financial and other personnel. Future growth and/or contractions would impose

significant added responsibilities on members of management, including:

| |

● |

identifying, recruiting, integrating, maintaining and motivating employees; |

| |

● |

managing our internal development efforts effectively, including the clinical, FDA and international regulatory review process for our product candidates, while complying with our contractual obligations to contractors and other third parties; and |

| |

● |

maintaining and improving our operational, financial and management controls, reporting systems and procedures. |

Our future financial performance

and our ability to commercialize our product candidates will depend, in part, on our ability to effectively manage any future growth,

and our management may also have to divert a disproportionate amount of its attention away from day-to-day activities in order to devote

a substantial amount of time to managing these activities.

We currently rely, and for

the foreseeable future will continue to rely, in substantial part on certain independent organizations, advisors and consultants to provide

certain services, including certain aspects of regulatory approval, clinical management and manufacturing. There can be no assurance that

the services of independent organizations, advisors and consultants will continue to be available to us on a timely basis when needed,

or that we can find qualified replacements. In addition, if we are unable to effectively manage our outsourced activities or if the quality

or accuracy of the services provided by consultants is compromised for any reason, our clinical trials may be extended, delayed or terminated,

and we may not be able to obtain regulatory approval of our product candidates or otherwise advance our business. There can be no assurance

that we will be able to manage our existing consultants and contractors or find other competent outside contractors and consultants on

economically reasonable terms, or at all.

If we are not able to effectively

expand our organization by hiring new employees and expanding our groups of consultants and contractors, we may not be able to successfully

implement the tasks necessary to further develop and commercialize our product candidates and, accordingly, may not achieve our research,

development and commercialization goals.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus, and any documents

we incorporate by reference, contain certain forward-looking statements that involve substantial risks and uncertainties. All statements

contained in this prospectus and any documents we incorporate herein by reference, other than statements of historical or current facts,

are “forward-looking statements” within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act.

Forward-looking statements include statements regarding our strategy, future operations, future financial position, future revenue, projected

costs, prospects, plans, objectives of management and expected market growth. These statements involve known and unknown risks, uncertainties

and other important factors that may cause our actual results, performance or achievements to be materially different from any future

results, performance or achievements expressed or implied by the forward-looking statements. Certain of these risks and uncertainties

are discussed under the heading “Risk Factors” above or incorporated herein by reference and may, from time to time, be discussed

in our other filings with the SEC.

The words “anticipate”,

“believe”, “estimate”, “expect”, “intend”, “may”, “plan”, “predict”,

“project”, “target”, “potential”, “will”, “would”, “could”, “should”,

“continue” and similar expressions are intended to identify forward-looking statements, although not all forward-looking statements

contain these identifying words. These forward-looking statements include, among other things, statements about:

| · |

our ability to maintain compliance with the continued listing requirements of the Nasdaq Stock Market LLC; |

| |

|

| · |

our ability to satisfy our payment obligations in connection with the acquisition of First Wave Bio, Inc.; |

| |

|

| · |

statements regarding geopolitical events, including the wars in Israel and Ukraine and their effects on our operations, access to capital, research and development and clinical trials and potential disruption in the operations and business of third-party vendors, contract research organizations (“CROs”), contract development and manufacturing organizations (“CDMOs”), other service providers, and collaborators with whom we conduct business; |

| |

|

| · |

the availability of capital to satisfy our working capital requirements; |

| |

|

| · |

our current and future capital requirements and our ability to raise additional funds to satisfy our capital needs; |

| |

|

| · |

our ability to consummate our potential sale of Niclosamide, and other strategic transactions; |

| · |

the integration and effects of our acquisitions, including the IMGX Merger, and other strategic transactions; |

| |

|

| · |

the accuracy of our estimates regarding expense, future revenue and capital requirements; |

| |

|

| · |

ability to continue operating as a going concern; |

| |

|

| · |

our plans to develop and commercialize our product candidates, including Latiglutenase, Capeserod, Adrulipase and Niclosamide; |

| |

|

| · |

our ability to initiate and complete our clinical trials and to advance our principal product candidates into additional clinical trials, including pivotal clinical trials, and successfully complete such clinical trials; |

| |

|

| · |

regulatory developments in the U.S. and foreign countries; |

| |

|

| · |

the performance of our third-party vendor(s), CROs, CDMOs and other third-party non-clinical and clinical development collaborators and regulatory service providers |

| |

|

| · |

our ability to obtain and maintain intellectual property protection for our core assets; |

| |

|

| · |

the size of the potential markets for our product candidates and our ability to serve those markets; |

| |

|

| · |

the rate and degree of market acceptance of our product candidates for any indication once approved; |

| |

|

| · |

the success of competing products and product candidates in development by others that are or become available for the indications that we are pursuing; |

| |

|

| · |

other risks and uncertainties, including those listed in the “Risk Factors” section of this prospectus and the documents incorporated by reference herein. |

These forward-looking statements

are only predictions and we may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements,

so you should not place undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans,

intentions and expectations disclosed in the forward-looking statements we make. We have based these forward-looking statements largely

on our current expectations and projections about future events and trends that we believe may affect our business, financial condition

and operating results. We have included important factors in the cautionary statements included in this prospectus that could cause actual

future results or events to differ materially from the forward-looking statements that we make. You should specifically consider the factors

identified or referred to in this prospectus, any accompanying prospectus supplement and our filings with the SEC, and any subsequent

annual, quarterly or current report that is incorporated by reference into this prospectus, which could cause actual results to differ

from those referred to in forward-looking statements. Our forward-looking statements do not reflect the potential impact of any future

acquisitions, mergers, dispositions, joint ventures or investments we may make.

You should read this prospectus,

and any documents incorporated by reference hereto, with the understanding that our actual future results may be materially different

from what we expect. Except as required by law, we expressly disclaim any obligation to update or revise any forward-looking statements,

whether as a result of new information, future events or otherwise. You are advised, however, to consult any additional disclosures we

make in our periodic reports to the SEC. All subsequent written and oral forward-looking statements attributable to us or persons acting

on our behalf are expressly qualified in their entirety by the cautionary statements contained or incorporated by reference in this prospectus

and any accompanying prospectus supplement.

PRIVATE PLACEMENT

On July 10, 2024, we entered

into a warrant exercise inducement offer letter (the “Inducement Letter”) with a certain holder (the “Holder”)

of warrants to purchase shares of our Common Stock (the “Existing Warrants”) pursuant to which the Holder agreed to exercise

for cash their Existing Warrants to purchase 1,762,674 shares of our Common Stock, in the aggregate, at a reduced purchase price of $1.09

per share, in exchange for our agreement to issue the Warrants on substantially the same terms as the Existing Warrants as described below,

to purchase up to 3,525,348 Warrant Shares. We received aggregate gross proceeds of approximately $1.9 million from the exercise of the

Existing Warrants by the Holder. The Company engaged Roth Capital Partners, LLC (“Roth”) to act as its financial advisor in

connection with the Private Placement and paid Roth approximately $96,000 for its services, in addition to reimbursement of certain expenses.

Other Terms of the Private Placement

In the Inducement Letter,

we agreed not to issue, enter into any agreement to issue or announce the issuance or proposed issuance of any shares of Common Stock

or any securities convertible into or exercisable or exchangeable for shares of Common Stock or file any registration statement or prospectus,

or any amendment or supplement thereto for 60 days from the date of the Inducement Letter, subject to certain exceptions. In addition,

we have agreed not to effect or enter into an agreement to effect any issuance of Common Stock or any securities convertible into or exercisable

or exchangeable for shares of Common Stock involving a variable rate transaction (as defined in those agreements) for 1 year after the

date of the Inducement Letter, subject to certain exceptions. The Inducement Letter additionally contained customary representations,

warranties and agreements by the Company. The representations, warranties and covenants contained in the Inducement Letter were made only

for the purposes of such letter and as of specific dates, is solely for the benefit of the parties to such agreement, and may be subject

to limitations agreed upon by the contracting parties.

We have agreed to hold an

annual or special meeting of stockholders on or before January 10, 2025, for the purpose of obtaining stockholder approval for the issuance

of the Warrant Shares. If we do not obtain stockholder approval for issuance of the Warrant Shares at the first meeting, we have agreed

to call a meeting to seek stockholder approval of the issuance of the Warrant Shares every ninety (90) days until July 10, 2026, and every

six (6) months thereafter until the earlier of the date on which such stockholder approval is obtained or July 10, 2029.

Other Terms of the Warrants

The exercise price and number

of Warrant Shares issuable upon exercise are subject to appropriate adjustment in the event of share dividends, share splits, reorganizations

or similar events affecting our shares of Common Stock. The Warrants were issued in certificated form only.

The Warrants will be exercisable

upon receiving stockholder approval, at the option of each holder, in whole or in part, by delivering to us a duly executed exercise notice

accompanied by payment in full for the number of shares of common stock purchased upon such exercise (except in the case of a cashless

exercise as discussed below). A holder (together with its affiliates) may not exercise any portion of such holder’s warrants to

the extent that the holder would own more than 4.99% (or, at the election of the purchaser, 9.99%) of our outstanding shares of common

stock immediately after exercise, except that prior to the issuance of the Warrants, the holder may elect to increase the amount of ownership

of outstanding shares of common stock after exercising the holder’s Warrants up to 9.99% of the number of shares of common stock

outstanding immediately after giving effect to the exercise, as such percentage ownership is determined in accordance with the terms of

the Warrants.

If at the time of exercise

of the Warrants there is no effective registration statement registering, or the prospectus contained therein is not available for the

resale of the shares of common stock issuable upon exercise of the Warrants, then the Warrants will only be exercisable on a “cashless

exercise” basis under which the holder will receive upon such exercise a net number of common shares determined according to a formula

set forth in the Warrants.

In the event of any fundamental

transaction, as described in the Warrants and generally including any merger with or into another entity, sale of all or substantially

all of our assets, tender offer or exchange offer, or reclassification of our common stock other than a Strategic Transaction (as defined

in the Inducement Letter), then upon any subsequent exercise of a Warrant, the holder will have the right to receive as alternative consideration,

for each share of our common stock that would have been issuable upon such exercise immediately prior to the occurrence of such fundamental

transaction, the number of shares of common stock of the successor or acquiring corporation or of our company, if it is the surviving

corporation, and any additional consideration receivable upon or as a result of such transaction by a holder of the number of shares of

our common stock for which the Warrant is exercisable immediately prior to such event. Notwithstanding the foregoing, in the event of

a fundamental transaction other than a Strategic Transaction, the holder of the Warrants has the right to require us or a successor entity

to redeem the Warrants for cash in the amount of the Black-Scholes Value (as defined in each Warrant) of the unexercised portion of the

Warrants concurrently with or within 30 days following the consummation of a fundamental transaction.

However, in the event of a

fundamental transaction which is not in our control, including a fundamental transaction not approved by our board of directors, the holder

of the Warrants will only be entitled to receive from us or our successor entity, as of the date of consummation of such fundamental transaction

the same type or form of consideration (and in the same proportion), at the Black Scholes Value of the unexercised portion of the Warrant

that is being offered and paid to the holder of our common stock in connection with the fundamental transaction, whether that consideration

is in the form of cash, stock or any combination of cash and stock, or whether the holder of our common stock are given the choice to

receive alternative forms of consideration in connection with the fundamental transaction.

No fractional shares of common

stock will be issued upon the exercise of the Warrants. Rather, the number of shares of common stock to be issued will, at our election,

either be rounded up to the nearest whole number or we will pay a cash adjustment in respect of such final fraction in an amount equal

to such fraction multiplied by the exercise price.

Except as otherwise provided

in the Warrants or by virtue of the holder’s ownership of shares of our Common Stock, such holder of Warrants does not have the

rights or privileges of a holder of our Common Stock, including any voting rights, until such holder exercises such holder’s Warrants.

The Warrants will provide that the holders of the Warrants have the right to participate in distributions or dividends paid on our shares

of Common Stock.

USE OF PROCEEDS

The Common Stock to be offered

and sold using this prospectus will be offered and sold by the Selling Stockholders named in this prospectus. Accordingly, we will not

receive any proceeds from any sale or disposition of shares of Common Stock held by the Selling Stockholders pursuant to this prospectus.

To the extent all of the Warrants are exercised for cash at the exercise price per share of $1.09, we would receive in aggregate gross

proceeds of $3,842,629.32. There can be no assurance that any of the Warrants will be exercised by the Selling Stockholders or that they

will exercise any of the Warrants for cash instead of using any applicable cashless exercise feature.

We intend to use the net proceeds,

if any, from the cash exercise of the Warrants for working capital or general corporate purposes.

DETERMINATION OF OFFERING PRICE

The Selling Stockholders will

offer or sell the shares of Common Stock offered by this prospectus at market prices prevailing at the time of sale, at prices related

to prevailing market price or at privately negotiated prices. The offering price of our Common Stock does not necessarily bear any relationship

to our book value, assets, past operating results, financial condition or any other established criteria of value. Our Common Stock might

not trade at market prices in excess of the offering price as prices for our Common Stock in any public market will be determined in the

marketplace and may be influenced by many factors, including the depth and liquidity. See “Plan of Distribution” for more

information.

SELLING STOCKHOLDERS

This prospectus relates to

the offer and resale from time to time by the Selling Stockholders of up to 3,525,348 shares of our Common Stock underlying the Warrants

issued to Selling Stockholders named herein in connection with the Private Placement. When we refer to the “Selling Stockholders”

in this prospectus, we mean the persons and entities listed in the table below, and their respective pledgees, donees, permitted transferees,

assignees, successors and others who later come to hold any of the Selling Stockholders’ interests in shares of our Common Stock

other than through a public sale.

The Selling Stockholders may

sell some, all or none of their respective shares of Common Stock. We do not know how long the Selling Stockholders will hold the shares

of Common Stock before selling them, and we currently have no agreements, arrangements or understandings with any Selling Stockholder

regarding the sale or disposition of any of the shares of Common Stock covered by this prospectus. The shares of Common Stock covered

hereby may be offered from time to time by the Selling Stockholders. As a result, we cannot estimate the number of shares of Common Stock

the Selling Stockholders will beneficially own after termination of sales under this prospectus.

The following table presents

information regarding (i) the names of the Selling Stockholders, (ii) the number of shares of our Common Stock beneficially owned by the

Selling Stockholders, including the Warrant Shares (see “Beneficial Ownership Prior to this Offering” in the table below)

and (iii) the number of shares of Common Stock beneficially owned by the Selling Stockholders, excluding the Warrant Shares (see “Beneficial

Ownership After this Offering” in the table below).

The number of shares Common

Stock beneficially owned by the Selling Stockholders is determined in accordance with Rule 13d-3(d) under the Exchange Act and under rules

promulgated by the SEC.

| | |

Shares of Common

Stock

Beneficially

Owned | | |

Maximum Number of

Warrant Shares to be Sold

Pursuant to | | |

Shares of

Common Stock

Beneficially

Owned

After this

Offering(3) | |

Name of Selling

Stockholder | |

Prior to this

Offering(1)(2)(3) | | |

this

Prospectus | | |

Number

(3) | | |

Percent

(4) | |

| Armistice Capital, LLC(5) | |

| 173,326 | (6) | |

| 3,525,348 | (7) | |

| -- | (8) | |

| -- | % |

| (1) |

Except as noted below, beneficial ownership is determined in accordance with the rules of the SEC and generally includes voting or investment power with respect to securities. All entries exclude beneficial ownership of shares issuable pursuant to warrants, options or other derivative securities that have not vested or that are not otherwise exercisable as of the date hereof or which will not become vested or exercisable within 60 days of July 24, 2024. |

| |

|

| (2) |

The information set forth in the table above is based upon information obtained from the Selling Stockholders. |

| |

|

| (3) |

Includes shares of Common Stock which are not being offered pursuant to this prospectus. |

| (4) |

All percentage calculations are based on 3,253,290 shares of Common Stock outstanding as of July 24, 2024 and are rounded to the nearest tenth of a percent. Warrants, options or other derivative securities that are presently exercisable or exercisable within 60 days are deemed to be beneficially owned by the person holding such securities for the purpose of calculating the percentage ownership of that person, but are not treated as outstanding for the purpose of calculating the percentage ownership of any other person. |

| |

|

| (5) |

The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands exempted company (the “Master Fund”) and may be deemed to be indirectly beneficially owned by: (i) Armistice Capital, LLC (“Armistice Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital. The warrants are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the Selling Stockholder from exercising that portion of the warrants that would result in the Selling Stockholder and its affiliates owning, after exercise, a number of shares of Common Stock in excess of the beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd. is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| |

|

| (6) |

The number of shares of securities owned by the Selling Stockholder

prior to this offering consists of: (i) 173,326 shares of Common Stock, (ii) 1,488,674 shares being held in abeyance; and (iii) Warrants

issued in the Private Placement to purchase up to an aggregate of 3,525,348 shares of Common Stock (without giving effect to the 4.99%

beneficial ownership limitation contained in such Warrants). |

|

| (7) |

The maximum number of shares being offered pursuant to this prospectus consists of the number of shares of Common Stock issuable upon the exercise on a cash basis of the Warrants exercisable into 3,525,348 shares of Common Stock (without giving effect to an applicable 4.99% or other beneficial ownership limitation). |

| |

|

| (8) |

The shares beneficially owned after this private placement give effect to the 4.99% beneficial ownership limitation contained in the Warrants held by the Selling Stockholder and applicable to the beneficial ownership of Common Stock held by the Selling Stockholder. We do not know when or in what amounts a Selling Stockholder may offer shares for sale. The Selling Stockholders might not sell any or might sell all of the shares offered by this prospectus. However, for purposes of this table, we have assumed that, after completion of the offering, none of the Warrant Shares covered by this prospectus will be held by the Selling Stockholders. |

Issuances of our Common Stock

to the Selling Stockholders will not affect the rights or privileges of our existing stockholders, except that the economic and voting

interests of each of our existing stockholders will be diluted as a result of any such issuance. Although the number of shares of Common

Stock that our existing stockholders own will not decrease, the shares owned by our existing stockholders will represent a smaller percentage

of our total outstanding shares after any such issuance to the Selling Stockholders identified herein.

PLAN OF DISTRIBUTION

Each Selling Stockholder of

the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any or all of their securities

covered hereby on The Nasdaq Capital Market or any other stock exchange, market or trading facility on which the securities are traded

or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of the following

methods when selling securities:

| · |

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

| · |

block trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block as principal to facilitate the transaction; |

| |

|

| · |

purchases by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

| · |

an exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

| · |

privately negotiated transactions; |

| |

|

| · |

settlement of short sales; |

| |

|

| · |

in transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated price per security; |

| |

|

| · |

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

| · |

a combination of any such methods of sale; or |

| |

|

| · |

any other method permitted pursuant to applicable law. |

The Selling Stockholders may

also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available, rather than under

this prospectus.

Broker-dealers engaged by

the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions or discounts

from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser) in amounts

to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in excess of a

customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or markdown in

compliance with FINRA Rule 2121.

In connection with the sale

of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers or other financial

institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they assume. The Selling

Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan or pledge the securities

to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option or other transactions with

broker-dealers or other financial institutions or create one or more derivative securities which require the delivery to such broker-dealer

or other financial institution of securities offered by this prospectus, which securities such broker-dealer or other financial institution

may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The Selling Stockholders and

any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters” within the meaning

of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers or agents and any

profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts under the Securities

Act. Each Selling Stockholder has informed the Company that it does not have any written or oral agreement or understanding, directly

or indirectly, with any person to distribute the securities.

The Company is required to

pay certain fees and expenses incurred by the Company incident to the registration of the securities. The Company has agreed to indemnify

the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We agreed to keep this prospectus

effective until the earlier of (i) the date on which the securities may be resold by the Selling Stockholders without registration and

without regard to any volume or manner-of-sale limitations by reason of Rule 144, without the requirement for the Company to be in compliance

with the current public information under Rule 144 under the Securities Act or any other rule of similar effect or (ii) all of the securities

have been sold pursuant to this prospectus or Rule 144 under the Securities Act or any other rule of similar effect. The resale securities

will be sold only through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in

certain states, the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable

state or an exemption from the registration or qualification requirement is available and is complied with.

Under applicable rules and

regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously engage in market

making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M, prior to the commencement

of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the Exchange Act and the rules

and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the Common Stock by the Selling

Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders and have informed them

of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including by compliance with Rule

172 under the Securities Act).

Our Common Stock is listed

on The Nasdaq Capital Market under the symbol “ENTO”.

DESCRIPTION OF SECURITIES

The following summary

of the rights of our capital stock is not complete and is subject to and qualified in its entirety by reference to our Charter and Bylaws,

copies of which are filed as exhibits to the registration statement of which this prospectus forms a part and our Annual Report on Form 10-K for the year ended December 31, 2023, filed with the SEC on March 29, 2024, and forms of securities, copies of which are filed as

exhibits to the registration statement of which this prospectus forms a part, which in each case are incorporated by reference herein.

General

Our authorized capital stock

consists of:

| · |

100,000,000 shares of common stock, par value $0.0001 per share; and |

| |

|

| · |

10,000,000 shares of preferred stock, par value $0.0001. |

As of March 31, 2024, there

were 100,000,000 shares of Common Stock authorized, and 10,000,000 shares of preferred stock authorized, of which a series of 5,194.81

shares of Series B Convertible Preferred Stock (the “Series B Preferred Stock”), a series of 75,000 shares of Series C 9.00%

Convertible Junior Preferred Stock (the “Series C Preferred Stock”), a series of 150 shares of Series D Preferred Stock, a

series of 150 shares of Series E Preferred Stock, a series of 7,000 shares of Series F Preferred Stock, and a series of 13,000 shares

of Series G Non-Voting Convertible Preferred Stock (“Series G Preferred Stock”) have been designated.

On December 12, 2023,

shareholders at the Special Meeting approved a proposal to amend our Charter to increase the authorized shares of common stock from

50,000,000 shares to 100,000,000 shares and to effect a reverse stock split of our issued and outstanding common stock at a ratio of

not less than 1-for-10 and not more than 1-for-20, with such ratio to be determined by the Board of Directors. On December 13, 2023,

we filed an amendment to our Charter with the Secretary of State of the State of Delaware increasing our authorized shares of common

stock to 100,000,000 shares and to effect a reverse stock split of our Common Stock at a ratio of 1-for-20, effective at 12:01 AM on

December 18, 2023. Our Common Stock began trading on a split-adjusted basis when the market opened on Monday, December 18, 2023.

There was no corresponding reduction in the number of authorized shares of common stock and no change in the par value per

share.

As of March 31, 2024, there

were 2,025,208 shares of Common Stock issued and outstanding, approximately 504.81 shares of Series B Preferred Stock issued and outstanding,

no shares of Series C Preferred Stock issued and outstanding, no shares of Series D Preferred Stock issued and outstanding, no shares

of Series E Preferred Stock issued and outstanding, no shares of Series F Preferred Stock issued and outstanding, and 12,373.226 shares

of Series G Preferred Stock issued and outstanding. As of July 24, 2024, there were 3,253,290 shares of Common Stock issued and outstanding.

The additional shares of our

authorized capital stock available for issuance may be issued at times and under circumstances so as to have a dilutive effect on earnings

per share and on the equity ownership of the holders of our Common Stock. The ability of our board of directors to issue additional shares

of stock could enhance the board’s ability to negotiate on behalf of the stockholders in a takeover situation but could also be

used by the board to make a change of control more difficult, thereby denying stockholders the potential to sell their shares at a premium

and entrenching current management. The following description is a summary of the material provisions of our capital stock. You should

refer to our certificate of incorporation, as amended and restated (the “Charter”), and our bylaws, as amended and restated

(the “Bylaws”), both of which are on file with the SEC as exhibits to previous SEC filings, for additional information. The

summary below is qualified by provisions of applicable law.

Common Stock

Holders of our Common Stock

are entitled to one vote for each share held of record on all matters on which the holders are entitled to vote (or consent pursuant to

written consent). Directors are elected by a plurality of the votes present in person or represented by proxy and entitled to vote. Our

Charter and Bylaws do not provide for cumulative voting rights.

Holders of our Common Stock

are entitled to receive, ratably, dividends only if, when and as declared by our board of directors out of funds legally available therefor

and after provision is made for each class of capital stock having preference over the common stock.

In the event of our liquidation,

dissolution or winding-up, the holders of common stock are entitled to share, ratably, in all assets remaining available for distribution

after payment of all liabilities and after provision is made for each class of capital stock having preference over the common stock.

Holders of our Common Stock

have no preemptive, conversion or subscription rights, and there are no redemption or sinking fund provisions applicable to the common

stock. The rights, preferences and privileges of the holders of common stock are subject to, and may be adversely affected by, the rights

of the holders of shares of any series of our preferred stock that we may designate and issue in the future.

Listing

Our Common Stock is listed on the Nasdaq

Capital Market under the symbol “ENTO”.

Transfer Agent and Registrar

The transfer agent and registrar

for our Common Stock is Colonial Stock Transfer Co., Inc., 7840 S. 700 E., Sandy, Utah 84070, Tel: (801) 355-5740.

Preferred Stock

We currently have up to

10,000,000 shares of preferred stock, par value $0.0001 per share, authorized and available for issuance in one or more series. Our

board of directors is authorized to divide the preferred stock into any number of series, fix the designation and number of each

such series, and determine or change the designation, relative rights, preferences, and limitations of any series of preferred

stock. The board of may increase or decrease the number of shares initially fixed for any series, but no decrease may reduce the

number below the shares then outstanding and duly reserved for issuance. As of July 24, 2024, approximately 5,194.81 shares were

designated as Series B Preferred Stock, of which approximately 484.52 shares were issued and outstanding, 75,000 shares were

designated as Series C Preferred Stock, none of which were issued and outstanding, 150 shares were designated as Series D Preferred

Stock, none of which were issued and outstanding, 150 shares were designated as Series E Preferred Stock, none of which were issued

and outstanding, 7,000 shares were designated as Series F Preferred Stock, none of which were issued and outstanding, and 13,000

shares were designated as Series G Preferred Stock, 12,373.226 of which were issued and outstanding.

Anti-Takeover Effects of Certain Provisions

of Delaware Law and of Our Charter and Bylaws

Certain provisions of Delaware

law, our Charter and Bylaws discussed below may have the effect of making more difficult or discouraging a tender offer, proxy contest

or other takeover attempt. These provisions are expected to encourage persons seeking to acquire control of our company to first negotiate

with our Board of Directors. We believe that the benefits of increasing our ability to negotiate with the proponent of an unfriendly or

unsolicited proposal to acquire or restructure our company outweigh the disadvantages of discouraging these proposals because negotiation

of these proposals could result in an improvement of their terms.

Delaware Anti-Takeover Law

We are subject to Section

203 of the Delaware General Corporation Law (the “DGCL”). Section 203 generally prohibits a public Delaware corporation from

engaging in a “business combination” with an “interested stockholder” for a period of three years after the date

of the transaction in which the person became an interested stockholder, unless:

| · |

prior to the date of the transaction, the Board of Directors of the corporation approved either the business combination or the transaction which resulted in the stockholder becoming an interested stockholder; |

| |

|

| · |

upon consummation of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned at least 85% of the voting stock of the corporation outstanding at the time the transaction commenced, excluding specified shares; or |

| |

|

| · |

at or subsequent to the date of the transaction, the business combination is approved by the Board of Directors and authorized at an annual or special meeting of stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock which is not owned by the interested stockholder. |

| |

|

Section 203 defines a “business

combination” to include:

| · |

any merger or consolidation involving the corporation and the interested stockholder; |

| |

|

| · |

any sale, lease, exchange, mortgage, pledge, transfer or other disposition of 10% or more of the assets of the corporation to or with the interested stockholder; |

| |

|

| · |

subject to exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation to the interested stockholder; |

| |

|

| · |

subject to exceptions, any transaction involving the corporation that has the effect of increasing the proportionate share of the stock of any class or series of the corporation beneficially owned by the interested stockholder; or |

| |

|

| · |

the receipt by the interested stockholder of the benefit of any loans, advances, guarantees, pledges or other financial benefits provided by or through the corporation. |

In general, Section 203 defines

an “interested stockholder” as any person that is:

| · |

the owner of 15% or more of the outstanding voting stock of the corporation; |

| |

|

| · |

an affiliate or associate of the corporation who was the owner of 15% or more of the outstanding voting stock of the corporation at any time within three years immediately prior to the relevant date; or |

| |

|

| · |

the affiliates and associates of the above. |

Under specific circumstances,

Section 203 makes it more difficult for an “interested stockholder” to effect various business combinations with a corporation

for a three-year period, although the stockholders may, by adopting an amendment to the corporation’s certificate of incorporation

or bylaws, elect not to be governed by this section, effective 12 months after adoption.

Our Charter and Bylaws do

not exclude us from the restrictions of Section 203. We anticipate that the provisions of Section 203 might encourage companies interested

in acquiring us to negotiate in advance with our Board of Directors since the stockholder approval requirement would be avoided if a majority

of the directors then in office approve either the business combination or the transaction that resulted in the stockholder becoming an

interested stockholder.

Charter and Bylaws

Provisions of our Charter

and Bylaws may delay or discourage transactions involving an actual or potential change of control or change in our management, including