First Financial Corporation (NASDAQ:THFF) today announced results

for the fourth quarter of 2023.

- Net income was $12.4 million

compared to the $16.5 million reported for the same period of

2022;

- Diluted net income per common share

of $1.06 compared to $1.37 for the same period of 2022;

- Return on average assets was 1.05%

compared to 1.34% for the three months ended December 31,

2022;

- Credit loss provision was $2.5

million compared to provision of $2.7 million for the fourth

quarter 2022; and

- Pre-tax, pre-provision net income

was $16.6 million compared to $21.7 million for the same period in

2022.1

The Corporation further reported results for the year ended

December 31, 2023:

- Net income was $60.7 million

compared to the $71.1 million reported for the same period of 2022,

which included the proceeds of a legal settlement and pandemic

related reserve releases, both of which were non-recurring

events;

- Diluted net income per common share

of $5.08 compared to $5.82 for the same period of 2022;

- Return on average assets was 1.26%

compared to 1.41% for the twelve months ended

December 31, 2022;

- Credit loss provision was $7.3

million compared to negative provision of $2.0 million for the

twelve months ended December 31, 2022; and

- Pre-tax, pre-provision net income

was $79.7 million compared to $84.9 million for the same period in

2022.1

___________________________1 Non-GAAP financial measure that

Management believes is useful for investors and management to

understand pre-tax profitability before giving effect to credit

loss expense and to provide additional perspective on the

Corporation’s performance over time as well as comparison to the

Corporation’s peers and evaluating the financial results of the

Corporation – please refer to the Non GAAP reconciliations

contained in this release.

Average Total Loans

Average total loans for the fourth quarter of 2023 were $3.13

billion versus $3.02 billion for the comparable period in 2022, an

increase of $117 million or 3.89%.

Total Loans Outstanding

Total loans outstanding as of December 31, 2023, were $3.17

billion compared to $3.07 billion as of December 31, 2022, an

increase of $100 million or 3.27%, primarily driven by increases in

Commercial Construction and Development, Commercial Real Estate,

and Consumer Auto loans.

“We are pleased with our fourth quarter results, as we

experienced another quarter of loan growth in a challenging

environment. Our credit quality remains stable, and disciplined

approach to expense management is constant,” said Norman D. Lowery,

President and Chief Executive Officer. “During the quarter we were

pleased to announce the signing of a definitive agreement with

SimplyBank, which expands our presence into new attractive MSAs in

the Tennessee market.”

Average Total Deposits

Average total deposits for the quarter ended December 31,

2023, were $4.05 billion versus $4.38 billion as of

December 31, 2022. On a linked quarter basis, average deposits

increased $50.7 million, or 1.27% from $4.00 billion as of

September 30, 2023.

Total Deposits

Total deposits were $4.09 billion as of December 31, 2023,

compared to $4.37 billion as of December 31, 2022.

Shareholder Equity

Shareholder equity at December 31, 2023, was $526.6 million

compared to $475.3 million on December 31, 2022. Overall

accumulated other comprehensive income/(loss) (“AOCI”) on

investments available for sale increased $10.9 million in

comparison to December 31, 2022, and increased $47.4 million in

comparison to September 30, 2023. During the quarter, there were no

share repurchases. An additional 518,860 shares remains under the

current repurchase authorization. The Corporation also declared a

$0.45 quarterly dividend during the quarter.

Book Value Per Share

Book Value per share was $44.64 as of December 31, 2023,

compared to $39.44 as of December 31, 2022, an increase of

13.20%.

Tangible Common Equity to Tangible Asset

Ratio

The Corporation’s tangible common equity to tangible asset ratio

was 9.12% at December 31, 2023, compared to 7.79% at

December 31, 2022.

Net Interest Income

Net interest income for the fourth quarter of 2023 was $39.6

million, compared to $43.7 million reported for the same period of

2022, a decrease of $4.1 million or 9.32%.

Net Interest Margin

The net interest margin for the quarter ended December 31,

2023, was 3.63% compared to the 3.81% reported at December 31,

2022, an decrease of 17 basis points or 4.55%.

Nonperforming Loans

Nonperforming loans as of December 31, 2023, were $24.6

million versus $9.6 million as of December 31, 2022. The ratio

of nonperforming loans to total loans and leases was 0.78% as of

December 31, 2023, versus 0.31% as of December 31, 2022.

The increase in nonperforming loans is due to a commercial

relationship that was downgraded during the quarter.

Credit Loss Provision

The provision for credit losses for the three months ended

December 31, 2023, was $2.5 million, compared to $2.7 million

for the fourth quarter 2022.

Net Charge-Offs

In the fourth quarter of 2023 net charge-offs were $1.76 million

compared to $2.44 million in the same period of 2022.

Allowance for Credit Losses

The Corporation’s allowance for credit losses as of

December 31, 2023, was $39.8 million compared to $39.8 million

as of December 31, 2022. The allowance for credit losses as

a percent of total loans was 1.26% as of December 31,

2023, compared to 1.30% as of December 31, 2022. On a linked

quarter basis, the allowance for credit losses as a percent of

total loans increased 1 basis point from 1.25% as of September 30,

2023.

Non-Interest Income

Non-interest income for the three months ended

December 31, 2023 and 2022 was $11.2 million and $10.6

million, respectively, an increase of $679 thousand or 6.43%.

Non-Interest Expense

Non-interest expense for the three months ended

December 31, 2023, was $34.2 million compared to $32.5 million

in 2022.

Efficiency Ratio

The Corporation’s efficiency ratio was 65.62% for the quarter

ending December 31, 2023, versus 58.78% for the same period in

2022.

Income Taxes

Income tax expense for the three months ended

December 31, 2023, was $1.7 million versus $2.5 million for

the same period in 2022. The effective tax rate for 2023 was 16.31%

compared to 18.97% for 2022. The decrease in effective tax rate is

due to a $1 million increase in tax credit investments, as well as

an increase in tax exempt interest income compared to December 31,

2022.

About First Financial Corporation

First Financial Corporation (NASDAQ:THFF) is the holding company

for First Financial Bank N.A. First Financial Bank N.A., the fifth

oldest national bank in the United States, operates 70 banking

centers in Illinois, Indiana, Kentucky and Tennessee. Additional

information is available at www.first-online.bank.

Investor Contact:Rodger A. McHargueChief

Financial OfficerP: 812-238-6334E: rmchargue@first-online.com

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| END OF PERIOD

BALANCES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Assets |

|

$ |

4,851,146 |

|

|

$ |

4,784,806 |

|

|

$ |

4,989,281 |

|

|

$ |

4,851,146 |

|

|

$ |

4,989,281 |

|

|

Deposits |

|

$ |

4,090,068 |

|

|

$ |

4,040,995 |

|

|

$ |

4,368,871 |

|

|

$ |

4,090,068 |

|

|

$ |

4,368,871 |

|

|

Loans, including net deferred loan costs |

|

$ |

3,167,821 |

|

|

$ |

3,117,626 |

|

|

$ |

3,067,438 |

|

|

$ |

3,167,821 |

|

|

$ |

3,067,438 |

|

|

Allowance for Credit Losses |

|

$ |

39,767 |

|

|

$ |

39,034 |

|

|

$ |

39,779 |

|

|

$ |

39,767 |

|

|

$ |

39,779 |

|

|

Total Equity |

|

$ |

527,976 |

|

|

$ |

470,168 |

|

|

$ |

475,293 |

|

|

$ |

527,976 |

|

|

$ |

475,293 |

|

|

Tangible Common Equity(a) |

|

$ |

435,405 |

|

|

$ |

377,367 |

|

|

$ |

381,594 |

|

|

$ |

435,405 |

|

|

$ |

381,594 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| AVERAGE

BALANCES |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total Assets |

|

$ |

4,725,297 |

|

|

$ |

4,814,251 |

|

|

$ |

4,930,611 |

|

|

$ |

4,802,448 |

|

|

$ |

5,043,987 |

|

|

Earning Assets |

|

$ |

4,485,766 |

|

|

$ |

4,575,996 |

|

|

$ |

4,690,594 |

|

|

$ |

4,564,135 |

|

|

$ |

4,800,481 |

|

|

Investments |

|

$ |

1,279,821 |

|

|

$ |

1,351,433 |

|

|

$ |

1,393,753 |

|

|

$ |

1,358,661 |

|

|

$ |

1,432,681 |

|

|

Loans |

|

$ |

3,133,267 |

|

|

$ |

3,147,317 |

|

|

$ |

3,015,903 |

|

|

$ |

3,111,784 |

|

|

$ |

2,884,053 |

|

|

Total Deposits |

|

$ |

4,050,968 |

|

|

$ |

4,000,302 |

|

|

$ |

4,383,505 |

|

|

$ |

4,106,132 |

|

|

$ |

4,408,510 |

|

|

Interest-Bearing Deposits |

|

$ |

3,291,931 |

|

|

$ |

3,222,633 |

|

|

$ |

3,509,416 |

|

|

$ |

3,304,816 |

|

|

$ |

3,517,468 |

|

|

Interest-Bearing Liabilities |

|

$ |

206,778 |

|

|

$ |

309,948 |

|

|

$ |

84,210 |

|

|

$ |

199,551 |

|

|

$ |

97,134 |

|

|

Total Equity |

|

$ |

463,004 |

|

|

$ |

493,764 |

|

|

$ |

438,767 |

|

|

$ |

486,572 |

|

|

$ |

494,837 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| INCOME STATEMENT

DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net Interest Income |

|

$ |

39,590 |

|

|

$ |

41,150 |

|

|

$ |

43,658 |

|

|

$ |

167,262 |

|

|

$ |

165,042 |

|

|

Net Interest Income Fully Tax Equivalent(b) |

|

$ |

40,942 |

|

|

$ |

42,539 |

|

|

$ |

44,724 |

|

|

$ |

172,716 |

|

|

$ |

169,699 |

|

|

Provision for Credit Losses |

|

$ |

2,495 |

|

|

$ |

1,200 |

|

|

$ |

2,725 |

|

|

$ |

7,295 |

|

|

$ |

(2,025 |

) |

|

Non-interest Income |

|

$ |

11,247 |

|

|

$ |

11,627 |

|

|

$ |

10,568 |

|

|

$ |

42,702 |

|

|

$ |

46,716 |

|

|

Non-interest Expense |

|

$ |

34,244 |

|

|

$ |

32,265 |

|

|

$ |

32,501 |

|

|

$ |

130,176 |

|

|

$ |

126,023 |

|

|

Net Income |

|

$ |

12,420 |

|

|

$ |

16,285 |

|

|

$ |

16,521 |

|

|

$ |

60,672 |

|

|

$ |

71,109 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| PER SHARE

DATA |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and Diluted Net Income Per Common Share |

|

$ |

1.06 |

|

|

$ |

1.37 |

|

|

$ |

1.37 |

|

|

$ |

5.08 |

|

|

$ |

5.82 |

|

|

Cash Dividends Declared Per Common Share |

|

$ |

0.45 |

|

|

$ |

— |

|

|

$ |

0.74 |

|

|

$ |

0.99 |

|

|

$ |

1.28 |

|

|

Book Value Per Common Share |

|

$ |

44.76 |

|

|

$ |

40.00 |

|

|

$ |

39.44 |

|

|

$ |

44.76 |

|

|

$ |

39.44 |

|

|

Tangible Book Value Per Common Share(c) |

|

$ |

31.47 |

|

|

$ |

33.69 |

|

|

$ |

28.67 |

|

|

$ |

36.91 |

|

|

$ |

31.66 |

|

|

Basic Weighted Average Common Shares Outstanding |

|

|

11,772 |

|

|

|

11,901 |

|

|

|

12,037 |

|

|

|

11,937 |

|

|

|

12,211 |

|

________________________________

(a) Tangible common equity is a non-GAAP

financial measure derived from GAAP-based amounts. We calculate

tangible common equity by excluding goodwill and other intangible

assets from shareholder’s equity.(b) Net interest

income fully tax equivalent is a non-GAAP financial measure derived

from GAAP-based amounts. We calculate net interest income fully tax

equivalent by adding back the tax equivalent factor of tax exempt

income to net interest income. We calculate the tax equivalent

factor of tax exempt income by dividing tax exempt income by the

net of tax rate of 75%.(c) Tangible book value per

common share is a non-GAAP financial measure derived from

GAAP-based amounts. We calculate the factor by dividing average

tangible common equity by average shares outstanding. We calculate

average tangible common equity by excluding average intangible

assets from average shareholder’s equity.

|

|

|

|

|

|

|

|

|

|

|

|

|

| Key

Ratios |

|

Three Months Ended |

|

Year Ended |

|

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

|

| |

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

|

| Return on average assets |

|

1.05 |

% |

1.35 |

% |

1.34 |

% |

1.26 |

% |

1.41 |

% |

| Return on average common

shareholder's equity |

|

10.73 |

% |

13.19 |

% |

15.06 |

% |

12.47 |

% |

14.37 |

% |

| Efficiency ratio |

|

65.62 |

% |

59.57 |

% |

58.78 |

% |

60.43 |

% |

58.23 |

% |

| Average equity to average

assets |

|

9.80 |

% |

10.26 |

% |

8.90 |

% |

10.13 |

% |

9.81 |

% |

| Net interest margin(a) |

|

3.63 |

% |

3.74 |

% |

3.81 |

% |

3.78 |

% |

3.54 |

% |

| Net charge-offs to average

loans and leases |

|

0.22 |

% |

0.24 |

% |

0.32 |

% |

0.23 |

% |

0.23 |

% |

| Credit loss reserve to loans

and leases |

|

1.26 |

% |

1.25 |

% |

1.30 |

% |

1.26 |

% |

1.30 |

% |

| Credit loss reserve to

nonperforming loans |

|

161.94 |

% |

310.19 |

% |

414.36 |

% |

161.94 |

% |

414.36 |

% |

| Nonperforming loans to loans

and leases |

|

0.78 |

% |

0.40 |

% |

0.31 |

% |

0.78 |

% |

0.31 |

% |

| Tier 1 leverage |

|

12.14 |

% |

11.72 |

% |

10.78 |

% |

12.14 |

% |

10.78 |

% |

| Risk-based capital - Tier

1 |

|

14.76 |

% |

14.61 |

% |

13.58 |

% |

14.76 |

% |

13.58 |

% |

__________________________________

(a) Net interest margin is calculated on a tax

equivalent basis.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Asset

Quality |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

September 30, |

|

December 31, |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2023 |

|

2022 |

|

2023 |

|

2022 |

| Accruing loans and leases past

due 30-89 days |

|

$ |

20,168 |

|

|

$ |

15,961 |

|

|

$ |

28,875 |

|

|

$ |

20,168 |

|

|

$ |

28,875 |

|

| Accruing loans and leases past

due 90 days or more |

|

$ |

960 |

|

|

$ |

1,370 |

|

|

$ |

1,119 |

|

|

$ |

960 |

|

|

$ |

1,119 |

|

| Nonaccrual loans and

leases |

|

$ |

23,596 |

|

|

$ |

11,214 |

|

|

$ |

8,481 |

|

|

$ |

23,596 |

|

|

$ |

8,481 |

|

| Other real estate owned |

|

$ |

107 |

|

|

$ |

63 |

|

|

$ |

337 |

|

|

$ |

107 |

|

|

$ |

337 |

|

| Nonperforming loans and other

real estate owned |

|

$ |

24,663 |

|

|

$ |

12,647 |

|

|

$ |

9,937 |

|

|

$ |

24,663 |

|

|

$ |

9,937 |

|

| Total nonperforming

assets |

|

$ |

27,665 |

|

|

$ |

15,671 |

|

|

$ |

12,923 |

|

|

$ |

27,665 |

|

|

$ |

12,923 |

|

| Gross charge-offs |

|

$ |

3,976 |

|

|

$ |

3,601 |

|

|

$ |

4,388 |

|

|

$ |

15,496 |

|

|

$ |

15,706 |

|

| Recoveries |

|

$ |

2,213 |

|

|

$ |

1,528 |

|

|

$ |

1,947 |

|

|

$ |

8,188 |

|

|

$ |

9,205 |

|

| Net

charge-offs/(recoveries) |

|

$ |

1,763 |

|

|

$ |

2,073 |

|

|

$ |

2,441 |

|

|

$ |

7,308 |

|

|

$ |

6,501 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

Reconciliations |

|

Three Months Ended December 31, |

| |

|

2023 |

|

2022 |

| ($in thousands, except

EPS) |

|

|

|

|

|

|

|

|

| Income before Income

Taxes |

|

$ |

14,098 |

|

|

$ |

19,000 |

|

| Provision for credit

losses |

|

|

2,495 |

|

|

|

2,725 |

|

| Provision for unfunded

commitments |

|

|

— |

|

|

|

— |

|

| Pre-tax, Pre-provision

Income |

|

$ |

16,593 |

|

|

$ |

21,725 |

|

| |

|

|

|

|

|

|

| Non-GAAP

Reconciliations |

|

Year Ended December 31, |

| |

|

2023 |

|

2022 |

| ($ in thousands, except

EPS) |

|

|

|

|

|

|

|

Income before Income Taxes |

|

$ |

72,493 |

|

|

$ |

87,760 |

|

| Provision for credit

losses |

|

|

7,295 |

|

|

|

(2,025 |

) |

| Provision for unfunded

commitments |

|

|

(100 |

) |

|

|

(850 |

) |

| Pre-tax, Pre-provision

Income |

|

$ |

79,688 |

|

|

$ |

84,885 |

|

| |

|

|

|

|

|

|

|

|

| |

|

CONSOLIDATED BALANCE SHEETS(Dollar amounts in thousands, except per

share data) |

| |

|

|

|

|

|

|

| |

|

December 31, |

|

December 31, |

| |

|

2023 |

|

2022 |

| |

|

(unaudited) |

| ASSETS |

|

|

|

|

|

|

|

Cash and due from banks |

|

$ |

76,759 |

|

|

$ |

222,517 |

|

| Federal funds sold |

|

|

282 |

|

|

|

9,374 |

|

| Securities

available-for-sale |

|

|

1,259,137 |

|

|

|

1,330,481 |

|

| Loans: |

|

|

|

|

|

|

| Commercial |

|

|

1,817,526 |

|

|

|

1,798,260 |

|

| Residential |

|

|

695,788 |

|

|

|

673,464 |

|

| Consumer |

|

|

646,758 |

|

|

|

588,539 |

|

| |

|

|

3,160,072 |

|

|

|

3,060,263 |

|

| (Less) plus: |

|

|

|

|

|

|

| Net deferred loan costs |

|

|

7,749 |

|

|

|

7,175 |

|

| Allowance for credit

losses |

|

|

(39,767 |

) |

|

|

(39,779 |

) |

| |

|

|

3,128,054 |

|

|

|

3,027,659 |

|

| Restricted stock |

|

|

15,364 |

|

|

|

15,378 |

|

| Accrued interest

receivable |

|

|

24,877 |

|

|

|

21,288 |

|

| Premises and equipment,

net |

|

|

67,286 |

|

|

|

66,147 |

|

| Bank-owned life insurance |

|

|

114,122 |

|

|

|

115,704 |

|

| Goodwill |

|

|

86,985 |

|

|

|

86,985 |

|

| Other intangible assets |

|

|

5,586 |

|

|

|

6,714 |

|

| Other real estate owned |

|

|

107 |

|

|

|

337 |

|

| Other assets |

|

|

72,587 |

|

|

|

86,697 |

|

| TOTAL ASSETS |

|

$ |

4,851,146 |

|

|

$ |

4,989,281 |

|

| |

|

|

|

|

|

|

| LIABILITIES AND SHAREHOLDERS’

EQUITY |

|

|

|

|

|

|

| Deposits: |

|

|

|

|

|

|

| Non-interest-bearing |

|

$ |

750,335 |

|

|

$ |

857,920 |

|

| Interest-bearing: |

|

|

|

|

|

|

| Certificates of deposit

exceeding the FDIC insurance limits |

|

|

92,921 |

|

|

|

50,608 |

|

| Other interest-bearing

deposits |

|

|

3,246,812 |

|

|

|

3,460,343 |

|

| |

|

|

4,090,068 |

|

|

|

4,368,871 |

|

| Short-term borrowings |

|

|

67,221 |

|

|

|

70,875 |

|

| FHLB advances |

|

|

108,577 |

|

|

|

9,589 |

|

| Other liabilities |

|

|

57,304 |

|

|

|

64,653 |

|

| TOTAL LIABILITIES |

|

|

4,323,170 |

|

|

|

4,513,988 |

|

| |

|

|

|

|

|

|

| Shareholders’ equity |

|

|

|

|

|

|

| Common stock, $.125 stated

value per share; |

|

|

|

|

|

|

| Authorized

shares-40,000,000 |

|

|

|

|

|

|

| Issued shares-16,137,220 in

2023 and 16,114,992 in 2022 |

|

|

|

|

|

|

| Outstanding shares-11,795,024

in 2023 and 12,051,964 in 2022 |

|

|

2,014 |

|

|

|

2,012 |

|

| Additional paid-in

capital |

|

|

144,152 |

|

|

|

143,185 |

|

| Retained earnings |

|

|

663,726 |

|

|

|

614,829 |

|

| Accumulated other

comprehensive income/(loss) |

|

|

(127,087 |

) |

|

|

(139,974 |

) |

| Less: Treasury shares at

cost-4,342,196 in 2023 and 4,063,028 in 2022 |

|

|

(154,829 |

) |

|

|

(144,759 |

) |

| TOTAL SHAREHOLDERS’

EQUITY |

|

|

527,976 |

|

|

|

475,293 |

|

| TOTAL LIABILITIES AND

SHAREHOLDERS’ EQUITY |

|

$ |

4,851,146 |

|

|

$ |

4,989,281 |

|

| |

|

|

|

|

|

|

|

|

| |

|

CONSOLIDATED STATEMENTS OF INCOME AND COMPREHENSIVE INCOME(Dollar

amounts in thousands, except per share data) |

| |

|

|

|

|

|

|

|

|

|

| |

|

Year Ended |

| |

|

December 31, |

| |

|

2023 |

|

2022 |

|

2021 |

| |

|

(unaudited) |

| INTEREST INCOME: |

|

|

|

|

|

|

|

|

|

|

Loans, including related fees |

|

$ |

189,641 |

|

|

$ |

146,295 |

|

|

$ |

128,000 |

|

| Securities: |

|

|

|

|

|

|

|

|

|

| Taxable |

|

|

24,643 |

|

|

|

21,014 |

|

|

|

13,110 |

|

| Tax-exempt |

|

|

10,573 |

|

|

|

9,974 |

|

|

|

8,762 |

|

| Other |

|

|

3,540 |

|

|

|

6,018 |

|

|

|

2,326 |

|

| TOTAL INTEREST INCOME |

|

|

228,397 |

|

|

|

183,301 |

|

|

|

152,198 |

|

| INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

| Deposits |

|

|

51,694 |

|

|

|

16,743 |

|

|

|

8,158 |

|

| Short-term borrowings |

|

|

5,370 |

|

|

|

1,243 |

|

|

|

387 |

|

| Other borrowings |

|

|

4,071 |

|

|

|

273 |

|

|

|

252 |

|

| TOTAL INTEREST EXPENSE |

|

|

61,135 |

|

|

|

18,259 |

|

|

|

8,797 |

|

| NET INTEREST INCOME |

|

|

167,262 |

|

|

|

165,042 |

|

|

|

143,401 |

|

| Provision for credit

losses |

|

|

7,295 |

|

|

|

(2,025 |

) |

|

|

2,466 |

|

| NET INTEREST INCOME AFTER

PROVISION |

|

|

|

|

|

|

|

|

|

| FOR LOAN LOSSES |

|

|

159,967 |

|

|

|

167,067 |

|

|

|

140,935 |

|

| NON-INTEREST INCOME: |

|

|

|

|

|

|

|

|

|

| Trust and financial

services |

|

|

5,155 |

|

|

|

5,155 |

|

|

|

5,255 |

|

| Service charges and fees on

deposit accounts |

|

|

28,079 |

|

|

|

27,540 |

|

|

|

24,700 |

|

| Other service charges and

fees |

|

|

801 |

|

|

|

665 |

|

|

|

1,163 |

|

| Securities gains (losses),

net |

|

|

(1 |

) |

|

|

3 |

|

|

|

114 |

|

| Interchange income |

|

|

676 |

|

|

|

559 |

|

|

|

438 |

|

| Loan servicing fees |

|

|

1,176 |

|

|

|

1,554 |

|

|

|

1,849 |

|

| Gain on sales of mortgage

loans |

|

|

966 |

|

|

|

1,994 |

|

|

|

5,003 |

|

| Other |

|

|

5,850 |

|

|

|

9,246 |

|

|

|

3,562 |

|

| TOTAL NON-INTEREST INCOME |

|

|

42,702 |

|

|

|

46,716 |

|

|

|

42,084 |

|

| NON-INTEREST EXPENSE: |

|

|

|

|

|

|

|

|

|

| Salaries and employee

benefits |

|

|

68,525 |

|

|

|

65,555 |

|

|

|

64,474 |

|

| Occupancy expense |

|

|

9,351 |

|

|

|

9,764 |

|

|

|

8,774 |

|

| Equipment expense |

|

|

14,020 |

|

|

|

12,391 |

|

|

|

10,174 |

|

| FDIC Expense |

|

|

2,907 |

|

|

|

2,327 |

|

|

|

1,294 |

|

| Other |

|

|

35,373 |

|

|

|

35,986 |

|

|

|

32,690 |

|

| TOTAL NON-INTEREST

EXPENSE |

|

|

130,176 |

|

|

|

126,023 |

|

|

|

117,406 |

|

| INCOME BEFORE INCOME

TAXES |

|

|

72,493 |

|

|

|

87,760 |

|

|

|

65,613 |

|

| Provision for income

taxes |

|

|

11,821 |

|

|

|

16,651 |

|

|

|

12,626 |

|

| NET INCOME |

|

|

60,672 |

|

|

|

71,109 |

|

|

|

52,987 |

|

| OTHER COMPREHENSIVE INCOME

(LOSS) |

|

|

|

|

|

|

|

|

|

| Change in unrealized

gains/(losses) on securities, net of reclassifications and

taxes |

|

|

10,896 |

|

|

|

(144,570 |

) |

|

|

(18,488 |

) |

| Change in funded status of

post retirement benefits, net of taxes |

|

|

1,991 |

|

|

|

7,022 |

|

|

|

6,298 |

|

| COMPREHENSIVE INCOME

(LOSS) |

|

$ |

73,559 |

|

|

$ |

(66,439 |

) |

|

$ |

40,797 |

|

| PER SHARE DATA |

|

|

|

|

|

|

|

|

|

| Basic and Diluted Earnings per

Share |

|

$ |

5.08 |

|

|

$ |

5.82 |

|

|

$ |

4.02 |

|

| Weighted average number of

shares outstanding (in thousands) |

|

|

11,937 |

|

|

|

12,211 |

|

|

|

13,190 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

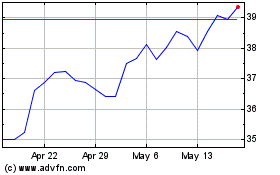

First Financial (NASDAQ:THFF)

Historical Stock Chart

From Jun 2024 to Jul 2024

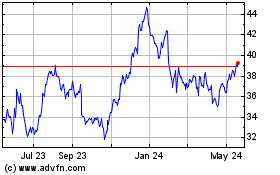

First Financial (NASDAQ:THFF)

Historical Stock Chart

From Jul 2023 to Jul 2024