Form 8-K - Current report

November 06 2024 - 4:20PM

Edgar (US Regulatory)

false0000035527Fifth Third BancorpDepositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock00000355272024-11-062024-11-060000035527us-gaap:CommonStockMember2024-11-062024-11-060000035527fitb:DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf6.625FixedToFloatingRateNotCumulativePerpetualPreferredStockSeriesI2Member2024-11-062024-11-060000035527fitb:DepositarySharesRepresentingA140thOwnershipInterestInAShareOf6.00NotCumulativePerpetualClassBPreferredStockSeriesAMember2024-11-062024-11-060000035527fitb:DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf4.95NotCumulativePerpetualPreferredStockSeriesKMember2024-11-062024-11-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): November 6, 2024

Fifth Third Bancorp

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Ohio | | 001-33653 | | 31-0854434 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | | | | | | | | | | |

| Fifth Third Center | | |

| 38 Fountain Square Plaza | , | Cincinnati | , | Ohio | | 45263 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(800) 972-3030

(Registrant's telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below)

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

| | | | | | | | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: | | | | |

| | | | | | |

| Title of each class | | Trading

Symbol(s) | | Name of each exchange

on which registered |

| Common Stock, Without Par Value | | FITB | | The | NASDAQ | Stock Market LLC |

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series I | | FITBI | | The | NASDAQ | Stock Market LLC |

| Depositary Shares Representing a 1/40th Ownership Interest in a Share of 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A | | FITBP | | The | NASDAQ | Stock Market LLC |

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 4.95% Non-Cumulative Perpetual Preferred Stock, Series K | | FITBO | | The | NASDAQ | Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01 Regulation FD Disclosure

On November 8, 2024, Fifth Third Bancorp will present at the 2024 BancAnalysts Association of Boston Conference. A copy of this presentation is attached as Exhibit 99.1.

The information in this Form 8-K and Exhibits attached hereto shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, nor shall they be deemed incorporated by reference in any filing under the Securities Exchange Act of 1934 or the Securities Act of 1933, except as shall be expressly set forth by specific reference.

Item 9.01 Financial Statements and Exhibits

Exhibit 104 – Cover Page Interactive Data File (embedded within the Inline XBRL document)

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | FIFTH THIRD BANCORP |

| | (Registrant) |

| | | |

Date: November 6, 2024 | | /s/ Bryan D. Preston |

| | | |

| | Bryan D. Preston |

| | Executive Vice President and

Chief Financial Officer |

© Fifth Third Bancorp | All Rights Reserved © Fifth Third Bancorp | All Rights Reserved BancAnalysts Association of Boston Conference Jamie Leonard | Chief Operating Officer Bryan Preston | Chief Financial Officer November 8, 2024 • November 2025

© Fifth Third Bancorp | All Rights Reserved This presentation contains statements that we believe are “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, and Rule 3b-6 promulgated thereunder. All statements other than statements of historical fact are forward-looking statements. These statements relate to our financial condition, results of operations, plans, objectives, future performance, capital actions or business. They usually can be identified by the use of forward-looking language such as “will likely result,” “may,” “are expected to,” “is anticipated,” “potential,” “estimate,” “forecast,” “projected,” “intends to,” or may include other similar words or phrases such as “believes,” “plans,” “trend,” “objective,” “continue,” “remain,” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “can,” or similar verbs. You should not place undue reliance on these statements, as they are subject to risks and uncertainties, including but not limited to the risk factors set forth in our most recent Annual Report on Form 10-K as updated by our filings with the U.S. Securities and Exchange Commission (“SEC”). There are a number of important factors that could cause future results to differ materially from historical performance and these forward-looking statements. Factors that might cause such a difference include, but are not limited to: (1) deteriorating credit quality; (2) loan concentration by location or industry of borrowers or collateral; (3) problems encountered by other financial institutions; (4) inadequate sources of funding or liquidity; (5) unfavorable actions of rating agencies; (6) inability to maintain or grow deposits; (7) limitations on the ability to receive dividends from subsidiaries; (8) cyber-security risks; (9) Fifth Third’s ability to secure confidential information and deliver products and services through the use of computer systems and telecommunications networks; (10) failures by third-party service providers; (11) inability to manage strategic initiatives and/or organizational changes; (12) inability to implement technology system enhancements; (13) failure of internal controls and other risk management programs; (14) losses related to fraud, theft, misappropriation or violence; (15) inability to attract and retain skilled personnel; (16) adverse impacts of government regulation; (17) governmental or regulatory changes or other actions; (18) failures to meet applicable capital requirements; (19) regulatory objections to Fifth Third’s capital plan; (20) regulation of Fifth Third’s derivatives activities; (21) deposit insurance premiums; (22) assessments for the orderly liquidation fund; (23) weakness in the national or local economies; (24) global political and economic uncertainty or negative actions; (25) changes in interest rates and the effects of inflation; (26) changes and trends in capital markets; (27) fluctuation of Fifth Third’s stock price; (28) volatility in mortgage banking revenue; (29) litigation, investigations, and enforcement proceedings by governmental authorities; (30) breaches of contractual covenants, representations and warranties; (31) competition and changes in the financial services industry; (32) potential impacts of the adoption of real-time payment networks; (33) changing retail distribution strategies, customer preferences and behavior; (34) difficulties in identifying, acquiring or integrating suitable strategic partnerships, investments or acquisitions; (35) potential dilution from future acquisitions; (36) loss of income and/or difficulties encountered in the sale and separation of businesses, investments or other assets; (37) results of investments or acquired entities; (38) changes in accounting standards or interpretation or declines in the value of Fifth Third’s goodwill or other intangible assets; (39) inaccuracies or other failures from the use of models; (40) effects of critical accounting policies and judgments or the use of inaccurate estimates; (41) weather-related events, other natural disasters, or health emergencies (including pandemics); (42) the impact of reputational risk created by these or other developments on such matters as business generation and retention, funding and liquidity; (43) changes in law or requirements imposed by Fifth Third’s regulators impacting our capital actions, including dividend payments and stock repurchases; and (44) Fifth Third's ability to meet its environmental and/or social targets, goals and commitments. You should refer to our periodic and current reports filed with the Securities and Exchange Commission, or “SEC,” for further information on other factors, which could cause actual results to be significantly different from those expressed or implied by these forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to us. We expressly disclaim any obligation or undertaking to release publicly any updates or revisions to any forward-looking statements contained herein to reflect any change in our expectations or any changes in events, conditions or circumstances on which any such statement is based, except as may be required by law, and we claim the protection of the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995. The information contained herein is intended to be reviewed in its totality, and any stipulations, conditions or provisos that apply to a given piece of information in one part of this press release should be read as applying mutatis mutandis to every other instance of such information appearing herein. Copies of those filings are available at no cost on the SEC’s website at www.sec.gov or on our website at www.53.com. Annualized, pro forma, projected and estimated numbers are used for illustrative purpose only, are not forecasts and may not reflect actual results. In this presentation, we may sometimes provide non-GAAP financial information. Please note that although non-GAAP financial measures provide useful insight to analysts, investors and regulators, they should not be considered in isolation or relied upon as a substitute for analysis using GAAP measures. We provide a discussion of non-GAAP measures and reconciliations to the most directly comparable GAAP measures on pages 27 through 29 of our 3Q24 earnings release. Management does not provide a reconciliation for forward-looking non-GAAP financial measures where it is unable to provide a meaningful or accurate calculation or estimation of reconciling items and the information is not available without unreasonable effort. This is due to the inherent difficulty of forecasting the occurrence and the financial impact of various items that have not yet occurred, are out of the Bancorp's control or cannot be reasonably predicted. For the same reasons, Bancorp's management is unable to address the probable significance of the unavailable information. Forward-looking non-GAAP financial measures provided without the most directly comparable GAAP financial measures may vary materially from the corresponding GAAP financial measures. This presentation incorporates the following peers: CFG, CMA, FCNCA, FHN, HBAN, KEY, MTB, PNC, RF, TFC, USB, & ZION. Cautionary statement 2

© Fifth Third Bancorp | All Rights Reserved Disciplined execution guided by core principles Stability Profitability Growth Consistent and disciplined management, with a long-term focus throughout the company 3 • Defensive balance sheet positioning • Strong credit profile • Diverse fee mix with high total revenue contribution • Expense discipline • Drive NIM expansion • Southeast demographics • Midwest & renewables infrastructure investments • Tech-enabled product innovation #2 #3#1

© Fifth Third Bancorp | All Rights Reserved Midwest footprint Major FITB markets 2 with a top 5 deposit share London office Leading position in the markets we compete in 3 Key Southeast MSAs of focus Toronto office Top performing regional bank with local scale and national reach 4 Fifth Third Corporate Headquarters Cincinnati, Ohio Assets $214 billion Ranked 11 th in the U.S. 1 Deposits $168 billion Ranked 9 th in the U.S. 1 U.S. branches 1,072 Ranked 8 th in the U.S. 1 Commercial Payments Top 5 market share across several product categories 5 Southeast footprint #2 #6Midwest Southeast unchanged YoY unchanged YoY Deposit share rankings 4 #3 Fifth Third footprint unchanged YoY Significant locational share in notable MSAs Nashville, TN Charlotte, NC #3 #4 Cincinnati, OH #1 Chicago, IL #3 Top 10 deposit share in ~96% of retail footprint Columbus, OH Indianapolis, IN #3 #3 Tampa, FL #6 Grand Rapids, MI #1 Assets, deposits, and branches as of 9/30/24; 1 Rankings as of 6/30/24 and consist of US commercial banks and exclude foreign, trust, & traditional investment banks; 2 Includes MSAs with $5BN+ in deposits on a capped basis (deposits per branch capped at $250MM per June 2024 FDIC data); 3 Data sourced from S&P Global Market Intelligence; 4 Deposits per branch capped at $250MM per June 2024 FDIC data; Midwest and Southeast rankings represent in footprint deposit market share; 5 Source: 2023 Cash Management Services Survey administered by EY

© Fifth Third Bancorp | All Rights Reserved Since 2018, Fifth Third has been on a journey to transform our branch network Southeast de novo program is driving long-term organic growth with compelling strategic rationale 5 2017 ~20% ~80% Branch footprint reflects continued investment in the southeast 2024 1 32% 68% Mix and count of branches Midwest Southeast Midwest US Southeast ~2x • Opened 119 branches in Southeast markets over last 7 years • Added 98 branches, the 2 nd most new branches in the Southeast over the past 4 years 5-10 added > 15 added 10-15 added < 5 added Branch openings since 2017 with total branch count in white 1 ~6x 1 Expected as of December 31, 2024, See forward-looking statements on page 2 of this presentation; 2 Data sourced from S&P Global Market Intelligence 273 352 736881 ~4% 41 80 30 187 14 Southeast has favorable population trends Expected population growth (2024 – 2029) 2

© Fifth Third Bancorp | All Rights Reserved Midwest Footprint 1 Southeast Footprint 1 Deposit Share 10.9% 3.9% Locational Share 8.7% 5.4% Capped Deposit Growth (YoY) Fifth Third 2.2% 15.7% Market Avg. 1.2% 0.2% Avg Deposits per Branch Fifth Third $122MM $82MM Market Avg. $96MM $114MM 3-year GDP growth (%) 3.4% 9.8% Population growth since 2010 (%) 3.2% 22.7% Deposit share rank in MSAs where Fifth Third operates 1 As of June 30, 2024; deposits capped at $250MM Maintaining market share across Midwest branch network while increasing share in high-growth Southeast markets 9 th 12 th 5 th 13 th 14 th 3 rd 2 nd 1 st 5 th 2 nd 3 rd 6 Deposit trend vs. peers and large commercial banks Average total deposits indexed to 100; H8, non-seasonally adjusted total deposits +49% +43% +42% Midwest#2 Deposit share rankings Southeast#6 10.9% deposit share 3.9% deposit share 1 Source: 2024 FDIC Summary of Deposits; 2 FITB data adjusted for the impact from MBFI Acquisition; 3 Peer Data excludes banks with bank M&A transactions during the period 4Q17 3Q18 2Q19 1Q20 4Q20 3Q21 2Q22 1Q23 4Q23 3Q24 FITB Peer median H8 2 3

© Fifth Third Bancorp | All Rights Reserved 1 Filtered for de novos and based on 2024 FDIC data. Not all de novos have been open for 5 years 183 119 42 39 23 20 17 16 6 4 1 1 1 1 Trillionaire 1 X Peer 1 Peer 2 Trillionaire 2 Peer 3 Trillionaire 3 Peer 4 Peer 5 Peer 6 Peer 7 Peer 8 Peer 9 Peer 10 Regional bank leader in Southeast de novo builds and deposit performance Southeast de novo branch builds Average de novo deposits per branch by vintage 1 In Southeast states from 2018 – September 2024 • ~20% IRR • Model 36 months to breakeven • Model 60 months to cumulative breakeven Fifth Third Southeast de novo results 7 $0 $10 $20 $30 $40 $50 Year 1 Year 2 Year 3 Year 4 Year 5 Fifth Third Peer Avg $ in millions

© Fifth Third Bancorp | All Rights Reserved Best-in-class branch site selection process 8 Site selection driven by award winning data science tools • Proprietary Market Strength Index (“MSI”) prioritizes new cities for expansion • Proprietary heat map identifies attractive areas to explore for branch sites in prioritized cities • Trillions of calculations on hundreds of trillions of data points lead to better site selections; this includes cell phone data showing retail destinations people frequent most Network of branches in attractive locations 3.1 2.8 2.5 2018 2023 2028 1 Tier is a representation of the attractiveness of a given zone (or hexagon) for building a new branch • Each hexagon is given a tiering score based on multiple factors (e.g., HH deposits, HH income, # of retailers, # of banks) • Tiers range from 1 (best) to 7 (worst) • We target locations in tiers 1 – 3 which comprise only ~3.5% of all space in the Southeast markets where we operate Fifth Third branch network tiering Lower is better 1 See forward-looking statements on page 2 of this presentation

© Fifth Third Bancorp | All Rights Reserved NextGen branch design and technology enabled solutions 9 Efficient NextGen branch design • 40% reduction in branch square footage primarily from transaction areas • Engagement zones featuring relaxed seating, booths, and tech table • Digital evolution supported by the customer recommendation engine, tablets, and Wi-Fi Technology enabled relationship management • 75+ AI/ML models power the customer recommendation engine, informing direct marketing campaigns and other deposit initiatives, and presented through our proprietary MyDay banker portal and digital channels • Specific marketing support to help drive new customer acquisition – Every Door Direct Mail campaign • Early recruiting / hiring to ensure staff are ready to begin sales efforts 1 to 3 months prior to branch opening ~90% of customers who used a branch pre-COVID continue to use it today but with less frequency Digital Banking Stats 75.2% US Average 3Q24 Digital adoption % of checking households $2.5B 3Q23 3Q24 Zelle Transactions Send and receive volume 4.3 4.7 Peer Average 3Q24 Digital experience Android app store rating

© Fifth Third Bancorp | All Rights Reserved An efficient branch network with opportunities in the Southeast 10 $90 $95 $96 $106 $110 $114 $115 $118 $122 $127 $132 $139 $140 $143 Peer 11 x Peer 10 Peer 9 Peer 8 Peer 7 Peer 6 Peer 5 Peer 4 x Peer 3 Peer 2 x Peer 1 Branches with <$50mm deposits Midwest Total Southeast 42% 35% 34% 30% 29% 27% 23% 21% 20% 20% 18% 17% 16% 8% Peer 8 x Peer 11 Peer 9 Peer 6 Peer 10 Peer 3 Peer 5 Peer 7 Peer 2 x Peer 4 Peer 1 x Midwest Total Southeast Source: 2024 FDIC Summary of Deposits & S&P Global Market Intelligence; Note: Based on SNL deposit per MSA market share data, individual deposits per branch considered are capped at $1bn % of total branches Deposits per branch $ in millions Seasoning of the southeast branch network generates outsized opportunity for growth Median branch age in years 22 25 23 22 14 26 25 22 35 26 29 42 5 18

© Fifth Third Bancorp | All Rights Reserved 6.0% 3.9% 2.3% 2.1% 2.1% 1.6% 1.5% 1.2% 1.1% 1.1% 0.4% 0.4% Peer 6 Peer 10 Peer 9 Peer 7 Peer 8 Peer 1 Peer 5 Peer 4 Peer 2 Peer 3 Peer 11 Seasoning of current branch network creates deposit growth potential Illustrative deposit growth potential from branches aged <5y achieving levels of branches aged >5y 1 Share of total branches <5y 1.5%3.3%4.3% 2.2% 2.7% 1.8% 2.0% 0.4%8.5% 1.5% 1.2% 0.5% Median of 1.5% Source: 2024 FDIC Summary of Deposits & S&P Global Market Intelligence; 1 Reflects the growth potential for total deposits if all branches aged <5y achieved the average deposit per branch productivity of all branches aged >5y for each bank, respectively. Based on SNL deposit per MSA market share data, individual deposits per branch considered are capped at $1bn Deposit growth opportunity due to seasoning of existing network ($B) $1.4$2.7$10.4 $2.3 $2.4 $0.7 $0.9 $0.3$8.1 $3.0 $3.0 $0.2 11

© Fifth Third Bancorp | All Rights Reserved Well-positioned to accelerate growth and market share gains in Southeast De novo acceleration through 2028 Projected footprint for December 31,2028 1 Total deposits from de novos 2025-2028 ~$7B • Open 50-60 de novos per year from 2025 to 2028 • Add 1 new state and 11 new markets 12 Target minimum location share By 2028 8% 2017 2024 1 2028 1 Total branches 1,154 1,088 ~1,250 Midwest branches 881 736 ~675 Southeast branches 273 352 ~575 % of branches in Southeast 24% 32% ~50% Southeast locational share 7 th 6 th 5 th 1 See forward-looking statements on page 2 of this presentation Expansion highlights 1 2025 - 2028 ~$15B to $20B deposit opportunity over the next 7 years 1 from a combination of new de novos, southeast network density strengthening, and entire FITB network seasoning

© Fifth Third Bancorp | All Rights Reserved ✓ Well-diversified and resilient balance sheet to provide stability and profitability ✓ Consistent investments to generate balanced and growing revenue streams while maintaining peer-leading expense discipline ✓ Multi-year track record of making appropriate and preemptive changes to the business ✓ Transparent management team Positioned to generate long-term sustainable value to shareholders despite the environment Why Fifth Third 13

v3.24.3

Cover Page

|

Nov. 06, 2024 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 06, 2024

|

| Entity Registrant Name |

Fifth Third Bancorp

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000035527

|

| Entity Incorporation, State or Country Code |

OH

|

| Entity File Number |

001-33653

|

| Entity Tax Identification Number |

31-0854434

|

| Entity Address, Address Line One |

Fifth Third Center

|

| Entity Address, Address Line Two |

38 Fountain Square Plaza

|

| Entity Address, City or Town |

Cincinnati

|

| Entity Address, State or Province |

OH

|

| Entity Address, Postal Zip Code |

45263

|

| City Area Code |

800

|

| Local Phone Number |

972-3030

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Common Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, Without Par Value

|

| Trading Symbol |

FITB

|

| Security Exchange Name |

NASDAQ

|

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series I |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 6.625% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock

|

| Trading Symbol |

FITBI

|

| Security Exchange Name |

NASDAQ

|

| Depositary Shares Representing a 1/40th Ownership Interest in a Share of 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Representing a 1/40th Ownership Interest in a Share of 6.00% Non-Cumulative Perpetual Class B Preferred Stock, Series A

|

| Trading Symbol |

FITBP

|

| Security Exchange Name |

NASDAQ

|

| Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 4.95% Non-Cumulative Perpetual Preferred Stock, Series K |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Depositary Shares Representing a 1/1000th Ownership Interest in a Share of 4.95% Non-Cumulative Perpetual Preferred Stock, Series K

|

| Trading Symbol |

FITBO

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fitb_DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf6.625FixedToFloatingRateNotCumulativePerpetualPreferredStockSeriesI2Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fitb_DepositarySharesRepresentingA140thOwnershipInterestInAShareOf6.00NotCumulativePerpetualClassBPreferredStockSeriesAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=fitb_DepositarySharesRepresentingA11000thOwnershipInterestInAShareOf4.95NotCumulativePerpetualPreferredStockSeriesKMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

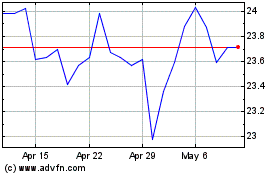

Fifth Third Bancorp (NASDAQ:FITBP)

Historical Stock Chart

From Oct 2024 to Nov 2024

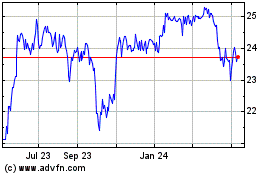

Fifth Third Bancorp (NASDAQ:FITBP)

Historical Stock Chart

From Nov 2023 to Nov 2024