Elutia Inc. (Nasdaq: ELUT) (“Elutia” or the “Company”), a pioneer

in drug-eluting biomatrix products, today provided a business

update and financial results for the second quarter ended June 30,

2024.

Business Highlights:

- Received FDA

clearance for EluPro®, the first antibiotic-eluting BioEnvelope for

protecting patients with implantable electronic devices, including

pacemakers, defibrillators, and neuromodulation devices.

- Completed a

successful FDA inspection of the EluPro and CanGaroo manufacturing

facility in Roswell, GA.

- Commenced

manufacturing of EluPro ahead of commercial launch.

- Received

enthusiastic responses from potential industry partners, treating

physicians and hospital purchasing organizations regarding EluPro's

availability.

- Strengthened

the balance sheet with approximately $29.0 million in gross

proceeds from a registered direct offering and exercise of

warrants.

- Appointed

industry veteran Ryan Marques, Ph.D., MBA, as Vice President of

Operations.

- Initiated the

expansion of commercial teams for both EluPro and SimpliDerm.

“With the FDA clearance of EluPro, we are

equipped with what we believe is a superior product, which is

bringing us significant attention from a range of participants in

the multi-billion-dollar pacemaker and defibrillator market,” said

Dr. Randy Mills, Elutia’s Chief Executive Officer. “Additionally,

our manufacturing and quality systems were evaluated by the FDA

with no deficiencies noted, clearing the way for commercial

production of EluPro. Simultaneously, we have initiated the value

analysis committee submission process, all in a coordinated effort

to ensure this revolutionary product reaches our surgeon partners,

enabling them to provide the best care for their patients.”

Dr. Mills continued, “With a robust financial

position, we are laser focused on the successful launch of EluPro

and further expanding our commercial footprint. We are

systematically building our commercial teams for both EluPro and

SimpliDerm and intensifying business development efforts to extend

the reach of our drug-eluting biomatrix technology into adjacent

markets covered under the EluPro approval. I want to thank our

incredible team, who did a beautiful job executing on our plan to

maximize the value of Elutia for all stakeholders.”

Second Quarter 2024 Financial

Results

For the three-month period ended June 30, 2024,

as compared to the same period of 2023:

- Overall net

sales were essentially unchanged at $6.3 million.

- Net sales of

CanGaroo increased 19% to $2.6 million, compared to $2.2

million.

- Net sales of

SimpliDerm increased 7% to $2.6 million, compared to $2.4

million.

- Net sales of

Cardiovascular products were $1.1 million, a decrease of 38%,

reflecting the start of the Company’s exclusive distribution

relationship with LeMaitre Vascular in April 2023.

- Gross margin on

a GAAP basis was 45%, compared to 43%. The year-over-year increase

was primarily due to rectifying non-production issues in the

SimpliDerm product line.

- Adjusted gross

margin (a non-GAAP measure which excludes non-cash amortization of

intangibles) was 58%, compared to 56%.

- Total operating

expenses were $11.3 million, compared to $9.0 million. The increase

included higher general and administrative, sales and marketing and

research and development expenses.

- Loss from

operations was $8.5 million, compared to $6.3 million.

- Net loss was

$28.2 million, compared to a net loss of $10.6 million. The

increased net loss was primarily due to an $18.3 million non-cash

charge in the second quarter of 2024 related to the revaluation of

the Company’s liability on warrants and pre-funded warrants related

to the Company’s September 2023 private placement financing.

- Adjusted EBITDA

(a non-GAAP measure that excludes from net loss certain

non-operating, non-cash and non-recurring items) was a loss of $2.9

million, compared to a loss of $3.4 million. A reconciliation of

net loss to adjusted EBITDA is included in the accompanying

financial tables.

- Cash balance as

of June 30, 2024, was $18.2 million and does not reflect

approximately $13.8 million in proceeds received from the exercise

of outstanding warrants following the end of the quarter.

Conference Call

Elutia will host a conference call today at 4:30

p.m. Eastern Time / 1:30 p.m. Pacific Time to discuss its second

quarter 2024 financial results and performance.

The conference call can be accessed using the

following information:

Webcast: Click hereU.S.

Investors: 877-407-8029International

Investors: 201-689-8029Conference ID:

13747696

About Elutia

Elutia develops and commercializes drug-eluting

biomatrix products to improve compatibility between medical devices

and the patients who need them. With a growing population in need

of implantable technologies, Elutia’s mission is humanizing

medicine so patients can thrive without compromise. For more

information, visit www.Elutia.com.

Non-GAAP Disclosure

In addition to the Company's financial results

determined in accordance with U.S. GAAP, the Company provides

non-GAAP measures that it determines to be useful in evaluating its

operating performance and liquidity. The Company presents in this

press release the following non-GAAP financial measures: earnings

before interest, taxes, depreciation and amortization (“EBITDA”),

adjusted earnings before interest, taxes, depreciation and

amortization (“adjusted EBITDA”), adjusted gross margin and

adjusted gross profit. The Company defines EBITDA as GAAP net loss

excluding interest expense, income tax expense, depreciation and

amortization, and the Company defines adjusted EBITDA as EBITDA

excluding income from discontinued operations, stock-based

compensation, FiberCel litigation costs, loss on extinguishment of

debt, net of gain on debt forgiveness, loss on revaluation of

warranty liability and gain on revaluation of revenue interest

obligation. The Company defines adjusted gross profit and adjusted

gross margin as GAAP gross profit and GAAP gross margin,

respectively, excluding amortization of acquired intangible assets.

The amortization of these intangible assets will recur in future

periods until such intangible assets have been fully amortized.

Management believes that presentation of non-GAAP financial

measures provides useful supplemental information to investors and

facilitates the analysis of the Company's core operating results

and comparison of operating results across reporting periods. The

Company uses this non-GAAP financial information to establish

budgets, manage the Company's business, and set incentive and

compensation arrangements. Non-GAAP financial information, when

taken collectively, may be helpful to investors because it provides

consistency and comparability with past financial performance.

However, non-GAAP financial information is presented for

supplemental information purposes only, has limitations as an

analytical tool and should not be considered in isolation or as a

substitute for financial information presented in accordance with

U.S. GAAP. For a reconciliation of these non-GAAP measures to GAAP,

see below “Non-GAAP Reconciliations of EBITDA and Adjusted EBITDA”

and “Non-GAAP Reconciliations of Adjusted Gross Profit and Adjusted

Gross Margin.”

Forward-Looking Statements

This press release contains “forward-looking

statements” within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Forward-looking statements can be identified

by words such as “projects,” “may,” “will,” “could,” “would,”

“should,” “believes,” “expects,” “anticipates,” “estimates,”

“intends,” “plans,” “potential,” “promise” or similar references to

future periods. All statements contained in this press release that

do not relate to matters of historical fact should be considered

forward-looking statements, including any statements and

information concerning our future interactions with the U.S. Food

and Drug Administration (“FDA”); preparations for the launch of

EluPro, including the timing and anticipated success thereof; the

size of the pacemaker and implantable defibrillator protection

market and the potential of EluPro to compete in that market; and

the potential for applying our drug-eluting biomatrix technology

into adjacent markets. These forward-looking statements are based

on our management’s beliefs and assumptions and on information

currently available to us. Such beliefs and assumptions may or may

not prove to be correct. Additionally, such forward-looking

statements are subject to a number of known and unknown risks,

uncertainties and other important factors that may cause our actual

results, performance or achievements to be materially different

from any future results, performance or achievements expressed or

implied in the forward-looking statements, including, but not

limited to the following: our ability to obtain regulatory approval

or other marketing authorizations by the FDA and comparable foreign

authorities for our products and product candidates; our ability to

continue as a going concern; the risk of product liability claims

and our ability to obtain or maintain adequate product liability

insurance; our ability to defend against the various lawsuits and

claims related to our recalled FiberCel and other viable bone

matrix products and avoid a material adverse financial consequence

from those lawsuits and claims; our ability to achieve or sustain

profitability; our ability to enhance our products, expand our

product indications and develop, acquire and commercialize

additional product offerings; our dependence on our commercial

partners and independent sales agents to generate a substantial

portion of our net sales; our dependence on a limited number of

third-party suppliers and manufacturers, which, in certain cases

are exclusive suppliers for products essential to our business; our

ability to successfully realize the anticipated benefits of the

November 2023 sale of our Orthobiologics business; physician

awareness of the distinctive characteristics, benefits, safety,

clinical efficacy and cost-effectiveness of our products; the

continued and future acceptance of our products by the medical

community; our ability to compete against other companies, most of

which have longer operating histories, more established products

and/or greater resources than we do; pricing pressure as a result

of cost-containment efforts of our customers, purchasing groups,

third-party payors and governmental organizations could adversely

affect our sales and profitability; and our ability to obtain,

maintain and adequately protect our intellectual property rights;

and other important factors which can be found in the “Risk

Factors” section of Elutia’s public filings with the Securities and

Exchange Commission (“SEC”), including Elutia’s Annual Report on

Form 10-K for the year ended December 31, 2023, as such factors may

be updated from time to time in Elutia’s other filings with the

SEC, including Elutia’s Quarterly Reports on Form 10-Q, accessible

on the SEC’s website at www.sec.gov and the Investor Relations page

of Elutia’s website at https://investors.elutia.com. Because

forward-looking statements are inherently subject to risks and

uncertainties, you should not rely on these forward-looking

statements as predictions of future events. Any forward-looking

statement made by Elutia in this press release is based only on

information currently available and speaks only as of the date on

which it is made. Except as required by applicable law, Elutia

expressly disclaims any obligations to publicly update any

forward-looking statements, whether written or oral, that may be

made from time to time, whether as a result of new information,

future developments or otherwise.

Investors:Matt SteinbergFINN

Partnersmatt.steinberg@finnpartners.com

|

|

|

|

ELUTIA INC. |

|

|

CONSOLIDATED BALANCE SHEET DATA |

|

|

(Unaudited, in thousands) |

|

|

|

|

|

|

|

|

|

Assets |

June 30, 2024 |

|

|

December 31, 2023 |

|

| Current

assets: |

|

|

|

|

Cash |

$ |

18,188 |

|

|

$ |

19,276 |

|

|

Accounts receivable, net |

|

3,518 |

|

|

|

3,263 |

|

|

Inventory |

|

3,115 |

|

|

|

3,853 |

|

|

Receivables of litigation costs |

|

4,421 |

|

|

|

2,696 |

|

|

Prepaid expense and other current assets |

|

1,109 |

|

|

|

2,165 |

|

|

Total current assets |

|

30,351 |

|

|

|

31,253 |

|

|

|

|

|

|

| Property and

equipment, net |

|

159 |

|

|

|

172 |

|

| Intangible assets,

net |

|

9,972 |

|

|

|

11,671 |

|

| Operating lease

right-of-use assets, and other |

|

1,422 |

|

|

|

332 |

|

|

Total assets |

$ |

41,904 |

|

|

$ |

43,428 |

|

|

|

|

|

|

|

|

|

|

|

|

Liabilities and Stockholders' Deficit |

|

|

|

| Current

liabilities: |

|

|

|

|

Accounts payable and accrued expenses and other current

liabilities |

$ |

11,273 |

|

|

$ |

12,676 |

|

|

Current portion of long-term debt |

|

3,449 |

|

|

|

3,321 |

|

|

Current portion of revenue interest obligation |

|

4,400 |

|

|

|

11,741 |

|

|

Contingent liability for legal proceedings |

|

20,198 |

|

|

|

15,024 |

|

|

Current operating lease liabilities |

|

488 |

|

|

|

275 |

|

|

Total current liabilities |

|

39,808 |

|

|

|

43,037 |

|

|

|

|

|

|

| Long-term

debt |

|

18,873 |

|

|

|

20,356 |

|

| Long-term revenue

interest obligation |

|

6,972 |

|

|

|

5,360 |

|

| Warrant

liability |

|

39,018 |

|

|

|

12,760 |

|

| Other long-term

liabilities |

|

1,571 |

|

|

|

515 |

|

|

Total liabilities |

|

106,242 |

|

|

|

82,028 |

|

|

|

|

|

|

| Stockholders'

equity (deficit): |

|

|

|

| Common stock |

|

28 |

|

|

|

23 |

|

| Additional paid-in

capital |

|

157,452 |

|

|

|

137,021 |

|

| Accumulated

deficit |

|

(221,818 |

) |

|

|

(175,644 |

) |

|

Total stockholders' equity (deficit) |

|

(64,338 |

) |

|

|

(38,600 |

) |

|

Total liabilities and stockholders' equity |

$ |

41,904 |

|

|

$ |

43,428 |

|

|

|

|

|

|

|

|

|

ELUTIA INC. |

|

CONSOLIDATED STATEMENT OF OPERATIONS |

|

(Unaudited, in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

6,291 |

|

|

$ |

6,351 |

|

|

$ |

12,985 |

|

|

$ |

12,743 |

|

| Cost of goods sold |

|

3,492 |

|

|

|

3,637 |

|

|

|

7,343 |

|

|

|

6,655 |

|

|

Gross profit |

|

2,799 |

|

|

|

2,714 |

|

|

|

5,642 |

|

|

|

6,088 |

|

| |

|

|

|

|

|

|

|

| Operating expenses: |

|

|

|

|

|

|

|

|

Sales and marketing |

|

3,330 |

|

|

|

3,022 |

|

|

|

6,639 |

|

|

|

7,713 |

|

|

General and administrative |

|

4,689 |

|

|

|

3,861 |

|

|

|

9,745 |

|

|

|

7,381 |

|

|

Research and development |

|

1,001 |

|

|

|

869 |

|

|

|

2,173 |

|

|

|

2,460 |

|

|

FiberCel litigation costs |

|

2,289 |

|

|

|

1,271 |

|

|

|

4,074 |

|

|

|

3,182 |

|

|

Total operating expenses |

|

11,309 |

|

|

|

9,023 |

|

|

|

22,631 |

|

|

|

20,736 |

|

|

Loss from operations |

|

(8,510 |

) |

|

|

(6,309 |

) |

|

|

(16,989 |

) |

|

|

(14,648 |

) |

| |

|

|

|

|

|

|

|

| Interest expense |

|

1,267 |

|

|

|

1,409 |

|

|

|

2,580 |

|

|

|

2,839 |

|

| Other (income) expense,

net |

|

18,594 |

|

|

|

- |

|

|

|

26,788 |

|

|

|

- |

|

|

Loss before provision of income taxes |

|

(28,371 |

) |

|

|

(7,718 |

) |

|

|

(46,357 |

) |

|

|

(17,487 |

) |

| |

|

|

|

|

|

|

|

| Provision for income

taxes |

|

(11 |

) |

|

|

12 |

|

|

|

(3 |

) |

|

|

24 |

|

| Net loss from continuing

operations |

|

(28,360 |

) |

|

|

(7,730 |

) |

|

|

(46,354 |

) |

|

|

(17,511 |

) |

| Income (loss) from

discontinued operations |

|

180 |

|

|

|

(2,891 |

) |

|

|

180 |

|

|

|

(1,084 |

) |

| Net Loss |

|

(28,180 |

) |

|

|

(10,621 |

) |

|

|

(46,174 |

) |

|

|

(18,595 |

) |

| |

|

|

|

|

|

|

|

| Net loss from continuing

operations per share |

|

|

|

|

|

|

|

|

basic and diluted |

$ |

(1.14 |

) |

|

$ |

(0.48 |

) |

|

$ |

(1.90 |

) |

|

$ |

(1.08 |

) |

| Net income (loss) from

discontinued operations per share |

|

|

|

|

|

|

|

|

basic and diluted |

$ |

0.01 |

|

|

$ |

(0.18 |

) |

|

$ |

0.01 |

|

|

$ |

(0.07 |

) |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

| Weighted average common shares

outstanding - |

|

|

|

|

|

|

|

|

basic and diluted |

|

24,900,167 |

|

|

|

16,223,919 |

|

|

|

24,408,651 |

|

|

|

16,208,905 |

|

| |

|

|

|

|

|

|

|

|

ELUTIA INC. |

|

|

NON-GAAP RECONCILIATIONS OF ADJUSTEDGROSS

PROFIT AND ADJUSTED GROSS MARGIN |

|

|

(Unaudited, in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net sales |

$ |

6,291 |

|

|

$ |

6,351 |

|

|

$ |

12,985 |

|

|

$ |

12,743 |

|

|

| Gross profit |

|

2,799 |

|

|

|

2,714 |

|

|

|

5,642 |

|

|

|

6,088 |

|

|

|

Intangible asset amortization expense |

|

849 |

|

|

|

849 |

|

|

|

1,699 |

|

|

|

1,699 |

|

|

| Adjusted gross profit

(Non-GAAP) |

$ |

3,648 |

|

|

$ |

3,563 |

|

|

$ |

7,341 |

|

|

$ |

7,787 |

|

|

| Gross margin |

|

44.5 |

% |

|

|

42.7 |

% |

|

|

43.5 |

% |

|

|

47.8 |

% |

|

| Adjusted gross margin

percentage (Non-GAAP) |

|

58.0 |

% |

|

|

56.1 |

% |

|

|

56.5 |

% |

|

|

61.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

ELUTIA INC. |

|

|

NON-GAAP RECONCILIATIONS OFEBITDA AND

ADJUSTED EBITDA |

|

|

(Unaudited, in thousands, except share and per share

data) |

|

|

|

|

|

|

|

|

|

|

|

| |

Three months ended June 30, |

|

Six months ended June 30, |

|

|

|

|

2024 |

|

|

|

2023 |

|

|

|

2024 |

|

|

|

2023 |

|

|

|

|

|

|

|

|

|

|

|

|

| Net loss |

$ |

(28,180 |

) |

|

$ |

(10,621 |

) |

|

$ |

(46,174 |

) |

|

$ |

(18,595 |

) |

|

| Interest expense(1) |

|

1,267 |

|

|

|

1,409 |

|

|

|

2,580 |

|

|

|

2,839 |

|

|

| Provision (benefit) for income

taxes |

|

(11 |

) |

|

|

12 |

|

|

|

(3 |

) |

|

|

24 |

|

|

| Depreciation and

amortization |

|

862 |

|

|

|

943 |

|

|

|

1,726 |

|

|

|

1,880 |

|

|

| Earnings before interest,

taxes, depreciation and amortization (“EBITDA”) (Non-GAAP) |

|

(26,062 |

) |

|

|

(8,257 |

) |

|

|

(41,871 |

) |

|

|

(13,852 |

) |

|

| Income from discontinued

operations |

|

(180 |

) |

|

|

2,891 |

|

|

|

(180 |

) |

|

|

1,084 |

|

|

| Stock-based compensation |

|

2,711 |

|

|

|

672 |

|

|

|

4,909 |

|

|

|

1,351 |

|

|

| FiberCel litigation

costs(2) |

|

2,289 |

|

|

|

1,271 |

|

|

|

4,074 |

|

|

|

3,182 |

|

|

| Loss on revaluation of

warranty liability(3) |

|

18,337 |

|

|

|

- |

|

|

|

27,974 |

|

|

|

- |

|

|

| Gain on revaluation of revenue

interest obligation(4) |

|

- |

|

|

|

- |

|

|

|

(1,443 |

) |

|

|

- |

|

|

| Adjusted EBITDA

(Non-GAAP) |

$ |

(2,905 |

) |

|

$ |

(3,423 |

) |

|

$ |

(6,537 |

) |

|

$ |

(8,235 |

) |

|

|

(1) |

Represents interest expense recorded on all outstanding long-term

debt as well as the revenue interest obligation. |

|

(2) |

Represents FiberCel litigation

costs consisting primarily of legal fees and the estimated and

actual costs to resolve the outstanding FiberCel litigation cases

offset by the estimated amounts recoverable and recovered under

insurance, indemnity and contribution agreements for such

costs. |

|

(3) |

Represents non-cash expense

attributable to the revaluation of Common Warrants and Prefunded

Warrants issued in connection with a private offering of Class A

common stock on September 21, 2023. |

|

(4) |

Represents the gain on the

revaluation of the revenue interest obligation. At each reporting

period, the value of the revenue interest obligation is re-measured

based on current estimates of future payments, with changes to be

recorded in the consolidated statements of operations using the

catch-up method. |

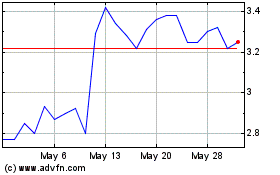

Elutia (NASDAQ:ELUT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Elutia (NASDAQ:ELUT)

Historical Stock Chart

From Nov 2023 to Nov 2024