Dyne Therapeutics Announces Proposed Public Offering of Common Stock

May 20 2024 - 4:01PM

Dyne Therapeutics, Inc. (Nasdaq: DYN), a clinical-stage muscle

disease company focused on advancing innovative life-transforming

therapeutics for people living with genetically driven diseases,

today announced that it has commenced an underwritten public

offering of $300,000,000 of shares of its common stock. Dyne also

intends to grant the underwriters a 30-day option to purchase up to

an additional $45,000,000 of shares of its common stock. All of the

shares in the proposed offering are to be sold by Dyne.

Morgan Stanley, Jefferies, Stifel and Guggenheim Securities are

acting as joint book-running managers for the offering. Oppenheimer

& Co. and Raymond James are acting as co-managers for the

offering. The proposed offering is subject to market and other

conditions, and there can be no assurance as to whether or when the

offering may be completed, or as to the actual size or terms of the

offering.

The proposed offering is being made pursuant to a shelf

registration statement on Form S-3 that was previously filed with

the Securities and Exchange Commission (“SEC”) on March 5, 2024 and

became automatically effective upon filing. This offering will be

made only by means of a prospectus supplement and accompanying

prospectus that form a part of the registration statement. A

preliminary prospectus supplement relating to and describing the

terms of the offering is expected to be filed with the SEC and, if

and when filed, copies of the preliminary prospectus supplement

relating to the offering may be obtained for free by visiting the

SEC’s website at www.sec.gov. Copies of the preliminary prospectus

supplement and the accompanying prospectus may also be obtained by

contacting: Morgan Stanley & Co. LLC, Attention: Prospectus

Department, 180 Varick Street, 2nd Floor, New York, NY 10014, or by

email at prospectus@morganstanley.com; Jefferies LLC, Attention:

Equity Syndicate Prospectus Department, 520 Madison Avenue, New

York, NY 10022, by telephone at (877) 821-7388, or by email at

Prospectus_Department@Jefferies.com; Stifel, Nicolaus &

Company, Incorporated, Attention: Prospectus Department, One

Montgomery Street, Suite 3700, San Francisco, CA 94104, by

telephone at (415) 364-2720 or by email at

syndprospectus@stifel.com; or Guggenheim Securities, LLC,

Attention: Equity Syndicate Department, 330 Madison Avenue, 8th

Floor, New York, NY 10017, by telephone at (212) 518-9544, or by

email at GSEquityProspectusDelivery@guggenheimpartners.com. The

final terms of the offering will be disclosed in a final prospectus

supplement to be filed with the SEC.

This press release shall not constitute an offer to sell, or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Dyne Therapeutics

Dyne Therapeutics is a clinical-stage muscle disease company

focused on advancing innovative life-transforming therapeutics for

people living with genetically driven diseases. With its

proprietary FORCE™ platform, Dyne is developing modern

oligonucleotide therapeutics that are designed to overcome

limitations in delivery to muscle tissue. Dyne has a broad pipeline

for serious muscle diseases, including clinical programs for

myotonic dystrophy type 1 (DM1) and Duchenne muscular dystrophy

(DMD) and a preclinical program for facioscapulohumeral muscular

dystrophy (FSHD).

Forward-Looking Statements

This press release contains forward-looking statements that

involve substantial risks and uncertainties. All statements, other

than statements of historical facts, contained in this press

release, including statements relating to the proposed underwritten

public offering, the anticipated terms of the proposed offering,

market and other conditions relating to the offering, constitute

forward-looking statements within the meaning of The Private

Securities Litigation Reform Act of 1995. The words “anticipate,”

“believe,” “continue,” “could,” “estimate,” “expect,”

“intend,” “may,” “might,” “objective,” “ongoing,” “plan,”

“predict,” “project,” “potential,” “should,” or “would,” or the

negative of these terms, or other comparable terminology are

intended to identify forward-looking statements, although not all

forward-looking statements contain these identifying words. Dyne

may not actually achieve the plans, intentions or expectations

disclosed in these forward-looking statements, and you should not

place undue reliance on these forward-looking statements. Actual

results or events could differ materially from the plans,

intentions and expectations disclosed in these forward-looking

statements as a result of various important factors, including: the

uncertainties related to market conditions and the completion of

the public offering on the anticipated terms or at all and other

factors discussed in the “Risk Factors” section of the preliminary

prospectus supplement to be filed with the SEC, as well as the

risks and uncertainties identified in Dyne’s filings with the SEC,

including Dyne’s most recent Form 10-Q and in subsequent filings

Dyne may make with the SEC. In addition, the forward-looking

statements included in this press release represent Dyne’s views as

of the date of this press release. Dyne anticipates that subsequent

events and developments will cause its views to change. However,

while Dyne may elect to update these forward-looking statements at

some point in the future, it specifically disclaims any obligation

to do so. These forward-looking statements should not be relied

upon as representing Dyne’s views as of any date subsequent to the

date of this press release.

Contacts:

InvestorsAmy Reillyareilly@dyne-tx.com

857-341-1203

MediaStacy

Nartkersnartker@dyne-tx.com781-317-1938

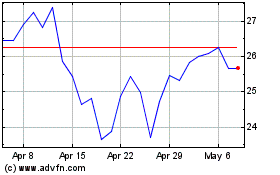

Dyne Therapeutics (NASDAQ:DYN)

Historical Stock Chart

From Oct 2024 to Nov 2024

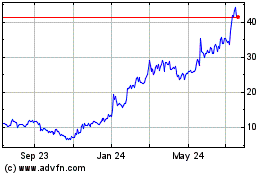

Dyne Therapeutics (NASDAQ:DYN)

Historical Stock Chart

From Nov 2023 to Nov 2024