Third Quarter Revenue of $638.8 Million, up

0.9% year-over-year on an as reported and constant currency

basis

GAAP Operating Margin of 20.0% and Non-GAAP

Operating Margin of 36.2%

Net Cash Provided by Operating Activities of

$274.2 Million and Free Cash Flow of $270.1 Million

Dropbox, Inc. (NASDAQ: DBX), today announced financial results

for its third quarter ended September 30, 2024.

“As we've shared over the last year, we're in a transitional

period as a company and we continue to face a challenging

environment in 2024. We recently announced a reduction in our

workforce to both increase efficiency in and strengthen our core

business, and accelerate growth in our new bets, like Dropbox

Dash,” said Dropbox Co-Founder and Chief Executive Officer Drew

Houston. “As the market opportunity heats up, we can leverage our

large installed base, trusted brand, and scaled infrastructure to

deliver on our next phase of growth. I’m excited about the

opportunity to reimagine how we solve our customers' biggest

problems for the cloud-native, AI-powered world.”

Third Quarter Fiscal 2024 Results

- Total revenue was $638.8 million, an increase of 0.9% from the

same period last year on an as reported and constant currency

basis.(1)

- Total ARR was $2.579 billion, an increase of 2.1% from the same

period last year. On a constant currency basis, year-over-year

growth would have been 1.4%.(2) Total ARR increased $5.8 million

quarter-over-quarter.

- Paying users was 18.24 million, as compared to 18.17 million

for the same period last year. Average revenue per paying user was

$139.05, as compared to $138.71 for the same period last year.

Paying users increased 19,000 quarter-over-quarter.

- GAAP gross margin was 82.5%, as compared to 81.1% for the same

period last year. Non-GAAP gross margin was 84.0%, as compared to

82.6% for the same period last year. Effective January 1, 2024, the

Company changed the estimate of the useful lives of certain

infrastructure server and component assets, which are included in

property and equipment, net and are depreciated through cost of

revenue, from four to five years. The effect of this change in

estimate during the three months ended September 30, 2024 was a

reduction in depreciation expense of $6.9 million.(4)

- GAAP operating margin was 20.0%, as compared to 20.6% for the

same period last year. Non-GAAP operating margin was 36.2%, as

compared to 36.0% for the same period last year.

- GAAP net income was $106.7 million, as compared to $114.1

million for the same period last year. Non-GAAP net income was

$190.4 million, as compared to $194.1 million for the same period

last year.

- Net cash provided by operating activities was $274.2 million,

as compared to $255.9 million for the same period last year. Free

cash flow was $270.1 million, as compared to $246.5 million for the

same period last year.

- GAAP diluted net income per share attributable to common

stockholders was $0.34, as compared to $0.33 in the same period

last year. Non-GAAP diluted net income per share attributable to

common stockholders was $0.60, as compared to $0.56 in the same

period last year.(3)

- Cash, cash equivalents and short-term investments ended at

$890.8 million.

(1) We calculate constant currency revenue

growth rates by applying the prior period weighted average exchange

rates to current period results.

(2) We calculate total annual recurring

revenue ("Total ARR") as the number of users who have active paid

licenses for access to our platform as of the end of the period,

multiplied by their annualized subscription price to our platform.

We adjust our exchange rates used to calculate Total ARR on an

annual basis, at the beginning of each fiscal year. We calculate

constant currency Total ARR growth rates by applying the current

period exchange rate to prior period results.

(3) GAAP and Non-GAAP diluted net income

per share attributable to common stockholders is calculated based

upon 316.4 million and 346.0 million diluted weighted-average

shares of common stock for the three months ended September 30,

2024 and 2023, respectively.

(4) The impact from the change in our

estimate was calculated based on assets that existed as of the

effective date of the change and applying the revised estimated

useful lives prospectively.

Financial Outlook

Dropbox will provide forward-looking guidance in connection with

this quarterly earnings announcement on its conference call,

webcast, and on its investor relations website at

http://investors.dropbox.com.

Conference Call Information

Dropbox plans to host a conference call today to review its

third quarter financial results and to discuss its financial

outlook. This call is scheduled to begin at 2:00 p.m. PT / 5:00

p.m. ET and can be accessed by using the web link at

http://investors.dropbox.com.

Other Upcoming Events

- Tim Regan, Chief Financial Officer, will be attending the UBS

Global Technology Conference on Tuesday, December 3rd, 2024.

About Dropbox

Dropbox is the one place to keep life organized and keep work

moving. With more than 700 million registered users across

approximately 180 countries, we're on a mission to design a more

enlightened way of working. Dropbox is headquartered in San

Francisco, CA, and has employees around the world. For more

information on our mission and products, visit

http://dropbox.com.

Use of Non-GAAP Financial Measures

Reconciliations of non-GAAP financial measures to the most

directly comparable financial results as determined in accordance

with GAAP are included at the end of this press release following

the accompanying financial data. For a description of these

non-GAAP financial measures, including the reasons management uses

each measure, please see the section of the tables titled "About

Non-GAAP Financial Measures."

Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of 1995

including, among other things, our expectations regarding

distributed work and artificial intelligence and machine learning

trends, related market opportunities and our ability to capitalize

on those opportunities, as well as our ability to improve

shareholder returns. Words such as "believe," "may," "will,"

"estimate," "continue," "anticipate," "intend," "expect," "plans,"

and similar expressions are intended to identify forward-looking

statements. We have based these forward-looking statements largely

on our current expectations and projections about future events and

financial trends that we believe may affect our business, financial

condition, and results of operations. These forward-looking

statements speak only as of the date of this press release and are

subject to risks, uncertainties, and assumptions including, but not

limited to: (i) our ability to retain and upgrade paying users, and

increase our recurring revenue; (ii) our ability to attract new

users or convert registered users to paying users; (iii) our

expectations regarding general economic, political, and market

trends and their respective impacts on our business; (iv) impacts

to our financial results and business operations as a result of

pricing and packaging changes to our subscription plans; (v) our

future financial performance, including trends in revenue, costs of

revenue, gross profit or gross margin, operating expenses, paying

users, and free cash flow; (vi) our ability to achieve or maintain

profitability; (vii) our liability or other potential legal,

regulatory, or reputational consequences of any unauthorized access

to our data or our users’ content, including through privacy and

data security breaches; (viii) significant disruption of service on

our platform or loss of content; (ix) any decline in demand for our

platform or for content collaboration solutions in general; (x)

changes in the interoperability of our platform across devices,

operating systems, and third-party applications that we do not

control; (xi) competition in our markets; (xii) our ability to

respond to rapid technological changes, extend our platform,

develop new features or products, or gain market acceptance for

such new features or products; (xiii) our ability to improve

quality and ease of adoption of our new and enhanced product

experiences, features, and capabilities; (xiv) our ability to

manage our growth or plan for future growth; (xv) our various

acquisitions of businesses and the potential of such acquisitions

to require significant management attention, disrupt our business,

or dilute stockholder value; (xvi) our ability to attract, retain,

integrate, and manage key and other highly qualified personnel,

including as a result of our reduction in workforce announced in

October 2024 or our Virtual First model with an increasingly

distributed workforce; (xvii) our ability to realize the intended

benefits of our workforce reduction announced in October 2024,

(xviii) our capital allocation plans with respect to our stock

repurchase program and other investments; and (xix) the dual class

structure of our common stock and its effect of concentrating

voting control with certain stockholders who held our capital stock

prior to the completion of our initial public offering. Further

information on risks that could affect Dropbox’s results is

included in our filings with the Securities and Exchange Commission

("SEC"), including our Form 10-Q for the quarter ended June 30,

2024. Additional information will be made available in our

quarterly report on Form 10-Q for the quarter ended September 30,

2024 and other reports that we may file with the SEC from time to

time, which could cause actual results to vary from expectations.

If the risks materialize or assumptions prove incorrect, actual

results could differ materially from the results implied by these

forward-looking statements. Dropbox assumes no obligation to, and

does not currently intend to, update any such forward-looking

statements after the date of this release, except as required by

applicable law.

Dropbox, Inc.

Condensed Consolidated

Statements of Operations

(In millions, except per share

data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Revenue

$

638.8

$

633.0

$

1,904.6

$

1,866.6

Cost of revenue(1)(2)

111.5

119.6

324.3

356.5

Gross profit

527.3

513.4

1,580.3

1,510.1

Operating expenses:

Research and development(1)(2)

225.7

216.4

671.9

714.4

Sales and marketing(1)(2)

110.5

106.3

331.8

346.4

General and administrative(1)(2)

63.3

60.0

178.3

175.8

Net loss on real estate assets(3)

—

—

—

2.2

Total operating expenses

399.5

382.7

1,182.0

1,238.8

Income from operations

127.8

130.7

398.3

271.3

Interest income, net

3.8

5.0

15.8

12.6

Other income (expense), net

1.1

(0.2

)

3.3

(1.8

)

Income before income taxes

132.7

135.5

417.4

282.1

Provision for income taxes

(26.0

)

(21.4

)

(67.9

)

(55.8

)

Net income

$

106.7

$

114.1

$

349.5

$

226.3

Basic net income per share

$

0.34

$

0.34

$

1.08

$

0.66

Diluted net income per share

$

0.34

$

0.33

$

1.07

$

0.65

Weighted-average shares used in computing

net income per share attributable to common stockholders, basic

314.5

339.2

323.9

342.5

Weighted-average shares used in computing

net income per share attributable to common stockholders,

diluted

316.4

346.0

327.1

345.9

(1) Includes stock-based compensation

expense as follows (in millions):

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Cost of revenue

$

5.8

$

5.8

$

17.0

$

17.6

Research and development(4)

66.7

58.6

186.3

178.9

Sales and marketing

6.1

5.2

17.4

17.0

General and administrative

13.7

14.2

40.1

41.6

Total stock-based compensation

$

92.3

$

83.8

$

260.8

$

255.1

(2) Includes expenses related to our 2023

reduction in workforce such as severance, benefits and other

related items during the three and nine months ended September 30,

2023.

(3) Includes impairment charges related to

real estate assets as a result of our Virtual First work model.

(4) On March 15, 2023, the former

President resigned, resulting in the reversal of $6.7 million in

stock-based compensation expense. Of the total amount reversed,

$4.4 million related to expense recognized prior to January 1,

2023.

Dropbox, Inc.

Condensed Consolidated Balance

Sheets

(In millions)

(Unaudited)

As of

September 30, 2024

December 31, 2023

Assets

Current assets:

Cash and cash equivalents

$

517.6

$

614.9

Short-term investments

373.2

741.1

Trade and other receivables, net

69.5

68.7

Prepaid expenses and other current

assets

85.2

91.9

Total current assets

1,045.5

1,516.6

Property and equipment, net

346.3

309.2

Operating lease right-of-use asset

167.9

183.8

Intangible assets, net

62.2

58.1

Goodwill

442.7

402.2

Deferred tax assets

458.1

460.4

Other assets

54.0

53.2

Total assets

$

2,576.7

$

2,983.5

Liabilities and stockholders'

deficit

Current liabilities:

Accounts payable

$

35.5

$

38.5

Accrued and other current liabilities

147.1

155.2

Accrued compensation and benefits

90.7

109.2

Operating lease liability

68.8

57.4

Finance lease obligation

120.2

116.2

Deferred revenue

739.8

725.0

Total current liabilities

1,202.1

1,201.5

Operating lease liability, non-current

264.9

310.7

Finance lease obligation, non-current

188.6

168.5

Convertible senior notes, net,

non-current

1,380.6

1,377.8

Other non-current liabilities

86.6

90.8

Total liabilities

3,122.8

3,149.3

Stockholders' deficit:

Additional paid-in-capital

2,454.5

2,598.0

Accumulated deficit

(2,993.0

)

(2,742.3

)

Accumulated other comprehensive loss

(7.6

)

(21.5

)

Total stockholders' deficit

(546.1

)

(165.8

)

Total liabilities and stockholders'

deficit

$

2,576.7

$

2,983.5

Dropbox, Inc.

Condensed Consolidated

Statements of Cash Flows

(In millions)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended September

30,

2024

2023

2024

2023

Cash flows from operating

activities

Net income

$

106.7

$

114.1

$

349.5

$

226.3

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization

35.3

41.8

99.1

127.0

Stock-based compensation

92.3

83.8

260.8

255.1

Net loss on real estate assets

—

—

—

2.2

Amortization of debt issuance costs

1.1

1.1

3.2

3.2

Amortization of deferred commissions

7.7

9.4

22.6

30.2

Non-cash operating lease expense

9.0

10.5

27.1

34.0

Deferred taxes

2.7

4.2

3.2

11.7

Other

(5.3

)

1.8

(5.2

)

2.3

Changes in operating assets and

liabilities:

Trade and other receivables, net

(1.5

)

(4.1

)

(0.4

)

(10.6

)

Prepaid expenses and other current

assets

10.5

(6.4

)

(11.2

)

(24.0

)

Other assets

1.3

2.8

3.3

6.5

Accounts payable

(2.0

)

0.5

(3.8

)

7.4

Accrued and other current liabilities

5.7

(1.7

)

(12.3

)

(9.3

)

Accrued compensation and benefits

22.8

19.9

(19.2

)

(45.2

)

Deferred revenue

(2.8

)

0.2

13.8

31.5

Other non-current liabilities

1.1

(3.0

)

3.5

(10.6

)

Operating lease liabilities

(10.4

)

(19.1

)

(38.8

)

(54.4

)

Tenant improvement allowance

reimbursement

—

0.1

—

0.1

Cash paid for lease termination

—

—

(14.9

)

—

Net cash provided by operating

activities

274.2

255.9

680.3

583.4

Cash flows from investing

activities

Capital expenditures

(4.1

)

(9.4

)

(19.2

)

(14.3

)

Business combinations, net of cash

acquired

(36.7

)

—

(57.8

)

—

Purchases of short-term investments

—

(64.7

)

(62.3

)

(112.6

)

Proceeds from sales of short-term

investments

105.7

4.2

164.3

335.8

Proceeds from maturities of short-term

investments

76.7

77.7

283.2

197.1

Other

11.5

2.5

21.8

11.2

Net cash provided by investing

activities

153.1

10.3

330.0

417.2

Cash flows from financing

activities

Payments of debt issuance costs

—

—

—

(0.1

)

Payments for taxes related to net share

settlement of restricted stock units and awards

(33.2

)

(34.4

)

(109.2

)

(100.6

)

Proceeds from issuance of common stock,

net of taxes withheld

0.2

1.2

0.3

2.4

Principal payments on finance lease

obligations

(32.3

)

(31.3

)

(96.2

)

(95.2

)

Common stock repurchases

(348.7

)

(104.1

)

(888.3

)

(433.7

)

Payment of acquisition-related

holdback

(17.1

)

—

(17.1

)

—

Net cash used in financing

activities

(431.1

)

(168.6

)

(1,110.5

)

(627.2

)

Effect of exchange rate changes on cash

and cash equivalents

6.3

(3.6

)

2.9

(1.9

)

Change in cash and cash equivalents

2.5

94.0

(97.3

)

371.5

Cash and cash equivalents - beginning

of period

515.1

510.3

614.9

232.8

Cash and cash equivalents - end of

period

$

517.6

$

604.3

$

517.6

$

604.3

Supplemental cash flow data:

Property and equipment acquired under

finance leases

$

58.5

$

26.2

$

120.4

$

94.1

Dropbox, Inc.

Three Months Ended September

30, 2024

Reconciliation of GAAP to

Non-GAAP results

(In millions, except for

percentages, which may not foot due to rounding)

(Unaudited)

GAAP

Stock-based

compensation

Acquisition-related and other

expenses

Intangibles

amortization

Non-GAAP

Cost of revenue

$

111.5

$

(5.8

)

$

—

$

(3.6

)

$

102.1

Cost of revenue margin

17.5

%

(0.9

%)

—

%

(0.6

%)

16.0

%

Gross profit

527.3

5.8

—

3.6

536.7

Gross margin

82.5

%

0.9

%

—

%

0.6

%

84.0

%

Research and development

225.7

(66.7

)

(3.6

)

—

155.4

Research and development margin

35.3

%

(10.4

%)

(0.6

%)

—

%

24.3

%

Sales and marketing

110.5

(6.1

)

—

(3.4

)

101.0

Sales and marketing margin

17.3

%

(1.0

%)

—

%

(0.5

%)

15.8

%

General and administrative

63.3

(13.7

)

(0.8

)

—

48.8

General and administrative margin

9.9

%

(2.1

%)

(0.1

%)

—

%

7.6

%

Income from operations

$

127.8

$

92.3

$

4.4

$

7.0

$

231.5

Operating margin

20.0

%

14.4

%

0.7

%

1.1

%

36.2

%

Dropbox, Inc.

Three Months Ended September

30, 2023

Reconciliation of GAAP to

Non-GAAP results

(In millions, except for

percentages, which may not foot due to rounding)

(Unaudited)

GAAP

Stock-based

compensation

Acquisition- related and other

expenses

Intangibles

amortization

Workforce reduction

expense(1)

Non-GAAP

Cost of revenue

$

119.6

$

(5.8

)

$

—

$

(3.7

)

$

(0.2

)

$

109.9

Cost of revenue margin

18.9

%

(0.9

%)

—

%

(0.6

%)

—

%

17.4

%

Gross profit

513.4

5.8

—

3.7

0.2

523.1

Gross margin

81.1

%

0.9

%

—

%

0.6

%

—

%

82.6

%

Research and development

216.4

(58.6

)

(4.6

)

—

(0.6

)

152.6

Research and development margin

34.2

%

(9.3

%)

(0.7

%)

—

%

(0.1

%)

24.1

%

Sales and marketing

106.3

(5.2

)

—

(3.4

)

(0.3

)

97.4

Sales and marketing margin

16.8

%

(0.8

%)

—

%

(0.5

%)

—

%

15.4

%

General and administrative

60.0

(14.2

)

—

—

(0.3

)

45.5

General and administrative margin

9.5

%

(2.2

%)

—

%

—

%

—

%

7.2

%

Income from operations

$

130.7

$

83.8

$

4.6

$

7.1

$

1.4

$

227.6

Operating margin

20.6

%

13.2

%

0.7

%

1.1

%

0.2

%

36.0

%

(1) Includes expenses related to our 2023

reduction in workforce such as severance, benefits and other

related items.

Dropbox, Inc.

Nine Months Ended September

30, 2024

Reconciliation of GAAP to

Non-GAAP results

(In millions, except for

percentages, which may not foot due to rounding)

(Unaudited)

GAAP

Stock-based

compensation

Acquisition-related and other

expenses

Intangibles

amortization

Non-GAAP

Cost of revenue

$

324.3

$

(17.0

)

$

—

$

(9.5

)

$

297.8

Cost of revenue margin

17.0

%

(0.9

%)

—

%

(0.5

%)

15.6

%

Gross profit

1,580.3

17.0

—

9.5

1,606.8

Gross margin

83.0

%

0.9

%

—

%

0.5

%

84.4

%

Research and development

671.9

(186.3

)

(9.9

)

—

475.7

Research and development margin

35.3

%

(9.8

%)

(0.5

%)

—

%

25.0

%

Sales and marketing

331.8

(17.4

)

—

(9.5

)

304.9

Sales and marketing margin

17.4

%

(0.9

%)

—

%

(0.5

%)

16.0

%

General and administrative

178.3

(40.1

)

(2.1

)

—

136.1

General and administrative margin

9.4

%

(2.1

%)

(0.1

%)

—

%

7.1

%

Income from operations

$

398.3

$

260.8

$

12.0

$

19.0

$

690.1

Operating margin

20.9

%

13.7

%

0.6

%

1.0

%

36.2

%

Dropbox, Inc.

Nine Months Ended September

30, 2023

Reconciliation of GAAP to

Non-GAAP results

(In millions, except for

percentages, which may not foot due to rounding)

(Unaudited)

GAAP

Stock-based

compensation

Acquisition- related and other

expenses

Intangibles

amortization

Net loss on real estate

assets(1)

Workforce reduction

expense(2)

Non-GAAP

Cost of revenue

$

356.5

$

(17.6

)

$

—

$

(10.9

)

$

—

$

(2.9

)

$

325.1

Cost of revenue margin

19.1

%

(0.9

%)

—

%

(0.6

%)

—

%

(0.2

%)

17.4

%

Gross profit

1,510.1

17.6

—

10.9

—

2.9

1,541.5

Gross margin

80.9

%

0.9

%

—

%

0.6

%

—

%

0.2

%

82.6

%

Research and development

714.4

(178.9

)

(17.9

)

—

—

(27.6

)

490.0

Research and development margin

38.3

%

(9.6

%)

(1.0

%)

—

%

—

%

(1.5

%)

26.3

%

Sales and marketing

346.4

(17.0

)

(8.3

)

(10.2

)

—

(6.6

)

304.3

Sales and marketing margin

18.6

%

(0.9

%)

(0.4

%)

(0.5

%)

—

%

(0.4

%)

16.3

%

General and administrative

175.8

(41.6

)

(0.4

)

—

—

(1.8

)

132.0

General and administrative margin

9.4

%

(2.2

%)

—

%

—

%

—

%

(0.1

%)

7.1

%

Net loss on real estate assets

2.2

—

—

—

(2.2

)

—

—

Net loss on real estate assets margin

0.1

%

—

%

—

%

—

%

(0.1

%)

—

%

—

%

Income from operations

$

271.3

$

255.1

$

26.6

$

21.1

$

2.2

$

38.9

$

615.2

Operating margin

14.5

%

13.7

%

1.4

%

1.1

%

0.1

%

2.1

%

33.0

%

(1) Includes impairment charges related to

real estate assets as a result of changes in the corporate real

estate market which has impacted our subleasing strategy in

conjunction with the Company's Virtual First model.

(2) Includes expenses related to our 2023

reduction in workforce such as severance, benefits and other

related items.

Dropbox, Inc.

Three and Nine Months Ended

September 30, 2024 and 2023

Reconciliation of GAAP net

income to Non-GAAP net income and Non-GAAP diluted net income per

share

(In millions, except per share

data)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

GAAP net income

$

106.7

$

114.1

$

349.5

$

226.3

Stock-based compensation

92.3

83.8

260.8

255.1

Acquisition-related and other expenses

4.4

4.6

12.0

26.6

Amortization of acquired intangible

assets

7.0

7.1

19.0

21.1

Net loss on real estate assets

—

—

—

2.2

Workforce reduction expense

—

1.4

—

38.9

Income tax effects of non-GAAP

adjustments

(20.0

)

(16.9

)

(60.1

)

(56.0

)

Non-GAAP net income

$

190.4

$

194.1

$

581.2

$

514.2

Non-GAAP diluted net income per share

$

0.60

$

0.56

$

1.78

$

1.49

Weighted-average shares used to compute

Non-GAAP diluted net income per share

316.4

346.0

327.1

345.9

Dropbox, Inc.

Three and Nine Months Ended

September 30, 2024 and 2023

Reconciliation of free cash

flow and supplemental cash flow disclosure

(In millions, except for

percentages)

(Unaudited)

Three Months Ended

September 30,

Nine Months Ended

September 30,

2024

2023

2024

2023

Free cash flow reconciliation:

Net cash provided by operating

activities

$

274.2

$

255.9

$

680.3

$

583.4

Less:

Capital expenditures

(4.1

)

(9.4

)

(19.2

)

(14.3

)

Free cash flow

$

270.1

$

246.5

$

661.1

$

569.1

Free cash flow margin

42.3

%

38.9

%

34.7

%

30.5

%

Supplemental disclosures:

Key employee holdback payments related to

acquisitions(1)

$

0.8

$

0.5

$

1.8

$

21.9

Payments related to workforce

reduction(2)

$

—

$

4.9

$

—

$

38.9

Cash paid for lease termination(3)

$

—

$

—

$

14.9

$

—

(1) Includes payments related to employee

holdbacks pertaining to our acquisitions. The related expenses are

recognized within research and development expenses over the

required service period during the three and nine months ended

September 30, 2024.

(2) Includes payments made related to our

2023 reduction in workforce such as severance, benefits, and other

related items.

(3) Includes the second tranche payment

made for the partial termination of our lease for our San

Francisco, California corporate headquarters.

About Non-GAAP Financial Measures

To provide investors and others with additional information

regarding Dropbox's results, we have disclosed the following

non-GAAP financial measures: revenue growth and Total ARR growth

excluding foreign exchange effect, which we refer to as on a

constant currency basis, non-GAAP cost of revenue, non-GAAP gross

profit, non-GAAP operating expenses (including research and

development, sales and marketing and general and administrative),

non-GAAP income from operations, non-GAAP net income, free cash

flow ("FCF") and non-GAAP diluted net income per share. Dropbox has

provided a reconciliation of each non-GAAP financial measure used

in this earnings release to the most directly comparable GAAP

financial measure. Non-GAAP cost of revenue, gross profit,

operating expenses, income from operations, and net income differ

from GAAP in that they exclude stock-based compensation expense,

amortization of acquired intangible assets, other

acquisition-related expenses, which include third-party diligence

costs and expenses related to key employee holdback agreements, net

loss on real estate assets, expenses related to our reduction in

workforce and the income tax effect of the aforementioned

adjustments. FCF differs from GAAP net cash provided by operating

activities in that it treats capital expenditures as a reduction to

net cash provided by operating activities. Free cash flow margin is

calculated as FCF divided by revenue. In order to present revenue

on a constant currency basis for the quarter ended September 30,

2024, Dropbox calculates constant currency revenue growth rates by

applying the prior period weighted average exchange rates to

current period results. Dropbox calculates constant currency Total

ARR growth rates by applying the current period rate to prior

period results. Dropbox presents constant currency information to

provide a framework for assessing how our underlying business

performed excluding the effect of foreign currency rate

fluctuations.

Dropbox's management uses these non-GAAP financial measures to

understand and compare operating results across accounting periods,

for internal budgeting and forecasting purposes, for short and

long-term operating plans, and to evaluate Dropbox's financial

performance and the ability to generate cash from operations.

Management believes these non-GAAP financial measures reflect

Dropbox's ongoing business in a manner that allows for meaningful

period-to-period comparisons and analysis of trends in Dropbox's

business, as they exclude expenses that are not reflective of

ongoing operating results. Management also believes that these

non-GAAP financial measures provide useful supplemental information

to investors and others in understanding and evaluating Dropbox's

operating results and future prospects in the same manner as

management and in comparing financial results across accounting

periods and to those of peer companies.

We believe that the non-GAAP financial measures, non-GAAP cost

of revenue, gross profit, operating expenses, income from

operations, net income, and diluted net income per share are

meaningful to investors because they help identify underlying

trends in our business that could otherwise be masked by the effect

of the expenses that we exclude.

We believe that FCF is an indicator of our liquidity over the

long term and provides useful information regarding cash provided

by operating activities and cash used for investments in property

and equipment required to maintain and grow our business. FCF is

presented for supplemental informational purposes only and should

not be considered a substitute for financial information presented

in accordance with GAAP. FCF has limitations as an analytical tool,

and it should not be considered in isolation or as a substitute for

analysis of other GAAP financial measures, such as net cash

provided by operating activities. Some of the limitations of FCF

are that FCF does not reflect our future contractual commitments,

excludes investments made to acquire assets under finance leases,

includes capital expenditures, and may be calculated differently by

other companies in our industry, limiting its usefulness as a

comparative measure.

The use of non-GAAP cost of revenue, gross profit, operating

expenses, income from operations, net income, free cash flow, and

diluted net income per share measures has certain limitations as

they do not reflect all items of income, expense, and cash

expenditures, as applicable, that affect Dropbox's operations.

Dropbox mitigates these limitations by reconciling the non-GAAP

financial measures to the most comparable GAAP financial measures.

Additionally, we have provided supplemental disclosures in our

reconciliation of net cash provided by operating activities to free

cash flow to include expenses related to key employee holdback

payments related to our various acquisitions, payments related to

workforce reduction and cash paid for lease termination. These

non-GAAP financial measures should be considered in addition to,

not as a substitute for or in isolation from, measures prepared in

accordance with GAAP. Further, these non-GAAP measures may differ

from the non-GAAP information used by other companies, including

peer companies, and therefore comparability may be limited.

Management encourages investors and others to review Dropbox's

financial information in its entirety and not rely on a single

financial measure.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241107415014/en/

Investors: Peter Stabler ir@dropbox.com or Media:

Maddy Pelton press@dropbox.com

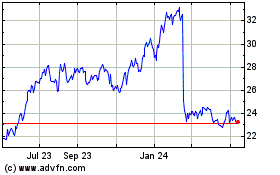

Dropbox (NASDAQ:DBX)

Historical Stock Chart

From Jan 2025 to Feb 2025

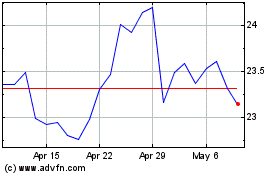

Dropbox (NASDAQ:DBX)

Historical Stock Chart

From Feb 2024 to Feb 2025