DLocal Limited (“dLocal”, “we”, “us”, and “our”) (NASDAQ:DLO), a

technology - first payments platform today announced its financial

results for the second quarter ended June 30, 2024.

We continue to see strong growth in our

business, achieving another quarterly record of $6.0 billion of TPV

during the second quarter of 2024, an increase of nearly 40%

year-over-year. This occurred despite the tough comparison with

last year's 80% growth during the same period. The evolution of

this key metric demonstrates our continued ability to grow as we

gain share of wallet from our global merchant base and add new

merchants to the mix. It also underscores our unique value

proposition as a trusted partner for some of the largest and most

sophisticated global companies across emerging markets.

The TPV performance was good across multiple

verticals, including continued strong growth in the commerce,

on-demand delivery, and remittance verticals; accelerating growth

from SaaS and ride-hailing. This kind of sustained and well

diversified TPV growth, with a focused commitment to low-risk

high-reputation verticals, sets us up well for long-term success.

We believe that our year-over-year growth showcases a unique in

class combination of growth while focusing on reputable verticals,

which sets us apart from relevant comps base, who either grow less,

over index high-risk verticals, or do both.

Net take rates have held up sequentially,

despite unfavorable events, like repricing by our largest merchant

at the beginning of the year, material currency devaluations in

Nigeria and Egypt, and continued weakening across most emerging

markets currencies. The stable sequential net take rate and growing

TPV during the quarter translated to 11% quarter-over-quarter gross

profit growth.

Our OPEX, excluding non-cash share-based

compensation, grew by only $1 million sequentially, after previous

quarters of sequential growth above $4 million, as we adjusted our

cash spend to the weaker gross profit. As mentioned previously,

there is a limit to how much we are willing to defend margins in

the short-term, as we are committed to certain investments, which

are crucial for our long-term success, particularly those in our

engineering pool, back-office capabilities and behind our license

portfolio. But, to balance this out, we are always revising other

discretionary spending to make sure it matches our topline

performance and is aligned with our general philosophy of

frugality. Consequently, our Adjusted EBITDA reached $43 million,

reflecting our still lean structure and disciplined spending. Our

cash generation also accelerated versus the prior quarter, posting

a $35 million of Free Cash Flow from own funds, a conversion rate

of 77%, up $23 million and 7 percentage points compared to the

second quarter of 2023.

These highlights also come with certain

challenges that we are focused on rapidly addressing.

Year-over-year gross profit performance was flat, primarily due to

a 13% decline in LatAm. This decline was driven by (i) the

Argentine FX devaluation and (ii) the repricing by our largest

merchant in Brazil and Mexico. Despite stellar Africa and Asia

gross profit growth of 79% year-over-year, it did not suffice to

offset those two events.

Taking a step back from a short-term quarterly

prism, dLocal remains an incredibly strong company, with a

fantastic total addressable market, attractive business model and

extremely promising future, that at some point will be reflected in

capital market performance. To keep things in perspective:

- We maintain strong product market validation as witnessed by

almost 40% year-over-year and 14% quarter-over-quarter TPV

growth;

- Still run a high margin financial

model with Adjusted EBITDA to Gross Profit at 60%+ and ability to

scale from there to previous levels;

- Cash conversion is strong and

growing as EBITDA increased sequentially, with a cash conversion

close to 100% for the last twelve months.

When we analyze the potential of all this

compounded over time, it is hard to not be optimistic about our

future, despite the inherent challenges and volatility existent in

emerging markets. The long term future is bright, and our own

ability to execute is the most important factor.

Our optimism in the future is also reflected in

our capital allocation strategy. Our business has an attractive

cash generation profile, and we see upside in our stock as we grow

and scale; and as a consequence of this we have bought back stock

during the quarter at a rapid pace.

As known, emerging markets are inherently

volatile, which can, and often do, impact our short-term results.

However, our long-term view remains optimistic as stated earlier.

The quarterly bottom-up review of our pipeline and existing

contracts, where we project out probable market growth, and new

commercial opportunities on a merchant-by-merchant basis, gets us

to the following revised outlook for 2024:

- TPV of $24.5-26.5 billion; due to slower volume ramp-ups,

pipeline volume even more skewed towards Tier 0 merchants, and

weakening currencies in emerging markets

- Gross profit of $280-300 million; in addition to the reasons

outlined above, driven by increased local-to-local flows, and

- Adjusted EBITDA of $180-200 million, supporting crucial

long-term investments that enhance our value proposition and

internal controls

We continue to thrive across emerging markets,

embracing their complexities and delivering simple, effective

solutions to our merchants. Our focus remains on execution and

long-term growth. Our commitment to our merchants and our expertise

in these regions enable us to consistently win business from these

global merchants. As we scale, this growth will help mitigate

short-term volatility and dilute market fluctuations. Therefore, it

is crucial to continue focusing on TPV growth, increasing our share

of wallet, and adding new clients - all of which we have

consistently delivered since the company's inception, while driving

operational leverage in the business once we get through the

current disciplined investment cycle we are in.

We are thankful for the continued support and

confidence in our vision. We are committed to executing our

strategy and driving long-term value for our shareholders. We look

forward to updating you on our progress in the coming quarters.

Second quarter 2024 Financial

Highlights

- Total Payment Volume (“TPV”)

reached a record US$6.0 billion in the second quarter, up 38%

year-over-year compared to US$4.4 billion in the second quarter of

2023 and up 14% compared to US$5.3 billion in the first quarter of

2024.

- Revenues amounted to US$171.3

million, up 6% year-over-year compared to US$161.1 million in the

second quarter of 2023 and down 7% compared to US$184.4 million in

the first quarter of 2024. This quarter-over-quarter decline was

mostly driven by the currency devaluation in Nigeria and Egypt,

despite the healthy TPV growth.

- Gross profit was US$69.8 million in

the second quarter of 2024, down 1% compared to US$70.8 million in

the second quarter of 2023 and up 11% compared to US$63.0 million

in the first quarter of 2024. The improvement in gross profit

quarter-over-quarter was primarily due to (i) temporary FX dynamics

in Nigeria; (ii) positive performance of Argentina, Other LatAm and

Other Africa and Asia countries; and (iii) Brazil, with lower

processing costs following renegotiation with processors, and

change in payment mix, which partially offset the impact of key

merchant repricing (full impact in second quarter of 2024 versus

two months in first quarter of 2024).

- As a result, gross profit margin

was 41% in this quarter, compared to 44% in the second quarter of

2023 and 34% in the first quarter of 2024.

- Gross profit over TPV was at 1.2%

decreasing from 1.6% in the second quarter of 2023 and flat

compared to the first quarter of 2024, mainly due to FX dynamics in

Nigeria and Egypt and renegotiation with processors in Brazil,

which combined were sufficient to offset the incremental sequential

impact of the above-mentioned top merchant repricing..

- Operating income was US$30.2

million, down 37% compared to US$47.8 million in the second quarter

of 2023 and up 12% compared to US$26.9 million in the first quarter

of 2024, impacted by higher gross profit and disciplined OPEX

investment. In this context, operating expenses grew by 72%

year-over-year and 10% quarter-over-quarter, with a clear

allocation tilt towards investments focused on Product Development

& IT capabilities; coupled with investment to strengthen our

back-office capabilities for future growth. In addition, in the

second quarter of 2024, we recorded an extraordinary US$1.6 million

operating loss as we wrote-off certain amounts related to

merchants/processors off-boarded by dLocal.

- As a result, Adjusted EBITDA was

US$42.7 million , down 18% compared to US$52.0 million in the

second quarter of 2023 and up 16% compared to US$36.8 million in

the first quarter of 2024.

- Adjusted EBITDA margin was 25%,

compared to the 32% recorded in the second quarter of 2023 and 20%

in the first quarter of 2024. On the annual comparison, the

decrease is explained by the gross profit dynamics and our decision

to sustain many of the long-term investments, as previously

mentioned. Following the same trend, Adjusted EBITDA over gross

profit of 61% decreased compared to 74% in the second quarter of

2023 and increased compared to 58% in the first quarter of

2024.

- Net financial income was US$28.0

million, compared to US$7.5 million in the second quarter of 2023

and US$0.3 million in the first quarter of 2024.

- Effective income tax rate was 18%,

compared to 16% in the second quarter of 2023 and 29% in the first

quarter of 2024, closer to levels of previous quarters.

- Net income for the second quarter

of 2024 was US$46.2 million, or US$0.15 per diluted share, up 3%

compared to a profit of US$44.8 million, or US$0.15 per diluted

share, for the second quarter of 2023 and up 161% compared to a

profit of US$17.7 million, or US$0.06 per diluted share for the

first quarter of 2024. During the second quarter of 2024, net

income was mostly impacted by higher finance income, given the $23

million non-cash mark to market effect related to Argentine bonds

investments used to hedge our local currency position in that

market.

- As of June 30, 2024, dLocal had

US$531.6 million in cash and cash equivalents, including US$186.2

million of own funds and US$345.4 million of merchants’ funds. The

consolidated cash position decreased by US$17.8 million from

US$549.4 million as of June 30, 2023. When compared to the US$572.4

million cash position as of March 31, 2024, it decreased by US$40.7

million, mainly explained by the US$81.8 million of own funds used

to buy back the company’s own shares, in connection to the US$200

million Share Buyback Program announced in May 2024.

The following table summarizes our key performance

metrics:

|

|

Three months ended 30 of June |

Six months ended 30 of June |

|

|

2024 |

2023 |

% change |

2024 |

2023 |

% change |

|

Key Performance metrics |

(In millions of US$ except for %) |

|

TPV |

6,035 |

4,373 |

38% |

11,346 |

7,948 |

43% |

|

Revenue |

171.3 |

161.1 |

6% |

355.7 |

298.4 |

19% |

|

Gross Profit |

69.8 |

70.8 |

-1% |

132.8 |

132.6 |

0% |

|

Gross Profit margin |

41% |

44% |

-3p.p |

37% |

44% |

-7p.p |

|

Adjusted EBITDA |

42.7 |

52.0 |

-18% |

79.5 |

97.5 |

-19% |

|

Adjusted EBITDA margin |

25% |

32% |

-7p.p |

22% |

33% |

-10p.p |

|

Adjusted EBITDA/Gross Profit |

61% |

74% |

-12p.p |

60% |

74% |

-14p.p |

|

Profit |

46.2 |

44.8 |

3% |

64.0 |

80.2 |

-20% |

|

Profit margin |

27% |

28% |

-1p.p |

18% |

27% |

-9p.p |

|

|

|

|

|

|

|

|

First quarter 2024 Business

Highlights

- During the second quarter of 2024,

pay-ins TPV increased 34% year-over-year and 17%

quarter-over-quarter to US$4.3 billion, accounting for 71% of the

TPV.

- Pay-outs TPV increased by 49%

year-over-year and 7% quarter-over-quarter to US$1.8 billion,

accounting for the remaining 29% of the TPV.

- Cross-border TPV increased by 22%

year-over-year and 11% quarter-over-quarter to US$2.7 billion.

Cross-border volume accounted for 45% of the TPV in the second

quarter of 2024.

- Local-to-local TPV increased by 55%

year-over-year and 16% quarter-over-quarter to US$3.3 billion.

Local-to- local volume accounted for 55% of the TPV in the second

quarter of 2024.

- LatAm revenue increased 9%

year-over-year to US$138.7 million, accounting for 81% of total

revenue. On the annual comparison, the growth was primarily driven

by commerce and streaming in Mexico, and strong performance of

Other LatAm, across different verticals. Sequentially, LatAm

revenue grew by 11% mainly driven by recovery in Argentina revenues

due to strong performance across commerce and on-demand delivery

verticals.

- In the Africa and Asia region,

revenue decreased by 5% year-over-year, primarily driven by lower

revenues in Nigeria due to Naira devaluation in February 2024,

despite strong growth performance in Egypt across advertising and

streaming verticals; and in Other Africa and Asia. The currency

devaluation is also the main driver of the sequential

decrease.

- LatAm gross profit decreased by 13%

year-over-year and increased by 10% quarter-over-quarter to US$53.5

million, accounting for 77% of total gross profit. Most of the

year-over-year decline is explained by Argentina, due to lower FX

spreads following the currency devaluation in December 2023. In the

region, gross profit was also impacted by Mexico, due to merchant

repricing and local-to-local increase; and by Chile, given lower

cross-border volumes. Other LatAm markets showed a 10%

year-over-year increase in gross profit, driven by Tier 0

merchants’ growth. Sequentially, the growth was mainly driven by

the (i) growth in Argentina, and other LatAm markets, primarily

Colombia and Costa Rica; and (ii) Brazil, with lower processing

costs following renegotiation with processors, coupled with change

in payment mix. Those two factors partially offset the impact of a

key merchant repricing, with full impact in the second quarter of

2024 compared to 2 months in previous one.

- Africa and Asia gross profit

increased by 79% year-over-year to US$16.3 million, accounting for

the remaining 23% of total gross profit. This annual comparison is

explained by our overall growth in Egypt; ramp-up of our merchants

in South Africa, primarily in the commerce vertical; and temporary

FX dynamics in Nigeria. Sequentially, gross profit increased by

13%, attributable to temporary FX dynamics in Nigeria and growth in

Other Africa and Asia.

- During the quarter, Revenue from

Existing Merchants reached US$161.7 million compared to US$ 177.1

million in the first quarter of 2024. The quarter-over-quarter

comparison was negatively affected by the currency devaluation, as

previously discussed, despite healthy volume growth. On the annual

comparison, Revenue from Existing Merchants increased by 8% and the

net revenue retention rate, or NRR, reached 100%, which was

impacted by Nigeria currency devaluation.

- Revenue from New Merchants

accounted for US$9.6 million in the second quarter of 2024 compared

to US$ 11.2 million in the same quarter of the prior year.

The tables below present a breakdown of dLocal’s

TPV by product and type of flow:

|

In millions of US$ except for % |

Three months ended 30 of June |

Six months ended 30 of June |

|

|

2024 |

% share |

2023 |

% share |

2024 |

% share |

2023 |

% share |

|

Pay-ins |

4,273 |

71 |

% |

3,190 |

73 |

% |

7,930 |

70 |

% |

5,693 |

72 |

% |

|

Pay-outs |

1,763 |

29 |

% |

1,184 |

27 |

% |

3,416 |

30 |

% |

2,255 |

28 |

% |

|

Total TPV |

6,035 |

100 |

% |

4,373 |

100 |

% |

11,346 |

100 |

% |

7,948 |

100 |

% |

|

In millions of US$ except for % |

Three months ended 30 of June |

Six months ended 30 of June |

|

|

2024 |

% share |

2023 |

% share |

2024 |

% share |

2023 |

% share |

|

Cross-border |

2,701 |

45 |

% |

2,219 |

51 |

% |

5,127 |

45 |

% |

4,179 |

53 |

% |

|

Local-to-local |

3,334 |

55 |

% |

2,154 |

49 |

% |

6,219 |

55 |

% |

3,769 |

47 |

% |

|

Total TPV |

6,035 |

100 |

% |

4,373 |

100 |

% |

11,346 |

100 |

% |

7,948 |

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The tables below present a breakdown of dLocal’s

revenue by geography:

|

In millions of US$ except for % |

Three months ended 30 of June |

Six months ended 30 of June |

|

|

2024 |

% share |

2023 |

% share |

2024 |

% share |

2023 |

% share |

|

Latin America |

138.7 |

81 |

% |

126.9 |

79 |

% |

264.1 |

74 |

% |

225.1 |

75 |

% |

|

Brazil |

42.3 |

25 |

% |

41.2 |

26 |

% |

85.3 |

24 |

% |

64.0 |

21 |

% |

|

Argentina |

20.5 |

12 |

% |

20.7 |

13 |

% |

34.3 |

10 |

% |

40.7 |

14 |

% |

|

Mexico |

35.8 |

21 |

% |

28.3 |

18 |

% |

69.9 |

20 |

% |

51.0 |

17 |

% |

|

Chile |

12.3 |

7 |

% |

14.2 |

9 |

% |

24.7 |

7 |

% |

28.4 |

10 |

% |

|

Other LatAm |

27.8 |

16 |

% |

22.5 |

14 |

% |

49.9 |

14 |

% |

41.0 |

14 |

% |

|

|

|

|

|

|

|

|

|

|

|

Africa & Asia |

32.6 |

19 |

% |

34.3 |

21 |

% |

91.6 |

26 |

% |

73.3 |

25 |

% |

|

Nigeria |

1.1 |

1 |

% |

20.4 |

13 |

% |

8.3 |

2 |

% |

47.3 |

16 |

% |

|

Egypt |

15.0 |

9 |

% |

4.7 |

3 |

% |

54.0 |

15 |

% |

8.1 |

3 |

% |

|

Other Africa & Asia |

16.5 |

10 |

% |

9.2 |

6 |

% |

29.2 |

8 |

% |

17.9 |

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

Total Revenue |

171.3 |

100 |

% |

161.1 |

100 |

% |

355.7 |

100 |

% |

298.4 |

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

The tables below present a breakdown of dLocal’s

gross profit by geography:

|

In millions of US$ except for % |

Three months ended 30 of June |

Six months ended 30 of June |

|

|

2024 |

% share |

2023 |

% share |

2024 |

% share |

2023 |

% share |

|

Latin America |

53.5 |

77 |

% |

61.7 |

87 |

% |

102.1 |

77 |

% |

114.5 |

86 |

% |

|

Brazil |

19.2 |

28 |

% |

19.6 |

28 |

% |

37.1 |

28 |

% |

30.6 |

23 |

% |

|

Argentina |

7.6 |

11 |

% |

13.8 |

19 |

% |

12.8 |

10 |

% |

31.6 |

24 |

% |

|

Mexico |

8.8 |

13 |

% |

10.6 |

15 |

% |

18.7 |

14 |

% |

17.5 |

13 |

% |

|

Chile |

8.3 |

12 |

% |

8.9 |

13 |

% |

15.7 |

12 |

% |

18.0 |

14 |

% |

|

Other LatAm |

9.6 |

14 |

% |

8.7 |

12 |

% |

17.7 |

13 |

% |

16.8 |

13 |

% |

|

|

|

|

|

|

|

|

|

|

|

Africa & Asia |

16.3 |

23 |

% |

9.1 |

13 |

% |

30.7 |

23 |

% |

18.1 |

14 |

% |

|

Nigeria |

2.0 |

3 |

% |

0.2 |

0 |

% |

2.5 |

2 |

% |

2.6 |

2 |

% |

|

Egypt |

9.8 |

14 |

% |

4.2 |

6 |

% |

20.1 |

15 |

% |

6.9 |

5 |

% |

|

Other Africa & Asia |

4.5 |

7 |

% |

4.7 |

7 |

% |

8.1 |

6 |

% |

8.5 |

6 |

% |

|

|

|

|

|

|

|

|

|

|

|

Total Gross Profit |

69.8 |

100 |

% |

70.8 |

100 |

% |

132.8 |

100 |

% |

132.6 |

100 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Special note regarding Adjusted EBITDA and

Adjusted EBITDA Margin

dLocal has only one operating segment. dLocal

measures its operating segment’s performance by Revenues, Adjusted

EBITDA and Adjusted EBITDA Margin, and uses these metrics to make

decisions about allocating resources.

Adjusted EBITDA as used by dLocal is defined as

the profit from operations before financing and taxation for the

year or period, as applicable, before depreciation of property,

plant and equipment, amortization of right-of-use assets and

intangible assets, and further excluding the changes in fair value

of financial assets and derivative instruments carried at fair

value through profit or loss, impairment gains/(losses) on

financial assets, transaction costs, share-based payment non-cash

charges, secondary offering expenses, and inflation adjustment.

dLocal defines Adjusted EBITDA Margin as the Adjusted EBITDA

divided by consolidated revenues.

Although Adjusted EBITDA and Adjusted EBITDA

Margin may be commonly viewed as non-IFRS measures in other

contexts, pursuant to IFRS 8, (“Operating Segments”), Adjusted

EBITDA and Adjusted EBITDA Margin are treated by dLocal as IFRS

measures based on the manner in which dLocal utilizes these

measures. Nevertheless, dLocal’s Adjusted EBITDA and Adjusted

EBITDA Margin metrics should not be viewed in isolation or as a

substitute for net income for the periods presented under IFRS.

dLocal also believes that its Adjusted EBITDA and Adjusted EBITDA

Margin metrics are useful metrics used by analysts and investors,

although these measures are not explicitly defined under IFRS.

Additionally, the way dLocal calculates operating segment’s

performance measures may be different from the calculations used by

other entities, including competitors, and therefore, dLocal’s

performance measures may not be comparable to those of other

entities. Finally, dLocal is unable to present a quantitative

reconciliation of forward-looking guidance for Adjusted EBITDA and

Adjusted EBITDA over gross profit, which are forward-looking

non-IFRS measures, because dLocal cannot reliably predict certain

of their necessary components, such as impairment gains/(losses) on

financial assets, transaction costs, and inflation adjustment.

The table below presents a reconciliation of

dLocal’s Adjusted EBITDA and Adjusted EBITDA Margin to net

income:

|

$ in thousands |

Three months ended 30 of June |

Six months ended 30 of June |

|

|

2024 |

2023 |

2024 |

2023 |

| Profit for the

period |

46,239 |

44,791 |

63,957 |

80,241 |

| Income tax expense |

10,060 |

8,774 |

17,174 |

13,055 |

| Depreciation and

amortization |

4,089 |

2,869 |

7,851 |

5,384 |

| Finance income and costs,

net1 |

(28,045) |

(7,459) |

(28,344) |

(8,850) |

| Share-based payment non-cash

charges |

6,776 |

1,421 |

11,237 |

3,750 |

|

Other operating loss2 |

1,553 |

- |

3,372 |

- |

|

Impairment loss / (gain) on financial assets |

76 |

(21) |

(101) |

30 |

|

Inflation adjustment |

1,941 |

1,661 |

4,309 |

2,680 |

|

Other non-recurring costs |

- |

- |

- |

1,229 |

|

Adjusted EBITDA |

42,689 |

52,036 |

79,455 |

97,519 |

|

|

|

|

|

|

Note: 1In Q2 2024, the Finance income and costs,

net line was impacted by the non-cash mark to market effect related

to Argentine bonds investments in the amount of US$22.8 million.

2In Q2 2024, the company wrote-off certain amounts related to

merchants/processors off-boarded by dLocal.

Special note regarding Adjusted Net

Income

Adjusted Net Income is a non-IFRS financial

measure. As used by dLocal Adjusted net income is defined as the

profit for the period (net income) excluding impairment

gains/(losses) on financial assets, transaction costs, share-based

payment non-cash charges, secondary offering expenses, and other

operating (gain)/loss, in line with our Adjusted EBITDA calculation

(see detailed methodology for Adjusted EBITDA in page 13). It

further excludes the accounting non-cash charges related to the

fair value gain from the Argentine dollar-linked bonds and the

exchange difference loss from the intercompany loan denominated in

USD that we granted to our Argentine subsidiary to purchase the

bonds. In addition, it excludes the inflation adjustment based on

IFRS rules for hyperinflationary economies. We believe Adjusted Net

Income is a useful measure for understanding our results for

operations while excluding for certain non-cash effects such as

currency devaluation and inflation. Our calculation for Adjusted

Net Income may differ from similarly-titled measures presented by

other companies and should not be considered in isolation or as a

replacement for our measure of profit for the period as presented

in accordance with IFRS.

The table below presents a reconciliation of

dLocal’s Adjusted net income:

|

|

|

|

|

|

|

$ in thousands |

Three months ended 30 of June |

Six months ended 30 of June |

|

|

2024 |

2023 |

2024 |

2023 |

|

Net income as reported |

46,239 |

44,791 |

63,957 |

80,241 |

|

Inflation adjustment |

1,941 |

1,661 |

4,309 |

2,680 |

|

Loan - exchange difference |

5,831 |

1,815 |

12,560 |

1,815 |

|

Fair value (loss) / gains of financial assets at FVTPL (bonds) |

(22,774) |

(3,565) |

(33,589) |

(3,654) |

|

Impairment loss / (gain) on financial assets |

76 |

(21) |

(101) |

30 |

|

Share-based payment non-cash charges |

6,776 |

1,421 |

11,237 |

3,750 |

|

Other operating (gain)/loss |

1,553 |

- |

3,372 |

- |

|

Other non-recurring costs |

- |

- |

- |

1,229 |

|

Tax on adjustments |

5,998 |

(613) |

4,638 |

(644) |

|

Adjusted net income |

45,640 |

45,490 |

66,383 |

85,447 |

|

|

|

|

|

|

Note: Adjusted Net Income is a non-IFRS

financial measure. As used by dLocal Adjusted net income is defined

as the profit for the period (net income) excluding impairment

gains/(losses) on financial assets, transaction costs, share-based

payment non-cash charges, secondary offering expenses, and other

operating (gain)/loss, in line with our Adjusted EBITDA calculation

(see detailed methodology for Adjusted EBITDA in page 13). It

further excludes the accounting non-cash charges related to the

fair value gain from the Argentine dollar-linked bonds and the

exchange difference loss from the intercompany loan denominated in

USD that we granted to our Argentine subsidiary to purchase the

bonds. In addition, it excludes the inflation adjustment based on

IFRS rules for hyperinflationary economies. We believe Adjusted Net

Income is a useful measure for understanding our results for

operations while excluding for certain non-cash effects such as

currency devaluation and inflation. Our calculation for Adjusted

Net Income may differ from similarly-titled measures presented by

other companies and should not be considered in isolation or as a

replacement for our measure of profit for the period as presented

in accordance with IFRS. Unaudited quarterly results.

Earnings per share

We calculate basic earnings per share by

dividing the profit attributable to owners of the group by the

weighted average number of common shares issued and outstanding

during the three-month and six-month periods ended June 30, 2024

and 2023.

Our diluted earnings per share is calculated by

dividing the profit attributable to owners of the group of dLocal

by the weighted average number of common shares outstanding during

the period plus the weighted average number of common shares that

would be issued on conversion of all dilutive potential common

shares into common shares.

|

|

Three months ended 30 of June |

Six months ended 30 of June |

|

|

2024 |

2023 |

2024 |

2023 |

|

Profit attributable to common shareholders (thousands USD) |

46,244 |

44,697 |

63,952 |

80,141 |

|

Weighted average number of common shares |

293.430.253 |

291,700,873 |

294.781.316 |

293,403,907 |

|

Adjustments for calculation of diluted earnings per share |

14.996.249 |

16,160,368 |

15.348.015 |

16,358,508 |

|

Weighted average number of common shares for calculating diluted

earnings per share |

308.426.502 |

307,861,241 |

310.129.331 |

309,762,415 |

|

Basic earnings per share |

0.16 |

0.15 |

0.22 |

0.27 |

|

Diluted earnings per share |

0.15 |

0.15 |

0.21 |

0.26 |

|

|

|

|

|

|

This press release does not contain sufficient

information to constitute an interim financial report as defined in

International Accounting Standards 34, “Interim Financial

Reporting” nor a financial statement as defined by International

Accounting Standards 1 “Presentation of Financial Statements”. The

quarterly financial information in this press release has not been

audited, whereas the annual results for the year ended December 31,

2023 are audited.

Conference call and webcast

dLocal’s management team will host a conference call and audio

webcast on August 14th, 2024 at 5:00 p.m. Eastern Time. Please

click here to pre-register for the conference call and obtain your

dial in number and passcode.

The live conference call can be accessed via

audio webcast at the investor relations section of dLocal’s

website, at https://investor.dlocal.com/. An archive of the webcast

will be available for a year following the conclusion of the

conference call. The investor presentation will also be filed on

EDGAR at www.sec.gov.

About dLocal dLocal powers

local payments in emerging markets, connecting global enterprise

merchants with billions of emerging market consumers in more than

40 countries across Africa, Asia, and Latin America. Through the

“One dLocal” platform (one direct API, one platform, and one

contract), global companies can accept payments, send pay-outs and

settle funds globally without the need to manage separate pay-in

and pay-out processors, set up numerous local entities, and

integrate multiple acquirers and payment methods in each

market.

Definition of selected operational

metrics “API” means application programming interface,

which is a general term for programming techniques that are

available for software developers when they integrate with a

particular service or application. In the payments industry, APIs

are usually provided by any party participating in the money flow

(such as payment gateways, processors, and service providers) to

facilitate the money transfer process.

“Cross-border” means a payment transaction

whereby dLocal is collecting in one currency and settling into a

different currency and/or in a different geography.

“Local payment methods” refers to any payment

method that is processed in the country where the end user of the

merchant sending or receiving payments is located, which include

credit and debit cards, cash payments, bank transfers, mobile

money, and digital wallets.

“Local-to-local” means a payment transaction

whereby dLocal is collecting and settling in the same currency.

“Net Revenue Retention Rate” or “NRR” is a U.S.

dollar-based measure of retention and growth of dLocal’s merchants.

NRR is calculated for a period or year by dividing the Current

Period/Year Revenue by the Prior Period/Year Revenue. The Prior

Period/Year Revenue is the revenue billed by us to all our

customers in the prior period. The Current Period/Year Revenue is

the revenue billed by us in the current period to the same

customers included in the Prior Period/Year Revenue. Current

Period/Year Revenue includes revenues from any upselling and

cross-selling across products, geographies, and payment methods to

such merchant customers, and is net of any contractions or

attrition, in respect of such merchant customers, and excludes

revenue from new customers on-boarded in the preceding twelve

months. As most of dLocal revenues come from existing merchants,

the NRR rate is a key metric used by management, and we believe it

is useful for investors in order to assess our retention of

existing customers and growth in revenues from our existing

customer base.

“Pay-in” means a payment transaction whereby

dLocal’s merchant customers receive payment from their

customers.

“Pay-out” means a payment transaction whereby

dLocal disburses money in local currency to the business partners

or customers of dLocal’s merchant customers.

“Revenue from New Merchants” means the revenue

billed by us to merchant customers that we did not bill revenues in

the same quarter (or period) of the prior year.

“Revenue from Existing Merchants” means the

revenue billed by us in the last twelve months to the merchant

customers that we billed revenue in the same quarter (or period) of

the prior year.

“TPV” dLocal presents total payment volume, or

TPV, which is an operating metric of the aggregate value of all

payments successfully processed through dLocal’s payments platform.

Because revenue depends significantly on the total value of

transactions processed through the dLocal platform, management

believes that TPV is an indicator of the success of dLocal’s global

merchants, the satisfaction of their end users, and the scale and

growth of dLocal’s business.

Rounding: We have made rounding adjustments to

some of the figures included in this interim report. Accordingly,

numerical figures shown as totals in some tables may not be an

arithmetic aggregation of the figures that preceded them.

Forward-looking statements This

press release contains certain forward-looking statements. These

forward-looking statements convey dLocal’s current expectations or

forecasts of future events, including guidance in respect of total

payment volume, gross profit, Adjusted EBITDA, and Adjusted EBITDA

over gross profit margin. Forward-looking statements regarding

dLocal and amounts stated as guidance are based on current

management expectations and involve known and unknown risks,

uncertainties and other factors that may cause dLocal’s actual

results, performance or achievements to be materially different

from any future results, performances or achievements expressed or

implied by the forward-looking statements. Certain of these risks

and uncertainties are described in the “Risk Factors,”

“Forward-Looking Statements” and “Cautionary Statement Regarding

Forward-Looking Statements” sections of dLocal’s filings with the

U.S. Securities and Exchange Commission. Unless required by law,

dLocal undertakes no obligation to publicly update or revise any

forward-looking statements to reflect circumstances or events after

the date hereof. In addition, dLocal is unable to present a

quantitative reconciliation of forward-looking guidance for

Adjusted EBITDA and Adjusted EBITDA over gross profit, which are

forward-looking non-IFRS measures, because dLocal cannot reliably

predict certain of their necessary components, such as impairment

gains/(losses) on financial assets, transaction costs, and

inflation adjustment.

dLocal Limited Certain

financial information Consolidated Condensed Interim Statements of

Comprehensive Income for the three-month and six-month periods

ended June 30, 2024 and 2023 (In thousands of U.S. dollars, except

per share amounts)

|

|

Three months ended30 of June |

Six months ended30 of June |

|

|

2024 |

2023 |

2024 |

2023 |

|

Continuing operations |

|

|

|

|

|

Revenues |

171,279 |

161,138 |

355,709 |

298,425 |

|

Cost of services |

(101,468) |

(90,378) |

(222,927) |

(165,828) |

|

Gross profit |

69,811 |

70,760 |

132,782 |

132,597 |

|

|

|

|

|

|

|

Technology and development expenses |

(6,408) |

(2,640) |

(11,873) |

(4,930) |

|

Sales and marketing expenses |

(4,505) |

(3,106) |

(9,136) |

(7,963) |

|

General and administrative expenses |

(27,074) |

(17,268) |

(51,406) |

(32,548) |

|

Impairment (loss)/gain on financial assets |

(76) |

21 |

101 |

(30) |

|

Other operating (loss)/gain |

(1,553) |

- |

(3,372) |

- |

|

Operating profit |

30,195 |

47,767 |

57,096 |

87,126 |

|

Finance income |

29,247 |

18,878 |

47,504 |

25,866 |

|

Finance costs |

(1,202) |

(11,419) |

(19,160) |

(17,016) |

|

Inflation adjustment |

(1,941) |

(1,661) |

(4,309) |

(2,680) |

|

Other results |

26,104 |

5,798 |

24,035 |

6,170 |

|

Profit before income tax |

56,299 |

53,565 |

81,131 |

93,296 |

|

Income tax expense |

(10,060) |

(8,774) |

(17,174) |

(13,055) |

|

Profit for the period |

46,239 |

44,791 |

63,957 |

80,241 |

|

|

|

|

|

|

|

Profit attributable to: |

|

|

|

|

|

Owners of the Group |

46,244 |

44,697 |

63,952 |

80,141 |

|

Non-controlling interest |

(5) |

94 |

5 |

100 |

|

Profit for the period |

46,239 |

44,791 |

63,957 |

80,241 |

|

|

|

|

|

|

|

Earnings per share (in USD) |

|

|

|

|

|

Basic Earnings per share |

0.16 |

0.15 |

0.22 |

0.27 |

|

Diluted Earnings per share |

0.15 |

0.15 |

0.21 |

0.26 |

|

|

|

|

|

|

|

Other comprehensive income |

|

|

|

|

|

Items that may be reclassified to profit or loss: |

|

|

|

|

|

Exchange difference on translation on foreign operations |

(5,604) |

1,675 |

(6,273) |

3,163 |

|

Other comprehensive income for the period, net of

tax |

(5,604) |

1,675 |

(6,273) |

3,163 |

|

Total comprehensive income for the period, net of

tax |

40,635 |

46,466 |

57,684 |

83,404 |

|

|

|

|

|

|

|

Total comprehensive income for the period |

|

|

|

|

|

Owners of the Group |

40,642 |

46,371 |

57,678 |

83,305 |

|

Non-controlling interest |

(7) |

95 |

6 |

99 |

|

Total comprehensive income for the period |

40,635 |

46,466 |

57,684 |

83,404 |

|

|

|

|

|

|

dLocal Limited Certain

financial information Consolidated Condensed Interim Statements of

Financial Position as of June 30, 2024 and December 31, 2023 (In

thousands of U.S. dollars)

|

|

30 of June, 2024 |

31 of December, 2023 |

|

ASSETS |

|

|

|

Current Assets |

|

|

|

Cash and cash equivalents |

531,620 |

536,160 |

|

Financial assets at fair value through profit or loss |

120,297 |

102,677 |

|

Trade and other receivables |

455,503 |

363,374 |

|

Derivative financial instruments |

622 |

2,040 |

|

Other assets |

10,878 |

11,782 |

|

Total Current Assets |

1,118,920 |

1,016,033 |

|

|

|

|

|

Non-Current Assets |

|

|

|

Financial assets at fair value through profit or loss |

- |

1,710 |

|

Trade and other receivables |

1,787 |

- |

|

Deferred tax assets |

1,913 |

2,217 |

|

Property, plant and equipment |

3,576 |

2,917 |

|

Right-of-use assets |

3,508 |

3,689 |

|

Intangible assets |

60,637 |

57,887 |

|

Other Assets |

5,343 |

- |

|

Total Non-Current Assets |

76,764 |

68,420 |

|

TOTAL ASSETS |

1,195,684 |

1,084,453 |

|

|

|

|

|

LIABILITIES |

|

|

|

Current Liabilities |

|

|

|

Trade and other payables |

719,097 |

602,493 |

|

Lease liabilities |

782 |

626 |

|

Tax liabilities |

26,907 |

20,800 |

|

Derivative financial instruments |

815 |

948 |

|

Provisions |

276 |

362 |

|

Total Current Liabilities |

747,877 |

625,229 |

|

|

|

|

|

Non-Current Liabilities |

|

|

|

Deferred tax liabilities |

2,299 |

753 |

|

Lease liabilities |

3,106 |

3,331 |

|

Total Non-Current Liabilities |

5,405 |

4,084 |

|

TOTAL LIABILITIES |

753,282 |

629,313 |

|

|

|

|

|

EQUITY |

|

|

|

Share Capital |

574 |

591 |

|

Share Premium |

173,093 |

173,001 |

|

Treasury Shares |

(181,670) |

(99,936) |

|

Capital Reserve |

32,812 |

21,575 |

|

Other Reserves |

(14,829) |

(9,808) |

|

Retained earnings |

432,307 |

369,608 |

|

Total Equity Attributable to owners of the

Group |

442,287 |

455,031 |

|

Non-controlling interest |

115 |

109 |

|

TOTAL EQUITY |

442,402 |

455,140 |

|

|

|

|

dLocal Limited Certain interim

financial information Consolidated Condensed Interim Statements of

Cash flows for the three-month and six-month periods ended June 30,

2024 and 2023 (In thousands of U.S. dollars)

|

|

Three months ended30 of June |

Six months ended30 of June |

|

|

2024 |

2023 |

2024 |

2023 |

|

Cash flows from operating activities |

|

|

|

|

|

Profit before income tax |

56,299 |

53,565 |

81,131 |

93,296 |

|

Adjustments: |

|

|

|

|

|

Interest income from financial instruments |

(6,473) |

(15,313) |

(13,915) |

(22,212) |

|

Interest charges for lease liabilities |

44 |

52 |

87 |

95 |

|

Other finance expense |

1,673 |

765 |

1,800 |

1,202 |

|

Finance expense related to derivative financial instruments |

2,446 |

4,634 |

12,324 |

9,869 |

|

Net exchange differences |

(1,469) |

3,551 |

6,168 |

4,082 |

|

Fair value gain on financial assets at fair value through profit or

loss |

(22,774) |

(3,565) |

(33,589) |

(3,654) |

|

Amortization of Intangible assets |

3,690 |

2,492 |

7,114 |

4,668 |

|

Depreciation of Property, plant and equipment and right-of-use |

410 |

377 |

737 |

716 |

|

Disposals of property, plant and equipment, intangible assets and

right-of-use asset |

(62) |

- |

11 |

- |

|

Share-based payment expense, net of forfeitures |

6,776 |

1,421 |

11,237 |

3,750 |

|

Other operating loss/(gain) |

1,553 |

- |

3,372 |

- |

|

Net Impairment loss/(gain) on financial assets |

76 |

(21) |

(101) |

30 |

|

Inflation adjustment |

(5,982) |

- |

(11,874) |

- |

|

|

36,207 |

47,957 |

64,502 |

91,842 |

|

Changes in working capital |

|

|

|

|

|

Increase in Trade and other receivables |

(69,322) |

(50,312) |

(102,158) |

(59,386) |

|

Decrease/(increase) in Other assets |

(716) |

(1,597) |

2,503 |

12,157 |

|

Increase in Trade and other payables |

67,268 |

148,761 |

113,232 |

190,139 |

|

Decrease in Tax Liabilities |

8,870 |

(2,279) |

7,750 |

(3,341) |

|

Decrease/(increase) in Provisions |

(90) |

(252) |

(86) |

(557) |

|

Cash from operating activities |

42,218 |

142,278 |

85,743 |

230,854 |

|

Income tax paid |

(13,409) |

(2,774) |

(16,967) |

(6,816) |

|

Net cash from operating activities |

28,808 |

139,504 |

68,776 |

224,038 |

|

|

|

|

|

|

|

Cash flows from investing activities |

|

|

|

|

|

Acquisitions of Property, plant and equipment |

(440) |

(608) |

(1,226) |

(657) |

|

Additions of Intangible assets |

(4,842) |

(4,339) |

(9,864) |

(8,145) |

|

Acquisitions of financial assets at FVTPL |

(96,841) |

(48,139) |

(96,841) |

(48,139) |

|

Net collections/acquisitions of financial assets at FVPL |

98,544 |

478 |

98,301 |

1,523 |

|

Interest collected from financial instruments |

6,473 |

15,155 |

13,915 |

21,975 |

|

Net cash used in investing activities |

2,894 |

(37,453) |

4,285 |

(33,443) |

|

|

|

|

|

|

|

Cash flows from financing activities |

|

|

|

|

|

Repurchase of shares |

(81,751) |

(61,011) |

(81,751) |

(97,929) |

|

Share-options exercise |

92 |

84 |

92 |

153 |

|

Interest payments on lease liability |

(44) |

(52) |

(87) |

(95) |

|

Principal payments on lease liability |

26 |

(146) |

(69) |

(276) |

|

Finance expense paid related to derivative financial

instruments |

(888) |

(9,184) |

(11,039) |

(11,337) |

|

Other finance expense paid |

(272) |

(768) |

(399) |

(1,205) |

|

Net cash (used in) / provided by financing

activities |

(82,837) |

(71,077) |

(93,253) |

(110,689) |

|

Net increase in cash flow |

(51,135) |

30,975 |

(20,192) |

79,906 |

|

|

|

|

|

|

|

Cash and cash equivalents at the beginning of the

period |

572,357 |

517,892 |

536,160 |

468,092 |

|

Net increase in cash flow |

(51,135) |

30,975 |

(20,192) |

79,906 |

|

Effects of exchange rate changes on cash and cash equivalents |

10,398 |

519 |

15,652 |

1,388 |

|

Cash and cash equivalents at the end of the

period |

531,620 |

549,386 |

531,620 |

549,386 |

Investor Relations Contact:

investor@dlocal.com

Media Contact: media@dlocal.com

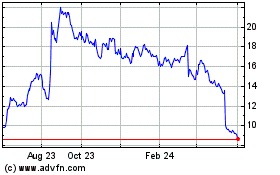

DLocal (NASDAQ:DLO)

Historical Stock Chart

From Nov 2024 to Dec 2024

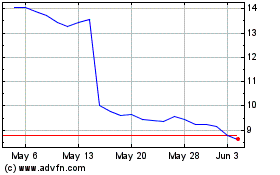

DLocal (NASDAQ:DLO)

Historical Stock Chart

From Dec 2023 to Dec 2024