Form 8-K - Current report

July 23 2024 - 4:01PM

Edgar (US Regulatory)

false

0001880613

0001880613

2024-07-17

2024-07-17

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

July 17, 2024

Direct Digital Holdings, Inc.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

001-41261 |

|

87-2306185 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

1177 West Loop South, Suite 1310

Houston, Texas |

|

77027 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including

area code: (832) 402-1051

Not Applicable

(Former name or former address, if changed since

last report)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange

on which registered |

| Class A common stock, par value $0.001 per share |

|

DRCT |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange

Act of 1934 (the “Exchange Act”) (§240.12b-2 of this chapter).

Emerging growth company x

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act.

As previously disclosed, on

April 17, 2024 and May 21, 2024, Direct Digital Holdings, Inc. (the “Company”) received delinquency notification letters (the

“Notices”) from the Listing Qualifications Department (the “Staff”) of the Nasdaq Stock Market LLC (“Nasdaq”)

regarding the Company’s failure to timely file its Annual Report on Form 10-K for the year ended December 31, 2023 and its Quarterly

Report on Form 10-Q for the fiscal quarter ended March 31, 2024, respectively. The Notices had no immediate effect on the Company’s

continued listing on Nasdaq.

The Company was given until

June 17, 2024 to submit a plan to regain compliance (the “Compliance Plan”) with Nasdaq Listing Rule 5250(c)(1) (the “Rule”),

which requires Nasdaq-listed companies to timely file all required periodic financial reports with the U.S. Securities and Exchange Commission

(the “SEC”). The Company submitted its Compliance Plan on June 14, 2024, and on July 17, 2024, the Staff granted the Company’s

request for an extension through October 14, 2024 to regain compliance with its periodic filing obligations under the Rule.

The Company intends to take

all reasonable measures available to regain compliance under the Nasdaq Listing Rules and remain listed on Nasdaq. However, there can

be no assurance that the Company will ultimately regain compliance with all applicable requirements for continued listing.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Current Report on Form 8-K may contain forward-looking

statements within the meaning of federal securities laws that are subject to certain risks, trends and uncertainties.

As used below, “we,” “us,”

and “our” refer to the Company. We use words such as “could,” “would,” “may,” “might,”

“will,” “expect,” “likely,” “believe,” “continue,” “anticipate,”

“estimate,” “intend,” “plan,” “project” and other similar expressions to identify forward-looking

statements, but not all forward-looking statements include these words. All of our forward-looking statements involve estimates and uncertainties

that could cause actual results to differ materially from those expressed in or implied by the forward-looking statements. Accordingly,

any such statements are qualified in their entirety by reference to the information described under the caption “Risk Factors”

and elsewhere in our most recent Annual Report on Form 10-K (the “Form 10-K”) and subsequent periodic and or current reports

filed with the Securities and Exchange Commission.

The forward-looking statements contained in this

Current Report on Form 8-K are based on assumptions that we have made in light of our industry experience and our perceptions of historical

trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you

read and consider this Current Report on Form 8-K, you should understand that these statements are not guarantees of performance or results.

They involve risks, uncertainties (many of which are beyond our control) and assumptions. Although we believe that these forward-looking

statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial

performance and cause our performance to differ materially from the performance expressed in or implied by the forward-looking statements.

We believe these factors include, but are not limited to, the following: the restrictions and covenants imposed upon us by our credit

facilities; our ability to secure additional financing to meet our capital needs; any significant fluctuations caused by our high customer

concentration; risks related to non-payment by our clients; reputational and other harms caused by our failure to detect advertising fraud;

operational and performance issues with our platform, whether real or perceived, including a failure to respond to technological changes

or to upgrade our technology systems; restrictions on the use of third-party “cookies,” mobile device IDs or other tracking

technologies, which could diminish our platform’s effectiveness; unfavorable publicity and negative public perception about our

industry, particularly concerns regarding data privacy and security relating to our industry’s technology and practices, and any

perceived failure to comply with laws and industry self-regulation; our failure to manage our growth effectively; the difficulty in identifying

and integrating any future acquisitions or strategic investments; any changes or developments in legislative, judicial, regulatory or

cultural environments related to information collection, use and processing; challenges related to our buy-side clients that are destination

marketing organizations and that operate as public/private partnerships; any strain on our resources or diversion of our management’s

attention as a result of being a public company; the intense competition of the digital advertising industry and our ability to effectively

compete against current and future competitors; any significant inadvertent disclosure or breach of confidential and/or personal information

we hold, or of the security of our or our customers’, suppliers’ or other partners’ computer systems; as a holding company,

we depend on distributions from Direct Digital Holdings, LLC (“DDH LLC”) to pay our taxes, expenses (including payments under

the Tax Receivable Agreement) and any amount of any dividends we may pay to the holders of our common stock; the fact that DDH LLC is

controlled by DDM, whose interest may differ from those of our public stockholders; any risks associated with the material weakness that

was identified in our review of internal control over financial reporting as of December 31, 2022; any failure by us to maintain or implement

effective internal controls or to detect fraud; the ability of our independent registered public accounting firm to complete the audit

of our financial statements for the fiscal year ended December 31, 2023 and for us to prepare and submit any delinquent annual or periodic

reports with the SEC; and other factors and assumptions discussed in our Form 10-K and subsequent periodic and current reports we may

file with the SEC. Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove to be incorrect,

our actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements.

Further, any forward-looking statement speaks only as of the date on which it is made, and except as required by law, we undertake no

obligation to update any forward-looking statement contained in this Current Report on Form 8-K to reflect events or circumstances after

the date on which it is made or to reflect the occurrence of anticipated or unanticipated events or circumstances. New factors that could

cause our business not to develop as we expect emerge from time to time, and it is not possible for us to predict all of them. Further,

we cannot assess the impact of each currently known or new factor on our results of operations or the extent to which any factor, or combination

of factors, may cause actual results to differ materially from those contained in any forward-looking statements.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

July 23, 2024

(Date) |

Direct Digital Holdings, Inc.

(Registrant) |

| |

|

| |

/s/ Diana P. Diaz |

| |

Diana P. Diaz |

| |

Chief Financial Officer |

v3.24.2

Cover

|

Jul. 17, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jul. 17, 2024

|

| Entity File Number |

001-41261

|

| Entity Registrant Name |

Direct Digital Holdings, Inc.

|

| Entity Central Index Key |

0001880613

|

| Entity Tax Identification Number |

87-2306185

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

1177 West Loop South

|

| Entity Address, Address Line Two |

Suite 1310

|

| Entity Address, City or Town |

Houston

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77027

|

| City Area Code |

832

|

| Local Phone Number |

402-1051

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A common stock, par value $0.001 per share

|

| Trading Symbol |

DRCT

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

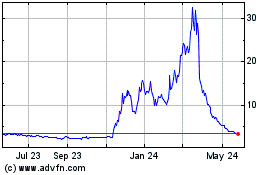

Direct Digital (NASDAQ:DRCT)

Historical Stock Chart

From Dec 2024 to Jan 2025

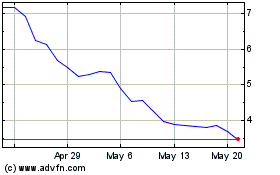

Direct Digital (NASDAQ:DRCT)

Historical Stock Chart

From Jan 2024 to Jan 2025