Crown Receives Nasdaq Delisting Determination and Plans to Request Reconsideration

March 04 2025 - 4:01PM

Crown Electrokinetics Corp. (NASDAQ: CRKN)

("Crown" or the "Company”), a leading provider of

innovative technology infrastructure solutions that benefit

communities and the environment, today announced that it has

received a delisting determination from The Nasdaq Stock Market.

The Company intends to submit a request for reconsideration to the

Nasdaq Hearings Panel and to otherwise appeal the determination to

the Nasdaq Listing and Hearing Review Council as necessary. While

Crown pursues those processes, trading in the Company’s common

stock will be suspended on Nasdaq effective with the open of the

market on Wednesday, March 5, 2025. The Company’s common stock

should be eligible to trade on the OTC Market’s Pink Current

Information tier effective with the open of the market on March 5,

2024.

Crown today is a fundamentally stronger company than in the

past, with expanded business operations, growing revenue, and a

strengthened financial position. The Company provides cutting-edge

critical infrastructure solutions through its Crown Construction

business, specializing in fiber optics, water service lines, water

intake solutions, and XXL diameter pipelines. The Company has also

significantly improved its financial standing, maintaining a cash

balance exceeding $20 million with no debt. Since completing its

reverse stock split, Crown has evidenced compliance with Nasdaq’s

minimum $1.00 bid price requirement for 22 consecutive business

days, closing at approximately $3.40 per share on Monday, March 3,

2025. The Company otherwise satisfies all other applicable criteria

for continued listing on The Nasdaq Capital Market, including a

significant margin of compliance above the minimum $2.5 million

stockholders’ equity requirement.

“Crown has taken all the necessary steps to meet Nasdaq’s

listing requirements, and we firmly believe the Company deserves to

remain on the exchange,” said Doug Croxall, CEO and Chairman,

Crown. “Over the past year, we have consistently generated revenue

through our construction business, delivering innovative critical

infrastructure solutions, including our proprietary slant wells

designed to combat water scarcity. With a strong financial

position, over $20 million in cash, no debt, and increasing market

demand, Crown is well-positioned for continued expansion. We are

actively securing new opportunities across all our businesses, and

we remain confident in our ability to drive long-term growth. While

we work through the Nasdaq reconsideration/appeal process, our

focus remains on executing our strategy, scaling operations, and

delivering sustainable value to our shareholders.”

Although Crown will not trade on Nasdaq pending resolution of

the reconsideration and appeal processes, Crown’s securities will

remain technically listed on Nasdaq pending a final decision. The

Company will continue executing its growth strategy and provide

updates as appropriate in the interim.

For additional information, please refer to the Company’s

filings with the Securities and Exchange Commission ("SEC") at

https://ir.crownek.com/sec-filings.

About CrownCrown (Nasdaq: CRKN) is an

innovative infrastructure solutions provider dedicated to

benefiting communities and the environment. Operating across

multiple businesses – Smart Windows, and Construction – Crown is

developing and delivering cutting edge solutions that are

challenging the status quo and redefining industry standards. For

more information, please visit www.crownek.com.

Forward Looking StatementsCertain statements in

this news release may be "forward-looking statements" (within the

meaning of Section 27A of the Securities Act of 1933, Section 21E

of the Securities Exchange Act of 1934 and the Private Securities

Litigation Reform Act of 1995) regarding future events or Crown’s

future financial performance that involve certain contingencies and

uncertainties, including those discussed in Crown’s Annual Report

on Form 10-K for the year ended December 31, 2023, and subsequent

reports Crown files with the U.S. Securities and Exchange

Commission from time to time, in the sections entitled

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations”. Forward-looking statements include, but are

not limited to, statements that express our intentions, beliefs,

expectations, strategies, predictions, or any other statements

relating to our future activities or other future events or

conditions. These statements are based on current expectations,

estimates and projections about our business based, in part, on

assumptions made by management. These statements are not guarantees

of future performance and involve risks, uncertainties and

assumptions that are difficult to predict. Therefore, actual

outcomes and results may, and are likely to, differ materially from

what is expressed or forecasted in forward-looking statements due

to numerous factors. Any forward-looking statements speak only as

of the date of this news release and Crown Electrokinetic

Corporation undertakes no obligation to update any forward-looking

statement to reflect events or circumstances after the date of this

news release.

This press release does not constitute a public offer of any

securities for sale. Any securities offered privately will not be

or have not been registered under the Act and may not be offered or

sold in the United States absent registration or an applicable

exemption from registration requirements.

For more information, please contact:

Investor Relations ir@crownek.com

Public Relations pr@crownek.com

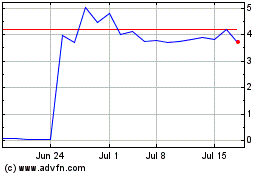

Crown Electrokinetics (NASDAQ:CRKN)

Historical Stock Chart

From Feb 2025 to Mar 2025

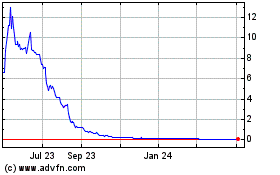

Crown Electrokinetics (NASDAQ:CRKN)

Historical Stock Chart

From Mar 2024 to Mar 2025