Copart, Inc. (NASDAQ: CPRT) today reported financial results for

the quarter ended January 31, 2025.

For the three months ended January 31, 2025, revenue, gross

profit, and net income attributable to Copart, Inc. were $1.16

billion, $525.6 million, and $387.4 million, respectively. These

represent an increase in revenue of $143.2 million, or 14.0%; an

increase in gross profit of $61.4 million, or 13.2%; and an

increase in net income attributable to Copart, Inc. of $61.8

million, or 19.0%, respectively, from the same period last year.

Fully diluted earnings per share for three months ended January 31,

2025 was $0.40 compared to $0.33 last year, an increase of

21.2%.

For the six months ended January 31, 2025, revenue, gross

profit, and net income attributable to Copart, Inc. were $2.31

billion, $1.0 billion, and $749.5 million, respectively. These

represent an increase in revenue of $269.6 million, or 13.2%; an

increase in gross profit of $109.5 million, or 11.8%; and an

increase in net income attributable to Copart, Inc. of $91.3

million, or 13.9%, respectively, from the same period last year.

Fully diluted earnings per share for the six months ended January

31, 2025 was $0.77 compared to $0.68 last year, an increase of

13.2%.

On Thursday, February 20, 2025, at 5:30 p.m. Eastern Time (4:30

p.m. Central Time), Copart, Inc. will conduct a conference call to

discuss the results for the quarter. The call will be webcast live

and can be accessed via hyperlink at

www.copart.com/investorrelation. A replay of the call will be

available through May 2025 by visiting

www.copart.com/investorrelation.

About Copart

Copart, Inc., founded in 1982, is a global leader in online

vehicle auctions. Copart’s innovative technology and online auction

platform connect vehicle consignors to approximately 1 million

members in over 185 countries. Copart offers a comprehensive suite

of vehicle remarketing services to insurance companies, financial

institutions, dealers, rental car companies, charities, fleet

operators, and individuals, and offers vehicles via auction to

dealers, dismantlers, rebuilders, exporters, and the general

public. With operations at over 250 locations in 11 countries,

Copart sold more than 4 million units in the last year. Copart

currently operates in the United States (Copart.com), Canada

(Copart.ca), the United Kingdom (Copart.co.uk), Brazil

(Copart.com.br), the Republic of Ireland (Copart.ie), Germany

(Copart.de), Finland (Copart.fi), the United Arab Emirates, Oman

and Bahrain (Copartmea.com), and Spain (Copart.es). For more

information, or to become a Member, visit Copart.com/register.

Cautionary Note About Forward-Looking Statements

This press release contains forward-looking statements within

the meaning of federal securities laws. These forward-looking

statements are subject to substantial risks and uncertainties.

These forward-looking statements are subject to certain risks,

trends and uncertainties that could cause actual results to differ

materially from those projected or implied by our statements and

comments. For a more complete discussion of the risks that could

affect our business, please review the “Management’s Discussion and

Analysis” and the other risks identified in Copart’s latest Annual

Report on Form 10-K, Quarterly Reports on Form 10-Q, and Current

Reports on Form 8-K, as filed with the Securities and Exchange

Commission. We encourage investors to review these disclosures

carefully. We do not undertake to update any forward-looking

statement that may be made from time to time on our behalf.

Copart, Inc. Consolidated

Statements of Income (In thousands, except per share amounts)

(Unaudited)

Three Months Ended

January 31,

Six Months Ended

January 31,

2025

2024

% Change

2025

2024

% Change

Service revenues and vehicle sales:

Service revenues

$

991,281

$

861,745

15.0

%

$

1,977,617

$

1,721,281

14.9

%

Vehicle sales

172,035

158,404

8.6

%

332,528

319,284

4.1

%

Total service revenues and vehicle

sales

1,163,316

1,020,149

14.0

%

2,310,145

2,040,565

13.2

%

Operating expenses:

Facility operations

439,274

366,342

19.9

%

886,519

734,184

20.7

%

Cost of vehicle sales

147,707

146,819

0.6

%

285,885

294,715

(3.0

)%

Facility depreciation and amortization

48,963

41,208

18.8

%

96,440

80,311

20.1

%

Facility stock-based compensation

1,819

1,628

11.7

%

3,643

3,184

14.4

%

Gross profit

525,553

464,152

13.2

%

1,037,658

928,171

11.8

%

General and administrative

86,608

72,657

19.2

%

177,605

130,288

36.3

%

General and administrative depreciation

and amortization

5,236

4,054

29.2

%

11,386

8,115

40.3

%

General and administrative stock-based

compensation

7,498

7,541

(0.6

)%

16,089

14,492

11.0

%

Total operating expenses

737,105

640,249

15.1

%

1,477,567

1,265,289

16.8

%

Operating income

426,211

379,900

12.2

%

832,578

775,276

7.4

%

Other income (expense):

Interest income, net

40,747

33,956

20.0

%

86,294

65,961

30.8

%

Other (expense), net

(3,907

)

(3,103

)

25.9

%

(4,503

)

(7,175

)

(37.2

)%

Total other income

36,840

30,853

19.4

%

81,791

58,786

39.1

%

Income before income taxes

463,051

410,753

12.7

%

914,369

834,062

9.6

%

Income tax expense

76,510

85,226

(10.2

)%

166,652

176,003

(5.3

)%

Net income

386,541

325,527

18.7

%

747,717

658,059

13.6

%

Less: Net (loss)/income attributable to

noncontrolling interest

(859

)

(108

)

695.4

%

(1,769

)

(103

)

1617.5

%

Net income attributable to Copart,

Inc.

$

387,400

$

325,635

19.0

%

$

749,486

$

658,162

13.9

%

Basic net income per common share

$

0.40

$

0.34

17.6

%

$

0.78

$

0.69

13.0

%

Weighted average common shares

outstanding

964,746

960,525

0.4

%

963,961

959,326

0.5

%

Diluted net income per common share

$

0.40

$

0.33

21.2

%

$

0.77

$

0.68

13.2

%

Diluted weighted average common shares

outstanding

977,910

974,589

0.3

%

977,208

973,135

0.4

%

Copart, Inc. Consolidated

Balance Sheets (In thousands) (Unaudited)

January 31, 2025

July 31, 2024

ASSETS

Current assets:

Cash, cash equivalents, and restricted

cash

$

3,338,909

$

1,514,111

Investment in held to maturity

securities

458,542

1,908,047

Accounts receivable, net

882,745

785,877

Vehicle pooling costs

142,815

132,638

Inventories

59,072

43,639

Income taxes receivable

48,240

—

Prepaid expenses and other assets

36,460

33,872

Total current assets

4,966,783

4,418,184

Property and equipment, net

3,462,768

3,175,838

Operating lease right-of-use assets

114,839

116,301

Intangibles, net

68,083

74,088

Goodwill

509,670

513,909

Other assets

65,204

129,444

Total assets

$

9,187,347

$

8,427,764

LIABILITIES, REDEEMABLE

NONCONTROLLING INTERESTS AND STOCKHOLDERS’ EQUITY

Current liabilities:

Accounts payable and accrued

liabilities

$

562,205

$

518,148

Deferred revenue

26,892

28,121

Income taxes payable

17,844

60,994

Current portion of operating and finance

lease liabilities

22,696

21,304

Total current liabilities

629,637

628,567

Deferred income taxes

92,886

93,653

Income taxes payable

44,091

59,560

Operating and finance lease liabilities,

net of current portion

96,701

97,429

Total liabilities

863,315

879,209

Commitments and contingencies

Redeemable non-controlling interest

22,775

24,544

Stockholders' equity:

Preferred stock

—

—

Common stock

97

96

Additional paid-in capital

1,179,816

1,120,985

Accumulated other comprehensive loss

(171,560

)

(142,972

)

Retained earnings

7,292,904

6,545,902

Total stockholders' equity

8,301,257

7,524,011

Total liabilities, redeemable

noncontrolling interests and stockholders’ equity

$

9,187,347

$

8,427,764

Copart, Inc. Consolidated

Statements of Cash Flows (In thousands) (Unaudited)

Six Months Ended January

31,

2025

2024

Cash flows from operating

activities:

Net income

$

747,717

$

658,059

Adjustments to reconcile net income to net

cash provided by operating activities:

Depreciation and amortization, including

debt cost

109,122

88,485

Allowance for credit loss

1,056

3,702

Equity in losses of unconsolidated

affiliates

(61

)

(5,402

)

Stock-based compensation

19,732

17,676

Gain on sale of property and equipment

(194

)

(971

)

Deferred income taxes

47

(2,103

)

Changes in operating assets and

liabilities:

Accounts receivable

(133,024

)

(169,508

)

Vehicle pooling costs

(10,675

)

(14,387

)

Inventories

(16,175

)

(2,994

)

Prepaid expenses, other current and

non-current assets

4,976

(35,040

)

Operating lease right-of-use assets and

lease liabilities

614

865

Accounts payable, accrued liabilities and

other liabilities

44,765

6,556

Deferred revenue

(1,066

)

(13

)

Income taxes receivable

(48,239

)

(10,463

)

Income taxes payable

(58,194

)

2,577

Net cash provided by operating

activities

660,401

537,039

Cash flows from investing

activities:

Purchases of property and equipment

(353,399

)

(285,289

)

Purchase of assets and liabilities in

connection with acquisitions

(1,213

)

17,662

Proceeds from sale of property and

equipment

662

2,069

Purchases of held to maturity

securities

(458,542

)

(1,411,122

)

Proceeds from held to maturity

securities

1,940,000

1,430,000

Investment in unconsolidated affiliate

—

(1,000

)

Net cash provided by (used in) investing

activities

1,127,508

(247,680

)

Cash flows from financing

activities:

Proceeds from the exercise of stock

options

32,833

13,482

Proceeds from the issuance of Employee

Stock Purchase Plan shares

7,404

5,961

Payments for employee stock-based tax

withholdings

(2,484

)

(2,164

)

Principal payments on revolver

facility

—

(10,820

)

Payments of finance lease obligations

(40

)

(11

)

Net cash provided by financing

activities

37,713

6,448

Effect of foreign currency translation

(824

)

3,746

Net increase in cash, cash equivalents,

and restricted cash

1,824,798

299,553

Cash, cash equivalents, and restricted

cash at beginning of period

1,514,111

957,395

Cash, cash equivalents, and restricted

cash at end of period

$

3,338,909

$

1,256,948

Supplemental disclosure of cash flow

information:

Interest paid

$

1,371

$

2,036

Income taxes paid, net of refunds

$

277,051

$

188,480

Purchase of property and equipment through

settlement of deposit

$

57,453

$

—

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250220164482/en/

Copart Investor Relations investor.relations@copart.com

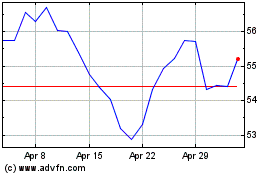

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Jan 2025 to Feb 2025

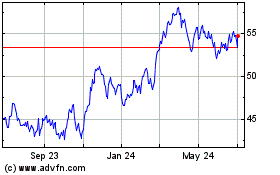

Copart (NASDAQ:CPRT)

Historical Stock Chart

From Feb 2024 to Feb 2025