Declares Quarterly Cash Dividend of $0.1125

Per Share

Colony Bankcorp, Inc. (Nasdaq: CBAN) (“Colony” or the “Company”)

today reported financial results for the first quarter of 2024.

Financial highlights are shown below.

Financial Highlights:

- Net income decreased to $5.3 million, or $0.30 per diluted

share, for the first quarter of 2024, compared to $5.6 million, or

$0.32 per diluted share, for the fourth quarter of 2023, but

increased from the first quarter of 2023 net income of $5.0

million, or $0.29 per diluted share.

- Operating net income increased to $5.8 million, or $0.33 of

adjusted earnings per diluted share, for the first quarter of 2024,

compared to $5.4 million, or $0.31 of adjusted earnings per diluted

share, for the fourth quarter of 2023, and $5.5 million, or $0.31

of adjusted earnings per diluted share, for the first quarter of

2023. (See Reconciliation of Non-GAAP Measures).

- Strong liquidity with available sources of funding of

approximately $1.3 billion at March 31, 2024. No overnight

borrowings utilized as of March 31, 2024.

- Estimated uninsured deposits of $785.6 million, or 30.82% of

total Bank deposits at March 31, 2024. Adjusted uninsured deposit

estimate (excluding deposits collateralized by public funds or

internal accounts) of $459.9 million, or 18.04% of total Bank

deposits at March 31, 2024.

- Provision for credit losses of $1.0 million was recorded in

first quarter of 2024 compared to $1.5 million in fourth quarter of

2023, and $900,000 in first quarter of 2023.

- Total loans were $1.86 billion at March 31, 2024, a decrease of

$24.5 million, or 1.30%, from the prior quarter.

- Total deposits were $2.52 billion and $2.54 billion at March

31, 2024 and December 31, 2023, respectively, a decrease of $22.0

million.

- Mortgage production was $50.1 million, and mortgage sales

totaled $36.6 million in the first quarter of 2024 compared to

$45.3 million and $40.1 million, respectively, for the fourth

quarter of 2023.

- Small Business Specialty Lending (“SBSL”) closed $35.6 million

in Small Business Administration (“SBA”) loans and sold $24.0

million in SBA loans in the first quarter of 2024 compared to $24.0

million and $18.0 million, respectively, for the fourth quarter of

2023.

The Company also announced that on April 24, 2024, the Board of

Directors declared a quarterly cash dividend of $0.1125 per share,

to be paid on its common stock on May 22, 2024, to shareholders of

record as of the close of business on May 8, 2024. The Company had

17,558,611 shares of its common stock outstanding as of April 23,

2024.

“We are pleased with the announcement of our improved operating

results for the first quarter, including the continued improvement

in our complementary lines of business which have contributed to

our increased noninterest income. Although margin declined slightly

during the first quarter, the decline was less than anticipated as

we begin to see some stability in our increasing funding costs,”

said Heath Fountain, Chief Executive Officer.

“Total loans declined in the first quarter, largely due to the

sale of portfolio mortgages for a gain and credit related payoffs

of a limited number of loans, along with the general slowdown in

loan production we’ve seen over the past few quarters. Looking

ahead, based on our current pipeline projections we do expect to

see modest loan growth for the rest of the year.

“While our total deposits experienced a decline due to wholesale

deposit payoffs in the first quarter, we are pleased to report that

customer deposits increased by $12.5 million and is a result of our

commitment to growing customer relationships. Also during the

quarter, we strategically sold underperforming securities for a

loss which enables us to reinvest those proceeds into higher

performing assets and improve our overall earnings.

"We saw an improvement in nonperforming loans and maintain

confidence in overall credit quality. Following a period of

historically low charge-offs, the few charge-offs observed in

recent quarters have not raised any concerns regarding the quality

of our portfolio.

“We are proud of the effort and progress our team has made

towards achieving our performance objectives and we expect that we

will see continued improvement as we move forward.”

Balance Sheet

- Total assets were $3.02 billion at March 31, 2024, a decrease

of $37.9 million from December 31, 2023.

- Total loans, including loans held for sale, were at $1.89

billion at March 31, 2024, a decrease of $21.3 million from the

quarter ended December 31, 2023.

- Total deposits were $2.52 billion and $2.54 billion at March

31, 2024 and December 31, 2023, respectively, a decrease of $22.0

million. Interest bearing demand deposits increased $43.3 million

which was offset by decreases in savings and money market deposits

of $10.1 million and time deposits of $32.6 million from December

31, 2023 to March 31, 2024.

- Total borrowings at March 31, 2024 totaled $218.0 million, a

decrease of $20.5 million or, 8.6%, compared to December 31, 2023,

related to decreases in Federal Home Loan Bank advances.

Capital

- Colony continues to maintain a strong capital position, with

ratios that exceed regulatory minimums required to be considered as

“well-capitalized.”

- Preliminary tier one leverage ratio, tier one capital ratio,

total risk-based capital ratio and common equity tier one capital

ratio were 9.19%, 13.04%, 15.79%, and 11.90%, respectively, at

March 31, 2024.

First Quarter and March 31, 2024 Year to Date Results of

Operations

- Net interest income, on a tax-equivalent basis, totaled $18.8

million for the first quarter ended March 31, 2024 compared to

$20.7 million for the same period in 2023. Increases can be seen in

income on interest earning assets which is more than offset by

increases in expenses on interest bearing liabilities due to the

significant rise in interest rates period over period along with

increases in FHLB advances. Income on interest earning assets

increased $5.0 million, to $33.5 million for the first quarter of

2024 compared to the respective period in 2023. Expense on interest

bearing liabilities increased $6.9 million, to $14.7 million for

the first quarter of 2024 compared to the respective period in

2023.

- Net interest margin for the first quarter of 2024 was 2.69%

compared to 3.08% for the first quarter of 2023. The decrease is

the result of rate increases in interest bearing liabilities

outpacing the rate increases in interest earning assets.

- Noninterest income totaled $9.5 million for the first quarter

ended March 31, 2024, an increase of $1.8 million, or 23.87%,

compared to the same period in 2023. This increase was primarily

related to increases in service charges on deposit accounts,

mortgage fee income, gains on sales of SBA loans and income on

wealth advisory services which is included in other noninterest

income which were partially offset by decreases in interchange fee

income and losses on the sales of investment securities.

- Noninterest expense totaled $20.4 million for the first quarter

ended March 31, 2024, compared to $21.2 million for the same period

in 2023. This decrease was a result of overall decreases in

salaries and employee benefits primarily related to the expense

initiative in 2023 which lowered total number of employees period

over period as well as a decrease in data processing expense as a

result of cost savings upon renewal of the core processing contract

in second quarter of 2023.

Asset Quality

- Nonperforming assets totaled $7.0 million and $10.7 million at

March 31, 2024 and December 31, 2023, respectively, a decrease of

$3.7 million.

- Other real estate owned and repossessed assets totaled $562,000

at March 31, 2024 and $448,000 at December 31, 2023.

- Net loans charged-off were $664,000, or 0.14% of average loans

for the first quarter of 2024, compared to $692,000 or 0.15% for

the fourth quarter of 2023.

- The credit loss reserve was $18.7 million, or 1.00% of total

loans, at March 31, 2024, compared to $18.4 million, or 0.98% of

total loans at December 31, 2023.

Earnings call information

The Company will host an earnings conference call at 9:00 a.m.

ET on Thursday, April 25, 2024, to discuss the recent results and

answer appropriate questions. The conference call can be accessed

by dialing 800-274-8461 and using the Conference ID: COLONY1Q. A

replay of the call will be available until Thursday, May 2, 2024.

To listen to the replay, dial 800-757-4761.

About Colony Bankcorp

Colony Bankcorp, Inc. is the bank holding company for Colony

Bank. Founded in Fitzgerald, Georgia in 1975, Colony operates

locations throughout Georgia and has expanded to serve Birmingham,

Alabama, as well as Tallahassee and the Florida Panhandle. At

Colony Bank, we offer a range of banking solutions for personal and

business customers. In addition to traditional banking services,

Colony provides specialized solutions including mortgage,

government guaranteed lending, consumer insurance, wealth

management, and merchant services. Colony’s common stock is traded

on the NASDAQ Global Market under the symbol “CBAN.” For more

information, please visit www.colony.bank. You can also follow the

Company on social media.

Forward-Looking Statements

Certain statements contained in this press release that are not

statements of historical fact constitute “forward-looking

statements” within the meaning of, and subject to the protections

of, Section 27A of the Securities Act of 1933, as amended, and

Section 21E of the Securities Exchange Act of 1934, as amended. In

addition, certain statements may be contained in the Company’s

future filings with the SEC, in press releases, and in oral and

written statements made by or with the approval of the Company that

are not statements of historical fact and constitute

“forward-looking statements” within the meaning of, and subject to

the protections of, Section 27A of the Securities Act of 1933, as

amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Examples of forward-looking statements include, but are

not limited to: (i) projections and/or expectations of revenues,

income or loss, earnings or loss per share, the payment or

nonpayment of dividends, capital structure and other financial

items; (ii) statement of plans and objectives of Colony Bankcorp,

Inc. or its management or Board of Directors, including those

relating to products or services; (iii) statements of future

economic performance; (iv) statements regarding growth strategy,

capital management, liquidity and funding, and future

profitability; and (v) statements of assumptions underlying such

statements. Words such as “may”, “will”, “anticipate”, “assume”,

“should”, “support”, “indicate”, “would”, “believe”, “contemplate”,

“expect”, “estimate”, “continue”, “further”, “plan”, “point to”,

“project”, “could”, “intend”, “target” and similar expressions are

intended to identify forward-looking statements but are not the

exclusive means of identifying such statements.

Prospective investors are cautioned that any such

forward-looking statements are not guarantees of future performance

and involve known and unknown risks and uncertainties. Factors that

might cause such differences include, but are not limited to: the

impact of current and economic conditions, particularly those

affecting the financial services industry, including the effects of

declines in the real estate market, high unemployment rates,

inflationary pressures, elevated interest rates and slowdowns in

economic growth, as well as the financial stress on borrowers as a

result of the foregoing; the risk of potential reductions in

benchmark interest rates and the resulting impacts on net interest

income; potential impacts of adverse developments in the banking

industry highlighted by high-profile bank failures, including

impacts on customer confidence, deposit outflows, liquidity and the

regulatory response thereto; risks arising from media coverage of

the banking industry; risks arising from perceived instability in

the banking sector; the risks of changes in interest rates and

their effects on the level, cost, and composition of, and

competition for, deposits, loan demand and timing of payments, the

values of loan collateral, securities, and interest sensitive

assets and liabilities; the ability to attract new or retain

existing deposits, to retain or grow loans or additional interest

and fee income, or to control noninterest expense; the effect of

pricing pressures on the Company’s net interest margin; the failure

of assumptions underlying the establishment of reserves for

possible credit losses, fair value for loans and other real estate

owned; changes in real estate values; the Company’s ability to

implement its various strategic and growth initiatives; increased

competition in the financial services industry, particularly from

regional and national institutions, as well as from fintech

companies; economic conditions, either nationally or locally, in

areas in which the Company conducts operations being less favorable

than expected; changes in the prices, values and sales volumes of

residential and commercial real estate; developments in our

mortgage banking business, including loan modifications, general

demand, and the effects of judicial or regulatory requirements or

guidance; legislation or regulatory changes which adversely affect

the ability of the consolidated Company to conduct business

combinations or new operations; adverse results from current or

future litigation, regulatory examinations or other legal and/or

regulatory actions, including as a result of the Company’s

participation in and execution of government programs; significant

turbulence or a disruption in the capital or financial markets and

the effect of a fall in the stock market prices on our investment

securities; the effects of war or other conflicts including the

impacts related to or resulting from Russia’s military action in

Ukraine or the conflict in Israel and surrounding areas; risks

related to the Company’s recently completed acquisitions, including

that the anticipated benefits from the recently completed

acquisitions are not realized in the time frame anticipated or at

all as a result of changes in general economic and market

conditions or other unexpected factors or events; the risks

associated with the Company’s pursuit of future acquisitions; the

impact of generative artificial intelligence; fraud or misconduct

by internal or external actors, and system failures, cybersecurity

threats or security breaches and the cost of defending against

them; a deterioration of the credit rating for U.S. long-term

sovereign debt, actions that the U.S. government may take to avoid

exceeding the debt ceiling, and uncertainties surrounding debt

ceiling and the federal budget; a potential U.S. federal government

shutdown and the resulting impacts; and general competitive,

economic, political and market conditions or other unexpected

factors or events. These and other factors, risks and uncertainties

could cause the actual results, performance or achievements of the

Company to be materially different from the future results,

performance or achievements expressed or implied by such

forward-looking statements. Many of these factors are beyond the

Company’s ability to control or predict.

Forward-looking statements speak only as of the date on which

such statements are made. These forward-looking statements are

based upon information presently known to the Company’s management

and are inherently subjective, uncertain and subject to change due

to any number of risks and uncertainties, including, without

limitation, the risks and other factors set forth in the Company’s

filings with the Securities and Exchange Commission, the Company’s

Annual Report on Form 10-K for the year ended December 31, 2023,

under the captions “Cautionary Note Regarding Forward-Looking

Statements” and “Risk Factors,” and in the Company’s quarterly

reports on Form 10-Q and current reports on Form 8-K. The Company

undertakes no obligation to update any forward-looking statement to

reflect events or circumstances after the date on which such

statement is made, or to reflect the occurrence of unanticipated

events. Readers are cautioned not to place undue reliance on these

forward-looking statements.

Explanation of Certain Unaudited Non-GAAP Financial

Measures

The measures entitled operating noninterest income, operating

noninterest expense, operating net income, adjusted earnings per

diluted share, operating return on average assets, operating return

on average equity, tangible book value per common share, tangible

equity to tangible assets, operating efficiency ratio, operating

net noninterest expense to average assets and pre-provision net

revenue are not measures recognized under U.S. generally accepted

accounting principles (GAAP) and therefore are considered non-GAAP

financial measures. The most comparable GAAP measures are

noninterest income, noninterest expense, net income, diluted

earnings per share, return on average assets, return on average

equity, book value per common share, total equity to total assets,

efficiency ratio, net noninterest expense to average assets and net

interest income before provision for credit losses, respectively.

Operating noninterest income excludes gain on sale of bank premises

and loss on sales of securities. Operating noninterest expense

excludes acquisition-related expenses and severance costs.

Operating net income, operating return on average assets, operating

return on average equity and operating efficiency ratio all exclude

acquisition-related expenses, severance costs, gain on sale of bank

premises and loss on sales of securities from net income, return on

average assets, return on average equity and efficiency ratio,

respectively. Operating net noninterest expense to average assets

ratio excludes from net noninterest expense, severance costs,

acquisition-related expenses, gain on sale of bank premises and

loss on sales of securities. Acquisition-related expenses includes

fees associated with acquisitions and vendor contract buyouts.

Severance costs includes costs associated with termination and

retirement of employees. Adjusted earnings per diluted share

includes the adjustments to operating net income. Tangible book

value per common share and tangible equity to tangible assets

exclude goodwill and other intangibles from book value per common

share and total equity to total assets, respectively. Pre-provision

net revenue is calculated by adding noninterest income to net

interest income before provision for credit losses, and subtracting

noninterest expense.

Management uses these non-GAAP financial measures in its

analysis of the Company's performance and believes these

presentations provide useful supplemental information, and a

clearer understanding of the Company's performance, and if not

provided would be requested by the investor community. The Company

believes the non-GAAP measures enhance investors' understanding of

the Company's business and performance. These measures are also

useful in understanding performance trends and facilitate

comparisons with the performance of other financial institutions.

The limitations associated with operating measures are the risk

that persons might disagree as to the appropriateness of items

comprising these measures and that different companies might

calculate these measures differently.

These disclosures should not be considered an alternative to

GAAP. The computations of operating noninterest income, operating

noninterest expense, operating net income, adjusted earnings per

diluted share, operating return on average assets, operating return

on average equity, tangible book value per common share, tangible

equity to tangible assets, operating efficiency ratio, operating

net noninterest expense to average assets and pre-provision net

revenue and the reconciliation of these measures to noninterest

income, noninterest expense, net income, diluted earnings per

share, return on average assets, return on average equity, book

value per common share, total equity to total assets, efficiency

ratio, net noninterest expense to average assets and net interest

income before provision for credit losses are set forth in the

table below.

Colony Bankcorp, Inc.

Reconciliation of Non-GAAP

Measures

2024

2023

(dollars in

thousands, except per share data)

First Quarter

Fourth Quarter

Third Quarter

Second Quarter

First Quarter

Operating noninterest income

reconciliation

Noninterest income (GAAP)

$

9,487

$

9,305

$

9,721

$

8,952

$

7,656

Gain on sale of bank premises

—

(236

)

—

(125

)

—

Loss on sales of securities

555

—

—

—

—

Operating noninterest income

$

10,042

$

9,069

$

9,721

$

8,827

$

7,656

Operating noninterest expense

reconciliation

Noninterest expense (GAAP)

$

20,397

$

19,587

$

20,881

$

21,432

$

21,165

Severance costs

(23

)

—

(220

)

(635

)

(431

)

Acquisition-related expenses

—

—

—

—

(161

)

Operating noninterest expense

$

20,374

$

19,587

$

20,661

$

20,797

$

20,573

Operating net income

reconciliation

Net income (GAAP)

$

5,333

$

5,598

$

5,804

$

5,302

$

5,043

Severance costs

23

—

220

635

431

Acquisition-related expenses

—

—

—

—

161

Gain on sale of bank premises

—

(236

)

—

(125

)

—

Loss on sales of securities

555

—

—

—

—

Income tax benefit

(121

)

52

(48

)

(93

)

(107

)

Operating net income

$

5,790

$

5,414

$

5,976

$

5,719

$

5,528

Weighted average diluted shares

17,560,210

17,567,839

17,569,493

17,580,557

17,595,688

Adjusted earnings per diluted

share

$

0.33

$

0.31

$

0.34

$

0.33

$

0.31

Operating return on average assets

reconciliation

Return on average assets (GAAP)

0.71

%

0.73

%

0.75

%

0.70

%

0.69

%

Severance costs

—

—

0.03

0.08

0.06

Acquisition-related expenses

—

—

—

—

0.02

Gain on sale of bank premises

—

(0.03

)

—

(0.02

)

—

Loss on sales of securities

0.07

—

—

—

—

Tax effect of adjustment items

(0.02

)

0.01

(0.01

)

(0.01

)

(0.01

)

Operating return on average

assets

0.76

%

0.71

%

0.77

%

0.75

%

0.76

%

Operating return on average equity

reconciliation

Return on average equity (GAAP)

8.38

%

9.20

%

9.61

%

8.88

%

8.73

%

Severance costs

0.04

—

0.36

1.06

0.75

Acquisition-related expenses

—

—

—

—

0.28

Gain on sale of bank premises

—

(0.39

)

—

(0.21

)

—

Loss on sales of securities

0.87

—

—

—

—

Tax effect of adjustment items

(0.19

)

0.09

(0.08

)

(0.16

)

(0.19

)

Operating return on average

equity

9.10

%

8.90

%

9.89

%

9.57

%

9.57

%

Tangible book value per common share

reconciliation

Book value per common share (GAAP)

$

14.80

$

14.51

$

13.59

$

13.65

$

13.57

Effect of goodwill and other

intangibles

(3.01

)

(3.02

)

(3.04

)

(3.07

)

(3.08

)

Tangible book value per common share

$

11.79

$

11.49

$

10.55

$

10.58

$

10.49

Tangible equity to tangible assets

reconciliation

Equity to assets (GAAP)

8.62

%

8.35

%

7.72

%

7.72

%

7.97

%

Effect of goodwill and other

intangibles

(1.63

)

(1.62

)

(1.63

)

(1.63

)

(1.70

)

Tangible equity to tangible assets

6.99

%

6.73

%

6.09

%

6.09

%

6.27

%

Operating efficiency ratio

calculation

Efficiency ratio (GAAP)

72.48

%

69.51

%

71.17

%

76.18

%

74.98

%

Severance costs

(0.08

)

—

(0.75

)

(2.26

)

(1.53

)

Acquisition-related expenses

—

—

—

—

(0.57

)

Gain on sale of bank premises

—

0.84

—

0.44

—

Loss on sales of securities

(1.97

)

—

—

—

—

Operating efficiency ratio

70.43

%

70.35

%

70.42

%

74.36

%

72.88

%

Operating net noninterest expense(1) to

average assets calculation

Net noninterest expense to average

assets

1.45

%

1.35

%

1.45

%

1.65

%

1.86

%

Severance costs

—

—

(0.03

)

(0.09

)

(0.06

)

Acquisition-related expenses

—

—

—

—

(0.02

)

Gain on sale of bank premises

—

0.03

—

0.02

—

Loss on sales of securities

(0.07

)

—

—

—

—

Operating net noninterest expense to

average assets

1.38

%

1.38

%

1.42

%

1.58

%

1.78

%

Pre-provision net revenue

Net interest income before provision for

credit losses

$

18,654

$

18,874

$

19,621

$

19,181

$

20,568

Noninterest income

9,487

9,305

9,718

8,952

7,659

Total income

28,141

28,179

29,339

28,133

28,227

Noninterest expense

20,397

19,587

20,881

21,432

21,165

Pre-provision net revenue

$

7,744

$

8,592

$

8,458

$

6,701

$

7,062

(1) Net noninterest expense is defined as

noninterest expense less noninterest income.

Colony Bankcorp, Inc.

Selected Financial Information

2024

2023

(dollars in

thousands, except per share data)

First Quarter

Fourth Quarter

Third Quarter

Second Quarter

First Quarter

EARNINGS SUMMARY

Net interest income

$

18,654

$

18,874

$

19,621

$

19,181

$

20,568

Provision for credit losses

1,000

1,500

1,000

200

900

Noninterest income

9,487

9,305

9,718

8,952

7,659

Noninterest expense

20,397

19,587

20,881

21,432

21,165

Income taxes

1,411

1,494

1,654

1,199

1,119

Net income

$

5,333

$

5,598

$

5,804

$

5,302

$

5,043

PERFORMANCE MEASURES

Per common share:

Common shares outstanding

17,558,611

17,564,182

17,567,983

17,541,661

17,593,879

Weighted average basic shares

17,560,210

17,567,839

17,569,493

17,580,557

17,595,688

Weighted average diluted shares

17,560,210

17,567,839

17,569,493

17,580,557

17,595,688

Earnings per basic share

$

0.30

$

0.32

$

0.33

$

0.30

$

0.29

Earnings per diluted share

0.30

0.32

0.33

0.30

0.29

Adjusted earnings per diluted share(b)

0.33

0.31

0.34

0.33

0.31

Cash dividends declared per share

0.1125

0.1100

0.1100

0.1100

0.1100

Common book value per share

14.80

14.51

13.59

13.65

13.57

Tangible book value per common

share(b)

11.79

11.49

10.55

10.58

10.49

Pre-provision net revenue(b)

$

7,744

$

8,592

$

8,458

$

6,701

$

7,062

Performance ratios:

Net interest margin (a)

2.69

%

2.70

%

2.78

%

2.77

%

3.08

%

Return on average assets

0.71

0.73

0.75

0.70

0.69

Operating return on average assets (b)

0.76

0.71

0.77

0.75

0.76

Return on average total equity

8.38

9.20

9.61

8.88

8.73

Operating return on average total equity

(b)

9.10

8.90

9.89

9.57

9.57

Efficiency ratio

72.48

69.51

71.17

76.18

74.98

Operating efficiency ratio (b)

70.43

70.35

70.42

74.36

72.88

Net noninterest expense to average

assets

1.45

1.35

1.45

1.65

1.86

Operating net noninterest expense to

average assets(b)

1.38

1.38

1.42

1.58

1.78

ASSET QUALITY

Nonperforming portfolio loans

$

3,674

$

7,804

$

5,625

$

6,716

$

5,636

Nonperforming government guaranteed

loans

2,757

2,035

3,641

4,369

1,529

Loans 90 days past due and still

accruing

—

370

9

—

—

Total nonperforming loans (NPLs)

6,431

10,209

9,275

11,085

7,165

Other real estate owned

562

448

812

792

651

Total nonperforming assets (NPAs)

6,993

10,657

10,087

11,877

7,816

Classified loans

25,965

23,754

20,704

19,267

18,747

Criticized loans

55,065

56,879

50,741

48,074

43,281

Net loan charge-offs (recoveries)

664

692

698

(37

)

237

Allowance for credit losses to total

loans

1.00

%

0.98

%

0.93

%

0.93

%

0.92

%

Allowance for credit losses to total

NPLs

290.11

179.95

187.26

153.96

231.67

Allowance for credit losses to total

NPAs

266.80

172.38

172.18

143.69

212.37

Net charge-offs (recoveries) to average

loans, net

0.14

0.15

0.15

(0.01

)

0.05

NPLs to total loans

0.35

0.54

0.50

0.60

0.40

NPAs to total assets

0.23

0.35

0.33

0.38

0.26

NPAs to total loans and foreclosed

assets

0.38

0.57

0.54

0.65

0.43

AVERAGE BALANCES

Total assets

$

3,036,093

$

3,027,812

$

3,058,485

$

3,030,044

$

2,949,986

Loans, net

1,853,077

1,860,652

1,854,367

1,814,172

1,765,845

Loans, held for sale

24,612

21,251

29,444

21,237

14,007

Deposits

2,543,259

2,538,500

2,565,026

2,524,949

2,473,464

Total stockholders’ equity

255,927

241,392

239,571

239,579

234,147

(a) Computed using fully

taxable-equivalent net income.

(b) Non-GAAP measure - see “Explanation of

Certain Unaudited Non-GAAP Financial Measures” for more information

and reconciliation to GAAP.

Colony Bankcorp, Inc.

Average Balance Sheet and Net Interest

Analysis

Three Months Ended March

31,

2024

2023

(dollars in

thousands)

Average

Balances

Income/ Expense

Yields/ Rates

Average

Balances

Income/ Expense

Yields/ Rates

Assets

Interest-earning assets:

Loans, net of unearned income 1

$

1,896,014

$

27,145

5.76

%

$

1,779,852

$

22,199

5.06

%

Investment securities, taxable

737,257

5,042

2.75

%

786,900

5,374

2.77

%

Investment securities, tax-exempt 2

106,819

605

2.28

%

114,346

594

2.11

%

Deposits in banks and short term

investments

71,431

693

3.90

%

50,898

357

2.85

%

Total interest-earning assets

2,811,521

33,485

4.79

%

2,731,996

28,524

4.23

%

Noninterest-earning assets

224,572

217,990

Total assets

$

3,036,093

$

2,949,986

Liabilities and stockholders'

equity

Interest-bearing liabilities:

Interest-bearing demand and savings

$

1,451,490

$

6,408

1.78

%

$

1,409,834

$

2,324

0.67

%

Other time

612,241

5,683

3.73

%

507,415

2,675

2.14

%

Total interest-bearing deposits

2,063,731

12,091

2.36

%

1,917,249

4,999

1.06

%

Federal funds purchased

13

—

5.72

%

7,012

88

5.09

%

Federal Home Loan Bank advances

156,978

1,572

4.03

%

149,444

1,626

4.41

%

Other borrowings

63,086

993

6.33

%

76,083

1,089

5.80

%

Total other interest-bearing

liabilities

220,077

2,565

4.69

%

232,539

2,803

4.89

%

Total interest-bearing liabilities

2,283,808

14,656

2.58

%

2,149,788

7,802

1.47

%

Noninterest-bearing liabilities:

Demand deposits

479,528

$

556,216

Other liabilities

16,830

9,835

Stockholders' equity

255,927

234,147

Total noninterest-bearing liabilities and

stockholders' equity

752,285

800,198

Total liabilities and stockholders'

equity

$

3,036,093

$

2,949,986

Interest rate spread

2.21

%

2.76

%

Net interest income

$

18,829

$

20,722

Net interest margin

2.69

%

3.08

%

____________________________________

1The average balance of loans includes the

average balance of nonaccrual loans. Income on such loans is

recognized and recorded on the cash basis. Taxable-equivalent

adjustments totaling $48,000 and $45,000 for the quarters ended

March 31, 2024 and 2023, respectively, are calculated using the

statutory federal tax rate and are included in income and fees on

loans. Accretion expense of $5,000 and income of $71,000 for the

quarters ended March 31, 2024 and 2023 are also included in income

and fees on loans.

2Taxable-equivalent adjustments totaling

$127,000 and $108,000 for the quarters ended March 31, 2024 and

2023, respectively, are calculated using the statutory federal tax

rate and are included in tax-exempt interest on investment

securities.

Colony Bankcorp, Inc.

Segment Reporting

2024

2023

(dollars in

thousands)

First Quarter

Fourth Quarter

Third Quarter

Second Quarter

First Quarter

Banking Division

Net interest income

$

17,552

$

17,986

$

18,778

$

18,562

$

20,138

Provision for credit losses

455

979

286

60

900

Noninterest income

5,680

5,992

6,233

5,433

4,918

Noninterest expenses

17,129

16,619

16,653

17,650

17,812

Income taxes

1,166

1,365

1,777

1,157

1,155

Segment income

$

4,482

$

5,015

$

6,295

$

5,128

$

5,189

Total segment assets

$

2,910,102

$

2,956,121

$

2,999,071

$

3,013,689

$

2,930,421

Full time employees

377

378

382

383

407

Mortgage Banking Division

Net interest income

$

40

$

23

$

52

$

31

$

3

Provision for credit losses

—

—

—

—

—

Noninterest income

1,165

1,206

1,725

2,015

1,277

Noninterest expenses

1,218

1,203

2,040

1,971

1,712

Income taxes

1

8

(53

)

14

(86

)

Segment income

$

(14

)

$

18

$

(210

)

$

61

$

(346

)

Total segment assets

$

8,011

$

7,890

$

9,991

$

15,984

$

7,895

Variable noninterest expense(1)

$

603

$

597

$

1,245

$

1,149

$

890

Fixed noninterest expense

615

606

795

822

822

Full time employees

43

42

45

51

59

Small Business Specialty Lending

Division

Net interest income

$

1,062

$

865

$

791

$

588

$

427

Provision for credit losses

545

521

714

140

—

Noninterest income

2,642

2,107

1,760

1,504

1,464

Noninterest expenses

2,050

1,765

2,188

1,811

1,641

Income taxes

244

121

(70

)

28

50

Segment income

$

865

$

565

$

(281

)

$

113

$

200

Total segment assets

$

97,396

$

89,411

$

84,761

$

71,398

$

58,625

Full time employees

31

33

33

32

30

Total Consolidated

Net interest income

$

18,654

$

18,874

$

19,621

$

19,181

$

20,568

Provision for credit losses

1,000

1,500

1,000

200

900

Noninterest income

9,487

9,305

9,718

8,952

7,659

Noninterest expenses

20,397

19,587

20,881

21,432

21,165

Income taxes

1,411

1,494

1,654

1,199

1,119

Segment income

$

5,333

$

5,598

$

5,804

$

5,302

$

5,043

Total segment assets

$

3,015,509

$

3,053,422

$

3,093,823

$

3,101,071

$

2,996,941

Full time employees

451

453

460

466

496

(1) Variable noninterest expense includes

commission based salary expenses and volume based loan related

fees.

Colony Bankcorp, Inc.

Consolidated Balance Sheets

March 31, 2024

December 31, 2023

(dollars in

thousands)

(unaudited)

(audited)

ASSETS

Cash and due from banks

$

22,914

$

25,339

Interest-bearing deposits in banks and

federal funds sold

71,755

57,983

Cash and cash equivalents

94,669

83,322

Investment securities available for sale,

at fair value

382,953

407,382

Investment securities held to maturity, at

amortized cost

447,157

449,031

Other investments

16,034

16,868

Loans held for sale

31,102

27,958

Loans, net of unearned income

1,859,018

1,883,470

Allowance for credit losses

(18,657

)

(18,371

)

Loans, net

1,840,361

1,865,099

Premises and equipment

39,381

39,870

Other real estate

562

448

Goodwill

48,923

48,923

Other intangible assets

3,855

4,192

Bank owned life insurance

56,765

56,925

Deferred income taxes, net

24,587

25,405

Other assets

29,160

27,999

Total assets

$

3,015,509

$

3,053,422

LIABILITIES AND STOCKHOLDERS’

EQUITY

Liabilities:

Deposits:

Noninterest-bearing

$

476,413

$

498,992

Interest-bearing

2,046,335

2,045,798

Total deposits

2,522,748

2,544,790

Federal Home Loan Bank advances

155,000

175,000

Other borrowed money

62,969

63,445

Accrued expenses and other liabilities

14,878

15,252

Total liabilities

$

2,755,595

$

2,798,487

Stockholders’ equity

Common stock, $1 par value; 50,000,000

shares authorized, 17,558,611 and 17,564,182 issued and

outstanding, respectively

$

17,559

$

17,564

Paid in capital

168,951

168,614

Retained earnings

127,758

124,400

Accumulated other comprehensive loss, net

of tax

(54,354

)

(55,643

)

Total stockholders’ equity

259,914

254,935

Total liabilities and stockholders’

equity

$

3,015,509

$

3,053,422

Colony Bankcorp, Inc.

Consolidated Statements of Income

(unaudited)

Three months ended March

31,

2024

2023

(dollars in

thousands, except per share data)

Interest income:

Loans, including fees

$

27,097

$

22,153

Investment securities

5,520

5,860

Deposits in banks and short term

investments

693

357

Total interest income

33,310

28,370

Interest expense:

Deposits

12,091

4,999

Federal funds purchased

—

88

Federal Home Loan Bank advances

1,572

1,626

Other borrowings

993

1,089

Total interest expense

14,656

7,802

Net interest income

18,654

20,568

Provision for credit losses

1,000

900

Net interest income after provision for

credit losses

17,654

19,668

Noninterest income:

Service charges on deposits

2,373

1,914

Mortgage fee income

1,249

1,183

Gain on sales of SBA loans

2,046

1,057

Loss on sales of securities

(555

)

—

Interchange fees

2,028

2,068

BOLI income

533

331

Insurance commissions

465

460

Other

1,348

646

Total noninterest income

9,487

7,659

Noninterest expense:

Salaries and employee benefits

12,018

12,609

Occupancy and equipment

1,507

1,622

Information technology expenses

2,110

2,341

Professional fees

834

715

Advertising and public relations

960

993

Communications

226

294

Other

2,742

2,591

Total noninterest expense

20,397

21,165

Income before income taxes

6,744

6,162

Income taxes

1,411

1,119

Net income

$

5,333

$

5,043

Earnings per common share:

Basic

$

0.30

$

0.29

Diluted

0.30

0.29

Dividends declared per share

0.1125

0.1100

Weighted average common shares

outstanding:

Basic

17,560,210

17,595,688

Diluted

17,560,210

17,595,688

Colony Bankcorp, Inc.

Quarterly Comparison

2024

2023

(dollars in

thousands, except per share data)

First Quarter

Fourth Quarter

Third Quarter

Second Quarter

First Quarter

Assets

$

3,015,509

$

3,053,422

$

3,093,823

$

3,101,071

$

2,996,941

Loans, net

1,840,361

1,865,099

1,847,603

1,821,776

1,783,254

Deposits

2,522,748

2,544,790

2,591,332

2,627,211

2,516,129

Total equity

259,914

254,935

238,692

239,455

238,777

Net income

5,333

5,598

5,804

5,302

5,043

Earnings per basic share

$

0.30

$

0.32

$

0.33

$

0.30

$

0.29

Key Performance Ratios:

Return on average assets

0.71

%

0.73

%

0.75

%

0.70

%

0.69

%

Operating return on average assets (a)

0.76

%

0.71

%

0.77

%

0.75

%

0.76

%

Return on average total equity

8.38

%

9.20

%

9.61

%

8.88

%

8.73

%

Operating return on average total equity

(a)

9.10

%

8.90

%

9.89

%

9.57

%

9.57

%

Total equity to total assets

8.62

%

8.35

%

7.72

%

7.72

%

7.97

%

Tangible equity to tangible assets (a)

6.99

%

6.73

%

6.09

%

6.09

%

6.27

%

Net interest margin

2.69

%

2.70

%

2.78

%

2.77

%

3.08

%

(a) Non-GAAP measure - see “Explanation of

Certain Unaudited Non-GAAP Financial Measures” for more information

and reconciliation to GAAP.

Colony Bankcorp, Inc.

Quarterly Loan Comparison

2024

2023

(dollars in

thousands)

First Quarter

Fourth Quarter

Third Quarter

Second Quarter

First Quarter

Core

$

1,718,284

$

1,729,866

$

1,698,219

$

1,664,855

$

1,614,216

Purchased

140,734

153,604

166,752

173,987

185,637

Total

$

1,859,018

$

1,883,470

$

1,864,971

$

1,838,842

$

1,799,853

Colony Bankcorp, Inc.

Quarterly Loans by Composition

Comparison

2024

2023

(dollars in

thousands)

First Quarter

Fourth Quarter

Third Quarter

Second Quarter

First Quarter

Construction, land & land

development

$

234,000

$

247,146

$

245,268

$

249,423

$

249,720

Other commercial real estate

971,205

974,649

969,168

979,509

985,627

Total commercial real estate

1,205,205

1,221,795

1,214,436

1,228,932

1,235,347

Residential real estate

347,277

355,973

339,501

325,407

316,415

Commercial, financial &

agricultural

239,837

242,743

252,725

243,458

225,269

Consumer and other

66,699

62,959

58,309

41,045

22,822

Total

$

1,859,018

$

1,883,470

$

1,864,971

$

1,838,842

$

1,799,853

Colony Bankcorp, Inc.

Quarterly Loans by Location

Comparison

2024

2023

(dollars in

thousands)

First Quarter

Fourth Quarter

Third Quarter

Second Quarter

First Quarter

Alabama

$

44,806

$

45,594

$

45,135

$

44,301

$

41,118

Florida

1,579

40

—

—

—

Augusta

71,483

65,284

55,508

55,124

53,415

Coastal Georgia

232,557

243,492

239,281

242,249

248,253

Middle Georgia

121,131

118,806

116,776

119,041

119,720

Atlanta and North Georgia

425,753

426,724

431,632

420,231

419,480

South Georgia

409,681

436,728

446,221

463,558

448,558

West Georgia

183,679

187,751

188,208

192,348

204,664

Small Business Specialty Lending

71,196

68,637

65,187

56,908

50,513

Consumer Portfolio Mortgages

261,204

255,771

245,057

226,755

211,225

Marine/RV Lending

35,017

33,191

31,009

17,137

2,060

Other

932

1,452

957

1,190

847

Total

$

1,859,018

$

1,883,470

$

1,864,971

$

1,838,842

$

1,799,853

Colony Bankcorp, Inc.

Quarterly Deposits Comparison

2024

2023

(dollars in thousands)

First Quarter

Fourth Quarter

Third Quarter

Second Quarter

First Quarter

Noninterest-bearing demand

$

476,413

$

498,992

$

494,221

$

541,119

$

537,928

Interest-bearing demand

802,596

759,299

740,672

733,708

764,070

Savings

650,188

660,311

681,229

659,137

612,397

Time, $250,000 and over

173,386

167,680

187,218

184,459

152,914

Other time

420,165

458,508

487,992

508,788

448,820

Total

$

2,522,748

$

2,544,790

$

2,591,332

$

2,627,211

$

2,516,129

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240424708104/en/

Derek Shelnutt EVP & Chief Financial Officer 229-426-6000,

extension 6119

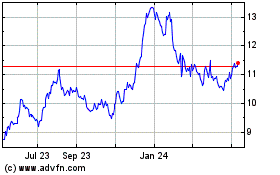

Colony Bankcorp (NASDAQ:CBAN)

Historical Stock Chart

From Dec 2024 to Jan 2025

Colony Bankcorp (NASDAQ:CBAN)

Historical Stock Chart

From Jan 2024 to Jan 2025