As

filed with the Securities and Exchange Commission on July 15, 2024

Registration

No. 333-

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

S-3

REGISTRATION

STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

| CINGULATE,

INC. |

| (Exact

name of registrant as specified in its charter) |

| Delaware |

|

86-3825535 |

(State

or other jurisdiction of

incorporation

or organization) |

|

(I.R.S.

Employer

Identification

Number) |

1901

W. 47th Place

Kansas

City, KS 66205

(913)

942-2300

(Address,

including zip code, and telephone number,

including

area code, of registrant’s principal executive offices)

Shane

J. Schaffer

Chief

Executive Officer

Cingulate

Inc.

1901

W. 47th Place

Kansas

City, KS 66205

(913)

942-2300

(Name,

address, including zip code, and telephone number,

including

area code, of agent for service)

Copies

to:

Michael

J. Lerner, Esq.

Steven

M. Skolnick, Esq.

Lowenstein

Sandler LLP

1251

Avenue of the Americas

New

York, New York 10020

(212)

262-6700

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration Statement becomes effective, as determined

by the selling stockholders.

If

the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check

the following box: ☐

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, other than securities offered only in connection with dividend or interest reinvestment plans, check the following

box: ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective

upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional

securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large

accelerated filer |

☐ |

Accelerated

filer |

☐ |

| Non-accelerated

filer |

☒ |

Smaller

reporting company |

☒ |

| |

|

Emerging

growth company |

☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

The

Registrant hereby amends this Registration Statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the Registration Statement shall become effective

on such date as the Commission, acting pursuant to said Section 8(a), may determine.

The

information in this preliminary prospectus is not complete and may be changed. The Selling Stockholders may not resell these securities

until the registration statement filed with the Securities and Exchange Commission is effective. This preliminary prospectus is not an

offer to sell these securities, nor is it a solicitation of offers to buy these securities, in any state where the offer or sale is not

permitted.

| PRELIMINARY

PROSPECTUS |

SUBJECT

TO COMPLETION |

DATED

JULY 15, 2024 |

6,630,000

Shares of Common Stock

Issuable

Upon Exercise of Outstanding Warrants

This

prospectus relates to the resale of up to 6,630,000 shares of Cingulate, Inc. (the “Company,” “we,” “our”

or “us”) common stock, par value $0.0001 per share (the “Common Stock”), by the Selling Stockholders listed in

this prospectus or their permitted transferees (the “Selling Stockholders”). The shares of Common Stock registered for resale

pursuant to this prospectus consist of (i) 4,250,000 shares of Common Stock (the “Series C Warrant Shares”) issuable upon

the exercise of series C warrants (the “Series C Warrants”), (ii) 2,125,000 shares of Common Stock (the “Series D Warrant

Shares”) issuable upon the exercise of series D warrants (the “Series D Warrants), and (iii) 255,000 shares of Common Stock

(the “Placement Agent Warrant Shares” and together with the Series C Warrant Shares and Series D Warrant Shares, the “Warrant

Shares”) issuable upon the exercise of certain warrants issued to our placement agent (the “Placement Agent Warrants”

and together with the Series C Warrants and Series D Warrants, the “Warrants”). The Warrants were issued to the Selling Stockholders

in a private placement offering (the “Private Placement”) which closed on July 1, 2024.

For

additional information about the Private Placement, see “Private Placement.”

The

Series C Warrants and the Series D Warrants have an exercise price of $0.585 per share. The Series C Warrants will be exercisable on

or after the effective date of stockholder approval of the issuance of the shares upon exercise of the warrants (the “Stockholder

Approval Date”) until the five (5) year anniversary of the Stockholder Approval Date. The Series D Warrants will be exercisable

on or after the Stockholder Approval Date until the two (2) year anniversary of the Stockholder Approval Date. The Placement Agent Warrants

have substantially the same terms as the Series C Warrants, except that the Placement Agent Warrants have an exercise price of $0.7313.

The

Selling Stockholders may, from time to time, sell, transfer or otherwise dispose of any or all of their shares of Common Stock or interests

in their shares of Common Stock on any stock exchange, market or trading facility on which the shares of Common Stock are traded or in

private transactions. These dispositions may be at fixed prices, at prevailing market prices at the time of sale, at prices related to

the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices. See “Plan of Distribution”

in this prospectus for more information. We will not receive any proceeds from the resale or other disposition of the shares of Common

Stock by the Selling Stockholders. However, we will receive the proceeds of any cash exercise of the Warrants. See “Use of Proceeds”

beginning on page 9 and “Plan of Distribution” beginning on page 10 of this prospectus for more information.

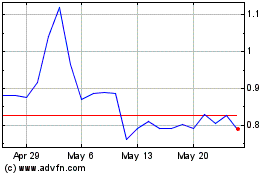

Our

Common Stock and certain of our outstanding warrants (the “Public Warrants”) are listed on the Nasdaq Capital Market (“Nasdaq”)

under the symbols “CING” and “CINGW,” respectively. On July 12, 2024, the last reported sale price of

our Common Stock and Public Warrants as reported on Nasdaq was $0.43 and $0.0099, respectively.

You

should read this prospectus, together with additional information described under the headings “Incorporation of Certain Information

by Reference” and “Where You Can Find More Information,” carefully before you invest in any of our securities.

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report

on Form 10-K for the fiscal year ended December 31, 2023, filed with the Securities and Exchange Commission, or the SEC, on April 1,

2024 and our other filings we make with the Securities and Exchange Commission from time to time, which are incorporated by reference

herein in their entirety, together with other information in this prospectus and the information incorporated by reference herein.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or determined

if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024

TABLE

OF CONTENTS

PROSPECTUS

SUMMARY

This

summary highlights information contained elsewhere in this prospectus and the documents incorporated by reference herein. This summary

does not contain all of the information that you should consider before deciding to invest in our securities. You should read this entire

prospectus carefully, including the section entitled “Risk Factors” beginning on page 4, our consolidated financial statements

and the related notes and the other information incorporated by reference into this prospectus before making an investment decision.

Overview

We

are a biopharmaceutical company using our proprietary Precision Timed ReleaseTM (“PTRTM”) drug delivery

platform technology to build and advance a pipeline of next-generation pharmaceutical products designed to improve the lives of patients

suffering from frequently diagnosed conditions characterized by burdensome daily dosing regimens and suboptimal treatment outcomes. With

an initial focus on the treatment of Attention Deficit/Hyperactivity Disorder (“ADHD”) and anxiety, we are identifying and

evaluating additional therapeutic areas where our PTR technology may be employed to develop future product candidates. Our PTR platform

incorporates a proprietary Erosion Barrier Layer (“EBL”) designed to allow for the release of drug substance at specific,

pre-defined time intervals, unlocking the potential for once-daily, multi-dose tablets.

We

are targeting the ADHD treatment market, with an estimated US market size of over $23 billion as of November 2023, of which $18.6 billion

is attributable to stimulants. Stimulants are the most commonly prescribed class of medications for ADHD and account for approximately

88% of all ADHD medication prescriptions in the United States. By contrast, non-stimulant medications are typically employed only in

the second-line or adjunctive therapy setting and accounting for approximately 12% of all ADHD medication prescriptions. Extended-release,

or long-acting, dosage forms of stimulant medications are most frequently deployed as the first-line treatment for ADHD and constitute

approximately $16 billion of the overall ADHD market spend and accounting for 54% of all stimulant prescriptions. Most of these extended-release

dosage forms are approved for once-daily dosing in the morning and were designed to eliminate the need for re-dosing during the day.

However, with the current ‘once-daily’ extended-release dosage forms, most patients still receive a second or “booster”

dose for administration later in the day (typically in the early afternoon) to achieve active-day coverage and suffer from a multitude

of unwanted side effects as a result. We believe there is a significant, unmet need within the current treatment paradigm for true once-daily

ADHD stimulant medications with a duration that provides entire active-day coverage combined with an improved side effect profile to

better serve the numerous unmet needs of patients.

Our

two proprietary, first-line stimulant medications: CTx-1301 (dexmethylphenidate) and CTx-1302 (dextroamphetamine), are being developed

for the treatment of ADHD across all three patient segments: children (ages 6 -12), adolescents (ages 13-17), and adults (ages 18+).

Both CTx-1301 and CTx-1302 are designed to address the key shortcomings of currently approved stimulant therapies by: providing an immediate

onset of action (within 30 minutes); offering entire ‘active-day’ duration; eliminating the need for ‘booster/recovery’

doses of additional stimulant medications; minimizing or eliminating the rebound/crash symptoms associated with early medication ‘wear-off;’

and providing favorable tolerability with a controlled descent of drug blood levels. Furthermore, by eliminating the ‘booster’

dose used by up to 60% of ADHD patients in conjunction with their primary medication, we believe our product candidates will provide

important societal and economic benefits: reducing the abuse and diversion associated with short-acting stimulant medications; allowing

physicians to prescribe one medication versus two; allowing patients to pay for one medication versus two; and allowing payers to reimburse

one medication versus two.

Our

Organizational Structure

Cingulate

Inc. is a Delaware corporation that was formed to serve as a holding company. In connection with our initial public offering, we effected

certain organizational transactions. On September 29, 2021, Cingulate acquired Cingulate Therapeutics LLC, or CTx, through the merger

of a wholly-owned acquisition subsidiary of Cingulate with and into CTx (the “Reorganization Merger”). As a result of the

Reorganization Merger, CTx became a wholly-owned subsidiary of Cingulate. Unless otherwise stated or the context otherwise requires,

all information in this prospectus reflects the consummation of the Reorganization Merger.

Corporate

Information

Our

primary executive offices are located at 1901 West 47th Place, Kansas City, Kansas 66205 and our telephone number is (913)

942-2300. Our website address is www.cingulate.com. The information contained on, or that can be accessed through, our website

is not part of this prospectus and should not be considered as part of this prospectus or in deciding whether to purchase our securities.

Cingulate,

PTR, Cingulate Therapeutics, Enfoqis, Enfoqus, Trodesca, Ivoqus, Taylerza, Tymprezi, Accomplish, Mastery and our logo are some of our

trademarks used in this prospectus. This prospectus also includes trademarks, tradenames and service marks that are the property of other

organizations. Solely for convenience, our trademarks and tradenames referred to in this prospectus may appear without the ® and

™ symbols, but those references are not intended to indicate, in any way, that we will not assert, to the fullest extent under

applicable law, our rights or the right of the applicable licensor to these trademarks and tradenames.

Implications

of Being an Emerging Growth Company

As

a company with less than $1.235 billion in revenue during our most recently completed fiscal year, we qualify as an “emerging growth

company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage

of relief from certain reporting requirements and other burdens that are otherwise applicable generally to public companies. These provisions

include:

| |

● |

reduced

obligations with respect to financial data, including presenting only two years of audited financial statements and only two years

of selected financial data in this prospectus; |

| |

|

|

| |

● |

an

exception from compliance with the auditor attestation requirement of Section 404 of the Sarbanes-Oxley Act of 2002, as amended,

or the Sarbanes-Oxley Act; |

| |

|

|

| |

● |

reduced

disclosure about our executive compensation arrangements in our periodic reports, proxy statements and registration statements; and |

| |

|

|

| |

● |

exemptions

from the requirements of holding non-binding advisory votes on executive compensation or golden parachute arrangements. |

We

may take advantage of exemptions for up to five years or such earlier time that we are no longer an emerging growth company. Accordingly,

the information contained herein may be different than the information you receive from other public companies in which you hold stock.

We would cease to be an emerging growth company upon the earliest to occur of: (1) the last day of the fiscal year in which we have more

than $1.235 billion in annual gross revenue, (2) December 31, 2026, (3) the date we are deemed to be a “large accelerated filer”

as defined in the Securities Exchange Act of 1934, as amended, or the Exchange Act, and (4) the date on which we have during the previous

three-year period issued more than $1.0 billion in non-convertible debt securities.

The

JOBS Act also permits us, as an emerging growth company, to take advantage of an extended transition period to comply with the new or

revised accounting standards applicable to public companies and thereby allow us to delay the adoption of those standards until those

standards would apply to private companies. We have irrevocably elected to avail ourselves of this exemption and therefore, we will not

be subject to the same new or revised accounting standards as other public companies that are not emerging growth companies.

THE

OFFERING

| Shares

of Common Stock offered by the Selling Stockholders |

|

Up

to 6,630,000 shares of Common Stock issuable upon exercise of the Warrants. |

| |

|

|

| Use

of Proceeds |

|

We

will not receive any proceeds from the shares of Common Stock offered by the Selling Stockholders pursuant to this prospectus. However,

we will receive the proceeds of any cash exercise of the Warrants. We intend to use the net proceeds from any cash exercise of the

Warrants for working capital and general corporate purposes. Please see the section entitled see “Use of Proceeds”

on page 9 of this prospectus for a more detailed discussion. |

| |

|

|

| National

Securities Exchange Listing |

|

Our

Common Stock and our Public Warrants are currently listed on Nasdaq under the symbols “CING” and “CINGW,”

respectively. |

| |

|

|

| Risk

Factors |

|

An

investment in our securities involves a high degree of risk. Please see the section entitled “Risk Factors” beginning

on page 4 of this prospectus. In addition before deciding whether to invest in our securities, you should consider carefully the

risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report on Form

10-K for the fiscal year ended December 31, 2023 filed with the SEC on April 1, 2024, and other filings we make with the SEC from

time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus and

the information incorporated by reference herein. |

RISK

FACTORS

An

investment in our securities involves a high degree of risk. Before deciding whether to invest in our securities, you should consider

carefully the risks and uncertainties described in the section captioned “Risk Factors” contained in our Annual Report

on Form 10-K for the fiscal year ended December 31, 2023 filed with the SEC on April 1, 2024, and our other filings we make with the

SEC from time to time, which are incorporated by reference herein in their entirety, together with other information in this prospectus

and the information incorporated by reference herein. If any of these risks actually occurs, our business, financial condition, results

of operations or cash flow could suffer materially. In such an event, the trading price of our shares of Common Stock could decline,

and you might lose all or part of your investment.

CAUTIONARY

NOTE REGARDING FORWARD-LOOKING STATEMENTS

Except

for historical information, this prospectus and the documents incorporated herein by reference contain forward-looking statements within

the meaning of Section 27A of the Securities Act of 1933, as amended, (the “Securities Act”) and the Exchange Act. Forward-looking

statements include statements with respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates,

intentions and future performance, and involve known and unknown risks, uncertainties and other factors, which may be beyond our control,

and which may cause our actual results, performance or achievements to be materially different from future results, performance or achievements

expressed or implied by such forward-looking statements. All statements other than statements of historical fact are statements that

could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,”

“can,” “anticipate,” “assume,” “should,” “indicate,” “would,”

“believe,” “contemplate,” “expect,” “seek,” “estimate,” “continue,”

“plan,” “point to,” “project,” “predict,” “could,” “intend,”

“target,” “potential” and other similar words and expressions of the future.

There

are a number of important factors that could cause the actual results to differ materially from those expressed in any forward-looking

statement made by us. These factors include, but are not limited to:

| |

● |

our

ability to regain and maintain compliance with the continued listing requirements of Nasdaq; |

| |

|

|

| |

● |

our

lack of operating history and need for additional capital; |

| |

|

|

| |

● |

our

plans to develop and commercialize our product candidates; |

| |

|

|

| |

● |

the

timing of our planned clinical trials for CTx-1301, CTx-1302, and CTx-2103; |

| |

|

|

| |

● |

the

timing of our New Drug Application submissions for CTx-1301, CTx-1302, and CTx-2103; |

| |

|

|

| |

● |

the

timing of and our ability to obtain and maintain regulatory approvals for CTx-1301, CTx-1302, CTx-2103, or any other future product

candidate; |

| |

|

|

| |

● |

the

clinical utility of our product candidates; |

| |

|

|

| |

● |

our

commercialization, marketing and manufacturing capabilities and strategy; |

| |

|

|

| |

● |

our

ability to identify strategic partnerships; |

| |

|

|

| |

● |

our

expected use of cash; |

| |

|

|

| |

● |

our

competitive position and projections relating to our competitors or our industry; |

| |

|

|

| |

● |

our

ability to identify, recruit, and retain key personnel; |

| |

|

|

| |

● |

the

impact of laws and regulations; |

| |

|

|

| |

● |

our

expectations regarding the time during which we will be an emerging growth company under the JOBS Act; |

| |

|

|

| |

● |

our

plans to identify additional product candidates with significant commercial potential that are consistent with our commercial objectives; |

| |

|

|

| |

● |

the

identified material weaknesses in our internal control over financial reporting; and |

| |

|

|

| |

● |

our

estimates regarding future revenue and expenses. |

Because

forward-looking statements are inherently subject to risks and uncertainties, some of which cannot be predicted or quantified and some

of which are beyond our control, you should not rely on these forward-looking statements as predictions of future events. The events

and circumstances reflected in our forward-looking statements may not be achieved or occur and actual results could differ materially

from those projected in the forward-looking statements. You should refer to the “Risk Factors” section of this prospectus

and the documents we incorporate by reference for a discussion of important factors that may cause our actual results to differ materially

from those expressed or implied by our forward-looking statements. Moreover, we operate in an evolving environment. New risk factors

and uncertainties may emerge from time to time, and it is not possible for management to predict all risk factors and uncertainties.

As a result of these factors, we cannot assure you that the forward-looking statements in this prospectus and the documents we incorporate

by reference will prove to be accurate. Except as required by applicable law, we do not plan to publicly update or revise any forward-looking

statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. You should,

however, review the factors and risks and other information we describe in the reports we will file from time to time with the SEC after

the date of this prospectus.

You

should read this prospectus and the documents that we incorporate by reference in this prospectus and have filed as exhibits to the registration

statement of which this prospectus is a part completely and with the understanding that our actual future results may be materially different

from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

PRIVATE

PLACEMENT

On

June 28, 2024, we entered into an inducement offer letter agreement (the “Inducement Letter”) with certain holders (the “Holders”)

of certain of our existing warrants to purchase up to an aggregate of 3,187,500 shares of our Common Stock issued to the Holders on February

6, 2024 (the “Existing Warrants”). The Existing Warrants had an exercise price of $2.00 per share.

Pursuant

to the Inducement Letter, the Holders agreed to exercise for cash their Existing Warrants at a reduced exercise price of $0.585 per share

in consideration for our agreement to issue in a private placement (i) the Series C Warrants to purchase an aggregate of 4,250,000 shares

of Common Stock and (ii) the Series D Warrants to purchase an aggregate of 2,125,000 shares of Common Stock.

The

Series C Warrants and Series D Warrants were issued on July 1, 2024 (the “Closing Date”). We received aggregate gross proceeds

of approximately $1.86 million from the exercise of the Existing Warrants by the Holders, before deducting placement agent fees and other

offering expenses payable by us.

Pursuant

to the Inducement Letter, we agreed to file a registration statement on Form S-3 providing for the resale of the Series C Warrant Shares

and Series D Warrant Shares as soon as practicable after the Closing Date (and in any event within 30 calendar days of the date of the

Inducement Letter), and to use commercially reasonable efforts to cause such registration statement to be declared effective by the SEC

within 60 days following the date of the Inducement Letter (or within 90 calendar days in case of “full review” by the SEC)

and to keep such registration statement effective at all times until the Holders no longer own any Series C Warrants or Series D Warrants

or the shares issuable upon exercise thereof. We have filed the registration statement of which this prospectus forms a part pursuant

to the Inducement Letter.

We

engaged H.C. Wainwright & Co., LLC (the “Placement Agent”) to act as our exclusive placement agent in connection with

the transactions summarized above and paid the Placement Agent a cash fee equal to 8.0% of the aggregate gross proceeds received from

the Holders’ exercise of their Existing Warrants pursuant to that certain engagement letter, by and between the Placement Agent

and us, dated as of December 27, 2023 (as amended, the “Engagement Letter”). Pursuant to the Engagement Letter, we reimbursed

the Placement Agent for its expenses in connection with the exercise of the Existing Warrants and the issuance of the Series C Warrants

and Series D Warrants of: (i) $50,000 for fees and expenses of its counsel, (ii) $35,000 for its non-accountable expenses and (iii) and

$15,950 for its clearing costs. We also issued to the Placement Agent or its designees the Placement Agent Warrants to purchase up to

255,000 shares of Common Stock. The Placement Agent Warrants have substantially the same terms as the Series C Warrants, except that

the Placement Agent Warrants have an exercise price equal to $0.7313.

SELLING

STOCKHOLDERS

This

prospectus covers the resale or other disposition by the Selling Stockholders identified in the table below of up to an aggregate 6,630,000

shares of our Common Stock issuable upon the exercise of the Warrants. The Selling Stockholders acquired their securities in the transactions

described above under the heading “Private Placement.”

The

Warrants held by the Selling Stockholders contain limitations which prevent the holder from exercising such Warrants if such exercise

would cause the Selling Stockholder, together with certain related parties, to beneficially own a number of shares of Common Stock which

would exceed 4.99% of our then outstanding shares of Common Stock following such exercise, excluding for purposes of such determination,

shares of Common Stock issuable upon exercise of the Warrants which have not been exercised.

The

table below sets forth, as of July 10, 2024, the following information regarding the Selling Stockholders:

| |

● |

the

names of the Selling Stockholders; |

| |

|

|

| |

● |

the

number of shares of Common Stock owned by the Selling Stockholders prior to this offering, without regard to any beneficial ownership

limitations contained in the Warrants; |

| |

|

|

| |

● |

the

number of shares of Common Stock to be offered by the Selling Stockholders in this offering; |

| |

|

|

| |

● |

the

number of shares of Common Stock to be owned by the Selling Stockholders assuming the sale of all of the shares of Common Stock covered

by this prospectus; and |

| |

|

|

| |

● |

the

percentage of our issued and outstanding shares of Common Stock to be owned by Selling Stockholders assuming the sale of all of the

shares of Common Stock covered by this prospectus based on the number of shares of Common Stock issued and outstanding as of July

10, 2024. |

Except

as described above, the number of shares of Common Stock beneficially owned by the Selling Stockholder has been determined in accordance

with Rule 13d-3 under the Exchange Act and includes, for such purpose, shares of Common Stock that the Selling Stockholder has the right

to acquire within 60 days of July 10, 2024.

All

information with respect to the Common Stock ownership of the Selling Stockholders has been furnished by or on behalf of the Selling

Stockholders. We believe, based on information supplied by the Selling Stockholders, that except as may otherwise be indicated in the

footnotes to the table below, the Selling Stockholder has sole voting and dispositive power with respect to the shares of Common Stock

reported as beneficially owned by the Selling Stockholders. Because the Selling Stockholders identified in the table may sell some or

all of the shares of Common Stock beneficially owned by them and covered by this prospectus, and because there are currently no agreements,

arrangements or understandings with respect to the sale of any of the shares of Common Stock, no estimate can be given as to the number

of shares of Common Stock available for resale hereby that will be held by the Selling Stockholders upon termination of this offering.

In addition, the Selling Stockholders may have sold, transferred or otherwise disposed of, or may sell, transfer or otherwise dispose

of, at any time and from time to time, the shares of Common Stock they beneficially own in transactions exempt from the registration

requirements of the Securities Act after the date on which they provided the information set forth in the table below. We have, therefore,

assumed for the purposes of the following table, that the Selling Stockholders will sell all of the shares of Common Stock owned beneficially

by it that are covered by this prospectus, but will not sell any other shares of Common Stock that they presently own. Except as set

forth below, the Selling Stockholders have not held any position or office, or have otherwise had a material relationship, with us or

any of our subsidiaries within the past three years other than as a result of the ownership of our shares of Common Stock or other securities.

| Name of Selling Stockholders | |

Shares Owned prior to Offering (1) | | |

Shares Offered by this Prospectus | | |

Shares Owned after Offering | | |

Percentage of

Shares Beneficially Owned

after Offering

(1) | |

| Armistice Capital, LLC | |

| 6,389,892 | (2) | |

| 4,500,000 | | |

| 1,889,892 | | |

| 4.99 | % |

| Bigger Capital Fund, LP | |

| 1,252,550 | (3) | |

| 1,125,000 | | |

| 127,550 | | |

| 1.1 | % |

| District 2 Capital Fund LP | |

| 829,200 | (4) | |

| 750,000 | | |

| 79,200 | | |

| * | |

| Noam Rubinstein | |

| 52,789 | (5) | |

| 31,875 | | |

| 20,914 | | |

| * | |

| Craig Schwabe | |

| 14,252 | (5) | |

| 8,606 | | |

| 5,646 | | |

| * | |

| Michael Mirksy | |

| 80,239 | (5) | |

| 48,450 | | |

| 31,789 | | |

| * | |

| Michael Vasinkevich | |

| 270,809 | (5) | |

| 163,519 | | |

| 107,290 | | |

| * | |

| Charles Worthman | |

| 4,223 | (5) | |

| 2,550 | | |

| 1,673 | | |

| * | |

*

Less than 1.0%.

| (1) |

Percentages

are based on 10,339,143 share of Common Stock outstanding as of July 10, 2024, assuming the resale of all of the shares of Common

Stock covered by this prospectus. |

| |

|

| (2) |

Contains

(i) Series C Warrants to purchase up to 3,000,000 shares of Common Stock, (ii) Series D Warrants to purchase up to 1,500,000 shares

of Common Stock, (iii) certain outstanding warrants to purchase up to 539,892 shares of Common Stock, (iv) 860,000 shares of Common

Stock and (v) 490,000 shares of Common Stock issuable pursuant to the Inducement Letter underlying Existing Warrants, subject to

a beneficial ownership blocker of 9.99%. The securities are directly held by Armistice Capital Master Fund Ltd., a Cayman Islands

exempted company (the “Master Fund”) and may be deemed to be beneficially owned by: (i) Armistice Capital, LLC (“Armistice

Capital”), as the investment manager of the Master Fund; and (ii) Steven Boyd, as the Managing Member of Armistice Capital.

The warrants are subject to a beneficial ownership limitation of 4.99%, which such limitation restricts the Selling Stockholder from

exercising that portion of the warrants that would result in the Selling Stockholder and its affiliates owning, after exercise, a

number of shares of common stock in excess of the beneficial ownership limitation. The address of Armistice Capital Master Fund Ltd.

is c/o Armistice Capital, LLC, 510 Madison Avenue, 7th Floor, New York, NY 10022. |

| |

|

| (3) |

Contains

(i) Series C Warrants to purchase up to 750,000 shares of Common Stock, (ii) Series D Warrants to purchase up to 375,000 shares of

Common Stock, (iii) certain outstanding warrants to purchase up to 8,750 shares of Common Stock, and (iv) certain outstanding pre-funded

warrants to purchase up to 118,800 shares of Common Stock. The securities are directly owned by Bigger Capital Fund, LP (“Bigger

Capital”). Michael Bigger, the managing member of Bigger Capital, may be deemed to beneficially own the securities owned by

Bigger Capital. The address of the principal business office of Bigger Capital is 11700 West Charleston BLVD. #170-659, Las Vegas,

NV 89135. |

| |

|

| (4) |

Contains

(i) Series C Warrants to purchase up to 500,000 shares of Common Stock, (ii) Series D Warrants to purchase up to 250,000 shares of

Common Stock and (iii) certain outstanding pre-funded warrants to purchase up to 79,200 shares of Common Stock. The securities are

directly owned by District 2 Capital Fund LP (“District 2”). Michael Bigger, the managing member of District 2, may be

deemed to beneficially own the securities owned by District 2. The address of the principal business office of District 2 is 14 Wall

Street, 2nd Floor, Huntington, NY 11743. |

| |

|

| (5) |

Each

of the Selling Stockholders is affiliated with H.C. Wainwright & Co., LLC, a registered broker dealer with a registered address

of H.C. Wainwright & Co., LLC, 430 Park Ave, 3rd Floor, New York, NY 10022, and has sole voting and dispositive power over the

securities held. The number of shares beneficially owned prior to this offering consist of shares of Common Stock issuable upon exercise

of the Placement Agent Warrants and other warrants received as compensation in connection with the offerings consummated by us in

September 2023 and February 2024. The Selling Stockholder acquired the Placement Agent Warrants in the ordinary course of business

and, at the time the Placement Agent Warrants were acquired, the Selling Stockholder had no agreement or understanding, directly

or indirectly, with any person to distribute such securities. |

USE

OF PROCEEDS

The

Common Stock to be offered and sold using this prospectus will be offered and sold by the Selling Stockholders named in this prospectus.

Accordingly, we will not receive any proceeds from any sale of shares of Common Stock in this offering. However, we will receive the

exercise price per share for each Warrant exercised for cash; however, we are unable to predict the timing or amount of potential Warrant

exercises. As such, we have not allocated any proceeds of such exercises to any particular purpose. Accordingly, all such proceeds, if

any, will be used for working capital and other general corporate purposes.

PLAN

OF DISTRIBUTION

Each

Selling Stockholder of the securities and any of their pledgees, assignees and successors-in-interest may, from time to time, sell any

or all of their securities covered hereby on Nasdaq or any other stock exchange, market or trading facility on which the securities are

traded or in private transactions. These sales may be at fixed or negotiated prices. A Selling Stockholder may use any one or more of

the following methods when selling securities:

| |

● |

ordinary

brokerage transactions and transactions in which the broker-dealer solicits purchasers; |

| |

|

|

| |

● |

block

trades in which the broker-dealer will attempt to sell the securities as agent but may position and resell a portion of the block

as principal to facilitate the transaction; |

| |

|

|

| |

● |

purchases

by a broker-dealer as principal and resale by the broker-dealer for its account; |

| |

|

|

| |

● |

an

exchange distribution in accordance with the rules of the applicable exchange; |

| |

|

|

| |

● |

privately

negotiated transactions; |

| |

|

|

| |

● |

settlement

of short sales; |

| |

|

|

| |

● |

in

transactions through broker-dealers that agree with the Selling Stockholders to sell a specified number of such securities at a stipulated

price per security; |

| |

|

|

| |

● |

through

the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise; |

| |

|

|

| |

● |

a

combination of any such methods of sale; or |

| |

|

|

| |

● |

any

other method permitted pursuant to applicable law. |

The

Selling Stockholders may also sell securities under Rule 144 or any other exemption from registration under the Securities Act, if available,

rather than under this prospectus.

Broker-dealers

engaged by the Selling Stockholders may arrange for other brokers-dealers to participate in sales. Broker-dealers may receive commissions

or discounts from the Selling Stockholders (or, if any broker-dealer acts as agent for the purchaser of securities, from the purchaser)

in amounts to be negotiated, but, except as set forth in a supplement to this Prospectus, in the case of an agency transaction not in

excess of a customary brokerage commission in compliance with FINRA Rule 2121; and in the case of a principal transaction a markup or

markdown in compliance with FINRA Rule 2121.

In

connection with the sale of the securities or interests therein, the Selling Stockholders may enter into hedging transactions with broker-dealers

or other financial institutions, which may in turn engage in short sales of the securities in the course of hedging the positions they

assume. The Selling Stockholders may also sell securities short and deliver these securities to close out their short positions, or loan

or pledge the securities to broker-dealers that in turn may sell these securities. The Selling Stockholders may also enter into option

or other transactions with broker-dealers or other financial institutions or create one or more derivative securities which require the

delivery to such broker-dealer or other financial institution of securities offered by this prospectus, which securities such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The

Selling Stockholders and any broker-dealers or agents that are involved in selling the securities may be deemed to be “underwriters”

within the meaning of the Securities Act in connection with such sales. In such event, any commissions received by such broker-dealers

or agents and any profit on the resale of the securities purchased by them may be deemed to be underwriting commissions or discounts

under the Securities Act. Each Selling Stockholder has informed us that it does not have any written or oral agreement or understanding,

directly or indirectly, with any person to distribute the securities.

We

are required to pay certain fees and expenses incurred by us incident to the registration of the securities. We have agreed to indemnify

the Selling Stockholders against certain losses, claims, damages and liabilities, including liabilities under the Securities Act.

We

agreed to keep the registration statement of which this prospectus is a part effective until at all times until the Holders no longer

own any Series C Warrants or Series D Warrants or the shares issuable upon exercise thereof. The resale securities will be sold only

through registered or licensed brokers or dealers if required under applicable state securities laws. In addition, in certain states,

the resale securities covered hereby may not be sold unless they have been registered or qualified for sale in the applicable state or

an exemption from the registration or qualification requirement is available and is complied with.

Under

applicable rules and regulations under the Exchange Act, any person engaged in the distribution of the resale securities may not simultaneously

engage in market making activities with respect to the Common Stock for the applicable restricted period, as defined in Regulation M,

prior to the commencement of the distribution. In addition, the Selling Stockholders will be subject to applicable provisions of the

Exchange Act and the rules and regulations thereunder, including Regulation M, which may limit the timing of purchases and sales of the

Common Stock by the Selling Stockholders or any other person. We will make copies of this prospectus available to the Selling Stockholders

and have informed them of the need to deliver a copy of this prospectus to each purchaser at or prior to the time of the sale (including

by compliance with Rule 172 under the Securities Act).

Our

Common Stock is quoted on Nasdaq under the symbol “CING.”

DESCRIPTION

OF SECURITIES

The

following description summarizes the most important terms of our securities. Because it is only a summary, it does not contain all the

information that may be important to you. For a complete description, you should refer to our amended and restated certificate of incorporation

and restated bylaws, copies of which are filed as exhibits to the registration statement of which this prospectus forms a part, which

are incorporated by reference herein.

Authorized

Capitalization

We

have 250,000,000 shares of capital stock authorized under our amended and restated certificate of incorporation, consisting of 240,000,000

shares of Common Stock with a par value of $0.0001 per share and 10,000,000 shares of preferred stock with a par value of $0.0001 per

share.

As

of July 10, 2024, there were 10,339,143 shares of Common Stock outstanding, and no shares of preferred stock outstanding.

Common

Stock

Holders

of our Common Stock are entitled to such dividends as may be declared by our board of directors out of funds legally available for such

purpose. The shares of Common Stock are neither redeemable nor convertible. Holders of Common Stock have no preemptive or subscription

rights to purchase any of our securities.

Each

holder of our Common Stock is entitled to one vote for each such share outstanding in the holder’s name. No holder of Common Stock

is entitled to cumulate votes in voting for directors.

In

the event of our liquidation, dissolution or winding up, the holders of our Common Stock are entitled to receive a pro rata share of

our assets, which are legally available for distribution, after payments of all debts and other liabilities. All of the outstanding shares

of our Common Stock are fully paid and non-assessable.

Preferred

Stock

Our

board of directors has the authority, without further action by our stockholders, to issue up to 10,000,000 shares of preferred stock

in one or more classes or series and to fix the designations, rights, preferences, privileges and restrictions thereof, without further

vote or action by the stockholders. These rights, preferences and privileges could include dividend rights, conversion rights, voting

rights, terms of redemption, liquidation preferences, sinking fund terms and the number of shares constituting, or the designation of,

such class or series, any or all of which may be greater than the rights of Common Stock. The issuance of our preferred stock could adversely

affect the voting power of holders of Common Stock and the likelihood that such holders will receive dividend payments and payments upon

our liquidation. In addition, the issuance of preferred stock could have the effect of delaying, deferring or preventing a change in

control of our company or other corporate action. No shares of preferred stock are outstanding, and we have no present plan to issue

any shares of preferred stock.

Anti-Takeover

Effects of Delaware law and Our Certificate of Incorporation and Bylaws

The

provisions of Delaware law, our amended and restated certificate of incorporation and our amended and restated bylaws described below

may have the effect of delaying, deferring or discouraging another party from acquiring control of us.

Section

203 of the Delaware General Corporation Law

We

are subject to Section 203 of the Delaware General Corporation Law, which prohibits a Delaware corporation from engaging in any business

combination with any interested stockholder for a period of three years after the date that such stockholder became an interested stockholder,

with the following exceptions:

| |

● |

before

such date, the board of directors of the corporation approved either the business combination or the transaction that resulted in

the stockholder becoming an interested stockholder; |

| |

● |

upon

completion of the transaction that resulted in the stockholder becoming an interested stockholder, the interested stockholder owned

at least 85% of the voting stock of the corporation outstanding at the time the transaction began, excluding for purposes of determining

the voting stock outstanding (but not the outstanding voting stock owned by the interested stockholder) those shares owned (i) by

persons who are directors and also officers and (ii) employee stock plans in which employee participants do not have the right to

determine confidentially whether shares held subject to the plan will be tendered in a tender or exchange offer; or |

| |

● |

on

or after such date, the business combination is approved by the board of directors and authorized at an annual or special meeting

of the stockholders, and not by written consent, by the affirmative vote of at least 66 2/3% of the outstanding voting stock that

is not owned by the interested stockholder. |

In

general, Section 203 defines business combination to include the following:

| |

● |

any

merger or consolidation involving the corporation and the interested stockholder; |

| |

|

|

| |

● |

any

sale, transfer, pledge or other disposition of 10% or more of the assets of the corporation involving the interested stockholder; |

| |

|

|

| |

● |

subject

to certain exceptions, any transaction that results in the issuance or transfer by the corporation of any stock of the corporation

to the interested stockholder; |

| |

|

|

| |

● |

any

transaction involving the corporation that has the effect of increasing the proportionate share of the stock or any class or series

of the corporation beneficially owned by the interested stockholder; or |

| |

|

|

| |

● |

the

receipt by the interested stockholder of the benefit of any loss, advances, guarantees, pledges or other financial benefits by or

through the corporation. |

In

general, Section 203 defines an “interested stockholder” as an entity or person who, together with the person’s affiliates

and associates, beneficially owns, or within three years prior to the time of determination of interested stockholder status did own,

15% or more of the outstanding voting stock of the corporation.

Certificate

of Incorporation and Bylaws

Our

amended and restated certificate of incorporation and amended and restated bylaws provide for:

| |

● |

classifying

our board of directors into three classes; |

| |

|

|

| |

● |

authorizing

the issuance of “blank check” preferred stock, the terms of which may be established and shares of which may be issued

without stockholder approval; |

| |

|

|

| |

● |

limiting

the removal of directors by the stockholders; |

| |

|

|

| |

● |

requiring

a supermajority vote of stockholders to amend our bylaws or certain provisions our certificate of incorporation; |

| |

|

|

| |

● |

prohibiting

stockholder action by written consent, thereby requiring all stockholder actions to be taken at a meeting of our stockholders; |

| |

|

|

| |

● |

eliminating

the ability of stockholders to call a special meeting of stockholders; |

| |

|

|

| |

● |

establishing

advance notice requirements for nominations for election to the board of directors or for proposing matters that can be acted upon

at stockholder meetings; and |

| |

|

|

| |

● |

establishing

Delaware as the exclusive jurisdiction for certain stockholder litigation against us. |

Potential

Effects of Authorized but Unissued Stock

Pursuant

to our amended and restated certificate of incorporation, we have shares of Common Stock and preferred stock available for future issuance

without stockholder approval. We may utilize these additional shares for a variety of corporate purposes, including future public offerings

to raise additional capital, to facilitate corporate acquisitions or payment as a dividend on the capital stock.

The

existence of unissued and unreserved Common Stock and preferred stock may enable our board of directors to issue shares to persons friendly

to current management or to issue preferred stock with terms that could render more difficult or discourage a third-party attempt to

obtain control of us by means of a merger, tender offer, proxy contest or otherwise, thereby protecting the continuity of our management.

In addition, the board of directors has the discretion to determine designations, rights, preferences, privileges and restrictions, including

voting rights, dividend rights, conversion rights, redemption privileges and liquidation preferences of each series of preferred stock,

all to the fullest extent permissible under the Delaware General Corporation Law and subject to any limitations set forth in our certificate

of incorporation. The purpose of authorizing the board of directors to issue preferred stock and to determine the rights and preferences

applicable to such preferred stock is to eliminate delays associated with a stockholder vote on specific issuances. The issuance of preferred

stock, while providing desirable flexibility in connection with possible financings, acquisitions and other corporate purposes, could

have the effect of making it more difficult for a third-party to acquire, or could discourage a third-party from acquiring, a majority

of our outstanding voting stock.

Choice

of Forum

Unless

we consent in writing to the selection of an alternative forum, the Court of Chancery of the State of Delaware shall be the sole and

exclusive forum for any stockholder to bring (i) any derivative action or proceeding brought on behalf of the Company, (ii) any action

asserting a claim of breach of fiduciary duty owed by any director, officer or other employee of the Company or the Company’s stockholders,

(iii) any action asserting a claim against the Company or any director or officer of the Company arising pursuant to, or a claim against

the Company or any director or officer of the Company, with respect to the interpretation or application of any provision of the DGCL,

our certificate of incorporation or bylaws, or (iv) any action asserting a claim governed by the internal affairs doctrine, except for,

in each of the aforementioned actions, any claims to which the Court of Chancery of the State of Delaware determines it lacks jurisdiction.

This provision will not apply to claims arising under the Exchange Act, or for any other federal securities laws which provide for exclusive

federal jurisdiction. However, the exclusive forum provision provides that unless we consent in writing to the selection of an alternative

forum, the federal district courts of the United States of America will be the exclusive forum for the resolution of any complaint asserting

a cause of action arising under the Securities Act. Therefore, this provision could apply to a suit that falls within one or more of

the categories enumerated in the exclusive forum provision and that asserts claims under the Securities Act, inasmuch as Section 22 of

the Securities Act creates concurrent jurisdiction for federal and state courts over all suits brought to enforce any duty or liability

created by the Securities Act or the rules and regulations thereunder. There is uncertainty as to whether a court would enforce such

an exclusive forum provision with respect to claims under the Securities Act.

We

note that there is uncertainty as to whether a court would enforce the provision and that investors cannot waive compliance with the

federal securities laws and the rules and regulations thereunder. Although we believe this provision benefits us by providing increased

consistency in the application of Delaware law in the types of lawsuits to which it applies, the provision may have the effect of discouraging

lawsuits against our directors and officers.

Transfer

Agent

The

transfer agent of our Common Stock is Computershare Trust Company, N.A.

LEGAL

MATTERS

The

validity of the shares of Common Stock offered hereby will be passed upon for us by Lowenstein Sandler LLP, New York, New York.

EXPERTS

Our

consolidated financial statements as of December 31, 2023 and 2022, and for each of the years in the two-year period ended December 31,

2023, have been incorporated by reference herein in reliance upon the report of KPMG LLP, independent registered public accounting firm,

incorporated by reference herein, and upon the authority of said firm as experts in accounting and auditing. The audit report covering

the December 31, 2023 and 2022 consolidated financial statements contains an explanatory paragraph that states that our losses and negative

cash flows from operations raise substantial doubt about the entity’s ability to continue as a going concern. The consolidated

financial statements do not include any adjustments that might result from the outcome of that uncertainty.

WHERE

YOU CAN FIND MORE INFORMATION

We

have filed with the SEC a registration statement on Form S-3 under the Securities Act with respect to the shares of Common Stock offered

by this prospectus. This prospectus, which is part of the registration statement, omits certain information, exhibits, schedules and

undertakings set forth in the registration statement. For further information pertaining to us and our securities, reference is made

to our SEC filings and the registration statement and the exhibits and schedules to the registration statement. Statements contained

in this prospectus as to the contents or provisions of any documents referred to in this prospectus are not necessarily complete, and

in each instance where a copy of the document has been filed as an exhibit to the registration statement, reference is made to the exhibit

for a more complete description of the matters involved.

In

addition, registration statements and certain other filings made with the SEC electronically are publicly available through the SEC’s

web site at http://www.sec.gov. The registration statement, including all exhibits and amendments to the registration statement, has

been filed electronically with the SEC.

We

are subject to the information and periodic reporting requirements of the Securities Exchange Act of 1934, as amended, and, in accordance

with such requirements, will file periodic reports, proxy statements, and other information with the SEC. These periodic reports, proxy

statements, and other information will be available for inspection and copying at the web site of the SEC referred to above. We also

maintain a website at https://www.cingulate.com, at which you may access these materials free of charge as soon as reasonably practicable

after they are electronically filed with, or furnished to, the SEC. The information contained in, or that can be accessed through, our

website is not part of, and is not incorporated into, this prospectus. We have included our website address in this prospectus solely

as an inactive textual reference.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” information that we file with it into this prospectus, which means that we can

disclose important information to you by referring you to those documents. The information incorporated by reference is an important

part of this prospectus. The information incorporated by reference is considered to be a part of this prospectus, and information that

we file later with the SEC will automatically update and supersede information contained in this prospectus and any accompanying prospectus

supplement.

We

incorporate by reference the documents listed below that we have previously filed with the SEC:

| |

● |

our

Annual Report on Form 10-K for the year ended December 31, 2023, filed on April 1, 2024; |

| |

|

|

| |

● |

our

Quarterly Report on Form 10-Q for the quarter ended March 31, 2024, filed on May 8, 2024; |

| |

|

|

| |

● |

our

Current Reports on Form 8-K, filed January 29, 2024, February 7, 2024, February 13, 2024, February 26, 2024, March 18, 2024, May 13, 2024, May 28, 2024, June 12, 2024, June 18, 2024, and July 1, 2024 (other than any portions deemed furnished and not filed);

and |

| |

|

|

| |

● |

the

description of our Common Stock contained in our Registration Statement on Form 8-A, filed with the SEC on December 3, 2021, including

any amendments thereto or reports filed for the purposes of updating this description, including Exhibit 4.5 to our Annual Report

on Form 10-K for the year ended December 31, 2023, filed with the SEC on April 1, 2024. |

All

reports and other documents that we file with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of

the initial registration statement and prior to effectiveness of the registration statement, and after the date of this prospectus but

before the termination of the offering of the securities hereunder will also be considered to be incorporated by reference into this

prospectus from the date of the filing of these reports and documents, and will supersede the information herein; provided, however,

that all reports, exhibits and other information that we “furnish” to the SEC will not be considered incorporated by reference

into this prospectus. We undertake to provide without charge to each person (including any beneficial owner) who receives a copy of this

prospectus, upon written or oral request, a copy of all of the preceding documents that are incorporated by reference (other than exhibits,

unless the exhibits are specifically incorporated by reference into these documents). You may request a copy of these materials in the

manner set forth under the heading “Where You Can Find More Information,” above.

We

will provide you without charge, upon your oral or written request, with a copy of any or all reports, proxy statements and other documents

we file with the SEC, as well as any or all of the documents incorporated by reference in this prospectus or the registration statement

(other than exhibits to such documents unless such exhibits are specifically incorporated by reference into such documents). Requests

for such copies should be directed to:

Cingulate,

Inc.

Attn:

Shane J. Schaffer

Chief

Executive Officer

1901

W. 47th Place

Kansas

City, KS 66205

Telephone

Number: (913) 942-2300

6,630,000

Shares of Common Stock

Issuable

Upon Exercise of Outstanding Warrants

PRELIMINARY

PROSPECTUS

,

2024

PART

II

INFORMATION

NOT REQUIRED IN PROSPECTUS

Item

14. Other Expenses of Issuance and Distribution.

The

following table indicates the expenses to be incurred in connection with the offering described in this registration statement, other

than underwriting discounts and commissions, all of which will be paid by us. All amounts are estimated except the Securities and Exchange

Commission registration fee.

| | |

Amount | |

| SEC Registration Fee | |

$ | 383 | |

| Legal Fees and Expenses | |

| 25,000 | |

| Accounting Fees and Expenses | |

| 25,000 | |

| Transfer Agent and Registrar fees and expenses | |

| 5,000 | |

| Miscellaneous Expenses | |

| 5,000 | |

| Total expenses | |

$ | 60,383 | |

Item

15. Indemnification of Directors and Officers.

As

permitted by Section 102 of the Delaware General Corporation Law, we have adopted provisions in our amended and restated certificate

of incorporation and bylaws that limit or eliminate the personal liability of our directors for a breach of their fiduciary duty of care

as a director. The duty of care generally requires that, when acting on behalf of the corporation, directors exercise an informed business

judgment based on all material information reasonably available to them. Consequently, a director will not be personally liable to us

or our stockholders for monetary damages for breach of fiduciary duty as a director, except for liability for:

| |

● |

any

breach of the director’s duty of loyalty to us or our stockholders; |

| |

|

|

| |

● |

any

act or omission not in good faith or that involves intentional misconduct or a knowing violation of law; |

| |

|

|

| |

● |

any

act related to unlawful stock repurchases, redemptions or other distributions or payment of dividends; or |

| |

|

|

| |

● |

any

transaction from which the director derived an improper personal benefit. |

These

limitations of liability do not affect the availability of equitable remedies such as injunctive relief or rescission. Our amended and

restated certificate of incorporation also authorizes us to indemnify our officers, directors and other agents to the fullest extent

permitted under Delaware law.

As

permitted by Section 145 of the Delaware General Corporation Law, our bylaws provide that:

| |

● |

we

may indemnify our directors, officers, and employees to the fullest extent permitted by the Delaware General Corporation Law, subject

to limited exceptions; |

| |

|

|

| |

● |

we

may advance expenses to our directors, officers and employees in connection with a legal proceeding to the fullest extent permitted

by the Delaware General Corporation Law, subject to limited exceptions; and |

| |

|

|

| |

● |

the

rights provided in our bylaws are not exclusive. |

Our

amended and restated certificate of incorporation, filed as Exhibit 3.1 hereto, and our amended and restated bylaws, filed as Exhibit

3.2 hereto, provide for the indemnification provisions described above and elsewhere herein. We have entered into and intend to continue

to enter into separate indemnification agreements with our directors and elective officers which may be broader than the specific indemnification

provisions contained in the Delaware General Corporation Law. These indemnification agreements generally require us, among other things,

to indemnify our officers and directors against liabilities that may arise by reason of their status or service as directors or officers,

other than liabilities arising from willful misconduct. These indemnification agreements also generally require us to advance any expenses

incurred by the directors or officers as a result of any proceeding against them as to which they could be indemnified. In addition,

we have purchased a policy of directors’ and officers’ liability insurance that insures our directors and officers against

the cost of defense, settlement or payment of a judgment in some circumstances. These indemnification provisions and the indemnification

agreements may be sufficiently broad to permit indemnification of our officers and directors for liabilities, including reimbursement

of expenses incurred, arising under the Securities Act.

Item

16. Exhibits

Item

17. Undertakings

The

undersigned registrant hereby undertakes:

1)

To file, during any period in which offers or sales are being made, a post-effective amendment to this registration

statement:

a.

To include any prospectus required by Section 10(a)(3) of the Securities Act of 1933;

b.

To reflect in the prospectus any facts or events arising after the effective date of the registration statement (or the most recent

post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set

forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in volume of securities offered (if the

total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of

the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b)

if, in the aggregate, the changes in volume and price represent no more than a 20 percent change in the maximum aggregate offering

price set forth in the “Calculation of Registration Fee” table in the effective registration statement;

c.

To include any material information with respect to the plan of distribution not previously disclosed in the registration statement

or any material change to such information in the registration statement.

Provided,

however, That: Paragraphs (1)(a), (1)(b) and (1)(c) above do not apply if the information required to be included in a post-effective

amendment by those paragraphs is contained in periodic reports filed with or furnished to the Commission by the registrant pursuant to

Section 13 or Section 15(d) of the Securities Exchange Act of 1934 that are incorporated by reference in the registration statement,

or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

2)

That, for the purpose of determining any liability under the Securities Act of 1933, each such post-effective amendment shall be

deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that

time shall be deemed to be the initial bona fide offering thereof.

3)

To remove from registration by means of a post-effective amendment any of the securities being registered which remain unsold at the

termination of the offering.

4)

That, for the purpose of determining liability under the Securities Act of 1933 to any purchaser:

| |

a. |

If

the registrant is relying on Rule 430B: |

| |

i. |

Each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the

date the filed prospectus was deemed part of and included in the registration statement; and |

| |

|

|

| |

ii. |

Each

prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in reliance on

Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information

required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in the registration statement

as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale

of securities in the offering described in the prospectus. As provided in Rule 430B, for liability purposes of the issuer and any

person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating

to the securities in the registration statement to which that prospectus relates, and the offering of such securities at that time

shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement

or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into

the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract

of sale prior to such effective date, supersede or modify any statement that was made in the registration statement or prospectus

that was part of the registration statement or made in any such document immediately prior to such effective date. |

| |

b. |

If

the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating

to an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A,

shall be deemed to be a part of and included in the registration statement as of the date it is first used after effectiveness. Provided,

however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a

document incorporated or deemed incorporated by reference into the registration statement or prospectus that is part of the registration

statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that

was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately

prior to such date of first use. |

| 5) |

That,

for the purpose of determining liability of the registrant under the Securities Act of 1933 to any purchaser in the initial distribution

of the securities, the undersigned registrant undertakes that in a primary offering of securities of the registrant pursuant to this

registration statement, regardless of the underwriting method used to sell the securities to the purchaser, if the securities are

offered or sold to such purchaser by means of any of the following communications, the registrant will be a seller to the purchaser

and will be considered to offer or sell such securities to such purchaser: |

| |

a. |

Any

preliminary prospectus or prospectus of the registrant relating to the offering required to be filed pursuant to Rule 424; |

| |

|

|

| |

b. |

Any

free writing prospectus relating to the offering prepared by or on behalf of the undersigned registrant or used or referred to by

the undersigned registrant; |

| |

|

|

| |

c. |

The

portion of any free writing prospectus relating to the offering containing material information about the registrant or its securities

provided by or on behalf of the registrant; and |

| |

|

|

| |

d. |

Any

other communication that is an offer in the offering made by a registrant to the purchaser. |

| 6) |

That,

for the purposes of determining any liability under the Securities Act of 1933, each filing of the registrant’s annual report