Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

July 12 2024 - 8:29AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2024.

Commission File Number 0-26046

China Natural Resources, Inc.

(Translation of registrant's name into English)

Room 2205, 22/F, West Tower, Shun Tak Centre,

168-200 Connaught Road Central, Sheung Wan,

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files of will file

annual reports under cover of Form 20-F or Form 40-F. Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Nasdaq Minimum Bid Price Deficiency Letter

On July 5, 2024, China Natural Resources, Inc. (the

“Company”) received a deficiency letter from the Listing Qualifications Department (the “Staff”) of The Nasdaq

Capital Market (“Nasdaq”) notifying the Company that, for the preceding 30 consecutive business days, the closing bid price

for the Company’s common shares, without par value (the “Common Shares”), was below the minimum $1.00 per share requirement

for continued listing on Nasdaq pursuant to Nasdaq Listing Rule 5550(a)(2) (the “Bid Price Requirement”).

The receipt of the deficiency letter has no immediate

effect on the Company’s Nasdaq listing. In accordance with Nasdaq rules, the Company has been provided an initial period of 180

calendar days, or until January 2, 2025 (the “Compliance Date”), to regain compliance with the Bid Price Requirement. If the

Company does not regain compliance during such 180-day period, the Company may be eligible for an extension of an additional 180 calendar

days, provided that the Company meets the continued listing requirement for market value of publicly held shares and all other initial

listing standards for Nasdaq except for the Bid Price Requirement, and provide a written notice of its intention to cure the deficiency

during the second compliance period, by effecting a reverse stock split, if necessary. If the Company does not qualify for the second

compliance period or fails to regain compliance during the second 180-day period, then Nasdaq will notify the Company of its determination

to delist the Company’s Common Shares, at which point the Company will have an opportunity to appeal the delisting determination

to a Hearings Panel. If, at any time before the Compliance Date, the closing bid price for the Common Shares is at least $1.00 for a minimum

of ten consecutive business days, the Staff will provide the Company written confirmation of compliance with the Bid Price Requirement.

The Company intends to monitor the closing bid price

of the Common Shares and may, if appropriate, consider available options to regain compliance with the Bid Price Requirement.

On July 11, 2024, the Company issued a press release

discussing the receipt of the deficiency letter, which is filed as Exhibit 15.1 to this Form 6-K.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities Exchange

Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

CHINA NATURAL RESOURCES, INC.

|

| |

|

|

| Date: July 12, 2024 |

By: |

/s/ Wong Wah On Edward |

| |

|

Wong Wah On Edward |

| |

|

Chairman and Chief Executive Officer |

EXHIBIT 15.1

China Natural Resources

Receives Nasdaq Notification Regarding Minimum Bid Requirements

HONG KONG, July 11, 2024 – On July 5,

2024, China Natural Resources, Inc. (NASDAQ: CHNR) (the “Company”) received a letter from the Listing Qualifications Department

of The Nasdaq Capital Market (“Nasdaq”) notifying the Company that it is currently not in compliance with the minimum bid

price requirement set forth under Nasdaq Listing Rule 5550(a)(2), because the closing bid price of the Company’s common shares was

below the minimum of $1.00 per share for a period of 30 consecutive business days. This press release is issued pursuant to Nasdaq Listing

Rule 5810(b), which requires prompt disclosure of receipt of a deficiency notification. The notification has no immediate effect on the

listing of the Company’s common shares, which will continue to trade uninterrupted on Nasdaq under the ticker “CHNR”.

Pursuant to Nasdaq Listing Rule 5810(c)(3)(A), the

Company has a compliance period of 180 calendar days, or until January 2, 2025 (the “Compliance Period”), to regain compliance

with Nasdaq’s minimum bid price requirement. If at any time during the Compliance Period, the closing bid price per share of the

Company’s common shares is at least $1.00 for a minimum of ten consecutive business days, Nasdaq will provide the Company a written

confirmation of compliance and the matter will be closed.

In the event the Company does not regain compliance

with the minimum bid price requirement by January 2, 2025, the Company may be eligible for an additional 180-calendar-day grace period.

About China Natural Resources:

China Natural Resources, Inc., a British Virgin Islands

corporation, through its operating subsidiaries in the People’s Republic of China (the “PRC”), is currently engaged

in the exploration for lead, silver and other metals in the Inner Mongolia Autonomous Region of the PRC and is actively exploring further

business opportunities in the natural resources sector and other sectors.

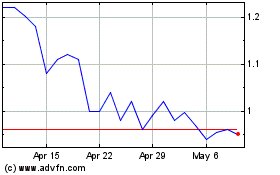

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Feb 2025 to Mar 2025

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Mar 2024 to Mar 2025