UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of July 2023.

Commission File Number 0-26046

China Natural Resources, Inc.

(Translation of registrant's name into English)

Room 2205, 22/F, West Tower, Shun Tak Centre,

168-200 Connaught Road Central, Sheung Wan,

Hong Kong

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover of Form 20-F or Form 40-F. Form 20-F þ Form 40-F ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant

is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This report on Form 6-K is hereby incorporated

by reference into the Registration Statements on Form F-3 (File No. 333-268454) of China Natural Resources, Inc. (the “Company”).

Sale of Precise Space-Time

Technology

On July 28, 2023, the Company entered into a Sale and Purchase Agreement

(“Sale and Purchase Agreement”) with Feishang Group Limited (“Feishang”). Feishang is the Company’s largest

shareholder and a British Virgin Islands company wholly owned by Mr. LI Feilie, the principal beneficial owner of the Company and its

former Chairman and CEO.

Pursuant to the Sale and Purchase Agreement, Feishang will pay

the Company RMB95,761,119 (approximately $13.2 million, the “Base Purchase Price”) in exchange for all outstanding shares

of Precise Space-Time Technology Limited (“Precise Space-Time Technology” or “PSTT”), and PSTT’s outstanding

payable owed to the Company. The Base Purchase Price is subject to upward post-closing adjustment based on the difference between net

assets of PSTT as included in its unaudited consolidated balance sheet as of June 30, 2023 and the base net assets (which is determined

as the higher of RMB-49,074,962, PSTT’s consolidated net assets as of December 31, 2022 and RMB-34,197,300, the value of PSTT as

determined by the valuation report dated July 28, 2023), as referenced in the Sale and Purchase Agreement.

Precise Space-Time Technology, through

its wholly owned subsidiaries, owns a 51% equity interest in Shanghai Onway Environmental Development Co., Ltd. (“Shanghai Onway”).

Shanghai Onway is principally engaged in the provision of equipment for rural wastewater treatment and provision of engineering, procurement

and construction services in relation to wastewater treatment in China.

The valuation of PSTT as of December

31, 2022 as determined by an independent valuation firm on July 28, 2023 is RMB-34,197,300. The Company acquired all outstanding shares

of PSTT from Mr. LI Feilie for an aggregate consideration of approximately RMB104.1 million in July 2021.

The description of the Sale and Purchase

Agreement herein is qualified in its entirety by reference to the Sale and Purchase Agreement and the letter between Feishang and the

Company, which is filed as Exhibit 99.1, respectively, to this Form 6-K.

Press Release

On July 28, 2023, the Company issued

a press release discussing the foregoing matters, which is filed as Exhibit 99.2 to this Form 6-K.

Forward-Looking Statements

This Current Report on Form 6-K includes

forward-looking statements within the meaning of the U.S. federal securities laws. These statements include, without limitation, statements

regarding the intent, belief and current expectations of the Company, its directors or its officers with respect to: the potential presented

by the healthcare and wastewater treatment sectors in the People’s Republic of China (the “PRC”) and other industry

sectors in the PRC generally; the impact on the Company’s financial position, growth potential and business of an investment in

the wastewater treatment sector of the PRC generally and in Precise Space-Time Technology and Shanghai Onway specifically; the experience,

supply chain and customer relationships and market insights of the Precise Space-Time Technology team; the growth potential of the wastewater

treatment and environmental protection industries in the PRC; the impact on the Company’s financial position of an investment in

the healthcare sector of the PRC; and the Company’s ability to locate and execute on strategic opportunities. Forward-looking statements

are not a guarantee of future performance and involve risks and uncertainties, and actual results may differ materially from those in

the forward-looking statement as a result of various factors. Among the risks and uncertainties that could cause the Company’s

actual results to differ from its forward-looking statements are: possible downturns in the healthcare or wastewater treatment sectors

in the PRC or other sectors that the Company may invest in; the results of the next assessment by the Staff of the Nasdaq Listing Qualifications

department of the Company’s compliance with the Nasdaq Listing Rules; uncertainties related to governmental, economic and political

circumstances in the PRC; uncertainties related to metal price volatility; uncertainties related to the Company’s ability to fund

operations; uncertainties related to possible future increases in operating expenses, including costs of labor and materials; uncertainties

related to the impact of the COVID-19 pandemic; uncertainties related to the political situation between the PRC and the United States,

and potential negative impacts on companies with operations in the PRC that are listed on exchanges in the United States; and other risks

detailed from time to time in the Company’s filings with the U.S. Securities and Exchange Commission. When, in any forward-looking

statement, the Company, or its management, expresses an expectation or belief as to future results, that expectation or belief is expressed

in good faith and is believed to have a reasonable basis, but there can be no assurance that the stated expectation or belief will result

or be achieved or accomplished. Except as required by law, the Company undertakes no obligation to update any forward-looking statements.

EXHIBIT INDEX

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned, thereunto duly authorized.

| |

CHINA NATURAL RESOURCES, INC.

|

| |

|

|

|

| Date: July 28, 2023 |

By: |

/s/ Wong

Wah On Edward |

|

| |

|

Wong Wah On Edward |

|

| |

|

Chairman and Chief Executive Officer |

|

EXHIBT 99.1

| |

|

Dated July 28, 2023

FEISHANG GROUP LIMITED. |

|

as Purchaser

and

CHINA NATURAL RESOURCES, INC.

as Vendor

|

| |

SALE AND

PURCHASE AGREEMENT

relating to

the entire issued share capital in

PRECISE SPACE-TIME TECHNOLOGY LIMITED

|

|

| |

|

|

THIS AGREEMENT is made on July 28, 2023

BETWEEN:

| 1. | FEISHANG GROUP LIMITED., a company incorporated in the British Virgin

Islands with limited liability, and whose registered office is at Portcullis Chambers, 4th Floor, Ellen Skelton Building, 3076 Sir Francis

Drake Highway, Road Town, Tortola, British Virgin Islands VG1110 (“Purchaser”); and |

| 2. | CHINA NATURAL RESOURCES, INC., a company incorporated in the British

Virgin Islands with limited liability and listed on The Nasdaq Capital Market under the symbol “CHNR”, and whose registered

office is at Sea Meadow House, Blackborne Highway, PO Box 116, Road Town, Tortola, British Virgin Islands (“Vendor”). |

RECITALS:

| (A) | Precise Space-Time Technology Limited is a company incorporated in Hong

Kong with limited liability with company number 2638400 and its registered office at Room 2205, 22/F, West Tower, Shun Tak Centre, 200

Connaught Road Central, Sheung Wan, Hong Kong (the “Company”). The entire issued share capital of the Company as at

the date of this Agreement is owned by the Vendor and is comprised of 10,000 ordinary shares paid up as to HK$10,000. |

| (B) | As at the date of this Agreement, the Company, via Shenzhen New Precise

Space-Time Technology, which in turn via Shenzhen Qianhai, owns 51% of the equity interests in Shanghai Onway, which is principally engaged

in the provision of equipment in rural wastewater treatment and provision of engineering, procurement and construction activities in relation

to wastewater treatment in the PRC. The corporate structure and details of the Company and its subsidiaries are set out in Schedule

1. |

| (C) | The Vendor wishes to sell its entire shareholding in the Company to the

Purchaser. |

| (D) | The Purchaser wishes to buy the Company at the Total Consideration. |

| (E) | The Vendor has agreed to sell, and the Purchaser has agreed to buy, the

Sale Shares (as defined below) upon the terms and conditions of this Agreement. |

NOW IT IS HEREBY AGREED as follows:-

| 1.1 | In this Agreement the following expressions have the following meanings:- |

| |

“Applicable Laws” |

any constitutions, enactments, ordinances, regulations, orders, notices, judgments, common law, treaties and any other legislations or laws of any relevant jurisdictions or competent authorities; |

| |

“Business Day” |

a day on which banking institutions in Hong Kong are open for the transaction of business; |

| |

|

|

| |

“CNY” |

Chinese Yuan, the lawful currency of the PRC; |

| |

|

|

| |

“Completion” |

the completion of the sale and purchase of the Sale Shares in accordance with this Agreement; |

| |

|

|

| |

“Completion Date” |

the Business Day on which the last outstanding Condition (other than the Conditions which can only be fulfilled upon Completion) shall have been fulfilled or waived (or such other date agreed by the Purchaser and the Vendor in writing) on which Completion is to take place or such other date as the parties hereto may agree; |

| |

|

|

| |

“Conditions” |

the conditions referred to in Clause 4.1, Clause 5.2 and Clause 5.3; |

| |

|

|

| |

“Encumbrances” |

any mortgage, charge, pledge, lien, option, restriction, right of first refusal, right of pre-emption, third-party right or interest, other encumbrance or security interest of any kind, or another type of preferential arrangement (including, without limitation, any title transfer or retention arrangement) having similar effect, and “Encumber” shall be construed accordingly; |

| |

|

|

| |

“Hong Kong” |

the Hong Kong Special Administrative Region of the People's Republic of China; |

| |

|

|

| |

“HK$” |

Hong Kong Dollars; |

| |

|

|

| |

“Long Stop Date” |

December 31, 2023, or another date as agreed by the Parties in writing; |

| |

|

|

| |

“Management Accounts” |

the unaudited consolidated balance sheet of the Company made up as at the Management Accounts Date and the unaudited consolidated profit and loss accounts of the Company for the six months ended on the Management Accounts Date; |

| |

|

|

| |

“Management Accounts Date” |

June 30, 2023; |

| |

“Management Accounts Receivables” |

Receivables which due from the Company to the Vendor as reflected on the unaudited consolidated financial statements of the Company as of December 31, 2022, in the amount of CNY129,958,419; |

| |

|

|

| |

“NASDAQ” |

National Association of Securities Dealers Automated Quotations Stock Market of the US; |

| |

|

|

| |

“Material Adverse Change” |

any change (or effect) which has a material and adverse effect on the financial position, business or prospects or results of operations, of the Company as a whole; |

| |

|

|

| |

“PRC” or “China” |

the People’s Republic of China; |

| |

|

|

| |

“post-Completion Obligation(s)” |

any of the post-Completion obligations referred to in Clause 5.2.3(b) in relation to stamping of the contract notes of the Sale Shares; or any other Completion obligation in this Agreement as may be designated by the Purchaser in writing as a post-Completion Obligation; |

| |

|

|

| |

“Sale Shares” |

the entire issued share capital in the Company held by the Vendor, comprised of 10,000 ordinary shares and paid-up as to HK$10,000 as at the date hereof; |

| |

|

|

| |

“Shanghai Onway” |

上海昂未环保发展有限公司(Shanghai Onway Environmental Development Co., Ltd.), a limited liability company established under the laws of the PRC; |

| |

|

|

| |

“Shenzhen New Precise” |

深圳市精准新时空科技有限公司 (Shenzhen New Precise Space-Time Technology Co., Ltd.), a limited liability company established under the laws of the PRC, which holds 100% of the equity interests in Shenzhen Qianhai as the date of this Agreement; |

| |

|

|

| |

“Shenzhen Qianhai” |

深圳市前海飞尚环境投资有限公司 (Shenzhen Qianhai Feishang Environmental Investment Co., Ltd.), a limited liability company established under the laws of the PRC, which holds 51% of the equity interests in Shanghai Onway as the date of this Agreement; |

| |

“SEC” |

The Securities and Exchange Commission of the US; |

| |

|

|

| |

“Share” |

an ordinary share in the capital of the Company in issue from time to time; |

| |

|

|

| |

“Tax” or “Taxation” |

(1)any

form of tax whenever created or imposed and whether of Hong Kong, the United States or elsewhere, payable to or imposed by any taxation

authority and including, without limitation, profits tax, provisional profits tax, interest tax, salaries tax, property tax, land appreciation

tax, taxes on income, estate duty, capital duty, stamp duty, payroll tax and other similar liabilities or contributions and any other

taxes, levies, duties, charges, imposts, social security contributions, rates or withholdings similar to, corresponding with, or replacing

or replaced by any of the foregoing and including an amount equal to any deprivation of any relief from taxation; and

(2)all

charges, interests, penalties and fines, incidental or relating to any Taxation falling within (1) above; |

| |

|

|

| |

“Total Consideration” |

has the meaning ascribed to it under Clause 3.1; |

| |

|

|

| |

“United States” or “US” |

the United States of America; |

| |

|

|

| |

“US$” |

United States Dollars; |

| |

|

|

| |

“Warranties” |

the representations warranties and undertakings given by the Vendor under this Agreement to the Purchaser as contained in Clause 6 and Schedule 2 and “Warranty” means any one of them; |

| |

|

|

| |

“Warranty Expiry Date” |

shall have the meaning ascribed in Clause 6.5; and |

| |

|

|

| |

“%” |

per cent. |

| 1.2.1 | references to “Clauses”, “Recitals” and “Schedules”,

unless the context otherwise requires, are references to clauses, recitals and schedules to this Agreement; and |

| 1.2.2 | a reference to a “party”, unless the context otherwise requires,

is a reference to a party to this Agreement. |

| 1.3 | Headings in this Agreement are for ease of reference only and shall not

affect the interpretation or construction of this Agreement. |

| 2. | SALE AND PURCHASE OF THE SALE SHARES |

| 2.1 | Subject to the terms and conditions of this Agreement, the Vendor agrees

to sell as beneficial owner, and the Purchaser agrees to purchase, the Sale Shares and each right attaching to such shares at or after

the Completion Date, free of all Encumbrances. |

| 3.1 | The aggregate consideration payable for the Sale Shares, shall be

CNY95,761,119 (the “Base Purchase Price”) comprising (i) a consideration of CNY-34,197,300 for the consolidated

net assets of the Company (the “Base Net Assets”), being the higher value of the Company’s consolidated net

assets set forth in the Company’s unaudited consolidated financial statements as of December 31, 2022, a copy of which has

been attached to this Agreement as exhibit to Schedule 4, or such value as determined by the Valuation Report (as defined

below) and (ii) a consideration of CNY129,958,419 for the Management Accounts Receivables due to the Vendor, as adjusted in

accordance with Section 3.2 below (as adjusted, the “Adjusted Purchase Price” or “Total

Consideration”). |

| 3.2 | The Base Purchase Price shall be adjusted in the following manner: |

| 3.2.1 | On or before the one hundred and twentieth (120th) day after the Completion

Date, the Vendor shall prepare and deliver to the Purchaser a statement setting forth its calculation of the Net Assets of the Company

as of the Management Accounts Date (the “Management Accounts Net Assets”). The Vendor and the Purchaser will cooperate

with each other and their respective representatives in good faith and in all reasonable respects as may be requested by the opposite

Party in preparing and reviewing the Management Accounts Net Assets. |

| 3.2.2 | If the Management Accounts Net Assets is lower than the Base Net Assets,

the Parties agree that there shall be no adjustment to the Base Purchase Price relating to such difference between the Management Accounts

Net Assets and the Base Net Assets; if the Management Accounts Net Assets is higher than the Base Net Assets, the Parties agree that the

Base Purchase Price shall be adjusted upwards for such difference between the Management Accounts Net Assets and the Base Net Assets (the

“Post-Closing Adjustment Amount”). |

| 3.3 | Upon the terms of this Agreement, the consideration shall be paid by the

Purchaser to the Vendor (or otherwise set off against any outstanding amount remaining due from the Vendor to the Purchaser under any

promissory note or indebtedness) in the following manner: |

| 3.3.1 | CNY28,728,336, approximately thirty percent (30%) of the Base Purchase Price,

shall be due and payable within three (3) Business Days of the signing of this Agreement; |

| 3.3.2 | CNY57,456,671, approximately sixty percent (60%) of the Base Purchase Price,

shall be due and payable in accordance with Clause 5.3.2; |

| 3.3.3 | CNY9,576,112, approximately ten percent (10%) of the Base Purchase Price,

together with the Post-Closing Adjustment Amount, shall be due and payable within three (3) Business Days of availability of the Management

Accounts Net Assets. |

| 4.1 | Completion of this Agreement is conditional upon: |

| 4.1.1 | the passing of the necessary resolutions by both the Purchaser and the Vendor

approving this Agreement and all other transactions contemplated hereunder and the granting of such regulatory approvals as may be necessary,

including without limitation in accordance with the listing rules and other applicable laws; |

| 4.1.2 | the representation, warranties and/or undertakings given by the Vendor under

this Agreement shall remain true, accurate and not misleading throughout the period from the date of this Agreement to the Completion

Date, and there having been no breach by any party of this Agreement; and |

| 4.1.3 | (if required) all requisite waivers, consents and approvals from any relevant

governments or regulatory authorities or other relevant third parties in connection with the transactions contemplated by this Agreement

required to be obtained on the part of the Purchaser having been obtained. |

| 4.2 | In the event that the conditions set out in Clause 4.1 shall not

have been fulfilled (or waived in accordance with the terms of this Agreement) at or before 12:00 noon (Hong Kong time) on the Long Stop

Date, this Agreement shall lapse and be of no further effect (save for Clauses 5, 7, 8, 9, 10 and 11) which shall continue to take

effect), and no party to this Agreement shall have any liability and obligation to the other parties, save in respect of any antecedent

breaches of this Agreement. |

| 5.1 | Subject to fulfilment of all the conditions set out in Clause 4.1

or the effective waiver thereof in accordance with the terms of this Agreement, Completion shall take place at or before 4:00 p.m. (Hong

Kong time) on the Completion Date at such place as shall be agreed by the parties hereto when all of the business required under Clause

5 shall be transacted. |

| 5.2 | The Vendor shall deliver or cause to be delivered to the Purchaser: |

| 5.2.1 | in respect of the Sale Shares, duly executed instrument(s) of transfer and

the related sold notes in respect of all such Sale Shares in favour of the Purchaser and/or such nominee(s) as the Purchaser may designate,

such waivers or consents (if any) as the Purchaser may require to be signed by the Vendor to enable the Purchaser and/or its nominee(s)

to be registered as a holder or holders of the Sale Shares; |

| 5.2.2 | the original certificate(s) for the Sale Shares; |

| 5.2.3 | contract notes duly executed by (i) the Vendor as transferor and (ii) the

Purchaser as transferee in respect of the Sale Shares; and |

| 5.3 | Upon performance of all the obligations of the Vendor contained in Clauses

5.2, the Purchaser shall: |

| 5.3.1 | deliver a certified true copy of the board resolutions of the Purchaser

(certified as a true and complete copy by a director of the Purchaser) approving this Agreement and authorising one or more person(s)

to execute and deliver this Agreement on its behalf (and to affix the common seal thereon, if applicable). |

| 5.3.2 | arrange for payment of CNY57,456,671,

approximately sixty percent (60%) of the Base Purchase Price, to the Vendor by (i) delivering a cheque drawn on a licensed bank in the

PRC in the sum of CNY57,456,671 and made payable to the

Vendor (or to its nominee as directed by the Vendor in writing) or (ii) a set-off against any outstanding amount remaining due from the

Vendor to the Purchaser under any promissory note or indebtedness in the amount of CNY57,456,671). |

| 5.4 | No party hereto shall be obliged to complete this Agreement or perform any

obligations hereunder unless the other party complies fully with the requirements of Clauses 5.2 to 5.3. |

| 5.5 | In the event that the Completion cannot take place due to the default of the defaulting party, such defaulting

party shall bear all the professional fees, expenses and/or costs in connection with the transactions contemplated under this Agreement

incurred by the non-defaulting party and shall settle such fees, expenses and/or costs within 10 Business Days from the date of termination

of this Agreement. |

| 6. | REPRESENTATIONS, WARRANTIES AND UNDERTAKINGS |

| 6.1 | The Vendor represents and warrants to the Purchaser that it has the legal

right, full power, legal capacity and authority, and has obtained all necessary approvals, to enter into this Agreement and any other

documents to be executed by such pursuant to or in connection with this Agreement and to exercise its rights and perform its obligations

hereunder, and this Agreement and the said documents when signed shall constitute legal, valid and binding obligations on the Vendor and

enforceable in accordance with their terms. |

| 6.2 | The Vendor represents and warrants to the Purchaser that upon Completion,

the Sale Shares sold by the Vendor shall be fully paid up and are legally and beneficially owned by it, and it has the power, authority,

legal capacity and has obtained authorisation to sell and transfer the Sale Shares to be sold by it, and that the Sale Shares to be sold

by it shall be free of all Encumbrances with all rights attached thereto on the Completion Date. |

| 6.3 | If, after the signing of this Agreement and before Completion, any event

shall occur or matter shall arise which results or may result in any of the Warranties of the Vendor being untrue, misleading or inaccurate

in any respect, the Vendor shall immediately notify the Purchaser in writing thereof prior to Completion. |

| 6.4 | The total aggregate liability of the Vendor for any claim or claims of breaches

under this Agreement (excluding other legal and other costs and expenses) shall not in any event exceed an amount equals to the Total

Consideration. |

| 6.5 | No claim may be brought against the Vendor in respect of a breach of any

of the Warranties after expiration of a period of 24 months from the Completion Date (“Warranty Expiry Date”) and the

Vendor shall not be liable in respect of a breach of any of the Warranties unless it shall have received written notice from the Purchaser

prior to the Warranty Expiry Date giving reasonable details of the relevant claim and any such claim shall (if not previously satisfied,

settled or withdrawn) be deemed to have been waived or withdrawn at the expiry of a period of six months after the Warranty Expiry Date

unless proceedings in respect thereof shall have already been commenced against the Vendor. |

| 6.6 | The Purchaser’s rights in respect of each of the Warranties shall

survive Completion and continue in full force and effect notwithstanding Completion. |

| 6.7 | The Purchaser shall be entitled to claim both before and after Completion

that any of the Warranties is or was untrue or misleading or has or had been breached even if the Purchaser discovered or could have discovered

on or before Completion that the Warranty in question was untrue, misleading or had been breached and Completion shall not in any way

constitute a waiver of any of the Purchaser’s rights. |

| 6.8 | The Purchaser hereby acknowledges that the Vendor has relied upon a valuation

report dated 31 December 2022 (the “Valuation Report”) for determining the Base Purchase Price and which valuation

report contains assumptions and other information supplied by the Vendor. The Vendor hereby warrants that all the assumptions in the valuation

report and all other matters supplied by it for the purpose of compiling the valuation report will remain true and valid for a period

of 24 months after Completion. |

| 6.9 | The Vendor hereby undertakes to indemnify and keep indemnified the Purchaser

from and against all reasonable claims, liabilities, losses, damages, costs and expenses which the Purchaser may suffer or incur or which

may be made against the Vendor either before or after the commencement of and arising out of, or in respect of, any action in connection

with: |

| (a) | the breach of any of the Warranties or any provision of this Agreement by the Vendor; |

| (b) | the settlement of any claim that any of the Warranties is untrue or misleading or has been breached in

any aspects; |

| (c) | any legal proceedings taken by the Purchaser claiming that any of the Warranties is untrue or misleading

or has been breached and in which judgment is given for the Purchaser; and |

| (d) | the enforcement of any such settlement or judgment. |

| 6.10 | No claim shall lie against the Vendor (under or in relation to the Warranties

or any provision of this Agreement) to the extent that such claim is attributable to any voluntary act, omission, transaction, or arrangement

carried out directly by the Purchaser or on its behalf or by persons deriving title from the Purchaser after the Completion. |

| 6.11 | The Vendor represents and warrants that, in entering into this Agreement

it is not in breach or violation of, and has not engaged in any acts, omissions or conduct which may cause it or the Purchaser to be in

breach or violation of, any Applicable Laws. |

| 7. | CONFIDENTIALITY AND ANNOUNCEMENT |

| 7.1 | For the purpose of this Clause 7 “Confidential Information”

means all information received or obtained as a result of entering into or performing, or supplied by or on behalf of a party in the negotiations

leading to this Agreement and which relates to: |

| 7.1.1 | the Purchaser or Vendor or any of their affiliates; |

| 7.1.2 | the provisions this Agreement; |

| 7.1.3 | the negotiations relating to this Agreement; or |

| 7.1.4 | the subject matter of this Agreement. |

| 7.2 | Each party (“Receiving Party”) hereby undertakes to each

other party (“Disclosing Party”), both during and after the term or termination of this Agreement, to preserve the

confidentiality of, and not directly or indirectly reveal, report, publish, disclose or transfer or use the Confidential Information for

its own or any purposes other than for the sole purpose of the transactions or matters contemplated in this Agreement except: |

| 7.2.1 | under the circumstances set out in Clause 7.3; or |

| 7.2.2 | to the extent otherwise expressly permitted by this Agreement; or |

| 7.2.3 | with the prior written consent of the Disclosing Party and the party to

whose affairs such Confidential Information relates; or |

| 7.2.4 | under the provisions set out in Clause 7.4. |

| 7.3 | The circumstances referred to in Clause 7.2.1 above are: |

| 7.3.1 | where the Confidential Information, before it is furnished to the Receiving

Party, is in the public domain; or |

| 7.3.2 | where the Confidential Information, after it is furnished to the Receiving

Party, enters the public domain otherwise than as a result of a breach by the Receiving Party of its obligations in this Clause 7;

or |

| 7.3.3 | if and to the extent the Receiving Party makes disclosure of the Confidential

Information to any person: |

| (i) | in compliance with any requirement of law; |

| (ii) | in response to any applicable regulatory authority to which it is subject where such requirement has the

force of law; or |

| (iii) | in order to obtain tax or other clearances or consents from any relevant taxing or regulatory authorities;

or |

| 7.3.4 | where the Company is required to disclose the Confidential Information or

make public announcements in respect of this Agreement as required by the NASDAQ or the SEC or under the listing rules. |

| 7.4 | The Receiving Party is allowed to provide the Confidential Information to

those of the employees, directors, officers, accountants and attorneys (collectively, the “Related Parties” for the

purpose of this Clause 7) of the Receiving Party who need to know the same for the sole purpose of the transactions or matters

contemplated in this Agreement and who also have been informed of the confidential nature of the Confidential Information and have been

directed to hold such information in strict confidence and to use such information solely for the purposes permitted hereunder. |

| 7.5 | The Receiving Party agrees that it will procure its Related Parties who

will have access to the Confidential Information at any time (whether during the term or after the termination of this Agreement) to refrain

from: |

| 7.5.1 | using any Confidential Information for any purposes other than in connection

with the transaction or matters contemplated in this Agreement; and |

| 7.5.2 | disclosing any Confidential Information to any person other than the Receiving

Party and those of the Receiving Party’s Related Parties permitted to have access to Confidential Information as provided above,

and any such use or disclosure shall be at all times and in all events on the terms of and in compliance with the restrictions of this

Clause 7. |

Each party agrees to be responsible for

the compliance by its Related Parties under this Clause 7.

| 7.6 | The restrictions contained in this Clause 7 shall continue to apply

after the termination of this Agreement without limit in time. |

| 7.7 | The damage that a Disclosing Party will suffer in the event that a Receiving

Party breaches any covenant or agreement contained in this Clause 7 cannot be compensated by monetary damages alone, and the Receiving

Party therefore agrees that the Disclosing Party, in addition to any other remedies or rights which it may have either under this Agreement

or otherwise, shall have the right to obtain an injunction against the Receiving Party or any other appropriate form of equitable relief

from any court of competent jurisdiction, enjoining any such breach. |

| 7.8 | Notwithstanding anything to the contrary in this Agreement, each of the

parties hereto acknowledges that the other party and/or the Company may disclose any Confidential Information for purposes of compliance

with the listing rules and relevant laws and regulations which include, but is not limited to, publication of announcement, filing of

relevant disclosure of interests forms, and compliance with any applicable requirements of The Nasdaq Capital Market. |

| 8.1 | This Agreement shall be binding on and shall enure for the benefit of each

party's successors and assigns, but no party may assign any of its rights or obligations hereunder without the prior written consent of

the other party. |

| 8.2 | Time shall be of the essence of this Agreement. |

| 8.3 | The failure to exercise, or any delay in exercising, a right or remedy provided

by this Agreement or by law shall not impair or constitute a waiver of such right or remedy or an impairment of or a waiver of any other

right or remedy. |

| 8.4 | The Vendor will bear all the legal and professional fees, costs and expenses

(including those incurred by the Purchaser) incurred in connection with the negotiation and preparation of this Agreement. |

| 8.5 | All stamp duty payable in connection with the sale and purchase of the Sale

Shares shall be borne by the Vendor and the Purchaser respectively in accordance with its respective portion as vendor and purchaser. |

| 8.6 | This Agreement may be signed in any number of counterparts, each of which

shall be binding on the party who shall have executed it and which together shall constitute but one agreement. |

| 8.7 | This Agreement sets forth the entire agreement and understanding between

the parties in relation to the Company and the subject matter of this Agreement and supersedes all previous agreements, letters of intent,

correspondence, understandings, agreements and undertakings (if any) between the parties with respect to the Company and the subject matter

hereof, whether written or oral. |

| 8.8 | All provisions of this Agreement shall so far as they are capable of being

performed or observed continue in full force and effect notwithstanding Completion except in respect of those matters then already performed. |

| 8.9 | Save as required by law or any relevant stock exchange or pursuant to any

applicable listing rules, no press or other announcement shall be made in connection with the subject matter of this Agreement by any

party without the prior approval of the other. |

| 8.10 | The invalidity, illegality or unenforceability of any provision of this

Agreement shall not affect or impair the continuation in force of the other provisions of this Agreement. |

| 8.11 | Except to the extent required by applicable law or applicable listing rules,

or by any regulatory authority or stock exchange, no party shall (and shall procure that none of its directors, employees, independent

contractors or subsidiaries shall) at any time disclose to any person (other than professional advisers who are subject to obligations

of confidentiality) the terms of this Agreement or any trade secret or other confidential information relating to the Company or the parties,

or make any use of such information other than to the extent necessary for the purpose of exercising or performing its rights and obligations

under this Agreement. |

| 9.1 | Any notice or other communication under or in connection with this Agreement

shall be in writing and shall be left at or sent by pre-paid registered airmail or facsimile transmission to the respective addresses

set out below or to such other address and/or number as may have been last notified in writing by such party to the other. |

To the Vendor:

| |

Address: |

Room 2205, 22/F, West Tower, Shun Tak Centre, 200 Connaught Road Central, Sheung Wan, Hong Kong |

| |

Attention: |

WONG Wah On Edward |

| |

Facsimile: |

852-28106963 |

To the Purchaser:

| |

Address: |

Room 2205, 22/F, West Tower, Shun Tak Centre, 200 Connaught Road Central, Sheung Wan, Hong Kong |

| |

Attention: |

LI Feilie |

| |

Facsimile: |

852-28106963 |

| 9.2 | A notice delivered personally shall be deemed to be received when delivered

and any notice sent by pre-paid recorded delivery post shall be deemed (in the absence of evidence of earlier receipt) to be received

two days after posting (six days if sent by airmail) and in proving the time of despatch it shall be sufficient to show that the envelope

containing such notice was properly addressed, stamped and posted. A notice sent by facsimile transmission shall be deemed to have been

received when confirmation of successful transmission has been recorded by the sender's facsimile machine. |

| 9.3 | The Vendor hereby irrevocably

appoints the Company whose principal place of business in Hong Kong is at Room 2205, Shun Tak Centre, 200 Connaught Road Central, Hong

Kong as its service agent to receive and acknowledge on its behalf service of any notice, writ, summons, order, judgment or communication

in relation to this Agreement and further agrees that any such legal process or notice shall be sufficiently served on it if delivered

during normal office hours to such agent for service at its address for the time being in Hong Kong. |

| 9.4 | The Purchaser hereby irrevocably

appoints the Company whose principal place of business in Hong Kong is at Room 2205, Shun Tak Centre, 200 Connaught Road Central, Hong

Kong as its service agent to receive and acknowledge on its behalf service of any notice, writ, summons, order, judgment or communication

in relation to this Agreement and further agrees that any such legal process or notice shall be sufficiently served on it if delivered

during normal office hours to such agent for service at its address for the time being in Hong Kong. |

A person who is not a

party to this Agreement has no right under the Contracts (Rights of Third Parties) Ordinance (Chapter 623 of the Laws of Hong Kong) to

enforce or to enjoy the benefit of any term of this Agreement.

This Agreement shall be governed by and

construed in accordance with the laws of Hong Kong, and the parties hereby submit to the non-exclusive jurisdiction of the courts of Hong

Kong in respect of all matters arising in connection with this Agreement.

[The rest of this page is deliberately left

blank.]

Schedule 1

Corporate Structure of Precise Space-Time

Technology Limited

Schedule 1 - A

Details of the Company

Name |

: |

Precise Space-Time Technology Co., Ltd. |

| |

|

|

| Company No. |

: |

2638400 |

| |

|

|

| Place of Incorporation |

: |

Hong Kong |

| |

|

|

| Date of Incorporation |

: |

11 January 2018 |

| |

|

|

| Registered Office |

: |

Room 2204, 22/F, West Tower, Shun Tak Centre,

168-200 Connaught Road Central, Sheung Wan, Hong Kong |

| |

|

|

| Issued Share Capital |

: |

HK$ 10,000 |

| |

|

|

| Paid Up Capital |

: |

HK$ 10,000 |

| |

|

|

| Shareholder(s) |

: |

The Vendor (100%) |

| |

|

|

| Director(s) |

: |

Tam Cheuk Ho |

| |

|

|

| Company Secretary |

: |

Law Ping Wah

Anka Consultants Limited |

| |

|

|

| Principal activities |

: |

Investment Holding |

| |

|

|

| Property Owned |

: |

Nil |

| |

|

|

| Intellectual Property Held |

: |

Nil |

| |

|

|

| Charges |

: |

Nil |

| |

|

|

Schedule 1 - B

Details of the Company’s Subsidiaries

| Name |

: |

深圳市精准新时空科技有限公司 (Shenzhen New Precise Space-Time Technology Co., Ltd.) |

| |

|

|

| Company No. |

: |

91440300MA5F1D6B96 |

| |

|

|

| Place of Incorporation |

: |

the PRC |

| |

|

|

| Date of Incorporation |

: |

15 March, 2018 |

| |

|

|

| Registered Office |

: |

Room 4H, Donghua Building, 5012 Binhe Road, Futian District, Shenzhen, the PRC |

| |

|

|

| Registered Capital |

: |

US$ 800,000 |

| |

|

|

| Paid Up Capital |

: |

To be paid |

| |

|

|

| Shareholder(s) |

: |

Precise Space-Time Technology Limited (100%) |

| |

|

|

| Director(s) |

: |

Chen Gongbao |

| |

|

|

| Principal activities |

: |

Investment Holding |

| |

|

|

| Property Owned |

: |

Nil |

| |

|

|

| Intellectual Property Held |

: |

Nil |

| |

|

|

| Charges |

: |

Nil |

| |

|

|

Schedule 1 - C

Details of the Company’s Subsidiaries

Name |

: |

深圳市前海飞尚环境投资有限公司 (Shenzhen Qianhai Feishang Environmental Investment Co., Ltd.) |

| |

|

|

| Company No. |

: |

914403003263945000 |

| |

|

|

| Place of Incorporation |

: |

the PRC |

| |

|

|

| Date of Incorporation |

: |

15 January 2015 |

| |

|

|

| Registered Office |

: |

Room 201, A Building, 1st Qianwan Road, Shenzhen - Hong Kong Cooperation Zone, Qianhai, Shenzhen, the PRC |

| |

|

|

| Registered Capital |

: |

CNY 100,000,000 |

| |

|

|

| Paid Up Capital |

: |

CNY 100,000,000 |

| |

|

|

| Shareholder(s) |

: |

深圳市精准新时空科技有限公司(Shenzhen New Precise Space-Time Technology Co., Ltd.) (100%) |

| |

|

|

| Director(s) |

: |

Li Zongyang |

| |

|

|

| Principal activities |

: |

Investment Holding |

| |

|

|

| Property Owned |

: |

Nil |

| |

|

|

| Intellectual Property Held |

: |

Nil |

| |

|

|

| Charges |

: |

Nil |

| |

|

|

Schedule 1 - D

Details of the Company’s Subsidiaries

| Name |

: |

上海昂未环保发展有限公司 (Shanghai Onway Environmental Development Co., Ltd.) |

| |

|

|

| Company No. |

: |

91310000322311813W |

| |

|

|

| Place of Incorporation |

: |

the PRC |

| |

|

|

| Date of Incorporation |

: |

7 July 2015 |

| |

|

|

| Registered Office |

: |

Room 7953, 2# Building, 1800 Panyuan Road, Changxing Town, Chongming District, Shanghai, the PRC |

| |

|

|

| Registered Capital |

: |

CNY 20,408,163 |

| |

|

|

| Paid Up Capital |

: |

CNY 20,408,163 |

| |

|

|

| Shareholder(s) |

: |

(1)深圳市前海飞尚环境投资有限公司

(Shenzhen Qianhai Feishang Environmental Investment Co., Ltd.) (51%)

(2) Anxon

Envirotech Pte. Ltd (24.99%)

(3)上海兴禹环境工程有限公司

(Shanghai Xingyu Environment Engineering Co., Ltd.) (24.01%) |

| |

|

|

| Director(s) |

: |

(1) Peng

Wenlie

(2) Hu

Yiming

(3) Li

Qi

(4) Zheng

Lei

(5) Qiu

Jiangping |

| |

|

|

| Principal activities |

: |

Provision of equipment in rural wastewater treatment and provision of engineering, procurement and construction

activities in relation to wastewater treatment in the PRC |

| |

|

|

| Property Owned, |

: |

Nil |

| |

|

|

| Intellectual Property Held |

: |

Please refer to the following page |

| |

|

|

| Charges |

: |

Nil |

Patents

held by 上海昂未环保发展有限公司

(Shanghai Onway Environmental Development Co., Ltd.)

| No. |

Name |

Patent Number |

Validity |

| 1 |

具有均匀布水及自动复氧效果的生物滴滤池填料框

(Bio-trickling filter packing frame with uniform

water distribution and automatic reoxygenation effects) |

ZL201822079471.2 |

10 years from 12 December 2018 |

| 2 |

一种污水强化除磷填料及其制备方法

(Sewage reinforced phosphorous removal packing

and preparation method thereof) |

ZL201410005588.X |

20 years from 6 January 2014 |

| 3 |

滨岸梯级组合式面源污染控制系统

(Shore bank step combination formula non -point

source pollution control system) |

ZL201720472506.1 |

10 years from 28 April 2017 |

| 4 |

具有子母连接扣模块化生态基复合生物浮岛

(Modularization ecological substrate composite

biological chinampa with primary and secondary connector link) |

ZL201720460870.6 |

10 years from 28 April 2017 |

| 5 |

一种布水器

(Water distributor) |

ZL201720030805.X |

10 years from 11 January 2017 |

Trademarks

held by 上海昂未环保发展有限公司

(Shanghai Onway Environmental Development Co., Ltd.)

| No. |

Trademark |

Registration Number |

Validity |

| 1 |

|

24855688 |

10 years from 21 June 2018 |

| 2 |

|

24855687 |

10 years from 21 June 2018 |

Schedule 1 - E

Details of the Company’s Subsidiaries

| Name |

|

浙江新禹环境科技有限公司 (Zhejiang Xinyu Environmental Technology Co., Ltd.) |

| |

|

|

| Company No. |

: |

9133050332791949XL |

| |

|

|

| Place of Incorporation |

: |

the PRC |

| |

|

|

| Date of Incorporation |

: |

25 January 2015 |

| |

|

|

| Registered Office |

: |

16-1 Weiduoliya Avenue, Shuanglin Town, Nanxun District, Huzhou, Zhejiang, the PRC |

| |

|

|

| Registered Capital |

: |

CNY 20,000,000 |

| |

|

|

| Paid Up Capital |

: |

CNY 20,000,000 |

| |

|

|

| |

|

|

| Shareholder(s) |

: |

上海昂未环保发展有限公司 (Shanghai Onway Environmental Development Co., Ltd.) (100%) |

| |

|

|

| Director(s) |

: |

Zhang Zhengshi |

| |

|

|

| Principal activities |

: |

Provision of engineering, procurement and construction activities in relation to wastewater treatment |

| |

|

|

| Property Owned |

: |

Nil |

| |

|

|

| Intellectual Property Held |

: |

Nil |

| |

|

|

| Charges |

: |

Nil |

| |

|

|

Schedule 1 - F

Details of the Company’s Subsidiaries

| Name |

: |

韶关市昂瑞环保科技发展有限公司

(Shaoguan Angrui Environmental Technology Development Co., Ltd.) |

| |

|

|

| Company No. |

: |

91440203MA51WMC327 |

| |

|

|

| Place of Incorporation |

: |

the PRC |

| |

|

|

| Date of Incorporation |

: |

22 June 2018 |

| |

|

|

| Registered Office |

: |

Room 317, Enterprise Office Building, West Lingjiao of Huanggangling,

Lower Management Area, Longgui Town, Wujiang District, Shaoguan,

Guangdong, the PRC |

| |

|

|

| Registered Capital |

: |

CNY 26,682,100 |

| |

|

|

| Paid Up Capital |

: |

CNY 26,682,100 |

| |

|

|

| Shareholder(s) |

: |

(1)

上海昂未环保发展有限公司

(Shanghai Onway Environmental Development Co., Ltd.) (55%)

(2)

韶关市武江区润恒城乡建设投资有限公司

(Shaoguan Wujiang Runheng Urban and Rural Construction Investment Co., Ltd.)

(20%)

(3)广州市瑞奕环保科技有限公司(Guangzhou

Ruiyi Environmental Technology Co., Ltd.) (20%)

(4)

广东惜福环保科技有限公司(Guangdong

Xifu Environmental Technology Co., Ltd.) (4%)

(5)

广东信震建设工程有限公司(Guangdong

Xinzhen Construction Engineering Co., Ltd.) (1%) |

| |

|

|

| Director(s) |

: |

(1) Ma Xiongbing

(2) Guan Xiangdong

(3) Chen Wei

(4) Peng Wenlie

(5) Zhang Xinghai |

| |

|

|

| Principal activities |

: |

PPP project of Wujiang Village Garbage and Rural Wastewater Treatment Infrastructure in Shaoguan City |

| |

|

|

| Property Owned |

: |

Nil |

| |

|

|

| Intellectual Property Held |

|

Nil |

| |

|

|

| Charges |

: |

Shanghai Onway Environmental Development Co., Ltd.’s 55% equity interests in

Shaoguan Angrui Environmental Technology Development Co., Ltd. was pledged

to a financial institution for facilities granted to Shanghai Onway Environmental Development Co., Ltd. |

Schedule 2

Vendor’s Warranties

Save as disclosed in writing to the Purchaser prior

to the signing of this Agreement:

| 1. | The matters stated in the Recitals and Schedule 1 to this Agreement are

true and accurate and any and all information provided by the Vendor (and its agents and professional advisers (if any)) to the Purchaser

(and its agents and professional advisers) prior to the execution of this Agreement and Completion are true and accurate in all respects

and not misleading in any respect. |

| 2. | The Vendor has full power and legal capacity and has obtained all necessary

approval, authorisation and consents to enter into and perform this Agreement and this Agreement will, when executed, constitute legal,

valid and binding obligations on the Vendor in accordance with its terms. |

| 3. | The execution, delivery and performance of this Agreement by the Vendor

does not and will not violate in any respect any provision of (i) any law or regulation or any order or decree of any governmental authority,

agency or court of Hong Kong or any other part of the world prevailing as at the date of this Agreement and as at Completion; or (ii)

any mortgage, contract or other undertaking or instrument to which any of the Vendor or the Company is a party or which is binding upon

any of them or any of their assets, and does not and will not result in the creation or imposition of any Encumbrance on any of their

assets pursuant to the provisions of any such mortgage, contract or other undertaking or instrument. |

| 4. | No consent of or other requirement of any governmental department, authority

or agency in Hong Kong or any other part of the world is required by the Vendor in relation to the valid execution, delivery or performance

of this Agreement (or to ensure the validity or enforceability thereof) and the sale and purchase of the Sale Shares, and the Sale Shares

are freely transferable by it to the Purchaser at Completion without the consent, approval, permission, licence or concurrence of any

third party. |

| 5. | The Sale Shares to be transferred by the Vendor are allotted and issued

fully paid in accordance with the articles of association of the Company and in compliance with all applicable laws as at Completion.

All Sale Shares are rank pari passu with each other. |

| 6. | The Sale Shares to be transferred by the Vendor under this Agreement shall

represent 100% of the issued share capital of the Company as at Completion and the Company is not under any contract, options, warrants

or any other obligations regarding any part of its capital, issued or unissued, or for the issue of any shares, debentures, warrants,

options, or other similar securities or has agreed to acquire and share or interest or loan capital in any company or the right to require

the creation of any mortgage, charge, pledge, lien or other security or encumbrance. |

| 7. | The Sale Shares and the Sale Loan are free from all Encumbrances and will

be sold and transferred to the Purchaser (or its nominee) free from all Encumbrances together with all rights and entitlements attaching

thereto. The Sale Shares and the Sale Loan are freely transferable to the Purchaser without the consent, approval, permission, licence

or concurrence of any third party. The Vendor is the sole legal and beneficial owner of the

Sale Shares and the Sale Loan. |

| 8. | Neither the Company nor any of its subsidiaries has taken steps to enter

into liquidation and there are no grounds on which a petition or application could be properly based for the winding up or appointment

of a receiver of the Company or any of its subsidiaries. |

| 9. | All outstanding share capital of the Company (i) have been duly and validly

issued (or subscribed for), is fully paid, (ii) are free of limitation in voting rights, pre-emptive rights, any other restrictions on

transfer and other liens (except for any restrictions on transfer under applicable laws and the articles of association of the Company),

and (iii) have been issued in compliance with all applicable laws, contracts, and pre-emptive rights. |

| 10. | There are no (i) resolutions pending to increase/decrease issued share capital

of the Company or equity incentive plans with respect to the Company; (ii) dividends which have accrued or been declared but are unpaid

by the Company; or (iii) obligations, contingent or otherwise, of the Company to repurchase, redeem or otherwise acquire any equity securities

or any voting trusts, shareholder agreements, registration rights, proxies or other agreements or understandings in effect with respect

to the voting, issuance, redemption, acquisition or transfer of any equity securities of the Company. |

| 11. | Each of the Company and its subsidiaries has duly and properly complied

with all filing and registration requirements in respect of corporate or other documents imposed under the laws of the jurisdiction in

which it was incorporated or any other jurisdiction to which it is subject. |

| 12. | To the best knowledge of the Vendor, each of the Company and its subsidiaries

has complied with all relevant and applicable legislation and obtained and complied with all necessary licences and consents to carry

on business in the country, territory or state in which it is incorporated, including applicable legislation relating to companies and

securities, real property, taxation and prevention of corruption and have complied with all applicable legal requirements in relation

to any transactions to which it is or has been a party prior to Completion. |

| 13. | The Company is not under any contract, options, warrants or any other obligations

regarding any part of its capital, issued or unissued, or for the issue of any shares, debentures, warrants, options, or other similar

securities or has agreed to acquire any share or interest or loan capital in any company at any time before or after Completion. There

is no option, right to acquire, mortgage, charge, pledge, lien or other form of security, encumbrance or third party rights on, over or

affecting any part of the unissued share capital or loan capital of the Company or over any part of the issued or unissued share capital

or loan capital of the Company and there is no agreement or commitment to give or create any of the foregoing and no claim has been made

by any person to be entitled to any of the foregoing which has not been waived in its entirety or satisfied in full. |

| 14. | To the best knowledge of the Vendor, the Management Accounts have been prepared

in accordance with International Financial Reporting Standards and comply with all applicable legislation, and are complete and accurate,

and show a true and fair view of the affairs and financial position of the Company as at, and the profits and loss of the Company for

the period ended on, the Management Accounts Date. Without limitation, all assets (tangible or otherwise) in the Management Accounts have

been validly accounted for, accurately recorded and classified, all receivables in the Management Accounts are recoverable and sufficient

provisions have been made, the inventory in the Management Accounts are complete and up to date and there are no existing or contingent

liabilities not fully reflected or reserved against, or specifically disclosed to the Purchaser in writing or which are otherwise unidentified

as of the Completion Date. |

| 15. | There has been no Material Adverse Change in respect of the Company and

its subsidiaries since the Management Accounts Date. |

| 16. | The Company has full power under its articles of association to carry on

its existing business and undertakings, and all authorisations, approvals, consents and licences required by the Company have been obtained

and are in full force and effect. |

| 17. | Each of the Company and its subsidiaries has been duly incorporated and

is validly subsisting under the laws of the jurisdiction of its incorporation. |

| 18. | The Company, other than its subsidiaries listed out in Schedule 1, has no

other subsidiaries or investments in other companies. |

| 19. | None of the licences/certificates of the Company and its subsidiaries have

been revoked and all such licences/certificates are still valid and subsisting and no circumstances has arisen which has resulted or may

result in a suspension or revocation of any of the above licences/certificates. |

| 20. | There are no circumstances in relation to the Company and its subsidiaries

which give rise or, as far as the Vendor is aware, are likely to give rise or have given rise to any material civil, criminal, administrative

or other action, claim, suit, complaint, proceeding, investigation, decontamination, remediation or expenditure by any competent authority. |

Schedule 3

[Reserved]

Schedule 4

PRECISE SPACE-TIME TECHNOLOGY LIMITED

CONDENSED CONSOLIDATED STATEMENTS OF PROFIT OR LOSS

(Amounts in thousands)

| |

|

12 Months Period Ended December 31, |

| |

|

2022 |

|

|

2022 |

|

| |

|

CNY |

|

US$ |

|

| |

|

|

|

| Revenue |

|

20,306 |

|

3,150 |

|

| Cost of sales |

|

14,485 |

|

2,247 |

|

| Gross profit |

|

5,821 |

|

903 |

|

| Selling and distribution expenses |

|

700 |

|

109 |

|

| Administrative expenses |

|

11,501 |

|

1,784 |

|

| |

|

|

|

| OPERATING PROFIT |

|

5,834 |

|

905 |

|

| |

|

|

|

| |

|

|

|

| Investment income |

|

1,073 |

|

166 |

|

| Finance costs |

|

|

|

|

|

| Other income |

|

|

|

|

|

| |

|

|

|

| PROFIT BEFORE INCOME TAX |

|

6,907 |

|

1,071 |

|

| |

|

|

|

| INCOME TAX |

|

5,864 |

|

909 |

|

| |

|

|

|

| PROFIT FOR THE PERIOD |

|

1,043 |

|

162 |

|

| |

|

|

|

| ATTRIBUTABLE TO: |

|

|

|

| Owners of the Company |

|

(1,284) |

|

(199) |

|

| Non-controlling interests |

|

2,327 |

|

361 |

|

| |

|

1,043 |

|

162 |

|

| |

|

|

|

PRECISE SPACE-TIME TECHNOLOGY LIMITED

UNAUDITED CONDENSED CONSOLIDATED STATEMENTS OF FINANCIAL POSITION

(Amounts in thousands)

| |

|

As Of December 31, |

| |

|

2022 |

|

2022 |

|

| |

|

CNY |

|

US$ |

|

| ASSETS |

|

|

|

| NON-CURRENT ASSETS |

|

|

|

| Property, plant and equipment |

|

367 |

|

57 |

|

| Intangible assets |

|

19,381 |

|

3,007 |

|

| Long-term receivables |

|

10,520 |

|

1,632 |

|

| Contract assets |

|

89,713 |

|

13,916 |

|

| Right-of-use assets |

|

1,980 |

|

307 |

|

| TOTAL NON-CURRENT ASSETS |

|

121,961 |

|

18,919 |

|

| CURRENT ASSETS |

|

|

|

| Prepayments |

|

1,718 |

|

267 |

|

| Trade Receivables |

|

46,760 |

|

7,253 |

|

| Other Receivables |

|

82,716 |

|

12,831 |

|

| Inventory |

|

729 |

|

113 |

|

| Contract assets |

|

21,647 |

|

3,358 |

|

| Cash and cash equivalents |

|

25,655 |

|

3,980 |

|

| TOTAL CURRENT ASSETS |

|

193,040 |

|

29,944 |

|

| |

|

|

|

| TOTAL ASSETS |

|

315,001 |

|

48,863 |

|

| |

|

|

|

| LIABILITIES |

|

|

|

| CURRENT LIABILITIES |

|

|

|

| Trade payables |

|

20,225 |

|

3,137 |

|

| Other payables and accrued liabilities |

|

11,178 |

|

1,734 |

|

| Taxes payable |

|

10,731 |

|

1,665 |

|

| Due to fellow subsidiaries |

|

129,959 |

|

20,159 |

|

| Due to related companies |

|

443 |

|

69 |

|

| TOTAL CURRENT LIABILITIES |

|

176,872 |

|

27,436 |

|

| NON- CURRENT LIABILITIES |

|

|

|

| Deferred tax liabilities |

|

5,276 |

|

818 |

|

| Long-term loan |

|

71,000 |

|

11,014 |

|

| TOTAL NON- CURRENT LIABILITIES |

|

77,524 |

|

12,026 |

|

| TOTAL LIABILITIES |

|

254,396 |

|

39,462 |

|

| |

|

|

|

| EQUITY |

|

|

|

| Issued capital |

|

8 |

|

1 |

|

| Accumulated loss |

|

39,084 |

|

6,063 |

|

| Other comprehensive income |

|

1 |

|

- |

|

| EQUITY ATTRIBUTABLE TO OWNERS |

|

(49,075) |

|

(7,613) |

|

| NON-CONTROLLING INTERESTS |

|

109,680 |

|

17,014 |

|

| TOTAL EQUITY |

|

60,605 |

|

9,401 |

|

| TOTAL LIABILITIES AND EQUITY |

|

315,001 |

|

48,863 |

|

IN WITNESS WHEREOF the parties have executed

this Agreement the day and year first above written.

| Purchaser |

|

| |

|

| SIGNED by LI Feilie |

) /s/

LI Feilie |

| for and on behalf of |

) |

| FEISHANG GROUP LIMITED |

) |

| in the presence of: - SHEN

You |

) |

| |

|

| |

|

| |

|

| Vendor |

|

| SIGNED by WONG Wah On Edward |

) /s/

WONG Wah On Edward |

| for and on behalf of |

) |

| CHINA NATURAL RESOURCES, INC. |

) |

| in the presence of:

- NG Kam Ming |

) |

Exhibit 99.2

CHINA NATURAL

RESOURCES TO SELL PRECISE SPACE-TIME TECHNOLOGY

HONG KONG, July 28, 2023

– China Natural Resources, Inc. (NASDAQ: CHNR) (the “Company”) announced today that it has agreed to sell all outstanding

shares of Precise Space-Time Technology Limited (“Precise Space-Time Technology” or “PSTT”) to Feishang Group

Limited, together with PSTT’s outstanding payable owed to the Company, for consideration of approximately RMB95,761,119 in cash

(approximately $13.2 million, the “Base Purchase Price”). The Base Purchase Price is subject to upward post-closing adjustment

based on the difference between net assets of PSTT as included in its unaudited consolidated balance sheet as of June 30, 2023 and the

base net assets (which is determined as the higher of RMB-49,074,962, PSTT’s consolidated net assets as of December 31, 2022 and

RMB-34,197,300, the value of PSTT as determined by the valuation report dated July 28, 2023).

Precise Space-Time Technology, through

its wholly owned subsidiaries, owns a 51% equity interest in Shanghai Onway Environmental Co., Ltd. (“Shanghai Onway”). Shanghai

Onway is principally engaged in the provision of equipment for rural wastewater treatment and the provision of engineering, procurement

and construction services in relation to wastewater treatment in China.

The valuation of PSTT as of December 31, 2022 as determined by an

independent valuation firm on July 28, 2023 is RMB-34,197,300. The Company acquired all outstanding shares of PSTT from Mr. LI Feilie

for an aggregate consideration of approximately RMB104.1 million in July 2021.

Mr. Wong Wah On Edward, Chairman of the Company, said, “The disposition

of Shanghai Onway can help the Company streamline its resources and invest in opportunities that will help the Company grow.”

About China Natural Resources:

China Natural Resources, Inc. (NASDAQ: CHNR) is currently a holding company

that operates in two reportable operating segments: wastewater treatment and exploration and mining. After the completion of Precise Space-Time

Technology disposition, the Company will be engaged in the acquisition and exploitation of mining rights in Inner Mongolia, including

exploring for lead, silver and other nonferrous metal, and is actively exploring business opportunities in the healthcare and other non-natural

resource sectors. China Natural Resources recently agreed to acquire Williams Minerals, which operates a lithium mine in Zimbabwe, for

a maximum consideration of US$1.75 billion. Williams Minerals is owned by China Natural Resources’ controlling shareholder, Feishang

Group Limited, and a non-affiliate, Top Pacific (China) Limited. While there is no guarantee, the acquisition of Williams Minerals is

expected to close in 2023.

Forward-Looking Statements:

This press release includes forward-looking statements within the meaning

of the U.S. federal securities laws. These statements include, without limitation, statements regarding the intent, belief and current

expectations of the Company, its directors or its officers with respect to: the potential presented by the healthcare and wastewater treatment

sectors in the People’s Republic of China (the “PRC”) and other industry sectors in the PRC generally; the impact on

the Company’s financial position, growth potential and business of an investment in the wastewater treatment sector of the PRC generally

and in Precise Space-Time Technology and Shanghai Onway specifically; the experience, supply chain and customer

relationships and market insights of the Precise Space-Time Technology team; the growth potential of the wastewater treatment and environmental

protection industries in the PRC; the impact on the Company’s financial position of an investment in the healthcare sector of the

PRC; and the Company’s ability to locate and execute on strategic opportunities. Forward-looking statements are not a guarantee

of future performance and involve risks and uncertainties, and actual results may differ materially from those in the forward-looking

statement as a result of various factors. Among the risks and uncertainties that could cause the Company’s actual results to differ

from its forward-looking statements are: possible downturns in the healthcare or wastewater treatment sectors in the PRC or other sectors

that the Company may invest in; the results of the next assessment by the Staff of the Nasdaq Listing Qualifications department of the

Company’s compliance with the Nasdaq Listing Rules; uncertainties related to governmental, economic and political circumstances

in the PRC; uncertainties related to metal price volatility; uncertainties related to the Company’s ability to fund operations;

uncertainties related to possible future increases in operating expenses, including costs of labor and materials; uncertainties related

to the impact of the COVID-19 pandemic; uncertainties related to the political situation between the PRC and the United States, and potential

negative impacts on companies with operations in the PRC that are listed on exchanges in the United States; and other risks detailed from

time to time in the Company’s filings with the U.S. Securities and Exchange Commission. When, in any forward-looking statement,

the Company, or its management, expresses an expectation or belief as to future results, that expectation or belief is expressed in good

faith and is believed to have a reasonable basis, but there can be no assurance that the stated expectation or belief will result or be

achieved or accomplished. Except as required by law, the Company undertakes no obligation to update any forward-looking statements.

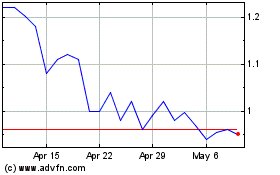

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Nov 2024 to Dec 2024

China Natural Resources (NASDAQ:CHNR)

Historical Stock Chart

From Dec 2023 to Dec 2024