false

0001015155

0001015155

2024-12-05

2024-12-05

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported):

December 5, 2024

Charles &

Colvard, Ltd.

(Exact name of registrant as specified in

its charter)

| North Carolina |

000-23329 |

56-1928817 |

|

(State or other jurisdiction of

incorporation) |

(Commission File

Number) |

(I.R.S. Employer

Identification No.) |

| 170 Southport Drive |

|

| Morrisvillex, North Carolina |

27560 |

| (Address of principal executive offices) |

(Zip Code) |

(919) 468-0399

(Registrant’s telephone number, including

area code)

N/A

(Former name or former address, if changed

since last report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| |

|

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| |

|

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of

the Act:

| Title of each class |

Trading Symbol(s) |

Name of each exchange on which registered |

| Common Stock, no par value per share |

CTHR |

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging

growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities

Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging

growth company ¨

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange

Act. ¨

| Item 7.01 |

Regulation FD Disclosure. |

As previously disclosed, on December 12, 2014,

Charles & Colvard, Ltd. (the “Company”) entered into an exclusive supply agreement (the “Supply Agreement”)

with Wolfspeed, Inc. (“Wolfspeed”), formerly known as Cree, Inc. Under the Supply Agreement, subject to certain terms and

conditions, the Company agreed to exclusively purchase from Wolfspeed, and Wolfspeed agreed to exclusively supply, 100% of the Company’s

required SiC materials in quarterly installments that must equal or exceed a set minimum order quantity.

On July 28, 2023, Wolfspeed

initiated a confidential arbitration against the Company for breach of contract claiming damages, plus interest, costs, and attorneys’

fees. Wolfspeed alleged that the Company failed to satisfy the purchase obligations provided in the Supply Agreement for the Company’s

fiscal year ending June 30, 2023 in the amount of $4.25 million and failed to pay for $3.30 million of SiC crystals Wolfspeed

delivered to the Company. Wolfspeed further alleged that the Company intended to breach its remaining purchase obligations under the Supply

Agreement, representing an additional $18.5 million in alleged damages. An arbitration hearing was held the week of September 30,

2024.

On December 5, 2024, the arbitrators rejected Wolfspeed’s

claims for expectation damages and made the following interim award. The Company is required to pay Wolfspeed the undisputed amount of

approximately $1.3 million for product previously purchased and already reflected as a payable in the Company’s historical financial

statements. In addition, the Company is also required to purchase and pay Wolfspeed approximately $2.0 million for raw material delivered

to the Company on consignment, which will have a positive impact on the Company’s balance sheet by increasing inventory by a similar

amount as of June 30, 2024. Wolfspeed is entitled to recover interest at the rate of 8% per annum on the foregoing compensatory damages

between April 24, 2023 until paid. The arbitrators’ fees and expenses shall be borne by the Company and will be included in the

final award. Wolfspeed was awarded attorney’s fees and costs incurred in connection with this arbitration, but not for any time

related to arguing for expectation damages, nor for expert witness fees and expenses. No later than January 4, 2025, Wolfspeed shall submit

a petition for its attorney’s fees and costs together with a supporting affidavit on the reasonableness and necessity of (i) the

time spent, (ii) the number of attorneys who worked on the matter, (iii) the hourly rates charged, compared to the customary fees charged

in the community for similar services by lawyers of similar experience, and (iv) the costs incurred. All such costs shall be supported

by documentation. The Company shall have 15 days from the service of Wolfspeed’s petition to respond. The arbitrators shall review

the parties’ submissions on the issue of attorney’s fees and costs and then issue a final award.

On December 11, 2024 the Company issued a press

release regarding the interim award. A copy of the press release is attached hereto as Exhibit 99.1.

Forward-Looking Statements

This Form 8-K contains a number of forward-looking

statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended. Words such as “plan,” “expect,” “will,” “working,” and variations

of such words and similar future or conditional expressions are intended to identify forward-looking statements. These forward-looking

statements include, but are not limited to, the ability of the Company to continue its business. These forward-looking statements are

not guarantees of future results and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond

our control. Actual results could differ materially from those contemplated by the forward-looking statements as a result of certain factors

detailed in the Company’s filings with the Securities and Exchange Commission, including the risks and uncertainties described in

more detail in our filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and subsequent

reports filed with the SEC. For example, there can be no assurance that the Company will succeed in pursuing its strategic plan, or regain

compliance with the Nasdaq Listing Rules during any compliance period or in the future, or otherwise meet Nasdaq compliance standards,

and its reliance on Wolfspeed as its sole supplier of silicon carbide subjects it to risk. Forward-looking statements speak only as of

the date they are made. The Company disclaims and does not undertake any obligation to update or revise any forward-looking statement

in this press release, except as required by applicable law or regulation and you are urged to review and consider disclosures that we

make in the reports that we file with the SEC that discuss other factors relevant to our business.

In accordance with General Instruction B.2 of Form

8-K, the information in this Current Report on Form 8-K, including Exhibit 99.1, which is incorporated into this Item 7.01, is being furnished

pursuant to Item 7.01 and shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated

by reference in any filing under the Exchange Act, as amended, or the Securities Act of 1933, as amended, except as shall be expressly

set forth by specific reference in such a filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

Charles & Colvard, Ltd. |

|

| |

|

|

|

| December 11, 2024 |

By: |

/s/ Clint J. Pete |

|

| |

|

Clint J. Pete |

|

| |

|

Chief Financial Officer

|

|

Exhibit 99.1

Charles & Colvard, Ltd. Receives Interim

Award in Wolfspeed Arbitration

RESEARCH TRIANGLE PARK, N.C., December 11, 2024 – Charles

& Colvard, Ltd. (“Charles & Colvard” or the “Company”) (Nasdaq: CTHR) today announced that on

December 5, 2024, it received an interim award in its confidential arbitration with Wolfspeed, Inc. Importantly, the award rejected Wolfspeed’s

claims to expectation damages of approximately $22.8 million, limiting the Company’s damages to just $3.3 million representing approximately

$1.3 million for inventory previously purchased and approximately $2.0 million of consigned inventory in the Company’s possession,

that will now be recorded on the Company’s balance sheet as of June 30, 2024 - along with interest, arbitration and limited attorney’s

fees as described below.

“We consider this a significant victory for the Company and its

shareholders, as Wolfspeed sought total damages in excess of $28 million. This resolution allows us to focus on our business and move

forward to execute on our strategic plans while no longer being obligated under a long-term purchase commitment that we believe hindered

the Company’s growth and profitability for quite some time,” said Company President and Chief Executive Officer Don O’Connell.

Under the terms of the interim award, the arbitrators rejected Wolfspeed’s

claims for additional expectation damages. The Company is required to pay Wolfspeed the undisputed amount of approximately $1.3 million

for product previously purchased and already reflected as a payable in the Company’s historical financial statements. In addition,

the Company is also required to purchase and pay Wolfspeed approximately $2.0 million for raw material delivered to the Company on consignment,

which will have a positive impact on the Company’s balance sheet by increasing inventory by a similar amount as of June 30, 2024.

Wolfspeed is entitled to recover interest at the rate of 8% per annum on the foregoing compensatory damages between April 24, 2023, until

paid. The arbitrators’ fees and expenses shall be borne by the Company and will be included in the final award. Wolfspeed was awarded

attorney’s fees and costs incurred in connection with this arbitration, but not for any time related to arguing for expectation

damages, nor for expert witness fees and expenses. No later than January 4, 2025, Wolfspeed shall submit a petition for its attorney’s

fees and costs together with a supporting affidavit on the reasonableness and necessity of (i) the time spent, (ii) the number of attorneys

who worked on the matter, (iii) the hourly rates charged, compared to the customary fees charged in the community for similar services

by lawyers of similar experience, and (iv) the costs incurred. All such costs shall be supported by documentation. The Company shall have

15 days from the service of Wolfspeed’s petition to respond. The arbitrators shall review the parties’ submissions on the

issue of attorney’s fees and costs and then issue a final award.

About Charles & Colvard, Ltd.

Charles & Colvard, Ltd. (Nasdaq: CTHR) believes that fine jewelry

should be as ethical as it is exquisite. Charles & Colvard is the original creator of lab grown moissanite (a rare gemstone formed

from silicon carbide). The Company brings revolutionary gems and fine jewelry to market by using exclusively Made, not Mined™ above

ground gemstones and a dedication to 100% recycled precious metals. The Company's Forever One™ moissanite and Caydia® lab

grown diamond brands provide exceptional quality, incredible value and a conscious approach to bridal, high fashion, and everyday jewelry.

Charles & Colvard was founded in 1995 and is based in North Carolina's Research Triangle Park region. For more information, please

visit https://www.charlesandcolvard.com/.

Forward-Looking Statements

This press release contains a number of forward-looking statements

within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as

amended. Words such as “plan,” “expect,” “will,” “working,” and variations of such words

and similar future or conditional expressions are intended to identify forward-looking statements. These forward-looking statements include,

but are not limited to, the ability of the Company to continue its business. These forward-looking statements are not guarantees of future

results and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond our control. Actual

results could differ materially from those contemplated by the forward-looking statements as a result of certain factors detailed in the

Company’s filings with the Securities and Exchange Commission, including the risks and uncertainties described in more detail in

our filings with the SEC, including our Annual Report on Form 10-K for the fiscal year ended June 30, 2023 and subsequent reports filed

with the SEC. For example, there can be no assurance that the Company will succeed in pursuing its strategic plan, or regain compliance

with the Nasdaq Listing Rules during any compliance period or in the future, or otherwise meet Nasdaq compliance standards, and its reliance

on Wolfspeed as its sole supplier of silicon carbide subjects it to risk. Forward-looking statements speak only as of the date they are

made. The Company disclaims and does not undertake any obligation to update or revise any forward-looking statement in this press release,

except as required by applicable law or regulation and you are urged to review and consider disclosures that we make in the reports that

we file with the SEC that discuss other factors relevant to our business.

Charles & Colvard Corporate Contact:

Clint J. Pete

Chief Financial Officer

Charles & Colvard, Ltd.

919-468-0399

ir@charlesandcolvard.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

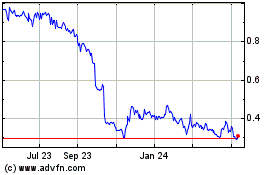

Charles and Colvard (NASDAQ:CTHR)

Historical Stock Chart

From Dec 2024 to Jan 2025

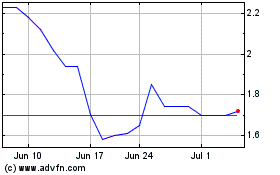

Charles and Colvard (NASDAQ:CTHR)

Historical Stock Chart

From Jan 2024 to Jan 2025