UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of May 2024

Commission File Number 001-39124

Centogene N.V.

(Translation of registrant's name into English)

Am Strande

7

18055 Rostock

Germany

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Centogene N.V.

Press Release Announcements

Financial Results

On May 15, 2024, Centogene N.V. (the “Company”)

issued a press release reporting its financial results for the fourth quarter of 2023 and full year ended December 31, 2023. A copy

of the press release is attached hereto as Exhibit 99.1 and is incorporated by reference herein.

Lifera Transactions

On May 15, 2024, the Company issued a press release announcing

its entry into certain transactions with Pharmaceutical Investment Company, a closed joint stock company incorporated pursuant to the

laws of Saudi Arabia and trading as “Lifera” and a wholly-owned subsidiary of the Public Investment Fund based in Riyadh.

A copy of the press release is attached hereto as Exhibit 99.2 and is incorporated by reference herein.

Exhibits 99.1 and 99.2 to this Report on Form 6-K shall not be

deemed “filed” for purposes of Section 18 of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange

Act”), or otherwise subject to the liabilities of that section, nor shall they be deemed incorporated by reference in any filing

under the U.S. Securities Act of 1933, as amended, or the Exchange Act.

Convening of Annual General Meeting of Shareholders and Related

Materials

On May 15, 2024, the Company convened the annual general meeting

of shareholders to be held on May 31, 2024, and made available to its shareholders certain other materials in connection with such

meeting. Such materials are attached as Exhibits 99.3, 99.4, 99.5 and 99.6 to this Report on Form 6-K and are incorporated by reference

herein.

Signatures

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: May 15, 2024

| |

CENTOGENE N.V. |

| |

|

|

| |

By: |

/s/

Jose Miguel Coego Rios |

| |

|

Name: |

Jose Miguel Coego

Rios |

| |

|

Title: |

Chief Financial Officer |

Exhibit Index

Exhibit 99.1

CENTOGENE Reports Full Year 2023 Financial

Results and Recent Business Highlights

| • | Reported

Full Year 2023 total revenues of 2% growth at €48.5 million |

| • | Secured

approximately USD 20 million – strengthening cash position and expanding relationship

with Lifera, a biopharma company owned by the PIF |

| • | Positioned

for strong performance in 2024, driven by new and existing Pharma business and

solid Diagnostic growth in line with industry standards; guidance of FY2024 total revenue

growth between 10-15% |

| • | Ongoing

strategic alternatives process focused on sustainable long-term value creation for the benefit

of its stakeholders |

CAMBRIDGE, Mass. and ROSTOCK, Germany and BERLIN, May 15,

2024 (GLOBE NEWSWIRE) –

Centogene N.V. (Nasdaq: CNTG) (“we” or the “Company”),

the essential life science partner for data-driven answers in rare and neurodegenerative diseases, today announced financial results

for the fiscal year ended December 31, 2023, and provided a business update.

"In 2023, we focused on strategic growth – strengthening

our Diagnostic portfolio and introducing new data and wet lab solutions to accelerate drug discovery, development, and commercialization

for Pharma. We expanded our partnership model with a joint venture in Saudi Arabia, securing a $30 million investment and additional

milestone payments. However, delays in Pharma program timelines impacted our 2023 revenue. Looking ahead to 2024, our Diagnostics business

is expected to maintain steady growth in line with industry standards, and our Pharma orderbook is on a record trajectory –

with momentum expected to compound each quarter."

Kim Stratton continued, “We are excited to be engaged in discussions

with multiple potential strategic partners and to have deepened our relationship with Lifera over the past months. With this progress

at the forefront, CENTOGENE is positioned for growth and a path towards profitability. We expect to see 2024 annual revenue growth between

10-15%.”

Full Year 2023 Financial Highlights

| • | Total

revenues increased by 2% to €48.5 million in FY2023, compared to €47.5

million in FY2022 |

| • | Diagnostics

segment revenues increased by 8% in 2023 to €33.7 million, primarily related to an increase

of 11% in revenues for CentoXome® (CENTOGENE’s proprietary Whole Exome Sequencing)

and CentoGenome® (CENTOGENE’s proprietary Whole Genome Sequencing).

Achieved upselling 47% of CentoXome® and CentoGenome® orders to MOx (CENTOGENE’s

portfolio of multiomic testing solutions) in FY2023 |

| • | Pharma segment revenues

of €14.8 million, reflecting a decrease of 8%, primarily driven by a lag in Pharma program

timelines in H2 2023 |

| • | Overall

gross profit margin of 36% of revenues or €17.2 million in FY2023, compared to

42% of revenues or €19.8 million in FY2022 |

| • | Net

loss position increased by 12.2% at €35.8 million in FY2023 compared to a net loss of

€31.9 million in FY2022 |

| • | Total

segment adjusted EBITDA was at €11.1 million in FY2023, compared to €13.2 million

in FY2022. This decrease was mainly driven by the lag in pharma revenues, as well as the

increase in cost of sales and selling expenses |

| • | Cash and cash

equivalents were €19.1 million as of December 31, 2023, compared to €35.9

million for the period ended December 31, 2022 |

“We are focused on streamlining processes and strengthening

our financial position to enable us to execute on our leading rare and neurodegenerative disease business and sustainable long-term value

creation,” said Miguel Coego, Chief Financial Officer at CENTOGENE. “Looking ahead, we will remain prudent with our capital

allocation – serving as a key driver to our goal of hitting EBITDA breakeven by the end of this year and our path to cash profitability.

We believe this will enable us to advance our strategic alternatives process to unlock value for our patients, physicians, pharma partners,

and CENTOGENE stakeholders.”

Recent Business Highlights Corporate

| • | Announced

strategic collaboration with Lifera, a biopharmaceutical company wholly-owned by the PIF,

with the formation of a joint venture (JV), Lifera Omics, to increase local and regional

access and rapid delivery of world-class genomic and multiomic testing to patients in Saudi

Arabia and countries of the Gulf Cooperation Council (GCC). Under the terms of the collaboration,

CENTOGENE received a $30 million mandatory convertible loan from Lifera, as well as milestone

payments |

| • | Secured

an additional approximately $20 million proceeds from Lifera via the sale of $15 million

in CENTOGENE’s accounts receivables (AR) in Saudi Arabia at face value with no recourse.

Additionally, Lifera purchased 16% of CENTOGENE’s stake into their JV at a value of

approximately $5 million with CENTOGENE maintaining 4% ownership in the JV with the option

to repurchase the previous ownership on substantially the same terms in the next 6-24 months.

CENTOGENE to remain active in Lifera Omics’ operations to deliver genomic and multiomic

testing |

| • | Initiated

strategic alternatives process focused on sustainable long-term value creation for the benefit

of its stakeholders |

| • | Expanded

the CENTOGENE Biodatabank to over 850,000 patients, over 70% of whom are of non- European

descent, approximately 30,000 active physicians, and more than 85 million unique variants

thanks to the increasing number of CentoXome® and CentoGenome® analyses, which contain

significantly more variants than more targeted diagnostic tests |

| • | Authored

over 30 peer-reviewed scientific publications in FY2023, reaching a milestone of over 300

publications in the Company’s history. The research unlocked insights into Parkinson’s

disease, Gaucher disease, Niemann-Pick type C1 disease, hereditary angioedema, autosomal

recessive spastic paraplegia, colorectal carcinomas, renal hypouricemia, CLN6 disease, ELOVL4-related

autosomal recessive neuro-ichthyosis, CFTR-related disease, TOR1A-related disorders, as well

as a range of variants associated with epilepsy, genetic cancers, metabolic disorders, developmental

disorders, and other rare and neurodegenerative diseases |

Pharma

| • | Led

48 collaborations with 34 different pharmaceutical partners in FY2023. Of these 48 collaborations, 12 were with new partners. Starting

off Q1 2024, the Company has formed collaborations with eight new partners |

| • | Extended

Takeda partnership to March 2026 to continue providing access to genetic testing for

patients with lysosomal storage disorders |

| • | Announced

research project with The Michael J. Fox Foundation to validate the genetic risk factors

of Parkinson’s disease using multiomics |

| • | Reached

initial recruitment and genetic testing milestone in the observational EFRONT Study, being

conducted to advance the genetic understanding of frontotemporal dementia (FTD) |

| • | Leading,

alongside Denali Therapeutics, the ROPAD Study, the world’s largest observational study

on Parkinson’s disease genetics with over 15,000 enrolled patients to date. Patients

enrolled in ROPAD and identified with LRRK2 genetic variations may be eligible for

participation in ongoing interventional clinical studies |

Diagnostics

| • | Strong

test requests of approximately 81,500 test requests for FY2023, representing an increase

of approximately 18% as compared to approximately 57,100 in the prior year |

| • | Strengthened

Diagnostics Sales team and expanded direct footprint distribution network in targeted geographic

areas, such as Canada, Colombia, Italy, Spain, and Portugal |

| • | Expanded

MOx, the Company’s multiomic diagnostic portfolio, now incorporating cutting-edge transcriptomic

analysis. CENTOGENE’s MOx 2.0 is a single-step multiomic solution that combines DNA

sequencing, biochemical testing, and now RNA sequencing to provide physicians with the most

comprehensive testing capability |

| • | Launched

NEW CentoGenome®, the world's most comprehensive Whole Genome Sequencing tool for diagnosis

of rare and neurodegenerative diseases, which now detects Copy Number Variations associated

with spinal muscular atrophy, as well as complex disease-causing variants associated with

Gaucher disease and susceptibility to GBA1-related Parkinson's disease |

| • | Launched

CENTOGENE’s FilterTool to fuel rapid, reliable analysis for diagnosis and research

of rare genetic diseases by significantly reducing time- and resource-intensive processes

– enabling users to display, filter, select, and classify variants. Seamlessly integrating

with CentoCloud®, CENTOGENE’s CE-marked Software as a Service (SaaS) bioinformatics

pipeline, FilterTool is one of the first applications to receive CE mark under new In Vitro

Diagnostic Regulation (IVDR) from the European Parliament |

| • | Launched

together with TWIST Bioscience three Next Generation Sequencing target enrichment panels,

Twist Alliance CNTG Exome, Twist Alliance CNTG Rare Disease Panel, and Twist Alliance CNTG

Hereditary Oncology Panel, to support rare disease and hereditary cancer research and support

diagnostics |

| • | Integrated

Illumina’s new NovaSeq X Plus Sequencer into the Company’s state-of-the-art,

CAP/CLIA accredited laboratory in Rostock, Germany, to further optimize throughput, scale,

and cost efficiencies |

| • | Published

research in Science in collaboration with the Laboratory of Human Genetics of Infectious

Diseases at Institut Imagine on human pre-T cell receptor alpha (pre-TCRα) deficiency

and its effect on human immunity |

| • | Published

study in the European Journal of Human Genetics revealing unique genetic variants

in world's largest Niemann-Pick type C1 disease cohort |

| • | Published

the discovery of a new form of early-onset dystonia and parkinsonism in the context of neurodevelopmental

abnormalities associated to the gene called ACBD6 (Acyl-CoA Binding Domain Containing

6) as part of an international team of researchers. The landmark study’s findings have

been published in Brain |

| • | Published

a study in the Diagnostics journal establishing lyso-Gb1 (glucosylsphingosine) as

a predictive biomarker |

2024 Revenue Guidance

The Company expects revenue growth to be between 10-15% in FY2024

compared to FY2023.

Update on Process to Review Strategic Alternatives

On February 28, 2024, we announced a process to explore

strategic alternatives, including the sale of the Company, divestitures of asset, licensing/partnership transactions, and/or

additional financing. We engaged an investment banker firm to advise us in connection with this process. We are currently in active

discussions with several interested parties, which could result in a near-term transaction by July 15, 2024. We do not expect to

disclose developments unless and until our board of directors has concluded that disclosure is appropriate or required. There can be

no assurance that our strategic review process will result in any transaction or other strategic outcome. We do not intend to

disclose further developments on this strategic review process unless and until we determine that such disclosure is appropriate or

necessary.

About CENTOGENE

CENTOGENE’s mission is to provide data-driven, life-changing

answers to patients, physicians, and pharma companies for rare and neurodegenerative diseases. We integrate multiomic technologies with

the CENTOGENE Biodatabank – providing dimensional analysis to guide the next generation of precision medicine. Our unique approach

enables rapid and reliable diagnosis for patients, supports a more precise physician understanding of disease states, and accelerates

and de-risks targeted pharma drug discovery, development, and commercialization.

Since our founding in 2006, CENTOGENE has been offering rapid and

reliable diagnosis – building a network of approximately 30,000 active physicians. Our ISO, CAP, and CLIA certified multiomic reference

laboratories in Germany utilize Phenomic, Genomic, Transcriptomic, Epigenomic, Proteomic, and Metabolomic datasets. This data is captured

in our CENTOGENE Biodatabank, with over 850,000 patients represented from over 120 highly diverse countries, over 70% of whom are of

non-European descent. To date, the CENTOGENE Biodatabank has contributed to generating novel insights for more than 300 peer-reviewed

publications.

By translating our data and expertise into tangible insights, we have

supported over 50 collaborations with pharma partners. Together, we accelerate and de-risk drug discovery, development, and commercialization

in target and drug screening, clinical development, market access and expansion, as well as offering CENTOGENE Biodata Licenses and Insight

Reports to enable a world healed of all rare and neurodegenerative diseases.

To discover more about our products, pipeline, and patient-driven

purpose, visit www.centogene.com and follow us on LinkedIn.

Forward-Looking Statements

This press release contains “forward-looking statements”

within the meaning of the U.S. federal securities laws. Statements contained herein that are not clearly historical in nature are forward-looking,

and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,”

“intend,” “project,” “plan,” “is designed to,” “potential,” “predict,”

“objective” and similar expressions and future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “can,” and “may,” or the negative of these are generally intended to

identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties, and other important

factors that may cause CENTOGENE’s actual results, performance, or achievements to be materially different from any future results,

performance, or achievements expressed or implied by the forward- looking statements. Such risks and uncertainties include, among others,

our ability to achieve the revenue levels set forth in our guidance, negative economic and geopolitical conditions and instability and volatility in the worldwide financial

markets, possible changes in current and proposed legislation, regulations and governmental policies, pressures from increasing competition

and consolidation in our industry, the expense and uncertainty of regulatory approval, including from the U.S. Food and Drug Administration,

our reliance on third parties and collaboration partners, including our ability to manage growth, our ability to execute our business

plan and strategy, including to enter into new client relationships, our ability to execute on our announced strategic alternatives process,

our dependency on the rare disease industry, our ability to manage international expansion, our reliance on key personnel, our reliance

on intellectual property protection, fluctuations of our operating results due to the effect of exchange rates, our ability to streamline

cash usage, our continued ongoing compliance with covenants linked to financial instruments, including timing requirements with respect

to our strategic alternatives process, our requirement for additional financing, and our ability to continue as a going concern, or other

factors. For further information on the risks and uncertainties that could cause actual results to differ from those expressed in these

forward-looking statements, as well as risks relating to CENTOGENE’s business in general, see CENTOGENE’s risk factors set

forth in CENTOGENE’s Form 20-F filed on May 15, 2024, with the Securities and Exchange Commission (the “SEC”)

and subsequent filings with the SEC. Any forward-looking statements contained in this press release speak only as of the date hereof,

and CENTOGENE specifically disclaims any obligation to update any forward-looking statement, whether as a result of new information,

future events, or otherwise.

Non-IFRS Measures

This document may contain summarized, non-audited, or non-GAAP financial

information. The information contained herein should therefore be considered as a whole and in conjunction with all the public information

regarding the Company available, including any other documents released by the Company that may contain more detailed information. Adjusted

EBITDA, adjusted EBITDA as a percentage of sales, working capital as a percentage of sales, adjusted EBITDA margin, working capital,

adjusted net profit, adjusted profit per share, adjusted gross debt, and net cash/debt are non-IFRS financial metrics that management

uses in its decision making. CENTOGENE has included these financial metrics to provide supplemental measures of its performance. The

Company believes these metrics are important and useful to investors because they eliminate items that have less bearing on the Company’s

current and future operating performance and highlight trends in its core business that may not otherwise be apparent when relying solely

on IFRS financial measures.

CONTACT

CENTOGENE

Melissa Hall

Corporate Communications

Press@centogene.com

Lennart Streibel

Investor Relations

IR@centogene.com

Exhibit 99.2

CENTOGENE Secures

Approx. $20 Million to Strengthen Cash Position

Expanding Relationship

With Lifera, a Biopharma Company Owned by the PIF

CAMBRIDGE, Mass. and ROSTOCK, Germany, and BERLIN, May 15,

2024 (GLOBE NEWSWIRE) --

Centogene N.V. (Nasdaq: CNTG), the essential life science partner for

data-driven answers in rare and neurodegenerative diseases, today announced it has entered into a set of agreements with Lifera, a biopharmaceutical

company wholly-owned by the Public Investment Fund (PIF) in Saudi Arabia. The expanded relationship, which takes the form of a $15 million

purchase of certain of CENTOGENE’s accounts receivables (AR) and an increased investment in the parties’ joint venture (JV)

relationship, provides funding in aggregate of approximately $20 million to CENTOGENE to support ongoing activities and to position the

Company for future growth and profitability.

“This transaction strengthens our financial position and accelerates

CENTOGENE’s ongoing efforts to optimize our working capital,” said Kim Stratton, Chief Executive Officer at CENTOGENE. “By

securing approximately $20 million, we are providing greater liquidity to support our operations, strategic initiatives, and overall mission

to provide data-driven, life-changing answers to patients, physicians, and pharma companies for rare and neurodegenerative diseases. CENTOGENE

is committed to achieving EBITDA breakeven by the end of this year, and we are on a very good path to achieving this target.”

Transaction Details

Lifera is providing this financing on the basis of several CENTOGENE

assets, such as AR and participations. In exchange, certain terms of the previously announced $30 million convertible loan provided by

Lifera to CENTOGENE will be adjusted, including that it will be extended to 24 months and a portion will convert at $0.79, and CENTOGENE’S

equity interest in the parties’ previously announced joint venture will be reduced (subject to an option to repurchase such interest

in the future).

A complete description of these transactions can be found in the Current

Report on Form 6-K and the Annual Report on 20-F that the Company filed today with the U.S. Securities and Exchange Commission and

the Current Reports on Form 6-Ks previously filed by the Company on May 1, 2024, as well as June 27, October 27, and

November 28, 2023.

About CENTOGENE

CENTOGENE’s mission is to provide data-driven, life-changing

answers to patients, physicians, and pharma companies for rare and neurodegenerative diseases. We integrate multiomic technologies with

the CENTOGENE Biodatabank – providing dimensional analysis to guide the next generation of precision medicine. Our unique approach

enables rapid and reliable diagnosis for patients, supports a more precise physician understanding of disease states, and accelerates

and de-risks targeted pharma drug discovery, development, and commercialization.

Since our founding in 2006, CENTOGENE has been offering rapid and reliable

diagnosis – building a network of approximately 30,000 active physicians. Our ISO, CAP, and CLIA certified multiomic reference laboratories

in Germany utilize Phenomic, Genomic, Transcriptomic, Epigenomic, Proteomic, and Metabolomic datasets. This data is captured in our CENTOGENE

Biodatabank, with over 850,000 patients represented from over 120 highly diverse countries, over 70% of whom are of non-European descent.

To date, the CENTOGENE Biodatabank has contributed to generating novel insights for more than 300 peer-reviewed publications.

By translating our data and expertise into tangible insights, we have

supported over 50 collaborations with pharma partners. Together, we accelerate and de-risk drug discovery, development, and commercialization

in target and drug screening, clinical development, market access and expansion, as well as offering CENTOGENE Biodata Licenses and Insight

Reports to enable a world healed of all rare and neurodegenerative diseases.

To discover more about our products, pipeline, and patient-driven

purpose, visit www.centogene.com and follow us on LinkedIn.

Forward-Looking Statements

This press

release contains “forward-looking statements” within the meaning of the U.S. federal securities laws. These statements

include, but are not limited to, statements about our financial outlook (including our plans to achieve EBITDA

break and attain profitability), pursuit of our strategic initiatives and receipt of funding under our announced transactions with

Lifera. Statements contained herein that are not clearly historical in nature

are forward-looking, and the words “anticipate,” “believe,” “continues,” “expect,” “estimate,”

“intend,” “project,” “plan,” “is designed to,” “potential,” “predict,”

“objective” and similar expressions and future or conditional verbs such as “will,” “would,” “should,”

“could,” “might,” “can,” and “may,” or the negative of these are generally intended to

identify forward-looking statements. Such forward-looking statements involve known and unknown risks, uncertainties, and other important

factors that may cause CENTOGENE’s actual results, performance, or achievements to be materially different from any future results,

performance, or achievements expressed or implied by the forward- looking statements. Such risks and uncertainties include, among others,

negative economic and geopolitical conditions and instability and volatility in the worldwide financial markets, possible changes in current

and proposed legislation, regulations and governmental policies, pressures from increasing competition and consolidation in our industry,

the expense and uncertainty of regulatory approval, including from the U.S. Food and Drug Administration, our reliance on third parties

and collaboration partners, including our ability to manage growth, our ability to execute our business plan and strategy, including to

enter into new client relationships, our dependency on the rare disease industry, our ability to manage international expansion, our reliance

on key personnel, our reliance on intellectual property protection, fluctuations of our operating results due to the effect of exchange

rates, our ability to streamline cash usage, our satisfaction of conditions precedent to receiving funding under our announced transactions

with Lifera, our continued ongoing compliance with covenants linked to financial instruments, our requirement for additional financing,

and our ability to continue as a going concern, or other factors. For further information on the risks and uncertainties that could cause

actual results to differ from those expressed in these forward-looking statements, as well as risks relating to CENTOGENE’s business

in general, see CENTOGENE’s risk factors set forth in CENTOGENE’s Form 20-F filed on May 15, 2024, with the Securities

and Exchange Commission (the “SEC”) and subsequent filings with the SEC. Any forward-looking statements contained in this

press release speak only as of the date hereof, and CENTOGENE specifically disclaims any obligation to update any forward-looking statement,

whether as a result of new information, future events, or otherwise.

CONTACT

CENTOGENE

Melissa Hall

Corporate Communications

Press@centogene.com

Lennart Streibel

Investor Relations

IR@centogene.com

Exhibit 99.3

CONVENING NOTICE

This is the convening notice for the annual general

meeting of shareholders of Centogene N.V. (the "Company") to be held on May 31, 2024 at 11.00 a.m. CEST at

the offices of NautaDutilh N.V., Beethovenstraat 400, 1082 PR Amsterdam, the Netherlands (the "AGM").

The agenda for the AGM is as follows:

| 2. | Extension of the period for drawing up the Dutch statutory annual accounts and board report for the financial

year ended December 31, 2023 (voting item) |

| 3. | Instruction to Ernst & Young Accountants LLP as the external auditor of the Company for the financial

year ending December 31, 2024 (voting item) |

| 4. | Discussion of the Company's dividend and reservation policy (discussion item) |

| 5. | Compensation of the Company's supervisory board (voting item) |

| 6. | Extension of authorization for the Company's management board (the "Management Board")

to issue shares and grant rights to subscribe for shares (voting item) |

| 7. | Extension of authorization for the Management Board to limit and exclude pre-emption rights (voting

item) |

| 8. | Extension of authorization for the Management Board to acquire shares and depository receipts for shares

in the Company's capital (voting item) |

No business shall be voted on at the AGM, except

such items as included in the above-mentioned agenda.

The record date for the AGM is May 3, 2024

(the "Record Date"). Those who are shareholders of the Company, or who otherwise have voting rights and/or meeting rights

with respect to shares in the Company's capital, on the Record Date and who are recorded as such in the Company's shareholders' register

or in the register maintained by the Company's U.S. transfer agent (the "Registers") may attend and, if relevant, vote

at the AGM ("Persons with Meeting Rights"), irrespective of changes to their shareholdings or rights after the Record

Date.

Those who beneficially own shares in the Company's

capital in an account at a bank, a financial institution, an account holder or other financial intermediary (the "Beneficial Owners")

on the Record Date, must also have their financial intermediary or their agent with whom the underlying shares are on deposit issue a

proxy to them which confirms they are authorized to take part in and vote at the AGM.

Persons with Meeting Rights and Beneficial Owners

who wish to attend the AGM, in person or represented by proxy, must notify the Company in writing of their identity and intention to attend

the AGM (an "Attendance Notice") no later than 6:00 a.m. CEST on the fourth day prior to the AGM (the "Cut-off

Time"). Beneficial Owners must enclose with their Attendance Notice (i) proof of their beneficial ownership of the relevant

underlying shares in the Company's capital, such as a recent account statement, and (ii) their signed proxy from the relevant shareholder

who is registered in either of the Registers as the holder of those underlying shares on the Record Date.

Persons with Meeting Rights and Beneficial Owners

who have duly provided an Attendance Notice to the Company may have themselves represented at the AGM through the use of a written or

electronically recorded proxy. Proxyholders must submit a signed proxy to the Company no later than the Cut-off Time and present a copy

of their proxy upon entry to the AGM. A proxy form can be downloaded from the Company's website (http://www.centogene.com)

Any Attendance Notice, proof of beneficial ownership

or signed proxy to be sent to the Company as part of the procedures described above must be provided via regular mail or e-mail to:

Centogene N.V.

c/o Jan Boysen

Am Strande 7

18055 Rostock

Germany

(jan.boysen@centogene.com)

Any Attendance Notice, proof of beneficial ownership

or signed proxy received after the Cut-off Time may be ignored. Persons with Meeting Rights, Beneficial Owners and proxyholders who have

not complied with the procedures described above may be refused entry to the AGM.

EXPLANATORY NOTES TO THE AGENDA

| 2. | Extension of the period for drawing up the Dutch statutory annual accounts and board report for the

financial year ended December 31, 2023 (voting item) |

It is proposed to extend the period

for drawing up and making available for inspection at the Company's offices the Dutch statutory annual accounts and board report for the

financial year ended December 31, 2023 by a maximum period of five months, as referred to in Section 2:101 of the Dutch Civil

Code, in view of special circumstances.

The reason for the requested extension

is that the Company is unable to file its annual accounts and board report for the year ended December 31, 2023 within the prescribed

filing date without unreasonable effort or expense. The Company is still in the process of compiling certain required information to complete

the filing. As a result, the Company requires additional time to prepare and review its consolidated financial statements and other related

disclosures.

After finalizing the annual accounts

and board report for the financial year 2023, the Management Board will convene an extraordinary general meeting of shareholders of the

Company for the adoption of the Dutch statutory annual accounts and the discussion of the Dutch statutory board report for the financial

year ended December 31, 2023.

| 3. | Instruction to Ernst & Young Accountants LLP as the external auditor of the Company for the

financial year ending December 31, 2024 (voting item) |

It is proposed to instruct Ernst &

Young Accountants LLP as the external independent Dutch auditor for the audit of the Company's annual accounts for the financial year

ending December 31, 2024. If instructed, Ernst & Young Accountants LLP shall perform the statutory Dutch audit activities

for the Company in relation to the Company's Dutch statutory annual accounts, board report and, to the extent required, sustainability

reporting.

| 4. | Discussion of the Company's dividend and reservation policy

(discussion item) |

The Company has never paid or declared

any cash dividends on its shares, and the Company does not anticipate paying any cash dividends on its shares in the foreseeable future.

The Company intends to retain available funds and future earnings to fund the development and expansion of its business. Under Dutch law,

the Company may only pay dividends to the extent its shareholders' equity (eigen vermogen) exceeds the sum of the Company's paid-up

and called-up share capital plus the reserves required to be maintained by Dutch law or by the Company's articles of association (if any).

Subject to such restrictions, any future determination to pay dividends will be at the discretion of the Management Board and the Company's

supervisory board (the "Supervisory Board") and will depend upon a number of factors, including the Company's results

of operations, financial condition, future prospects, contractual restrictions, restrictions imposed by applicable law and other factors

the Management Board and the Supervisory Board deem relevant. If and when the Company does intend to distribute a dividend, such dividend

may be distributed in the form of cash only or shares only, through a combination of the foregoing (cash and shares) or through a choice

dividend (cash or shares), in each case subject to applicable law.

| 5. | Compensation of the Supervisory Board (voting item) |

At the recommendation of the Company's

compensation committee (the "Compensation Committee"), the Supervisory Board proposes the following changes to the compensation

packages of the Supervisory Board members as of the financial year 2023 and onwards:

Cash component:

| a. | There will be no cash component that is part of the compensation packages of the Supervisory Board members; |

| b. | in deviation of a. above, for the financial year 2023, Mary Sheahan will be granted a one-time cash bonus

of EUR 25,000 (gross). |

Equity component under the Company's

long-term incentive plan:

| a. | Each member of the Supervisory Board shall annually receive an award of options ("Options")

and restricted stock units ("RSUs") for ordinary shares in the Company's capital ("Shares") (such Options

and RSUs collectively, the "LTIs") with a value of EUR 160,000 multiplied by the LTI Factor (as defined below); |

| b. | the chairperson of the Supervisory Board shall annually receive additional LTIs with a value of EUR 120,000

multiplied by the LTI Factor (as defined below); |

| c. | the vice-chairperson of the Supervisory Board shall annually receive additional LTIs with a value of EUR

80,000 multiplied by the LTI Factor (as defined below); |

| d. | the chairperson of the Company's audit committee shall annually receive additional LTIs with a value of

EUR 80,000 multiplied by the LTI Factor (as defined below); |

| e. | the chairperson of the Compensation Committee shall annually receive additional LTIs with a value of EUR

16,000 multiplied by the LTI Factor (as defined below); |

| f. | the LTIs shall be granted retrospectively for the preceding financial year following the audit of the

Company's annual accounts over such financial year; |

| g. | each LTI shall consist of: |

| i. | RSUs for 75% of the value of the LTI; and |

| ii. | Options for 25% of the value of the LTI; |

| h. | for the purpose of calculating the value of the LTIs: |

| i. | the assumed value of an Option shall be 66.67% of the End of Year VWAP (as defined below); |

| ii. | the assumed value of an RSU shall be 100% of the End of Year VWAP (as defined below); and |

| iii. | the "End of Year VWAP" shall be the volume-weighted average stock price of the Shares

on the principal stock exchange where they have been admitted for trading calculated over a 60-trading day period preceding December 31

of the financial year preceding the relevant Grant Date; |

| i. | the "LTI Factor" for the LTIs shall be calculated as follows: |

| i. | the LTI Factor shall be 100% if the End of Year VWAP for the financial year preceding the relevant Grant

Date (the "Reference FY") exceeds the End of Year VWAP for the financial year preceding the Reference FY by at least

25%; |

| ii. | the LTI Factor shall be 75% if the End of Year VWAP for the Reference FY exceeds the End of Year VWAP

for the financial year preceding the Reference FY by at least 15% but less than 25%; and |

| iii. | the LTI Factor shall be 50% if the End of Year VWAP for the Reference FY exceeds the End of Year VWAP

for the financial year preceding the Reference FY by less than 15%; |

| i. | vest in four equal instalments on each relevant anniversary of the Grant Date: |

| ii. | vest in full upon the occurrence of a Change of Control, provided the holder of the LTIs is an Eligible

Participant on the date of such Change of Control; |

| iii. | expire on the ten-year anniversary of the applicable Grant Date; |

| iv. | not be subject to any performance criteria (without prejudice to the applicable LTI Factor); |

| v. | have no exercise price (as regards the RSUs comprised in the LTIs) and shall have FMV (as defined in the

Company's long-term incentive plan) as exercise price (as regards the Options comprised in the LTIs); and |

| k. | if a Supervisory Board member would serve as such and/or in any of the additional capacities described

above for part, but not all, of a financial year, the entitlement to the LTIs shall be adjusted and, if already made, shall promptly be

forfeited by such Supervisory Board member on a pro rata tempore basis; and |

| l. | if a Supervisory Board member was in office during all or part of a financial year but would cease to

be a Supervisory Board member before the LTIs are granted for such financial year, such former Supervisory Board member shall retain his

or her entitlement to such LTIs subject to the terms set forth above. |

Each of Mr. Hubert Birner, Mr. Guido

Prehn and Mr. Eric Souêtre has waived the equity component of his compensation as described above, for the duration of his

term as a member of the Supervisory Board.

| 6. | Extension of authorization for the Management Board to issue shares and grant rights to subscribe for

shares (voting item) |

The Management Board has been authorized,

for a period of five years following the 2023 annual general meeting of shareholders held on June 30, 2023 (the "2023 AGM"),

to resolve to issue ordinary shares and/or grant rights to subscribe for ordinary shares, in each case up to the Company's authorized

share capital included in its articles of association from time to time. It is proposed that this authorization be extended to expire

five years following the date of this AGM. If the resolution proposed under this agenda item 6 is passed, the proposed authorization shall

replace the currently existing authorization.

| 7. | Extension of authorization for the Management Board to limit and exclude pre-emption rights (voting

item) |

The Management Board has been authorized,

for a period of five years following the 2023 AGM, to limit and/or exclude pre-emption rights in relation to an issuance of, or a granting

of rights to subscribe for, ordinary shares resolved upon by the Management Board. It is proposed that this authorization be extended

to expire five years following the date of this AGM. If the resolution proposed under this agenda item 7 is passed, the proposed authorization

shall replace the currently existing authorization.

| 8. | Extension of authorization for the Management Board to acquire shares and depository receipts for shares

in the Company's capital (voting item) |

The Management Board has been authorized,

for a period of 18 months following the 2023 AGM, to resolve for the Company to acquire fully paid-up ordinary shares in the Company's

capital (and depository receipts for such ordinary shares), by any means, including through derivative products, purchases on a stock

exchange, private purchases, block trades, or otherwise, for a price which is higher than nil and does not exceed 110% of the average

market price of the Company's ordinary shares on the Nasdaq Stock Market (such average market price being the average of the closing prices

on each of the five consecutive trading days preceding the date the acquisition is agreed upon by the Company), up to 20% of the Company's

issued share capital (determined as at the close of business on the date of the AGM). It is proposed that this authorization be renewed

for a period of, and effectively extended until, 18 months following the date of the AGM for up to 20% of the Company's issued share capital

(determined as at the close of business on the date of the AGM). If the resolution proposed under this agenda item 8 is passed, the proposed

authorization shall replace the currently existing authorization.

Exhibit 99.4

VOTING PROXY

THE UNDERSIGNED

acting on behalf of (only to be completed if

relevant)

(the "Principal").

DECLARES AS FOLLOWS

| 1. | The Principal hereby registers for the annual general meeting of shareholders of Centogene N.V. (the "Company")

to be held on May 31, 2024 at 11.00 a.m. CEST at the offices of NautaDutilh N.V., Beethovenstraat 400, 1082 PR Amsterdam, the

Netherlands (the "AGM") and, for purposes of being represented at the AGM, grants a power of attorney to Mr. P.C.S.

van der Bijl, civil law notary and partner of NautaDutilh N.V., or any substitute to be appointed by him (the "Proxyholder"). |

| 2. | The scope of this power of attorney extends to the performance of the following acts on behalf of the

Principal at the AGM: |

| a. | to exercise the voting rights of the Principal in accordance with paragraph 3 below; and |

| b. | to exercise any other right of the Principal which the Principal would be allowed to exercise at the AGM. |

| 3. | This power of attorney shall be used by the Proxyholder to exercise the Principal's voting rights in the

manner directed as set out below. If no choice is specified in respect of the sole voting item on the agenda, the Proxyholder shall vote

"FOR" such agenda item. |

| Agenda item |

FOR |

AGAINST |

ABSTAIN |

| Extension of the period for drawing up the Dutch statutory annual accounts and board report for the financial year ended December 31, 2023 |

|

|

|

| Instruction to Ernst & Young Accountants LLP as the external auditor of the Company for the financial year ending December 31, 2024 |

|

|

|

| Compensation of the Company's supervisory board |

|

|

|

| Extension of authorization for the Company's management board (the "Management Board") to issue shares and grant rights to subscribe for shares |

|

|

|

| Extension of authorization for the Management Board to limit and exclude pre-emption rights |

|

|

|

| Extension of authorization for the Management Board to acquire shares and depository receipts for shares in the Company's capital |

|

|

|

| 4. | This power of attorney is granted with full power of substitution. |

| 5. | The relationship between the Principal and the Proxyholder under this power of attorney is governed exclusively

by the laws of the Netherlands. |

(signature page follows)

SIGN HERE

Please return this signed proxy via regular

mail or e-mail to:

Centogene N.V.

c/o Jan Boysen

Am Strande 7

18055 Rostock

Germany

(jan.boysen@centogene.com)

If the Principal is a beneficial owner of shares

in the Company's capital, please carefully review the convening notice for the AGM and enclose the relevant documents stipulated by such

convening notice.

Exhibit 99.5

WRITTEN RESOLUTIONS OF THE

MANAGEMENT BOARD OF

CENTOGENE N.V.

DATED 15, MAY 2024

Resolutions of the management board (the "Management

Board") of Centogene N.V., a public company with limited liability, having its corporate seat in Amsterdam, with address:

Am Strande 7, 18055 Rostock, Germany, and trade register number: 72822872 (the "Company").

WHEREAS

| A. | The undersigned constitute the entire Management Board. |

| B. | There are no regulations and/or other rules adopted by any of the Company's corporate bodies that

would preclude the Management Board from validly passing the resolutions set out below in the present form and manner. |

| C. | With respect to the resolutions set out below, none of the Company's managing directors has a direct or

indirect personal interest which conflicts with the interests of the Company and of the business connected with it. |

| D. | The Company's managing directors are familiar with the resolutions set out below and do not object to

the present manner of decision-making. |

| E. | By signing this written resolution, (i) each of the Company's managing directors votes in favour

of the resolutions set out below and (ii) each of the Company's managing directors confirms the statements made in these recitals. |

RESOLUTIONS

Approval of matters related to the 2024 annual

general meeting

| 1. | The Management Board hereby sets May 31,

2024 as the date for the Company's 2024 annual general meeting of shareholders (the "AGM"),

sets the location for the AGM to be the offices of NautaDutilh N.V., Beethovenstraat 400,

1082 PR Amsterdam, the Netherlands, and sets and approves the 28th day prior to

the AGM as the record date for the AGM (the "Record Date") and authorises

the Company's Chief Executive Officer (the "CEO") and the chairman of the

Company's supervisory board (the (the "Chairman"), each individually, if

deemed appropriate or necessary by the CEO and/or the Chairman, to change the date and/or

location of the AGM. |

| 2. | The Management Board determines that the Company's shareholders' register and the register maintained

for common shares in the Company's capital by the Company's U.S. transfer agent are the relevant registers for determining who are entitled

to attend and, if relevant, vote at the AGM as per the Record Date. |

| 3. | The Management Board hereby sets the agenda for the AGM to be as follows, with such additions or alterations

as the Chairman and the CEO, or either one of them acting individually, may deem to be appropriate or necessary: |

| 2. | Extension of the period for drawing up the Dutch statutory annual accounts and board report for the financial

year ended December 31, 2023 (voting item) |

| 3. | Instruction to Ernst & Young Accountants LLP as the external auditor of the Company for the financial

year ending December 31, 2024 (voting item) |

| 4. | Discussion of the Company's dividend and reservation policy (discussion item) |

| 5. | Compensation of the Company's supervisory board (voting item) |

| 6. | Extension of authorization for the Company's management board (the "Management Board")

to issue shares and grant rights to subscribe for shares (voting item) |

| 7. | Extension of authorization for the Management Board to limit and exclude pre-emption rights (voting

item) |

| 8. | Extension of authorization for the Management Board to acquire shares and depository receipts for shares

in the Company's capital (voting item) |

| 4. | The Management Board hereby sets the cut-off time and date for shareholders and others with statutory

meeting rights under Dutch law as per the Record Date to give notice of their intention to attend the AGM to be 6:00 a.m. Amsterdam

time on the fourth day prior to the AGM. |

| 5. | The Management Board hereby authorizes the Chairman and the CEO, or either one of them acting individually,

to approve the explanatory notes to the agenda for the AGM, to be prepared by counsel and to be published at the time of the AGM being

convened. |

General authority

| 6. | The CEO and the Company's chief financial officer (the "CFO"), or either one of them

acting individually, are hereby authorized in the name and on behalf of the Company to approve and/or execute and/or deliver any and all

agreements, instruments or other documents whatsoever (including, without limitation, any powers of attorney authorizing any one or more

persons, whether or not they are directors, officers or employees of the Company, to act on behalf of the Company), incur all such fees

and expenses and do any and all other things whatsoever as such officer shall in his or her absolute and unfettered discretion determine

to be necessary or desirable (such determination to be conclusively evidenced by any such execution or delivery or the taking of any such

action by such person) in connection with the foregoing and all matters contemplated thereby or ancillary thereto. |

(signature page follows)

Signature page to a written resolution

of the Management Board.

This written resolution may be signed in multiple counterparts.

| /s/

Kim Stratton |

|

| Kim Stratton |

|

| |

|

| /s/ Miguel Coego

Rios |

|

| Miguel Coego Rios |

|

| |

|

| /s/ Peter Bauer |

|

| Prof. Peter Bauer |

|

Exhibit 99.6

WRITTEN RESOLUTIONS OF THE

SUPERVISORY BOARD OF

CENTOGENE N.V.

DATED 15, MAY 2024

Resolutions of the supervisory board (the "Supervisory

Board") of Centogene N.V., a public company with limited liability, having its corporate seat in Amsterdam, with address:

Am Strande 7, 18055 Rostock, Germany, and trade register number: 72822872 (the "Company").

WHEREAS

| A. | The undersigned constitute the entire Supervisory Board. |

| B. | There are no regulations and/or other rules adopted by any of the Company's corporate bodies that

would preclude the Supervisory Board from validly passing the resolution set out below in the present form and manner. |

| C. | With respect to the resolutions set out below, the undersigned do not have a direct or indirect personal

interest which conflicts with the interests of the Company and of the business connected with it. |

| D. | By signing this written resolution, each of the undersigned (i) consents with this manner of decision-making,

(ii) votes in favour of any resolution set out below, (iii) confirms the completeness and correctness of these recitals and

(iv) grants the waiver of compensation set out below. |

| E. | To the extent relevant and appropriate, these resolution set out below are also considered to be resolutions

of the Company's audit committee, the Company's compensation committee and the Company's nomination and corporate governance committee,

as applicable, passing, effecting, recommending and approving these resolutions and the matters contemplated thereby. |

| F. | All members of the Supervisory Board have a conflict of interests with respect to resolution 3. Under

the Company's articles of association, the Supervisory Board is nevertheless authorized to pass those resolutions as if no Supervisory

Board member has such a conflict of interests. |

RESOLUTIONS

| 1. | The Supervisory Board hereby approves the resolutions of the Company's management board regarding the

approval of matters related to the 2024 annual general meeting (the "AGM"), a copy of which is attached hereto as Annex

A. |

| 2. | The convening notice for the AGM, the explanatory notes thereto, substantially in the form as distributed

to the Supervisory Board, and the matters contemplated thereby are hereby approved. |

| 3. | At the recommendation of the Company's compensation committee (the "Compensation Committee"),

the Supervisory Board hereby approves and adopts the changes to the compensation packages of the Supervisory Board members as reflected

in the convening notice for the AGM and the explanatory notes thereto. |

Each of the undersigned irrevocably waives his

or her cash compensation for his or her position as a member of the Supervisory Board as of the financial year 2023 and onwards, except

for the one-time cash bonus of EUR 25,000 (gross) payable to Mary Sheahan, subject to the adoption of agenda item 5 included in the convening

notice for the AGM and the explanatory notes thereto.

Each of Hubert Birner, Guido Prehn and Eric Souêtre

waives the equity component of their respective compensation as a member of the supervisory Board for the duration of their respective

terms as a member of the Supervisory Board.

(signature page follows)

Signature page to a written resolution

of the Supervisory Board.

This written resolution may be signed in multiple counterparts.

| /s/ Hubert Birner |

|

| Hubert Birner |

|

| |

|

| /s/ Guido Prehn |

|

| Guido Prehn |

|

| |

|

| /s/ Peer Schatz |

|

| Peer Schatz |

|

| |

|

| /s/ Jonathan Sheldon |

|

| Jonathan Sheldon |

|

| |

|

| /s/ Eric Souêtre |

|

| Eric Souêtre |

|

| |

|

| /s/ Mary Sheahan |

|

| Mary Sheahan |

|

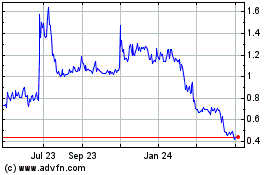

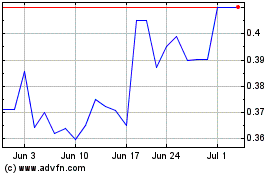

Centogene NV (NASDAQ:CNTG)

Historical Stock Chart

From Oct 2024 to Nov 2024

Centogene NV (NASDAQ:CNTG)

Historical Stock Chart

From Nov 2023 to Nov 2024