0000744218 False 0000744218 2024-08-08 2024-08-08 iso4217:USD xbrli:shares iso4217:USD xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_________________

FORM 8-K

_________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

_______________________________

Celldex Therapeutics, Inc.

(Exact name of registrant as specified in its charter)

_______________________________

| Delaware | 000-15006 | 13-3191702 |

| (State or Other Jurisdiction of Incorporation) | (Commission File Number) | (I.R.S. Employer Identification No.) |

Perryville III Building, 53 Frontage Road, Suite 220

Hampton, New Jersey 08827

(Address of Principal Executive Offices) (Zip Code)

(908) 200-7500

(Registrant's telephone number, including area code)

(Former name or former address, if changed since last report)

_______________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, par value $.001 | CLDX | Nasdaq Capital Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition.

On August 8, 2024, Celldex Therapeutics, Inc. (the "Company") issued a press release announcing its financial results for the second quarter of 2024. The full text of the press release is furnished as Exhibit 99.1 hereto and is incorporated by reference herein.

The information in this Item 2.02 of this Current Report on Form 8-K and Exhibit 99.1 attached hereto shall not be deemed "filed" for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), or otherwise subject to the liabilities of that Section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the "Securities Act"), or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

Item 9.01. Financial Statements and Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | Celldex Therapeutics, Inc. |

| | | |

| | | |

| Date: August 8, 2024 | By: | /s/ Sam Martin |

| | | Sam Martin |

| | | Senior Vice President and

Chief Financial Officer |

| | | |

EXHIBIT 99.1

Celldex Reports Second Quarter 2024 Financial Results and Provides Corporate Update

- Phase 3 CSU studies initiated July 2024

- Positive topline Phase 2 CIndU 12 week data reported July 2024 supporting Phase 3 advancement

- 52 week Phase 2 CSU data and full 12 week Phase 2 CIndU data to be reported 2H 2024

- Enrollment continues in Phase 2 PN and EOE studies; Phase 2 AD study to start YE 2024

- Celldex’s first bispecific for inflammatory diseases, CDX-622, to enter the clinic this year

HAMPTON, N.J., Aug. 08, 2024 (GLOBE NEWSWIRE) -- Celldex Therapeutics, Inc. (NASDAQ:CLDX) today reported financial results for the second quarter ended June 30, 2024 and provided a corporate update.

“2024 has been a monumental year for Celldex. We presented data establishing clinical benefit and safety for barzolvolimab in two distinct forms of urticaria—chronic spontaneous urticaria and inducible urticaria—both of which support advancement to registration studies,” said Anthony Marucci, Co-founder, President and Chief Executive Officer of Celldex Therapeutics. “Last month, we initiated two of the largest, global studies to be conducted in CSU and we are now planning for the initiation of a second Phase 3 program in CIndU. With ongoing Phase 2 trials also in prurigo nodularis, eosinophilic esophagitis and, by year end, in atopic dermatitis—barzolvolimab is actively delivering on its significant pipeline in a product potential and we remain committed to our goal of bringing this potential new medicine to patients.”

Mr. Marucci continued, “As the year progresses, we continue to build on our leadership in the development of mast cell-targeted therapeutics and plan to advance CDX-622, our first bispecific for inflammatory diseases, into the clinic by year end. We think this candidate is an exciting entrant to the field, targeting two complementary pathways that drive chronic inflammation, TSLP and stem cell factor. Importantly, the Company is well capitalized with more than $800M in cash to support the continued advancement and expansion of the barzolvolimab program and our growing pipeline.”

Recent Program Highlights

Barzolvolimab - KIT Inhibitor Program

Barzolvolimab is a humanized monoclonal antibody developed by Celldex that binds the KIT receptor with high specificity and potently inhibits its activity. The KIT receptor tyrosine kinase is expressed in a variety of cells, including mast cells, which mediate inflammatory responses such as hypersensitivity and allergic reactions. KIT signaling controls the differentiation, tissue recruitment, survival and activity of mast cells.

Chronic Urticarias

- Celldex initiated a global Phase 3 program in chronic spontaneous urticaria (CSU) in July, consisting of two Phase 3 trials (EMBARQ-CSU1 and EMBARQ-CSU2) designed to establish the efficacy and safety of barzolvolimab in adult patients with CSU who remain symptomatic despite H1 antihistamine treatment. The studies will also include patients who remain symptomatic after treatment with biologics. Both studies are actively enrolling patients.

- Celldex is completing Phase 2 clinical studies of barzolvolimab for the treatment of chronic spontaneous urticaria (CSU) and the two most common forms of chronic inducible urticaria (CIndU) - cold urticaria (ColdU) and symptomatic dermographism (SD). These randomized, double-blind, placebo-controlled Phase 2 studies are evaluating the efficacy and safety profile of multiple dose regimens of barzolvolimab in patients who remain symptomatic despite antihistamine therapy, to determine the optimal dosing strategies.

- In July 2024, the Company reported topline 12 week primary endpoint results from the Phase 2 CIndU study. Data from the 196 patients randomized in the study showed that barzolvolimab achieved the primary efficacy endpoint, a statistically significant difference between the percent of patients with a negative provocation test (complete response) compared to placebo at Week 12, in ColdU and in SD across both dose groups. Importantly, barzolvolimab demonstrated rapid, durable and clinically meaningful responses. Barzolvolimab was well tolerated with a favorable safety profile consistent with prior studies. Patients on study will continue to receive barzolvolimab for 20 weeks and the Company plans to present the full 12 week data from this study at an upcoming medical meeting in the second half of 2024.

- In February 2024, 12 week treatment results were reported from the Phase 2 CSU study at the American Academy of Allergy, Asthma & Immunology (AAAAI) Annual Meeting. Barzolvolimab achieved the primary efficacy endpoint of the study, a statistically significant mean change from baseline to Week 12 of UAS7 (weekly urticaria activity score) compared to placebo across multiple dosing groups, and was well tolerated. Secondary and exploratory endpoints strongly support the primary endpoint results. Importantly, barzolvolimab demonstrated rapid, durable and clinically meaningful responses, including in patients with prior omalizumab treatment. Patients on study continue to receive barzolvolimab for 52 weeks and the Company plans to report 52 week data in the second half of 2024.

In June 2024, data from this study on the impact of barzolvolimab on angioedema were presented at the European Academy of Allergy and Clinical Immunology (EAACI) Congress 2024. Barzolvolimab profoundly improved angioedema at 12 weeks, demonstrating statistically significant, rapid and durable improvements in the weekly angioedema activity score (AAS7) and additional measures of angioedema control across all doses at Week 12.

Additional Indications

- A Phase 2 study in prurigo nodularis (PN) was initiated in early 2024 and enrollment is ongoing. This randomized, double-blind, placebo-controlled, parallel group study is evaluating the efficacy and safety profile of barzolvolimab in approximately 120 patients with moderate to severe PN who had inadequate response to prescription topical medications, or for whom topical medications are medically inadvisable, including patients who received prior biologics.

- A Phase 2 study in eosinophilic esophagitis (EoE) was initiated in July 2023 and enrollment is ongoing. This randomized, double-blind, placebo-controlled study is evaluating the efficacy and safety profile of barzolvolimab in approximately 75 patients with active EoE.

- In May 2024, Celldex announced that atopic dermatitis (AD) has been selected as the fifth indication for the development of barzolvolimab. Barzolvolimab’s novel mast cell depleting mechanism could play an important role in addressing patients with moderate to severe AD who do not achieve complete disease control on currently available systemic therapies. Celldex plans to initiate a Phase 2 study in AD by year end.

Bispecific Antibody Platform

CDX-622 – Bispecific SCF & TSLP

CDX-622 targets two complementary pathways that drive chronic inflammation, potently neutralizing the alarmin thymic stromal lymphopoietin (TSLP) and depleting mast cells via stem cell factor (SCF) starvation. Combined neutralization of SCF and TSLP with CDX-622 is expected to simultaneously reduce tissue mast cells and inhibit Type 2 inflammatory responses to potentially offer enhanced therapeutic benefit in inflammatory and fibrotic disorders.

- Celldex has completed preclinical, manufacturing and IND-enabling activities for CDX-622 and plans to initiate a Phase 1 study of the candidate in healthy volunteers by the end of 2024. In preclinical studies, CDX-622 inhibits TSLP and SCF with similar potency to both its respective parental mAbs and comparator mAbs in vitro. CDX-622 was well tolerated in a multi-dose 8 week toxicology study in non-human primates and the No Adverse Event Level (NOAEL) was established to be 75 mg/kg, the highest dose level tested. In inflammatory and fibrotic disorders, TSLP is often upregulated and associated with disease severity. Similarly, mast cells drive or contribute to the pathophysiology of many of these disorders and CDX-622 contains a unique SCF neutralizing function that is expected to inhibit and deplete mast cells.

CDX-585 – Bispecific ILT4 & PD-1

CDX-585 combines highly active PD-1 blockade with anti-ILT4 blockade to overcome immunosuppressive signals in T cells and myeloid cells. ILT4 is emerging as an important immune checkpoint on myeloid cells.

- In May 2023, the first patient was dosed in the Phase 1 study of CDX-585. This open-label, multi-center study of CDX-585 is evaluating patients with advanced or metastatic solid tumors that have progressed during or after standard of care therapy. Enrollment is ongoing in the dose-escalation portion of the study.

Second Quarter 2024 Financial Highlights and 2024 Guidance

Cash Position: Cash, cash equivalents and marketable securities as of June 30, 2024 were $802.3 million compared to $823.8 million as of March 31, 2024. The decrease was primarily driven by second quarter cash used in operating activities of $29.3 million, partially offset by proceeds from issuance of stock under employee benefit plans of $3.7 million. At June 30, 2024, Celldex had 66.3 million shares outstanding.

Revenues: Total revenue was $2.5 million in the second quarter of 2024 and $2.7 million for the six months ended June 30, 2024, compared to $0.3 million and $1.2 million for the comparable periods in 2023. The increase in revenue was primarily due to an increase in services performed under our manufacturing and research and development agreements with Rockefeller University.

R&D Expenses: Research and development (R&D) expenses were $39.7 million in the second quarter of 2024 and $71.3 million for the six months ended June 30, 2024, compared to $26.3 million and $53.0 million for the comparable periods in 2023. The increase in R&D expenses was primarily due to an increase in barzolvolimab clinical trial and personnel expenses, partially offset by a decrease in barzolvolimab contract manufacturing expenses.

G&A Expenses: General and administrative (G&A) expenses were $9.1 million in the second quarter of 2024 and $18.2 million for the six months ended June 30, 2024, compared to $7.2 million and $13.9 million for the comparable periods in 2023. The increase in G&A expenses was primarily due to an increase in stock-based compensation and barzolvolimab commercial planning expenses.

Net Loss: Net loss was $35.8 million, or ($0.54) per share, for the second quarter of 2024, and $68.7 million, or ($1.10) per share, for the six months ended June 30, 2024, compared to a net loss of $30.5 million, or ($0.65) per share, for the second quarter of 2023, and $59.9 million, or ($1.27) per share, for the six months ended June 30, 2023.

Financial Guidance: Celldex believes that the cash, cash equivalents and marketable securities at June 30, 2024 are sufficient to meet estimated working capital requirements and fund current planned operations through 2027.

About Celldex Therapeutics, Inc.

Celldex is a clinical stage biotechnology company leading the science at the intersection of mast cell biology and the development of transformative therapeutics for patients. Our pipeline includes antibody-based therapeutics which have the ability to engage the human immune system and/or directly affect critical pathways to improve the lives of patients with severe inflammatory, allergic, autoimmune and other devastating diseases. Visit www.celldex.com.

Forward Looking Statement

This release contains "forward-looking statements" made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. These statements are typically preceded by words such as "believes," "expects," "anticipates," "intends," "will," "may," "should," or similar expressions. These forward-looking statements reflect management's current knowledge, assumptions, judgment and expectations regarding future performance or events. Although management believes that the expectations reflected in such statements are reasonable, they give no assurance that such expectations will prove to be correct or that those goals will be achieved, and you should be aware that actual results could differ materially from those contained in the forward-looking statements. Forward-looking statements are subject to a number of risks and uncertainties, including, but not limited to, our ability to successfully complete research and further development and commercialization of Company drug candidates, including barzolvolimab (also referred to as CDX-0159), in current or future indications; the uncertainties inherent in clinical testing and accruing patients for clinical trials; our limited experience in bringing programs through Phase 3 clinical trials; our ability to manage and successfully complete multiple clinical trials and the research and development efforts for our multiple products at varying stages of development; the availability, cost, delivery and quality of clinical materials produced by our own manufacturing facility or supplied by contract manufacturers, who may be our sole source of supply; the timing, cost and uncertainty of obtaining regulatory approvals; the failure of the market for the Company's programs to continue to develop; our ability to protect the Company's intellectual property; the loss of any executive officers or key personnel or consultants; competition; changes in the regulatory landscape or the imposition of regulations that affect the Company's products; our ability to continue to obtain capital to meet our long-term liquidity needs on acceptable terms, or at all, including the additional capital which will be necessary to complete the clinical trials that we have initiated or plan to initiate; and other factors listed under "Risk Factors" in our annual report on Form 10-K and quarterly reports on Form 10-Q.

All forward-looking statements are expressly qualified in their entirety by this cautionary notice. You are cautioned not to place undue reliance on any forward-looking statements, which speak only as of the date of this release. We have no obligation, and expressly disclaim any obligation, to update, revise or correct any of the forward-looking statements, whether as a result of new information, future events or otherwise.

Company Contact

Sarah Cavanaugh

Senior Vice President, Corporate Affairs & Administration

(508) 864-8337

scavanaugh@celldex.com

Patrick Till

Meru Advisors

(484) 788-8560

ptill@meruadvisors.com

| |

| CELLDEX THERAPEUTICS, INC. |

| (In thousands, except per share amounts) |

| | | | | | | | | | |

| | | | Three Months | | Six Months |

| Consolidated Statements of Operations Data | | Ended June 30, | | Ended June 30, |

| | | | | 2024 | | | | 2023 | | | | 2024 | | | | 2023 | |

| | | | (Unaudited) | | (Unaudited) |

| Revenues: | | | | | | | | |

| Product development and licensing agreements | | $ | - | | | $ | 16 | | | $ | 2 | | | $ | 16 | |

| Contracts and grants | | | 2,498 | | | | 252 | | | | 2,652 | | | | 1,218 | |

| | | | | | | | | | |

| Total revenues | | | 2,498 | | | | 268 | | | | 2,654 | | | | 1,234 | |

| | | | | | | | | | |

| Operating expenses: | | | | | | | | |

| Research and development | | | 39,687 | | | | 26,252 | | | | 71,348 | | | | 53,049 | |

| General and administrative | | | 9,128 | | | | 7,221 | | | | 18,231 | | | | 13,861 | |

| | | | | | | | | | |

| Total operating expenses | | | 48,815 | | | | 33,473 | | | | 89,579 | | | | 66,910 | |

| | | | | | | | | | |

| Operating loss | | | (46,317 | ) | | | (33,205 | ) | | | (86,925 | ) | | | (65,676 | ) |

| | | | | | | | | | |

| Investment and other income, net | | | 10,475 | | | | 2,703 | | | | 18,275 | | | | 5,813 | |

| | | | | | | | | | |

| Net loss | | $ | (35,842 | ) | | $ | (30,502 | ) | | $ | (68,650 | ) | | $ | (59,863 | ) |

| | | | | | | | | | |

| Basic and diluted net loss per common share | | $ | (0.54 | ) | | $ | (0.65 | ) | | $ | (1.10 | ) | | $ | (1.27 | ) |

| | | | | | | | | | |

| Shares used in calculating basic and diluted net loss per share | | | 66,019 | | | | 47,253 | | | | 62,445 | | | | 47,233 | |

| | | | | | | | | | |

| | | | | |

| | | | | | | | | | |

| Condensed Consolidated Balance Sheet Data | | June 30, | | December 31, | | | | |

| | | | | 2024 | | | | 2023 | | | | | |

| | | | (Unaudited) | | | | | | |

| Assets | | | | | | | | |

| Cash, cash equivalents and marketable securities | | $ | 802,317 | | | $ | 423,598 | | | | | |

| Other current assets | | | 9,658 | | | | 8,095 | | | | | |

| Property and equipment, net | | | 3,864 | | | | 4,060 | | | | | |

| Intangible and other assets, net | | | 29,747 | | | | 29,874 | | | | | |

| | Total assets | | $ | 845,586 | | | $ | 465,627 | | | | | |

| | | | | | | | | | |

| Liabilities and stockholders' equity | | | | | | | | |

| Current liabilities | | $ | 27,658 | | | $ | 31,125 | | | | | |

| Long-term liabilities | | | 4,269 | | | | 5,331 | | | | | |

| Stockholders' equity | | | 813,659 | | | | 429,171 | | | | | |

| | Total liabilities and stockholders' equity | | $ | 845,586 | | | $ | 465,627 | | | | | |

| | | | | | | | | | |

v3.24.2.u1

Cover

|

Aug. 08, 2024 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Aug. 08, 2024

|

| Entity File Number |

000-15006

|

| Entity Registrant Name |

Celldex Therapeutics, Inc.

|

| Entity Central Index Key |

0000744218

|

| Entity Tax Identification Number |

13-3191702

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

Perryville III Building, 53 Frontage Road, Suite 220

|

| Entity Address, City or Town |

Hampton

|

| Entity Address, State or Province |

NJ

|

| Entity Address, Postal Zip Code |

08827

|

| City Area Code |

908

|

| Local Phone Number |

200-7500

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock, par value $.001

|

| Trading Symbol |

CLDX

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

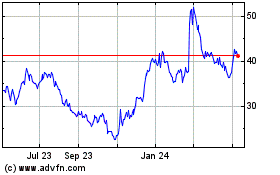

Celldex Therapeutics (NASDAQ:CLDX)

Historical Stock Chart

From Nov 2024 to Dec 2024

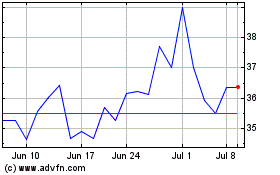

Celldex Therapeutics (NASDAQ:CLDX)

Historical Stock Chart

From Dec 2023 to Dec 2024