false000173792700-000000000017379272024-05-302024-05-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 30, 2024

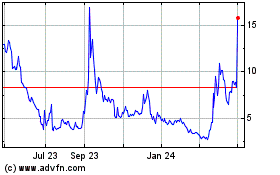

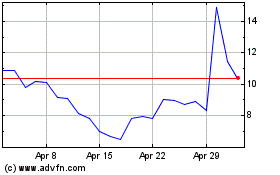

Canopy Growth Corporation

(Exact name of registrant as specified in its charter)

|

|

|

Canada |

001-38496 |

N/A |

(State or other jurisdiction of incorporation) |

(Commission File Number) |

(IRS Employer Identification No.) |

|

|

|

1 Hershey Drive

Smiths Falls, Ontario |

|

K7A 0A8 |

(Address of principal executive offices) |

|

(Zip Code) |

(855) 558-9333

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Shares, no par value |

|

CGC |

|

NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

On May 30, 2024, Canopy Growth Corporation issued a press release announcing its financial results for the fourth quarter ended March 31, 2024. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

The information set forth in Item 2.02 of this Current Report on Form 8-K (“Current Report”), including Exhibit 99.1 attached hereto, is being furnished and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of such section. The information set forth in Item 2.02 of this Current Report, including Exhibit 99.1 attached hereto, shall not be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, regardless of any incorporation by reference language in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

* Filed herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

|

|

|

|

|

|

|

CANOPY GROWTH CORPORATION |

|

|

|

|

Date: May 30, 2024 |

|

By: |

/s/ Judy Hong |

|

|

|

Judy Hong |

|

|

|

Chief Financial Officer |

Exhibit 99.1

Canopy Growth Reports Fourth Quarter and Fiscal Year 2024 Financial Results; Q4 FY2024 Net Revenue increased 7% year-over-year, or 16% excluding divested businesses

Storz & Bickel® delivered its best Q4 revenue quarter, with net revenue increasing 43% as compared to Q4 2023

Canada medical cannabis net revenue increased 16% in Q4 FY2024 and 10% in FY2024 year-over-year

Canada cannabis Cost of Goods Sold decreased by 54% in FY2024 versus FY2023

Following recent balance sheet actions, the Company has no material debt obligation due until March 20261

SMITHS FALLS, ON, May 30, 2024 /PRNewswire/ - Canopy Growth Corporation ("Canopy", “Canopy Growth” or the “Company”) (TSX:WEED) (NASDAQ: CGC), a world-leading cannabis company dedicated to unleashing the power of cannabis, today announced its financial results for the fourth quarter and fiscal year ended March 31, 2024 and the filing of an annual report on Form 10-K, including the audited consolidated financial statements for the fiscal year ended March 31, 2024 and the unqualified report thereon of the Company’s independent registered public accounting firm. All financial information in this press release is reported in Canadian dollars, unless otherwise indicated.

Highlights

•Storz & Bickel® net revenue in Q4 FY2024 increased 43% as compared to Q4 FY2023 driven by strong sales of the new Venty portable vaporizer.

•Canada cannabis net revenue in Q4 FY2024 increased 4% as compared to Q4 FY2023 led by a 16% increase in the Canada medical cannabis business.

•Total Cost of Goods Sold ("COGS") decreased by 45% in FY2024 and Canada cannabis COGS decreased by 54% year-over-year, driven by the cost reduction actions.

•Consolidated Gross Margins increased to 27%, an improvement of 4,600 basis points year-over-year in FY2024, with Canada cannabis, International markets cannabis and Storz & Bickel all posting higher Gross Margins year-over-year.

•Operating loss from continuing operations of $229 MM in FY2024. Adjusted EBITDA loss was $59 MM in FY2024, representing an improvement of 72% year-over-year, driven primarily by revenue growth and successful cost reduction actions taken to date.

•Cash, cash equivalents, and short-term investments of $203 MM at March 31, 2024. Benefiting from balance sheet strengthening actions completed subsequent to the end of FY2024, the Company has no material debt due until March 2026.

"In Fiscal 2024 we fortified Canopy's foundation for future growth. With a resolute focus on cannabis, we have momentum and are poised to seize the opportunity presented by continued regulatory developments in Germany and the United States. Entering FY2025, Canopy has growing businesses in all of the world’s most attractive cannabis markets, a leading portfolio of high-impact brands, and a rapidly developing U.S. ecosystem.’’

David Klein, Chief Executive Officer

"We have made remarkable progress and delivered dramatic reductions in expenses, cash burn, and debt over the past year. These efforts have significantly enhanced our financial stability and moved us toward achieving positive Consolidated Adjusted EBTIDA. With no material debt maturing until 2026, Canopy is equipped to capitalize on growth opportunities and enhance shareholder value."

Judy Hong, Chief Financial Officer

|

|

|

|

|

- 1 - 1

|

1 Considering debt-related transactions completed subsequent to the end of FY2024

Fourth Quarter FY2024 Financial Summary

|

|

|

|

|

|

|

|

(in millions of Canadian

dollars, unaudited) |

|

Net Revenue |

Gross margin

percentage |

Adjusted

gross margin

percentage2 |

Net loss from continuing operations |

Adjusted

EBITDA3 |

Free cash

flow4 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported |

|

$72.8 |

21% |

21% |

$(94.7) |

$(15.1) |

$(22.7) |

vs. Q4 FY2023 |

|

7% |

11,500 bps |

1,000 bps |

84% |

63% |

77% |

FY2024 Financial Summary

|

|

|

|

|

|

|

|

(in millions of Canadian

dollars, unaudited) |

|

Net Revenue |

Gross margin

percentage |

Adjusted

gross margin

percentage5 |

Net loss from continuing operations |

Adjusted

EBITDA |

Free cash

flow |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported |

|

$297.1 |

27% |

27% |

$(483.7) |

$(58.9) |

$(231.9) |

vs. FY2023 |

|

(11%) |

4,600 bps |

2,200 bps |

84% |

72% |

43% |

Fourth Quarter FY2024 Financial Highlights

•Storz & Bickel® net revenue in Q4 FY2024 increased 43% as compared to Q4 FY2023 to $22 MM driven by strong sales of the new Venty portable vaporizer. Storz & Bickel Gross Margins improved to 41% in Q4 FY2024 driven primarily by a positive shift in product mix.

•Canada medical cannabis delivered its 5th consecutive quarter of revenue growth in Q4 FY2024 with revenue increasing 16% as compared to Q4 FY2023 benefiting from customer mix and larger product assortment in the Spectrum Therapeutics online store. Canada cannabis segment revenue in Q4 FY2024 increased 4% as compared to Q4 FY2023 to $37 MM driven by growth in the Canadian medical cannabis business.

•International markets cannabis net revenue in Q4 FY2024 increased 32% as compared to Q4 FY2023 to $12 MM driven by growth in Germany and Poland as well as the timing of revenue from the US CBD business which is non-recurring. International markets cannabis Gross Margins improved by 5,000 bps to 54% in Q4 FY2024 driven primarily by change in geographic mix and impact from non-recurring revenue from the US CBD business.

•Consolidated Gross Margins in Q4 FY2024 improved to 21% due to cost reduction activities, as well as lower excess and obsolete inventory charges in Canada cannabis. Q4 FY2024 Canada Gross Margins, however, were negatively impacted by lower cultivation yields partly due to seasonality, and an associated reduction in manufacturing utilization, which are expected to improve in FY2025.

•Selling, general & administrative (“SG&A”) expenses in Q4 FY2024 declined 23% as compared to Q4 FY2023 primarily due to cost reduction programs undertaken to date.

•Cash outflow from operations improved 77% in Q4 FY2024 as compared to Q4 FY2023 driven by cost reduction programs and reduction in interest payments.

•Operating loss from continuing operations of $107 MM in Q4 FY2024, representing an improvement of 80% as compared to Q4 FY2023. Adjusted EBITDA loss was $15 MM in Q4 FY2024, representing a 63% improvement as compared to Q4 FY2023.

|

|

|

|

|

- 2 - 2

|

2 Adjusted gross margin is a non-GAAP measure, and for Q4 FY2024 excludes $(0.3) million of restructuring cost reversals recorded in COGS (Q4 FY2023 - excludes $71.7 million of restructuring costs recorded in COGS). See "Non-GAAP Measures" and Schedule 4 for a reconciliation of net revenue to adjusted gross margin.

3 Adjusted EBITDA is a non-GAAP measure. See "Non-GAAP Measures" and Schedule 5 for a reconciliation of net loss from continuing operations to adjusted EBITDA.

4 Free cash flow is a non-GAAP measure. See "Non-GAAP Measures" and Schedule 6 for a reconciliation of net cash used in operating activities - continuing operations to free cash flow - continuing operations.

5 Adjusted gross margin is a non-GAAP measure, and for FY2024 excludes $(1.0) million of restructuring cost reversals recorded in cost of goods sold (FY2023 - excludes $81.8 million of restructuring costs recorded in COGS). See "Non-GAAP Measures" and Schedule 4 for a reconciliation of net revenue to adjusted gross margin.

FY2024 Financial Highlights

•Canada cannabis segment Gross Margins improved to 16% in FY2024 driven by lower excess and obsolete inventory charges and lower operating costs.

•SG&A expenses declined by 33% compared to FY2023 primarily driven by cost reductions actions executed in the first half of FY2024.

•When adjusted for the sale of the Canadian retail business divested in Q3 FY2023, Canada cannabis segment revenue increased by 2% year-over-year to $154 MM in FY2024 driven primarily by growth in Canada medical cannabis net revenue.

•Canada medical cannabis net revenue increased 10% year-over-year to $61 MM in FY2024 driven by customer mix and a larger assortment of products in the Spectrum Therapeautics online store.

•International markets cannabis FY2024 net revenue increased 6% year-over-year to $41 MM primarily attributable to growth in Australia. International markets cannabis Gross Margins in FY2024 improved to 40% primarily due to a positive shift in geographic mix.

|

Focus on innovation and increased distribution is driving growth in the Canadian cannabis market |

•Larger assortment of higher margin cannabis products on Spectrum Therapeutic online store is contributing to growth in Canada medical sales. |

•In Q4 FY2024, the Company launched new SKUs including new Tweed Lemon Meringue Pie flower in large format 28g packs, and 7ACRES Jack Haze Pre-rolled Joints ("PRJ") in a 0.5g x 14 large pack. Exclusive for medical cannabis customers in Canada, extended the Spectrum Reserve collection with Alien Breath and (GG#4 x Mendo Breath) PRJ in a 0.5g x 10 large pack. |

•The Company added over 2,300 points of distribution ("PODs") in the Canadian adult-use market in Q4 FY2024 including 915 PODs for Tweed flower, over 700 PODs for PRJ and over 650 PODs for Deep Space beverages. |

|

Multiple drivers of growth in International Markets medical cannabis |

•Benefiting from increasing supply of high-quality cannabis from Canada, the Company obtained the top 4 market share in the German medical cannabis market in FY20246. |

•Proven Canadian flower strains including Tweed Kush Mintz and Tweed Tiger Cake, launched in Q3 FY2024, accounted for over 25% of net revenue in Q4 FY2024. |

|

Continued demand for new Venty vaporizer driving strong growth in Storz & Bickel net revenue |

•Significant growth in Storz & Bickel Q4 FY2024 net revenue driven in part by continuing strong demand for the new Venty portable vaporizer. |

•Strong distributor and retailer load-in of all Storz & Bickel devices in Q4 FY2024 experienced in advance of 4/20 events and sales promotions. |

|

Canopy USA strategy advancing rapidly to seize U.S. opportunity |

•Subsequent to quarter end, shareholders of the Company overwhelmingly approved the creation of a new class of non-voting and non-participating exchangeable shares in the capital of the Company (“Exchangeable Shares”) at the special meeting of shareholders held on April 12, 2024. |

•Subsequent to quarter end, on April 18, 2024, Canopy Growth announced that Constellation Brands Inc. converted its Common Shares to Exchangeable Shares of the Company. |

•Subsequent to quarter end, on May 6, 2024, Canopy USA initiated the acquisitions of Mountain High Products, LLC, Wana Wellness, LLC and The Cima Group, LLC (collectively, “Wana”) and Lemurian, Inc. (“Jetty”). These acquisitions are expected to close in the first half of FY2025. |

|

|

|

|

|

- 3 - 3

|

6 Source: Insight Health Greenline ODV National Database

Fourth Quarter FY2024 Revenue Review7

Revenue by Channel

|

|

|

|

|

|

|

|

(in millions of Canadian dollars, unaudited) |

|

Q4 FY2024 |

Q4 FY2023 |

Vs. Q4 FY2023 |

FY2024 |

FY2023 |

Vs. FY2023 |

Canada cannabis |

|

|

|

|

|

|

|

Canadian adult-use cannabis |

|

|

|

|

|

|

|

Business-to-business8 |

|

$20.8 |

$21.6 |

(4%) |

$92.4 |

$95.0 |

(3%) |

Business-to-consumer |

|

$- |

$- |

0% |

$- |

$36.3 |

(100%) |

|

|

$20.8 |

$21.6 |

(4%) |

$92.4 |

$131.3 |

(30%) |

Canada medical cannabis9 |

|

$16.3 |

$14.1 |

16% |

$61.3 |

$55.8 |

10% |

|

|

$37.1 |

$35.7 |

4% |

$153.7 |

$187.1 |

(18%) |

|

|

|

|

|

|

|

|

International markets cannabis10 |

|

$11.6 |

$8.8 |

32% |

$41.3 |

$39.0 |

6% |

Storz & Bickel |

|

$22.2 |

$15.5 |

43% |

$70.7 |

$64.8 |

9% |

This Works |

|

$- |

$5.4 |

(100%) |

$21.2 |

$26.0 |

(18%) |

Other |

|

$1.9 |

$2.8 |

(32%) |

$10.2 |

$16.4 |

(38%) |

|

|

|

|

|

|

|

|

Net revenue |

|

$72.8 |

$68.2 |

7% |

$297.1 |

$333.3 |

(11%) |

The Q4 FY2024, Q4 FY2023, FY2024 and FY2023 financial results presented in this press release have been prepared in accordance with U.S. GAAP.

|

|

|

|

|

|

|

- 4 - 4

|

7 In Q4 FY2024, we are reporting our financial results for the following four reportable segments: (i) Canada cannabis; (ii) international markets cannabis; (iii) Storz & Bickel; and (iv) This Works. Information regarding segment net revenue and segment gross margin for the comparative periods has been restated to reflect the aforementioned change in reportable segments. 8 For Q4 FY2024, amount is net of excise taxes of $8.5 million and other revenue adjustments of $1.0 million (Q4 FY2023 - $9.3 million and $0.6 million, respectively). For FY2024, amount is net of excise taxes of $40.1 million and other revenue adjustments of $3.5 million (FY2023 - $43.1 million and $3.5 million, respectively). 9 For Q4 FY2024, amount is net of excise taxes of $1.8 million (Q4 FY2023 - $1.3 million). For FY2024, amount is net of excise taxes of $6.7 million (FY2023 - $4.9 million). 10 For Q4 FY2024, amount reflects other revenue adjustments of $0.2 million (Q4 FY2023 - $3.7 million). For FY2024, amount reflects other revenue adjustments of $0.6 million (FY2023 - $8.6 million) |

|

|

Webcast and Conference Call Information

The Company will host a conference call and audio webcast with David Klein, CEO and Judy Hong, CFO at 10:00 AM Eastern Time on May 30, 2024.

Webcast Information

A live audio webcast will be available at https://app.webinar.net/qa1JRpmzw04.

Replay Information

A replay will be accessible by webcast until 11:59 PM Eastern Time on August 28, 2024 at https://app.webinar.net/qa1JRpmzw04.

Non-GAAP Measures

Adjusted EBITDA is a non-GAAP measure used by management that is not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. Adjusted EBITDA is calculated as the reported net income (loss), adjusted to exclude income tax recovery (expense); other income (expense), net; loss on equity method investments; share-based compensation expense; depreciation and amortization expense; asset impairment and restructuring costs; expected credit losses on financial assets and related charges; restructuring costs recorded in cost of goods sold; and charges related to the flow-through of inventory step-up on business combinations, and further adjusted to remove acquisition-related costs. Asset impairments related to periodic changes to the Company’s supply chain processes are not excluded from Adjusted EBITDA given their occurrence through the normal course of core operational activities. The Adjusted EBITDA reconciliation is presented within this news release and explained in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2024 filed with the Securities and Exchange Commission (“SEC”).

Free Cash Flow is a non- GAAP measure used by management that is not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. This measure is calculated as net cash provided by (used in) operating activities less purchases of and deposits on property, plant and equipment. The Free Cash Flow reconciliation is presented within this news release and explained in the Company's Annual Report on Form 10-K for the fiscal year ended March 31, 2024 filed with the SEC.

Adjusted Gross Margin and Adjusted Gross Margin Percentage are non-GAAP measures used by management that are not defined by U.S. GAAP and may not be comparable to similar measures presented by other companies. Adjusted Gross Margin is calculated as gross margin excluding restructuring and other charges recorded in cost of goods sold, and charges related to the flow-through of inventory step-up on business combinations. Adjusted Gross Margin Percentage is calculated as Adjusted Gross Margin divided by net revenue. The Adjusted Gross Margin and Adjusted Gross Margin Percentage reconciliation is presented within this news release and explained in the Company's Annual Report on Form 10-K filed for the fiscal year ended March 31, 2024 with the SEC.

Contact:

Nik Schwenker

Vice President, Communications

media@canopygrowth.com

Tyler Burns

Director, Investor Relations

tyler.burns@canopygrowth.com

About Canopy Growth Corporation

Canopy Growth is a world leading cannabis company dedicated to unleashing the power of cannabis to improve lives.

Through an unwavering commitment to our consumers, Canopy Growth delivers innovative products with a focus on premium and mainstream cannabis brands including Doja, 7ACRES, Tweed, and Deep Space. Canopy Growth’s CPG portfolio features gourmet wellness products by Martha Stewart CBD, and category defining vaporizer technology made in Germany by Storz & Bickel.

Canopy Growth has also established a comprehensive ecosystem to realize the opportunities presented by the U.S. THC market through its rights to Acreage Holdings, Inc., ("Acreage") a vertically integrated multi-state cannabis operator with principal operations in densely populated

|

|

|

|

|

- 5 - 5

|

states across the Northeast, as well as Wana Brands, a leading cannabis edible brand in North America, and Jetty Extracts, a California-based producer of high- quality cannabis extracts and pioneer of clean vape technology.

Beyond its world-class products, Canopy Growth is leading the industry forward through a commitment to social equity, responsible use, and community reinvestment – pioneering a future where cannabis is understood and welcomed for its potential to help achieve greater well-being and life enhancement.

For more information visit www.canopygrowth.com.

Notice Regarding Forward Looking Statements

This press release contains “forward-looking statements” within the meaning of applicable securities laws, which involve certain known and unknown risks and uncertainties. To the extent any forward-looking statements in this news release constitutes “financial outlooks” within the meaning of applicable Canadian securities laws, the reader is cautioned that this information may not be appropriate for any other purpose and the reader should not place undue reliance on such financial outlooks. Forward-looking statements predict or describe our future operations, business plans, business and investment strategies and the performance of our investments. These forward-looking statements are generally identified by their use of such terms and phrases as “intend,” “goal,” “strategy,” “estimate,” “expect,” “project,” “projections,” “forecasts,” “plans,” “seeks,” “anticipates,” “potential,” “proposed,” “will,” “should,” “could,” “would,” “may,” “likely,” “designed to,” “foreseeable future,” “believe,” “scheduled” and other similar expressions. Our actual results or outcomes may differ materially from those anticipated. You are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date the statement was made.

Forward-looking statements include, but are not limited to, statements with respect to:

•laws and regulations and any amendments thereto applicable to our business and the impact thereof, including uncertainty regarding the application of U.S. state and federal law to hemp (including CBD) products and the scope of any regulations by the U.S. Food and Drug Administration, the U.S. Drug Enforcement Administration, the U.S. Federal Trade Commission, the U.S. Patent and Trademark Office, the U.S. Department of Agriculture (the “USDA”) and any state equivalent regulatory agencies over hemp (including CBD) products;

•expectations regarding the amount or frequency of impairment losses, including as a result of the write-down of intangible assets, including goodwill;

•our ability to refinance debt as and when required on terms favorable to us and comply with covenants contained in our debt facilities and debt instruments;

•the impacts of the Company’s strategy to accelerate entry into the U.S. cannabis market through the creation of Canopy USA, LLC (“Canopy USA”), including the costs and benefits associated with the amendments made to the Canopy USA structure to facilitate the deconsolidation of the financial results of Canopy USA within the Company’s financial statements;

•expectations for Canopy USA to capitalize on the opportunity for growth in the United States cannabis sector and the anticipated benefits of such strategy;

•the timing and outcome of the floating share arrangement, whereby, subject to the terms and conditions of a Floating Share Arrangement Agreement (the “Floating Share Arrangement Agreement”), Canopy USA is expected to acquire all of the issued and outstanding Class D subordinate voting shares (the “Floating Shares”) of Acreage by way of a court-approved plan on arrangement under the Business Corporations Act (British Columbia) (the “Floating Share Arrangement”) in exchange for 0.045 of a Company common share for each Floating Share held, the anticipated benefits of the Floating Share Arrangement, the anticipated timing of the acquisition of the Class E subordinate voting shares (the “Fixed Shares”) of Acreage and the Floating Shares by Canopy USA, the satisfaction or waiver of the closing conditions set out in the Floating Share Arrangement Agreement and the arrangement agreement dated April 18, 2019, as amended on May 15, 2019, September 23, 2020 and November 17, 2020 (the “Existing Acreage Arrangement Agreement”), including receipt of all regulatory approvals, and the anticipated timing and occurrence of the exercise of the option to acquire the Fixed Shares (the “Acreage Option”) and closing of such transaction;

•the Amended Acreage Arrangement (as defined below) and the Floating Share Arrangement , including the occurrence or waiver (at the Company’s discretion) of the occurrence or waiver (at the Company’s discretion) of changes in U.S. federal law to permit the general cultivation, distribution, and possession of marijuana, or to remove the regulation of such activities from the federal laws of the United States (the “Triggering Event”), and the satisfaction or waiver of the conditions to closing the acquisition of Acreage;

•expectations regarding the option purchased by an affiliate of the Company for C$38.0 million (US$28.5 million) (the “Option Premium”) to purchase certain of Acreage’s debt, including the ability to, and timing of, the exercise of such option;

•the transactions contemplated by the our agreement to acquire Wana , including the occurrence or waiver (at Canopy USA’s discretion) of the Triggering Event;

•the issuance of additional common shares of the Company (each whole share, a “Canopy Share” or a “Share”) to satisfy the payments to eligible participants to the existing tax receivable bonus plans of High Street Capital Partners, LLC, a subsidiary of Acreage, to satisfy any deferred and/or option exercise payments to the shareholders of Wana and Jetty and the issuance of additional non-voting Shares issuable to Canopy Growth from Canopy USA in consideration thereof;

|

|

|

|

|

|

- 6 - 6

|

|

|

•the acquisition of additional Class A shares of Canopy USA in connection with the investment in Canopy USA by the Huneeus 2017 Irrevocable Trust (the “Trust”) in the aggregate amount of up to US$20 million (the "Trust Transaction"), including any warrants of Canopy USA issued to the Trust in accordance with the share purchase agreement entered into by the Trust and Canopy USA;

•expectations regarding the laws and regulations and any amendments thereto relating to the hemp industry in the U.S., including the promulgation of regulations for the hemp industry by the USDA and relevant state regulatory authorities;

•expectations regarding the potential success of, and the costs and benefits associated with, our acquisitions, joint ventures, strategic alliances, equity investments and dispositions;

•the grant, renewal and impact of any license or supplemental license to conduct activities with cannabis or any amendments thereof;

•our international activities and joint venture interests, including required regulatory approvals and licensing, anticipated costs and timing, and expected impact;

•our ability to successfully create and launch brands and further create, launch and scale cannabis-based products and hemp-derived consumer products in jurisdictions where such products are legal and that we currently operate in;

•the benefits, viability, safety, efficacy, dosing and social acceptance of cannabis, including CBD and other cannabinoids;

•our ability to maintain effective internal control over financial reporting;

•our ability to continue as a going concern;

•expectations regarding the use of proceeds of equity financings;

•the legalization of the use of cannabis for medical or adult-use in jurisdictions outside of Canada, the related timing and impact thereof and our intentions to participate in such markets, if and when such use is legalized;

•our ability to execute on our strategy and the anticipated benefits of such strategy;

•the ongoing impact of the legalization of additional cannabis product types and forms for adult-use in Canada, including federal, provincial, territorial and municipal regulations pertaining thereto, the related timing and impact thereof and our intentions to participate in such markets;

•the ongoing impact of developing provincial, territorial and municipal regulations pertaining to the sale and distribution of cannabis, the related timing and impact thereof, as well as the restrictions on federally regulated cannabis producers participating in certain retail markets and our intentions to participate in such markets to the extent permissible;

•the timing and nature of legislative changes in the U.S. regarding the regulation of cannabis including tetrahydrocannabinol ;

•the future performance of our business and operations;

•our competitive advantages and business strategies;

•the competitive conditions of the industry;

•the expected growth in the number of customers using our products;

•our ability or plans to identify, develop, commercialize or expand our technology and research and development initiatives in cannabinoids, or the success thereof;

•expectations regarding revenues, expenses and anticipated cash needs;

•expectations regarding cash flow, liquidity and sources of funding;

•expectations regarding capital expenditures;

•the expansion of our production and manufacturing, the costs and timing associated therewith and the receipt of applicable production and sale licenses;

•expectations with respect to our growing, production and supply chain capacities;

•expectations regarding the resolution of litigation and other legal and regulatory proceedings, reviews and investigations;

•expectations with respect to future production costs;

•expectations with respect to future sales and distribution channels and networks;

•the expected methods to be used to distribute and sell our products;

•our future product offerings;

•the anticipated future gross margins of our operations;

•accounting standards and estimates;

•expectations regarding our distribution network;

•expectations regarding the costs and benefits associated with our contracts and agreements with third parties, including under our third-party supply and manufacturing agreements;

•our ability to comply with the listing requirements of the Nasdaq Stock Market LLC and the Toronto Stock Exchange ; and

•expectations on price changes in cannabis markets.

Certain of the forward-looking statements contained herein concerning the industries in which we conduct our business are based on estimates prepared by us using data from publicly available governmental sources, market research, industry analysis and on assumptions based on data and knowledge of these industries, which we believe to be reasonable. However, although generally indicative of relative market positions, market shares and performance characteristics, such data is inherently imprecise. The industries in which we conduct our business involve risks and uncertainties that are subject to change based on various factors, which are described further below.

|

|

|

|

|

|

- 7 - 7

|

|

|

The forward-looking statements contained herein are based upon certain material assumptions , including: (i) management’s perceptions of historical trends, current conditions and expected future developments; (ii) our ability to generate cash flow from operations; (iii) general economic, financial market, regulatory and political conditions in which we operate; (iv) the production and manufacturing capabilities and output from our facilities and our joint ventures, strategic alliances and equity investments; (v) consumer interest in our products; (vi) competition; (vii) anticipated and unanticipated costs; (viii) government regulation of our activities and products including but not limited to the areas of taxation and environmental protection; (ix) the timely receipt of any required regulatory authorizations, approvals, consents, permits and/or licenses; (x) our ability to obtain qualified staff, equipment and services in a timely and cost-efficient manner; (xi) our ability to conduct operations in a safe, efficient and effective manner; (xii) our ability to realize anticipated benefits, synergies or generate revenue, profits or value from our recent acquisitions into our existing operations; and (xiii) other considerations that management believes to be appropriate in the circumstances. While our management considers these assumptions to be reasonable based on information currently available to management, there is no assurance that such expectations will prove to be correct. Financial outlooks, as with forward-looking statements generally, are, without limitation, based on the assumptions and subject to various risks as set out herein. Our actual financial position and results of operations may differ materially from management’s current expectations.

By their nature, forward-looking statements are subject to inherent risks and uncertainties that may be general or specific and which give rise to the possibility that expectations, forecasts, predictions, projections or conclusions will not prove to be accurate, that assumptions may not be correct and that objectives, strategic goals and priorities will not be achieved. A variety of factors, including known and unknown risks, many of which are beyond our control, could cause actual results to differ materially from the forward-looking statements in this press release and other reports we file with, or furnish to, the SEC and other regulatory agencies and made by our directors, officers, other employees and other persons authorized to speak on our behalf. Such factors include, without limitation, our limited operating history; our ability to continue as a going concern; risks that we may be required to write down intangible assets, including goodwill, due to impairment; the adequacy of our capital resources and liquidity, including but not limited to, availability of sufficient cash flow to execute our business plan (either within the expected timeframe or at all); our ability to maintain an effective system of internal control; the diversion of management time on matters related to Canopy USA; the ability of parties to certain transactions to receive, in a timely manner and on satisfactory terms, the necessary regulatory, court and shareholder approvals; the risks that the Trust’s future ownership interest in Canopy USA is not quantifiable, and the Trust may have significant ownership and influence over Canopy USA; the risks relating to the conditions set forth in the Floating Share Arrangement Agreement and the Existing Acreage Arrangement Agreement not being satisfied or waived; the risks related to Acreage’s financial statements expressing doubt about its ability to continue as a going concern; the risks related to the Company losing the Option Premium; the risks in the event that Acreage cannot satisfy its debt obligations as they become due; the risks related to the fact that the Company has not received audited financial statements with respect to Jetty; volatility in and/or degradation of general economic, market, industry or business conditions; risks relating to our current and future operations in emerging markets; compliance with applicable environmental, economic, health and safety, energy and other policies and regulations and in particular health concerns with respect to vaping and the use of cannabis and hemp products in vaping devices; risks and uncertainty regarding future product development; changes in regulatory requirements in relation to our business and products; our reliance on licenses issued by and contractual arrangements with various federal, state and provincial governmental authorities; inherent uncertainty associated with projections; future levels of revenues and the impact of increasing levels of competition; third-party manufacturing risks; third-party transportation risks; inflation risks; our exposure to risks related to an agricultural business, including wholesale price volatility and variable product quality; changes in laws, regulations and guidelines and our compliance with such laws, regulations and guidelines; risks relating to inventory write downs; risks relating to our ability to refinance debt as and when required on terms favorable to us and to comply with covenants contained in our debt facilities and debt instruments; risks associated with jointly owned investments; our ability to manage disruptions in credit markets or changes to our credit ratings; the success or timing of completion of ongoing or anticipated capital or maintenance projects; risks related to the integration of acquired businesses; the timing and manner of the legalization of cannabis in the United States; business strategies, growth opportunities and expected investment; counterparty risks and liquidity risks that may impact our ability to obtain loans and other credit facilities on favorable terms; the potential effects of judicial, regulatory or other proceedings, litigation or threatened litigation or proceedings, or reviews or investigations, on our business, financial condition, results of operations and cash flows; risks associated with divestment and restructuring; the anticipated effects of actions of third parties such as competitors, activist investors or federal, state, provincial, territorial or local regulatory authorities, self-regulatory organizations, plaintiffs in litigation or persons threatening litigation; consumer demand for cannabis and hemp products; the implementation and effectiveness of key personnel changes; risks related to stock exchange restrictions; risks related to the protection and enforcement of our intellectual property rights; the risks related to the Exchangeable Shares having different rights from Canopy Shares and there may never be a trading market for the Exchangeable Shares; future levels of capital, environmental or maintenance expenditures, general and administrative and other expenses; and the factors discussed under the heading “Risk Factors” in the Company’s Annual Report on Form 10-K for the fiscal year ended March 31, 2024. Readers are cautioned to consider these and other factors, uncertainties and potential events carefully and not to put undue reliance on forward-looking statements.

|

|

|

|

|

|

- 8 - 8

|

|

|

Forward-looking statements are provided for the purposes of assisting the reader in understanding our financial performance, financial position and cash flows as of and for periods ended on certain dates and to present information about management’s current expectations and plans relating to the future, and the reader is cautioned that the forward-looking statements may not be appropriate for any other purpose. While we believe that the assumptions and expectations reflected in the forward-looking statements are reasonable based on information currently available to management, there is no assurance that such assumptions and expectations will prove to have been correct. Forward-looking statements are made as of the date they are made and are based on the beliefs, estimates, expectations and opinions of management on that date. We undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, estimates or opinions, future events or results or otherwise or to explain any material difference between subsequent actual events and such forward-looking statements, except as required by law. The forward-looking statements contained in this press release and other reports we file with, or furnish to, the SEC and other regulatory agencies and made by our directors, officers, other employees and other persons authorized to speak on our behalf are expressly qualified in their entirety by these cautionary statements.

|

|

|

|

|

|

- 9 - 9

|

|

|

Schedule 1

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED BALANCE SHEETS

(in thousands of Canadian dollars, except number of shares and per share data, unaudited)

|

|

|

|

|

|

|

|

|

|

|

March 31,

2024 |

|

|

March 31,

2023 |

|

ASSETS |

|

Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

170,300 |

|

|

$ |

667,693 |

|

Short-term investments |

|

|

33,161 |

|

|

|

105,526 |

|

Restricted short-term investments |

|

|

7,310 |

|

|

|

11,765 |

|

Amounts receivable, net |

|

|

51,847 |

|

|

|

68,459 |

|

Inventory |

|

|

77,292 |

|

|

|

83,230 |

|

Assets of discontinued operations |

|

|

8,038 |

|

|

|

116,291 |

|

Prepaid expenses and other assets |

|

|

23,232 |

|

|

|

24,290 |

|

Total current assets |

|

|

371,180 |

|

|

|

1,077,254 |

|

Other financial assets |

|

|

437,629 |

|

|

|

568,292 |

|

Property, plant and equipment |

|

|

320,103 |

|

|

|

471,271 |

|

Intangible assets |

|

|

104,053 |

|

|

|

160,750 |

|

Goodwill |

|

|

43,239 |

|

|

|

85,563 |

|

Noncurrent assets of discontinued operations |

|

|

- |

|

|

|

56,569 |

|

Other assets |

|

|

24,126 |

|

|

|

19,996 |

|

Total assets |

|

$ |

1,300,330 |

|

|

$ |

2,439,695 |

|

|

|

|

|

|

|

|

LIABILITIES AND SHAREHOLDERS' EQUITY |

|

Current liabilities: |

|

|

|

|

|

|

Accounts payable |

|

$ |

28,673 |

|

|

$ |

31,835 |

|

Other accrued expenses and liabilities |

|

|

54,039 |

|

|

|

53,743 |

|

Current portion of long-term debt |

|

|

103,935 |

|

|

|

556,890 |

|

Liabilities of discontinued operations |

|

|

- |

|

|

|

67,624 |

|

Other liabilities |

|

|

48,068 |

|

|

|

93,750 |

|

Total current liabilities |

|

|

234,715 |

|

|

|

803,842 |

|

Long-term debt |

|

|

493,294 |

|

|

|

749,991 |

|

Noncurrent liabilities of discontinued operations |

|

|

- |

|

|

|

3,417 |

|

Other liabilities |

|

|

71,814 |

|

|

|

122,423 |

|

Total liabilities |

|

|

799,823 |

|

|

|

1,679,673 |

|

Commitments and contingencies |

|

|

|

|

|

|

Canopy Growth Corporation shareholders' equity: |

|

|

|

|

|

|

Common shares - $nil par value; Authorized - unlimited number of shares;

Issued and outstanding - 91,115,501 shares and 51,730,555 shares, respectively1 |

|

|

8,244,301 |

|

|

|

7,938,571 |

|

Additional paid-in capital |

|

|

2,602,148 |

|

|

|

2,506,485 |

|

Accumulated other comprehensive loss |

|

|

(16,051 |

) |

|

|

(13,860 |

) |

Deficit |

|

|

(10,330,030 |

) |

|

|

(9,672,761 |

) |

Total Canopy Growth Corporation shareholders' equity |

|

|

500,368 |

|

|

|

758,435 |

|

Noncontrolling interests |

|

|

139 |

|

|

|

1,587 |

|

Total shareholders' equity |

|

|

500,507 |

|

|

|

760,022 |

|

Total liabilities and shareholders' equity |

|

$ |

1,300,330 |

|

|

$ |

2,439,695 |

|

1 Prior year share amounts have been retrospectively adjusted to reflect the Share Consolidation (as defined in the FY2024 Form 10-K), which became effective on December 15, 2023.

Schedule 2

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

CANOPY GROWTH CORPORATION

CONDENSED INTERIM CONSOLIDATED STATEMENTS OF OPERATIONS

(in thousands of Canadian dollars, except number of shares and per share data, unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Three months ended March 31, |

|

|

Years ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

|

2024 |

|

|

2023 |

|

Revenue |

|

$ |

83,153 |

|

|

$ |

78,853 |

|

|

$ |

343,934 |

|

|

$ |

381,250 |

|

Excise taxes |

|

|

10,365 |

|

|

|

10,618 |

|

|

|

46,788 |

|

|

|

47,997 |

|

Net revenue |

|

|

72,788 |

|

|

|

68,235 |

|

|

|

297,146 |

|

|

|

333,253 |

|

Cost of goods sold |

|

|

57,320 |

|

|

|

132,556 |

|

|

|

216,264 |

|

|

|

396,782 |

|

Gross margin |

|

|

15,468 |

|

|

|

(64,321 |

) |

|

|

80,882 |

|

|

|

(63,529 |

) |

Operating expenses |

|

|

|

|

|

|

|

|

|

|

|

|

Selling, general and administrative expenses |

|

|

54,619 |

|

|

|

71,092 |

|

|

|

229,429 |

|

|

|

342,517 |

|

Share-based compensation |

|

|

4,053 |

|

|

|

4,429 |

|

|

|

14,180 |

|

|

|

25,322 |

|

Loss on asset impairment and restructuring |

|

|

63,535 |

|

|

|

404,934 |

|

|

|

65,987 |

|

|

|

2,199,146 |

|

Total operating expenses |

|

|

122,207 |

|

|

|

480,455 |

|

|

|

309,596 |

|

|

|

2,566,985 |

|

Operating loss from continuing operations |

|

|

(106,739 |

) |

|

|

(544,776 |

) |

|

|

(228,714 |

) |

|

|

(2,630,514 |

) |

Other income (expense), net |

|

|

10,629 |

|

|

|

(59,570 |

) |

|

|

(242,641 |

) |

|

|

(455,644 |

) |

Loss from continuing operations before income taxes |

|

|

(96,110 |

) |

|

|

(604,346 |

) |

|

|

(471,355 |

) |

|

|

(3,086,158 |

) |

Income tax (expense) recovery |

|

|

1,435 |

|

|

|

16,361 |

|

|

|

(12,327 |

) |

|

|

5,728 |

|

Net loss from continuing operations |

|

|

(94,675 |

) |

|

|

(587,985 |

) |

|

|

(483,682 |

) |

|

|

(3,080,430 |

) |

Net income (loss) from discontinued operations, net of

income tax |

|

|

2,338 |

|

|

|

(59,624 |

) |

|

|

(192,113 |

) |

|

|

(229,116 |

) |

Net loss |

|

|

(92,337 |

) |

|

|

(647,609 |

) |

|

|

(675,795 |

) |

|

|

(3,309,546 |

) |

Net loss from continuing operations attributable to

noncontrolling interests and redeemable

noncontrolling interest |

|

|

- |

|

|

|

(561 |

) |

|

|

- |

|

|

|

(1,897 |

) |

Net loss from discontinued operations attributable to

noncontrolling interests and redeemable

noncontrolling interest |

|

|

- |

|

|

|

(6,968 |

) |

|

|

(18,526 |

) |

|

|

(29,491 |

) |

Net loss attributable to Canopy Growth Corporation |

|

$ |

(92,337 |

) |

|

$ |

(640,080 |

) |

|

$ |

(657,269 |

) |

|

$ |

(3,278,158 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted loss per share1 |

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

$ |

(1.06 |

) |

|

$ |

(11.78 |

) |

|

$ |

(6.47 |

) |

|

$ |

(66.39 |

) |

Discontinued operations |

|

|

0.03 |

|

|

|

(1.05 |

) |

|

|

(2.32 |

) |

|

|

(4.30 |

) |

Basic and diluted loss per share |

|

$ |

(1.03 |

) |

|

$ |

(12.83 |

) |

|

$ |

(8.79 |

) |

|

$ |

(70.69 |

) |

Basic and diluted weighted average common shares

outstanding1 |

|

|

89,500,859 |

|

|

|

49,877,806 |

|

|

|

74,787,521 |

|

|

|

46,372,441 |

|

1 Prior year share amounts have been retrospectively adjusted to reflect the Share Consolidation (as defined in the FY2024 Form 10-K), which became effective on December 15, 2023.

Schedule 3

|

|

|

|

|

|

|

|

|

CANOPY GROWTH CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(in thousands of Canadian dollars, unaudited) |

|

|

|

|

|

|

|

|

|

|

Years ended March 31, |

|

|

|

2024 |

|

|

2023 |

|

Cash flows from operating activities: |

|

|

|

|

|

|

Net loss |

|

$ |

(675,795 |

) |

|

$ |

(3,309,546 |

) |

Loss from discontinued operations, net of income tax |

|

|

(192,113 |

) |

|

|

(229,116 |

) |

Net loss from continuing operations |

|

|

(483,682 |

) |

|

|

(3,080,430 |

) |

Adjustments to reconcile net loss to net cash used in operating activities: |

|

|

|

|

|

|

Depreciation of property, plant and equipment |

|

|

28,376 |

|

|

|

55,575 |

|

Amortization of intangible assets |

|

|

24,800 |

|

|

|

24,458 |

|

Share-based compensation |

|

|

14,180 |

|

|

|

25,322 |

|

Loss on asset impairment and restructuring |

|

|

53,797 |

|

|

|

2,170,588 |

|

Income tax expense (recovery) |

|

|

12,327 |

|

|

|

(5,728 |

) |

Non-cash fair value adjustments and charges related to

settlement of unsecured senior notes |

|

|

160,468 |

|

|

|

353,827 |

|

Change in operating assets and liabilities, net of effects from

purchases of businesses: |

|

|

|

|

|

|

Amounts receivable |

|

|

(3,749 |

) |

|

|

6,242 |

|

Inventory |

|

|

1,034 |

|

|

|

68,438 |

|

Prepaid expenses and other assets |

|

|

(2,433 |

) |

|

|

12,530 |

|

Accounts payable and other accrued expenses and accrued liabilities |

|

|

9,115 |

|

|

|

(28,240 |

) |

Other, including non-cash foreign currency |

|

|

(42,654 |

) |

|

|

2,995 |

|

Net cash used in operating activities - continuing operations |

|

|

(228,421 |

) |

|

|

(394,423 |

) |

Net cash used in operating activities - discontinued operations |

|

|

(53,529 |

) |

|

|

(163,123 |

) |

Net cash used in operating activities |

|

|

(281,950 |

) |

|

|

(557,546 |

) |

Cash flows from investing activities: |

|

|

|

|

|

|

Purchases of and deposits on property, plant and equipment |

|

|

(3,449 |

) |

|

|

(9,114 |

) |

Purchases of intangible assets |

|

|

(547 |

) |

|

|

(1,337 |

) |

Proceeds on sale of property, plant and equipment |

|

|

154,052 |

|

|

|

13,609 |

|

Redemption of short-term investments |

|

|

78,549 |

|

|

|

502,589 |

|

Net cash (outflow) proceeds on sale of subsidiaries |

|

|

(955 |

) |

|

|

14,932 |

|

Investment in other financial assets |

|

|

(347 |

) |

|

|

(67,150 |

) |

Other investing activities |

|

|

(7,705 |

) |

|

|

3,900 |

|

Net cash provided by investing activities - continuing operations |

|

|

219,598 |

|

|

|

457,429 |

|

Net cash provided by (used in) investing activities - discontinued operations |

|

|

21,992 |

|

|

|

(24,050 |

) |

Net cash provided by investing activities |

|

|

241,590 |

|

|

|

433,379 |

|

Cash flows from financing activities: |

|

|

|

|

|

|

Proceeds from issuance of common shares and warrants |

|

|

81,063 |

|

|

|

1,049 |

|

Proceeds from exercise of stock options |

|

|

- |

|

|

|

281 |

|

Issuance of long-term debt and convertible debentures |

|

|

- |

|

|

|

135,160 |

|

Repayment of long-term debt |

|

|

(509,779 |

) |

|

|

(118,179 |

) |

Other financing activities |

|

|

(36,339 |

) |

|

|

(38,005 |

) |

Net cash used in financing activities |

|

|

(465,055 |

) |

|

|

(19,694 |

) |

Effect of exchange rate changes on cash and cash equivalents |

|

|

(1,292 |

) |

|

|

44,863 |

|

Net decrease in cash and cash equivalents |

|

|

(506,707 |

) |

|

|

(98,998 |

) |

Cash and cash equivalents, beginning of period1 |

|

|

677,007 |

|

|

|

776,005 |

|

Cash and cash equivalents, end of period2 |

|

$ |

170,300 |

|

|

$ |

677,007 |

|

1 Includes cash of our discontinued operations of $9,314, and $13,610 for March 31, 2023 and 2022, respectively. |

|

2 Includes cash of our discontinued operations of $nil and $9,314 for March 31, 2024 and 2023, respectively. |

|

Schedule 4

|

|

|

|

|

|

|

|

|

Adjusted Gross Margin1 Reconciliation (Non-GAAP Measure) |

|

|

|

Three months ended March 31, |

|

(in thousands of Canadian dollars except where indicated; unaudited) |

|

2024 |

|

|

2023 |

|

Net revenue |

|

$ |

72,788 |

|

|

$ |

68,235 |

|

|

|

|

|

|

|

|

Gross margin, as reported |

|

|

15,468 |

|

|

|

(64,321 |

) |

Adjustments to gross margin: |

|

|

|

|

|

|

Restructuring costs recorded in cost of goods sold |

|

|

(297 |

) |

|

|

71,673 |

|

Adjusted gross margin1 |

|

$ |

15,171 |

|

|

$ |

7,352 |

|

|

|

|

|

|

|

|

Adjusted gross margin percentage1 |

|

|

21 |

% |

|

|

11 |

% |

1 Adjusted gross margin and adjusted gross margin percentage are non-GAAP measures. See "Non-GAAP Measures". |

|

|

|

|

|

|

|

|

|

|

|

|

Years ended March 31, |

|

(in thousands of Canadian dollars except where indicated; unaudited) |

|

2024 |

|

|

2023 |

|

Net revenue |

|

$ |

297,146 |

|

|

$ |

333,253 |

|

|

|

|

|

|

|

|

Gross margin, as reported |

|

|

80,882 |

|

|

|

(63,529 |

) |

Adjustments to gross margin: |

|

|

|

|

|

|

Restructuring costs recorded in cost of goods sold |

|

|

(986 |

) |

|

|

81,802 |

|

Adjusted gross margin1 |

|

$ |

79,896 |

|

|

$ |

18,273 |

|

|

|

|

|

|

|

|

Adjusted gross margin percentage1 |

|

|

27 |

% |

|

|

5 |

% |

1 Adjusted gross margin and adjusted gross margin percentage are non-GAAP measures. See "Non-GAAP Measures". |

|

Schedule 5

|

|

|

|

|

|

|

|

|

Adjusted EBITDA1 Reconciliation (Non-GAAP Measure) |

|

|

|

|

|

|

|

|

Three months ended March 31, |

|

(in thousands of Canadian dollars, unaudited) |

|

2024 |

|

|

2023 |

|

Net loss from continuing operations |

|

$ |

(94,675 |

) |

|

$ |

(587,985 |

) |

Income tax recovery |

|

|

(1,435 |

) |

|

|

(16,361 |

) |

Other (income) expense, net |

|

|

(10,629 |

) |

|

|

59,570 |

|

Share-based compensation |

|

|

4,053 |

|

|

|

4,429 |

|

Acquisition, divestiture, and other costs |

|

|

13,062 |

|

|

|

4,038 |

|

Depreciation and amortization2 |

|

|

11,295 |

|

|

|

19,301 |

|

Loss on asset impairment and restructuring |

|

|

63,535 |

|

|

|

404,934 |

|

Restructuring costs recorded in cost of goods sold |

|

|

(297 |

) |

|

|

71,673 |

|

Adjusted EBITDA1 |

|

$ |

(15,091 |

) |

|

$ |

(40,401 |

) |

1Adjusted EBITDA is a non-GAAP measure. See "Non-GAAP Measures". |

|

2 From Consolidated Statements of Cash Flows. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years ended March 31, |

|

(in thousands of Canadian dollars, unaudited) |

|

2024 |

|

|

2023 |

|

Net loss from continuing operations |

|

$ |

(483,682 |

) |

|

$ |

(3,080,430 |

) |

Income tax expense (recovery) |

|

|

12,327 |

|

|

|

(5,728 |

) |

Other (income) expense, net |

|

|

242,641 |

|

|

|

455,644 |

|

Share-based compensation |

|

|

14,180 |

|

|

|

25,322 |

|

Acquisition, divestiture, and other costs |

|

|

37,435 |

|

|

|

35,584 |

|

Depreciation and amortization2 |

|

|

53,176 |

|

|

|

80,033 |

|

Loss on asset impairment and restructuring |

|

|

65,987 |

|

|

|

2,199,146 |

|

Restructuring costs recorded in cost of goods sold |

|

|

(986 |

) |

|

|

81,802 |

|

Adjusted EBITDA1 |

|

$ |

(58,922 |

) |

|

$ |

(208,627 |

) |

1Adjusted EBITDA is a non-GAAP measure. See "Non-GAAP Measures". |

|

2 From Consolidated Statements of Cash Flows. |

|

|

|

|

|

|

Schedule 6

|

|

|

|

|

|

|

|

|

Free Cash Flow1 Reconciliation (Non-GAAP Measure) |

|

|

|

|

|

|

|

|

Three months ended March 31, |

|

(in thousands of Canadian dollars, unaudited) |

|

2024 |

|

|

2023 |

|

Net cash used in operating activities - continuing operations |

|

|

(22,460 |

) |

|

|

(95,633 |

) |

Purchases of and deposits on property, plant and equipment

- continuing operations |

|

|

(249 |

) |

|

|

(2,938 |

) |

Free cash flow - continuing operations1 |

|

|

(22,709 |

) |

|

|

(98,571 |

) |

1Free cash flow is a non-GAAP measure. See "Non-GAAP Measures". |

|

|

|

|

|

|

|

|

|

|

|

|

Years ended March 31, |

|

(in thousands of Canadian dollars, unaudited) |

|

2024 |

|

|

2023 |

|

Net cash used in operating activities - continuing operations |

|

|

(228,421 |

) |

|

|

(394,423 |

) |

Purchases of and deposits on property, plant and equipment

- continuing operations |

|

|

(3,449 |

) |

|

|

(9,114 |

) |

Free cash flow - continuing operations1 |

|

|

(231,870 |

) |

|

|

(403,537 |

) |

1Free cash flow is a non-GAAP measure. See "Non-GAAP Measures". |

|

Schedule 7

|

|

|

|

|

|

|

|

|

Segmented Gross Margin and Segmented Adjusted Gross Margin1 Reconciliation (Non-GAAP Measure) |

|

|

|

Three months ended March 31, |

|

(in thousands of Canadian dollars except where indicated; unaudited) |

2024 |

|

|

2023 |

|

Canada cannabis segment |

|

|

|

|

|

|

Net revenue |

|

$ |

37,082 |

|

|

$ |

35,731 |

|

Gross margin, as reported |

|

|

157 |

|

|

|

(69,826 |

) |

Gross margin percentage, as reported |

|

|

0 |

% |

|

|

(195 |

%) |

Adjustments to gross margin: |

|

|

|

|

|

|

Restructuring costs recorded in cost of goods sold |

|

|

- |

|

|

|

69,589 |

|

Adjusted gross margin1 |

|

$ |

157 |

|

|

$ |

(237 |

) |

Adjusted gross margin percentage1 |

|

|

0 |

% |

|

|

(1 |

%) |

|

|

|

|

|

|

|

International markets cannabis segment |

|

|

|

|

|

|

Revenue |

|

$ |

11,646 |

|

|

$ |

8,770 |

|

Gross margin, as reported |

|

|

6,318 |

|

|

|

354 |

|

Gross margin percentage, as reported |

|

|

54 |

% |

|

|

4 |

% |

Adjustments to gross margin: |

|

|

|

|

|

|

Restructuring costs recorded in cost of goods sold |

|

|

(297 |

) |

|

|

938 |

|

Adjusted gross margin1 |

|

$ |

6,021 |

|

|

$ |

1,292 |

|

Adjusted gross margin percentage1 |

|

|

52 |

% |

|

|

15 |

% |

|

|

|

|

|

|

|

Storz & Bickel segment |

|

|

|

|

|

|

Revenue |

|

$ |

22,153 |

|

|

$ |

15,494 |

|

Gross margin, as reported |

|

|

9,054 |

|

|

|

5,303 |

|

Gross margin percentage, as reported |

|

|

41 |

% |

|

|

34 |

% |

|

|

|

|

|

|

|

Adjusted gross margin1 |

|

$ |

9,054 |

|

|

$ |

5,303 |

|

Adjusted gross margin percentage1 |

|

|

41 |

% |

|

|

34 |

% |

|

|

|

|

|

|

|

This Works segment |

|

|

|

|

|

|

Revenue |

|

$ |

- |

|

|

$ |

5,352 |

|

Gross margin, as reported |

|

|

- |

|

|

|

1,223 |

|

Gross margin percentage, as reported |

|

|

0 |

% |

|

|

23 |

% |

Adjustments to gross margin: |

|

|

|

|

|

|

Restructuring costs recorded in cost of goods sold |

|

|

- |

|

|

|

1,146 |

|

Adjusted gross margin1 |

|

$ |

- |

|

|

$ |

2,369 |

|

Adjusted gross margin percentage1 |

|

|

0 |

% |

|

|

44 |

% |

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

Revenue |

|

$ |

1,907 |

|

|

$ |

2,888 |

|

Gross margin, as reported |

|

|

(61 |

) |

|

|

(1,375 |

) |

Gross margin percentage, as reported |

|

|

(3 |

%) |

|

|

(48 |

%) |

|

|

|

|

|

|

|

Adjusted gross margin1 |

|

$ |

(61 |

) |

|

$ |

(1,375 |

) |

Adjusted gross margin percentage1 |

|

|

(3 |

%) |

|

|

(48 |

%) |

1 Adjusted gross margin and adjusted gross margin percentage are non-GAAP measures. See "Non-GAAP Measures". |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Years ended March 31, |

|

(in thousands of Canadian dollars except where indicated; unaudited) |

2024 |

|

|

2023 |

|

Canada cannabis segment |

|

|

|

|

|

|

Net revenue |

|

$ |

153,716 |

|

|

$ |

187,067 |

|

Gross margin, as reported |

|

|

24,896 |

|

|

|

(95,291 |

) |

Gross margin percentage, as reported |

|

|

16 |

% |

|

|

(51 |

%) |

Adjustments to gross margin: |

|

|

|

|

|

|

Restructuring costs recorded in cost of goods sold |

|

|

(689 |

) |

|

|

71,278 |

|

Adjusted gross margin1 |

|

$ |

24,207 |

|

|

$ |

(24,013 |

) |

Adjusted gross margin percentage1 |

|

|

16 |

% |

|

|

(13 |

%) |

|

|

|

|

|

|

|

International markets cannabis segment |

|

|

|

|

|

|

Revenue |

|

$ |

41,312 |

|

|

$ |

38,949 |

|

Gross margin, as reported |

|

|

16,682 |

|

|

|

(3,322 |

) |

Gross margin percentage, as reported |

|

|

40 |

% |

|

|

(9 |

%) |

Adjustments to gross margin: |

|

|

|

|

|

|

Restructuring costs recorded in cost of goods sold |

|

|

(297 |

) |

|

|

8,224 |

|

Adjusted gross margin1 |

|

|

16,385 |

|

|

|

4,902 |

|

Adjusted gross margin percentage1 |

|

|

40 |

% |

|

|

13 |

% |

|

|

|

|

|

|

|

Storz & Bickel segment |

|

|

|

|

|

|

Revenue |

|

$ |

70,670 |

|

|

$ |

64,845 |

|

Gross margin, as reported |

|

|

30,128 |

|

|

|

26,112 |

|

Gross margin percentage, as reported |

|

|

43 |

% |

|

|

40 |

% |

|

|

|

|

|

|

|

Adjusted gross margin1 |

|

|

30,128 |

|

|

|

26,112 |

|

Adjusted gross margin percentage1 |

|

|

43 |

% |

|

|

40 |

% |

|

|

|

|

|

|

|

This Works segment |

|

|

|

|

|

|

Revenue |

|

$ |

21,256 |

|

|

$ |

26,029 |

|

Gross margin, as reported |

|

|

10,534 |

|

|

|

10,205 |

|

Gross margin percentage, as reported |

|

|

50 |

% |

|

|

39 |

% |

Adjustments to gross margin: |

|

|

|

|

|

|

Restructuring costs recorded in cost of goods sold |

|

|

- |

|

|

|

2,300 |

|

Adjusted gross margin1 |

|

$ |

10,534 |

|

|

$ |

12,505 |

|

Adjusted gross margin percentage1 |

|

|

50 |

% |

|

|

48 |

% |

|

|

|

|

|

|

|

Other |

|

|

|

|

|

|

Revenue |

|

$ |

10,192 |

|

|

$ |

16,363 |

|

Gross margin, as reported |

|

|

(1,358 |

) |

|

|

(1,233 |

) |

Gross margin percentage, as reported |

|

|

(13 |

%) |

|

|

(8 |

%) |

|

|

|

|

|

|

|

Adjusted gross margin1 |

|

$ |

(1,358 |

) |

|

$ |

(1,233 |

) |

Adjusted gross margin percentage1 |

|

|

(13 |

%) |

|

|

(8 |

%) |

1 Adjusted gross margin and adjusted gross margin percentage are non-GAAP measures. See "Non-GAAP Measures". |

|

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |