UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

For the month of September 2024

Commission File Number: 001-39127

Canaan Inc.

28 Ayer Rajah Crescent

#06-08

Singapore 139959

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form 40-F ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate

by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Canaan

Inc. Closes Third Tranche of Preferred Shares Financing

Canaan

Inc. (NASDAQ: CAN) (“Canaan” or the “Company”) closed the third

and final tranche of its previously announced preferred shares financing (the “Preferred Shares Financing”), raising additional

total gross proceeds of $50 million. Pursuant to the third tranche of Preferred Shares Financing, the Company issued 50,000 Preferred

Shares (the “Third Closing Shares”) at a price of US$1,000.00 per Preferred Share. Canaan agreed that the proceeds

from the sale of the Third Closing Shares will be used by the Company and/or its subsidiaries to

manufacture or invest in digital mining sites and equipment to be deployed or sold in North America, including any acquisition or disposition

of assets from or between subsidiaries.

On

November 27, 2023, the Company entered into a securities purchase agreement (the “Securities Purchase Agreement”) with an

institutional investor (the “Buyer”), pursuant to which the Company agreed to issue and sell to the Buyer up to 125,000 Series

A Convertible Preferred Shares at the price of US$1,000.00 for each Preferred Share. On December

11, 2023, the Company closed the first tranche of the Preferred Shares Financing, raising total gross proceeds of $25 million. On

January 22, 2024, the Company closed the second tranche of the Preferred Shares Financing, raising total gross proceeds of $50 million.

On

September 27, 2024, the Company closed the third and final tranche of the Preferred Shares

Financing under the Securities Purchase Agreement. The Third Closing Shares were sold under the amended terms of certain documents executed

on September 26, 2024, namely, a global amendment (the “Global Amendment”) to the Securities Purchase Agreement as well as

an amended certificate of designations (the “Certificate of Designations”) of Preferred Shares, par value US$0.00000005 per

share, as adopted by the Company. The amendments to the original terms of the securities purchase agreement and certificate of designations

include, among other things,

| (a) | while

the first and second tranches of preferred shares were sold as registered securities under

a registration statement of the Company, the Third Closing Shares were issued and sold as

“restricted securities” under applicable U.S. federal and state securities laws,

and the Buyer acknowledged that Company has no obligation to register or qualify the Third

Closing Shares, or the ADSs into which they may be converted; |

| (b) | the

Third Closing Shares are convertible, after six (6) months following their issuance, into

Class A Ordinary Shares that can be deposited with the Depositary for the issuance of ADSs;

and |

| (c) | so

long as the Buyer holds any of the Preferred Shares or any Conversion Shares, the Buyer will

limit its aggregate sales of Conversion Shares on the open market in any given calendar week

to no more than 10% of the weekly trading volume of the ADSs on all trading markets for such

week. |

The

Buyer and the Company have also made amendments to the preferred share conversion mechanism under the Certificate of Designations. First,

the Fixed Conversion Price has increased. For the first and second tranches, the Fixed Conversion Price was 120% of the Weighted Average

Price of the ADSs on the Trading Day immediately preceding the applicable Issuance Date of the Series A Preferred Shares being converted.

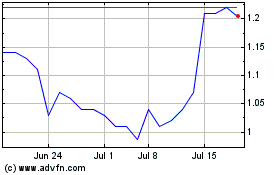

For the third tranche, the Fixed Conversion Price has been modified to $4.00. For reference, the closing trading price of the Company’s

ADSs on September 27, 2024, was $1.06. Second, a 90-day average Secured Overnight Financing Rate (“SOFR”) published

on the Trading Day immediately preceding the date of conversion, or a SOFR factor, has been added to the calculation of the Conversion

Amount, reflecting an additional cost for the Company to use the proceeds from the sales of the Third

Closing Shares until the Conversion Date. As of September 27, 2024, the 90-day average SOFR was 5.32675%.

The Securities

Purchase Agreement (as amended) contains customary representations, warranties and agreements by the Company and the Buyer, and

indemnification obligations of the Company against certain liabilities, including for liabilities under the Securities Act of 1933, as

amended. The provisions of the Securities Purchase Agreement (as amended), including the

representations and warranties contained therein, are not for the benefit of any party other than the parties to such agreement and are

not intended as a document for investors and the public to obtain factual information about the current state of affairs of the Company.

Rather, investors and the public should look to other disclosures contained in the Company’s filings with the SEC.

The

Certificate of Designations creates the Preferred Shares and provides for the designations, preferences and relative, participating,

optional or other rights, and the qualifications, limitations or restrictions thereof, of the Preferred Shares, which becomes effective

upon its adoption.

The

foregoing description does not purport to be complete and is qualified in its entirety by reference to the full text of the Securities

Purchase Agreement, as amended, and the Certificate of Designations, as amended. The full text of the amendment to the Securities

Purchase Agreement and the form of amended Certificate of Designations are attached hereto as Exhibits 10.1 and 10.2, each of which is

incorporated herein by reference. The full text of the Securities Purchase Agreement was previously

filed as an exhibit to the Company’s current report on Form 6-K dated November 28, 2023. Capitalized terms used in this

Form 6-K without definition shall have the meanings given to them in the Securities Purchase Agreement, the Certificate of Designations,

and any amendments thereto.

This

Form 6-K is for informational purposes only and is not an offer to sell or a solicitation of an offer to buy any securities, which is

made only by means of a prospectus supplement and related prospectus. There will be no sale of these securities in any jurisdiction in

which such an offer, solicitation of an offer to buy or sale would be unlawful.

About Canaan Inc.

Established

in 2013, Canaan Inc. (NASDAQ: CAN), is a technology company focusing on ASIC high-performance computing chip design, chip research and

development, computing equipment production, and software services. Canaan has extensive experience in chip design and streamlined production

in the ASIC field. In 2013, Canaan's founding team shipped to its customers the world's first batch of mining machines incorporating

ASIC technology in bitcoin's history under the brand name Avalon. In 2019, Canaan completed its initial public offering on the Nasdaq

Global Market. To learn more about Canaan, please visit https://www.canaan.io/.

Safe Harbor Statement

This Form 6-K contains forward−looking

statements. These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform

Act of 1995. These forward−looking statements can be identified by terminology such as “will,” “expects,”

“anticipates,” “future,” “intends,” “plans,” “believes,” “estimates”

and similar statements. Among other things, Canaan Inc.’s anticipated financing plans and its intended use of proceeds contain

forward−looking statements. Canaan Inc. may also make written or oral forward−looking statements in its periodic reports

to the U.S. Securities and Exchange Commission (“SEC”) on Forms 20−F and 6−K, in its annual report to shareholders,

in press releases and other written materials and in oral statements made by its officers, directors or employees to third parties. Statements

that are not historical facts, including statements about Canaan Inc.’s beliefs and expectations, are forward−looking statements.

Forward−looking statements involve inherent risks and uncertainties. A number of factors could cause actual results to differ materially

from those contained in any forward−looking statement, including but not limited to the following: the Company’s goals and

strategies; the Company’s future business development, financial condition and results of operations; the expected growth of the

bitcoin industry and the price of bitcoin; the Company’s expectations regarding demand for and market acceptance of its products,

especially its bitcoin mining machines; the Company’s expectations regarding maintaining and strengthening its relationships with

production partners and customers; the Company’s investment plans and strategies, fluctuations in the Company’s quarterly

operating results; competition in its industry in China; and relevant government policies and regulations relating to the Company and

cryptocurrency. Further information regarding these and other risks is included in the Company’s filings with the SEC. All information

provided in this Form 6-K and in the attachments is as of the date of this Form 6-K, and Canaan Inc. does not undertake any obligation

to update any forward−looking statement, except as required under applicable law.

Exhibit Index

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

| |

Canaan Inc. |

| |

|

| |

By: |

/s/ Nangeng Zhang |

| |

|

|

| |

Name: Nangeng Zhang

Title: Chairman and Chief Executive Officer |

Date: September 30, 2024

Exhibit 10.1

GLOBAL AMENDMENT

This Global Amendment

(this “Amendment”) is entered into as of September 26, 2024 by and between [the Investor]

(“Investor”), and Canaan Inc., a Cayman Islands exempted company (“Company”). Capitalized

terms used in this Amendment without definition shall have the meanings given to them in the Purchase Agreement (as defined

below).

A. Company

and Investor previously entered into a certain Securities Purchase Agreement dated as of November 27, 2023 (the “Purchase

Agreement”), pursuant to which Company shall issue and sell to Investor up to 125,000 Series A Convertible Preferred Shares

(the “Preferred Shares”). As of the date hereof, Investor had purchased 75,000 Preferred Shares from Company,

including 25,000 Preferred Shares in the First Closing and 50,000 Preferred Shares in the Second Closing.

B. Company

and Investor desire for Investor to purchase the final tranche of 50,000 Preferred Shares (the “Third Closing Shares”)

for a purchase price of $50,000,000.00 in aggregate (the “Third Closing Purchase Price”).

C. Investor

and Company have agreed, subject to the terms, amendments, conditions and understandings expressed in this Amendment, to amend the Purchase

Agreement as set forth herein.

NOW, THEREFORE, for good and

valuable consideration, the receipt and sufficiency of which are hereby acknowledged, the parties agree as follows:

1. Recitals.

Each of the parties hereto acknowledges and agrees that the recitals set forth above in this Amendment are true and accurate and are hereby

incorporated into and made a part of this Amendment.

2. No

Registration. Investor understands that the Third Closing Shares are "restricted securities" under applicable U.S. federal

and state securities laws and that, pursuant to these laws, Investor must hold the Third Closing Shares indefinitely unless they

are registered under the Securities Act of 1933, as amended (the “Securities Act”), or an exemption from such registration

and qualification requirements is available. Investor acknowledges that Company has no obligation to register or qualify the Third Closing

Shares, or the ADSs into which it may be converted. Investor hereby waives the closing condition set forth in Section 7(ii)(with

respect to the opinion of the Company’s U.S. counsel), 7(iii) and 7(ix) of the Purchase Agreement in connection with the

Third Closing.

3. Closing.

The issuance and sale of the Third Closing Shares will be treated as the Third Closing under the Purchase Agreement and will be subject

to conditions set forth in Sections 6 and 7 thereof, unless to the extent modified in this Amendment and/or waived by Investor. On the

Third Closing Date, Investor will pay the Third Closing Purchase Price to Company via wire transfer of immediately available funds

against delivery of the Third Closing Shares. Investor will not be obligated to pay the Third Closing Purchase Price until Company files

the amendment to the Certificate of Designations, Preferences and Rights of Series A Convertible Preferred Shares (“COD”)

attached hereto as Exhibit A.

4. Pre-Delivery

Shares. Within thirty (30) Trading Days of the issuance of the Third Closing Shares, Investor will sell to Company

2,800,000 of the Pre-Delivery Shares allocated to Investor in the First Closing and the Second Closing and Company will pay to

Investor the repurchase price of $2.10. Company acknowledges that 1,345,203 of the 2,800,000 Pre-Delivery Shares being returned to

Company will be returned in the form of 20,178,045 restricted class A ordinary shares. Company will have no obligation to issue any

Pre-Delivery Shares to Investor in connection with the Third Closing. For the avoidance of doubt, pursuant to

Section 4(s) (Return of Pre-Delivery Share) of the Purchase Agreement, upon such date no Preferred Shares are then held by

Investor (whether following the conversion or redemption, as applicable, of all Preferred Shares then held by such

Investor), Investor shall within thirty (30) Trading Days sell to Company the remaining 8,000,000 of the Pre-Delivery Shares

and the Company will pay to Investor the repurchase price of $6.00. Company will be responsible for any expenses and fees related to

the repurchase and cancellation of the 10,800,000 Pre-Delivery Shares.

5. Sales

Limitation. So long as Investor holds any of the Preferred Shares or any Conversion Shares, Investor will limit its aggregate

sales of Conversion Shares on the open market in any given calendar week to no more than 10% of the weekly trading volume of the ADSs

on all trading markets for such week. In the event Investor breaches the foregoing covenant, Company’s sole and exclusive remedy

will be to receive a cash payment from Investor in an amount equal to fifty percent (50%) of the net proceeds Investor received from excess

sales in such week.

6. Use

of Proceeds. Company covenants and agrees that the proceeds from the sale of the Third Closing Shares will be used by Company and/or

its subsidiaries to manufacture or invest in digital mining sites and equipment to be deployed or sold in North America, including any

acquisition or disposition of assets from or between subsidiaries.

7. Legal

Fees. Company agrees to pay $25,000.00 to Investor to cover Investor’s legal fees, accounting costs, due diligence, monitoring

and other transaction costs incurred in connection with the purchase and sale of the Third Closing Shares, which amount will be deducted

from the Third Closing Purchase Price. For clarity, save for the payment of fees specified in this clause, each party will be responsible

for its own expenses incurred in the negotiation and consummation of the definitive transaction documentation.

8. Company

and Investor agree that the following provisions under “3. REPRESENTATIONS AND WARRANTIES OF THE COMPANY,” “4.

COVENANTS,” and “5. REGISTER; DEPOSITARY INSTRUCTIONS; ASSISTANCE IN ADS CONVERSION” of the Purchase

Agreement shall not apply in connection with the Third Closing:

Sections 3(a) (Shelf Registration

Statement), 3(b) (Prospectus), 3(g)(i) and (ii) (Disclosure), 3(h) (Offering Materials), 3(i) (Ineligible Issuer

Status), 3(j) (Financial Statements), 4(b) (Maintenance of Registration Statement), 4(c) (Prospectus Supplement and Blue

Sky), 4(d) (Use of Proceeds), and 5(b) (Depositary Instructions).

9. Representations

and Warranties. In order to induce Investor to enter into this Amendment, Company, for itself, and for its affiliates, successors

and assigns, hereby acknowledges, represents, warrants and agrees as follows:

(a) Company

has full power and authority to enter into this Amendment and to incur and perform all obligations and covenants contained herein, all

of which have been duly authorized by all proper and necessary action. No consent, approval, filing or registration with or notice to

any governmental authority is required as a condition to the validity of this Amendment or the performance of any of the obligations of

Company hereunder.

(b) There

is no fact known to Company or which should be known to Company which Company has not disclosed to Investor on or prior to the date of

this Amendment which would or could materially and adversely affect the understanding of Investor expressed in this Amendment or any representation,

warranty, or recital contained in this Amendment.

(c) Except

as expressly set forth in this Amendment, Company acknowledges and agrees that neither the execution and delivery of this Amendment nor

any of the terms, provisions, covenants, or agreements contained in this Amendment shall in any manner release, impair, lessen, modify,

waive, or otherwise affect the liability and obligations of Company under the terms of the Purchase Agreement.

(d) Company

has no defenses, affirmative or otherwise, rights of setoff, rights of recoupment, claims, counterclaims, actions or causes of action

of any kind or nature whatsoever against Investor, directly or indirectly, arising out of, based upon, or in any manner connected with,

the transactions contemplated hereby, whether known or unknown, which occurred, existed, was taken, permitted, or begun prior to the execution

of this Amendment and occurred, existed, was taken, permitted or begun in accordance with, pursuant to, or by virtue of any of the terms

or conditions of the Purchase Agreement. To the extent any such defenses, affirmative or otherwise, rights of setoff, rights of recoupment,

claims, counterclaims, actions or causes of action exist or existed, such defenses, rights, claims, counterclaims, actions and causes

of action are hereby waived, discharged and released. Company hereby acknowledges and agrees that the execution of this Amendment by Investor

shall not constitute an acknowledgment of or admission by Investor of the existence of any claims or of liability for any matter or precedent

upon which any claim or liability may be asserted.

(e) Company

represents and warrants that as of the date hereof no events of default or other material breaches exist under the Purchase Agreement,

or have occurred prior to the date hereof.

(f) Investor

acknowledges that as of the date hereof it is an “accredited investor” as defined in Rule 501(a) of Regulation D

under the Securities Act. Investor further acknowledges that it is familiar with Rule 144 of the rules and regulations of the

Commission, as amended, promulgated pursuant to the Securities Act (“Rule 144”), and that it has been advised

that Rule 144 permits resales only under certain circumstances. Investor understands that to the extent that Rule 144 is not

available, it will be unable to sell any Securities without either registration under the Securities Act or the existence of another exemption

from such registration requirement.

(g) Investor

represents and warrants that it is acquiring the Third Closing Shares for investment purposes for its own account, for investment purposes

only and not with a view towards, or for resale in connection with, any public sale or distribution thereof. Investor further acknowledges

that (i) it has received and carefully reviewed such information and documentation relating to Company and the Preferred Shares that

Investor has requested, and (ii) it has such knowledge and experience in financial business matters as to be capable of evaluating

the merits and risks of its prospective investment in the Third Closing Shares.

10. Restrictive

Legend. Investor understands that the Preferred Shares acquired in connection with the Third Closing, unless and until registered

under the Securities Act or sold in compliance with an exemption from such registration, shall bear a legend to substantially the following

effect:

THE SECURITIES REPRESENTED HEREBY HAVE

NOT BEEN REGISTERED UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “ACT”), AND MAY NOT BE OFFERED, SOLD OR OTHERWISE

TRANSFERRED, PLEDGED OR HYPOTHECATED UNLESS AND UNTIL REGISTERED UNDER THE ACT OR, IN THE OPINION OF COUNSEL SATISFACTORY TO THE

ISSUER OF THESE SECURITIES, SUCH OFFER, SALE OR TRANSFER, PLEDGE OR HYPOTHECATION IS IN COMPLIANCE THEREWITH.

11. Company

Disclosure Letter. Schedule II to the Purchase Agreement (Company Disclosure Letter) shall be replaced in its entirety by the Revised

Schedule II attached hereto.

12. Certificate

of Good Standing and Articles. The Company and the Investor agree to amend the closing conditions set forth in Sections 7(iv) and

7(v) of the Purchase Agreement, as indicated by the underlined text below, in connection with the Third Closing.

(iv) The

Company shall have delivered to such Buyer a certificate evidencing the formation and good standing of the Company in such entity's jurisdiction

of formation issued by the Registrar (or comparable office) of such jurisdiction, as of a date within thirty (30) days prior

to each Closing Date.

(v) The

Company shall have delivered to such Buyer a certified copy of the Articles of Association as certified by the Registrar of the Cayman

Islands (or a fax or pdf copy of such certificate) within thirty (30) days prior to each Closing Date.

13. Other

Terms Unchanged. The Purchase Agreement, as amended by this Amendment, remains and continues in full force and effect, constitutes

legal, valid, and binding obligations of each of the parties, and is in all respects agreed to, ratified, and confirmed. Any reference

to the Purchase Agreement after the date of this Amendment is deemed to be a reference to the Purchase Agreement as amended by this Amendment.

If there is a conflict between the terms of this Amendment and the Purchase Agreement, the terms of this Amendment shall control. No forbearance

or waiver may be implied by this Amendment. Except as expressly set forth herein, the execution, delivery, and performance of this Amendment

shall not operate as a waiver of, or as an amendment to, any right, power, or remedy of Investor under the Purchase Agreement, as in effect

prior to the date hereof.

14. No

Reliance. Company acknowledges and agrees that neither Investor nor any of its officers, directors, members, managers, equity

holders, representatives or agents has made any representations or warranties to Company or any of its agents, representatives, officers,

directors, or employees except as expressly set forth in this Amendment and the Purchase Agreement and, in making its decision to enter

into the transactions contemplated by this Amendment, Company is not relying on any representation, warranty, covenant or promise of Investor

or its officers, directors, members, managers, equity holders, agents or representatives other than as set forth in this Amendment.

15. Counterparts.

This Amendment may be executed in any number of counterparts, each of which shall be deemed an original, but all of which together shall

constitute one instrument. The parties hereto confirm that any electronic copy of another party’s executed counterpart of this Amendment

(or such party’s signature page thereof) will be deemed to be an executed original thereof.

16. Further

Assurances. Each party shall do and perform or cause to be done and performed, all such further acts and things, and shall execute

and deliver all such other agreements, certificates, instruments and documents, as the other party may reasonably request in order to

carry out the intent and accomplish the purposes of this Amendment and the consummation of the transactions contemplated hereby.

[Remainder of page intentionally left blank]

IN WITNESS WHEREOF, the undersigned have executed

this Amendment as of the date set forth above.

| |

COMPANY: |

| |

|

| |

Canaan

Inc. |

| |

|

| |

By: |

/s/

Nangeng Zhang |

| |

Nangeng Zhang |

| |

Chairman and Chief

Executive Officer |

| |

|

| |

INVESTOR: |

| |

|

| |

[INVESTOR] |

| |

|

| |

By: |

|

| |

Authorized Signatory |

[Signature Page to Global Amendment]

Revised Schedule II

Company Disclosure Letter

Exhibit 10.2

CERTIFICATE OF DESIGNATIONS, PREFERENCES

AND RIGHTS OF SERIES A CONVERTIBLE PREFERRED SHARES

OF

CANAAN INC.

Canaan Inc. (the "Company"),

an exempted company incorporated and existing under the Companies Act (As Revised) of the Cayman Islands (the "Companies Act"),

does hereby certify that, pursuant to authority conferred upon the Board of Directors of the Company (the "Board") by

the Amended and Restated Memorandum and Articles of Association of the Company (the "Memorandum and Articles of Association"),

and pursuant to the provisions of the Companies Act, the Board adopted resolutions (i) re-designating 125,000 authorized but unissued

class A ordinary shares, par value US$0.00000005 (the “Class A Ordinary Shares”) each into Series A Convertible

Preferred Shares (as defined below) , and (ii) providing for the designations, preferences and relative, participating, optional

or other rights, and the qualifications, limitations or restrictions thereof, of 125,000 Series A Convertible Preferred Shares of

the Company, as follows:

RESOLVED, that pursuant and

in accordance with the authority delegated to the Board under Article 9 of the Memorandum and Articles of Association, the authorized

share capital of the Company be re-designated from US$50,000 divided into 1,000,000,000,000 shares comprising (i) 999,643,375,556

Class A Ordinary Shares, and (ii) 356,624,444 class B ordinary shares, par value US$0.0000005 each (the "Class B

Ordinary Shares", and together with the Class A Ordinary Shares, the "Ordinary Shares") to US$50,000

divided into 1,000,000,000,000 shares comprising (i) 999,643,250,556 Class A Ordinary Shares, (ii) 356,624,444 Class B

Ordinary Shares, and (iii) 125,000 Series A Convertible Preferred Shares, par value US$0.00000005 per share (the "Series A

Preferred Shares"), by the re-designation of 125,000 authorized but unissued Class A Ordinary Shares in the authorized share

capital of the Company as 125,000 Series A Preferred Shares, which shall have the following powers, designations, preferences and

other special rights:

(1) RANKING.

The Series A Preferred Shares shall rank prior and superior to all of the Ordinary Shares and any other shares in the capital of

the Company with respect to the preferences as to dividends, distributions and payments upon a Liquidation Event (such shares being referred

to hereinafter collectively as "Junior Shares"). The rights of the Junior Shares shall be of junior rank to and subject

to the preferences and relative rights of the Series A Preferred Shares.

(2) PAYMENTS

OF STATED VALUE; PREPAYMENT. If any Series A Preferred Shares remain issued and outstanding on the Maturity Date, the Company

shall redeem such Series A Preferred Shares in cash in an amount equal to 105% of the Conversion Amount (as defined in Section 5(b)(i))

for each such Series A Preferred Share. The "Maturity Date" with respect to any Series A Preferred Shares shall

be the date that is twelve (12) months immediately following the applicable Issuance Date of such Series A Preferred Shares, as may

be extended at the option of each Holder (i) in the event that, and for so long as, a Triggering Event (as defined in Section 6(a))

shall have occurred and be continuing on the Maturity Date (as may be extended pursuant to this Section 2) or any event shall have

occurred and be continuing on the Maturity Date (as may be extended pursuant to this Section 2) that with the passage of time and

the failure to cure would result in a Triggering Event and (ii) through the date that is ten (10) Business Days after the consummation

of a Change of Control in the event that a Change of Control is publicly announced or a Change of Control Notice (as defined in Section 7(c))

is delivered prior to the Maturity Date. Other than as specifically permitted by this Certificate of Designations, the Company may not

prepay any portion of the outstanding Stated Value, accrued and unpaid dividends, if any, or accrued and unpaid Late Charges (as defined

in Section 26(b)) on Stated Value and dividends, if any.

(3) LIQUIDATION.

(a) Preferential

Payment to Holders. In the event of a Liquidation Event, holders of Series A Preferred Shares (each, a "Holder"

and collectively, the "Holders") shall be entitled to receive in cash out of the assets of the Company, whether from

capital or from earnings available for distribution to its shareholders (the "Liquidation Funds"), upon such Liquidation

Event, but before any amount shall be paid to the holders of any Junior Shares, an amount per Series A Preferred Share equal

to the greater of (i) the Conversion Amount and (ii) the amount that would have been received had such Series A Preferred

Shares been converted into the Class A Ordinary Shares underlying the ADSs issuable upon conversion of the Series A Preferred

Shares immediately prior to such Liquidation Event at the then effective Alternative Conversion Price (without regard to any limitations

on conversion); provided that, if the Liquidation Funds are insufficient to pay the full amount due to the Holders and holders of shares

of other classes or series of preferred shares of the Company, if any, that are of equal rank with the Series A Preferred Shares

as to payments of Liquidation Funds (such shares being referred to hereinafter collectively as "Pari Passu Shares"),

if any, then each Holder and each holder of any such Pari Passu Shares shall receive a percentage of the Liquidation Funds equal to the

full amount of Liquidation Funds payable to such Holder as a liquidation preference, in accordance with their respective Certificate of

Designations, Preferences and Rights, as a percentage of the full amount of Liquidation Funds payable to all holders of Series A

Preferred Shares and Pari Passu Shares.

(b) Maximum

Percentage. Notwithstanding the foregoing, to the extent that a Holder's right to participate in any liquidation pursuant to this

Section 3 would result in such Holder and such Holder's other Attribution Parties exceeding the Maximum Percentage (as defined in

Section 5(d)), if applicable, then such Holder shall not be entitled to participate in such liquidation to such extent (and shall

not be entitled to beneficial ownership of such Class A Ordinary Shares as a result of such liquidation (and beneficial ownership)

to such extent) and the portion of such liquidation shall be held in abeyance for such Holder until such time or times as its right

thereto would not result in such Holder and its other Attribution Parties exceeding the Maximum Percentage, if applicable, at which time

or times such Holder shall be granted such rights (and any rights under this Section 3 to be held similarly in abeyance) to the same

extent as if there had been no such limitation.

(4) DIVIDENDS.

(a) From

and after the applicable Issuance Date, the Holders shall be entitled to receive dividends per Series A Preferred Share when, as

and if declared by the Board.

(b) In

addition to the dividends, if any, referred to in Section 4(a), from and after each Issuance Date, the Holders shall be entitled

to receive such dividends paid and distributions made to the holders of ADSs or Class A Ordinary Shares to the same extent as if

such Holders had converted the Series A Preferred Shares into ADSs or Class A Ordinary Shares underlying such ADSs (without

regard to any limitations on conversion and assuming for such purpose that the Series A Preferred Shares were converted at the Alternate

Conversion Price as of the applicable record date) and had held such ADSs or Class A Ordinary Shares on the record date for such

dividends and distributions. Payments under the preceding sentence shall be made concurrently with the dividends or distribution to the

holders of ADSs or Class A Ordinary Shares. Following the occurrence of a Liquidation Event and the payment in full to a Holder

of its applicable liquidation preference as set forth in Section 3 above, such Holder shall cease to have any rights hereunder to

participate in any future dividends or distributions made to the holders of ADSs or Class A Ordinary Shares. The Company shall not

declare or pay any dividends on any Junior Shares or Pari Passu Shares unless the Holders of Series A Preferred Shares then issued

and outstanding shall simultaneously receive dividends on a pro rata basis as if the Series A Preferred Shares had been converted

into ADSs or the underlying Class A Ordinary Shares represented by such ADSs issuable upon conversion of the Series A Preferred

Shares pursuant to Section 5 immediately prior to the record date for determining the shareholders eligible to receive such dividends

(without regard to any limitations on conversion). Notwithstanding the foregoing, to the extent that a Holder's right to participate in

any such dividends or distribution pursuant to this Section 4 would result in such Holder and its other Attribution Parties exceeding

the Maximum Percentage, then such Holder shall not be entitled to participate in such dividends or distribution to such extent (and shall

not be entitled to beneficial ownership of such Class A Ordinary Shares as a result of such dividends or distribution (and beneficial

ownership) to such extent) and the portion of such dividends or distribution shall be held in abeyance for such Holder until such time

or times as its right thereto would not result in such Holder and its other Attribution Parties exceeding the Maximum Percentage, at which

time or times such Holder shall be granted such rights (and any rights under this Section 4 on such initial rights or on any subsequent

such rights to be held similarly in abeyance) to the same extent as if there had been no such limitation.

(5) CONVERSION

OF SERIES A PREFERRED SHARES. The Series A Preferred Shares shall be convertible into Class A Ordinary Shares that can

be deposited with the Depositary for the issuance of ADSs at any time or times following the date that is six (6) months from the

applicable Issuance Date of such Series A Preferred Shares on the terms and conditions set forth in this Section 5.

(a) Conversion

Right. Subject to the provisions of Section 5(d), at any time or times on or after the date that is six (6) months from

the applicable Issuance Date, any Holder shall be entitled to convert any portion of the outstanding and unpaid Conversion Amount into

fully paid and non-assessable ADSs in accordance with Section 5(c), at the Conversion Rate (as defined below), subject to the delivery

of legal opinion(s) and representation letter(s) in form and substance reasonably satisfactory to the Depositary in connection

with such proposed conversion and deposit of the ADSs. The Company shall not issue any fraction of an ADS upon any conversion. If the

issuance would result in the issuance of a fraction of an ADS, the Company shall round such fraction of ADS up to the nearest

whole share. The Company shall pay any and all transfer, stamp and similar taxes that may be payable with respect to the issuance and

delivery of ADSs upon conversion of any Conversion Amount.

(b) Conversion

Rate. The number of ADSs issuable upon conversion of any Conversion Amount pursuant to Section 5(a) shall be determined

by dividing (x) such Conversion Amount by (y) the Conversion Price less the Issuance Fee (as defined below) (the "Conversion

Rate").

(i) "Conversion

Amount" means the sum of (A) the portion of the Stated Value to be converted, redeemed or otherwise with respect to which

this determination is being made, multiplied by the SOFR Factor, (B) accrued and unpaid dividends, if any, with respect to such Stated

Value, and (C) accrued and unpaid Late Charges, if any, with respect to such Stated Value and dividends.

(ii) "Conversion

Price" means, as of any Conversion Date or other date of determination, the lower of (x) $4.00 (the "Fixed Conversion

Price") and (y) the Market Price as in effect on the applicable date of determination, subject to adjustment as provided

herein.

(iii) “Issuance

Fee” means the fee charged by the Depositary (as defined in the Securities Purchase Agreement (as defined below)) for the issuance

of each ADS.

(c) Mechanics

of Conversion.

(i) Optional

Conversion. To convert Series A Preferred Shares into ADSs on any date (a "Conversion Date"), a Holder shall

(A) deliver on or prior to 11:59 p.m., New York time, on such date, a copy of an executed notice of conversion in the form attached

hereto as Exhibit I (a "Conversion Notice") to the Company and (B) if required by Section 5(c)(iv),

but without delaying the Company's requirement to deliver ADSs on the applicable Share Delivery Date (as defined below), surrender the

original certificates representing the Series A Preferred Shares (the "Series A Preferred Share Certificates")

being converted to a common carrier for delivery to the Company as soon as practicable on or following such date (or an indemnification

undertaking with respect to such Series A Preferred Share Certificates in the case of its loss, theft, destruction or mutilation

in compliance with the procedures set forth in Section 28). In lieu of converting the accrued and unpaid dividends, if any, on the

portion of the Conversion Amount that a Holder elects to convert and Late Charges, if any, on such Conversion Amount and dividends in

a number of fully paid and nonassessable ADSs (rounded to the nearest whole share in accordance with Section 5(a)), such Holder may

indicate in a Conversion Notice it elects to have all or any portion of any accrued and unpaid dividends on such Conversion Amount and

Late Charges, if any, on such Conversion Amount and dividends be paid in cash, by wire transfer of immediately available funds in accordance

with the Holder's wire instructions. No ink-original Conversion Notice shall be required, nor shall any medallion guarantee (or other

type of guarantee or notarization) of any Conversion Notice be required. Notwithstanding anything herein to the contrary, if, by virtue

of clause (y) of the definition of "Conversion Price", the Conversion Price with respect to a Holder's conversion of Series A

Preferred Shares is less than the Conversion Price specified by such Holder in its Conversion Notice, such Holder may, in its sole and

absolute discretion, deliver an updated Conversion Notice to the Company on or before the first (1st) Trading Day immediately

following the delivery by a Holder of its Conversion Notice (an "Updated Conversion Notice") updating (x) the Conversion

Price (and aggregate number of ADSs to be issued upon such conversion) and (y) the aggregate number of Series A Preferred Shares

subject to such Conversion Notice, as specified in such Holder's Conversion Notice.

(ii) Company's

Response. On or before the first (1st) Business Day following the date of delivery of a Conversion Notice, the Company shall transmit

via electronic mail a confirmation of receipt of such Conversion Notice to the applicable Holder and the Company's transfer agent (the

"Transfer Agent") and Depositary. On or before the sixth (6th) Business Day following the date on which

a Holder has delivered a Conversion Notice to the Company, provided, however that if a Holder delivers an Updated Conversion Notice to

the Company after 10:00 a.m., New York time on the Trading Day immediately following the applicable Conversion Date, such date, solely

with respect to the applicable conversion by such Holder, shall be extended by one (1) Trading Day (a "Share Delivery Date"),

the Company shall cause the Depositary to credit such aggregate number of ADSs to which such Holder shall be entitled to such Holder's

or its designee's balance account with the Depository Trust Company ("DTC"). If the number of Series A Preferred

Shares represented by the Series A Preferred Share Certificate(s) submitted for conversion, as required by Section 5(c)(iv),

is greater than the number of Series A Preferred Shares being converted, then the Company shall as soon as practicable and in no

event later than three (3) Business Days after receipt of the Series A Preferred Share Certificate(s) and at its own expense,

issue and deliver to such Holder a new Series A Preferred Share Certificate representing the number of Series A Preferred Shares

not converted. The Person or Persons entitled to receive the ADSs issuable upon a conversion of Series A Preferred Shares shall be

treated for all purposes as the record holder or holders of such ADSs and underlying Class A Ordinary Shares on the applicable Conversion

Date, irrespective of the date such ADSs are credited to such Holder's account with DTC.

(iii) Company's

Failure to Timely Convert. If the Company shall fail on or prior to the applicable Share Delivery Date to cause the Depositary

to credit such Holder's balance account with DTC for the number of ADSs to which such Holder is entitled upon such Holder's conversion

of any Conversion Amount (a "Conversion Failure"), then (A) if such Conversion Failure continues for five (5) consecutive

Trading Days, the Company shall pay damages to such Holder for each Trading Day following such fifth (5th) consecutive Trading

Day of such Conversion Failure in an amount equal to 1.5% of the product of (1) the sum of the number of ADSs not issued to such

Holder on or prior to the Share Delivery Date and to which such Holder is entitled, and (2) any trading price of the ADSs selected

by such Holder in writing as in effect at any time during the period beginning on the applicable Conversion Date and ending on the date

of such payment and (B) such Holder, upon written notice to the Company, may void its Conversion Notice with respect to, and retain

or have returned, as the case may be, any portion of such Holder's Series A Preferred Shares that has not been converted pursuant

to such Conversion Notice; provided that the voiding of a Conversion Notice shall not affect the Company's obligations to make

any payments which have accrued prior to the date of such notice. In addition to the foregoing, if the Company shall fail on or prior

to the applicable Share Delivery Date to cause the Depositary to credit such Holder's balance account with DTC for the number of ADSs

to which such Holder is entitled upon such Holder's conversion of any Conversion Amount or on any date of the Company's obligation to

cause the Depositary to deliver ADSs as contemplated pursuant to clause (y) below, and if on or after such Trading Day such Holder

purchases (in an open market transaction or otherwise) ADSs to deliver in satisfaction of a sale by such Holder of ADSs issuable upon

such conversion that such Holder anticipated receiving from the Company (a "Buy-In"), then the Company shall, within

five (5) Trading Days after such Holder's request and in such Holder's discretion, either (x) pay cash to such Holder in an

amount equal to such Holder's total purchase price (including brokerage commissions and other out-of-pocket expenses, if any) for the

ADSs so purchased (the "Buy-In Price"), at which point the Company's obligation to issue and deliver such certificate

or credit such Holder's balance account with DTC for the ADSs to which such Holder is entitled upon such Holder's conversion of the applicable

Conversion Amount shall terminate, or (y) promptly honor its obligation to credit such Holder's balance account with DTC for such

ADSs and pay cash to such Holder in an amount equal to the excess (if any) of the Buy-In Price over the product of (A) such number

of ADSs, times (B) the price at which the sell order giving rise to such purchase obligation was executed. Notwithstanding the foregoing,

on up to two (2) separate occasions, the Company, at its election, will have an additional ten (10) Trading Days following the

five (5) Trading Day grace period following the Conversion Failure to deliver the applicable ADSs without the application of the

failure to deliver fees set forth above.

(iv) Book-Entry.

Notwithstanding anything to the contrary set forth herein, upon conversion of Series A Preferred Shares in accordance with the terms

hereof, a Holder shall not be required to physically surrender the certificate representing the Series A Preferred Shares to the

Company unless (A) the full or remaining number of Series A Preferred Shares represented by the certificate are being converted

or (B) a Holder has provided the Company with prior written notice (which notice may be included in a Conversion Notice) requesting

reissuance of Series A Preferred Shares upon physical surrender of any Series A Preferred Shares. Each Holder and the Company

shall maintain records showing the number of Series A Preferred Shares so converted and the dates of such conversions or shall use

such other method, reasonably satisfactory to the Holders and the Company, so as not to require physical surrender of the certificate

representing the Series A Preferred Shares upon each such conversion. If the Company does not update its records to record such Stated

Value, dividends and Late Charges converted and/or paid (as the case may be) and the dates of such conversions and/or payments (as the

case may be) within two (2) Business Days of such occurrence, then the Company's records shall be automatically deemed updated to

reflect such occurrence. In the event of any dispute or discrepancy, such records of the Company establishing the number of Series A

Preferred Shares to which the record holder is entitled shall be controlling and determinative in the absence of manifest error. Notwithstanding

the foregoing, if Series A Preferred Shares represented by a certificate are converted as aforesaid, a Holder may not transfer the

certificate representing the Series A Preferred Shares unless such Holder first physically surrenders the certificate representing

the Series A Preferred Shares to the Company, whereupon the Company will forthwith issue and deliver upon the order of such Holder

a new certificate of like tenor, registered as such Holder may request, representing in the aggregate the remaining number of Series A

Preferred Shares represented by such certificate. A Holder and any assignee, by acceptance

of a certificate, acknowledge and agree that, by reason of the provisions of this paragraph, following conversion of any Series A

Preferred Shares, the number of Series A Preferred Shares represented by such certificate may be less than the number of Series A

Preferred Shares stated on the face thereof. Each certificate for Series A Preferred Shares shall bear the following legend:

ANY TRANSFEREE OF THIS CERTIFICATE SHOULD

CAREFULLY REVIEW THE TERMS OF THE COMPANY'S CERTIFICATE OF DESIGNATIONS RELATING TO THE SERIES A PREFERRED SHARES REPRESENTED BY THIS

CERTIFICATE, INCLUDING SECTION 5(c)(iv) THEREOF. THE NUMBER OF SERIES A PREFERRED SHARES REPRESENTED BY THIS CERTIFICATE

MAY BE LESS THAN THE NUMBER OF SERIES A PREFERRED SHARES STATED ON THE FACE HEREOF PURSUANT TO SECTION 5(c)(iv) OF THE

CERTIFICATE OF DESIGNATIONS RELATING TO THE SERIES A PREFERRED SHARES REPRESENTED BY THIS CERTIFICATE.

(v) Pro

Rata Conversion; Disputes. In the event the Company receives a Conversion Notice from more than one Holder for the same Conversion

Date and the Company can convert some, but not all, of such Series A Preferred Shares submitted for conversion, the Company, subject

to Section 5(d), shall convert from each Holder electing to have Series A Preferred Shares converted on such date, a pro rata

amount of such Holder's Series A Preferred Shares submitted for conversion based on the Stated Value of Series A Preferred Shares

submitted for conversion on such date by such Holder relative to the Stated Value of all Series A Preferred Shares submitted for

conversion on such date. In the event of a dispute as to the number of ADSs issuable to a Holder in connection with a conversion of Series A

Preferred Shares, the Company shall issue to such Holder the number of ADSs not in dispute and resolve such dispute in accordance with

Section 26. If a Conversion Notice delivered by a Holder to the Company would result in a breach of Section 5(d) below,

and such Holder does not elect in writing to withdraw, in whole, such Conversion Notice, the Company shall hold such Conversion Notice

in abeyance for such Holder until such time as such Conversion Notice may be satisfied without violating Section 5(d) below

(with such calculations thereunder made as of the date such Conversion Notice was initially delivered to the Company).

(d) Beneficial

Ownership Conversion Limitation. Notwithstanding anything to the contrary contained herein, the Company shall not issue any Series A

Convertible Preferred Shares pursuant to the terms of this Certificate of Designations, and Holder shall not have the right to any Series A

Convertible Preferred Shares otherwise issuable pursuant to the terms of this Certificate of Designations and such issuance shall be null

and void and treated as if never made, to the extent that after giving effect to such issuance, such Holder together with the other Attribution

Parties collectively would beneficially own in excess of 4.99% or 9.99%, as the Buyers shall have indicated on their respective signature

pages attached to the Securities Purchase Agreement or as any subsequent transferee of Series A Preferred Shares indicates in

a written notice to the Company (as applicable, the "Maximum Percentage") of the Class A Ordinary Shares issued

and outstanding immediately after giving effect to such issuance. For purposes of the foregoing sentence, the aggregate number of Class A

Ordinary Shares beneficially owned by a Holder and its other Attribution Parties shall include the number of Class A Ordinary Shares

(including those underlying any ADSs) held by such Holder and all other Attribution Parties plus the number of Class A Ordinary Shares

underlying the ADSs issuable upon conversion of the Series A Preferred Shares with respect to which the determination of such sentence

is being made, but shall exclude Class A Ordinary Shares (including the Class A Ordinary Shares underlying ADSs) which would

be issuable upon (A) conversion of the remaining, nonconverted Series A Preferred Shares beneficially owned by such Holder or

any of the other Attribution Parties and (B) exercise or conversion of the unexercised or nonconverted portion of any other securities

of the Company (including, without limitation, any convertible notes or convertible preferred shares or warrants) beneficially owned by

such Holder or any other Attribution Party subject to a limitation on conversion or exercise analogous to the limitation contained in

this Section 5(d). For purposes of this Section 5(d), beneficial ownership shall be calculated in accordance with Section 13(d) of

the Exchange Act. For purposes of determining the number of ADSs a Holder may acquire upon the conversion of Series A Preferred Shares

without exceeding the Maximum Percentage, such Holder may rely on the number of issued and outstanding Class A Ordinary Shares

as reflected in (x) the Company's most recent Annual Report on Form 20-F, Report of Foreign Private Issuer on Form 6-K

or other public filing with the SEC, as the case may be, (y) a more recent public announcement by the Company or (z) any other

written notice by the Company or the Transfer Agent setting forth the number of Class A Ordinary Shares issued and outstanding (the

"Reported Outstanding Share Number"). If the Company receives a Conversion Notice from a Holder at a time when the actual

number of issued and outstanding Class A Ordinary Shares is less than the Reported Outstanding Share Number, the Company shall notify

such Holder in writing of the number of Class A Ordinary Shares then outstanding and, to the extent that such Conversion Notice would

otherwise cause such Holder's beneficial ownership, as determined pursuant to this Section 5(d), to exceed the Maximum Percentage,

such Holder must notify the Company of a reduced number of ADSs to be purchased pursuant to such Conversion Notice. For any reason at

any time, upon the written request of any Holder, the Company shall within one (1) Trading Day confirm in writing or by electronic

mail to such Holder the number of Class A Ordinary Shares then outstanding. In any case, the number of issued and outstanding Class A

Ordinary Shares shall be determined after giving effect to the conversion or exercise of securities of the Company, including the Series A

Preferred Shares, by such Holder and any other Attribution Party since the date as of which the Reported Outstanding Share Number was

reported. In the event that the issuance of ADSs to a Holder upon conversion of such Holder's Series A Preferred Shares results in

such Holder and the other Attribution Parties being deemed to beneficially own, in the aggregate, more than the Maximum Percentage of

the number of issued and outstanding Class A Ordinary Shares (as determined under Section 13(d) of the Exchange Act), the

number of ADSs so issued by which such Holder's and the other Attribution Parties' aggregate beneficial ownership exceeds the Maximum

Percentage (the "Excess Shares") shall be deemed null and void and shall be cancelled ab initio, and such Holder shall

not have the power to vote or to transfer the Excess Shares. Upon delivery of a written notice to the Company, any Holder may from time

to time increase or decrease the Maximum Percentage to any other percentage not in excess of 9.99% as specified in such notice; provided

that (i) any such increase in the Maximum Percentage will not be effective until the sixty-first (61st) day after such notice is

delivered to the Company and (ii) any such increase or decrease will apply only to such Holder and its other Attribution Parties

and not to any other holder of Series A Preferred Shares that is not an Attribution Party of such Holder. For purposes of clarity,

the Class A Ordinary Shares underlying ADSs issuable with respect to the Series A Preferred Shares in excess of the Maximum

Percentage shall not be deemed to be beneficially owned by a Holder for any purpose including for purposes of Section 13(d) or

Rule 16a-1(a)(1) of the Exchange Act. The provisions of this paragraph shall be construed and implemented in a manner otherwise

than in strict conformity with the terms of this Section 5(d) to the extent necessary to correct this paragraph (or any portion

of this paragraph) which may be defective or inconsistent with the intended beneficial ownership limitation contained in this Section 5(d) or

to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitation contained in this paragraph

may not be waived and shall apply to a successor holder of Series A Preferred Shares.

(e) Adjustments

to Fixed Conversion Price. The Fixed Conversion Price will be subject to adjustment from time to time as provided in this Section 5(e).

(i) Adjustment

of Fixed Conversion Price upon Issuance of ADSs or Class A Ordinary Shares. If and whenever on or after the Subscription Date,

the Company issues or sells, or in accordance with this Section 5(e)(i) is deemed to have issued or sold, any ADSs or Class A

Ordinary Shares (including the issuance or sale of ADSs or Class A Ordinary Shares owned or held by or for the account of the Company,

but excluding ADSs or Class A Ordinary Shares issued or sold or deemed to have been issued or sold in connection with any Excluded

Securities) for a consideration per share (after giving effect, in the case of any issuance or sale or deemed issuance or sale of Class A

Ordinary Shares, to the ratio of Class A Ordinary Shares to ADSs) (the "New Issuance Price") less than a price (after

giving effect, in the case of any issuance or sale or deemed issuance or sale of Class A Ordinary Shares, to the ratio of Class A

Ordinary Shares to ADSs) (the "Applicable Price") equal to the Fixed Conversion Price in effect immediately prior to

such issuance or sale or deemed issuance or sale (the foregoing, a "Dilutive Issuance"), then immediately after such

Dilutive Issuance, the Fixed Conversion Price then in effect shall be reduced to an amount equal to the New Issuance Price. For purposes

of determining the adjusted Fixed Conversion Price under this Section 5(e)(i), the following shall be applicable:

(A) Issuance

of Options. If the Company in any manner grants or sells any Options and the lowest price per share for which one ADS or Class A

Ordinary Share is issuable upon the exercise of any such Option or upon conversion, exercise or exchange of any Convertible Securities

issuable upon exercise of any such Option is less than the Applicable Price, then such ADS or Class A Ordinary Share shall be deemed

to be outstanding and to have been issued and sold by the Company at the time of the granting or sale of such Option for such price per

share. For purposes of this Section 5(e)(i)(A), the "lowest price per share for which one ADS or Class A Ordinary Share

is issuable upon the exercise of any such Option or upon conversion, exercise or exchange of any Convertible Securities issuable upon

exercise of any such Option" shall be equal to the sum of the lowest amounts of consideration (if any) received or receivable by

the Company with respect to any one ADS or Class A Ordinary Share upon the granting or sale of the Option, upon exercise of the Option

and upon conversion, exercise or exchange of any Convertible Security issuable upon exercise of such Option less any consideration paid

or payable by the Company with respect to such one ADS or Class A Ordinary Share upon the granting or sale of such Option, upon exercise

of such Option and upon conversion, exercise or exchange of any Convertible Security issuable upon exercise of such Option. No further

adjustment of the Fixed Conversion Price shall be made upon the actual issuance of such ADSs or Class A Ordinary Shares or of such

Convertible Securities upon the exercise of such Options or upon the actual issuance of such ADSs or Class A Ordinary Shares upon

conversion, exercise or exchange of such Convertible Securities.

(B) Issuance

of Convertible Securities. If the Company in any manner issues or sells any Convertible Securities and the lowest price per share

for which one ADS or Class A Ordinary Share is issuable upon the conversion, exercise or exchange thereof is less than the

Applicable Price, then such ADS or Class A Ordinary Share shall be deemed to be outstanding and to have been issued and sold by the

Company at the time of the issuance or sale of such Convertible Securities for such price per share. For the purposes of this Section 5(e)(i)(B),

the "lowest price per share for which one ADS or Class A Ordinary Share is issuable upon the conversion, exercise or exchange"

shall be equal to the sum of the lowest amounts of consideration (if any) received or receivable by the Company with respect to any one

ADS or Class A Ordinary Share upon the issuance or sale of the Convertible Security and upon conversion, exercise or exchange of

such Convertible Security less any consideration paid or payable by the Company with respect to such one ADS or Class A Ordinary

Share upon the issuance or sale of such Convertible Security and upon conversion, exercise or exchange of such Convertible Security. No

further adjustment of the Fixed Conversion Price shall be made upon the actual issuance of such ADSs or Class A Ordinary Shares upon

conversion, exercise or exchange of such Convertible Securities, and if any such issue or sale of such Convertible Securities is made

upon exercise of any Options for which adjustment of the Fixed Conversion Price had been or are to be made pursuant to other provisions

of this Section 5(e)(i), no further adjustment of the Fixed Conversion Price shall be made by reason of such issue or sale.

(C) Change

in Option Price or Rate of Conversion. If the purchase or exercise price provided for in any Options, the additional consideration,

if any, payable upon the issue, conversion, exercise or exchange of any Convertible Securities, or the rate at which any Convertible Securities

are convertible into or exercisable or exchangeable for ADSs or Class A Ordinary Shares increases or decreases at any time,

the Fixed Conversion Price in effect at the time of such increase or decrease shall be adjusted to the Fixed Conversion Price which would

have been in effect at such time had such Options or Convertible Securities provided for such increased or decreased purchase price, additional

consideration or increased or decreased conversion rate, as the case may be, at the time initially granted, issued or sold. For purposes

of this Section 5(e)(i)(C), if the terms of any Option or Convertible Security that was outstanding as of the Subscription Date are

increased or decreased in the manner described in the immediately preceding sentence, then such Option or Convertible Security and the

ADSs and/or Class A Ordinary Shares deemed issuable upon exercise, conversion or exchange thereof shall be deemed to have been issued

as of the date of such increase or decrease. No adjustment pursuant to this Section 5(e)(i) shall be made if such adjustment

would result in an increase of the Fixed Conversion Price then in effect.

(D) Calculation

of Consideration Received. In case any Option is issued in connection with the issue or sale of other securities of the Company, together

comprising one integrated transaction, (x) the Options will be deemed to have been issued for the Option Value of such Options and

(y) the other securities issued or sold in such integrated transaction shall be deemed to have been issued or sold for the difference

of (I) the aggregate consideration received by the Company less any consideration paid or payable by the Company pursuant to the

terms of such other securities of the Company, less (II) the Option Value of such Options. If any ADSs or Class A Ordinary Shares,

Options or Convertible Securities are issued or sold or deemed to have been issued or sold for cash, the consideration received or receivable

therefor will be deemed to be the net amount received by the Company therefor. If any ADSs, Class A Ordinary Shares, Options or Convertible

Securities are issued or sold for a consideration other than cash, the amount of such consideration received by the Company will be the

fair value of such consideration, except where such consideration consists of publicly traded securities, in which case the amount of

consideration received by the Company will be the Closing Sale Price of such publicly traded securities on the date of receipt of such

publicly traded securities. If any ADSs, Class A Ordinary Shares, Options or Convertible Securities are issued to the owners of the

non-surviving entity in connection with any merger in which the Company is the surviving entity, the amount of consideration therefor

will be deemed to be the fair value of such portion of the net assets and business of the non-surviving entity as is attributable to such

ADSs or Class A Ordinary Shares, Options or Convertible Securities, as the case may be. The fair value of any consideration other

than cash or publicly traded securities will be determined jointly by the Company and the Required Holders. If such parties are unable

to reach agreement within ten (10) days after the occurrence of an event requiring valuation (the "Valuation Event"),

the fair value of such consideration will be determined within five (5) Business Days after the tenth (10th) day following

the Valuation Event by an independent, reputable appraiser jointly selected by the Company and the Required Holders. The determination

of such appraiser shall be final and binding upon all parties absent manifest error and the fees and expenses of such appraiser shall

be borne by the Company. Notwithstanding anything to the contrary contained herein, if any calculation pursuant to this Section 5(e)(i)(D) would

result in a dollar value that is lower than the par value of the Class A Ordinary Shares, then such dollar value shall be deemed

to equal the par value of the Class A Ordinary Shares.

(E) Record

Date. If the Company takes a record of the holders of ADSs or Class A Ordinary Shares for the purpose of entitling them

(I) to receive a dividend or other distribution payable in ADSs, Class A Ordinary Shares, Options or in Convertible Securities

or (II) to subscribe for or purchase ADSs, Class A Ordinary Shares, Options or Convertible Securities, then such record date

will be deemed to be the date of the issue or sale of the ADSs or Class A Ordinary Shares deemed to have been issued or sold upon

the declaration of such dividend or the making of such other distribution or the date of the granting of such right of subscription or

purchase, as the case may be.

(F) Readjustments.

If the Fixed Conversion Price has been adjusted pursuant to this Section 5(e)(i) and the Dilutive Issuance that triggered such

adjustment does not occur, is not consummated, is unwound or is cancelled after the fact for any reason whatsoever, the Fixed Conversion

Price shall be readjusted to the Fixed Conversion Price in effect immediately prior to such adjustment pursuant to this Section 5(e)(i).

(f) Adjustment

of Fixed Conversion Price upon Subdivision or Combination of ADSs or Class A Ordinary Shares. If the Company at any time on or

after the Subscription Date subdivides (by any share split, share dividend, recapitalization or otherwise) one or more classes of its

outstanding ADSs or Class A Ordinary Shares into a greater number of ADSs or Class A Ordinary Shares, as applicable, the Fixed

Conversion Price in effect immediately prior to such subdivision will be proportionately reduced. If the Company at any time on or after

the Subscription Date combines (by combination, reverse share split or otherwise) one or more classes of its outstanding ADSs or Class A

Ordinary Shares into a smaller number of ADSs or Class A Ordinary Shares, as applicable, the Fixed Conversion Price in effect immediately

prior to such combination will be proportionately increased. Any adjustment under this Section 5(e)(i) shall become effective

at the close of business on the date the subdivision or combination becomes effective.

(g) Voluntary

Adjustment by Company. The Company may at any time, with the prior written consent of the Required Holders, reduce the then current

Fixed Conversion Price to any amount and for any period of time deemed appropriate by the Board.

(h) Change

in ADS Ratio. If after the Subscription Date the ratio of ADSs to Class A Ordinary Shares is increased or reduced, then the number

of ADSs to be delivered upon conversion of the Series A Preferred Shares, the Conversion Price and any other prices referenced herein

will be appropriately adjusted.

(i) Change

from ADSs to Class A Ordinary Shares. Notwithstanding anything herein to the contrary, any Holder, in its sole and absolute discretion,

may elect to receive Class A Ordinary Shares upon conversion of such Holder's Series A Preferred Shares, in which case such

Series A Preferred Shares shall then become convertible for Class A Ordinary Shares, and (i) the number of Class A

Ordinary Shares to be issued and delivered upon conversion of such Series A Preferred Shares will equal the number of Class A

Ordinary Shares underlying the ADSs issuable upon conversion of such Series A Preferred Shares immediately prior to such change (without

regard to any limitation on conversion set forth herein), (ii) the Conversion Price and any other prices referenced herein shall

be proportionately adjusted and (iii) in such instances, all references herein to ADSs issuable upon conversion of the Series A

Preferred Shares shall be deemed to be references to the Class A Ordinary Shares and shall be read with any appropriate adjustments.

(j) Right

of Alternate Conversion Upon a Triggering Event.

(A) General.

Subject to Section 5(d), at any time after a Triggering Event has occurred and is continuing, such Holder may, at such Holder's option,

convert (each, an "Alternate Conversion", and the date of such Alternate Conversion, each, an "Alternate Conversion

Date") all, or any part of, the applicable Conversion Amount (such portion of the Conversion Amount subject to such Alternate

Conversion, each, an "Alternate Conversion Amount") into ADSs by dividing (x) the applicable Conversion Amount,

by (y) the Alternate Conversion Price.

(B) Mechanics

of Alternate Conversion. On any Alternate Conversion Date, such Holder may voluntarily convert any Alternate Conversion Amount pursuant

to Section 5(c) (with "Alternate Conversion Price" replacing "Conversion Price" for all purposes hereunder

with respect to such Alternate Conversion and with "115% of the Conversion Amount" replacing "Conversion Amount" in

clause (x) of the definition of Conversion Rate above with respect to such Alternate Conversion) by designating in the applicable

Conversion Notice delivered pursuant to this Section 5(j) that such Holder is electing to use the Alternate Conversion Price

for such conversion. Notwithstanding anything to the contrary in this Section 5(j), but subject to Section 5(d), until the Company

delivers ADSs representing the applicable Alternate Conversion Amount to such Holder, such Alternate Conversion Amount may be converted

by such Holder into ADSs pursuant to Section 5(c) without regard to this Section 5(j).

(C) Notwithstanding

the foregoing, if the Triggering Event has been cured or waived, such Holder shall not be entitled to the right of Alternate Conversion

with respect to such Triggering Event that has been cured or waived.

(6) RIGHTS

UPON TRIGGERING EVENT.

(a) Triggering

Event. Each of the following events shall constitute a "Triggering Event" and each of the events in clauses (vi) and

(vii) shall also constitute a "Bankruptcy Triggering Event":

(i) (A) the

suspension of the ADSs from trading on an Eligible Market for a period of five (5) consecutive Trading Days or for more than an aggregate

of ten (10) Trading Days in any 365-day period or (B) the failure of the ADSs to be listed on an Eligible Market;

(ii) the

Company's (A) failure to cure a Conversion Failure by delivery of the required number of ADSs within ten (10) Business Days

after the applicable Conversion Date or (B) written notice to any Holder, including by way of public announcement, or through any

of its agents, at any time, of its intention not to comply with a request for conversion of any Series A Preferred Shares into ADSs

that is tendered in accordance with the provisions of this Certificate of Designations, other than pursuant to Section 5(d);

(iii) at

any time following the tenth (10th) consecutive Business Day that the Holder's Authorized Share Allocation (as defined in Section 12(a))

is less than the Holder's Pro Rata Amount of the Required Reserve Amount (as defined in Section 12(a));

(iv) the

Company's failure to pay to such Holder any amount of Stated Value, dividends, Late Charges, Redemption Price or other amounts when and

as due under this Certificate of Designations or any other Transaction Document, except, in the case of a failure to pay dividends and/or

Late Charges when and as due, in which case only if such failure continues for a period of at least an aggregate of ten (10) Business

Days;

(v) there

occurs with respect to any Indebtedness of the Company or any of its Subsidiaries having an outstanding principal amount of $25,000,000

or more, (a) an event of default that has caused the holders thereof to declare such Indebtedness to be due and payable prior to

its stated maturity and/or (b) the failure to make a principal payment when due;

(vi) the

Company or any of its Significant Subsidiaries, pursuant to or within the meaning of Title 11, U.S. Code, or any similar federal, foreign

or state law for the relief of debtors (collectively, "Bankruptcy Law"), (A) commences a voluntary case, (B) consents

to the entry of an order for relief against it in an involuntary case, (C) consents to the appointment of a receiver, trustee, assignee,

liquidator or similar official (a "Custodian"), (D) makes a general assignment for the benefit of its creditors

or (E) admits in writing that it is generally unable to pay its debts as they become due;

(vii) a

court of competent jurisdiction enters an order or decree under any Bankruptcy Law that (A) is for relief against the Company or

any of its Significant Subsidiaries in an involuntary case, (B) appoints a Custodian of the Company or any of its Significant Subsidiaries

or (C) orders the liquidation of the Company or any of its Significant Subsidiaries, and such order or decree remains unstayed and

in effect for 60 consecutive days;

(viii) a

final judgment or judgments for the payment of money aggregating in excess of $25,000,000 are rendered against the Company or any of its

Subsidiaries and which judgments are not, within sixty (60) days after the entry thereof, bonded, discharged or stayed pending appeal,

or are not discharged within sixty (60) days after the expiration of such stay; provided, however, that any judgment which

is covered by insurance or an indemnity from a credit worthy party shall not be included in calculating the $5,000,000 amount set forth

above so long as the Company provides the Holders a written statement from such insurer or indemnity provider (which written statement

shall be reasonably satisfactory to the Holders) to the effect that such judgment is covered by insurance or an indemnity and the Company

or such Subsidiary (as the case may be) will receive the proceeds of such insurance or indemnity within thirty (30) days of the issuance

of such judgment;

(ix) any Material

Adverse Effect occurs;

(x) Company

breaches: (A) any negative covenant set forth in Section 15 below, or (B) any of the covenants set forth Sections 4(b),

(h), (j), (k) or (n) of the Securities Purchase Agreement; and

(xi) Company

breaches: (A) any affirmative covenant set forth in Section 16 below, or (B) any of the covenants in Securities Purchase

Agreement not enumerated in subsection (x) above, provided that any such breach would have a Material Adverse Effect and the Buyers