false000107553100010755312024-12-182024-12-180001075531us-gaap:CommonStockMember2024-12-182024-12-180001075531bkng:A0100SeniorNotesDue2025Member2024-12-182024-12-180001075531bkng:A4000SeniorNotesDue2026Member2024-12-182024-12-180001075531bkng:A1.8SeniorNotesDueMarch2027Member2024-12-182024-12-180001075531bkng:A05SeniorNotesDueMarch2028Member2024-12-182024-12-180001075531bkng:A3625SeniorNotesDue2028Member2024-12-182024-12-180001075531bkng:A4250SeniorNotesDue2029Member2024-12-182024-12-180001075531bkng:A3.500SeniorNotesDueMarch2029Member2024-12-182024-12-180001075531bkng:A450SeniorNotesDue2031Member2024-12-182024-12-180001075531bkng:A3.625SeniorNotesDueMarch2032Member2024-12-182024-12-180001075531bkng:A3.250SeniorNotesDue2032Member2024-12-182024-12-180001075531bkng:A4125SeniorNotesDue2033Member2024-12-182024-12-180001075531bkng:A4750SeniorNotesDue2034Member2024-12-182024-12-180001075531bkng:A3.750SeniorNotesDueMarch2036Member2024-12-182024-12-180001075531bkng:A3.750SeniorNotesDue2037Member2024-12-182024-12-180001075531bkng:A4.000SeniorNotesDueMarch2044Member2024-12-182024-12-180001075531bkng:A3.875SeniorNotesDueMarch2045Member2024-12-182024-12-18

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported) December 18, 2024

Booking Holdings Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-36691 | | 06-1528493 |

(State or other Jurisdiction of

Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | |

| 800 Connecticut Avenue | Norwalk | Connecticut | | 06854 |

| (Address of principal executive offices) | | (zip code) |

Registrant's telephone number, including area code: (203) 299-8000

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities Registered Pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | |

| Title of Each Class: | | Trading Symbol | | Name of Each Exchange on which Registered: |

| Common Stock par value $0.008 per share | | BKNG | | The NASDAQ Global Select Market |

| | | | |

| 0.100% Senior Notes Due 2025 | | BKNG 25 | | The NASDAQ Stock Market LLC |

| 4.000% Senior Notes Due 2026 | | BKNG 26 | | The NASDAQ Stock Market LLC |

| 1.800% Senior Notes Due 2027 | | BKNG 27 | | The NASDAQ Stock Market LLC |

| 0.500% Senior Notes Due 2028 | | BKNG 28 | | The NASDAQ Stock Market LLC |

| 3.625% Senior Notes Due 2028 | | BKNG 28A | | The NASDAQ Stock Market LLC |

| 4.250% Senior Notes Due 2029 | | BKNG 29 | | The NASDAQ Stock Market LLC |

| 3.500% Senior Notes Due 2029 | | BKNG 29A | | The NASDAQ Stock Market LLC |

| 4.500% Senior Notes Due 2031 | | BKNG 31 | | The NASDAQ Stock Market LLC |

| 3.625% Senior Notes Due 2032 | | BKNG 32 | | The NASDAQ Stock Market LLC |

| 3.250% Senior Notes Due 2032 | | BKNG 32A | | The NASDAQ Stock Market LLC |

| 4.125% Senior Notes Due 2033 | | BKNG 33 | | The NASDAQ Stock Market LLC |

| 4.750% Senior Notes Due 2034 | | BKNG 34 | | The NASDAQ Stock Market LLC |

| 3.750% Senior Notes Due 2036 | | BKNG 36 | | The NASDAQ Stock Market LLC |

| 3.750% Senior Notes Due 2037 | | BKNG 37 | | The NASDAQ Stock Market LLC |

| 4.000% Senior Notes Due 2044 | | BKNG 44 | | The NASDAQ Stock Market LLC |

| 3.875% Senior Notes Due 2045 | | BKNG 45 | | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

As previously reported by Booking Holdings Inc. (the "Company"), the Company entered into a letter agreement dated February 23, 2023 with David I. Goulden, the Company’s previous chief financial officer, as amended by the letter agreement amendment dated April 4, 2024 (together, the "Letter Agreement"), which set forth the terms and conditions of Mr. Goulden's continued service to the Company.

On December 18, 2024, the Company and Mr. Goulden entered into an additional letter agreement, which supplements the Letter Agreement (the "Additional Letter Agreement") and provides that Mr. Goulden’s part-time employment as Executive Vice President of Finance will extend from January 1, 2025 to March 31, 2025 (the "Additional Period").

The Additional Letter Agreement further provides that Mr. Goulden will receive a base salary of $315,000 (on an annualized basis) during the Additional Period and that Mr. Goulden’s outstanding equity awards will not be eligible to vest following the Additional Period.

The above summary is qualified by reference to the Additional Letter Agreement, which is filed as Exhibit 99.1 to this Current Report on Form 8-K, and which is incorporated by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit

Number | Description | | | |

| | | | |

| Additional Letter Agreement, dated December 18, 2024, by and between the Company and David I. Goulden.

| | | |

| 104 | Cover Page Interactive Data File - the cover page interactive data file does not appear in the Interactive Data File because its XBRL tags are embedded within the Inline XBRL document. | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | BOOKING HOLDINGS INC. |

| | |

| | | |

| | By: | /s/ Peter J. Millones |

| | | Name: | Peter J. Millones |

| | | Title: | Executive Vice President and General Counsel |

Date: December 18, 2024

December 18, 2024

Mr. David I. Goulden

c/o Booking Holdings Inc.

800 Connecticut Avenue

Norwalk, CT 06854

Dear David:

This letter agreement sets forth the terms and conditions of your “Additional Period,” pursuant to Section 1(3) of the letter agreement between you and Booking Holdings Inc. (including all predecessors and successors, including The Priceline Group Inc., the “Company”), dated February 23, 2023 (the “February 2023 Letter Agreement”), as amended by the letter agreement between you and the Company dated April 4, 2024 (the “April 2024 Letter Agreement”). Capitalized terms that are used but not defined in this letter have the meaning set forth in the February 2023 Letter Agreement or April 2024 Letter Agreement, as applicable.

Provided you remain employed through December 31, 2024, your Additional Period will commence January 1, 2025 and end March 31, 2025. During the Additional Period:

●You will have the title of Executive Vice President of Finance and report to the CEO of the Company.

●You will continue to receive a base salary at the annual rate of $315,000, payable in installments in accordance with the regular payroll practices of the Company.

●You will be employed by the Company on a part-time basis and you will be expected to work at least approximately 25 hours per week (other than vacations, holidays, and other time off in accordance with Company policies), as mutually agreed upon by you and the Company.

●Your duties will include, but not be limited to, those duties listed on Appendix A to the February 2023 Letter Agreement, as amended by the April 2024 Letter Agreement, and any additional tasks that are reasonably requested by the CEO. Your work may continue to be done in a flexible manner consistent with current practice.

●The Employment Agreement, the February 2023 Letter Agreement, and the April 2024 Letter Agreement shall remain in full force and effect.

You will not be eligible to receive any cash bonus, whether pursuant to the Company’s Annual Bonus Plan or otherwise, in respect of any period after December 31, 2024, and any of your equity awards that are unvested as of your voluntary termination of employment on the last day of the Additional Period will be forfeited. You and the Company agree that no equity awards will be eligible to vest after the last day of the Additional Period, regardless of any service you may perform in any capacity for the Company or its subsidiaries or affiliates, notwithstanding anything in the Booking Holdings Inc. 1999 Omnibus Plan or applicable award agreements to the contrary. However, for the avoidance of doubt, the portion of your Performance Share Unit award granted in 2023 for which the service vesting condition has been satisfied as of the last day of the Additional Period will vest, subject to satisfaction of the applicable performance criteria, and will be settled, pursuant to the terms of such award, in March 2026.

This letter agreement shall be governed by and construed in accordance with the laws of the State of New York without reference to principles of conflict of laws. All disputes and controversies arising under or in

connection with this letter agreement shall be resolved in accordance with the dispute resolution provisions of Section 16 of the Employment Agreement.

This letter agreement may be executed in separate counterparts, each of which shall be deemed to be an original and both of which taken together shall constitute one and the same agreement.

If you agree with the foregoing, please sign and date the enclosed copy of this letter agreement in the space indicated below.

Warm regards,

/s/ Glenn Fogel

Glenn Fogel

CEO, Booking Holdings Inc.

Acknowledged and Accepted:

/s/ David I. Goulden

David I. Goulden

Date: 12/18/2024

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A0100SeniorNotesDue2025Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4000SeniorNotesDue2026Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A1.8SeniorNotesDueMarch2027Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A05SeniorNotesDueMarch2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3625SeniorNotesDue2028Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4250SeniorNotesDue2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.500SeniorNotesDueMarch2029Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A450SeniorNotesDue2031Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.625SeniorNotesDueMarch2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4125SeniorNotesDue2033Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4750SeniorNotesDue2034Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.750SeniorNotesDueMarch2036Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A4.000SeniorNotesDueMarch2044Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.250SeniorNotesDue2032Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.750SeniorNotesDue2037Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=bkng_A3.875SeniorNotesDueMarch2045Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

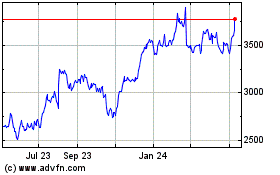

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Jan 2025 to Feb 2025

Booking (NASDAQ:BKNG)

Historical Stock Chart

From Feb 2024 to Feb 2025