Alumni Donors and Revenue in Higher Education Return to Pre-Recession Levels

April 23 2014 - 10:15AM

Business Wire

Blackbaud’s Annual donorCentrics™ Report

highlights key giving trends and patterns across higher education,

including public and private institutions

Blackbaud, Inc. (NASDAQ: BLKB) today released its 2013

donorCentrics Annual Report on Higher Education Alumni Giving. The

report looks at giving trends across 123 higher education

institutions over the past three years. Findings in the report

indicate that alumni donors and revenue are returning to patterns

of giving prior to the Great Recession.

- Download a copy of the report:

www.blackbaud.com/higherEd-report

“Before the economic recession, the national trends in higher

education were ‘donors down’ and ‘dollars up,’” said Shaun Keister,

author of the report and vice chancellor of development and alumni

relations at the University of California, Davis. “That all changed

in 2009 with both key metrics dipping and dipping sharply. For the

second year in a row, however, we are seeing a return to

pre-recession trends and patterns, indicating that the impact of

the recession has been minimized.”

Key findings from the report include:

- Alumni Donors were down –

Overall, alumni donors were slightly down for both public and

private institutions. The overall median change in donor counts was

down 1.1 percent, with private institutions dipping 0.7 percent and

public institutions down 1.1 percent.

- Revenue is up – Overall revenue

is up, with a positive change of 5.3 percent compared to 2012. This

marks the third consecutive year of positive change in revenue for

both public and private institutions, after tougher years in 2009

and 2010, showing that the impact of the recession has

subsided.

- Donors are giving more on average

– The actual median change in revenue per donor in 2013 was

impressive, with a 5.8 percent positive change overall. The median

revenue per donor in 2013 was $531 (compared to $488 in 2012 and

$469 in 2011).

“It’s interesting to see how the recession impacted nonprofits

and how they are responding afterward,” said Jenny Cooke Smith, a

Higher Education donorCentrics solutions consultant at Blackbaud.

“While participation rates continued to decline for both public and

private institutions – a byproduct of both growing class sizes and

generational shifts in donors – the report provides insight

into this trend, as well as suggestions for helping to combat these

issues.”

Download the report to learn more about alumni participation,

donor retention, reactivation, and donor acquisition trends from

123 institutions around the country.

About the survey

Blackbaud’s Target Analytics applied the following rules to

standardize data from each of the institutions participating in the

2013 donorCentrics Annual Report on Higher Education Alumni Giving:

Soft credits and matching gift payments are excluded. Direct mail,

telemarketing, and the Internet are by far the dominant revenue

sources for most schools; however, events, personal solicitation,

and other sources are included. Indicators are calculated on a cash

payment basis, as opposed to a pledge basis. Retention rates are

calculated by dividing the number of donors giving in the current

year who also gave during the previous year by the total number of

donors who gave in the previous year.

About Blackbaud

Serving the nonprofit and education sectors for 30 years,

Blackbaud (NASDAQ: BLKB) combines technology and expertise to help

organizations achieve their missions. Blackbaud works with more

than 29,000 customers in over 60 countries that support higher

education, healthcare, human services, arts and culture, faith, the

environment, independent K-12 education, animal welfare and other

charitable causes. The company offers a full spectrum of

cloud-based and on-premise software solutions and related services

for organizations of all sizes including: fundraising, eMarketing,

advocacy, constituent relationship management (CRM), financial

management, payment services, analytics and vertical-specific

solutions. Using Blackbaud technology, these organizations raise

more than $100 billion each year. Recognized as a top company by

Forbes, InformationWeek, and Software Magazine and honored by Best

Places to Work, Blackbaud is headquartered in Charleston, South

Carolina and has operations in the United States, Australia,

Canada, the Netherlands and the United Kingdom. For more

information, visit www.blackbaud.com.

Forward-looking Statements

Except for historical information, all of the statements,

expectations, and assumptions contained in this news release are

forward-looking statements that involve a number of risks and

uncertainties. Although Blackbaud attempts to be accurate in making

these forward-looking statements, it is possible that future

circumstances might differ from the assumptions on which such

statements are based. In addition, other important factors that

could cause results to differ materially include the following:

general economic risks; uncertainty regarding increased business

and renewals from existing customers; continued success in sales

growth; management of integration of acquired companies and other

risks associated with acquisitions; risks associated with

successful implementation of multiple integrated software products;

the ability to attract and retain key personnel; risks related to

our dividend policy and share repurchase program, including

potential limitations on our ability to grow and the possibility

that we might discontinue payment of dividends; risks relating to

restrictions imposed by the credit facility; risks associated with

management of growth; lengthy sales and implementation cycles,

particularly in larger organization; technological changes that

make our products and services less competitive; and the other risk

factors set forth from time to time in the SEC filings for

Blackbaud, copies of which are available free of charge at the

SEC’s website at www.sec.gov or upon request from Blackbaud's

investor relations department. All Blackbaud product names

appearing herein are trademarks or registered trademarks of

Blackbaud, Inc.

Blackbaud, Inc.Andy Prince, 512-289-4728media@blackbaud.com

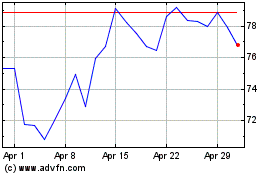

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Feb 2025 to Mar 2025

Blackbaud (NASDAQ:BLKB)

Historical Stock Chart

From Mar 2024 to Mar 2025