UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 8)*

BioRestorative Therapies, Inc.

|

|

(Name of Issuer)

|

| |

Common Stock, $.0001 Par Value

|

|

(Title of Class of Securities)

|

| |

| 090655606 |

|

(CUSIP Number)

|

| |

|

Dale Broadrick

3003 Brick Church Pike

Nashville, TN 37207

(615) 256-0600

|

|

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

|

| |

June 8, 2022

|

|

(Date of Event which Requires Filing of this Statement)

|

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of §§240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following box ☐.

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See §240.13d-7 for other parties to whom copies are to be sent.

* The remainder of this cover page shall be filled out for a reporting person's initial filing on this form with respect to the subject class of securities, and for any

subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be "filed" for the purpose of Section 18 of the Securities Exchange Act of 1934 ("Act") or otherwise subject to the liabilities of that section of the Act but shall

be subject to all other provisions of the Act (however, see the Notes).

|

1

|

NAMES OF REPORTING PERSONS

|

|

|

|

Dale Broadrick

|

|

|

|

|

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF A GROUP

|

(a)

|

☐

|

| |

(b)

|

☐

|

|

|

|

|

3

|

SEC USE ONLY

|

|

|

|

|

|

|

|

|

|

|

4

|

SOURCE OF FUNDS (SEE INSTRUCTIONS)

|

|

|

|

PF

|

|

|

|

|

|

|

5

|

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS IS REQUIRED PURSUANT TO ITEM 2(D) OR 2(E)

|

|

☐

|

| |

|

|

|

|

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

|

|

|

|

United States

|

|

|

|

|

|

|

NUMBER OF SHARES BENEFICIALLY OWNED BY EACH REPORTING PERSON WITH

|

7

|

SOLE VOTING POWER

|

|

|

|

611,745

|

|

|

|

|

|

|

8

|

SHARED VOTING POWER

|

|

|

|

0

|

|

|

|

|

|

|

9

|

SOLE DISPOSITIVE POWER

|

|

|

|

611,745

|

|

|

|

|

|

|

10

|

SHARED DISPOSITIVE POWER

|

|

|

|

0

|

|

|

|

|

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY EACH REPORTING PERSON

|

|

|

|

611,745

|

|

|

|

|

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11) EXCLUDES CERTAIN SHARES (SEE INSTRUCTIONS)

|

|

☐

|

| |

|

|

|

|

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT IN ROW (11)

|

|

|

|

16.8*

|

|

|

|

|

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

|

|

|

|

IN

|

|

|

|

|

|

*Based upon information contained in the Form 10-Q for the period ended March 31, 2022 filed by BioRestorative Therapies, Inc. (the "Company") with the Securities and Exchange Commission (the "SEC") on May 16, 2022, there were 3,637,219 shares of

the Company's common stock (the "Shares") issued and outstanding as of May 9, 2022.

This Amendment No. 8 to Schedule 13D reflects the aggregate number of Shares beneficially owned by the Reporting Person and includes (i) 294,773 Shares owned directly by the Reporting Person; (ii) 316,972 Shares owned indirectly by the Reporting

Person through Fleetco, Inc. of which he is a 93% shareholder; (iii) 250 Shares underlying warrants held by the Reporting Person with an exercise price of $120 per Share and an expiration date of February 19, 2024; (iv) 276 Shares underlying warrants

held by the Reporting Person with an exercise price of $120 per Share and an expiration date of May 7, 2024; and (v) 833 Shares underlying a warrant held by the Reporting Person with an exercise price of $120 per Share and an expiration date of October

6, 2024. As a result of the foregoing, as of the filing date of this Amendment No. 8 to Schedule 13D, the Reporting Person may be deemed to beneficially own 611,745 Shares, or 16.8% of the Shares issued and outstanding as of May 9, 2022. Percent of

class assumes the exercise of all of the Warrants held by the Reporting Person for the acquisition of 1,359 Shares.

Item 1. Security and Issuer.

This statement relates to the shares of Common Stock, par value $.0001 per share ("Shares" or the "Common Stock"), of BioRestorative Therapies, Inc., a Delaware corporation (the "Company"). The address of the principal executive offices of the

Company is 40 Marcus Drive, Suite One, Melville, New York 11747.

Item 2. Identity and Background.

Dale Broadrick

| b. |

Residence or Business Address |

3003 Brick Church Pike

Nashville, Tennessee 37207

The Reporting Person is a private investor.

During the last five years, the Reporting Person, to the best of is knowledge, has not been convicted in a criminal proceeding (excluding traffic violations and similar misdemeanors).

During the last five years, the Reporting Person, to the best of his knowledge, has not been a party to a civil proceeding of a judicial or administrative body of competent jurisdiction and as a result of such proceeding was or is subject to a

judgment, decree or final order enjoining future violations of, or prohibiting or mandating activities subject to, federal or state securities laws or finding any violation with respect to such laws.

The Reporting Person is a citizen of the United States of America.

Item 3. Source or Amount of Funds or Other Consideration.

See Item 4.

Item 4. Purpose of Transaction.

Between May 26, 2022 and June 16, 2022, the Reporting Person purchased, directly or indirectly, an aggregate of 39,061 Shares in the open market as set forth in Item 5.

The Shares were acquired, and are being held, for investment purposes. The Reporting Person believes that the Common Stock of the Company is significantly undervalued and does not reflect the value of its business opportunity and its intellectual

property.

The Reporting Person may purchase additional shares of Common Stock from time to time depending upon price, market conditions, availability of funds, evaluation of other investment opportunities, and other factors. The Reporting Person has no

present intention to sell any shares of Common Stock, although the Reporting Person could determine from time to time, based upon the same factors listed above for purchases, to sell some or all of the shares of Common Stock held by the Reporting

Person.

The Reporting Person does not have any plans or proposals that would result in any of the actions or transactions described in clauses (a) through (j) of Item 4 of Schedule 13D, except as set forth above.

| a. |

An Acquisition or Disposition |

| b. |

A Corporate Transaction: |

| c. |

A Sale or Transfer of Assets: |

| d. |

A Change in Board of Directors: |

| e. |

A Change in Capitalization: |

| f. |

Other Material Change: |

| i. |

Termination of Registration: |

Item 5. Interest in Securities of the Issuer.

|

a. |

State the aggregate number and percentage of the class of securities identified pursuant to Item 1 beneficially owned by each person named in Item 2. |

As of June 16, 2022 the Reporting Person beneficially owned 611,745 shares of Common Stock of the Company, including 1,359 shares of Common Stock of the Company issuable upon the exercise of currently exercisable warrants. As of such date, the

Reporting Person beneficially owned 16.8% of the outstanding Common Stock of the Company, based on there being 3,637,219 shares of Common Stock of the Company outstanding as of May 9, 2022, as set forth in the Company's Form 10-Q for the period ended

March 31, 2022 filed with the SEC on May 16, 2022 and presently exercisable warrants issued to the Reporting Person for the purchase of an aggregate of 1,359 shares of Common Stock of the Company.

|

b. |

For each person named, indicate the number of shares as to which there is sole power to vote or to direct the vote, shared power to vote or to direct the vote, sole power to dispose

or to direct the disposition, or shared power to dispose or to direct the disposition. |

As of June 16, 2022, the Reporting Person had sole voting power and sole dispositive power with respect to 611,745 shares of Common Stock.

|

c. |

Describe any transactions that were effected during the past sixty days or since the most recent filing of Schedule 13D. |

During the past sixty days, Reporting Person acquired, directly or indirectly, the following securities of the Company:

|

Transaction Date

|

|

Shares Purchased

|

|

|

Price per Share

|

|

May 26, 2022

|

|

|

4,950

|

|

|

|

$3.5079 |

(1) |

May 27, 2022

|

|

|

10,957

|

|

|

|

$3.6134 |

(2) |

June 1, 2022

|

|

|

9,213

|

|

|

|

$4.4635

|

(3)

|

June 2, 2022

|

|

|

1,000

|

|

|

|

$4.6878 |

(4) |

June 3, 2022

|

|

|

1,200

|

|

|

|

$4.8994

|

(5)

|

June 6, 2022

|

|

|

3,000

|

|

|

|

$4.9325

|

(6)

|

June 7, 2022

|

|

|

3,600

|

|

|

|

$4.7231

|

(7)

|

June 8, 2022

|

|

|

2,400

|

|

|

|

$4.3313 |

(8) |

June 9, 2022

|

|

|

1,000

|

|

|

|

$4.2657

|

(9)

|

June 10, 2022

|

|

|

600

|

|

|

|

$4.2333

|

(10)

|

June 13, 2022

|

|

|

1,300

|

|

|

|

$3.9204

|

(11)

|

June 15, 2022

|

|

|

1,200

|

|

|

|

$3.7199

|

(12)

|

June 16, 2022

|

|

|

2,000

|

|

|

|

$3.8055

|

(13)

|

(1) Represents the average price per share paid. Purchase prices ranged from $3.4787 per share to $3.5599 per share.

(2) Represents the average price per share paid. Purchase prices ranged from $3.3499 per share to $3.7999 per share.

(3) Represents the average price per share paid. Purchase prices ranged from $4.0659 per share to $4.62 per share.

(4) Represents the average price per share paid. Purchase prices ranged from $4.48 per share to $4.8943 per share.

(5) Represents the average price per share paid. Purchase prices ranged from $4.80 per share to $4.9199 per share.

(6) Represents the average price per share paid. Purchase prices ranged from $4.8531 per share to $4.9676 per share.

(7) Represents the average price per share paid. Purchase prices ranged from $4.585 per share to $4.7699 per share.

(8) Represents the average price per share paid. Purchase prices ranged from $4.1999 per share to $4.6199 per share.

(9) Represents the average price per share paid. Purchase prices ranged from $4.17 per share to $4.3699 per share.

(10) Represents the average price per share paid. Purchase prices ranged from $4.1899 per share to $4.2999 per share.

(11) Represents the average price per share paid. Purchase prices ranged from $3.8999 per share to $4.00 per share.

(12) Represents the average price per share paid. Purchase prices ranged from $3.65 per share to $3.7799 per share.

(13) Represents the average price per share paid. Purchase prices ranged from $3.5718 per share to $3.8999 per share.

During the past sixty days, Reporting Person sold, directly or indirectly, the following securities of the Company:

|

Transaction Date

|

|

Shares

Sold

|

|

|

Price per Share

|

|

May 26, 2022

|

|

|

2,000

|

|

|

|

$3.4378 |

(1) |

(1) Represents the average price per share received. Sale prices ranged from $3.39 per share to $3.465 per share.

|

d. |

If any other person is known to have the right to receive or direct dividends or proceeds from the sale of securities, a statement to that effect should be included: |

|

e. |

The date the reporting person ceased to be the beneficial owner of more than five percent of the class of securities: (If applicable) |

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Except with respect to the warrants held by the Reporting Person for the purchase of an aggregate of 1,359 shares of Common Stock of the Company, the Reporting Person does not have any contract, arrangement, understanding or relationship (legal or

otherwise) with any person with respect to any securities of the Company, including but not limited to the transfer of voting of any of the securities, finder's fees, joint ventures, loan or option arrangements, puts or calls, guarantees of profits,

division of profits or losses, or the giving or withholding of proxies.

Item 7. Material to Be Filed as Exhibits.

None.

SIGNATURE

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

Dated:June 20, 2022

| |

|

| |

|

| |

|

/s/ Dale Broadrick

|

| |

|

Dale Broadrick

|

| |

|

|

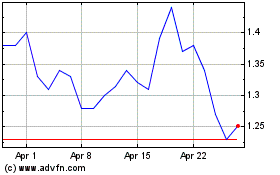

BioRestorative Therapies (NASDAQ:BRTX)

Historical Stock Chart

From Jun 2024 to Jul 2024

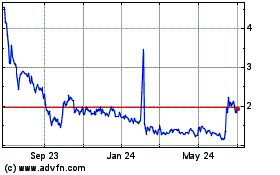

BioRestorative Therapies (NASDAQ:BRTX)

Historical Stock Chart

From Jul 2023 to Jul 2024