false000083436500008343652024-08-082024-08-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): August 8, 2024

BioLife Solutions, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-36362 | | 94-3076866 |

(State or other jurisdiction of

incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

3303 Monte Villa Parkway,

Bothell, WA 98021

(Address of principal executive offices) (Zip Code)

Registrant’s telephone number, including area code: (425) 402-1400

| | |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | |

| o | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | |

| o | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | |

| o | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | |

| o | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol | Name of exchange on which registered |

| Common Stock, par value $0.001 per share | BLFS | The NASDAQ Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company o

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Item 2.02 Results of Operations and Financial Condition.

On August 8, 2024, BioLife Solutions, Inc. (the “Company”) issued a press release announcing unaudited financial results and operational highlights for the second quarter ended June 30, 2024. A copy of the press release is furnished as Exhibit 99.1 to this current report on Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | BioLife Solutions, Inc. |

| | |

Date: August 8, 2024 | By: | /s/ Troy Wichterman |

| | | Name: Troy Wichterman |

| | Title: Chief Financial Officer |

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

BioLife Solutions Reports Second Quarter 2024 Financial Results

Cell Processing revenue increased 11% sequentially to $18.0 million

GAAP gross margin of 51% and non-GAAP adjusted gross margin of 52%

GAAP net loss from continuing operations of $7.1 million and non-GAAP adjusted EBITDA of $4.8 million or 17%

Raising full-year 2024 total revenue guidance to $99.0 million to $101.0 million; Cell Processing revenue guidance increased to $70.0 million to $71.0 million

Conference call begins at 4:30 p.m. Eastern time today

BOTHELL, Wash. (August 8, 2024) – BioLife Solutions, Inc. (Nasdaq: BLFS) (“BioLife” or the “Company”), a leading developer and supplier of bioproduction products and services for the cell and gene therapy (“CGT”) and the broader biopharma markets, today announced financial results for the three and six months ended June 30, 2024 and updated revenue guidance for 2024.

“We are pleased with our second quarter results. The business has stabilized and momentum continues with our third consecutive quarter of sequential revenue growth. With our continued focus on streamlining the business, we are now beginning to benefit from the strength of our high margin, recurring and consumable product offerings,” said Roderick de Greef, Chairman and CEO. “Our focus on our core cell processing product platform is emerging in our financial performance, with notable expansions in gross margin, increased adjusted EBITDA, and encouraging momentum into the second half of the year.”

de Greef continued, “As a pure play enabler of CGT’s globally, we are strategically aligned with the favorable secular trends, including a more favorable regulatory environment evidenced by increased therapy approvals with broadened indications, expanding geographic regions, and forward movement in the lines of treatment. We believe our market-leading biopreservation franchise supports more than 70% of U.S. commercial CGT trials and sets us up for a sustainable long-term and a promising future.”

Second Quarter 2024 Business Highlights

•Processed 12 new U.S. FDA Master File cross references for our biopreservation media, bringing the cumulative total processed to 728.

•Based on two additional regulatory approvals in the second quarter, our biopreservation media is embedded in 15 unique commercial CGTs as of June 30, 2024, with an expectation that 11 additional product approvals, geographic expansions, or new indications will occur in the next 12 months.

•In May, we introduced the CellSeal® CryoCaseTM at the International Society for Cell & Gene Therapies (ISCT) conference. The CryoCase is an addition to our CellSeal product line and was developed for the needs of CGT primary packaging to replace cryopreservation bags.

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

•In April, we completed the sale of our GCI freezer division, and the financial information presented in this news release excludes the results of GCI from the consolidated financial results.

Second Quarter 2024 Financial Performance

BioLife Solutions is presenting various financial metrics under U.S. generally accepted accounting principles (GAAP) and as adjusted (non-GAAP). In addition, BioLife Solutions is presenting adjusted (non-GAAP) metrics on a consolidated basis and also presenting its non-GAAP financial metrics excluding the financial results of GCI from its consolidated results. Reconciliations of GAAP to non-GAAP metrics appear at the end of this news release.

On April 17, 2024, the Company sold all of the issued and outstanding shares of common stock of Global Cooling, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Global Cooling”), to GCI Holdings Company, LLC, an Ohio limited liability company (“GCI Holdings”) pursuant to a Stock Purchase Agreement (the “Purchase Agreement”), by and between the Company and GCI Holdings (the “Global Cooling Divestiture”). Upon the execution of the Purchase Agreement, on April 17, 2024, Global Cooling business is presented in the accompanying unaudited condensed financial statements as a discontinued operation for all periods presented. All amounts included in this earnings release relate to continuing operations unless otherwise noted.

REVENUE

•Total revenue for the second quarter of 2024 was $28.3 million, a decrease of $0.9 million, or 3%, from $29.2 million for the second quarter of 2023 and up $1.5 million, or 6%, sequentially from the first quarter of 2024.

◦Cell Processing platform revenue was $18.0 million, a decrease of $0.7 million, or 4%, from the same period in 2023 and up $1.8 million, or 11%, sequentially from the first quarter of 2024.

◦Biostorage Services platform revenue was $7.0 million, an increase of $5,000, from the same period in 2023 and down $0.1 million, or 2%, sequentially from the first quarter of 2024.

◦Freezers and Thaw Systems platform revenue was $3.4 million, a decrease of $0.2 million, or 7%, from the same period in 2023 and down $0.1 million, or 4%, sequentially from the first quarter of 2024.

•Total revenue for the six months ended June 30, 2024 was $55.1 million, a decrease of $3.3 million, or 6%, from the same period in 2023.

◦Cell Processing platform revenue for the six months ended June 30, 2024 was $34.2 million, a decrease of $3.5 million, or 9%, from the same period in 2023.

◦Biostorage Services platform revenue was $14.0 million, an increase of $1.4 million, or 11%, from the same period in 2023 .

◦Freezers and Thaw Systems platform revenue was $6.9 million, a decrease of $1.2 million, or 15%, from the same period in 2023.

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

GROSS MARGIN

•Gross margin (GAAP) for the second quarter of 2024 was 51% compared with 35% for the second quarter of 2023. Adjusted gross margin (non-GAAP) for the second quarter of 2024 was 52% compared with 45% for the second quarter of 2023.

•Gross margin (GAAP) for the six months ended June 30, 2024 was 51% compared with 40% for the same period in 2023. Adjusted gross margin (non-GAAP) for the six months ended June 30, 2024 was 53% compared with 47% for the same period in 2023.

OPERATING LOSS FROM CONTINUING OPERATIONS

•Operating loss from continuing operations (GAAP) for the second quarter of 2024 was $2.8 million compared with $10.6 million for the second quarter of 2023. Adjusted operating loss from continuing operations (non-GAAP) for the second quarter of 2024 was $2.1 million compared with $5.8 million for the second quarter of 2023.

•Operating loss from continuing operations (GAAP) for the six months ended June 30, 2024 was $7.0 million compared with $19.3 million for the same period in 2023. Adjusted operating loss from continuing operations (non-GAAP) for the six months ended June 30, 2024 was $5.1 million compared with $11.4 million for the same period in 2023.

NET LOSS FROM CONTINUING OPERATIONS

•Net loss from continuing operations (GAAP) for the second quarter of 2024 was $7.1 million, which includes a $4.1 million write-off of our iVexSol equity investment, compared with $5.5 million for the second quarter of 2023. Adjusted net loss from continuing operations (non-GAAP) for the second quarter of 2024 was $2.3 million compared with $5.8 million for the second quarter of 2023.

•Net loss from continuing operations (GAAP) for the six months ended June 30, 2024 was $11.4 million, which includes a $4.1 million write-off of our iVexSol equity investment, compared with $14.2 million for the same period in 2023. Adjusted net loss from continuing operations (non-GAAP) for the six months ended June 30, 2024 was $5.3 million compared with $11.4 million for the same period in 2023.

LOSS PER SHARE FROM CONTINUING OPERATIONS

•Loss per share from continuing operations (GAAP) for the second quarter of 2024 was $0.16 compared with $0.12 for the second quarter of 2023.

•Loss per share from continuing operations (GAAP) for the six months ended June 30, 2024 was $0.25 compared with $0.33 for the same period in 2023.

ADJUSTED EBITDA

•Adjusted EBITDA, a non-GAAP measure, for the second quarter of 2024 was $4.8 million, or 17% of revenue, compared with $1.7 million, or 6% of revenue, for the second quarter of 2023.

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

•Adjusted EBITDA, a non-GAAP measure, for the six months ended June 30, 2024 was $8.5 million, or 15% of revenue, compared with $5.4 million, or 9% of revenue, for the same period in 2023.

CASH, CASH EQUIVALENTS, AND MARKETABLE SECURITIES

•Cash, cash equivalents, and marketable securities as of June 30, 2024, were $36.9 million.

(As a result of showing amounts in millions, rounding difference may exist in the percentages above.)

2024 Revenue Guidance

BioLife Solutions is updating its 2024 revenue guidance to $99.0 million to $101.0 million from prior guidance of $95.5 million to $100.0 million. This guidance is based on expectations for BioLife's Cell Processing and Biostorage Services platforms, which now include results from its ThawSTAR® product line and do not include revenue from the freezer product line (GCI and CBS).

•Cell Processing platform revenue: Revised to $70.0 million to $71.0 million from prior guidance of $66.0 million to $68.5 million. The revised guidance represents an increase of 6% to 8% compared with 2023. Compared with annualizing the second half of 2023 revenue run rate, growth is expected to be 25% to 26%

•Biostorage Services platform revenue: Revised to $29.0 million to $30.0 million from prior guidance of $29.5 million to $31.5 million. The revised guidance represents an increase of 3% to 7% compared with 2023. This platform now includes the ThawSTAR automated thawing product line. Without ThawSTAR, the growth rate is expected to be 8% to 12%.

Management expects full year positive adjusted EBITDA and adjusted EBITDA growth in 2024.

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

Conference Call & Webcast

Management will discuss the Company's financial results, provide a general business update and answer questions during a conference call and live webcast today at 4:30 p.m. ET (1:30 p.m. PT).

To access the webcast, log onto the Investor Relations page of the BioLife Solutions website at https://www.biolifesolutions.com/earnings. In addition, the conference call will be accessible by dialing toll-free 877-346-6112 or 848-280-6350 for international callers. A webcast replay will be available approximately two hours after the call ends and will be archived on https://www.biolifesolutions.com/ for 90 days.

About BioLife Solutions

BioLife Solutions is a leading supplier of cell processing tools and services for the cell and gene therapy (CGT) and broader biopharma markets. Our expertise facilitates the commercialization of new therapies by supplying solutions that maintain the health and function of biologic materials during the collection, development, storage and distribution. For more information, please visit www.biolifesolutions.com, and follow BioLife on LinkedIn and X.

Cautions Regarding Forward Looking Statements

Certain statements contained in this press release are not historical facts and may be forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. Words such as “plans,” “expects,” “believes,” “anticipates,” “designed,” and similar words are intended to identify forward-looking statements. Forward-looking statements are based on our current expectations and beliefs, and involve a number of risks and uncertainties that are difficult to predict and that could cause actual results to differ materially from those stated or implied by the forward-looking statements. A description of certain of these risks, uncertainties and other matters can be found in filings we make with the U.S. Securities and Exchange Commission, all of which are available at www.sec.gov. Because forward-looking statements involve risks and uncertainties, actual results and events may differ materially from results and events currently expected by us. Readers are cautioned not to place undue reliance on these forward-looking statements, which speak only as of the date hereof. We undertake no obligation to publicly update these forward-looking statements to reflect events or circumstances that occur after the date hereof or to reflect any change in its expectations with regard to these forward-looking statements or the occurrence of unanticipated events.

Non-GAAP Measures of Financial Performance

To supplement our financial statements, which are presented on the basis of U.S. generally accepted accounting principles (GAAP), the following non-GAAP measures of financial performance are included on a consolidated basis in this release: adjusted gross margin, adjusted operating expenses, adjusted operating income/(loss), adjusted net income/(loss), earnings before interest, taxes, depreciation and amortization (EBITDA), and adjusted EBITDA. A reconciliation of GAAP to adjusted non-GAAP financial measures is included as an attachment to this press release.

We believe these non-GAAP financial measures are useful to investors in assessing our operating performance. We use these financial measures internally to evaluate our operating

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

performance and for planning and forecasting of future periods. We also believe it is in the best interests of investors to provide this non-GAAP information.

While we believe these non-GAAP financial measures provide useful supplemental information to investors, there are limitations associated with the use of these non-GAAP financial measures. These non-GAAP financial measures may not be reported by competitors, and they may not be directly comparable to similarly titled measures of other companies due to differences in calculation methodologies. The non-GAAP financial measures are not an alternative to GAAP information and are not meant to be considered in isolation or as a substitute for comparable GAAP financial measures. They should be used only as a supplement to GAAP information and should be considered only in conjunction with our consolidated financial statements prepared in accordance with GAAP.

Media & Investor Relations

At the Company

Troy Wichterman

Chief Financial Officer

(425) 402-1400

twichterman@biolifesolutions.com

Investors

LHA Investor Relations

Jody Cain

(310) 691-7100

jcain@lhai.com

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

On April 17, 2024, the Company sold all of the issued and outstanding shares of common stock of Global Cooling, Inc., a Delaware corporation and wholly owned subsidiary of the Company (“Global Cooling”), to GCI Holdings Company, LLC, an Ohio limited liability company (“GCI Holdings”) pursuant to a Stock Purchase Agreement (the “Purchase Agreement”), by and between the Company and GCI Holdings (the “Global Cooling Divestiture”). Upon the execution of the Purchase Agreement, on April 17, 2024, Global Cooling business is presented in the unaudited condensed financial statements as a discontinued operation for all periods presented. All amounts included in this earnings release relate to continuing operations unless otherwise noted.

BIOLIFE SOLUTIONS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS

(Unaudited, amounts in thousands, except share and per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands, except per share and share data) | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| Product revenue | $ | 21,310 | | | $ | 22,786 | | | $ | 41,167 | | | $ | 46,307 | |

| Service revenue | 4,427 | | | 4,175 | | | 9,513 | | | 8,197 | |

| Rental revenue | 2,591 | | | 2,276 | | | 4,427 | | | 3,915 | |

| Total product, rental, and service revenue | 28,328 | | | 29,237 | | | 55,107 | | | 58,419 | |

| Costs and operating expenses: | | | | | | | |

| Cost of product, rental, and service revenue (exclusive of Intangible asset amortization) | $ | 13,435 | | | $ | 18,213 | | | $ | 26,001 | | | $ | 33,411 | |

| General and administrative | 10,893 | | | 13,540 | | | 22,603 | | | 26,755 | |

| Sales and marketing | 3,502 | | | 3,831 | | | 6,858 | | | 7,855 | |

| Research and development | 2,382 | | | 3,793 | | | 4,776 | | | 7,033 | |

| | | | | | | |

| Intangible asset amortization | 910 | | | 1,406 | | | 1,824 | | | 2,823 | |

| | | | | | | |

| Change in fair value of contingent consideration | — | | | (918) | | | — | | | (198) | |

| Total operating expenses | 31,122 | | | 39,865 | | | 62,062 | | | 77,679 | |

| Operating loss | (2,794) | | | (10,628) | | | (6,955) | | | (19,260) | |

| | | | | | | |

| Other (expense) income: | | | | | | | |

| Change in fair value of equity investments | (4,074) | | | — | | | (4,074) | | | — | |

| Gain on settlement of Global Cooling escrow | — | | | 5,115 | | | — | | | 5,115 | |

| Interest expense, net | (361) | | | (387) | | | (529) | | | (767) | |

| Other income | 84 | | | 384 | | | 322 | | | 767 | |

| Total other (expense) income, net | (4,351) | | | 5,112 | | | (4,281) | | | 5,115 | |

| | | | | | | |

| Loss before income tax expense | (7,145) | | | (5,516) | | | (11,236) | | | (14,145) | |

| Income tax expense | — | | | (2) | | | (121) | | | (94) | |

| Net loss from continuing operations | $ | (7,145) | | | $ | (5,518) | | | $ | (11,357) | | | $ | (14,239) | |

| | | | | | | |

| Discontinued operations: | | | | | | | |

| Loss from discontinued operations | (15,630) | | | (4,678) | | | (21,629) | | | (9,671) | |

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

| | | | | | | | | | | | | | | | | | | | | | | |

| Income tax expense | — | | | (3) | | | (10) | | | (3) | |

| Loss from discontinued operations | $ | (15,630) | | | $ | (4,681) | | | $ | (21,639) | | | $ | (9,674) | |

| | | | | | | |

| Net loss | $ | (22,775) | | | $ | (10,199) | | | $ | (32,996) | | | $ | (23,913) | |

| | | | | | | |

| Loss from continuing operations, attributable to common shareholders: | | | | | | | |

| Basic and Diluted | $ | (7,145) | | | $ | (5,518) | | | $ | (11,357) | | | $ | (14,239) | |

| Loss from discontinued operations, attributable to common shareholders: | | | | | | | |

| Basic and Diluted | $ | (15,630) | | | $ | (4,681) | | | $ | (21,639) | | | $ | (9,674) | |

| Loss per share from continuing operations, attributable to common shareholders: | | | | | | | |

| Basic and Diluted | $ | (0.16) | | | $ | (0.12) | | | $ | (0.25) | | | $ | (0.33) | |

| Loss per share from discontinued operations, attributable to common shareholders: | | | | | | | |

| Basic and Diluted | $ | (0.34) | | | $ | (0.11) | | | $ | (0.47) | | | $ | (0.22) | |

| Net loss attributable to common shareholders: | | | | | | | |

| Basic and Diluted | $ | (22,775) | | | $ | (10,199) | | | $ | (32,996) | | | $ | (23,913) | |

| Net loss per share attributable to common shareholders: | | | | | | | |

| Basic and Diluted | $ | (0.50) | | | $ | (0.23) | | | $ | (0.72) | | | $ | (0.55) | |

| Weighted average shares used to compute loss per share attributable to common shareholders: | | | | | | | |

| Basic and Diluted | 46,004,037 | | 43,441,219 | | 45,718,232 | | 43,235,558 |

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

BIOLIFE SOLUTIONS, INC.

CONDENSED CONSOLIDATED STATEMENTS OF COMPREHENSIVE LOSS

(Unaudited, amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Net loss | $ | (22,775) | | | $ | (10,199) | | | $ | (32,996) | | | $ | (23,913) | |

| Other comprehensive income | 11 | | | 35 | | | (210) | | | 180 | |

| Comprehensive loss | $ | (22,764) | | | $ | (10,164) | | | $ | (33,206) | | | $ | (23,733) | |

BIOLIFE SOLUTIONS, INC.

CONDENSED CONSOLIDATED BALANCE SHEET INFORMATION

(Unaudited, amounts in thousands)

| | | | | | | | | | | |

| | | |

| June 30, | | December 31, |

| (In thousands) | 2024 | | 2023 |

| Cash, cash equivalents, and marketable securities | $ | 36,853 | | | $ | 50,184 | |

| Working capital | 57,381 | | | 78,426 | |

| Current assets | 88,200 | | | 105,235 | |

| Current assets, discontinued operations | — | | | 15,369 | |

| Current liabilities | 30,819 | | | 29,382 | |

| Current liabilities, discontinued operations | — | | | 12,796 | |

| Total assets | 374,976 | | | 412,714 | |

| Long-term obligations, discontinued operations | — | | | 1,027 | |

| Long-term obligations | 22,715 | | | 31,846 | |

| | | |

Accumulated deficit(1) | (347,913) | | | (314,917) | |

| Total shareholders' equity | 321,442 | | | 337,663 | |

(1) During the three months ended March 31, 2024, we determined that an immaterial error existed in our previously issued consolidated financial statements related to stock compensation expense on unvested shares of market-based awards of certain employees upon their termination. Our Accumulated deficit was impacted by the error by $1.6 million and was corrected within our Quarterly Report on Form 10-Q filed for the three months ended March 31, 2024.

BIOLIFE SOLUTIONS, INC.

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS INFORMATION

(Unaudited, amounts in thousands)

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

| | | | | | | | | | | |

| Six Months Ended

June 30, |

| (In thousands) | 2024 | | 2023 |

| Net cash used in (provided by) operating activities | $ | 1,984 | | | $ | (10,430) | |

| Net cash provided by (used in) investing activities | (13,656) | | | 12,218 | |

| Net cash provided by (used in) financing activities | (1,656) | | | 142 | |

| Effects of currency translation | (65) | | | 28 | |

| Net decrease (increase) in cash, cash equivalents, and restricted cash | $ | (13,393) | | | $ | 1,958 | |

As a result of the Company's divestiture of Global Cooling during the quarter, several financial metrics were re-forecasted to more closely align with continuing operations. During this process, several non-GAAP measures were adjusted, resulting in differences between previously reported non-GAAP results on a continuing operations basis. All adjusted items are designated with a (*) symbol.

BIOLIFE SOLUTIONS, INC.

RECONCILIATION OF GAAP GROSS PROFIT TO NON-GAAP ADJUSTED GROSS MARGIN

(Unaudited, amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| Total revenues | $ | 28,328 | | | $ | 29,237 | | | $ | 55,107 | | | $ | 58,419 | |

| Cost of revenues | (13,435) | | | (18,213) | | | (26,001) | | | (33,411) | |

| COGS intangible asset amortization | (577) | | | (733) | | | (1,159) | | | (1,466) | |

| GROSS PROFIT | $ | 14,316 | | | $ | 10,291 | | | $ | 27,947 | | | $ | 23,542 | |

| GROSS MARGIN | 51 | % | | 35 | % | | 51 | % | | 40 | % |

| | | | | | | |

| ADJUSTMENTS TO GROSS PROFIT: | | | | | | | |

| Inventory reserve costs | — | | | 2,185 | | | — | | | 2,185 | |

| Gain on disposal of assets* | (25) | | | — | | | (48) | | | — | |

| Intangible asset amortization | 577 | | | 733 | | | 1,159 | | | 1,466 | |

| ADJUSTED GROSS PROFIT | $ | 14,868 | | | $ | 13,209 | | | $ | 29,058 | | | $ | 27,193 | |

| ADJUSTED GROSS MARGIN | 52 | % | | 45 | % | | 53 | % | | 47 | % |

BIOLIFE SOLUTIONS, INC.

RECONCILIATION OF GAAP OPERATING EXPENSES FROM CONTINUING OPERATIONS TO NON-GAAP ADJUSTED OPERATING EXPENSES FROM CONTINUING OPERATIONS

(Unaudited, amounts in thousands)

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| OPERATING EXPENSES FROM CONTINUING OPERATIONS | $ | 31,122 | | | $ | 39,865 | | | $ | 62,062 | | | $ | 77,679 | |

| | | | | | | |

| ADJUSTMENTS TO OPERATING EXPENSES FROM CONTINUING OPERATIONS: | | | | | | | |

| Cost of product, rental, and service revenues | (13,435) | | | (18,213) | | | (26,001) | | | (33,411) | |

| Acquisition costs | (153) | | | (2,143) | | | (390) | | | (2,976) | |

| | | | | | | |

| Intangible asset amortization | (910) | | | (1,406) | | | (1,824) | | | (2,823) | |

| Gain (loss) on disposal of assets | 25 | | | (19) | | | 100 | | | (28) | |

| Change in fair value of contingent consideration | — | | | 918 | | | — | | | 198 | |

| Other income | 300 | | | — | | | 300 | | | — | |

| | | | | | | |

| ADJUSTED OPERATING EXPENSES FROM CONTINUING OPERATIONS | $ | 16,949 | | | $ | 19,002 | | | $ | 34,247 | | | $ | 38,639 | |

BIOLIFE SOLUTIONS, INC.

RECONCILIATION OF GAAP OPERATING LOSS FROM CONTINUING OPERATIONS TO NON-GAAP ADJUSTED OPERATING LOSS FROM CONTINUING OPERATIONS

(Unaudited, amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| OPERATING LOSS FROM CONTINUING OPERATIONS | $ | (2,794) | | | $ | (10,628) | | | $ | (6,955) | | | $ | (19,260) | |

| | | | | | | |

| ADJUSTMENTS TO OPERATING LOSS FROM CONTINUING OPERATIONS | | | | | | | |

| Inventory reserve costs | — | | | 2,185 | | | — | | | 2,185 | |

| Acquisition costs | 153 | | | 2,143 | | | 390 | | | 2,976 | |

| | | | | | | |

| Intangible asset amortization | 910 | | | 1,406 | | | 1,824 | | | 2,823 | |

| (Gain) loss on disposal of assets | (25) | | | 19 | | | (100) | | | 28 | |

| Change in fair value of contingent consideration | — | | | (918) | | | — | | | (198) | |

| Other income | (300) | | | — | | | (300) | | | — | |

| | | | | | | |

| ADJUSTED OPERATING LOSS FROM CONTINUING OPERATIONS | $ | (2,056) | | | $ | (5,793) | | | $ | (5,141) | | | $ | (11,446) | |

BIOLIFE SOLUTIONS, INC.

RECONCILIATION OF GAAP NET LOSS FROM CONTINUING OPERATIONS TO NON-GAAP ADJUSTED NET LOSS FROM CONTINUING OPERATIONS

(Unaudited, amounts in thousands)

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| NET LOSS FROM CONTINUING OPERATIONS | $ | (7,145) | | | $ | (5,518) | | | $ | (11,357) | | | $ | (14,239) | |

| | | | | | | |

| ADJUSTMENTS TO NET LOSS FROM CONTINUING OPERATIONS | | | | | | | |

| Inventory reserve costs | — | | | 2,185 | | | — | | | 2,185 | |

| Acquisition costs | 153 | | | 2,143 | | | 390 | | | 2,976 | |

| | | | | | | |

| Intangible asset amortization | 910 | | | 1,406 | | | 1,824 | | | 2,823 | |

| (Gain) loss on disposal of assets | (25) | | | 19 | | | (100) | | | 28 | |

| Change in fair value of equity investments | 4,074 | | | — | | | 4,074 | | | — | |

| Change in fair value of contingent consideration | — | | | (918) | | | — | | | (198) | |

| Other income | (300) | | | — | | | (300) | | | — | |

| Income tax benefit | — | | | 2 | | | 121 | | | 94 | |

| Gain on settlement of Global Cooling escrow | — | | | (5,115) | | | — | | | (5,115) | |

| | | | | | | |

| ADJUSTED NET LOSS FROM CONTINUING OPERATIONS | $ | (2,333) | | | $ | (5,796) | | | $ | (5,348) | | | $ | (11,446) | |

3303 Monte Villa Parkway, Suite 310 | Bothell, WA 98021 USA | 866.424.6543 phone | BioLifeSolutions.com

BIOLIFE SOLUTIONS, INC.

RECONCILIATION OF GAAP NET LOSS FROM CONTINUING OPERATIONS TO NON-GAAP ADJUSTED EBITDA FROM CONTINUING OPERATIONS

(Unaudited, amounts in thousands)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

June 30, | | Six Months Ended

June 30, |

| (In thousands) | 2024 | | 2023 | | 2024 | | 2023 |

| NET LOSS FROM CONTINUING OPERATIONS | $ | (7,145) | | | $ | (5,518) | | | $ | (11,357) | | | $ | (14,239) | |

| | | | | | | |

| ADJUSTMENTS: | | | | | | | |

| Interest expense, net | 361 | | | 387 | | | 529 | | | 767 | |

| Accretion of available-for-sale investments* | (137) | | | (349) | | | (320) | | | (740) | |

| Income tax benefit | — | | | 2 | | | 121 | | | 94 | |

| Depreciation | 1,464 | | | 1,731 | | | 2,898 | | | 5,045 | |

| Intangible asset amortization | 910 | | | 1,406 | | | 1,824 | | | 2,823 | |

| EBITDA | $ | (4,547) | | | $ | (2,341) | | | $ | (6,305) | | | $ | (6,250) | |

| | | | | | | |

| OTHER ADJUSTMENTS: | | | | | | | |

| Share-based compensation (non-cash) | 5,461 | | | 5,732 | | | 10,699 | | | 11,732 | |

| Inventory reserve costs | — | | | 2,185 | | | — | | | 2,185 | |

| Acquisition costs | 153 | | | 2,143 | | | 390 | | | 2,976 | |

| | | | | | | |

| (Gain) loss on disposal of assets | (25) | | | 19 | | | (100) | | | 28 | |

| Change in fair value of equity investments | 4,074 | | | — | | | 4,074 | | | — | |

| Change in fair value of contingent consideration | — | | | (918) | | | — | | | (198) | |

| Other income | (300) | | | — | | | (300) | | | — | |

| Gain on settlement of Global Cooling escrow | — | | | (5,115) | | | — | | | (5,115) | |

| | | | | | | |

| ADJUSTED EBITDA FROM CONTINUING OPERATIONS | $ | 4,816 | | | $ | 1,705 | | | $ | 8,458 | | | $ | 5,358 | |

| % of Revenue | 17 | % | | 6 | % | | 15 | % | | 9 | % |

v3.24.2.u1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

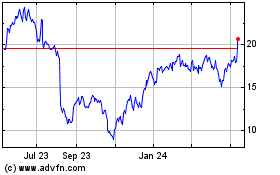

BioLife Solutions (NASDAQ:BLFS)

Historical Stock Chart

From Sep 2024 to Oct 2024

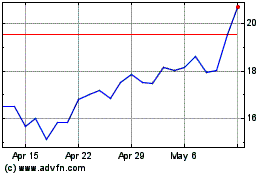

BioLife Solutions (NASDAQ:BLFS)

Historical Stock Chart

From Oct 2023 to Oct 2024