Berry Corporation Reaffirms a Strong Liquidity Position, Balance Sheet Strength, and Ongoing Free Cash Flow Generation

August 30 2024 - 6:30AM

Berry Corporation (bry) (NASDAQ: BRY) (“Berry” or the “Company”) is

reaffirming its strong liquidity position consisting of $94 million

of available borrowing capacity under its reserve-based lending

(“RBL”) facility and $11 million of cash as of August 23, 2024, as

well as its expectation of significant free cash flow generation

continuing during the second half of 2024.

As of August 23, 2024, the Company’s borrowings

outstanding under its RBL facility were $22 million, reflecting a

reduction of approximately 57%, or $29 million, since the first

quarter of 2024. This reduction included the final payment of $20

million made in July on the 2023 Macpherson transaction. The

Company maintains $125 million of available borrowing capacity

until the RBL facility matures on August 26, 2025. The Company is

actively working to address its debt obligations and is in

discussions to extend or refinance its RBL facility.

The Company continues to maintain ample

liquidity and generate the free cash flow necessary to further

reduce debt and fund shareholder returns as appropriate. Production

remains on track with the Company’s previously issued annual

guidance, and the Company has in-hand the necessary permits to

complete its planned drilling program for 2024, as well as to

support activity into 2025. Based on its inventory of workovers,

sidetracks, and new wells, and assuming permits continue to be

issued at the rate and in the manner they are currently being

issued, the Company has line of sight to keep production flat and

maintain free cash flow into 2026.

“We remain focused on creating value by

maintaining balance sheet strength and generating sustainable free

cash flow. The second half of the year traditionally has

significantly better free cash flow compared to the first half due

to lower working capital usage. Our capital expenditures are

expected to be well under cash flow from operations in the second

half of 2024 and we are on track to meet our annual production

goals,” said Mike Helm, Berry’s Chief Financial Officer.

He continued, “Supported by our strong

operations, we have and will continue to take steps to strengthen

our financial position. For example, we reduced our revolver

balance by 57% from the end of the first quarter to date. This

reflects our continued prioritization of debt reduction, prudently

investing in the business and returning capital to our shareholders

when appropriate. We are actively looking to further strengthen our

balance street, including the extension or refinancing of our RBL

facility, and addressing our senior unsecured notes due February

2026.”

About Berry Corporation

(BRY)

Berry is a publicly traded (NASDAQ: BRY) western

United States independent upstream energy company with a focus on

onshore, low geologic risk, low decline, long-lived oil and gas

reserves. We operate in two business segments: (i) exploration and

production (“E&P”) and (ii) well servicing and abandonment. Our

E&P assets are located in California and Utah, are

characterized by high oil content and are predominantly located in

rural areas with low population. Our California assets are in the

San Joaquin basin (100% oil), while our Utah assets are in the

Uinta basin (60% oil and 40% gas). We operate our well servicing

and abandonment segment in California. More information can be

found on the Company’s website at bry.com.

Forward Looking Statements

The information in this press release includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. You can typically identify forward-looking statements

by words such as aim, anticipate, achievable, believe, budget,

continue, could, effort, estimate, expect, forecast, goal,

guidance, intend, likely, may, might, objective, outlook, plan,

potential, predict, project, seek, should, target, will or would

and other similar words that reflect the prospective nature of

events or outcomes. All statements, other than statements of

historical facts, included in this press release that address

plans, activities, events, objectives, goals, strategies, or

developments that the Company expects, believes or anticipates will

or may occur in the future, such as those regarding our financial

position; liquidity; our ability to refinance or pay, when due, our

indebtedness; cash flows (including, but not limited to, Adjusted

Free Cash Flow); financial and operating results; capital program

and development and production plans; operations and business

strategy; potential acquisition and other strategic opportunities;

reserves; hedging activities; capital expenditures; return of

capital; our shareholder return model and the payment of future

dividends; future repurchases of stock or debt; capital

investments; our ESG strategy and the initiation of new projects or

business in connection therewith, recovery factors; and other

guidance are forward-looking statements. Actual results may differ

from anticipated results, sometimes materially, and reported

results should not be considered an indication of future

performance. For any such forward-looking statement that includes a

statement of the assumptions or bases underlying such

forward-looking statement, we caution that while we believe such

assumptions or bases to be reasonable and make them in good faith,

assumed facts or bases always vary from actual results, sometimes

materially.

Berry cautions you that these forward-looking

statements are subject to all of the risks and uncertainties

incident to acquisition transactions and the exploration for and

development, production, gathering and sale of natural gas, NGLs

and oil most of which are difficult to predict and many of which

are beyond Berry’s control. These risks include, but are not

limited to, our ability to refinance our indebtedness on terms

favorable to us; commodity price volatility; legislative and

regulatory actions that may prevent, delay or otherwise restrict

our ability to drill and develop our assets, including with respect

to existing and/or new requirements in the regulatory approval and

permitting process; legislative and regulatory initiatives in

California or our other areas of operation addressing climate

change or other environmental concerns; investment in and

development of competing or alternative energy sources; drilling,

production and other operating risks; effects of competition;

uncertainties inherent in estimating natural gas and oil reserves

and in projecting future rates of production; our ability to

replace our reserves through exploration and development activities

or strategic transactions; cash flow and access to capital; the

timing and funding of development expenditures; environmental,

health and safety risks; effects of hedging arrangements; potential

shut-ins of production due to lack of downstream demand or storage

capacity; disruptions to, capacity constraints in, or other

limitations on the third-party transportation and market takeaway

infrastructure (including pipeline systems) that deliver our oil

and natural gas and other processing and transportation

considerations; the ability to effectively deploy our ESG strategy

and risks associated with initiating new projects or business in

connection therewith; our ability to successfully integrate the

Macpherson assets into our operations; we fail to identify risks or

liabilities related to Macpherson, its operations or assets; our

inability to achieve anticipated synergies; our ability to

successfully execute other strategic bolt-on acquisitions; overall

domestic and global political and economic conditions; inflation

levels, including increased interest rates and volatility in

financial markets and banking; changes in tax laws and the other

risks described under the heading “Item 1A. Risk Factors” in the

Company’s Annual Report on Form 10-K for the year ended December

31, 2023 and subsequent filings with the SEC.

Any forward-looking statement speaks only as of

the date on which such statement is made, and we undertake no

responsibility to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise

except as required by applicable law. Investors are urged to

consider carefully the disclosure in our filings with the

Securities and Exchange Commission, available from us via our

website or via the Investor Relations contact below, or from the

SEC’s website at www.sec.gov.

Contact

Contact: Berry Corporation (BRY)

Todd Crabtree – Director, Investor Relations

(661) 616-3811

ir@bry.com

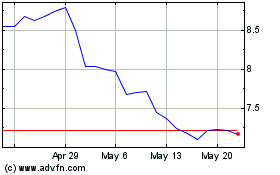

Berry (NASDAQ:BRY)

Historical Stock Chart

From Oct 2024 to Nov 2024

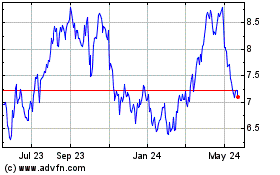

Berry (NASDAQ:BRY)

Historical Stock Chart

From Nov 2023 to Nov 2024