Berry Corporation (bry) (NASDAQ: BRY) (“Berry” or the “Company”)

today reported net loss of $65 million or $0.81 per diluted share

and Adjusted Net Income(1) of $5 million or $0.06 per diluted share

for the second quarter of 2020.

Quarterly Highlights

- Kept all employees safe and maintained continuous operations

while planning for continued COVID/oil demand uncertainty

- Reduced Unhedged OpEx 16% quarter over quarter through our

cost-savings initiative

- Generated positive Levered Free Cash Flow(1); began building

cash reserves as planned in July

- Achieved Adjusted EBITDA(1) of $57 million on strong hedge

position and cost savings

- Enhanced 2021 financial hedge portfolio at $46/Bbl Brent;

currently over 75% of first half targeted oil production

_______

(1) Please see “Non-GAAP Financial

Measures and Reconciliations” later in this press release for a

reconciliation and more information on these

Non-GAAP measures.

“Our flexible and adaptable business structure

and strong culture of teamwork, leadership and communication

enabled us to adapt our work processes quickly in response to the

challenges posed by COVID-19. We safely transitioned to a work from

home environment for our office employees, and then returned to the

office, without any problems with operations, accounting, financial

reporting or internal controls. In all of our locations, we

implemented CDC-aligned safety and health protocols, which have

kept employees and their families safe and healthy while

successfully supporting continuous operations," said Trem Smith,

Berry board chair and chief executive officer.

“While market conditions improved over the

latter part of the quarter we still anticipate, and have planned

for, a prolonged impact of the global demand destruction caused

primarily by COVID-19 to continue for the next few quarters. Our

experienced Berry management team is successfully managing through

this downturn by protecting our cash flow, maintaining our strong

liquidity position and positioning the company to thrive when the

market returns. Through sustainable cost and cash savings and

efficiency improvements, we reduced our Unhedged OpEx costs by 16%

quarter over quarter. We also improved our hedge position in 2021

to weather the continued volatility we expect through the first

half of next year and we are determined to continue to build cash

through the year. We currently plan to recommence drilling with one

rig in early October, which would continue to work throughout 2021.

As we have said before, the Berry business model is designed to

create value in any cycle, and we are confident we will continue to

do so in this one.”

Second Quarter 2020 Results

Adjusted EBITDA(1), on a hedged basis, was $57

million in the second quarter 2020 compared to $72 million in the

first quarter 2020. The decrease was mostly due to historically low

oil prices caused by the OPEC+ supply increase and COVID-19 demand

destruction Additionally, second quarter greenhouse gas ("GHG")

costs were higher as they returned to historical levels following a

significant decrease in the first quarter 2020 from a GHG allowance

market dislocation which allowed us to purchase significant

allowances at low prices. These decreases were largely offset by

higher oil hedge settlements received and lower costs including

OpEx.

Average daily production decreased 5% for the

second quarter of 2020 compared to the first quarter of 2020,

largely due to natural declines as a result of ending our drilling

activity in April and improved steam management which reduced costs

but temporarily increased water disposal needs and consequently

caused a slight decrease in production. Inventory also increased in

the second quarter. In the second quarter of 2020 we reduced

capital 58% and drilled only four wells. The Company's California

production of 23.4 MBoe/d for the second quarter of 2020 decreased

6% from the first quarter 2020.

The Company-wide hedged realized oil price for

the second quarter 2020 was $54.40 per Boe, only a 5% reduction

from the first quarter although the average Brent price declined

34%. The California average oil price before hedges for the second

quarter was $29.53/Bbl, or 88% of Brent, which was 39% lower than

the $48.38/Bbl in the first quarter 2020, which was 95% of Brent.

The financial hedges for oil sales for the second quarter 2020

added $27.78 per Bbl to the California realized price, highlighting

the effectiveness of our oil hedge positions.

On an unhedged basis, operating expenses

decreased by 16% or $2.90 per Boe to $15.33 for the second quarter

2020, compared to $18.23 for the first quarter 2020. The decrease

was driven by the effectiveness of our cost savings and efficiency

initiatives which resulted in $2.77 per Boe lower lease operating

expense. Additionally, operating expenses, including hedge effects,

decreased to $18.11 per Boe in the second quarter 2020 from $19.81

in the first quarter 2020 due to the same factors and $1.20 per Boe

higher gas hedge settlement paid period over period.

OpEx consists of lease operating expenses

("LOE"), third-party revenues and expenses from electricity

generation, transportation and marketing activities, as well as the

effect of derivative settlements (received or paid) for gas

purchases, and excludes taxes other than income taxes.

General and administrative expenses decreased by

$0.6 million, or 3%, to less than $19 million for the three months

ended June 30, 2020, compared to the three months ended March 31,

2020. Adjusted general and administrative expenses(1), which

exclude non-cash stock compensation costs and nonrecurring costs,

were $14 million for the second quarter 2020 compared to $15

million for the first quarter 2020. The cost reduction reflected

various cost savings initiatives partially offset by a slight

increase in bonus costs as the cost savings targets are met.

Taxes, other than income taxes were $3.94 per

Boe for the second quarter compared to $1.56 per Boe in the first

quarter 2020, as market rates for GHG requirements returned to more

historic levels from the unsustainable levels experienced in the

first quarter.

Net loss for the second quarter 2020 was $65

million compared to $115 million in the first quarter 2020.

Adjusted Net Income(1) was $5 million for the second quarter,

representing a 75% decrease from the first quarter 2020 due to

significantly lower oil prices, as well as higher GHG, DD&A and

income tax expenses.

For the second quarter of 2020, capital

expenditures were approximately $17 million, on an accrual basis

including capitalized overhead but excluding capitalized interest,

acquisitions and asset retirement spending. Approximately 96% of

this total was directed to California oil operations. In the second

quarter of 2020, the vast majority of capital spent was used for

activities which had no impact on current production, including

capital for facilities, equipping and cogeneration maintenance. We

also expended approximately $6 million for plugging and abandonment

activities. The Company currently has 185 wells permitted for

drilling and nearly 200 more in process at the regulatory

agencies.

The Company acquired approximately 740 net acres

in the North Midway Sunset Field for approximately $5 million. This

property is adjacent to, and extends, our existing producing area

in the Potter formation and we have identified numerous future

drilling locations.

At June 30, 2020, the Company had $142 million

available for borrowings under its RBL Facility which included $1

million of outstanding borrowings and $7 million of letters of

credit. The RBL Facility has a $200 million borrowing base with an

elected commitment of $200 million, limited to $150 million until

the next semi annual redetermination.

“While we have realized substantial market

improvements since April, these remain difficult times for our

industry. We continue to focus on our cash position in order to

provide Berry with the flexibility to move quickly in this cyclical

trough. We are continuing to plan for a two-year cyclical low;

however, our improved cost structure coupled with oil prices being

substantially better than our earlier estimates give us more

confidence in putting a drilling rig to work the last quarter of

this year and throughout 2021. We have and will continue to live by

our financial policy. We achieved positive Levered Free Cash Flow

in the second quarter, and even increased it compared to the first

quarter. We expect Levered Free Cash Flow for 2020 to be nearly

$100 million,” stated Cary Baetz, chief financial officer, EVP and

director._______

(1) Please see “Non-GAAP Financial

Measures and Reconciliations” later in this press release for a

reconciliation and more information on these

Non-GAAP measures.

Earnings Conference Call

The Company will host a conference call August 5, 2020 to

discuss these results:

|

Live Call Date: |

Wednesday, August 5, 2020 |

| Live Call Time: |

9:00 a.m. Eastern Time (6 a.m.

Pacific Time) |

| Live Call Dial-in: |

877-491-5169 from the

U.S. |

| |

720-405-2254 from

international locations |

| Live Call Passcode: |

2488098 |

| |

|

A replay of the audio webcast will also be archived on the

“Events” section of Berry’s

website at bry.com/category/events.An audio replay will

be available shortly after the broadcast:

|

Replay Dates: |

Through Wednesday, August 26, 2020 |

| Replay Dial-in: |

855-859-2056 from the

U.S. |

| |

404-537-3406 from

international locations |

| Replay Passcode: |

2488098 |

| |

|

A replay of the audio webcast will also be

archived on the “Events” section of Berry’s

website at bry.com/category/events. In addition, an

investor presentation will be available on the Company’s

website.

About Berry Corporation

(bry)

Berry is a publicly traded (NASDAQ: BRY) western

United States independent upstream energy company with a focus on

the conventional, long-lived oil reserves in the San Joaquin basin

of California. More information can be found at the Company’s

website at bry.com.

Forward-Looking Statements

The information in this press release includes

forward-looking statements within the meaning of Section 27A of the

Securities Act of 1933 and Section 21E of the Securities Exchange

Act of 1934. All statements, other than statements of historical

facts, included in this press release that address plans,

activities, events, objectives, goals, strategies, or developments

that the Company expects, believes or anticipates will or may occur

in the future are forward-looking statements. The forward-looking

statements in this press release are based upon various

assumptions, many of which are based, in turn, upon further

assumptions. Although we believe that these assumptions were

reasonable when made, these assumptions are inherently subject to

significant uncertainties and contingencies which are difficult or

impossible to predict and are beyond our control. Therefore, such

statements forward-looking statements involve significant risks and

uncertainties that could materially affect our expected results of

operations, liquidity, cash flows and business prospects. Without

limiting the generality of the forgoing, such statements

specifically include our expectations, beliefs or projections as to

our future:

- financial position;

- liquidity;

- cash flows;

- anticipated financial and operating results;

- our capital program and development and production plans;

- business strategy;

- potential acquisition opportunities;

- other plans and objectives for operations;

- maintenance capital requirements;

- expected production and costs;

- reserves;

- hedging activities;

- return of capital;

- payment of future dividends;

- future repurchases of stock or debt; and

- capital investments and other guidance.

Actual results may differ materially from

expectations, and reported results should not be considered an

indication of future performance. Known factors (but not all the

factors) that could cause actual results to differ materially from

those discussed in the forward-looking statements include:

- the length, scope and severity of the recent COVID-19 pandemic,

including the effects of related public health concerns and the

impact of actions taken by governmental authorities and other third

parties in response to the pandemic and its impact on commodity

prices, supply and demand considerations, and storage

capacity;

- global economic trends, geopolitical risks and general economic

and industry conditions, such as those resulting from the COVID-19

pandemic and from the actions of OPEC+, including the escalation of

tensions between Saudi Arabia and Russia and changes in OPEC+'s

production levels;

- volatility of oil, natural gas and NGL prices, including the

sharp decline in crude oil prices that occurred in the first

quarter and has continued into the second quarter of 2020;

- supply of and demand for oil, natural gas and NGLs;

- disruptions to, capacity constraints in, or other limitations

on the pipeline systems that deliver our oil and natural gas and

other processing and transportation considerations;

- inability to generate sufficient cash flow from operations or

to obtain adequate financing to fund capital expenditures,

meet our working capital requirements or fund planned

investments;

- price fluctuations and availability of natural gas and

electricity and the cost of steam;

- our ability to use derivative instruments to manage commodity

price risk;

- the regulatory environment, including availability or timing

of, and conditions imposed on, obtaining and/or maintaining permits

and approvals, including those necessary for drilling and/or

development projects;

- our ability to meet our planned drilling schedule, including

due to our ability to obtain permits on a timely basis or at all,

and to successfully drill wells that produce oil and natural gas in

commercially viable quantities;

- the impact of current, pending and/or future laws and

regulations, and of legislative and regulatory changes and other

government activities, including those related to drilling,

completion, well stimulation, operation, maintenance or abandonment

of wells or facilities, managing energy, water, land, greenhouse

gases or other emissions, protection of health, safety and the

environment, or transportation, marketing and sale of our

products;

- the California and global energy future, including the factors

and trends that are expected to shape it, such as concerns about

climate change and other air quality issues, the transition to a

low-emission economy and the expected role of different energy

sources;

- uncertainties associated with estimating proved reserves and

related future cash flows;

- our ability to replace our reserves through exploration and

development activities;

- drilling and production results, including lower-than-expected

production, reserves or resources from development projects or

higher-than-expected decline rates;

- our ability to obtain timely and available drilling and

completion equipment and crew availability and access to necessary

resources for drilling, completing and operating wells;

- changes in tax laws;

- effects of competition;

- uncertainties and liabilities associated with acquired and

divested assets;

- our ability to make acquisitions and successfully integrate any

acquired businesses;

- large or multiple customer defaults on contractual obligations,

including defaults resulting from actual or potential

insolvencies;

- geographical concentration of our operations;

- the creditworthiness and performance of our counterparties with

respect to our hedges;

- impact of derivatives legislation affecting our ability to

hedge;

- failure of risk management and ineffectiveness of internal

controls;

- catastrophic events, including wildfires, earthquakes and

pandemics;

- environmental risks and liabilities under federal, state,

tribal and local laws and regulations (including remedial

actions);

- potential liability resulting from pending or future

litigation;

- our ability to recruit and/or retain key members of our senior

management and key technical employees;

- information technology failures or cyber attacks; and other

material risks that appear in the Risk Factors section of our most

recent Quarterly Report on Form 10-Q, Annual Report on Form 10-K

and other periodic reports filed with the Securities and Exchange

Commission.

You can typically identify forward-looking

statements by words such as aim, anticipate, achievable, believe,

continue, could, estimate, expect, forecast, goal, guidance,

intend, likely, may, might, objective, outlook, plan, potential,

predict, project, seek, should, target, will or would and other

similar words that reflect the prospective nature of events

or outcomes.

Any forward-looking statement speaks only as of

the date on which such statement is made, and we undertake no

obligation to correct or update any forward-looking statement,

whether as a result of new information, future events or otherwise

except as required by applicable law. Investors are urged to

consider carefully the disclosure in our filings with the

Securities and Exchange Commission, available from us at via our

website or via the Investor Relations contact below, or from the

SEC’s website at www.sec.gov.

Tables Following

The financial information and certain other

information presented have been rounded to the nearest whole number

or the nearest decimal. Therefore, the sum of the numbers in a

column may not conform exactly to the total figure given for that

column in certain tables. In addition, certain percentages

presented here reflect calculations based upon the underlying

information prior to rounding and, accordingly, may not conform

exactly to the percentages that would be derived if the relevant

calculations were based upon the rounded numbers, or may not sum

due to rounding.

SUMMARY OF RESULTS

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| |

($ and shares in thousands, except per share amounts) |

| Statement of

Operations Data: |

|

|

|

|

|

| Revenues and

other: |

|

|

|

|

|

|

Oil, natural gas and natural gas liquids sales |

$ |

70,515 |

|

|

|

$ |

122,098 |

|

|

|

$ |

136,908 |

|

|

|

Electricity sales |

4,884 |

|

|

|

5,461 |

|

|

|

5,364 |

|

|

|

(Losses) gains on oil derivatives |

(42,267 |

) |

|

|

211,229 |

|

|

|

27,276 |

|

|

|

Marketing revenues |

292 |

|

|

|

453 |

|

|

|

414 |

|

|

|

Other revenues |

29 |

|

|

|

24 |

|

|

|

104 |

|

|

|

Total revenues and other |

33,453 |

|

|

|

339,265 |

|

|

|

170,066 |

|

|

| |

|

|

|

|

|

| Expenses and

other: |

|

|

|

|

|

|

Lease operating expenses |

40,733 |

|

|

|

50,752 |

|

|

|

47,879 |

|

|

|

Electricity generation expenses |

3,022 |

|

|

|

3,946 |

|

|

|

3,164 |

|

|

|

Transportation expenses |

1,789 |

|

|

|

1,822 |

|

|

|

1,694 |

|

|

|

Marketing expenses |

280 |

|

|

|

430 |

|

|

|

421 |

|

|

|

General and administrative expenses |

18,777 |

|

|

|

19,337 |

|

|

|

16,158 |

|

|

|

Depreciation, depletion and amortization |

37,512 |

|

|

|

35,329 |

|

|

|

23,654 |

|

|

|

Impairment of oil and gas properties |

— |

|

|

|

289,085 |

|

|

|

— |

|

|

|

Taxes, other than income taxes |

10,449 |

|

|

|

4,352 |

|

|

|

11,348 |

|

|

|

Losses on natural gas derivatives |

925 |

|

|

|

12,035 |

|

|

|

9,449 |

|

|

|

Other operating (income) expenses |

(1,192 |

) |

|

|

2,202 |

|

|

|

3,119 |

|

|

|

Total expenses and other |

112,295 |

|

|

|

419,290 |

|

|

|

116,886 |

|

|

| |

|

|

|

|

|

| Other (expenses)

income: |

|

|

|

|

|

|

Interest expense |

(8,676 |

) |

|

|

(8,920 |

) |

|

|

(8,961 |

) |

|

|

Other, net |

(6 |

) |

|

|

(6 |

) |

|

|

— |

|

|

|

Total other (expenses) income |

(8,682 |

) |

|

|

(8,926 |

) |

|

|

(8,961 |

) |

|

| Reorganization items, net |

— |

|

|

|

— |

|

|

|

(26 |

) |

|

| (Loss) income before

income taxes |

(87,524 |

) |

|

|

(88,951 |

) |

|

|

44,193 |

|

|

| Income tax (benefit)

expense |

(22,623 |

) |

|

|

26,349 |

|

|

|

12,221 |

|

|

| Net (loss)

income |

$ |

(64,901 |

) |

|

|

$ |

(115,300 |

) |

|

|

$ |

31,972 |

|

|

| |

|

|

|

|

|

| Net (loss) income per

share: |

|

|

|

|

|

| Basic |

$ |

(0.81 |

) |

|

|

$ |

(1.45 |

) |

|

|

$ |

0.39 |

|

|

| Diluted |

$ |

(0.81 |

) |

|

|

$ |

(1.45 |

) |

|

|

$ |

0.39 |

|

|

| |

|

|

|

|

|

| Weighted-average shares of

common stock outstanding - basic |

79,795 |

|

|

|

79,608 |

|

|

|

81,519 |

|

|

| Weighted-average shares of

common stock outstanding - diluted |

79,795 |

|

|

|

79,608 |

|

|

|

81,683 |

|

|

| |

|

|

|

|

|

| Adjusted Net Income(1) |

$ |

4,609 |

|

|

|

$ |

18,175 |

|

|

|

$ |

20,046 |

|

|

| Weighted-average shares of

common stock outstanding - diluted |

80,640 |

|

|

|

79,945 |

|

|

|

81,683 |

|

|

| Diluted earnings per share on

Adjusted Net Income |

$ |

0.06 |

|

|

|

$ |

0.23 |

|

|

|

$ |

0.25 |

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| |

($ and shares in thousands, except per share amounts) |

| Adjusted EBITDA(1) |

$ |

57,433 |

|

|

|

$ |

71,800 |

|

|

|

$ |

62,756 |

|

|

| Adjusted EBITDA

unhedged(1) |

$ |

5,559 |

|

|

|

$ |

52,175 |

|

|

|

$ |

66,082 |

|

|

| Levered Free Cash Flow(1) |

$ |

32,229 |

|

|

|

$ |

13,901 |

|

|

|

$ |

(12,560 |

) |

|

| Levered Free Cash Flow

unhedged(1) |

$ |

(19,645 |

) |

|

|

$ |

(5,724 |

) |

|

|

$ |

(9,234 |

) |

|

| Adjusted General and

Administrative expenses(1) |

$ |

14,081 |

|

|

|

$ |

14,556 |

|

|

|

$ |

12,277 |

|

|

| Effective Tax Rate |

26 |

|

% |

|

(30 |

) |

% |

|

28 |

|

% |

| Cash Flow

Data: |

|

|

|

|

|

| Net cash provided by operating

activities |

$ |

41,939 |

|

|

|

$ |

44,483 |

|

|

|

$ |

74,396 |

|

|

| Net cash used in investing

activities |

$ |

(22,480 |

) |

|

|

$ |

(43,038 |

) |

|

|

$ |

(59,608 |

) |

|

| Net cash used in financing

activities |

$ |

(19,460 |

) |

|

|

$ |

(1,444 |

) |

|

|

$ |

(16,223 |

) |

|

__________

(1) See further discussion and

reconciliation in “Non-GAAP Financial Measures and

Reconciliations”.

| |

June 30, 2020 |

|

December 31, 2019 |

| |

($ and shares in thousands) |

| Balance Sheet

Data: |

|

|

|

|

Total current assets |

$ |

156,602 |

|

|

$ |

100,432 |

|

| Total property, plant and

equipment, net |

$ |

1,288,844 |

|

|

$ |

1,576,267 |

|

| Total current liabilities |

$ |

94,687 |

|

|

$ |

156,628 |

|

| Long-term debt |

$ |

394,262 |

|

|

$ |

394,319 |

|

| Total equity |

$ |

789,515 |

|

|

$ |

972,448 |

|

| Outstanding common stock

shares as of |

79,871 |

|

|

79,543 |

|

SUMMARY BY AREA

The following table shows a summary by area of

our selected historical financial information and operating data

for the periods indicated.

| |

California (San Joaquin and Ventura

basins) |

| |

|

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

|

($ in thousands, except prices) |

|

|

|

|

|

|

Oil, natural gas and natural gas liquids sales |

$ |

62,943 |

|

|

$ |

109,519 |

|

|

|

$ |

120,917 |

|

|

| Operating income

(loss)(1) |

$ |

32,469 |

|

|

$ |

(113,203 |

) |

|

|

$ |

48,112 |

|

|

| Depreciation,

depletion, and amortization (DD&A) |

$ |

36,518 |

|

|

$ |

30,918 |

|

|

|

$ |

20,460 |

|

|

| Impairment of oil

and gas properties |

$ |

— |

|

|

$ |

163,879 |

|

|

|

$ |

— |

|

|

| Average daily

production (MBoe/d) |

23.4 |

|

|

24.9 |

|

|

|

20.8 |

|

|

| Production (oil %

of total) |

100 |

% |

|

100 |

|

% |

|

100 |

|

% |

| Realized sales

prices: |

|

|

|

|

|

|

Oil (per Bbl) |

$ |

29.53 |

|

|

$ |

48.38 |

|

|

|

$ |

63.91 |

|

|

|

NGLs (per Bbl) |

$ |

— |

|

|

$ |

— |

|

|

|

$ |

— |

|

|

|

Gas (per Mcf) |

$ |

— |

|

|

$ |

— |

|

|

|

$ |

— |

|

|

| Capital expenditures(2) |

$ |

15,916 |

|

|

$ |

38,072 |

|

|

|

$ |

52,374 |

|

|

| |

Utah (Uinta basin) |

|

Colorado (Piceance basin) |

| |

|

|

|

| |

Three Months Ended |

|

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

|

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

|

($ in thousands, except prices) |

|

|

|

|

|

|

|

|

|

|

|

|

Oil, natural gas and natural gas liquids sales |

$ |

6,439 |

|

|

|

$ |

11,278 |

|

|

|

$ |

14,153 |

|

|

$ |

1,132 |

|

|

$ |

1,299 |

|

|

$ |

1,817 |

|

|

| Operating (loss)

income(1) |

$ |

(584 |

) |

|

|

$ |

(127,700 |

) |

|

|

$ |

1,078 |

|

|

$ |

6 |

|

|

$ |

384 |

|

|

$ |

(74 |

) |

|

| Depreciation, depletion, and

amortization (DD&A) |

$ |

905 |

|

|

|

$ |

4,311 |

|

|

|

$ |

2,939 |

|

|

$ |

43 |

|

|

$ |

55 |

|

|

$ |

255 |

|

|

| Impairment of oil and gas

properties |

$ |

— |

|

|

|

$ |

125,206 |

|

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

| Average daily production

(MBoe/d) |

4.4 |

|

|

|

4.5 |

|

|

|

5.1 |

|

|

1.3 |

|

|

1.4 |

|

|

1.5 |

|

|

| Production (oil % of

total) |

49 |

|

% |

|

53 |

|

% |

|

53 |

% |

|

2 |

% |

|

1 |

% |

|

2 |

|

% |

| Realized sales prices: |

|

|

|

|

|

|

|

|

|

|

|

|

Oil (per Bbl) |

$ |

23.11 |

|

|

|

$ |

39.64 |

|

|

|

$ |

44.79 |

|

|

$ |

20.67 |

|

|

$ |

42.54 |

|

|

$ |

55.07 |

|

|

|

NGLs (per Bbl) |

$ |

5.82 |

|

|

|

$ |

13.16 |

|

|

|

$ |

16.86 |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

|

Gas (per Mcf) |

$ |

1.68 |

|

|

|

$ |

2.22 |

|

|

|

$ |

2.29 |

|

|

$ |

1.53 |

|

|

$ |

1.70 |

|

|

$ |

1.99 |

|

|

| Capital expenditures(2) |

$ |

82 |

|

|

|

$ |

857 |

|

|

|

$ |

1,363 |

|

|

$ |

145 |

|

|

$ |

6 |

|

|

$ |

80 |

|

|

__________

(1) Operating income (loss) includes oil,

natural gas and NGL sales, marketing revenues, other revenues, and

scheduled oil derivative settlements, offset by operating expenses,

general and administrative expenses, DD&A, impairment of oil

and gas properties, and taxes, other than income taxes.

(2) Excludes corporate capital

expenditures.

COMMODITY PRICING

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| Realized Sales Prices

(weighted-average) |

|

|

|

|

|

|

Oil without hedges ($/Bbl) |

$ |

28.98 |

|

|

$ |

47.61 |

|

|

$ |

61.69 |

|

| Effects of scheduled

derivative settlements ($/Bbl) |

$ |

25.42 |

|

|

$ |

9.67 |

|

|

$ |

0.13 |

|

| Oil with hedges ($/Bbl) |

$ |

54.40 |

|

|

$ |

57.28 |

|

|

$ |

61.82 |

|

| Natural gas ($/Mcf) |

$ |

1.62 |

|

|

$ |

2.00 |

|

|

$ |

2.16 |

|

| NGLs ($/Bbl) |

$ |

5.82 |

|

|

$ |

13.16 |

|

|

$ |

16.86 |

|

| |

|

|

|

|

|

| Index

Prices |

|

|

|

|

|

| Brent oil ($/Bbl) |

$ |

33.39 |

|

|

$ |

50.82 |

|

|

$ |

68.47 |

|

| WTI oil ($/Bbl) |

$ |

28.42 |

|

|

$ |

46.35 |

|

|

$ |

59.86 |

|

| Kern, Delivered natural gas

($/MMBtu)(1) |

$ |

1.45 |

|

|

$ |

1.97 |

|

|

$ |

2.07 |

|

| Henry Hub natural gas

($/MMBtu) |

$ |

1.70 |

|

|

$ |

1.91 |

|

|

$ |

2.57 |

|

__________

(1) Kern, Delivered Index is the relevant

index used for gas purchases in California.

CURRENT HEDGING SUMMARY

As of June 30, 2020, we had the following crude oil production

and gas purchases hedges.

| |

Q3 2020 |

|

Q4 2020 |

|

FY 2021 |

| |

|

|

|

|

|

| Fixed Price Oil Swaps

(Brent): |

|

|

|

|

|

|

Hedged volume (MBbls) |

2,208 |

|

2,208 |

|

4,678 |

|

Weighted-average price ($/Bbl) |

$ |

59.85 |

|

$ |

59.85 |

|

$ |

45.99 |

| Purchased Oil Calls

Options (Brent): |

|

|

|

|

|

|

Hedged volume (MBbls) |

276 |

|

276 |

|

— |

|

Weighted-average price ($/Bbl) |

$ |

65.00 |

|

$ |

65.00 |

|

$ |

— |

| Fixed Price Gas

Purchase Swaps (Kern, Delivered): |

|

|

|

|

|

|

Hedged volume (MMBtu) |

5,060,000 |

|

5,060,000 |

|

14,580,000 |

|

Weighted-average price ($/MMBtu) |

$ |

2.89 |

|

$ |

2.76 |

|

$ |

2.72 |

| Fixed Price Gas

Purchase Swaps (SoCal Citygate): |

|

|

|

|

|

|

Hedged volume (MMBtu) |

460,000 |

|

155,000 |

|

— |

|

Weighted-average price ($/MMBtu) |

$ |

3.80 |

|

$ |

3.80 |

|

$ |

— |

In July 2020, we added fixed price oil swaps

(Brent) of 4,663 Bbls/d at nearly $46 beginning January through

June 2021.

OPERATING EXPENSES

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| |

($ in thousands except per Boe amounts) |

|

Lease operating expenses |

$ |

40,733 |

|

|

$ |

50,752 |

|

|

$ |

47,879 |

|

| Electricity generation

expenses |

3,022 |

|

|

3,946 |

|

|

3,164 |

|

| Electricity sales(1) |

(4,884 |

) |

|

(5,461 |

) |

|

(5,364 |

) |

| Transportation expenses |

1,789 |

|

|

1,822 |

|

|

1,694 |

|

| Transportation sales(1) |

(29 |

) |

|

(24 |

) |

|

(104 |

) |

| Marketing expenses |

280 |

|

|

430 |

|

|

421 |

|

| Marketing revenues(1) |

(292 |

) |

|

(453 |

) |

|

(414 |

) |

| Derivative settlements paid

(received) for gas purchases(1) |

7,362 |

|

|

4,411 |

|

|

3,593 |

|

|

Total operating expenses(1) |

$ |

47,981 |

|

|

$ |

55,423 |

|

|

$ |

50,869 |

|

| |

|

|

|

|

|

| Lease operating expenses

($/Boe) |

$ |

15.37 |

|

|

$ |

18.14 |

|

|

$ |

19.18 |

|

| Electricity generation

expenses ($/Boe) |

1.14 |

|

|

1.41 |

|

|

1.27 |

|

| Electricity sales ($/Boe) |

(1.84 |

) |

|

(1.95 |

) |

|

(2.15 |

) |

| Transportation expenses

($/Boe) |

0.67 |

|

|

0.65 |

|

|

0.68 |

|

| Transportation sales

($/Boe) |

(0.01 |

) |

|

(0.01 |

) |

|

(0.04 |

) |

| Marketing expenses

($/Boe) |

0.11 |

|

|

0.15 |

|

|

0.17 |

|

| Marketing revenues

($/Boe) |

(0.11 |

) |

|

(0.16 |

) |

|

(0.17 |

) |

| Derivative settlements paid

(received) for gas purchases ($/Boe) |

2.78 |

|

|

1.58 |

|

|

1.44 |

|

|

Total operating expenses ($/Boe) |

$ |

18.11 |

|

|

$ |

19.81 |

|

|

$ |

20.38 |

|

|

Total unhedged operating expenses ($/Boe)(2) |

$ |

15.33 |

|

|

$ |

18.23 |

|

|

$ |

18.94 |

|

| |

|

|

|

|

|

| Total MBoe |

2,650 |

|

|

2,798 |

|

|

2,497 |

|

__________

(1) We report electricity, transportation

and marketing sales separately in our financial statements as

revenues in accordance with GAAP. However, these revenues are

viewed and used internally in calculating operating expenses which

is used to track and analyze the economics of development projects

and the efficiency of our hydrocarbon recovery. We purchase

third-party gas to generate electricity through our cogeneration

facilities to be used in our field operations activities and view

the added benefit of any excess electricity sold externally as a

cost reduction/benefit to generating steam for our thermal recovery

operations. Marketing revenues and expenses mainly relate to

natural gas purchased from third parties that moves through our

gathering and processing systems and then is sold to third parties.

Transportation sales relate to water and other liquids that we

transport on our systems on behalf of third parties and have not

been significant to date. Operating expenses also include the

effect of derivative settlements (received or paid) for gas

purchases.

(2) Total unhedged operating expenses

equals total operating expenses, excluding the derivative

settlements paid (received) for gas purchases.

PRODUCTION STATISTICS

| |

Three Months Ended |

|

|

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| Net Oil, Natural Gas

and NGLs Production Per

Day(1): |

|

|

|

|

|

| Oil

(MBbl/d) |

|

|

|

|

|

|

California |

23.4 |

|

24.9 |

|

20.8 |

|

Utah |

2.2 |

|

2.4 |

|

2.7 |

|

Colorado |

— |

|

— |

|

— |

|

Total oil |

25.6 |

|

27.3 |

|

23.5 |

| Natural gas

(MMcf/d) |

|

|

|

|

|

|

California |

— |

|

— |

|

— |

|

Utah |

11.5 |

|

10.5 |

|

11.7 |

|

Colorado |

7.7 |

|

8.0 |

|

9.1 |

|

Total natural gas |

19.2 |

|

18.5 |

|

20.8 |

| NGLs

(MBbl/d) |

|

|

|

|

|

|

California |

— |

|

— |

|

— |

|

Utah |

0.3 |

|

0.4 |

|

0.4 |

|

Colorado |

— |

|

— |

|

— |

|

Total NGLs |

0.3 |

|

0.4 |

|

0.4 |

| Total Production

(MBoe/d)(2) |

29.1 |

|

30.8 |

|

27.4 |

__________

(1) Production represents volumes sold

during the period.

(2) Natural gas volumes have been

converted to Boe based on energy content of six Mcf of gas to one

Bbl of oil. Barrels of oil equivalence does not necessarily result

in price equivalence. The price of natural gas on a barrel of oil

equivalent basis is currently substantially lower than the

corresponding price for oil and has been similarly lower for a

number of years. For example, in the three months ended June 30,

2020, the average prices of Brent oil and Henry Hub natural gas

were $33.39 per Bbl and $1.70 per MMBtu respectively, resulting in

an oil-to-gas ratio of approximately 3 to 1 on an energy equivalent

basis.

CAPITAL EXPENDITURES (ACCRUAL BASIS)

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| |

(in thousands) |

|

Capital expenditures (accrual basis) |

$ |

16,528 |

|

|

$ |

39,415 |

|

|

$ |

56,645 |

|

NON-GAAP FINANCIAL MEASURES AND

RECONCILIATIONS

Adjusted Net Income (Loss) is not a measure of

net income (loss), Levered Free Cash Flow is not a measure of cash

flow, and Adjusted EBITDA is not a measure of either, in all cases,

as determined by GAAP. Adjusted EBITDA, Adjusted Net Income (Loss)

and Levered Free Cash Flow are supplemental non-GAAP financial

measures used by management and external users of our financial

statements, such as industry analysts, investors, lenders and

rating agencies.

We define Adjusted EBITDA as earnings before

interest expense; income taxes; depreciation, depletion, and

amortization; derivative gains or losses net of cash received or

paid for scheduled derivative settlements; impairments; stock

compensation expense; and other unusual, out-of-period and

infrequent items, including restructuring costs and reorganization

items. We define Levered Free Cash Flow as Adjusted EBITDA less

capital expenditures, interest expense and dividends.

Our management believes Adjusted EBITDA provides

useful information in assessing our financial condition, results of

operations and cash flows and is widely used by the industry and

the investment community. The measure also allows our management to

more effectively evaluate our operating performance and compare the

results between periods without regard to our financing methods or

capital structure. Levered Free Cash Flow is used by

management as a primary metric to plan capital allocation to

sustain production levels and for internal growth opportunities, as

well as hedging needs. It also serves as a measure for assessing

our financial performance and our ability to generate excess cash

from operations to service debt and pay dividends.

Adjusted Net Income (Loss) excludes the impact

of unusual, out-of-period and infrequent items affecting earnings

that vary widely and unpredictably, including non-cash items such

as derivative gains and losses. This measure is used by management

when comparing results period over period. We define Adjusted

Net Income (Loss) as net income (loss) adjusted for derivative

gains or losses net of cash received or paid for scheduled

derivative settlements, other unusual, out-of-period and infrequent

items, including restructuring costs and reorganization items and

the income tax expense or benefit of these adjustments using our

effective tax rate.

While Adjusted EBITDA, Adjusted Net Income

(Loss) and Levered Free Cash Flow are non-GAAP measures, the

amounts included in the calculation of Adjusted EBITDA, Adjusted

Net Income (Loss) and Levered Free Cash Flow were computed in

accordance with GAAP. These measures are provided in addition to,

and not as an alternative for, income and liquidity measures

calculated in accordance with GAAP. Certain items excluded from

Adjusted EBITDA are significant components in understanding and

assessing our financial performance, such as our cost of capital

and tax structure, as well as the historic cost of depreciable and

depletable assets. Our computations of Adjusted EBITDA, Adjusted

Net Income (Loss) and Levered Free Cash Flow may not be comparable

to other similarly titled measures used by other companies.

Adjusted EBITDA, Adjusted Net Income (Loss) and Levered Free Cash

Flow should be read in conjunction with the information contained

in our financial statements prepared in accordance with GAAP.

Adjusted General and Administrative Expenses is

a supplemental non-GAAP financial measure that is used by

management and external users of our financial statements, such as

industry analysts, investors, lenders and rating agencies. We

define Adjusted General and Administrative Expenses as general and

administrative expenses adjusted for restructuring and other

non-recurring costs and non-cash stock compensation

expense. Management believes Adjusted General and

Administrative Expenses is useful because it allows us to more

effectively compare our performance from period to period.

We exclude the items listed above from general

and administrative expenses in arriving at Adjusted General and

Administrative Expenses because these amounts can vary widely and

unpredictably in nature, timing, amount and frequency and stock

compensation expense is non-cash in nature. Adjusted General and

Administrative Expenses should not be considered as an alternative

to, or more meaningful than, general and administrative expenses as

determined in accordance with GAAP. Our computations of Adjusted

General and Administrative Expenses may not be comparable to other

similarly titled measures of other companies.

ADJUSTED NET INCOME (LOSS)

The following table presents a reconciliation of

the GAAP financial measure of net income (loss) to the non-GAAP

financial measure of Adjusted Net Income (Loss).

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| |

($ thousands, except per share amounts) |

|

Net (loss) income |

$ |

(64,901 |

) |

|

$ |

(115,300 |

) |

|

$ |

31,972 |

|

|

Add (Subtract): discrete income tax items |

— |

|

|

46,700 |

|

|

— |

|

| Add (Subtract): |

|

|

|

|

|

|

Losses (gains) on oil and natural gas derivatives |

43,192 |

|

|

(199,194 |

) |

|

(17,827 |

) |

|

Net cash received (paid) for scheduled derivative settlements |

51,874 |

|

|

19,625 |

|

|

(3,326 |

) |

|

Other operating (income) expenses |

(1,192 |

) |

|

2,202 |

|

|

3,119 |

|

|

Impairment of oil and gas properties |

— |

|

|

289,085 |

|

|

— |

|

|

Non-recurring costs |

316 |

|

|

1,862 |

|

|

1,513 |

|

|

Reorganization items, net |

— |

|

|

— |

|

|

26 |

|

|

Total additions, net |

94,190 |

|

|

113,580 |

|

|

(16,495 |

) |

| |

|

|

|

|

|

| Income tax (expense) benefit

of adjustments at effective tax rate(1) |

(24,680 |

) |

|

(26,805 |

) |

|

4,569 |

|

| Adjusted Net Income

(Loss) |

$ |

4,609 |

|

|

$ |

18,175 |

|

|

$ |

20,046 |

|

| |

|

|

|

|

|

| Basic EPS on Adjusted Net

Income |

$ |

0.06 |

|

|

$ |

0.23 |

|

|

$ |

0.25 |

|

| Diluted EPS on Adjusted Net

Income |

$ |

0.06 |

|

|

$ |

0.23 |

|

|

$ |

0.25 |

|

| |

|

|

|

|

|

| Weighted average shares of

common stock outstanding - basic |

79,795 |

|

|

79,608 |

|

|

81,519 |

|

| Weighted average shares of

common stock outstanding - diluted |

80,640 |

|

|

79,945 |

|

|

81,683 |

|

__________

(1) Excludes prior year income tax credits

from the total additions, net line item and the tax effect the

prior tax credits have on the current year effective tax rate.

ADJUSTED EBITDA AND ADJUSTED EBITDA

UNHEDGED

The following tables present a reconciliation of

the GAAP financial measures of net income (loss) and net cash

provided or used by operating activities to the non-GAAP financial

measures of Adjusted EBITDA and Adjusted EBITDA Unhedged.

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| |

($ thousands) |

|

Net (loss) income |

$ |

(64,901 |

) |

|

$ |

(115,300 |

) |

|

$ |

31,972 |

|

| Add (Subtract): |

|

|

|

|

|

|

Interest expense |

8,676 |

|

|

8,920 |

|

|

8,961 |

|

|

Income tax (benefit) expense |

(22,623 |

) |

|

26,349 |

|

|

12,221 |

|

|

Depreciation, depletion and amortization |

37,512 |

|

|

35,329 |

|

|

23,654 |

|

|

Impairment of oil and gas properties |

— |

|

|

289,085 |

|

|

— |

|

|

Derivative loss (gain) |

43,192 |

|

|

(199,194 |

) |

|

(17,827 |

) |

|

Net cash received (paid) for scheduled derivative

settlements |

51,874 |

|

|

19,625 |

|

|

(3,326 |

) |

|

Other operating (income) expense |

(1,192 |

) |

|

2,202 |

|

|

3,119 |

|

|

Stock compensation expense |

4,579 |

|

|

2,922 |

|

|

2,443 |

|

|

Non-recurring costs |

316 |

|

|

1,862 |

|

|

1,513 |

|

|

Reorganization items, net |

— |

|

|

— |

|

|

26 |

|

| Adjusted EBITDA |

$ |

57,433 |

|

|

$ |

71,800 |

|

|

$ |

62,756 |

|

| Net cash (received) paid for

scheduled derivative settlements |

(51,874 |

) |

|

(19,625 |

) |

|

3,326 |

|

| Adjusted EBITDA unhedged |

$ |

5,559 |

|

|

$ |

52,175 |

|

|

$ |

66,082 |

|

| |

|

|

|

|

|

| Net cash provided by operating

activities |

$ |

41,939 |

|

|

$ |

44,483 |

|

|

$ |

74,396 |

|

| Add (Subtract): |

|

|

|

|

|

|

Cash interest payments |

648 |

|

|

14,879 |

|

|

1,272 |

|

|

Cash income tax payments |

— |

|

|

2 |

|

|

— |

|

|

Non-recurring costs |

316 |

|

|

1,862 |

|

|

1,513 |

|

|

Other changes in operating assets and liabilities |

14,530 |

|

|

10,574 |

|

|

(14,425 |

) |

| Adjusted EBITDA |

$ |

57,433 |

|

|

$ |

71,800 |

|

|

$ |

62,756 |

|

| Net cash (received) paid for

scheduled derivative settlements |

(51,874 |

) |

|

(19,625 |

) |

|

3,326 |

|

| Adjusted EBITDA unhedged |

$ |

5,559 |

|

|

$ |

52,175 |

|

|

$ |

66,082 |

|

LEVERED FREE CASH FLOW

The following table presents a reconciliation of

Adjusted EBITDA to the non–GAAP measures of Levered free cash flow.

The reconciliation of Adjusted EBITDA is presented above.

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| |

($ thousands) |

|

Adjusted EBITDA |

$ |

57,433 |

|

|

$ |

71,800 |

|

|

$ |

62,756 |

|

| Subtract: |

|

|

|

|

|

|

Capital expenditures - accrual basis |

(16,528 |

) |

|

(39,415 |

) |

|

(56,645 |

) |

|

Interest expense |

(8,676 |

) |

|

(8,920 |

) |

|

(8,961 |

) |

|

Cash dividends declared |

— |

|

|

(9,564 |

) |

|

(9,710 |

) |

| Levered free cash flow |

$ |

32,229 |

|

|

$ |

13,901 |

|

|

$ |

(12,560 |

) |

| Net cash (received) paid for

scheduled derivative settlements |

(51,874 |

) |

|

(19,625 |

) |

|

3,326 |

|

| Levered free cash flow

unhedged |

$ |

(19,645 |

) |

|

$ |

(5,724 |

) |

|

$ |

(9,234 |

) |

ADJUSTED GENERAL AND ADMINISTRATIVE

EXPENSES

The following table presents a reconciliation of the GAAP

financial measure of general and administrative expenses to the

non-GAAP financial measures of Adjusted general and administrative

expenses.

| |

Three Months Ended |

| |

June 30, 2020 |

|

March 31, 2020 |

|

June 30, 2019 |

| |

($ in thousands except per MBoe amounts) |

|

General and administrative expenses |

$ |

18,777 |

|

|

$ |

19,337 |

|

|

$ |

16,158 |

|

| Subtract: |

|

|

|

|

|

|

Non-cash stock compensation expense (G&A portion) |

(4,380 |

) |

|

(2,919 |

) |

|

(2,368 |

) |

|

Non-recurring costs |

(316 |

) |

|

(1,862 |

) |

|

(1,513 |

) |

| Adjusted general and

administrative expenses |

$ |

14,081 |

|

|

$ |

14,556 |

|

|

$ |

12,277 |

|

| |

|

|

|

|

|

| General and administrative

expenses ($/MBoe) |

$ |

7.09 |

|

|

$ |

6.91 |

|

|

$ |

6.47 |

|

| Subtract: |

|

|

|

|

|

|

Non-cash stock compensation expense ($/MBoe) |

(1.65 |

) |

. |

(1.04 |

) |

. |

(0.95 |

) |

|

Non-recurring costs ($/MBoe) |

(0.12 |

) |

|

(0.67 |

) |

|

(0.61 |

) |

| Adjusted general and

administrative expenses ($/MBoe) |

$ |

5.31 |

|

|

$ |

5.20 |

|

|

$ |

4.92 |

|

| |

|

|

|

|

|

| Total MBoe |

2,650 |

|

|

2,798 |

|

|

2,497 |

|

Contact

Contact: Berry Corporation

Todd Crabtree - Manager, Investor Relations

(661) 616-3811

ir@bry.com

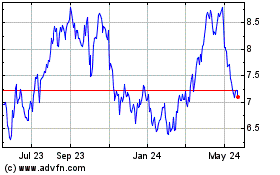

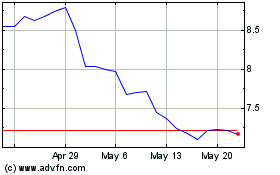

Berry (NASDAQ:BRY)

Historical Stock Chart

From Jun 2024 to Jul 2024

Berry (NASDAQ:BRY)

Historical Stock Chart

From Jul 2023 to Jul 2024