BankFinancial Corporation (Nasdaq – BFIN)

(“BankFinancial”) filed its Quarterly Report on Form 10-Q for

the quarter ended March 31, 2024, and a Quarterly

Financial and Statistical Supplement in Form 8-K with the U.S.

Securities and Exchange Commission (the “SEC”) today.

BankFinancial reported net income for the three

months ended March 31, 2024, of $1.7 million,

or $0.14 per common share. At March 31,

2024, BankFinancial had total assets of $1.480 billion,

total loans of $1.008 billion, total deposits of $1.259

billion and stockholders' equity of $156 million.

In the first quarter of 2024, interest income

increased by $422,000 due to our investment of scheduled loan and

lease portfolio payments into short-term liquidity

investments. Interest expense increased by $327,000 due to

higher interest rates paid on deposit accounts, as certain

depositors sought to benefit from increases in short-term market

rates. Our net interest margin increased to 3.59%, compared to

3.48% on a tax-equivalent basis.

Noninterest income decreased by $164,000 due to

a seasonal decline in VISA debit interchange income and a decline

in other income compared to the fourth quarter of 2023. The

decrease was partially offset by an increase in Trust and Insurance

income and a gain on the repurchase of $1.0 million of Subordinated

notes.

Noninterest expense increased by $887,000 due in

part to seasonal increases in employment benefits expenses

($280,000) and snow removal expenses ($198,000). Nonperforming

assets expenses increased by $232,000, primarily due to a $225,000

expense for the final resolution of pending litigation and an

inter-creditor tax liability related to a middle market equipment

finance transaction. These expense items total

approximately $703,000 or $0.04 per share on an after-tax

basis.

Cash & Cash Equivalent Assets

For the quarter ended March 31, 2024, cash and

cash equivalent assets were 9% of total assets, compared to 12% of

total assets at December 31, 2023.

Investment Securities Portfolio

For the quarter ended March 31, 2024, total

investment securities increased by $86.3 million due to $125

million in new investments in U.S. government-sponsored agencies at

an average tax-equivalent yield of 5.72% and an average duration of

1.5 years. The investment securities portfolio had a

weighted-average term to maturity of 1.4 years as of March 31,

2024, with an after-tax unrealized loss of $2.3 million or 1.5% of

Tier 1 capital. The new investment securities improved our

interest rate risk balance and reduced our exposure to declining

interest rates over the medium term.

Loan Portfolio

Our loan portfolio declined by $42.8 million in

the first quarter of 2024, primarily due to scheduled repayments of

equipment finance transactions and low levels of loan originations

in the equipment finance portfolio due to the lower market yields

this asset class offered during the fourth quarter of 2023. The

average yield on equipment finance portfolio repayments in the

first quarter was 4.80%, contributing to an increase in the average

yield on loans to 5.21% for the quarter ended March 31, 2024, from

4.99% for the quarter ended December 31, 2023. Commercial

line of credit utilization remained consistent intra-quarter,

offset by quarter-end repayment activity in the lessor finance

portfolio and a $3 million reduction in criticized and classified

commercial line of credit balances related to resolution agreements

with the borrowers.

Asset Quality

The ratio of nonperforming assets to total

assets declined to 1.54% at March 31, 2024, inclusive of two U.S.

Government equipment finance transactions in the total amount of

$18.9 million. Excluding these two U.S. Government

transactions, our ratio of nonperforming assets to total assets

would have been 0.27%. Past due trends improved, and

nonperforming asset resolution activity continued to accelerate

during the first quarter of 2024. As noted above, we concluded

all bankruptcy and other litigation with respect to the

nonperforming middle market credit exposure placed on nonaccrual

status in June 2023. The related equipment constitutes 81% of

the $2.3 million total other foreclosed assets and is now being

actively marketed pursuant to a six-month marketing plan. Our

allowance for credit losses increased to 0.81% of total loans at

March 31, 2024, compared to 0.79% at December 31, 2023.

Deposit Portfolio

Total deposits decreased by $2.3 million, 0.2%,

primarily due to seasonal activity by municipal depositors. Our

cost of total retail and commercial deposits increased to 1.75%

during the first quarter of 2024 from 1.59% at December 31,

2023. Core deposits represented 82% of total deposits, with

noninterest-bearing demand deposits representing 20% of total

deposits at March 31, 2024. Total commercial deposits were

21% of total deposits at March 31, 2024, and December 31,

2023. FDIC-insured deposits were 85% of total deposits and

collateralized public funds deposits were 1% of total deposits as

of March 31, 2024.

Capital Adequacy

The Company’s capital position remained strong,

with a Tier 1 leverage ratio of 10.59% at March 31, 2024. The

Company repurchased 15,203 common shares during the quarter ended

March 31, 2024, at a total cost of $156,000. The Company also

repurchased $1.0 million of its Subordinated notes issued in

2021. The book value of the Company’s common shares increased to

$12.52 at March 31, 2024, from $12.45 per share at December 31,

2023.

F. Morgan Gasior, the Chairman and CEO of the

Company, said: “The continuing deployment of our liquidity at

higher yields resulted in stable net interest income and a balanced

interest rate risk position in an uncertain environment at March

31, 2024. With our liquidity and Tier 1 tangible capital

strength, we look forward to focusing on expanding our net interest

margin via loan portfolio growth, strengthening our noninterest

income, and improving our operating expense efficiency during the

second quarter and the remainder of 2024.”

Second Quarter 2024 Outlook

Loans

New loan origination pipelines improved late in

the first quarter of 2024 from approximately $15 million as of

December 31, 2023, to approximately $60 million in new commitments

as of April 30, 2024. The average pipeline time to close is

approximately 80 days. In the first quarter of 2024, we

began marketing our new Community Finance business line of credit

products to existing and new small business customers via our new

dedicated Business Banking Department. We also

commenced initial marketing for our hybrid and universal Commercial

Finance products in the late first quarter of 2024 following the

conclusion of advanced product training for our Commercial

Bankers. In the second quarter of 2024, we released updated

Lessor Finance products for independent equipment lessors, with an

emphasis on working capital lines of credit, retained lease line of

credit and residual equipment equity lines of credit supported by

our Treasury Services Equipment Finance Paying Agency

product. We will commence new marketing to Healthcare Finance

supply-chain participants in the second quarter of 2024.

For the second quarter of 2024, total loan

balances are expected to increase by between 0% and 2% primarily

due to higher loan originations activity. Based on the

expected current yields on commercial credit originations and

scheduled repayments, we expect the total yield on the loan

portfolio to increase between 0.10% to 0.15%. For the second half

of 2024, we believe that quarterly loan growth similar to the

second quarter of 2024 is achievable in the current interest rate

environment, with total yields on the loan portfolio continuing to

increase between 0.10% to 0.15% per quarter due to higher yields on

loan originations.

Deposits

For the second quarter of 2024, total deposit

balances are expected to decline between 0% to 2% due to seasonal

tax payments and continued consumption of liquidity, particularly

by commercial depositors. We expect our cost of deposits to

increase by 0.05% during the second quarter of 2024. For the

second half of 2024, we expect that total deposits may further

decline by 1% per quarter and our cost of funds to further increase

by 0.05% per quarter due to continued reductions in liquidity for

both retail and commercial depositors, partially offset by modestly

increasing balances from new business, commercial and Treasury

Services customers.

Cash & Cash Equivalent Assets

For the second quarter of 2024, we expect cash and cash

equivalent assets to be between 9% and 12% of total assets.

For the second half of 2024, we expect cash and cash equivalent

assets to be between 8% and 11% of total assets.

Investments

For the second quarter of 2024, we expect the

investment portfolio balances to decline between 0% and 5% as we

utilize maturing investment proceeds for loan originations,

maintaining short-term liquidity or funding deposit

withdrawals. For the second half of 2024, we expect

investment portfolio balances to decline between 5% and 10%,

depending on loan and deposit portfolio activity and opportunities

for reinvestment at higher market interest rates. As of

March 31, 2024, we have $58.9 million in investment securities at

an average yield of 1.70% maturing during the remainder of

2024.

Net Interest Margin

For the second quarter of 2024, based on the

expected activity in the loan, deposit and investment portfolios,

we expect our net interest margin to remain stable, due to the

anticipated timing of loan originations later in the quarter.

For the second half of 2024, we expect our net interest margin to

increase between 2% and 4% each quarter.

Noninterest Income

For the second quarter of 2024, we expect

noninterest income to remain stable. For the second half of

2024, we expect noninterest income to grow between 3% and 5% per

quarter due to higher revenues from retail deposit services,

commercial/treasury services, trust services and bank-owned life

insurance.

Noninterest Expense

For the second quarter of 2024, we expect

noninterest expense to decline by approximately 6% to 8% due to

seasonal differences and declines in nonperforming assets and

foreclosed assets expenses compared to the first quarter of

2024. For the second half of 2024, we expect noninterest

expense to decline between 5% and 8% compared to the first half of

2024 as we achieve further operating efficiencies.

The Quarterly Financial and Statistical

Supplement will be available today on BankFinancial's website,

www.bankfinancial.com on the “Investor Relations” page, and through

the EDGAR database on the U.S. Securities and Exchange Commission's

website, www.sec.gov. The Quarterly Financial and Statistical

Supplement includes comparative GAAP and non-GAAP performance data

and financial measures for the most recent five quarters.

BankFinancial Corporation is the holding company

for BankFinancial, NA, a national bank providing banking, wealth

management and fiduciary services to individuals,

families, and businesses in the Chicago metropolitan area and on a

regional or national basis for commercial finance, equipment

finance, commercial real estate finance and treasury management

business customers. BankFinancial Corporation's common stock

trades on the Nasdaq Global Select Market under the symbol “BFIN.”

Additional information may be found at the company's

website, www.bankfinancial.com.

This release includes “forward-looking

statements” as defined in the Private Securities Litigation Reform

Act of 1995. A variety of factors could cause BankFinancial’s

actual results to differ from those expected at the time of this

release. For a discussion of some of the factors that may cause

actual results to differ from expectations, please refer to

BankFinancial’s most recent Annual Report on Form 10-K as filed

with the SEC, as supplemented by subsequent filings with the SEC.

Investors are urged to review all information contained in these

reports, including the risk factors discussed therein. Copies of

these filings are available at no cost on the SEC's web site at

www.sec.gov or on BankFinancial’s web site at

www.bankfinancial.com. Forward-looking statements speak only as of

the date they are made, and we do not undertake to update them to

reflect changes.

|

For Further Information Contact: |

|

|

| Shareholder, Analyst

and Investor Inquiries: |

|

Media

Inquiries: |

| Elizabeth A. DoolanSenior Vice

President – FinanceBankFinancial CorporationTelephone:

630-425-5568 |

|

Gregg T. AdamsPresident –

Marketing & SalesBankFinancial, NATelephone: 630-425-5877 |

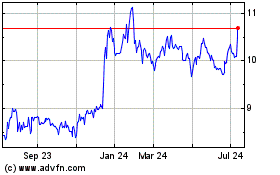

BankFinancial (NASDAQ:BFIN)

Historical Stock Chart

From Dec 2024 to Jan 2025

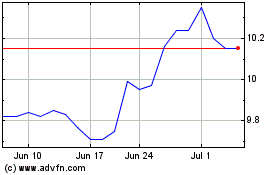

BankFinancial (NASDAQ:BFIN)

Historical Stock Chart

From Jan 2024 to Jan 2025