false

0001506928

0001506928

2023-10-26

2023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

October 26, 2023

Avinger, Inc.

(Exact name of registrant as specified in its charter)

|

Delaware

|

|

001-36817

|

|

20-8873453

|

|

(State or other jurisdiction of

incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer

Identification No.)

|

400 Chesapeake Drive

Redwood City, California 94063

(Address of principal executive offices, including zip code)

(650) 241-7900

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, par value $0.001 per share

|

AVGR

|

The NASDAQ Capital Market

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

|

Item 2.02

|

Results of Operations and Financial Condition.

|

On October 26, 2023, Avinger, Inc. issued a press release regarding its financial results for the quarter ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Form 8-K.

This information is intended to be furnished under Item 2.02 of Form 8-K and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such a filing.

The press release furnished herewith in Exhibit 99.1 contains non-GAAP financial measures. Management believes non-GAAP financial measures assist management and investors in evaluating and comparing period-to-period results and projections in a more meaningful and consistent manner. Reconciliations for these non-GAAP financial measures to the most directly comparable GAAP financial measures are included in the press release.

Item 9.01 Financial Statements and Exhibits.

|

Exhibit No.

|

|

Description

|

|

99.1

|

|

|

|

104

|

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

AVINGER, INC.

|

|

|

|

|

|

|

| |

|

|

|

|

Date: October 26, 2023

|

By:

|

/s/ Jeffrey M. Soinski

|

|

|

|

|

Jeffrey M. Soinski

|

|

|

|

|

Chief Executive Officer

|

|

Exhibit 99.1

Avinger Reports Third Quarter 2023 Results

Redwood City, Calif., October 26, 2023 - Avinger, Inc. (Nasdaq: AVGR), a commercial-stage medical device company developing and marketing the first and only intravascular image-guided, catheter-based systems for diagnosis and treatment of vascular disease, today reported results for the third quarter ended September 30, 2023.

Third Quarter and Recent Highlights

| |

●

|

Third quarter revenue of $1.8 million, and gross margin of 21%

|

| |

●

|

Initiated full commercial launch for Tigereye ST, Avinger’s most advanced image-guided CTO-crossing device, in September

|

| |

●

|

Commenced limited launch of the new Pantheris LV (large vessel) image-guided atherectomy device

|

| |

●

|

Advanced development of the first-ever image-guided coronary CTO-crossing system, including successful completion of additional animal and cadaver heart studies, in preparation for IDE submission anticipated mid-2024

|

| |

●

|

Named Phil Preuss to new position of Chief Commercial Officer in October, to lead sales force expansion and drive revenue growth initiatives

|

| |

●

|

Released updated, best-in-class interim data from the Pantheris SV IMAGE-BTK (below-the-knee) study in key opinion leader presentation at the AMP clinical conference

|

| |

●

|

Strengthened balance sheet through conversion of $1.9 million or 12% of outstanding debt to a new series of convertible preferred stock, and raising net proceeds of $5.1 million through the sale of common stock in the company’s at-the-market (ATM) facility

|

“With full commercial launch of our Tigereye ST CTO-crossing catheter and limited launch of our new Pantheris LV image-guided atherectomy system in the third quarter, exciting new clinical outcomes data for our Pantheris SV below-the-knee atherectomy device, and the outstanding performance and increased mobility of our Lightbox 3 imaging console launched last year, we have built the most advanced peripheral products portfolio in the industry,” commented Jeff Soinski, Avinger’s President and CEO.

“To support the launch of our new product offerings and drive meaningful revenue growth in 2024, we are commencing an expansion of our sales team with plans to increase the size of our direct sales force by more than 25% in the fourth quarter. I am thrilled to have Phil Preuss lead these efforts in his new role as Chief Commercial Officer. Phil brings over 15 years of direct industry experience to this expanded role and has been deeply involved in the commercial launch and development of our advanced product portfolio in his prior position as Chief Marketing Officer.

“We continue to make excellent progress on the development of our first coronary product application, including the successful completion of animal studies and cadaver heart studies in an innovative coronary test model at a leading clinical institution. We are excited about the results we are seeing as we continue to advance our lead design candidate and anticipate filing an IDE application with the FDA by mid-2024 to allow for the initiation of a clinical study following approval. Our first entry into the coronary space is designed to provide superior, simplified, and more predictable clinical outcomes while crossing chronic total occlusions in the coronary arteries, and we are excited about the prospect of extending our proprietary image-guided approach to this large and underserved market with well-established reimbursement.”

Third Quarter 2023 Financial Results

Total revenue was $1.8 million for the third quarter of 2023, compared with $2.0 million in the second quarter of 2023 and $2.3 million in the third quarter of 2022. The change in sales revenue primarily reflected a decrease in sales headcount, while sales productivity for existing team members remained consistent with the prior quarter. The company has hired two new clinical specialists in October as a first step in expanding our clinical support capabilities with the hiring of additional sales and clinical support personnel planned for the fourth quarter.

Gross margin for the third quarter of 2023 was 21%, compared with 30% in the second quarter of 2023 and 35% in the third quarter of 2022. The change in gross margin primarily reflected lower manufacturing volume over fixed costs in the third quarter. Operating expenses for the third quarter of 2023 were $4.4 million, up slightly from $4.3 million in the second quarter of 2023 and down from $4.5 million in the third quarter of 2022 as the company maintains an efficient operating expense structure.

Net loss and comprehensive loss for the third quarter of 2023 was $4.5 million, compared with $4.2 million in the second quarter of 2023 and $4.1 million in the third quarter of 2022.

Adjusted EBITDA, as defined under non-GAAP financial measures in this press release, was a loss of $3.7 million, up slightly from a loss of $3.4 million in the second quarter of 2023 and a loss of $3.6 million in the third quarter of 2022. For more information regarding non-GAAP financial measures discussed in this press release, please see “Non-GAAP Financial Measures” below, as well as the reconciliation of non-GAAP measures to the nearest GAAP measure, provided in the tables below.

Cash and cash equivalents totaled $8.7 million as of September 30, 2023.

Conference Call

Avinger will hold a conference call today, October 26, 2023, at 4:30pm ET to discuss its third quarter 2023 financial results.

To listen to a live webcast, please visit http://www.avinger.com and select Investor Relations. To join the call by telephone, please dial +1-973-528-0011 and use passcode 782086. A webcast replay of the call will be available on Avinger's website following completion of the call at www.avinger.com.

About Avinger, Inc.

Avinger is a commercial-stage medical device company that designs and develops the first and only image-guided, catheter-based system for the diagnosis and treatment of patients with Peripheral Artery Disease (PAD). PAD is estimated to affect over 12 million people in the U.S. and over 200 million worldwide. Avinger is dedicated to radically changing the way vascular disease is treated through its Lumivascular platform, which currently consists of the Lightbox imaging console, the Ocelot and Tigereye® family of chronic total occlusion (CTO) catheters, and the Pantheris® family of atherectomy devices. Avinger is based in Redwood City, California. For more information, please visit www.avinger.com.

Follow Avinger on Twitter and Facebook.

Forward-Looking Statements

This news release contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. These forward-looking statements include statements regarding our future performance, our expected hiring of additional sales and clinical support personnel, patient and physician benefits of our products, the impacts of our products on the treatment of vascular disease, our ability to successfully develop new products, including products relating to the treatment of coronary artery disease (CAD), the timing of the development of new products, the impact of products developed for the treatment of CAD on our business and results of operations, the potential success of our coronary product application, and our expectation regarding the timing relating to our goal of filing an IDE application relating to a clinical study, and the timing regarding the initiation of a clinical study. Such statements are based on current assumptions that involve risks and uncertainties that could cause actual outcomes and results to differ materially. These risks and uncertainties, many of which are beyond our control, include our dependency on a limited number of products; the resource requirements related to Pantheris, Tigereye and our Lightbox imaging console; the outcome of clinical trial results; the adoption of our products by physicians; our ability to obtain regulatory approvals for our products; as well as the other risks described in the section entitled "Risk Factors" and elsewhere in our Annual Report on Form 10-K filed with the Securities and Exchange Commission on March 16, 2023, as amended, and Quarterly Reports on Form 10-Q. These forward-looking statements speak only as of the date hereof and should not be unduly relied upon. Avinger disclaims any obligation to update these forward- looking statements.

Non-GAAP Financial Measures

Avinger has provided in this press release financial information that has not been prepared in accordance with generally accepted accounting principles in the United States (GAAP). The Company uses these non-GAAP financial measures internally in analyzing its financial results and believes that the use of these non-GAAP financial measures is useful to investors as an additional tool to evaluate ongoing operating results and trends and in comparing the Company’s financial results with other companies in its industry, many of which present similar non-GAAP financial measures.

The presentation of these non-GAAP financial measures should not be considered in isolation or as a substitute for comparable GAAP financial measures, and should be read only in conjunction with the Company’s financial statements prepared in accordance with GAAP. A reconciliation of the Company’s non-GAAP financial measures to their most directly comparable GAAP measures has been provided in the financial statement tables included in this press release, and investors are encouraged to review these reconciliations.

Adjusted EBITDA. Avinger defines Adjusted EBITDA as net loss and comprehensive loss plus interest expense, net, plus other income, net, plus stock-based compensation expense plus certain inventory charges plus certain depreciation and amortization expense. Investors are cautioned that there are a number of limitations associated with the use of non-GAAP financial measures as analytical tools. Furthermore, these non-GAAP financial measures are not based on any standardized methodology prescribed by GAAP, and the components that Avinger excludes in its calculation of non-GAAP financial measures may differ from the components that its peer companies exclude when they report their non-GAAP results of operations. Avinger compensates for these limitations by providing specific information regarding the GAAP amounts excluded from these non-GAAP financial measures. In the future, the Company may also exclude other non-recurring expenses and other expenses that do not reflect the Company’s core business operating results.

Investor Contact:

Matt Kreps

Darrow Associates Investor Relations

(214) 597-8200

mkreps@darrowir.com

Public Relations Contact:

Phil Preuss

Chief Commercial Officer

Avinger, Inc.

(650) 241-7942

pr@avinger.com

Statements of Operations and Comprehensive Loss

(in thousands, except per share amounts) (unaudited)

| |

|

For the Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues

|

|

$ |

1,817 |

|

|

$ |

2,041 |

|

|

$ |

2,252 |

|

|

$ |

5,746 |

|

|

$ |

6,272 |

|

|

Cost of revenues

|

|

|

1,429 |

|

|

|

1,436 |

|

|

|

1,462 |

|

|

|

4,117 |

|

|

|

4,301 |

|

|

Gross profit

|

|

|

388 |

|

|

|

605 |

|

|

|

790 |

|

|

|

1,629 |

|

|

|

1,971 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development

|

|

|

1,044 |

|

|

|

988 |

|

|

|

1,086 |

|

|

|

3,388 |

|

|

|

3,244 |

|

|

Selling, general and administrative

|

|

|

3,377 |

|

|

|

3,346 |

|

|

|

3,384 |

|

|

|

10,261 |

|

|

|

10,862 |

|

|

Total operating expenses

|

|

|

4,421 |

|

|

|

4,334 |

|

|

|

4,470 |

|

|

|

13,649 |

|

|

|

14,106 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loss from operations

|

|

|

(4,033 |

) |

|

|

(3,729 |

) |

|

|

(3,680 |

) |

|

|

(12,020 |

) |

|

|

(12,135 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest expense, net

|

|

|

(455 |

) |

|

|

(445 |

) |

|

|

(407 |

) |

|

|

(1,292 |

) |

|

|

(1,286 |

) |

|

Other income (expense), net

|

|

|

12 |

|

|

|

(2 |

) |

|

|

- |

|

|

|

16 |

|

|

|

(20 |

) |

|

Net loss and comprehensive loss

|

|

|

(4,476 |

) |

|

|

(4,176 |

) |

|

|

(4,087 |

) |

|

|

(13,296 |

) |

|

|

(13,441 |

) |

|

Waiver (accretion) of preferred stock dividends

|

|

|

2,436 |

|

|

|

(1,218 |

) |

|

|

(1,127 |

) |

|

|

- |

|

|

|

(3,381 |

) |

|

Deemed dividend arising from beneficial conversion feature of convertible preferred stock

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

(5,111 |

) |

|

Net loss applicable to common stockholders

|

|

$ |

(2,040 |

) |

|

$ |

(5,394 |

) |

|

$ |

(5,214 |

) |

|

$ |

(13,296 |

) |

|

$ |

(21,933 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss per share attributable to common stockholders basic and diluted

|

|

$ |

(2.92 |

) |

|

$ |

(8.86 |

) |

|

$ |

(11.51 |

) |

|

$ |

(21.48 |

) |

|

$ |

(56.67 |

) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average common shares used to compute net loss per share, basic and diluted

|

|

|

698 |

|

|

|

609 |

|

|

|

453 |

|

|

|

619 |

|

|

|

387 |

|

Reconciliation of Adjusted EBITDA to Net Loss and Comprehensive Loss

(in thousands) (unaudited)

| |

|

For the Three Months Ended

|

|

|

Nine Months Ended

|

|

| |

|

September 30,

|

|

|

June 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

|

September 30,

|

|

| |

|

2023

|

|

|

2023

|

|

|

2022

|

|

|

2023

|

|

|

2022

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net loss and comprehensive loss

|

|

$ |

(4,476 |

) |

|

$ |

(4,176 |

) |

|

$ |

(4,087 |

) |

|

$ |

(13,296 |

) |

|

$ |

(13,441 |

) |

|

Add: Interest expense, net

|

|

|

455 |

|

|

|

445 |

|

|

|

407 |

|

|

|

1,292 |

|

|

|

1,286 |

|

|

Add: Other income (expense), net (1)

|

|

|

(12 |

) |

|

|

2 |

|

|

|

- |

|

|

|

(16 |

) |

|

|

20 |

|

|

Add: Stock-based compensation

|

|

|

219 |

|

|

|

239 |

|

|

|

39 |

|

|

|

703 |

|

|

|

127 |

|

|

Add: Certain depreciation and amortization charges

|

|

|

74 |

|

|

|

68 |

|

|

|

54 |

|

|

|

214 |

|

|

|

133 |

|

|

Adjusted EBITDA

|

|

$ |

(3,740 |

) |

|

$ |

(3,422 |

) |

|

$ |

(3,587 |

) |

|

$ |

(11,103 |

) |

|

$ |

(11,875 |

) |

(1) Other income(expense), net primarily represents other miscellaneous income and expenses. Since these charges are non-operational, unusual or infrequent in nature, they are excluded accordingly.

Balance Sheet

(in thousands, except per share amounts) (unaudited)

| |

|

|

September 30,

|

|

|

December 31,

|

|

|

Assets

|

|

2023

|

|

|

2022

|

|

|

Current assets:

|

|

|

|

|

|

|

|

|

| Cash and cash equivalents |

|

$ |

8,725 |

|

|

$ |

14,603 |

|

| Accounts receivable, net of allowance for doubtful accounts of $24 at September 30, 2023 and $73 at December 31, 2022 |

|

|

828 |

|

|

|

1,057 |

|

| Inventories |

|

|

5,580 |

|

|

|

4,965 |

|

| Prepaid expenses and other current assets |

|

|

550 |

|

|

|

362 |

|

|

Total current assets

|

|

|

15,683 |

|

|

|

20,987 |

|

| |

|

|

|

|

|

|

|

|

|

Right of use asset

|

|

|

1,384 |

|

|

|

2,194 |

|

|

Property and equipment, net

|

|

|

528 |

|

|

|

702 |

|

|

Other assets

|

|

|

249 |

|

|

|

312 |

|

|

Total assets

|

|

$ |

17,844 |

|

|

$ |

24,195 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and stockholders' (deficit) equity

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Current liabilities:

|

|

|

|

|

|

|

|

|

| Accounts payable |

|

$ |

549 |

|

|

$ |

631 |

|

| Accrued compensation |

|

|

1,947 |

|

|

|

1,401 |

|

| Accrued expenses and other current liabilities |

|

|

897 |

|

|

|

657 |

|

| Leasehold liability, current portion |

|

|

1,179 |

|

|

|

1,092 |

|

| Borrowings |

|

|

13,794 |

|

|

|

14,165 |

|

|

Total current liabilities

|

|

|

18,366 |

|

|

|

17,946 |

|

| |

|

|

|

|

|

|

|

|

|

Leasehold liability, long-term portion

|

|

|

205 |

|

|

|

1,102 |

|

|

Other long-term liabilities

|

|

|

627 |

|

|

|

1,001 |

|

|

Total liabilities

|

|

|

19,198 |

|

|

|

20,049 |

|

| |

|

|

|

|

|

|

|

|

|

Stockholders' (deficit) equity:

|

|

|

|

|

|

|

|

|

| Convertible preferred stock, par value $0.001 |

|

|

- |

|

|

|

- |

|

| Common stock, par value $0.001 |

|

|

1 |

|

|

|

8 |

|

| Additional paid-in capital |

|

|

414,317 |

|

|

|

406,514 |

|

| Accumulated deficit |

|

|

(415,672 |

) |

|

|

(402,376 |

) |

|

Total stockholders' (deficit) equity

|

|

|

(1,354 |

) |

|

|

4,146 |

|

|

Total liabilities and stockholders' (deficit) equity

|

|

$ |

17,844 |

|

|

$ |

24,195 |

|

v3.23.3

Document And Entity Information

|

Oct. 26, 2023 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

Avinger, Inc.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 26, 2023

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-36817

|

| Entity, Tax Identification Number |

20-8873453

|

| Entity, Address, Address Line One |

400 Chesapeake Drive

|

| Entity, Address, City or Town |

Redwood City

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

94063

|

| City Area Code |

650

|

| Local Phone Number |

241-7900

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

AVGR

|

| Security Exchange Name |

NASDAQ

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001506928

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

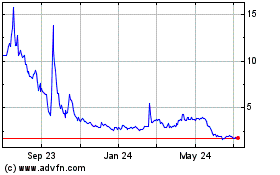

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Oct 2024 to Nov 2024

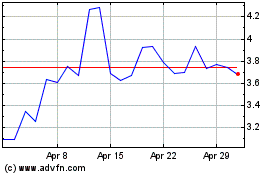

Avinger (NASDAQ:AVGR)

Historical Stock Chart

From Nov 2023 to Nov 2024