false

0001920406

0001920406

2024-06-13

2024-06-13

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities

Exchange Act of 1934

Date of Report (Date of earliest event reported):

June 13, 2024

| ASSET ENTITIES INC. |

| (Exact name of registrant as specified in its charter) |

| Nevada |

|

001-41612 |

|

88-1293236 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

| 100 Crescent Ct, 7th Floor, Dallas, TX |

|

75201 |

| (Address of principal executive offices) |

|

(Zip Code) |

| (214) 459-3117 |

| (Registrant’s telephone number, including area code) |

| |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Class B Common Stock, $0.0001 par value per share |

|

ASST |

|

The Nasdaq Stock Market LLC |

Indicate by check

mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 or Rule 12b-2 of the Securities

Exchange Act of 1934.

Emerging Growth Company ☒

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive Agreement.

On June

13, 2024, Asset Entities Inc., a Nevada corporation (the “Company”), entered into an amendment (the “Purchase

Agreement Amendment”) to the securities purchase agreement, dated as of May 24, 2024,

between the Company and the investor (the “Investor”) listed on the schedule of buyers

attached thereto (the “Purchase Agreement”). Pursuant to the Purchase Agreement Amendment, the Company and the Investor agreed

to amend the Purchase Agreement to provide that, while any of the shares of the Company’s Series

A Convertible Preferred Stock, $0.0001 par value per share (the “Series A Preferred Stock”), are outstanding, if the closing

price of the Class B Common Stock, $0.0001 par value per share (the “Class B Common Stock”), is equal to or less than $0.0855

per share for a period of ten consecutive trading days, then the Company will promptly take all corporate action necessary to authorize

a reverse stock split of the Class B Common Stock by a ratio equal to or greater than 300% of the quotient obtained by dividing $0.0855

by the lowest closing price of the Class B Common Stock during such ten-trading day period, including calling a special meeting of stockholders

to authorize such reverse stock split or obtaining written consent for such reverse stock split, and voting the management shares of the

Company in favor of such reverse stock split.

Item 3.03 Material Modification to Rights of Security Holders.

On June 14, 2024, the Company

filed an amendment (the “Amended Designation”) to the Certificate of Designation of Series A Convertible Preferred Stock of

the Company with the Secretary of State of the State of Nevada on May 24, 2024 (as amended, the “Certificate of Designation”),

which amended the original Certificate of Designation to provide that the Conversion Price (as defined in the Certificate of Designation)

will not be less than $0.0855 (the “Floor Price”) at any time, rather than only until the Ex-Exchange Limitation Date (as

defined in the Certificate of Designation), and to delete a requirement that the Company file a definitive information statement on Schedule

14C (the “Definitive Information Statement”) disclosing that the stockholders have approved by written consent the non-application

of the Floor Price for issuances that would otherwise exceed the Exchange Limitation (as defined in the Certificate of Designation) and

which action with respect to the Floor Price shall take effect 20 days following the date that such Definitive Information Statement is

sent or given.

The

foregoing summary of the Amended Designation does not purport to be complete and is qualified in its entirety by reference to the full

text of the Amended Designation filed as Exhibit 3.1 to this report, which is incorporated by reference herein.

Item 5.07 Submission of Matters to a Vote of Security Holders.

On June 13, 2024, the holder of all of the outstanding

shares of the Series A Preferred Stock approved the Amended

Designation by written consent.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| Date: June 20, 2024 |

ASSET ENTITIES INC. |

| |

|

| |

/s/ Arshia Sarkhani |

| |

Name: Arshia Sarkhani |

| |

Title: Chief Executive Officer and President |

2

Exhibit 3.1

|

FRANCISCO V. AGUILAR

Secretary

of State

401 North Carson Street

Carson City, Nevada 89701-4201

(775) 684-5708

Website: www.nvsos.gov

|

|

| Certificate, Amendment or Withdrawal of Designation |

| NRS 78.1955, 78.1955(6) |

| ☐ Certificate of Designation |

| ☐ Certificate of Amendment to Designation - Before Issuance of Class or Series |

| ☒ Certificate of Amendment to Designation - After Issuance of Class or Series |

☐ Certificate of

Withdrawal of Certificate of Designation

|

TYPE OR PRINT - USE DARK INK ONLY - DO NOT HIGHLIGHT

| 1. Entity information: |

Name of entity: |

|

| |

|

|

| |

Asset Entities Inc. |

|

|

| |

|

|

|

| |

Entity or Nevada Business Identification Number (NVID): |

E21638682022-8 |

| 2. Effective date and time: |

For Certificate of Designation or |

|

Date: |

|

Time: |

|

| |

Amendment to Designation Only

|

|

|

|

|

|

| |

(Optional): |

|

(must not be later than 90 days after the certificate is filed) |

3. Class or series of

|

The class or series of stock being designated within this filing: |

| stock: (Certificate of |

|

| Designation only) |

|

4. Information for

|

The original class or series of stock being amended within

this filing: |

| amendment of class |

Series A Convertible Preferred Stock |

| or series of stock: |

|

| 5. Amendment of |

☐ |

Certificate of Amendment to Designation- Before Issuance

of Class or Series |

| class or series of |

|

As of the date of this certificate no shares of the

class or series of stock have been issued. |

| stock: |

☒ |

Certificate of Amendment to Designation- After Issuance of Class or

Series |

| |

|

The amendment has been approved by the vote of stockholders holding

shares in the corporation |

| |

|

entitling them to exercise a majority of the voting power, or such

greater proportion of the voting |

| |

|

power as may be required by the articles of incorporation or the certificate

of designation. |

| 6. Resolution: |

By resolution of the board of directors pursuant to a provision in

the articles of incorporation this |

| Certificate of Designation |

certificate establishes OR amends the following regarding the voting

powers, designations, |

| and Amendment to |

preferences, limitations, restrictions and relative rights of the following

class or series of stock.* |

| Designation only) |

Section 4(b)(ii) of Exhibit A to the Certificate of Designation is

hereby |

| |

amended and restated in its entirety as set forth in Exhibit A hereto. |

| 7. Withdrawal: |

Designation being |

|

|

|

Date of |

|

| |

Withdrawn: |

|

|

|

Designation: |

|

| |

|

|

|

|

|

|

| |

No shares of the class or series of stock being withdrawn are outstanding. |

| |

|

| |

The resolution of the board of directors authorizing the withdrawal

of the certificate of |

| |

designation establishing the class or series of stock: * |

| |

|

| |

|

| |

|

| 8. Signature: (Required) |

☒ |

/s/ Arshia Sarkhani |

|

Date: |

06/14/2024 |

| |

|

Signature of Officer |

|

|

|

| * | Attach additional page(s) if necessary |

Page 1 of 1 |

| This form must be accompanied by appropriate fees. |

Revised: 8/1/2023 |

EXHIBIT A

(ii) “Conversion

Price” means, with respect to each Preferred Share, as of any Conversion Date or other date of determination, an initial price

of $0.75, subject to further adjustment as provided herein. In the event that the number of Conversion Shares (as defined below) subject

to a conversion would exceed the Exchange Limitation (as defined below) prior to the Ex-Exchange Limitation Date (as defined below), in

aggregate with any prior conversions of the Preferred Shares or other issuances of shares of Class B Common Stock that would be subject

to the Exchange Limitation, then the Conversion Price shall not be less than the “Minimum Price” as such term is defined in

Nasdaq Listing Rule 5635(d); provided that, the Company shall file a Preliminary Information Statement on Schedule 14C with the

SEC within ten (10) days after the Initial Issuance Date, and on or before the twentieth (20th) calendar day after the Initial Issuance

Date (or, if such filing is delayed by a court or regulatory agency including but not limited to the SEC, in no event later than the forty-fifth

(45th) calendar day after the Initial Issuance Date), file a Definitive Information Statement on Schedule 14C with the SEC, which shall

disclose that the Company’s stockholders have approved by written consent the non-application of the Minimum Price for issuances

that would otherwise exceed the Exchange Limitation, and which action shall take effect twenty (20) days following the date that such

Definitive Information Statement is sent or given (the “Ex-Exchange Limitation Date”). In the event that the Conversion

Price on a Conversion Date would have been less than the applicable Minimum Price or the Floor Price (as defined below) if not for the

immediately preceding sentence, then on any such Conversion Date the Stated Value shall automatically be increased by an amount equal

to the product obtained by multiplying (A) the higher of (I) the highest price that the Class B Common Stock trades at on the Trading

Day immediately preceding such Conversion Date and (II) the applicable Conversion Price and (B) the difference obtained by subtracting

(I) the number of shares of Class B Common Stock delivered (or to be delivered) to the Holder on the applicable Conversion Date with respect

to such conversion of Preferred Shares from (II) the quotient obtained by dividing (x) the applicable Conversion Amount that the Holder

has elected to be the subject of the applicable conversion of Preferred Shares, by (y) the applicable Conversion Price. Notwithstanding

anything to the contrary herein, the Conversion Price shall not be less than $0.0855 (the “Floor Price”), which shall

not be subject to any adjustment as provided herein, except for appropriate adjustments for any stock splits, stock dividends, stock combinations,

recapitalizations or other similar transactions.

Exhibit 10.1

first AMENDMENT

TO securities purchase AGREEMENT

FIRST AMENDMENT TO SECURITIES

PURCHASE AGREEMENT (this “Amendment”) is made and entered into as of June 13, 2024, by and between Asset

Entities Inc., a Nevada corporation (the “Company”), and Ionic

Ventures, LLC, a California limited liability company (the “Buyer”). Each of Company and Buyer are sometimes

referred to in this Agreement individually as a “Party” and, collectively, as the “Parties.”

RECITALS

A. Each

Party desires to amend that certain Securities Purchase Agreement, dated as of May 24, 2024, between the Company and the Buyer (the “Purchase

Agreement”).

AGREEMENT

NOW, THEREFORE, in consideration

of the mutual agreements herein contained, the Parties, intending to be legally bound, hereby agree as follows:

1. General.

This Amendment amends the Purchase Agreement. Except as expressly set forth in this Amendment, all terms and conditions of the Purchase

Agreement shall remain in full force and effect.

2. Amendment.

The Buyer and the Company hereby agree to amend Section 4(z) of the Purchase Agreement in its entirety to state as follows: “Reverse

Stock Split Floor Period. If any of the Preferred Shares remain outstanding and the closing price of the Class B Common Stock is equal

to or less than $0.0855 per share for a period of ten (10) consecutive Trading Days (the “Reverse Stock Split Floor Period”),

then the Company shall promptly take all corporate action necessary to authorize a reverse stock split of the Class B Common Stock by

a ratio equal to or greater than 300% of the quotient obtained by dividing $0.0855 by the lowest closing price of the Class B Common Stock

during the Reverse Stock Split Floor Period, including, without limitation, calling a special meeting of stockholders to authorize such

reverse stock split or obtaining by written consent of such reverse stock split, and voting the management shares of the Company in favor

of such reverse stock split.”

3. Conditions

to Effectiveness of Amendment. This Amendment shall become effective upon receipt by the Company and the Buyer of counterpart

signatures to this Amendment duly executed and delivered by the Company and the Buyer.

4. No

Implied Consent or Waiver. Except as expressly set forth in this Amendment, this Amendment shall not, by implication or

otherwise, limit, impair, constitute a waiver of or otherwise affect any rights or remedies of the Buyer or the Company under the Purchase

Agreement, or alter, modify, amend or in any way affect any of the terms, obligations or covenants contained in the Purchase Agreement,

which shall continue in full force and effect. Nothing in this Amendment shall be construed to imply any willingness on the part of the

Buyer or the Company to agree to or grant any similar or future amendment, consent or waiver of any of the terms and conditions of the

Purchase Agreement.

5. Counterparts.

This Amendment may be executed by the Parties in several counterparts, each of which shall be an original and all of which shall constitute

together but one and the same agreement. Delivery of an executed counterpart of a signature page of this Amendment by e-mail (e.g., “pdf”

or “tiff”) or fax transmission shall be effective as delivery of a manually executed counterpart of this Amendment.

6. Governing

Law. THIS AMENDMENT SHALL BE A CONTRACT MADE UNDER AND GOVERNED BY THE INTERNAL LAWS OF THE STATE OF NEVADA APPLICABLE

TO CONTRACTS MADE AND TO BE PREPARED ENTIRELY WITHIN SUCH STATE, WITHOUT REGARD TO CONFLICT OF LAWS PRINCIPLES.

IN WITNESS WHEREOF, the Parties

have caused this Amendment to be duly executed and delivered as of the date first set forth above.

| |

Asset Entities Inc. |

| |

|

|

| |

By: |

/s/ Arshia Sarkhani |

| |

Name: |

Arshia Sarkhani |

| |

Title: |

Chief Executive Officer |

| |

Ionic Ventures, LLC |

| |

|

| |

By: |

/s/ Brendan O’Neil |

| |

Name: |

Brendan O’Neil |

| |

Title: |

Manager, Authorized Signatory |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

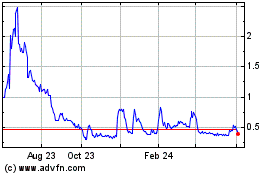

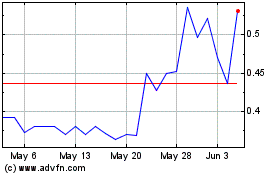

Asset Entities (NASDAQ:ASST)

Historical Stock Chart

From Nov 2024 to Dec 2024

Asset Entities (NASDAQ:ASST)

Historical Stock Chart

From Dec 2023 to Dec 2024