As filed with the Securities and Exchange

Commission on June 7, 2024

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM S-1

REGISTRATION STATEMENT UNDER

THE SECURITIES ACT OF 1933

Asset Entities Inc.

(Exact name of registrant as specified in its

charter)

| Nevada |

|

7372 |

|

88-1293236 |

(State or other jurisdiction of

incorporation or organization) |

|

(Primary Standard Industrial

Classification Code Number) |

|

(I.R.S. Employer

Identification Number) |

100 Crescent Ct, 7th Floor

Dallas, TX 75201

(214) 459-3117

(Address, including zip code, and telephone number,

including area code, of registrant’s principal executive offices)

Matthew Krueger, Chief Financial Officer

100 Crescent Ct, 7th Floor

Dallas, TX 75201

(262) 527-0966

(Name, address, including zip code, and telephone

number, including area code, of agent for service)

Copies to:

Louis A. Bevilacqua, Esq.

Bevilacqua PLLC

1050 Connecticut Avenue, NW, Suite 500

Washington, DC 20036

(202) 869-0888

Approximate

date of commencement of proposed sale to the public: From time to time after this Registration

Statement becomes effective.

If

any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the

Securities Act of 1933, check the following box. ☒

If

this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the

following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If

this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the

Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

Indicate

by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company,

or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller

reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| |

Large accelerated filer ☐ |

Accelerated filer ☐ |

| |

Non-accelerated filer ☒ |

Smaller reporting company ☒ |

| |

|

Emerging growth company ☒ |

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

The

registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the

registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective

in accordance with Section 8(a) of the Securities Act or until this registration statement shall become effective on such date as the

Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The

information in this prospectus is not complete and may be changed. The selling stockholder named in this prospectus may not sell these

securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an

offer to sell these securities and it is not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

| PRELIMINARY PROSPECTUS |

SUBJECT TO COMPLETION, DATED JUNE 7, 2024 |

Asset Entities Inc.

7,748,521 Shares of Class B Common Stock

This prospectus relates to the offer and resale

from time to time of:

| ● | up

to 7,594,521 of the shares of Class B Common Stock, $0.0001 par value per share (the “Class

B Common Stock”), of Asset Entities Inc., a Nevada corporation, by Ionic Ventures,

LLC, a California limited liability company (“Ionic”), issuable upon the conversion

of a variable amount of the 165 shares of our Series A Convertible Preferred Stock, $0.0001

par value per share (the “Series A Preferred Stock”), issued to Ionic, pursuant

to the securities purchase agreement, dated as of May 24, 2024, between the Company and Ionic

(the “Ionic Purchase Agreement”), and the Certificate of Designation of Series

A Convertible Preferred Stock of the Company filed with the Secretary of State of the State

of Nevada on May 24, 2024 (the “Certificate of Designation”), having an initial

stated value (“Stated Value”) of $10,000 per share of Series A Preferred Stock,

a cumulative annual dividend rate on the Stated Value of 6% (which will increase to 12% if

a Triggering Event (as defined in the Certificate of Designation) occurs until such Triggering

Event, if curable, is cured) payable in shares of Class B Common Stock (or cash at the Company’s

option) upon conversion or redemption of the Series A Preferred Stock, and an initial conversion

price (“Conversion Price”) of $0.75 per share of Class B Common Stock, and an

alternate Conversion Price equal to 85% (or 70% if the Class B Common Stock is suspended

from trading on or delisted from a principal trading market or upon occurrence of a Triggering

Event (as defined in the Certificate of Designation)) of the average lowest daily volume

weighed average price of the Class B Common Stock during the Alternate Conversion Measuring

Period (as defined in the Certificate of Designation) (the “Alternate Conversion Price”),

subject to applicable limitations or restrictions; and |

| ● | up

to 154,000 shares of Class B Common Stock by Boustead Securities, LLC, a registered broker-dealer

(“Boustead” and together with Ionic, the “Selling Stockholders”),

issuable upon exercise of a placement agent warrant issued to Boustead pursuant to the Company’s

engagement letter agreement with Boustead, dated November 29, 2021 (the “Boustead Engagement

Letter”), relating to placement agent services in connection with the transactions

contemplated by the Ionic Purchase Agreement, upon exercise of a placement agent warrant

issued as partial consideration for placement agent services with respect to the Ionic Purchase

Agreement, at an exercise price of $0.75 per share, subject to applicable limitations or

restrictions (the “Placement Agent Warrant”). |

A

holder of Series A Preferred Stock may not convert the Series A Preferred Stock into Class B Common Stock to the extent that such conversion

would cause such holder’s beneficial ownership of Class B Common Stock to exceed 4.99% of the outstanding Class B Common Stock

immediately after conversion, which may be increased by the holder to up to 9.99% upon no fewer than 61 days’ prior notice. In

addition, the Company will not issue shares of Class B Common Stock upon conversion of the Series A Preferred Stock at less than the

price (the “Minimum Price”) that is equal to the lower of the last closing price of the stock immediately preceding the signing

of the related binding agreement and the average closing price for the five trading days immediately preceding the signing of the related

binding agreement, in an amount exceeding 19.99% of the Company’s outstanding common stock, $0.0001 par value per share (“common

stock”), which number of shares shall be reduced, on a share-for-share basis, by the number of shares of common stock issued or

issuable pursuant to any transaction or series of transactions that may be aggregated with the transactions contemplated by the Certificate

of Designation under applicable rules of The Nasdaq Stock Market LLC (“Nasdaq”), including Nasdaq Listing Rule 5635(d) (such

amount, the “Exchange Limitation”), or less than a separate floor price (the “Floor Price”) of $0.0855 per share

regardless of whether the Exchange Limitation has been reached, before the effectiveness of the approval of such number of the holders

of the outstanding shares of the Company’s voting securities as required by the Bylaws of the Company (the “Bylaws”)

and the Nevada Revised Statutes (the “NRS”), to ratify and approve all of the transactions contemplated by the Transaction

Documents (as defined in the Ionic Purchase Agreements), including the issuance of all of the shares of Series A Preferred Stock and

shares of Class B Common Stock upon conversion of the shares of Series A Preferred Stock, all as may be required by the applicable rules

and regulations of The Nasdaq Capital Market tier of Nasdaq (or any successor entity) (the “Stockholder Approval”). The exercisability

of the Placement Agent Warrant will also be subject to the Exchange Limitation before the effectiveness of the Stockholder Approval.

We

are not selling any securities under this prospectus and will not receive any of the proceeds from the sale of our Class B Common Stock

by the Selling Stockholders. We may receive up to $115,500 in gross proceeds from the cash exercise of the Placement Agent Warrant.

See “Use of Proceeds” beginning on page 12 of this prospectus.

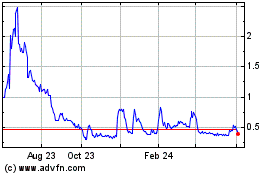

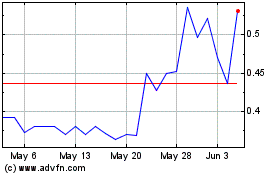

The Class B Common Stock is listed on The Nasdaq Capital Market tier of Nasdaq, under the symbol “ASST.” As of June 6, 2024,

the last reported sales price of the Class B Common Stock on Nasdaq was $0.491.

We

have two classes of authorized common stock, Class A Common Stock, $0.0001 par value per share (the “Class A Common Stock”),

and Class B Common Stock. The rights of the holders of Class A Common Stock and Class B Common Stock are identical, except with respect

to voting and conversion. Each share of Class A Common Stock is entitled to ten votes per share and is convertible into one share of

Class B Common Stock. Each share of Class B Common Stock is entitled to one vote per share. As of May 24, 2024, Asset Entities Holdings,

LLC (“AEH”), the holder of all of the outstanding Class A Common Stock, holds approximately 91.2% of the voting power of

our outstanding capital stock and is therefore our controlling stockholder. In addition, the officers, managers and beneficial owners

of the shares held by AEH, all of whom are also some of our officers and directors, have controlling voting power in the Company by collectively

controlling approximately 92.6% of all voting rights. As a result, we are a “controlled company” under Nasdaq’s

rules, although we do not intend to avail ourselves of the corporate governance exemptions afforded to a “controlled company”

under the rules of Nasdaq. See Item 1A. “Risk Factors – Risks Related to Ownership of Our Class B Common Stock –

As a ‘controlled company’ under the rules of Nasdaq, we may choose to exempt our company from certain corporate governance

requirements that could have an adverse effect on our public stockholders.” in our Annual

Report on Form 10-K for the fiscal year ended December 31, 2023 (the “Annual Report”), which is incorporated by reference

into this prospectus.

We

are an “emerging growth company”, as defined in the Jumpstart Our Business Startups Act of 2012, under applicable U.S. federal

securities laws, and are eligible for reduced public company reporting requirements. See Item 1A. “Risk Factors – Risks

Related to Ownership of Our Class B Common Stock – We are subject to ongoing public reporting requirements that are less rigorous

than Exchange Act rules for companies that are not emerging growth companies and our stockholders could receive less information than

they might expect to receive from more mature public companies.” in the Annual

Report, which is incorporated by reference into this prospectus.

The

Selling Stockholders may offer and sell the securities being offered by means of this prospectus from time to time in public or private

transactions, or both. These sales will occur at fixed prices, at market prices prevailing at the time of sale, at prices related to

prevailing market prices, or at negotiated prices. The Selling Stockholders may sell the securities being offered to or through underwriters,

broker-dealers or agents, who may receive compensation in the form of discounts, concessions or commissions from the Selling Stockholders,

the purchasers of the securities being offered by means of this prospectus, or both. Each of the Selling Stockholders may offer all,

some or none of the securities being offered by means of this prospectus. The Selling Stockholders, including any of the Selling Stockholders

who are broker-dealers or affiliates of broker-dealers, and any other participating broker-dealers, may be deemed to be “underwriters”

within the meaning of Section 2(a)(11) of the Securities Act of 1933, as amended (the “Securities Act”), and any commissions

or discounts given to any such broker-dealer, affiliates of a broker-dealer or other “underwriters” within the meaning of

the Securities Act may be regarded as underwriting commissions or discounts under the Securities Act. See “Plan of Distribution”

for a more complete description of the ways in which the securities being offered by means of this prospectus may be sold.

Investing

in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 9 of this

prospectus, in any applicable prospectus supplement, in any related free writing prospectus, and in the documents incorporated by reference

into this prospectus, any accompanying prospectus supplement and any related free writing prospectus before you make an investment decision.

Neither

the U.S. Securities and Exchange Commission nor any state or provincial securities commission has approved or disapproved of these securities

or determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

The

date of this prospectus is , 2024.

TABLE OF CONTENTS

You should rely only on the information that

we have provided or incorporated by reference in this prospectus, any supplement to this prospectus, and any related free writing prospectus

that we may authorize to be provided to you. We have not authorized anyone to provide you with different information. No dealer, salesperson

or other person is authorized to give any information or to represent anything not contained in or incorporated by reference in this prospectus,

any prospectus supplement, or any related free writing prospectus that we may authorize to be provided to you. You must not rely on any

unauthorized information or representation. This prospectus is an offer to sell only the securities offered hereby, but only under circumstances

and in jurisdictions where it is lawful to do so. You should assume that the information in this prospectus, prospectus supplement, or

any related free writing prospectus is accurate only as of the date on the front of the document and that any information we have incorporated

by reference is accurate only as of the date of the document incorporated by reference, regardless of the time of delivery of this prospectus,

any supplement to this prospectus, or any related free writing prospectus, or any sale of a security.

Trademarks, Trade Names and Service Marks

We use various trademarks, trade names and service

marks in our business, including “AE 360 DDM”, “Asset Entities Where Assets Are Created”, “SiN”, “Social

Influencer Network”, “Ternary D”, “Options Swing”, and associated marks. For convenience, we may not include

the ℠, ® or ™ symbols, but such omission is not meant to indicate that we would not protect our

intellectual property rights to the fullest extent permitted by law. Any other trademarks, trade names or service marks referred to in

this prospectus or any document incorporated by reference into this prospectus are the property of their respective owners.

Industry and Market Data

We are responsible for the information contained

in this prospectus or any document incorporated by reference into this prospectus. This prospectus and documents incorporated by reference

into this prospectus include industry data and forecasts that we obtained from industry publications and surveys as well as public filings

and internal company sources. Industry publications, surveys and forecasts generally state that the information contained therein has

been obtained from sources believed to be reliable. Statements as to our ranking, market position and market estimates are based on third-party

forecasts, management’s estimates and assumptions about our markets and our internal research. We have not independently verified

such third-party information, nor have we ascertained the underlying economic assumptions relied upon in those sources. While we believe

that all such information contained in this prospectus is accurate and complete, nonetheless such data involve uncertainties and risks,

including risks from errors, and is subject to change based on various factors, including those discussed under “Risk Factors”

and “Cautionary Note Regarding Forward-Looking Statements” in this prospectus and documents incorporated by reference

into this prospectus.

PROSPECTUS SUMMARY

This summary highlights selected information

contained elsewhere in or incorporated by reference into this prospectus. This summary is not complete and does not contain all of the

information that you should consider before deciding whether to invest in our securities. You should carefully read the entire prospectus

and the other information incorporated by reference into this prospectus, including the risks associated with an investment in our company

discussed in the “Risk Factors” section of this prospectus and the other documents incorporated by reference into this prospectus,

before making an investment decision. Some of the statements in this prospectus and the other documents incorporated by reference into

this prospectus are forward-looking statements. See the section titled “Cautionary Note Regarding Forward-Looking Statements.”

Company Overview

Asset Entities is a technology

company providing social media marketing and content delivery services across Discord, TikTok, and other social media platforms. We also

design, develop and manage servers for communities on Discord. Based on the growth of our Discord servers and social media following,

we have developed three categories of services: (1) our Discord investment education and entertainment services, (2) social media and

marketing services, and (3) our “AE.360.DDM” brand services. We also offer Ternary v2, a cloud-based subscription management

and payment processing solution for Discord communities, which includes a suite of customer relations management tools and Stripe-verified

payment processing. All of our services are based on our effective use of Discord as well as other social media including TikTok, X, Instagram,

and YouTube.

Our Discord investment

education and entertainment service is designed primarily by and for enthusiastic Generation Z, or Gen Z, retail investors, creators and

influencers. Gen Z is commonly considered to be people born between 1997 and 2012. Our investment education and entertainment service

focuses on stock, real estate, cryptocurrency, and NFT community learning programs designed for the next generation. While we believe

that Gen Z will continue to be our primary market, our Discord server offering features education and entertainment content covering real

estate investments, which is expected to appeal strongly to older generations as well. Our current combined server user membership is

approximately 209,417 as of May 2024.

Our social media and

marketing services utilize our management’s social influencer backgrounds by offering social media and marketing campaign services

to business clients. Our team of social influencer independent contractors, which we call our “SiN” or “Social Influencer

Network”, can perform social media and marketing campaign services to expand our clients’ Discord server bases and drive traffic

to their businesses, as well as increase membership in our own servers.

Our “AE.360.DDM,

Design Develop Manage” service, or “AE.360.DDM”, is a suite of services to individuals and companies seeking to create

a server on Discord. We believe we are the first company to provide “Design, Develop and Manage,” or DDM, services for any

individual, company, or organization that wishes to join Discord and create their own community. With our AE.360.DDM rollout, we are uniquely

positioned to offer DDM services in the growing market for Discord servers.

Through Ternary v2, our

subscription management and payment processing solution for Discord communities, subscribers can monetize and manage their Discord users.

Ternary v2 simplifies the process for our subscribers to sell memberships to their Discord servers on their websites and collect payments

through Stripe with daily payouts; add digital products and services and designate purchase options to their Discord servers; customize

their user Discord permissions and roles and other Discord settings; and utilize our Discord bot to automatically apply their

Discord user settings to authenticate new users, apply customizable permission sets to users, and remove users when their subscription

expire. As a Stripe-verified partner through Ternary v2, we can also assist subscribers with integrating other platforms into their Discord

servers with open application programming interfaces, further extending our platform’s capabilities.

We believe that we are

a leading provider of all of these services, and that demand for all of our services will continue to grow. We expect to experience rapid

revenue growth from our services. We believe that we have built a scalable and sustainable business model and that our competitive strengths

position us favorably in each aspect of our business.

Our revenue depends on

the number of paying subscribers to our Discord servers. During the three months ended March 31, 2024 and 2023, we received revenue from

438 and 382 Asset Entities Discord server paying subscribers, respectively.

Corporate Information

Our principal executive

offices are located at 100 Crescent Court, 7th Floor, Dallas, TX 75201, and our telephone number is (214) 459-3117. We maintain a website

at https://assetentities.com/. Information available on our website is not incorporated by reference in and is not deemed a part of this

prospectus.

May 2024 Private Placement

Securities Purchase

Agreement

On May 24, 2024, we entered

into the Ionic Purchase Agreement with Ionic for the issuance and sale of up to 330 shares of the Company’s newly designated Series

A Preferred Stock for maximum gross proceeds of $3,000,000. The shares of the Series A Preferred Stock are convertible into shares of

Class B Common Stock. Pursuant to the Ionic Purchase Agreement, we are required to issue and sell 165 shares of Series A Preferred Stock

at each of two closings subject to the satisfaction of the terms and conditions for each closing. The first closing (the “First

Closing”) occurred on May 24, 2024 for the issuance and sale of 165 shares of Series A Preferred Stock for gross proceeds of $1,500,000.

The second closing (the “Second Closing”), for the issuance and sale of 165 shares of Series A Preferred Stock for gross proceeds

of $1,500,000, will occur on the first business day on which the conditions specified in the Ionic Purchase Agreement for the Second Closing

are satisfied or waived, including the filing and effectiveness of the First Registration Statement (as defined below) and the effectiveness

of the Stockholder Approval.

Registration Rights

Agreement

In connection with the

Ionic Purchase Agreement, we agreed to provide certain registration rights to Ionic, pursuant to a registration rights agreement, dated

as of May 24, 2024 (the “Ionic Registration Rights Agreement”). The Ionic Registration Rights Agreement provides for the registration

for resale of any and all shares of Class B Common Stock issuable to Ionic with respect to the shares of Series A Preferred Stock under

the Ionic Purchase Agreement (the “Registrable Conversion Shares”). Within the later of 15 calendar days of the First Closing

or May 24, 2024, we were required to file the registration statement (the “First Registration Statement”) of which this prospectus

forms a part for the offer and resale of the maximum number of Registrable Conversion Shares permitted to be covered under the rules of

the Securities and Exchange Commission (the “SEC”). The First Registration Statement must be declared effective within 45

days of the First Closing, or 90 days if the First Registration Statement receives a review. If an additional registration statement must

be filed to cover the resale of Registrable Conversion Shares that were not permitted to be included in the First Registration Statement,

we must file an additional registration statement (the “Second Registration Statement”) within 15 days of the Second Closing

for the maximum number of Registrable Conversion Shares permitted to be covered under SEC rules. The Second Registration Statement must

be declared effective within 45 days of the Second Closing, or 90 days if the Second Registration Statement receives a review. In the

event the number of shares of Class B Common Stock available under the First Registration Statement and the Second Registration Statement

is insufficient to cover all of the Registrable Conversion Shares, we will be required to file at least one additional registration statement

(each of such additional registration statement, the First Registration Statement, and the Second Registration Statement, and collectively,

the “Registration Statement”) within 14 days of the date that the necessity arises and that such additional Registration Statement

may be filed under SEC rules to cover such Registrable Conversion Shares up to the maximum permitted to be covered under SEC rules, which

must be made effective within 45 days of such date, or 90 days if such additional Registration Statement receives a review. Any failure

to meet the filing deadline for either the First Registration Statement or the Second Registration Statement (“Filing Failure”)

will result in liquidated damages of 100,000 shares of Class B Common Stock. Any failure to meet the effectiveness deadline for any Registration

Statement (“Effectiveness Failure”) will result in liquidated damages of 100,000 shares of Class B Common Stock. Each of the

shares issuable upon a Filing Failure or an Effectiveness Failure must also be covered by a Registration Statement to the same extent

as the Registrable Conversion Shares. We will be required to use our best efforts to keep each Registration Statement effective until

all such shares of Class B Common Stock are sold or may be sold without restriction pursuant to Rule 144 under the Securities Act (“Rule

144”), and without the requirement for us to be in compliance with the current public information requirement under Rule 144.

Terms of Series

A Convertible Preferred Stock under Certificate of Designation and Securities Purchase Agreement

Pursuant to the Ionic

Purchase Agreement, on May 24, 2024, we filed the Certificate of Designation with the Secretary of State of the State of Nevada designating

660 shares of the Company’s Preferred Stock, $0.0001 par value per share, as “Series

A Convertible Preferred Stock,” and setting forth the voting and other powers, preferences and relative, participating, optional

or other rights of the Series A Preferred Stock. Each share of Series A Preferred Stock has an initial Stated Value of $10,000 per share.

The Series A Preferred

Stock ranks senior to all capital stock of the Company with respect to the payment of dividends, distributions and payments upon the liquidation,

dissolution and winding up of the Company, unless the holders of the majority of the outstanding shares of Series A Preferred Stock consent

to the creation of other capital stock of the Company that is senior or equal in rank to the Series A Preferred Stock.

Holders of Series A Preferred

Stock will be entitled to receive cumulative dividends, in shares of Class B Common Stock (or cash at the Company’s option) on the

Stated Value at an annual rate of 6% (which will increase to 12% if a Triggering Event occurs until such Triggering Event, if curable,

is cured). Dividends will be payable upon conversion or redemption of the Series A Preferred Stock.

Holders of Series A Preferred

Stock will be entitled to convert shares of Series A Preferred Stock into a number of shares of Class B Common Stock determined by dividing

the Stated Value of such shares (plus any accrued but unpaid dividends and other amounts due, unless paid by the Company in cash) by the

Conversion Price. The initial Conversion Price is $0.75, subject to adjustment including adjustments due to full-ratchet anti-dilution

provisions. Holders may elect to convert shares of Series A Preferred Stock to Class B Common Stock at the Alternate Conversion Price

equal to 85% (or 70% if the Company’s Class B Common Stock is suspended from trading on or delisted from a principal trading market

or upon occurrence of a Triggering Event) of the average lowest daily volume weighed average price of the Class B Common Stock during

the Alternate Conversion Measuring Period.

A holder of Series A

Preferred Stock may not convert the Series A Preferred Stock into Class B Common Stock to the extent that such conversion would cause

such holder’s beneficial ownership of Class B Common Stock to exceed 4.99% of the outstanding Class B Common Stock immediately after

conversion, which may be increased by the holder to up to 9.99% upon no fewer than 61 days’ prior notice. In addition, the Company

may not issue shares of Class B Common Stock upon conversion of the Series A Preferred Stock at less than the Minimum Price in an amount

that may exceed the Exchange Limitation, or conversions at less than the Floor Price regardless of whether the Exchange Limitation has

been reached, before the Stockholder Approval is obtained and effective for such issuances in excess of the Exchange Limitation in accordance

with the requirements described immediately below. The Ionic Purchase Agreement requires that the Company obtain the Stockholder Approval

by the prior written consent of the requisite stockholders to obtain the approval of such number of the holders of the outstanding shares

of the Company’s voting securities as required by the Bylaws and the NRS, to ratify and approve all of the transactions contemplated

by the Transaction Documents, including the issuance of all of the shares of Series A Preferred Stock and shares of Class B Common Stock

issuable upon conversion of such shares pursuant to the Ionic Purchase Agreement, all as may be required by the applicable rules and regulations

of The Nasdaq Capital Market tier of Nasdaq (or any successor entity). The Series A Preferred Stock also may not be converted except to

the extent that the shares of Class B Common Stock issuable upon such conversion may be resold pursuant to Rule 144 or an effective and

available registration statement.

The Ionic Purchase Agreement

and the Certificate of Designation require that the Company file a Preliminary Information Statement on Schedule 14C with the SEC within

10 days of the date of the First Closing followed by the filing of a Definitive Information Statement on Schedule 14C with the SEC within

20 days of the date of the First Closing, or within 45 days of the date of the First Closing if delayed due to a court or regulatory agency,

including but not limited to the SEC, which shall disclose the Stockholder Approval. In accordance with the rules of the SEC, the Stockholder

Approval will become effective 20 days after the Definitive Information Statement is sent or given in accordance with SEC rules. Prior

to such date of effectiveness, if the number of shares of Class B Common Stock subject to a conversion would exceed the Exchange Limitation

prior to the date of the effectiveness of the Stockholder Approval, and the Conversion Price for such conversion would be lower than the

Minimum Price or the Floor Price, then, upon any conversion of shares of Series A Preferred Stock, the Stated Value will automatically

be increased by an amount equal to the product obtained by multiplying (A) the higher of (I) the highest price that the Class B Common

Stock trades at on the Trading Day (as defined below) immediately preceding the conversion date and (II) the applicable Conversion Price

and (B) the difference obtained by subtracting (I) the number of shares of Class B Common Stock delivered (or to be delivered) to the

holder on the applicable conversion date with respect to such conversion of Series A Preferred Stock from (II) the quotient obtained by

dividing (x) the applicable value of the Series A Preferred Stock being converted that the holder has elected to be the subject of the

applicable conversion of Series A Preferred Stock, by (y) the applicable Conversion Price.

In accordance with the

requirements and provisions described above, on May 24, 2024, the Company obtained the Stockholder Approval by execution of a written

consent in lieu of a special meeting of a majority of the voting power of the stockholders of the Company approving a resolution approving

the issuance of Class B Common Stock in aggregate in excess of the limitations provided by Nasdaq Listing Rule 5635(d), including that

an amount of shares of Class B Common Stock equal to or greater than 20% of the total common stock or voting power outstanding on the

date of the Certificate of Designation may be issued pursuant to the Certificate of Designation at a price that may be less than either

or both of the Minimum Price or the Floor Price. In addition, on May 31, 2024, the Company filed a Preliminary Information Statement on

Schedule 14C with the SEC. The Company will be required to file a Definitive Information Statement on Schedule 14C with the SEC disclosing

the Stockholder Approval on or before June 13, 2024, or on or before July 8, 2024 if delayed due to a court or regulatory agency, including

but not limited to the SEC. On the 20th day following actions meeting these and other applicable requirements, the Stockholder

Approval will be effective, and the Company will be permitted to issue more than the limited number of shares as defined by the Exchange

Limitation, at prices that may be below the Minimum Price or the Floor Price.

Under the Ionic Purchase

Agreement, if the closing price of the Class B Common Stock falls below $0.75 per share, the holder’s total sales of Class B Common

Stock will be restricted. The holder may only sell either the greater of $25,000 per Trading Day or 15% of the daily trading volume of

the Class B Common Stock reported by Bloomberg, LP, until the closing price exceeds $0.75. “Trading Day” is defined as a day

on which the principal trading market for the Class B Common Stock is open for trading for at least six hours.

The Series A Preferred

Stock will automatically convert to Class B Common Stock upon the 24-month anniversary of the initial issuance date of the Series A Preferred

Stock.

The Company will have

the right at any time to redeem all or any portion of the Series A Preferred Stock then outstanding at a price equal to 110% of the Stated

Value plus any accrued but unpaid dividends and other amounts due.

Holders of the Series

A Preferred Stock will generally have the right to vote on an as-converted basis with the Class B Common Stock, subject to the beneficial

ownership limitation set forth in the Certificate of Designation.

We may not sell securities

in a financing transaction while Ionic beneficially owns any of the Series A Preferred Stock or the common stock until the end of the

30-day period following the initial date of the effectiveness of the First Registration Statement of which this prospectus forms a part

or during any Alternate Conversion Measuring Period. In addition, the Company may not file any other registration statement or any offering

statement under the Securities Act, other than a registration statement on Form S-8 or supplements or amendments to registration statements

that were filed and effective as of the date of the Ionic Purchase Agreement, unless each Registration Statement is effective and the

respective prospectus is available for use, or the shares of Series A Preferred Stock and underlying shares of Class B Common Stock that

must be included in each Registration Statement under the Ionic Registration Rights Agreement may be resold without limitation under Rule

144.

Placement Agent

Compensation

In connection with each

closing under the Ionic Purchase Agreement, pursuant to the Boustead Engagement Letter, and the underwriting agreement between us and

Boustead, as representative of the underwriters of our initial public offering, dated February 2, 2023 (the “Underwriting Agreement”),

we are required to pay Boustead a fee equal to 7% of the aggregate purchase price and a non-accountable expense allowance equal to 1%

of the aggregate purchase price for the Series A Preferred Stock. On the date of the First Closing, we therefore paid Boustead a total

amount of $120,000, and will be required to pay Boustead a total amount of $120,000 on the date of the Second Closing. In addition, on

the date of the First Closing, the Company was required to issue the Placement Agent Warrant to Boustead for the purchase of 154,000 shares

of Class B Common Stock, equal to 7% of the number of shares of Class B Common Stock that may be issued upon conversion of the Shares

sold at the First Closing at the initial Conversion Price of $0.75 per share, subject to the Exchange Limitation before the effectiveness

of the Stockholder Approval. If and when the Second Closing occurs, the Company will be required to issue an additional placement agent

warrant to Boustead for the purchase of 154,000 shares of Class B Common Stock, equal to 7% of the number of shares of Class B Common

Stock that may be issued upon conversion of the Shares sold at the Second Closing at the initial Conversion Price of $0.75 per share.

The Placement Agent Warrant and each additional placement agent warrant issuable under the Boustead Engagement Letter in connection with

the transactions contemplated by the Ionic Purchase Agreement will have an exercise price of $0.75 per share. In addition, we must issue

7,000 shares of Class B Common Stock to Boustead upon the occurrence of each Filing Failure and each Effectiveness Failure. Notwithstanding

certain provisions in the Boustead Engagement Letter, the Placement Agent Warrant and any additional placement agent warrant will not

contain piggyback registration rights and will not contain anti-dilution provisions for future stock issuances, etc., at a price or at

prices below the exercise price per share, or provide for automatic exercise immediately prior to expiration. The Placement Agent Warrant

and any additional placement agent warrant and the underlying shares may be deemed to be compensation by the Financial Industry Regulatory

Authority, Inc. (“FINRA”), and may be subject to limits on exercise under FINRA rules.

The Offering

| Class B Common Stock offered by the Selling Stockholders: |

|

This prospectus relates to 7,748,521 shares of Class B Common Stock which may be sold from time to time by the Selling Stockholders, which includes: |

| |

|

|

| |

|

● |

up to 7,594,521

of the shares of Class B Common Stock by Ionic issuable upon the conversion of shares of Series A Preferred Stock issued to Ionic

pursuant to the Ionic Purchase Agreement and the Certificate of Designation, subject to applicable limitations or restrictions; and |

| |

|

|

|

| |

|

● |

up to 154,000 shares of

Class B Common Stock by Boustead issuable upon exercise of the Placement Agent Warrant. |

| |

|

|

|

| Use of proceeds: |

|

We will not receive any proceeds from any sales of the Class B Common Stock by the Selling Stockholders. Assuming the full exercise of the Placement Agent Warrant for cash, we will receive gross proceeds of $115,500. |

| |

|

|

| Risk factors: |

|

Investing in our Class B Common Stock involves

a high degree of risk. As an investor, you should be able to bear a complete loss of your investment. You should carefully consider

the information set forth in the “Risk Factors” section beginning on page 9 before deciding to invest

in our Class B Common Stock. |

| |

|

|

| Trading market and symbol: |

|

Our Class B Common Stock is listed on The Nasdaq Capital Market tier of Nasdaq under the symbol “ASST”. |

DESCRIPTION OF SECURITIES

The description of our authorized capital stock

and our outstanding securities as of the date of the filing of the Annual Report is incorporated by reference to Exhibit 4.1 to

the Annual Report, and supplemented or updated as follows:

General

As of May 24, 2024, there were 7,532,029 shares of Class A Common Stock,

7,522,971 shares of Class B Common Stock, 165 shares of Series A Preferred Stock outstanding, and no other shares of preferred stock issued

and outstanding.

Series A Preferred Stock

Pursuant to the Ionic

Purchase Agreement, on May 24, 2024, we filed the Certificate of Designation with the Secretary of State of the State of Nevada designating

660 shares of the Company’s Preferred Stock, $0.0001 par value per share, as “Series

A Convertible Preferred Stock,” and setting forth the voting and other powers, preferences and relative, participating, optional

or other rights of the Series A Preferred Stock. Each share of Series A Preferred Stock has an initial Stated Value of $10,000 per share.

The Series A Preferred

Stock ranks senior to all capital stock of the Company with respect to the payment of dividends, distributions and payments upon the liquidation,

dissolution and winding up of the Company, unless the holders of the majority of the outstanding shares of Series A Preferred Stock consent

to the creation of other capital stock of the Company that is senior or equal in rank to the Series A Preferred Stock.

Holders of Series A Preferred

Stock will be entitled to receive cumulative dividends, in shares of Class B Common Stock (or cash at the Company’s option) on the

Stated Value at an annual rate of 6% (which will increase to 12% if a Triggering Event occurs until such Triggering Event, if curable,

is cured). Dividends will be payable upon conversion or redemption of the Series A Preferred Stock.

Holders of Series A Preferred

Stock will be entitled to convert shares of Series A Preferred Stock into a number of shares of Class B Common Stock determined by dividing

the Stated Value of such shares (plus any accrued but unpaid dividends and other amounts due, unless paid by the Company in cash) by the

Conversion Price. The initial Conversion Price is $0.75, subject to adjustment including adjustments due to full-ratchet anti-dilution

provisions. Holders may elect to convert shares of Series A Preferred Stock to Class B Common Stock at the Alternate Conversion Price

equal to 85% (or 70% if the Company’s Class B Common Stock is suspended from trading on or delisted from a principal trading market

or upon occurrence of a Triggering Event) of the average lowest daily volume weighed average price of the Class B Common Stock during

the Alternate Conversion Measuring Period.

A holder of Series A

Preferred Stock may not convert the Series A Preferred Stock into Class B Common Stock to the extent that such conversion would cause

such holder’s beneficial ownership of Class B Common Stock to exceed 4.99% of the outstanding Class B Common Stock immediately after

conversion, which may be increased by the holder to up to 9.99% upon no fewer than 61 days’ prior notice. In addition, we may not

issue shares of Class B Common Stock upon conversion of the Series A Preferred Stock at less than the Minimum Price in an amount exceeding

the Exchange Limitation, or less than the Floor Price of $0.0855 per share regardless of whether the Exchange Limitation has been reached,

before the effectiveness of the Stockholder Approval. The Ionic Purchase Agreement requires that the Company obtain the Stockholder Approval

by the prior written consent of the requisite stockholders to obtain the approval of such number of the holders of the outstanding shares

of the Company’s voting securities as required by the Bylaws and the NRS, to ratify and approve all of the transactions contemplated

by the Transaction Documents, including the issuance of all of the shares of Series A Preferred Stock and shares of Class B Common Stock

issuable upon conversion of such shares pursuant to the Ionic Purchase Agreement, all as may be required by the applicable rules and regulations

of The Nasdaq Capital Market tier of Nasdaq (or any successor entity). The Series A Preferred Stock also may not be converted except to

the extent that the shares of Class B Common Stock issuable upon such conversion may be resold pursuant to Rule 144 or an effective and

available registration statement.

The Ionic Purchase Agreement

and the Certificate of Designation require that the Company file a Preliminary Information Statement on Schedule 14C with the SEC within

10 days of the date of the First Closing followed by the filing of a Definitive Information Statement on Schedule 14C with the SEC within

20 days of the date of the First Closing, or within 45 days of the date of the First Closing if delayed due to a court or regulatory agency,

including but not limited to the SEC, which shall disclose the Stockholder Approval. In accordance with the rules of the SEC, the Stockholder

Approval will become effective 20 days after the Definitive Information Statement is sent or given in accordance with SEC rules. Prior

to such date of effectiveness, if the number of shares of Class B Common Stock subject to a conversion would exceed the Exchange Limitation

prior to the date of the effectiveness of the Stockholder Approval, and the Conversion Price for such conversion would be lower than the

Minimum Price or the Floor Price, then, upon any conversion of shares of Series A Preferred Stock, the Stated Value will automatically

be increased by an amount equal to the product obtained by multiplying (A) the higher of (I) the highest price that the Class B Common

Stock trades at on the Trading Day (as defined below) immediately preceding the conversion date and (II) the applicable Conversion Price

and (B) the difference obtained by subtracting (I) the number of shares of Class B Common Stock delivered (or to be delivered) to the

holder on the applicable conversion date with respect to such conversion of Series A Preferred Stock from (II) the quotient obtained by

dividing (x) the applicable value of the Series A Preferred Stock being converted that the holder has elected to be the subject of the

applicable conversion of Series A Preferred Stock, by (y) the applicable Conversion Price.

In accordance with the

requirements and provisions described above, on May 24, 2024, the Company obtained the Stockholder Approval by execution of a written

consent in lieu of a special meeting of a majority of the voting power of the stockholders of the Company approving a resolution approving

the issuance of Class B Common Stock in aggregate in excess of the limitations provided by Nasdaq Listing Rule 5635(d), including that

an amount of shares of Class B Common Stock equal to or greater than 20% of the total common stock or voting power outstanding on the

date of the Certificate of Designation may be issued pursuant to the Certificate of Designation at a price that may be less than either

or both of the Minimum Price or the Floor Price. In addition, on May 31, 2024, the Company filed a Preliminary Information Statement on

Schedule 14C with the SEC. The Company will be required to file a Definitive Information Statement on Schedule 14C with the SEC disclosing

the Stockholder Approval on or before June 13, 2024, or on or before July 8, 2024 if delayed due to a court or regulatory agency, including

but not limited to the SEC. On the 20th day following actions meeting these and other applicable requirements, the Stockholder

Approval will be effective, and the Company will be permitted to issue more than the limited number of shares as defined by the Exchange

Limitation, at prices that may be below the Minimum Price or the Floor Price.

Under the Ionic Purchase

Agreement, if the closing price of the Class B Common Stock falls below $0.75 per share, the holder’s total sales of Class B Common

Stock will be restricted. The holder can sell either the greater of $25,000 per Trading Day or 15% of the daily trading volume of the

Class B Common Stock reported by Bloomberg, LP, until the closing price exceeds $0.75. “Trading Day” is defined as a day on

which the principal trading market for the Class B Common Stock is open for trading for at least six hours.

The Series A Preferred

Stock will automatically convert to Class B Common Stock upon the 24-month anniversary of the initial issuance date of the Series A Preferred

Stock.

The Company will have

the right at any time to redeem all or any portion of the Series A Preferred Stock then outstanding at a price equal to 110% of the Stated

Value plus any accrued but unpaid dividends and other amounts due.

Holders of the Series

A Preferred Stock will generally have the right to vote on an as-converted basis with the Class B Common Stock, subject to the beneficial

ownership limitation set forth in the Certificate of Designation.

We may not sell securities

in a financing transaction while Ionic beneficially owns any of the Series A Preferred Stock or the common stock until the end of the

30-day period following the initial date of the effectiveness of the First Registration Statement of which this prospectus forms a part

or during any Alternate Conversion Measuring Period. In addition, the Company may not file any other registration statement or any offering

statement under the Securities Act, other than a registration statement on Form S-8 or supplements or amendments to registration statements

that were filed and effective as of the date of the Ionic Purchase Agreement, unless each Registration Statement is effective and the

respective prospectus is available for use, or the shares of Series A Preferred Stock and underlying shares of Class B Common Stock that

must be included in each Registration Statement under the Ionic Registration Rights Agreement may be resold without limitation under Rule

144.

Ionic also has certain

registration rights with respect to the Registrable Conversion Shares under the Ionic Registration Rights Agreement. The Ionic Registration

Rights Agreement provides for the registration for resale of the Registrable Conversion Shares, which consist of any and all shares of

Class B Common Stock issuable to Ionic with respect to the Series A Preferred Stock under the Ionic Purchase Agreement. Within the later

of 15 calendar days of the First Closing or May 24, 2024, we were required to file the First Registration Statement, of which this prospectus

forms a part, for the offer and resale of the maximum number of Registrable Conversion Shares permitted to be covered under SEC rules.

The First Registration Statement must be declared effective within 45 days of the First Closing, or 90 days if the First Registration

Statement receives a review. If an additional registration statement must be filed to cover the resale of Registrable Conversion Shares

that were not permitted to be included in the First Registration Statement, we must file the Second Registration Statement within 15 days

of the Second Closing for the maximum number of Registrable Conversion Shares permitted to be covered under SEC rules. The Second Registration

Statement must be declared effective within 45 days of the Second Closing, or 90 days if the Second Registration Statement receives a

review. In the event the number of shares of Class B Common Stock available under the First Registration Statement and the Second Registration

Statement is insufficient to cover all of the Registrable Conversion Shares, we will be required to file at least one additional Registration

Statement within 14 days of the date that the necessity arises and that such additional Registration Statement may be filed under SEC

rules to cover such Registrable Conversion Shares up to the maximum permitted to be covered under SEC rules, which must be made effective

within 45 days of such date, or 90 days if such additional Registration Statement receives a review. Any failure to meet the filing deadline

for either the First Registration Statement or the Second Registration Statement (“Filing Failure”) will result in liquidated

damages of 100,000 shares of Class B Common Stock. Any failure to meet the effectiveness deadline for any Registration Statement (“Effectiveness

Failure”) will result in liquidated damages of 100,000 shares of Class B Common Stock. Each of the shares issuable upon a Filing

Failure or an Effectiveness Failure must also be covered by a Registration Statement to the same extent as the Registrable Conversion

Shares. We will be required to use our best efforts to keep each Registration Statement effective until all such shares of Class B Common

Stock are sold or may be sold without restriction pursuant to Rule 144, and without the requirement for us to be in compliance with the

current public information requirement under Rule 144.

Placement Agent Warrant

Relating to First Closing Under Ionic Purchase Agreement

In connection with each

closing under the Ionic Purchase Agreement, pursuant to the Boustead Engagement Letter, and the Underwriting Agreement, on the date of

the First Closing, we were required to issue the Placement Agent Warrant to Boustead for the purchase of 154,000 shares of Class B Common

Stock, equal to 7% of the number of shares of Class B Common Stock that may be issued upon conversion of the shares of Series A Preferred

Stock sold at the First Closing, subject to the Exchange Limitation before the effectiveness of the Stockholder Approval. If and when

the Second Closing occurs, we will be required to issue an additional placement agent warrant to Boustead for the purchase of 154,000

shares of Class B Common Stock, equal to 7% of the number of shares of Class B Common Stock that may be issued upon conversion of the

shares of Series A Preferred Stock sold at the Second Closing. The Placement Agent Warrant and each additional placement agent warrant

issuable under the Boustead Engagement Letter in connection with the transactions contemplated by the Ionic Purchase Agreement will have

an exercise price of $0.75 per share. Notwithstanding certain provisions in the Boustead Engagement Letter, the Placement Agent Warrant

and any additional placement agent warrant will not contain piggyback registration rights and will not contain anti-dilution provisions

for future stock issuances, etc., at a price or at prices below the exercise price per share, or provide for automatic exercise immediately

prior to expiration. The Placement Agent Warrant and any additional placement agent warrant and the underlying shares may be deemed to

be compensation by FINRA, and may be subject to limits on exercise under FINRA rules.

Equity Incentive Plan Restricted Shares

On May 2, 2022, we adopted the Asset Entities

Inc. 2022 Equity Incentive Plan (the “Plan”). The purpose of the Plan is to grant restricted stock and stock options to our

officers, employees, directors, advisors and consultants. The maximum number of shares of Class B Common Stock that may be issued pursuant

to awards granted under the Plan is 2,750,000 shares. Cancelled and forfeited stock options and stock awards may again become available

for grant under the 2022 Plan. The Plan expires on May 2, 2032. As of May 24, 2024, we have granted 1,920,000 restricted shares of Class

B Common Stock under the Plan. For further information, please see Item 11. “Executive Compensation – 2022 Equity Incentive

Plan” of the Annual Report.

On February 6, 2023, we filed a Registration Statement

on Form S-8 to register shares of Class B Common Stock issuable to certain of our employees, consultants and directors pursuant to the

Plan. On February 7, 2023, we then granted a total of 1,411,000 restricted shares of Class B Common Stock under the Plan to the directors

and officers of the Company, which are subject to certain vesting conditions.

On May 15, 2023, we granted 100,000 restricted

shares of Class B Common Stock under the Plan to a consultant of the Company.

On June 8, 2023, we granted 100,000 restricted

shares of Class B Common Stock under the Plan to a consultant of the Company, which are subject to certain vesting conditions. These shares

were issued by our transfer agent on March 6, 2024.

On November 10, 2023, we granted a total of 300,000

restricted shares of Class B Common Stock under the Plan to employees and an officer of the Company, which are subject to certain vesting

conditions. These shares were issued by our transfer agent on January 22, 2024.

On May 16, 2024, we granted 9,000 restricted shares

of Class B Common Stock under the Plan to a director of the Company, which are subject to certain vesting conditions.

RISK FACTORS

An investment in our Class B Common Stock

involves a high degree of risk. You should carefully consider the following risk factors, together with the other information contained

in this prospectus, and the financial and other information set forth under Item 1A. “Risk Factors” of the Annual Report, which is incorporated herein by reference, and in other filings we make with the SEC, before purchasing our Class B Common Stock.

We have listed below (not necessarily in order of importance or probability of occurrence) what we believe to be the most significant

risk factors applicable to us, but they do not constitute all of the risks that may be applicable to us. Any of the following factors

could harm our business, financial condition, results of operations or prospects, and could result in a partial or complete loss of your

investment. Some statements in this prospectus and in the reports incorporated herein by reference, including statements in the following

risk factors, constitute forward-looking statements. Please refer to the section titled “Cautionary Note Regarding Forward-Looking

Statements”.

Risks Related to This Offering

Substantial future sales or issuances of

our common stock or securities convertible into, or exercisable or exchangeable for, our common stock, or the perception in the public

markets that these sales or issuances may occur, may depress our stock price. Also, future issuances of our common stock or rights to

purchase common stock could result in additional dilution of the percentage ownership of our stockholders and could cause our stock price

to fall.

The conversion or exercise of our outstanding

convertible or exercisable securities and resale of the underlying common stock, and any other future issuances of our common stock or

securities convertible into, or exercisable or exchangeable for, our common stock, would result in a decrease in the ownership percentage

of existing stockholders, i.e., dilution, which may cause the market price of our common stock to decline. We cannot predict the effect,

if any, of future issuances, conversions, or exercises of our securities, on the price of our common stock. In all events, future issuances

of our common stock would result in the dilution of your holdings. In addition, the perception that new issuances of our securities are

likely to occur, or the perception that holders of securities convertible or exercisable for common stock are likely to sell their securities,

could adversely affect the market price of our common stock. The effect of such dilution may be magnified as to all shares that are not

or may eventually not be subject to restrictions on resale as enumerated below.

If the Minimum Price and the Floor Price were

rendered inapplicable by the Stockholder Approval, then, based on the initial Conversion Price of $0.75 per share of Class B Common Stock,

if Ionic converted all 330 of the shares of Series A Preferred Stock that were issued or that may be issued to Ionic pursuant to the Ionic

Purchase Agreement and the Certificate of Designation, then, at the initial Stated Value of $10,000 per share, Ionic would be issued 4,400,000

shares of Class B Common Stock. An indeterminate number of shares of Class B Common Stock would be required to be issued if Ionic converts

the shares of Series A Preferred Stock at the Alternate Conversion Price. The applicable Conversion Price may also be reduced as a result

of a downward adjustment to the Conversion Price upon application of full-ratchet anti-dilution provisions. An additional 100,000 shares

of Class B Common Stock must also be issued for any Filing Failure or Effectiveness Failure, and an additional 7,000 shares of Class B

Common Stock must be issued to Boustead in connection with each such issuance. 308,000 shares of Class B Common Stock will also be issued

if the Placement Agent Warrant and the placement agent warrant that must be issued with respect to the shares of Series A Preferred Stock

at the time of the Second Closing are exercised in full. As a result, there may be significant dilution to our stockholders’ ownership,

voting power and right to participate in dividends or other payments from future earnings, if any, and may cause a decline in the market

price of our Class B Common Stock. Moreover, the Registration Statement, once effective, will allow such shares to be resold immediately

into the public market without restriction, which may also adversely affect the market price of our common stock. A decline in our market

price could also impair our ability to raise funds in additional equity or debt financings.

As of May

24, 2024, we have also granted 1,920,000 restricted shares of Class B Common Stock under the Plan to officers, directors, employees,

and consultants that remain outstanding. We have filed a registration statement on Form S-8 to register the offering of these shares as

well as other shares under stock options or other equity compensation that may be granted to our officers, directors, employees, and consultants

or reserved for future issuance under the Plan. Subject to the satisfaction of vesting conditions, all of these shares registered under

the registration statement on Form S-8 will be available for resale immediately in the public market without restriction other than those

restrictions imposed on sales by affiliates pursuant to Rule 144.

Additionally, our employees, executive officers,

and directors may enter into Rule 10b5-1 trading plans providing for sales of shares of our common stock from time to time. Under a Rule

10b5-1 trading plan, a broker executes trades pursuant to parameters established by the employee, director, or officer when entering into

the plan, without further direction from the employee, officer, or director. A Rule 10b5-1 trading plan may be amended or terminated in

some circumstances. Our employees, executive officers, and directors also may buy or sell additional shares outside of a Rule 10b5-1 trading

plan when they are not in possession of material, non-public information, subject to the Rule 144 requirements referred to above. Actual

or potential resales of our common stock by our employees, executive officers, and directors as restrictions end or pursuant to registration

rights may make it more difficult for us to sell equity securities in the future at a time and at a price that we deem appropriate. These

sales could also cause the trading price of our common stock to decline and make it more difficult for you to sell shares of our common

stock. The market price of shares of our common stock may drop significantly when restrictions on resale by our existing stockholders

and beneficial owners lapse. The effect of these grants on the value of your shares may therefore be substantial.

We also expect that significant additional capital

may be needed in the future beyond that raised in this offering to continue our planned operations, including potential acquisitions,

hiring new personnel, marketing our products, and continuing activities as an operating public company. To the extent we raise additional

capital by issuing equity securities, our stockholders may experience substantial dilution. We may sell common stock, convertible securities

or other equity securities in one or more transactions at prices and in a manner we determine from time to time. If we sell common stock,

convertible securities, or other equity securities in more than one transaction, investors may be materially diluted by subsequent sales.

Such sales may also result in material dilution to our existing stockholders, and new investors could gain rights superior to our existing

stockholders.

In the event that the market price of shares of

our common stock drops significantly when the restrictions on resale by our existing stockholders lapse, existing stockholders’

dilution might be reduced to the extent that the decline in the price of shares of our common stock impedes our ability to raise capital

through the issuance of additional shares of our common stock or other equity securities. However, in the event that our capital-raising

ability is weakened as a result of a lower stock price, we may be unable to continue to fund our operations, which may further harm the

value of our stock price.

Investors who buy shares at different times

will likely pay different prices.

Investors who purchase shares in this offering

at different times will likely pay different prices, and so may experience different levels of dilution and different outcomes in their

investment results. The Selling Stockholders may sell the shares being offered by means of this prospectus at different times and at different

prices.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus, including the documents that

we incorporate by reference herein, contains, and any applicable prospectus supplement or free writing prospectus including the documents

we incorporate by reference therein may contain, forward-looking statements within the meaning of Section 27A of the Securities Act and

Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), including statements regarding our future

financial condition, business strategy and plans and objectives of management for future operations. Forward-looking statements include

all statements that are not historical facts. In some cases, you can identify forward-looking statements by terminology such as “believe,”

“will,” “may,” “estimate,” “continue,” “anticipate,” “intend,”

“should,” “plan,” “might,” “approximately,” “expect,” “predict,”

“could,” “potentially” or the negative of these terms or other similar expressions. Forward-looking statements

appear in a number of places throughout this prospectus and include statements regarding our intentions, beliefs, projections, outlook,

analyses or current expectations concerning, among other things:

| ● | our

ability to introduce new products and services; |

| ● | our

ability to obtain additional funding to develop additional services and offerings; |

| ● | compliance

with obligations under intellectual property licenses with third parties; |

| ● | market

acceptance of our new offerings; |

| ● | competition

from existing online offerings or new offerings that may emerge; |

| ● | our

ability to establish or maintain collaborations, licensing or other arrangements; |

| ● | our

ability and third parties’ abilities to protect intellectual property rights; |

| ● | our

ability to adequately support future growth; |

| ● | our

goals and strategies; |

| ● | our

future business development, financial condition and results of operations; |

| ● | expected

changes in our revenue, costs or expenditures; |

| ● | growth

of and competition trends in our industry; |

| ● | the

accuracy and completeness of the data underlying our or third-party sources’ industry

and market analyses and projections; |

| ● | our

expectations regarding demand for, and market acceptance of, our services; |

| ● | our

expectations regarding our relationships with investors, institutional funding partners and

other parties with whom we collaborate; |

| ● | our

ability to comply with continued listing requirements of The Nasdaq Capital Market; |

| ● | fluctuations

in general economic and business conditions in the markets in which we operate; and |

| ● | relevant

government policies and regulations relating to our industry. |

Forward-looking statements relate to future events

or our future financial performance and involve known and unknown risks, uncertainties and other factors that could cause our actual results,

levels of activity, performance or achievement to differ materially from those expressed or implied by these forward-looking statements.

These statements reflect our current views with respect to future events and are based on assumptions and subject to such risks, uncertainties

and other factors. Discussions containing forward-looking statements may be found, among other places, in the section entitled “Risk

Factors” in this prospectus, and the sections entitled “Business,” “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and Results of Operations” contained in the documents

incorporated by reference herein, including our most recent Annual Report on Form 10-K and our Quarterly Reports on Form 10-Q, as well

as any amendments thereto.

The forward-looking statements contained in this

prospectus represent our judgment as of the date of this prospectus. We caution readers not to place undue reliance on such statements.

Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason, even if new information

becomes available or other events occur in the future. All subsequent written and oral forward-looking statements attributable to us or

persons acting on our behalf are expressly qualified in their entirety by the cautionary statements contained above and throughout this

prospectus.

All forward-looking statements contained in this

prospectus, any applicable prospectus supplement or free writing prospectus or any document incorporated by reference herein or therein

are qualified in their entirety by this cautionary statement.

USE OF PROCEEDS

We will not receive any proceeds from the sale

of Class B Common Stock by the Selling Stockholders. We will receive gross proceeds of up to $115,500 from cash exercise of the Placement

Agent Warrant, but not from the sale of the underlying Class B Common Stock.

The Selling Stockholders will pay any underwriting

discounts and commissions and expenses incurred by them for brokerage, accounting, tax or legal services or any other expenses incurred

by them in disposing of the shares. We will bear all other costs, fees and expenses incurred in effecting the registration of the shares

covered by this prospectus, including, without limitation, all registration and filing fees and fees and expenses of our counsel and our

accountants.

SELLING STOCKHOLDERS

The Class B Common Stock being offered by the

Selling Stockholders are shares of Class B Common Stock issuable to the Selling Stockholders upon the conversion of shares of Series A

Preferred Stock or the exercise of the Placement Agent Warrant. We are registering the shares for resale in order to permit the Selling

Stockholders to offer the shares for resale from time to time and to comply with our requirements under the Ionic Registration Rights

Agreement.

Except as disclosed below, the Selling Stockholders

have not had any position, office, or other material relationship with us or any of our predecessors or affiliates within the past three

years other than with respect to the ownership of these securities, and, except as disclosed below, based on the information provided

to us by the Selling Stockholders, none of the Selling Stockholders is a broker-dealer or an affiliate of a broker-dealer.

We have determined beneficial ownership in accordance

with the rules of the SEC. Except as indicated by the footnotes below, we believe, based on the information furnished to us, that the

persons and entities named in the table below have sole voting and investment power with respect to all shares that they beneficially

own, subject to applicable community property laws.

The table below lists the Selling Stockholders

and other information regarding the beneficial ownership of our Class B Common Stock by each of the Selling Stockholders. The second column

lists the number of shares of Class B Common Stock beneficially owned by each of the Selling Stockholders. The third column lists the

number of shares of Class B Common Stock being offered by this prospectus by the Selling Stockholders. The fourth column assumes the sale

of all of the shares of Class B Common Stock being offered by the Selling Stockholders pursuant to this prospectus.

Applicable percentage ownership is based on 7,522,971

shares of Class B Common Stock outstanding as of May 24, 2024. For purposes of computing percentage ownership after this offering, we

have assumed that all shares of Series A Preferred Stock into which the shares of Class B Common Stock being offered pursuant to this

prospectus will be converted into shares of Class B Common Stock and sold in this offering, and that the Placement Agent Warrant will

be exercised in full and that the shares of Class B Common Stock issuable upon such exercise will be sold in this offering. In computing

the number of shares beneficially owned by a person and the percentage ownership of that person, we deemed to be outstanding all shares

issuable upon exercise of warrants, conversion of shares of Series A Preferred Stock, or exercise or conversion of other exercisable or

convertible securities held by that person that are currently exercisable or convertible or that will become exercisable or convertible

within 60 days of May 24, 2024. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership

of any other person. Notwithstanding the foregoing, the shares of Series A Preferred Stock contain beneficial ownership limitations, such

that we shall not effect any conversion and no holder has the right to convert such shares to the extent that after giving effect to the

issuance of Class B Common Stock upon conversion thereof, the holder, together with its affiliates, would beneficially own in excess of

4.99% of the number of shares of Class B Common Stock outstanding immediately after giving effect to such conversion, which such limitation

may be increased to 9.99% upon no fewer than 61 days’ prior notice. The issuance of Class B Common Stock upon conversion of shares