false00018237940001823794arko:WarrantsEachWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150Member2024-03-082024-03-080001823794us-gaap:CommonStockMember2024-03-082024-03-0800018237942024-03-082024-03-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

|

Date of Report (Date of earliest event reported): March 08, 2024 |

ARKO Corp.

(Exact name of Registrant as Specified in Its Charter)

|

|

|

|

|

Delaware |

001-39828 |

85-2784337 |

(State or Other Jurisdiction

of Incorporation) |

(Commission File Number) |

(IRS Employer

Identification No.) |

|

|

|

|

|

8565 Magellan Parkway Suite 400 |

|

Richmond, Virginia |

|

23227-1150 |

(Address of Principal Executive Offices) |

|

(Zip Code) |

|

Registrant’s Telephone Number, Including Area Code: (804) 730-1568 |

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class

|

|

Trading

Symbol(s) |

|

Name of each exchange on which registered

|

Common Stock, $0.0001 par value per share |

|

ARKO |

|

The Nasdaq Stock Market LLC |

Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $11.50 |

|

ARKOW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

This Current Report on Form 8-K (the “Form 8-K”) is being filed by ARKO Corp., a Delaware corporation, solely for the purpose of filing Exhibit 5.1 and Exhibit 23.1 (included in Exhibit 5.1) to the Form 8-K.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

ARKO Corp. |

|

|

|

|

Date: |

March 8, 2024 |

By: |

/s/ Arie Kotler |

|

|

Name: Title: |

Arie Kotler

President, Chief Executive Officer and Chairman of the Board |

Exhibit 5.1

March 8, 2024

ARKO Corp.

865 Magellan Parkway, Suite 400

Richmond, Virginia 23227

Re: Registration Statement on Form S-3 Filed on March 8, 2024

Ladies and Gentlemen:

We have acted as legal counsel for ARKO Corp., a Delaware corporation (the “Company”), in connection with the Company’s registration of 3,417,915 shares of the Company’s common stock, par value $0.0001 per share (the “Shares”), covered by the above-referenced registration statement (including the prospectus contained therein, the “Registration Statement”), filed by the Company with the U.S. Securities and Exchange Commission (the “Commission”) under the Securities Act of 1933, as amended (the “Securities Act”), together with the Prospectus Supplement, dated March 8, 2024 (the “Prospectus Supplement”), filed with the Commission pursuant to Rule 424(b)(7) under the Securities Act, relating to the resale of the Shares by the selling stockholder named in the Prospectus Supplement. The Shares were issued pursuant to that certain asset purchase agreement, dated as of September 9, 2022 (the “Purchase Agreement”), by and among certain of the Company’s subsidiaries, such selling stockholder and the other parties thereto.

In connection with our representation of the Company and the preparation of this opinion letter, we have examined, considered and relied upon the following documents (collectively, the “Documents”):

1.the Registration Statement and all amendments thereto, and the related form of prospectus contained therein, in the form in which it was transmitted to the Commission;

2.the Prospectus Supplement, in the form transmitted to the Commission for filing on March 8, 2024 pursuant to Rule 424(b)(7) under the Securities Act;

3.the Purchase Agreement;

4.the Company’s Amended and Restated Certificate of Incorporation, as amended to the date hereof;

5.the Company’s Bylaws, as amended to the date hereof;

6.resolutions adopted by the Board of Directors of the Company in respect of the issuance of the Shares, certified as of the date hereof by an officer of the Company; and

7.such other documents and records and other certificates and instruments and matters of law as we have deemed necessary or appropriate to express the opinions set forth below, in each case subject to the assumptions, limitations and qualifications stated herein.

In rendering the opinions set forth below, we have assumed without investigation the following: (i) the genuineness of all signatures and the authenticity of all Documents submitted to us as originals, the conformity to authentic original documents of all Documents submitted to us as copies and the veracity of the Documents; (ii) each individual executing any of the Documents, whether on behalf of such individual or another person, is legally competent to do so; (iii) each of the parties (other than the Company) executing any of the Documents has duly and validly executed and delivered each of the Documents to which such party is a signatory; and (iv) the obligations of each party set forth in the Documents are valid and binding obligations of such party and are enforceable against such party in accordance with all stated terms.

As to various questions of fact material to this opinion, we have relied, to the extent we deemed reasonably appropriate, upon representations of officers or directors of the Company and upon documents, records and instruments furnished to us by the Company, without independently checking or verifying the accuracy of such documents, records and instruments.

Based upon the foregoing, and subject to the qualifications, assumptions and limitations set forth herein, we are of the opinion that the Shares have been duly authorized and validly issued and are fully paid and nonassessable.

This opinion letter is limited to the matters stated herein, and no opinions may be implied or inferred beyond the matters expressly stated herein. The opinions expressed herein are as of the date hereof, and we assume no obligation to update or supplement such opinions to reflect any facts or circumstances that may hereafter come to our attention or any changes in law that may hereafter occur. We do not express any opinion herein concerning any law other than the laws of the State of Delaware and the federal securities laws of the United States.

This opinion is being furnished to you for submission to the Commission as an exhibit to the Company’s Current Report on Form 8-K relating to the issuance of the Shares (the “Current Report”), which is incorporated by reference in the Registration Statement. We hereby consent to the filing of this opinion as an exhibit to the Current Report and such incorporation by reference into the Registration Statement, of which the Prospectus Supplement forms a part, and to the use of the name of our firm therein. In giving this consent, we do not admit that we are within the category of persons whose consent is required by Section 7 of the Securities Act or the rules and regulations of the Commission promulgated thereunder.

|

|

|

Sincerely, /s/ GREENBERG TRAURIG, LLP GREENBERG TRAURIG, LLP |

v3.24.0.1

Document And Entity Information

|

Mar. 08, 2024 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Mar. 08, 2024

|

| Entity Registrant Name |

ARKO Corp.

|

| Entity Central Index Key |

0001823794

|

| Entity Emerging Growth Company |

false

|

| Entity File Number |

001-39828

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Tax Identification Number |

85-2784337

|

| Entity Address, Address Line One |

8565 Magellan Parkway

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

Richmond

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

23227-1150

|

| City Area Code |

(804)

|

| Local Phone Number |

730-1568

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Common Stock [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, $0.0001 par value per share

|

| Trading Symbol |

ARKO

|

| Security Exchange Name |

NASDAQ

|

| Warrants Each Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of 11.50 [Member] |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants, each warrant exercisable for one share of Common Stock at an exercise price of $11.50

|

| Trading Symbol |

ARKOW

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=arko_WarrantsEachWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

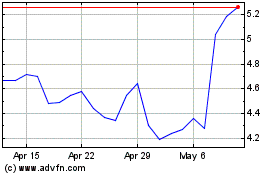

ARKO (NASDAQ:ARKO)

Historical Stock Chart

From Oct 2024 to Nov 2024

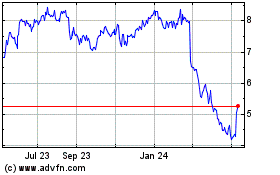

ARKO (NASDAQ:ARKO)

Historical Stock Chart

From Nov 2023 to Nov 2024