AppLovin Corporation Prices $3.55 Billion Offering of Senior Notes

November 20 2024 - 5:35PM

Business Wire

AppLovin Corporation (NASDAQ: APP) (the “Company”)

announced today the pricing of its public offering of $3.55 billion

aggregate principal amount of senior notes consisting of $1,000

million aggregate principal amount of 5.125% Senior Notes due 2029

(the “2029 Notes”), $1,000 million aggregate principal amount of

5.375% Senior Notes due 2031 (the “2031 Notes”), $1,000 million

aggregate principal amount of 5.500% Senior Notes due 2034 (the

“2034 Notes”) and $550 million aggregate principal amount of 5.950%

Senior Notes due 2054 (the “2054 Notes” and, collectively with the

2029 Notes, the 2031 Notes and the 2034 Notes, the “Notes”). The

offering is being made by means of an underwritten public offering

pursuant to an effective registration statement filed with the

Securities and Exchange Commission (the “SEC”). The Company intends

to use the net proceeds of the offering of the Notes to repay in

full its senior secured term loan facility due 2028 and its senior

secured term loan facility due 2030 and, to the extent of any

remaining net proceeds, for general corporate purposes. The Company

expects to close the sale of the Notes on December 5, 2024, subject

to the satisfaction of customary closing conditions.

The Notes will be senior unsecured obligations of the Company

and will not be guaranteed by any of its subsidiaries.

J.P. Morgan Securities LLC, BofA Securities, Inc. and Morgan

Stanley & Co. LLC are acting as joint lead book-running

managers for the offering. Citigroup Global Markets Inc. and

Goldman Sachs & Co. LLC are also acting as joint book-running

managers for the offering. BNP Paribas Securities Corp., MUFG

Securities Americas Inc. and Scotia Capital (USA) Inc. are acting

as co-managers for the offering.

The offering of Notes is being made pursuant to an effective

shelf registration on Form S-3 that has previously been filed with

the SEC and became automatically effective on June 1, 2023. A

prospectus supplement and accompanying base prospectus related to

the offering has been or will be filed with the SEC and may be

found on its website at www.sec.gov. Copies of the prospectus

supplement and related prospectus for the offering may be obtained

from any of the joint lead book-running managers at: J.P. Morgan

Securities LLC, 383 Madison Avenue, New York, New York, 10179,

Attention: Investment Grade Syndicate Desk, 3rd Floor, telephone

collect at 1-212-834-4533; BofA Securities, Inc., NC1-022-02-25,

201 North Tryon Street, Charlotte, NC 28255-0001, Attn: Prospectus

Department, email: dg.prospectus_requests@bofa.com or by telephone

1-800-294-1322; or Morgan Stanley & Co. LLC, 180 Varick Street,

New York, N.Y. 10014, Attention: Prospectus Department, by email:

prospectus@morganstanley.com or by calling 1-866-718-1649.

This press release shall not constitute an offer to sell or the

solicitation of an offer to buy, nor shall there be any sale of

these securities, in any state or jurisdiction in which such offer,

solicitation, or sale would be unlawful prior to registration or

qualification under the securities law of any such state or

jurisdiction.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of Section 27A of the Securities Act and Section 21E of

the Securities Exchange Act of 1934. Forward-looking statements in

this release include, but are not limited to, whether or not the

Company will consummate the offering of Notes and the anticipated

use of proceeds of the offering of Notes. These forward-looking

statements are subject to risks and uncertainties, including the

risks described in the preliminary prospectus supplement, the

accompanying bases prospectus, our Annual Report on Form 10-K for

the fiscal year ending December 31, 2023, our Quarterly Reports on

Form 10-Q for the periods ended March 31, 2024, June 30, 2024 and

September 30, 2024. The forward-looking statements in this press

release are based on information available to us as of the date

hereof, and we disclaim any obligation to update any

forward-looking statements, except as required by law.

About AppLovin

AppLovin makes technologies that help businesses of every size

connect to their ideal customers. The company provides end-to-end

software and AI solutions for businesses to reach, monetize and

grow their global audiences.

Source: AppLovin Corp.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241120661364/en/

Investors David Hsiao ir@applovin.com

Press Kim Hughes press@applovin.com

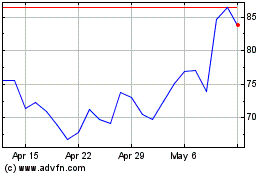

Applovin (NASDAQ:APP)

Historical Stock Chart

From Nov 2024 to Dec 2024

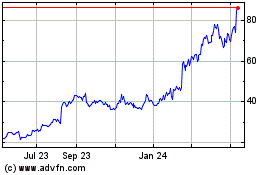

Applovin (NASDAQ:APP)

Historical Stock Chart

From Dec 2023 to Dec 2024