AMC Networks Inc. (Nasdaq: AMCX) (the “Company”) announced today

that it has commenced a cash tender offer (the “Offer”) to purchase

any and all of its outstanding 4.75% Senior Notes due 2025 (the

“Notes”).

The terms and conditions of the Offer are described in an Offer

to Purchase, dated March 25, 2024 (the “Offer to Purchase”). The

Company intends to fund the Offer, including accrued interest and

fees and expenses payable in connection with the Offer, with the

net proceeds from its concurrently launched offering of senior

secured notes and cash on hand or other immediately available

funds.

The following table sets forth certain terms of the Offer:

|

|

|

|

Dollars per $1,000 Principal Amount of Notes |

|

Title of Notes |

CUSIP Number /ISIN |

Aggregate Principal Amount

Outstanding(1) |

Tender Offer

Consideration(2) |

Early Tender Premium |

Total Consideration(2)(3) |

|

4.75% Senior Notes due 2025 |

00164VAE3 /US00164VAE39 |

$774,729,000 |

$970 |

$30 |

$1,000 |

|

|

(1) As of the date of the Offer to Purchase.(2) Holders will

also receive accrued and unpaid interest from the last interest

payment with respect to the Notes accepted for purchase to, but not

including, the Early Settlement Date or the Final Settlement Date,

as applicable.(3) Includes the Early Tender Premium.

Substantially concurrently with commencement of the Offer, the

Company is issuing a conditional notice of redemption to holders of

the Notes to redeem any and all Notes that remain outstanding after

completion of the Offer at a price of 100.000% of their principal

amount, plus accrued and unpaid interest to, but not including, the

redemption date.

The Offer will expire at 5:00 p.m., New York City time, on April

22, 2024, unless extended or earlier terminated by the Company

(such date and time, as it may be extended, the “Expiration Date”).

No tenders submitted after the Expiration Date will be valid.

Holders of Notes that are validly tendered (and not validly

withdrawn) at or prior to 5:00 p.m., New York City time, on April

5, 2024 (such date and time, as it may be extended, the “Early

Tender Date”) and accepted for purchase pursuant to the Offer will

receive the Total Consideration, which includes the early tender

premium set forth in the table above (the “Early Tender Premium”).

Holders of Notes tendering their Notes after the Early Tender Date

will only be eligible to receive the Tender Offer Consideration set

forth in the table above (the “Tender Offer Consideration”), which

is the Total Consideration less the Early Tender Premium.

All Notes validly tendered and accepted for purchase pursuant to

the Offer will receive the applicable consideration set forth in

the table above, plus accrued and unpaid interest on such Notes

from the last interest payment date with respect to the Notes to,

but not including, the applicable Settlement Date (as defined

below).

Tendered Notes may be withdrawn at or prior to 5:00 p.m., New

York City time, on April 5, 2024, unless extended by the

Company (such date and time, as it may be extended, the “Withdrawal

Date”). Holders of Notes who tender their Notes after the

Withdrawal Date, but prior to the Expiration Date, may not withdraw

their tendered Notes unless withdrawal rights are otherwise

required by applicable law.

Payment for any Notes validly tendered at or prior to the Early

Tender Date will be made on the settlement date that is expected to

be the second business day following the Early Tender Date, or as

promptly as practicable thereafter (the “Early Settlement Date”).

Payment for any Notes validly tendered after the Early Tender Date

and at or prior to the Expiration Date will be made on the

settlement date that is expected to be the business day following

the Expiration Date, or as promptly as practicable thereafter (the

“Final Settlement Date”). The Early Settlement Date and the Final

Settlement Date will subject to all conditions to the Offer having

been satisfied or waived by us, and assuming we accept for purchase

Notes validly tendered pursuant to the Offer.

The consummation of the Offer is not conditioned upon any

minimum amount of Notes being tendered. However, the Offer is

subject to, and conditioned upon, the satisfaction or waiver of

certain conditions described in the Offer to Purchase, including

the Company having raised net proceeds from its concurrently

commenced offering of $700,000,000 in aggregate principal amount of

its senior secured notes due 2029, which, together with cash on

hand or other immediately available funds, are sufficient to fund

the purchase of the Notes validly tendered and accepted for

purchase in the Offer.

This press release is neither an offer to purchase nor a

solicitation of an offer to sell securities, nor shall it

constitute a notice of redemption with respect to the Notes. No

offer, solicitation, purchase or sale will be made in any

jurisdiction in which such offer, solicitation, or sale would be

unlawful. The Offer is being made solely pursuant to terms and

conditions set forth in the Offer to Purchase.

The lead dealer manager for the Offer is BofA Securities, Inc.

and the co-dealer managers for the Offer are J.P. Morgan Securities

LLC and Citigroup Global Markets Inc. Any questions regarding the

terms of the Offer should be directed to BofA Securities, Inc. at

(toll-free) (888) 292-0070 or (980) 388-3646. Any questions

regarding procedures for tendering Notes and requests for documents

should be directed to the Information Agent for the Offer, D.F.

King & Co., Inc., toll-free at (800) 967-4617 (banks and

brokers call (212) 269-5550).

About AMC Networks

Inc.

AMC Networks (Nasdaq: AMCX) is home to many of the greatest

stories and characters in TV and film and the premier destination

for passionate and engaged fan communities around the world. The

company creates and curates celebrated series and films across

distinct brands and makes them available to audiences everywhere.

Its portfolio includes targeted streaming services AMC+, Acorn TV,

Shudder, Sundance Now, ALLBLK and HIDIVE; cable networks AMC, BBC

AMERICA (operated through a joint venture with BBC Studios, which

includes U.S. distribution and sales responsibilities for BBC

News), IFC, SundanceTV and WE tv; and film distribution labels IFC

Films and RLJE Films. The company also operates AMC Studios, its

in-house studio, production and distribution operation behind

acclaimed and fan-favorite original franchises including The

Walking Dead Universe and the Anne Rice Immortal Universe; and AMC

Networks International, its international programming business.

This press release may contain statements that constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995, including statements

concerning the terms and timing of the Offer, the redemption of any

Notes that remain outstanding after completion of the Offer and the

Company’s offering of senior secured notes. These statements are

based on management’s current expectations and are subject to

uncertainty and changes in circumstances. Investors are cautioned

that any such forward-looking statements are not guarantees of

future performance or results and involve risks and uncertainties

and that actual results or developments may differ materially from

those in the forward-looking statements as a result of various

factors, including financial community and rating agency

perceptions of the Company and its business, operations, financial

condition and the industries in which it operates and the factors

described in the Company’s filings with the Securities and Exchange

Commission, including the sections titled “Risk Factors” and

“Management’s Discussion and Analysis of Financial Condition and

Results of Operations” contained therein. The Company disclaims any

obligation to update any forward-looking statements contained

herein.

| Contacts: |

| |

|

| Investor Relations |

Corporate Communications |

| Nicholas Seibert |

Georgia Juvelis |

| nicholas.seibert@amcnetworks.com |

georgia.juvelis@amcnetworks.com |

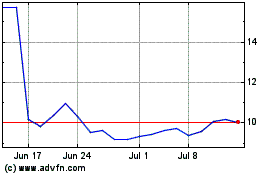

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Oct 2024 to Nov 2024

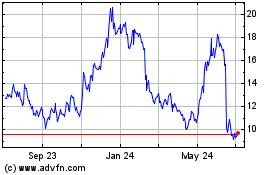

AMC Networks (NASDAQ:AMCX)

Historical Stock Chart

From Nov 2023 to Nov 2024