Alarum Technologies Ltd.

(Nasdaq, TASE: ALAR)

(“Alarum” or the “Company”), a global provider of internet

access and data collection solutions, today announced record

financial results for the three months and full year periods, ended

December 31, 2023.

Key highlights for the three months and year

ended December 31, 2023:

- Net Retention Rates (NRR)1-

Starting from 2024, the Company plans to update on a quarterly

basis its customer retention (NRR). NetNut Ltd.’s (“NetNut”) NRRs

were 153% as of December 31, 2023, and 144% as of September 30,

2023. NRR greater than 100% indicates that the company experiences

revenue growth from its existing customer base in the specific

period even after accounting for lost revenue due to customers’

churn. Conversely, an NRR lower than 100% suggests that the company

loses revenue from existing customers in the specific period due to

churn which is higher than revenue gain through up-sells or

cross-sells.

- IFRS net profit from continuing

operations reached $1.7 million in the fourth quarter of 2023,

compared to an IFRS net loss from continuing operations of $3.0

million in the fourth quarter of 2022.

- Adjusted EBITDA for the fourth

quarter of 2023 continued to grow, reaching $2.2 million, compared

to Adjusted EBITDA loss of $2.0 million in the fourth quarter of

2022.

- Revenues from continuing operations

for the three months ended December 31, 2023, reached a record high

of $7.1 million, an increase of approximately 39% compared to the

three months ended December 31, 2022.

- Revenues from continuing operations

for the full year of 2023 totaled $26.5 million, an increase of

approximately 43% compared to $18.6 million in 2022.

- NetNut's 2023 full year revenue

amounted to $21.3 million, reflecting growth of over 150%

year-over-year, compared to $8.5 million in revenues for 2022.

"I am proud to share the most successful quarter

in the Company's history, as revenue, net profit and Adjusted

EBITDA, all meaningfully exceeded results from the previous

quarter. We delivered efficient operational execution following our

decision, in the second quarter of 2023, to scale down other

activities and focus on NetNut's operations," said Shachar Daniel,

Alarum’s Chief Executive Officer.

Recent Business

Developments:

- In October 2023, NetNut launched

its first data collection product – the SERP Scraper API, which won

its first customers.

- In late January 2024, NetNut

introduced its new and innovative Website Unblocker, the second

product of the data collection product line.

- In February 2024, NetNut announced

the launch of its revolutionary AI data collector product

line.

- During the fourth quarter of 2023

and recent months, NetNut won new customers in the AI-powered sales

intelligence market and the Fintech market.

- NetNut was granted a U.S.

patent.

"We began 2024 on a high note, by setting new

monthly revenue records," Mr. Daniel added. "Looking ahead, our

strategy for 2024 involves expanding our cutting-edge product line,

with a special emphasis on our advanced AI data collector series.

The AI and data collection sectors complement each other

significantly; it is imperative that AI platforms have access to

large volumes of data. Furthermore, we aim to grow our presence in

the IP proxy network (IPPN) sector by entering new markets,

enhancing our network infrastructure, and partnering with more

top-tier customers globally."

Chen Katz, chairman of the board of directors of

Alarum, commented, "The ongoing demonstration of financial

stability, growth and operating performance supported the record

financial results for the quarter and entire year. We successfully

crystalized and executed our business strategy, transforming into a

high-growth, profitable company, which we believe will create value

for our shareholders."

Financial Results

from

Continuing

Operations for the Three Months

Ended December 31,

2023:

- Revenues amounted to $7.1 million

(Q4.2022: $5.1 million). The increase is attributed to the organic

growth in the enterprise access business revenues, despite a

reduction in the consumer access business revenues.

- Cost of revenues totaled $1.8

million (Q4.2022: $2.3 million). The reduction stems mainly from

CyberKick’s traffic acquisition costs stoppage in July 2023 and

clearing fees decrease, due to the Company’s updated scale down

strategy for its CyberKick operations. The reduction was offset by

an increase in enterprise internet access business costs of

addresses and networks and servers used for the generation of the

additional enterprise access business revenues.

- Research and development expenses

totaled $0.8 million (Q4.2022: $1.0 million). Reduced expenses in

the consumer internet access business due to the operations scale

down and a decrease in subcontractor costs in the enterprise

internet access business were offset by an increase in payroll and

related expenses in the enterprise business.

- Sales and marketing expenses

totaled $1.6 million (Q4.2022: $3.5 million). The decrease resulted

mainly from the stoppage of media acquisition costs in July 2023

due to CyberKick’s operations scale down strategy. This reduction

was slightly offset by higher payroll and related expenses in the

enterprise internet access business.

- General and administrative expenses

totaled $1.2 million (Q4.2022: $1.4 million). The decrease is

mainly due to lower salary costs as a result of CyberKick’s

operations scale down strategy and lower professional fees.

- Finance expenses reached $0.05

million (Q4.2022: $0.08 million).

- Tax benefit totaled $0.02 million

(Q4.2022: $0.1 million).

- As a result, IFRS net profit from

continuing operations reached $1.7 million, or $0.03 basic profit

per ordinary share (Q4.2022: IFRS net loss from continuing

operations of $3.0 million, or $0.09 basic loss per ordinary

share).

- Adjusted EBITDA was $2.2 million

(Q4.2022: Adjusted EBITDA loss of $2.0 million).

Financial Results

from continuing

operations for the

year Ended

December

31, 2023:

- Total revenues amounted to $26.5

million (2022: $18.6 million). The increase is attributed to the

organic growth in the enterprise access business revenues, which

was offset by a reduction of revenues in the consumer internet

access business.

- Cost of revenues totaled $7.7

million (2022: $8.4 million). The decrease is mainly a result of

the decrease in the traffic acquisition costs stoppage in July 2023

and reduced clearing fees due to CyberKick’s operations scale down

strategy in the consumer internet access business. This decrease

was offset by an increase in the core enterprise internet access

business costs of addresses and networks and servers and

intangibles impairment that resulted from the consumer business

scale down.

- Research and development expenses

totaled $3.6 million (2022: $3.8 million). The decrease is due to

lower subcontractors’ costs and lower salary and share-based

compensation related to the consumer internet access business,

partially offset mainly by higher payroll and related expenses in

the enterprise internet access business.

- Sales and marketing expenses

totaled $10.0 million (2022: $11.8 million). The decrease resulted

mainly from lower media costs and payroll and related expenses in

the consumer internet access business, partially offset by

intangible assets impairment loss related to CyberKick as well as

an increase in payroll and related expenses in the enterprise

internet access business.

- General and administrative expenses

totaled $4.4 million (2022: $6.7 million). The decrease is largely

due to reduced professional fees, particularly legal fees related

to resolved patent proceedings in May 2022.

- Goodwill impairment loss was $6.3

million (2022: $0.6 million). The Company recorded a goodwill

impairment loss related to the CyberKick cash-generating-unit of

$6.3 million due to the decrease in its forecasted operating

results, compared to a goodwill impairment loss during 2022 related

to the NetNut Networks cash-generating-unit (NetNut’s subsidiary)

of $0.6 million.

- Financial expenses reached $0.6

million (2022: $0.1 million). The increase is mainly due to an

increase in finance expenses resulting from the O.R.B. Spring Ltd.

agreement as well as interest expenses related to the short-term

bank loans, and the September 2023 private placement.

- Tax benefit totaled $0.5 million

(2022: $0.3 million). The increase is mainly due to the recognition

of deferred tax assets in NetNut as well as a reduction in deferred

taxes liabilities as a result of the intangible assets impairment

related to CyberKick.

- IFRS net loss from continuing

operations totaled $5.6 million, or $0.14 basic loss per ordinary

share (2022: IFRS net loss from continuing operations of $12.4

million, or $0.39 basic loss per ordinary share).

- Adjusted EBITDA was $5.2 million

(2022: Adjusted EBITDA loss of $8.5 million).

The Company defines

EBITDA (EBITDA loss) as net profit (loss) from continuing

operations before depreciation, amortization and impairment of

intangible assets, interest and tax, and defines Adjusted EBITDA

(Adjusted EBITDA loss) as EBITDA (EBITDA loss) as further adjusted

to remove the impact of (i) impairment of goodwill (if any); and

(ii) share-based compensation expense.

The following table presents the reconciled

effect of the above on the Company’s Adjusted EBITDA or Adjusted

EBITDA loss from continuing operations for the three and full year

ended December 31, 2023, and 2022:

|

|

For the year EndedDecember 31, |

|

For the Three-MonthPeriod

EndedDecember 31, |

|

(millions of U.S. dollars) |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net profit (loss) from continuing operations |

|

(5.6 |

) |

|

|

(12.4 |

) |

|

|

1.7 |

|

|

|

(3.0 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, amortization and impairment of intangible assets |

|

3.5 |

|

|

|

2.0 |

|

|

|

0.1 |

|

|

|

0.8 |

|

|

Finance expense, net |

|

0.6 |

|

|

|

* |

|

|

|

0.1 |

|

|

|

* |

|

|

Tax benefit |

|

(0.5 |

) |

|

|

(0.3 |

) |

|

|

* |

|

|

|

(0.1 |

) |

|

EBITDA (EBITDA loss) |

|

(2.0 |

) |

|

|

(10.7 |

) |

|

|

1.9 |

|

|

|

(2.3 |

) |

|

Adjustments: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Impairment of goodwill |

|

6.3 |

|

|

|

0.6 |

|

|

|

- |

|

|

|

- |

|

|

Share-based compensation |

|

0.9 |

|

|

|

1.6 |

|

|

|

0.3 |

|

|

|

0.3 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Adjusted EBITDA (Adjusted EBITDA loss) |

|

5.2 |

|

|

|

(8.5 |

) |

|

|

2.2 |

|

|

|

(2.0 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

*Less than $0.1 million |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Balance Sheet Highlights:

- As of December 31, 2023,

shareholders’ equity totaled $13.2 million, or approximately $2.20

per outstanding American Depositary Share, compared to

shareholders’ equity of $13.3 million as of December 31, 2022. The

reduction is due mainly to the goodwill and intangible assets

impairment recorded in the second quarter of 2023, offset by the

September 2023 private placement.

- As of December 31, 2023, the

Company’s cash and cash equivalents balance totaled $10.9 million,

compared to $3.3 million as of December 31, 2022.

Use of Non-IFRS Financial

ResultsIn addition to disclosing financial results

calculated in accordance with International Financial Reporting

Standards (IFRS), as issued by the International Accounting

Standards Board, this press release contains non-IFRS financial

measures of EBITDA, EBITDA loss, Adjusted EBITDA and Adjusted

EBITDA loss for the periods presented that exclude depreciation,

amortization and impairment of intangible assets, interest and tax,

as further adjusted for the effect of impairment of goodwill and

share-based compensation expenses. The Company’s management

believes the non-IFRS financial information provided in this

release is useful to investors’ understanding and assessment of the

Company’s ongoing operations. Management also uses both IFRS and

non-IFRS information in evaluating and operating its business

internally, and as such deemed it important to provide this

information to investors. The non-IFRS financial measures disclosed

by the Company should not be considered in isolation, or as a

substitute for, or superior to, financial measures calculated in

accordance with IFRS, and the financial results calculated in

accordance with IFRS and reconciliations to those financial

statements should be carefully evaluated. Investors are encouraged

to review the reconciliations of these non-IFRS measures to their

most directly comparable IFRS financial measures provided in the

financial statement tables herein.

Full Year

2023 Financial Results

Conference Call

Mr. Shachar Daniel, Chief Executive Officer of

Alarum, and Mr. Shai Avnit, Chief Financial Officer of Alarum, will

host a conference call on March 14, 2024, at 8:30 a.m. ET, to

discuss the fourth quarter and full year 2023 financial results,

followed by a Q&A session.

To attend the conference call, please dial one

of the following teleconferencing numbers. Please begin by placing

your call five minutes before the conference call commences. If you

are unable to connect using the toll-free number, please try the

international dial-in number:

|

Date: |

Thursday, March 14, 2024 |

|

|

|

|

Time: |

8:30 a.m. Eastern time, 5:30 a.m. Pacific time |

|

|

|

|

Toll-free dial-in number: |

1-877-407-0789 or 1-201-689-8562 |

|

|

|

|

Israel Toll Free: |

1 809 406 247 |

Participants will be required to state their

name and company upon entering the call. If you have any difficulty

connecting with the conference call, please contact Michal Efraty

on behalf of Alarum at +972-(0)-52-3044404.

The conference call will be broadcast live and

available for replay here.

A replay of the conference call will be

available after 11:30 a.m. Eastern time March 14, 2024, through

April 10, 2024:

|

Toll-free replay number: |

1-844-512-2921 or 1-412-317-6671 |

|

|

|

|

Replay ID: |

13744883 |

About Alarum Technologies

Ltd.

Alarum Technologies Ltd. (Nasdaq, TASE: ALAR) is

a global provider of internet access and web data collection

solutions.

The solutions by NetNut, our enterprise internet

access and data collection arm, are based on our world’s fastest

and most advanced and secured hybrid proxy network, enabling our

customers to collect data anonymously at any scale from any public

sources over the web. Our network comprises both exit points based

on our proprietary reflection technology and hundreds of servers

located at our ISP partners around the world. The infrastructure is

optimally designed to guarantee privacy, quality, stability, and

the speed of the service.

For more information about Alarum and its

internet access solutions, please visit www.alarum.io.

Follow us on Twitter

Subscribe to our YouTube channel

Forward-Looking Statements

This press release contains forward-looking

statements within the meaning of the “safe harbor” Words such as

“expects,” “anticipates,” “intends,” “plans,” “believes,” “seeks,”

“estimates” and similar expressions or variations of such words are

intended to identify forward-looking statements. Alarum is using

forward-looking statements in this press release when it discusses

its preliminary unaudited revenues for February 2024, the Company’s

ability to continue and drive revenue growth, expand its product

line, enter new markets, maintain operational efficiency, execute

its business strategy, grow profitability, and create value for

shareholders. Because such statements deal with future events and

are based on Alarum’s current expectations, they are subject to

various risks and uncertainties and actual results, performance or

achievements of Alarum could differ materially from those described

in or implied by the statements in this press release. The

forward-looking statements contained or implied in this press

release are subject to other risks and uncertainties, including

those discussed under the heading “Risk Factors” in Alarum’s annual

report on Form 20-F filed with the Securities and Exchange

Commission (“SEC”) on March 14, 2024, and in any subsequent filings

with the SEC. Except as otherwise required by law, Alarum

undertakes no obligation to publicly release any revisions to these

forward-looking statements to reflect events or circumstances after

the date hereof or to reflect the occurrence of unanticipated

events. References and links to websites have been provided as a

convenience, and the information contained on such websites is not

incorporated by reference into this press release. Alarum is not

responsible for the contents of third-party websites.

The Company is

providing a February 2024 revenue estimate in this press release,

rather than final amounts, primarily because the financial closing

process and review are not yet complete and, as a result, the

Company’s results upon completion of its closing process and review

may vary from this preliminary estimate.

Investor Relations

Contacts:

Michal Efraty+972-(0)52-3044404investors@alarum.io

|

|

|

|

|

Consolidated Statements of Financial Position |

|

(In thousands of USD) |

|

|

|

|

|

|

|

|

|

|

|

|

December 31, |

|

|

2023 |

|

2022 |

|

|

|

(Audited) |

|

Assets |

|

|

|

|

Current assets: |

|

|

|

|

Cash and cash equivalents |

|

10,872 |

|

|

|

3,290 |

|

|

Short-term restricted deposits |

|

- |

|

|

|

560 |

|

|

Trade receivables, net |

|

1,994 |

|

|

|

1,790 |

|

|

Other receivables |

|

399 |

|

|

|

760 |

|

|

|

|

13,265 |

|

|

|

6,400 |

|

|

|

|

|

|

|

|

|

|

|

Non-current assets: |

|

|

|

|

|

|

|

|

Long-term restricted deposits |

|

3 |

|

|

|

127 |

|

|

Long-term deposit |

|

104 |

|

|

|

21 |

|

|

Other non-current assets |

|

142 |

|

|

|

228 |

|

|

Property and equipment, net |

|

88 |

|

|

|

92 |

|

|

Right of use assets |

|

779 |

|

|

|

190 |

|

|

Deferred tax asset |

|

181 |

|

|

|

- |

|

|

Goodwill |

|

4,118 |

|

|

|

10,429 |

|

|

Intangible assets, net |

|

1,386 |

|

|

|

4,884 |

|

|

Total non-current assets |

|

6,801 |

|

|

|

15,971 |

|

|

Total assets |

|

20,066 |

|

|

|

22,371 |

|

|

|

|

|

|

|

|

|

|

|

Liabilities and equity |

|

|

|

|

|

|

|

|

Current liabilities: |

|

|

|

|

|

|

|

|

Trade payables |

|

369 |

|

|

|

2,167 |

|

|

Other payables |

|

2,439 |

|

|

|

2,350 |

|

|

Current maturities of long-term loan |

|

290 |

|

|

|

617 |

|

|

Short-term bank loans |

|

- |

|

|

|

1,606 |

|

|

Contract liabilities |

|

1,983 |

|

|

|

1,170 |

|

|

Derivative financial instruments |

|

109 |

|

|

|

26 |

|

|

Short-term lease liabilities |

|

370 |

|

|

|

204 |

|

|

Total current liabilities |

|

5,560 |

|

|

|

8,140 |

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities: |

|

|

|

|

|

|

|

|

Long-term loans |

|

802 |

|

|

|

606 |

|

|

Long-term lease liabilities |

|

523 |

|

|

|

13 |

|

|

Deferred tax liabilities |

|

- |

|

|

|

301 |

|

|

Total non-current liabilities |

|

1,325 |

|

|

|

920 |

|

|

Total liabilities |

|

6,885 |

|

|

|

9,060 |

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

Ordinary shares |

|

- |

|

|

|

- |

|

|

Share premium |

|

100,576 |

|

|

|

95,077 |

|

|

Other equity reserves |

|

14,938 |

|

|

|

15,042 |

|

|

Accumulated deficit |

|

(102,333 |

) |

|

|

(96,808 |

) |

|

Total equity |

|

13,181 |

|

|

|

13,311 |

|

|

Total liabilities and equity |

|

20,066 |

|

|

|

22,371 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Consolidated Statements of Profit or Loss |

|

(In thousands of USD, except per share amounts) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

For the Year EndedDecember 31, |

|

For the Three MonthsEndedDecember 31, |

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

| |

(Audited) |

|

(Audited) |

|

(Unaudited) |

|

(Unaudited) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

26,521 |

|

|

|

18,550 |

|

|

|

7,107 |

|

|

|

5,126 |

|

|

Cost of revenues |

|

7,711 |

|

|

|

8,402 |

|

|

|

1,778 |

|

|

|

2,299 |

|

|

Gross profit |

|

18,810 |

|

|

|

10,148 |

|

|

|

5,329 |

|

|

|

2,827 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development expenses |

|

3,557 |

|

|

|

3,824 |

|

|

|

795 |

|

|

|

1,019 |

|

|

Sales and marketing expenses |

|

10,035 |

|

|

|

11,823 |

|

|

|

1,579 |

|

|

|

3,499 |

|

|

General and administrative expenses |

|

4,406 |

|

|

|

6,661 |

|

|

|

1,207 |

|

|

|

1,374 |

|

|

Impairment of goodwill |

|

6,311 |

|

|

|

569 |

|

|

|

- |

|

|

|

- |

|

|

Operating expenses |

|

24,309 |

|

|

|

22,877 |

|

|

|

3,581 |

|

|

|

5,892 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating profit (loss) |

|

(5,499 |

) |

|

|

(12,729 |

) |

|

|

1,748 |

|

|

|

(3,065 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Finance expense, net |

|

(590 |

) |

|

|

(54 |

) |

|

|

(54 |

) |

|

|

(79 |

) |

|

Tax benefit (expense) |

|

482 |

|

|

|

327 |

|

|

|

(22 |

) |

|

|

112 |

|

|

Profit (loss) from continuing operations, net of tax |

|

(5,607 |

) |

|

|

(12,456 |

) |

|

|

1,672 |

|

|

|

(3,032 |

) |

|

Profit (loss) from discontinued operations, net of tax |

|

82 |

|

|

|

(695 |

) |

|

|

- |

|

|

|

136 |

|

|

Net profit (loss) |

|

(5,525 |

) |

|

|

(13,151 |

) |

|

|

1,672 |

|

|

|

(2,896 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Basic and diluted profit (loss) per share |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Continuing operations |

|

(0.14 |

) |

|

|

(0.39 |

) |

|

|

0.03 |

|

|

|

(0.09 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Discontinued operations |

|

0.00 |

|

|

|

(0.03 |

) |

|

|

- |

|

|

|

0.00 |

|

|

|

|

(0.14 |

) |

|

|

(0.42 |

) |

|

|

0.03 |

|

|

|

(0.09 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

______________________________1NRR represent the

average growth rates for preceding four quarters compared to the

equivalent period a year earlier, of current customers only,

without the revenues generated from new customers, but including

up-sales and cross-sales on one hand and churn on the other

hand.

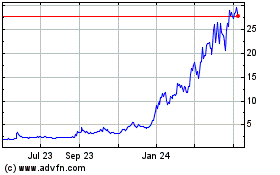

Alarum Technologies (NASDAQ:ALAR)

Historical Stock Chart

From Nov 2024 to Dec 2024

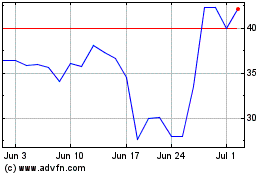

Alarum Technologies (NASDAQ:ALAR)

Historical Stock Chart

From Dec 2023 to Dec 2024