Agenus Announces Closing of Public Offering and Exercise of Over-Allotment Option

February 10 2014 - 10:01AM

Business Wire

Agenus Inc. (Nasdaq: AGEN) today announced the closing of its

previously announced underwritten registered public offering of

common stock. The total number of shares of common stock sold was

22,236,000, composed of 19,335,653 shares of common stock initially

offered and an additional 2,900,347 shares of common stock sold

pursuant to the exercise of the underwriters' over-allotment

option, in each case at a public offering price of $2.70 per share.

All of the shares in the offering were sold by Agenus. The net

proceeds to Agenus from the offering, after deducting underwriting

discounts and commissions and estimated offering expenses, are

approximately $56.0 million.

William Blair & Company, L.L.C. acted as sole book-running

manager for the offering. Maxim Group LLC acted as lead manager and

H.C. Wainwright & Co., LLC and MLV & Co. LLC acted as

co-managers for the offering. Geller Biopharm Inc. acted as

financial advisor for the offering.

The shares were offered by Agenus pursuant to a shelf

registration statement that was previously filed with, and declared

effective by, the Securities and Exchange Commission (SEC). The

final prospectus supplement and accompanying prospectus related to

this offering are located on the SEC’s website, www.sec.gov. Copies

of the final prospectus supplement and accompanying prospectus may

also be obtained from William Blair & Company, L.L.C.,

Attention: Prospectus Department, 222 West Adams Street, Chicago,

IL 60606, by telephone at (800) 621-0687, or by e-mail at

prospectus@williamblair.com.

This press release does not constitute an offer to sell or a

solicitation of an offer to buy nor shall there be any sale of

these securities in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such state or

jurisdiction.

About Agenus

Agenus Inc. is a biotechnology company working to develop

treatments for cancers and infectious diseases. The company is

focused on immunotherapeutic products based on strong platform

technologies with multiple product candidates advancing through the

clinic, including several product candidates that have advanced

into late-stage clinical trials through corporate partners. Between

Agenus and its partners, 23 programs are in clinical

development.

Additional Information

Statements made in this press release include forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, regarding, but not limited to, the use of

proceeds from the offering. Forward-looking statements can be

identified by the use of words such as “may,” “will,” “plan,”

“should,” “expect,” “anticipate,” “estimate,” “continue,” or

comparable terminology. Such forward-looking statements are

inherently subject to certain risks, trends and uncertainties, many

of which Agenus cannot predict with accuracy and some of which

Agenus might not even anticipate, and involve factors that may

cause actual results to differ materially from those projected or

suggested. These risks and uncertainties include, among others, the

factors described under the Risk Factors section of Agenus’ Current

Report on Form 8-K, which was filed with the SEC on February 4,

2014. Agenus cautions investors not to place considerable reliance

on the forward-looking statements contained in this release. These

statements speak only as of the date of this press release, and

Agenus undertakes no obligation to update or revise the

statements.

Media and Investor Contact:Agenus Inc.Jonae R. Barnes,

617-818-2985Vice PresidentInvestor Relations andCorporate

Communicationsjonae.barnes@agenusbio.com

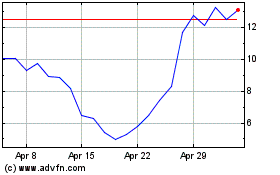

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Jun 2024 to Jul 2024

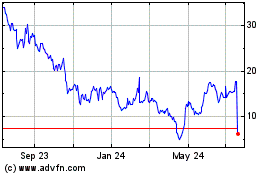

Agenus (NASDAQ:AGEN)

Historical Stock Chart

From Jul 2023 to Jul 2024