The major U.S. index futures are currently

pointing to a modestly higher open on Thursday, with stocks likely

to see further upside after recovering from an initial pullback to

end the previous session mostly higher.

Stocks may benefit from recent upward momentum, which has seen

the markets close higher for two straight days despite concerns

about tariffs and some disappointing earnings news.

Overall trading activity may be somewhat subdued, however, as

traders look ahead to the release of the Labor Department’s closely

watched monthly jobs report on Friday.

The report, which is expected to show employment climbed by

170,000 jobs in January after jumping by 256,000 jobs in December,

could impact the outlook for interest rates.

A day ahead of the release of the more closely watched monthly

jobs report, the Labor Department released a report this morning

showing first-time claims for U.S. unemployment benefits rose by

more than expected in the week ended February 1st.

The report said initial jobless claims climbed to 219,000, an

increase of 11,000 from the previous week’s revised level of

208,000.

Economists had expected initial jobless claims to rise to

213,000 from the 207,000 originally reported for the previous

week.

Stocks came under pressure early in the session on Wednesday but

showed a significant rebound over the course of the trading day.

The major averages climbed well off their worst levels of the day

and into positive territory.

The major averages reached new highs for the session going into

the close of trading. The Dow advanced 317.24 points or 0.7 percent

to 44,873.28, the S&P 500 climbed 23.60 points or 0.4 percent

to 6,061.48 and the Nasdaq rose 38.31 points or 0.2 percent to

19,692.33.

The rebound on Wall Street came amid a notable move to the

downside by treasury yields, with the yield on the benchmark

ten-year note slumping to its lowest closing level in well over a

month.

Treasury yields tumbled after the Treasury Department said its

current auction sizes leave it well positioned to address potential

changes to the fiscal outlook.

Based on current projected borrowing needs, the Treasury said it

anticipates maintaining long-term securities auction sizes for at

least the next several quarters.

The initial pullback on Wall Street came amid weakness among

tech stocks due to a negative reaction to earnings news from

Alphabet (NASDAQ:GOOGL) and Advanced Micro Devices

(NASDAQ:AMD).

Shares of Alphabet plunged by 7.3 percent after the Google

parent reported better than expected fourth quarter earnings but

its cloud revenues missed estimates.

Chip maker AMD also tumbled by 6.3 percent after reporting

fourth quarter earnings and revenues that beat estimates but its

data center sales fell short of expectations.

On the U.S. economic front, the Institute for Supply Management

released a report showing service sector growth in the U.S.

unexpectedly slowed modestly in the month of January.

The ISM said its services PMI dipped to 52.8 in January from a

revised 54.0 in December. While a reading above 50 still indicates

growth, economists had expected the index to inch up to 54.3 from

the 54.1 originally reported for the previous month.

Meanwhile, payroll processor ADP released a separate report

showing private sector employment in the U.S. increased by more

than expected in the month of January.

ADP said private sector employment climbed by 183,000 jobs in

January after rising by an upwardly revised 176,000 jobs in

December.

Economists had expected private sector employment to rise by

150,000 jobs compared to the addition of 122,000 jobs originally

reported for the previous month.

Gold stocks moved sharply higher on the day,

driving the NYSE Arca Gold Bugs Index up by 2.7 percent to a

three-month closing high.

The rally by gold stocks came as the price of the precious metal

continues to climb to record highs amid concerns about the

escalating U.S.-China trade war.

Computer hardware stocks also saw considerable strength on the

day, resulting in a 2.5 percent jump by the NYSE Arca Computer

Hardware Index.

Semiconductor, telecom and biotechnology stocks also showed

strong moves to the upside, while airline saw significant

weakness.

U.S Index Futures Trading – Taking the first steps with Plus500

Beginning your futures trading journey requires careful

preparation. Start by opening a Plus500

account with their minimum $100 deposit — qualifying

for their initial bonus program.

Spend time in the demo environment, understanding how futures

contracts behave and how the platform’s tools can support your

strategy.

As you develop confidence, consider starting with micro

contracts, which offer smaller position sizes ideal for learning

position management.

Plus500’s educational resources can guide you through

this process, helping you understand both basic concepts

and advanced trading strategies.

Start your futures trading journey with Plus500

today

Trading futures carries substantial risk of loss and is not

suitable for all investors. Plus500US Financial Services LLC is

registered with the CFTC and member of the NFA. Past performance

does not guarantee future results. Bonus terms and conditions

apply.

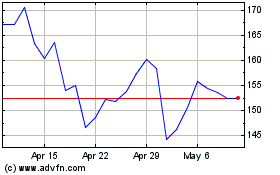

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Feb 2025 to Mar 2025

Advanced Micro Devices (NASDAQ:AMD)

Historical Stock Chart

From Mar 2024 to Mar 2025