Will 3M (MMM) Disappoint This Earnings Season? - Analyst Blog

April 22 2014 - 11:50AM

Zacks

3M Company (MMM)

is scheduled to report first-quarter 2014 results before the

opening bell on Apr 24, 2014. In the last-reported quarter, 3M

delivered a positive earnings surprise of 2.50%. Let’s see how

things are shaping up for this quarter.

Factors to Consider This Quarter

3M, a diversified technology company, has consistently delivered

sustainable increases in revenues and earnings in the past few

quarters.

3M’s industrial segment, its primary growth driver, is expected to

contribute significantly to the top line. Operations in emerging

countries, especially China, are witnessing strengthening demand

and are likely to drive revenues. However, headwinds such as

macroeconomic pressures, adverse currency movements and competitive

pricing might weigh on earnings.

3M is in the process of realigning its portfolio by divesting

underperforming assets and investing in high-growth industries such

as aerospace, energy, and healthcare. The resultant cost reductions

and earnings accretion have the potential to boost earnings this

quarter. But rising raw material inflation and higher research and

development (R&D) expenses might be a drag on the bottom

line.

Earnings

Whispers?

Our proven model does not conclusively show that 3M is likely to

beat earnings this quarter as it does not have the right

combination of two key ingredients. That is because a stock needs

to have both a positive Earnings ESP and a Zacks Rank #1, 2 or 3

for this to happen. That is not the case here as you will see

below.

Zacks ESP: ESP or Expected Surprise Prediction,

which represents the difference between the Most Accurate estimate

and the Zacks Consensus Estimate, is -1.68%. That is because the

Most Accurate estimate stands at $1.76 while the Zacks Consensus

Estimate is higher at $1.79.

Zacks Rank #3 (Hold): 3M’s Zacks Rank #3 lowers

the predictive power of ESP because the Zacks Rank #3 when combined

with a negative ESP makes surprise prediction difficult.

Other Stocks to Consider

Here are other companies you may want to consider, as our model

shows that these have the right combination of elements to post an

earnings beat this season:

Alaska Air Group, Inc. (ALK), with earnings ESP of

+7.14% and a Zacks Rank #1 (Strong Buy).

Advanced Energy Industries, Inc. (AEIS), with

earnings ESP of +10.00% and a Zacks Rank #1.

Convergys Corporation (CVG), with earnings ESP of

+10.34% and a Zacks Rank #1.

ADV ENERGY INDS (AEIS): Free Stock Analysis Report

ALASKA AIR GRP (ALK): Free Stock Analysis Report

CONVERGYS CORP (CVG): Free Stock Analysis Report

3M CO (MMM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

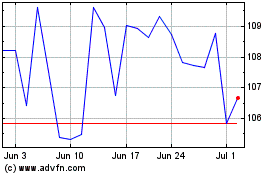

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jun 2024 to Jul 2024

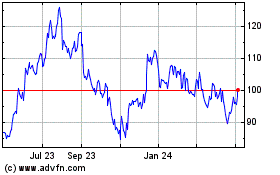

Advanced Energy Industries (NASDAQ:AEIS)

Historical Stock Chart

From Jul 2023 to Jul 2024