FALSE000172525500017252552024-11-052024-11-05

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

November 5, 2024

Date of Report (date of earliest event reported)

AdaptHealth Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38399 | | 82-3677704 |

(State or other jurisdiction of incorporation or organization) | | (Commission File Number) | | (I.R.S. Employer Identification Number) |

220 West Germantown Pike, Suite 250, Plymouth Meeting, PA 19462 |

(Address of principal executive offices and zip code) |

(610) 424-4515 |

(Registrant's telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

| | | | |

Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $0.0001 per share | | AHCO | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 - Results of Operations and Financial Condition.

The following information is furnished pursuant to Regulation FD.

On November 5, 2024, AdaptHealth Corp. (the "Company") issued a press release (the “Press Release”) announcing financial results for the quarter ended September 30, 2024. A copy of the Press Release is furnished herewith as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated herein by reference.

The information in this Item 2.02 (including Exhibit 99.1) shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”), or the Exchange Act, regardless of any general incorporation language in such filing, unless expressly incorporated by reference in such filing.

Item 9.01 - Financial Statements and Exhibits

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned, hereunto duly authorized.

Dated: November 5, 2024

| | | | | |

| AdaptHealth Corp. |

| |

By: | /s/ Jason Clemens |

Name: | Jason Clemens |

Title: | Chief Financial Officer |

Exhibit 99.1

FOR IMMEDIATE RELEASE

ADAPTHEALTH CORP. ANNOUNCES THIRD QUARTER 2024 RESULTS

PLYMOUTH MEETING, Pa. – November 5, 2024 - AdaptHealth Corp. (NASDAQ: AHCO) (“AdaptHealth” or the “Company”), a national leader in providing patient-centered, healthcare-at-home solutions including home medical equipment, medical supplies, and related services, announced today financial results for the third quarter ended September 30, 2024.

Third Quarter Results and Highlights

All comparisons are to the quarter ended September 30, 2023 unless otherwise stated.

•Net revenue was $805.9 million compared to $804.0 million, an increase of 0.2%.

•Net income attributable to AdaptHealth Corp. was $22.9 million compared to a net loss attributable to AdaptHealth Corp. of $454.1 million.

•Adjusted EBITDA was $164.3 million compared to $161.2 million, an increase of 1.9%.

•Cash flow from operations was $391.4 million year-to-date 2024, an increase from $325.4 million during the comparable period in 2023, and free cash flow was $162.7 million year-to-date 2024, an increase from $76.6 million during the comparable period in 2023.

•The Company completed the sale of certain custom rehab assets during the quarter.

Management Commentary

Suzanne Foster, Chief Executive Officer of AdaptHealth, stated, “I continue to be optimistic about the road ahead. We have identified growth opportunities, we are assembling a high performing team and investing in areas that allow us to serve even more patients in their homes.”

Financial Outlook

The Company is updating previous financial guidance for fiscal year 2024 as follows:

•Net revenue of $3.220 billion to $3.260 billion, from $3.255 billion to $3.315 billion

•Adjusted EBITDA of $655 million to $675 million, from $660 million to $700 million

•Free cash flow of $175 million to $195 million, from $160 million to $180 million

Conference Call

Management will host a teleconference today, Tuesday, November 5, 2024, at 8:30 am ET to discuss the results and business activities with analysts and investors.

Interested parties may participate in the call by dialing:

•(800) 343-4136 (Domestic) or

•(203) 518-9843 (International)

When prompted, reference Conference ID: AHCO3Q24

To access the Webcast, please go to the Company’s Investor Relations page at https://adapthealth.com/investorrelations/

Following the live call, a replay will be available for six months on the Company's website, www.adapthealth.com, under "Investor Relations."

About AdaptHealth Corp.

AdaptHealth is a national leader in providing patient-centered, healthcare-at-home solutions including home medical equipment (HME), medical supplies, and related services. The Company provides a full suite of medical products and solutions designed to help patients manage chronic conditions in the home, adapt to challenges in their activities of daily living, and thrive. Product and service offerings include (i) sleep therapy equipment, supplies, and related services (including CPAP and bi PAP services) to individuals suffering from obstructive sleep apnea, (ii) medical devices and supplies to patients for the treatment of diabetes (including continuous glucose monitors and insulin pumps), (iii) HME to patients discharged from acute care and other facilities, (iv) oxygen and related chronic therapy services in the home, and (v) other HME devices and supplies on behalf of chronically ill patients with wound care, urological, incontinence, ostomy and nutritional supply needs. The Company is proud to partner with an extensive and highly diversified network of referral sources, including acute care hospitals, sleep labs, pulmonologists, skilled nursing facilities, and clinics. AdaptHealth services beneficiaries of Medicare, Medicaid, and commercial insurance payors, reaching approximately 4.2 million patients annually in all 50 states through its network of approximately 670 locations in 47 states.

Forward-Looking Statements

This press release includes certain statements that are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding projections, estimates and forecasts of revenue and other financial and performance metrics and projections of market opportunity and expectations and the Company’s acquisition pipeline. These statements are based on various assumptions and on the current expectations of AdaptHealth management and are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on, by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of the Company.

These forward-looking statements are subject to a number of risks and uncertainties, including the outcome of judicial and administrative proceedings to which the Company may become a party or governmental investigations to which the Company may become subject that could interrupt or limit the Company’s operations, result in adverse judgments, settlements or fines and create negative publicity; changes in the Company’s customers’ preferences, prospects and the competitive conditions prevailing in the healthcare sector. A further description of such risks and uncertainties can be found in the Company’s filings with the Securities and Exchange Commission. If the risks materialize or assumptions prove incorrect, actual results could differ materially from the results implied by these forward-looking statements. There may be additional risks that the Company presently knows or that the Company currently believes are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect the Company’s expectations, plans or forecasts of future events and views as of the date of this press release. The Company anticipates that subsequent events and developments will cause the Company’s assessments to change. However, while the Company may elect to update these forward-looking statements at some point in the future, the Company specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing the Company’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

Use of Non-GAAP Financial Information

The Company uses EBITDA, Adjusted EBITDA, Adjusted EBITDA Margin and free cash flow, which are financial measures that are not in accordance with generally accepted accounting principles in the United States, or U.S. GAAP, to analyze its financial results and believes that they are useful to investors, as a supplement to U.S. GAAP measures. In addition, the Company’s ability to incur additional indebtedness and make investments under its existing credit agreement is governed, in part, by its ability to satisfy tests based on a variation of Adjusted EBITDA.

The Company believes Adjusted EBITDA and Adjusted EBITDA Margin are useful to investors in evaluating the Company’s financial performance. The Company uses Adjusted EBITDA as the profitability measure in its incentive compensation plans that have a profitability component and to evaluate acquisition opportunities, where it is most often used for purposes of contingent consideration arrangements.

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin should not be considered as measures of financial performance under U.S. GAAP, and the items excluded from EBITDA and Adjusted EBITDA are significant components in understanding and assessing financial performance. Accordingly, these key business metrics have limitations as an analytical tool. They should not be considered as an alternative to net income or any other performance measures derived in accordance with U.S. GAAP or as an alternative to cash flows from operating activities as a measure of the Company’s liquidity.

The Company uses free cash flow, which is a financial measure that is not in accordance with U.S. GAAP, in its operational and financial decision-making and believes free cash flow is useful to investors because similar measures are frequently used by securities analysts, investors, ratings agencies and other interested parties to evaluate the Company's competitors and to measure the ability of companies to service their debt. The Company's presentation of free cash flow should not be construed as a measure of liquidity or discretionary cash available to the Company to fund its cash needs, including investing in the growth of its business and meeting its obligations.

Free cash flow should not be considered as a measure of financial performance under U.S. GAAP. Accordingly, this key business metric has limitations as an analytical tool. It should not be considered as an alternative to any performance measures derived in accordance with U.S. GAAP or as an alternative to cash flows from operating activities as a measure of AdaptHealth’s liquidity.

Condensed Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | |

| (in thousands) | | September 30, 2024 | | December 31, 2023 |

| Assets | | | | |

| Current assets: | | | | |

| Cash | | $ | 100,180 | | | $ | 77,132 | |

| Accounts receivable | | 401,215 | | | 388,910 | |

| Inventory | | 133,490 | | | 113,642 | |

| Prepaid and other current assets | | 48,906 | | | 69,338 | |

| Total current assets | | 683,791 | | | 649,022 | |

| Equipment and other fixed assets, net | | 474,922 | | | 495,101 | |

| Operating lease right-of-use assets | | 106,390 | | | 110,465 | |

| Finance lease right-of-use assets | | 38,769 | | | 31,962 | |

| Goodwill | | 2,707,282 | | | 2,724,958 | |

| Identifiable intangible assets, net | | 113,452 | | | 130,160 | |

| Deferred tax assets | | 328,106 | | | 345,854 | |

| Other assets | | 17,224 | | | 21,128 | |

| Total Assets | | $ | 4,469,936 | | | $ | 4,508,650 | |

| Liabilities and Stockholders' Equity | | | | |

| Current liabilities: | | | | |

| Accounts payable and accrued expenses | | $ | 430,371 | | | $ | 391,994 | |

| Current portion of long-term debt | | 16,250 | | | 53,368 | |

| Current portion of operating lease obligations | | 30,276 | | | 29,270 | |

| Current portion of finance lease obligations | | 12,307 | | | 9,122 | |

| Contract liabilities | | 35,842 | | | 38,570 | |

| Warrant liability | | 2,221 | | | 4,021 | |

| Other liabilities | | 25,758 | | | 10,654 | |

| Total current liabilities | | 553,025 | | | 536,999 | |

| Long-term debt, less current portion | | 2,013,644 | | | 2,094,614 | |

| Operating lease obligations, less current portion | | 80,135 | | | 85,529 | |

| Finance lease obligations, less current portion | | 26,098 | | | 22,746 | |

| Other long-term liabilities | | 272,846 | | | 302,093 | |

| Total Liabilities | | 2,945,748 | | | 3,041,981 | |

| Total Stockholders' Equity | | 1,524,188 | | | 1,466,669 | |

| Total Liabilities and Stockholders' Equity | | $ | 4,469,936 | | | $ | 4,508,650 | |

| | | | |

Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended | | |

| September 30, | | September 30, | | |

| (in thousands, except share and per share data) | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Net revenue | $ | 805,858 | | | $ | 804,031 | | | $ | 2,404,330 | | | $ | 2,341,943 | | | | | |

| Costs and expenses: | | | | | | | | | | | |

| Cost of net revenue | 681,866 | | | 693,488 | | | 2,036,532 | | | 2,022,281 | | | | | |

| General and administrative expenses | 49,242 | | | 45,198 | | | 154,632 | | | 142,797 | | | | | |

| Depreciation and amortization, excluding patient equipment depreciation | 11,263 | | | 14,515 | | | 34,023 | | | 45,596 | | | | | |

| Goodwill impairment | — | | | 511,866 | | | 13,078 | | | 511,866 | | | | | |

| Total costs and expenses | 742,371 | | | 1,265,067 | | | 2,238,265 | | | 2,722,540 | | | | | |

| Operating income (loss) | 63,487 | | | (461,036) | | | 166,065 | | | (380,597) | | | | | |

| Interest expense, net | 31,429 | | | 32,306 | | | 96,939 | | | 96,813 | | | | | |

| Loss on extinguishment of debt | 2,273 | | | — | | | 2,273 | | | — | | | | | |

| Change in fair value of warrant liability | (2,243) | | | (9,160) | | | (1,800) | | | (31,886) | | | | | |

| Other loss, net | — | | | 3,317 | | | 3,345 | | | 6,574 | | | | | |

| Income (loss) before income taxes | 32,028 | | | (487,499) | | | 65,308 | | | (452,098) | | | | | |

| Income tax expense (benefit) | 8,073 | | | (34,578) | | | 21,931 | | | (30,893) | | | | | |

| Net income (loss) | 23,955 | | | (452,921) | | | 43,377 | | | (421,205) | | | | | |

| Income attributable to noncontrolling interest | 1,096 | | | 1,155 | | | 3,217 | | | 3,187 | | | | | |

| Net income (loss) attributable to AdaptHealth Corp. | $ | 22,859 | | | $ | (454,076) | | | $ | 40,160 | | | $ | (424,392) | | | | | |

| | | | | | | | | | | |

| Weighted average common shares outstanding - basic | 134,303 | | 134,825 | | 133,481 | | 134,549 | | | | |

| Weighted average common shares outstanding - diluted | 136,530 | | 134,982 | | 135,441 | | 135,202 | | | | |

| | | | | | | | | | | |

| Basic net income (loss) per share | $ | 0.16 | | | $ | (3.37) | | | $ | 0.28 | | | $ | (3.15) | | | | | |

| Diluted net income (loss) per share | $ | 0.15 | | | $ | (3.43) | | | $ | 0.27 | | | $ | (3.37) | | | | | |

Consolidated Statements of Cash Flows (Unaudited) | | | | | | | | | | | | | | |

| | Nine Months Ended

September 30, |

| (in thousands) | | 2024 | | 2023 |

| Cash flows from operating activities: | | | | |

| Net income (loss) | | $ | 43,377 | | | $ | (421,205) | |

| Adjustments to reconcile net income (loss) to net cash provided by operating activities: | | | | |

| Depreciation and amortization, including patient equipment depreciation | | 274,797 | | | 290,419 | |

| Goodwill impairment | | 13,078 | | | 511,866 | |

| Equity-based compensation | | 10,614 | | | 17,284 | |

| Change in fair value of warrant liability | | (1,800) | | | (31,886) | |

| Reduction in the carrying amount of operating lease right-of-use assets | | 24,902 | | | 26,309 | |

| Reduction in the carrying amount of finance lease right-of-use assets | | 7,927 | | | 3,821 | |

| Deferred income tax expense (benefit) | | 18,664 | | | (37,033) | |

| Change in fair value of interest rate swaps, net of reclassification adjustment | | (367) | | | (1,394) | |

| Amortization of deferred financing costs | | 4,247 | | | 3,926 | |

| Loss on extinguishment of debt | | 2,273 | | | — | |

| Payment of contingent consideration from an acquisition | | (1,850) | | | — | |

| Other | | 569 | | | 350 | |

| Changes in operating assets and liabilities, net of effects from acquisitions: | | | | |

| Accounts receivable | | (12,305) | | | (10,043) | |

| Inventory | | (21,474) | | | 12,769 | |

| Prepaid and other assets | | 23,656 | | | 10,956 | |

| Operating lease obligations | | (25,212) | | | (26,959) | |

| Operating liabilities | | 30,328 | | | (23,780) | |

| Net cash provided by operating activities | | 391,424 | | | 325,400 | |

| Cash flows from investing activities: | | | | |

| Purchases of equipment and other fixed assets | | (228,719) | | | (248,816) | |

| Proceeds from the sale of assets | | 5,316 | | | — | |

| Payments for business acquisitions, net of cash acquired | | — | | | (17,917) | |

| Payments for cost method investments | | — | | | (128) | |

| Net cash used in investing activities | | (223,403) | | | (266,861) | |

| Cash flows from financing activities: | | | | |

| Proceeds from borrowings on long-term debt and lines of credit | | 253,477 | | | 50,000 | |

| Repayments on long-term debt and lines of credit | | (373,477) | | | (75,000) | |

| Repayments of finance lease obligations | | (8,261) | | | (4,558) | |

| Payments for shares purchased under share repurchase program | | — | | | (9,224) | |

| Proceeds from the exercise of stock options | | 742 | | | 538 | |

| Proceeds received in connection with employee stock purchase plan | | 999 | | | 2,031 | |

| Payments relating to the Tax Receivable Agreement | | (1,432) | | | (3,202) | |

| Payments of debt financing costs | | (6,429) | | | — | |

| Distributions to noncontrolling interest | | (3,500) | | | (2,500) | |

| Payments for tax withholdings from restricted stock vesting and stock option exercises | | (1,794) | | | (5,253) | |

| Payments of contingent consideration and deferred purchase price from acquisitions | | (5,298) | | | (1,500) | |

| Net cash used in financing activities | | (144,973) | | | (48,668) | |

| Net increase in cash | | 23,048 | | | 9,871 | |

| Cash at beginning of period | | 77,132 | | | 46,272 | |

| Cash at end of period | | $ | 100,180 | | | $ | 56,143 | |

Non-GAAP Financial Measures

EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin

This press release presents AdaptHealth’s EBITDA, Adjusted EBITDA and Adjusted EBITDA Margin for the three and nine months ended September 30, 2024 and 2023.

AdaptHealth defines EBITDA as net income (loss) attributable to AdaptHealth Corp., plus net income (loss) attributable to noncontrolling interests, interest expense, net, income tax expense (benefit), and depreciation and amortization, including patient equipment depreciation.

AdaptHealth defines Adjusted EBITDA as EBITDA (as defined above), plus equity-based compensation expense, change in fair value of the warrant liability, goodwill impairment, loss on extinguishment of debt, litigation settlement expense, and certain other non-recurring items of expense or income.

AdaptHealth defines Adjusted EBITDA Margin as Adjusted EBITDA (as defined above) as a percentage of net revenue.

The following unaudited table presents the reconciliation of net income attributable to AdaptHealth Corp. to EBITDA and Adjusted EBITDA, and the reconciliation of net income attributable to AdaptHealth Corp. as a percentage of net revenue to Adjusted EBITDA Margin, for the three months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, |

| | 2024 | | 2023 |

| | (Unaudited) |

| (in thousands, except percentages) | | Dollars | Revenue Percentage | | Dollars | Revenue Percentage |

| Net income (loss) attributable to AdaptHealth Corp. | | $ | 22,859 | 2.8% | | $ | (454,076) | (56.5)% |

| Income attributable to noncontrolling interest | | 1,096 | 0.1% | | 1,155 | 0.1% |

| Interest expense, net | | 31,429 | 3.9% | | 32,306 | 4.0% |

| Income tax expense (benefit) | | 8,073 | 1.0% | | (34,578) | (4.2)% |

| Depreciation and amortization, including patient equipment depreciation | | 90,759 | 11.3% | | 97,310 | 12.1% |

| EBITDA | | 154,216 | 19.1% | | (357,883) | (44.5)% |

| Equity-based compensation expense (a) | | 863 | 0.1% | | 4,521 | 0.5% |

| Change in fair value of warrant liability (b) | | (2,243) | (0.3)% | | (9,160) | (1.1)% |

| Goodwill impairment (c) | | — | —% | | 511,866 | 63.7% |

| Loss on extinguishment of debt (d) | | 2,273 | 0.3% | | — | —% |

| Other non-recurring expenses, net (e) | | 9,148 | 1.2% | | 11,823 | 1.4% |

| Adjusted EBITDA | | $ | 164,257 | 20.4% | | $ | 161,167 | 20.0% |

| Adjusted EBITDA Margin | | | 20.4% | | | 20.0% |

(a)Represents equity-based compensation expense for awards granted to employees and non-employee directors.

(b)Represents a non-cash gain for the change in the estimated fair value of the warrant liability.

(c)Represents a non-cash goodwill impairment charge as a result of the fair value of the Company’s reporting unit being less than its carrying value.

(d)Represents lender fees and the write-off of unamortized deferred financing costs in connection with the refinancing of the Company's credit agreement.

(e)The 2024 period consists of $3.3 million of severance charges (primarily related to the separation of the Company's former President), $2.8 million of consulting expenses associated with systems implementation activities, $1.1 million write-down of assets, $0.5 million of expenses associated with litigation, and

$1.5 million of other non-recurring expenses. The 2023 period consists of $2.9 million of expenses associated with litigation, $1.5 million of severance charges, $3.6 million of lease termination costs associated with a cost management program, $1.3 million of consulting expenses associated with systems implementation activities, and $2.5 million of other non-recurring expenses.

The following unaudited table presents the reconciliation of net income attributable to AdaptHealth Corp. to EBITDA and Adjusted EBITDA, and the reconciliation of net income attributable to AdaptHealth Corp. as a percentage of net revenue to Adjusted EBITDA Margin, for the nine months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | |

| | Nine Months Ended September 30, |

| | 2024 | | 2023 |

| | (Unaudited) |

| (in thousands, except percentages) | | Dollars | Revenue Percentage | | Dollars | Revenue Percentage |

| Net income (loss) attributable to AdaptHealth Corp. | | $ | 40,160 | 1.7% | | $ | (424,392) | (18.1)% |

| Income attributable to noncontrolling interest | | 3,217 | 0.1% | | 3,187 | 0.1% |

| Interest expense, net | | 96,939 | 4.0% | | 96,813 | 4.1% |

| Income tax expense (benefit) | | 21,931 | 0.9% | | (30,893) | (1.3)% |

| Depreciation and amortization, including patient equipment depreciation | | 274,797 | 11.5% | | 290,419 | 12.4% |

| EBITDA | | 437,044 | 18.2% | | (64,866) | (2.8)% |

| Equity-based compensation expense (a) | | 10,614 | 0.4% | | 17,284 | 0.7% |

| Change in fair value of warrant liability (b) | | (1,800) | (0.1)% | | (31,886) | | (1.4)% |

| Goodwill impairment (c) | | 13,078 | 0.5% | | 511,866 | 21.9% |

| Loss on extinguishment of debt (d) | | 2,273 | 0.1% | | — | —% |

| Litigation settlement expense (e) | | 3,345 | 0.1% | | — | —% |

| Other non-recurring expenses, net (f) | | 23,503 | 1.1% | | 33,778 | 1.5% |

| Adjusted EBITDA | | $ | 488,057 | 20.3% | | $ | 466,176 | 19.9% |

| Adjusted EBITDA Margin | | | 20.3% | | | 19.9% |

(a)Represents equity-based compensation expense for awards granted to employees and non-employee directors.

(b)Represents a non-cash gain for the change in the estimated fair value of the warrant liability.

(c)The 2024 period includes non-cash goodwill impairment charges relating to the disposition of certain immaterial custom rehab technology assets. The 2023 period includes a non-cash goodwill impairment charge as a result of the fair value of the Company’s reporting unit being less than it's carrying value.

(d)Represents lender fees and the write-off of unamortized deferred financing costs in connection with the refinancing of the Company's credit agreement.

(e)Represents a $2.4 million charge for the change in fair value of shares of Common Stock of the Company that were issued in July 2024 following final court approval of the settlement of a previously disclosed securities class action lawsuit, as well as an expense of $0.9 million to settle a shareholder derivative complaint.

(f)The 2024 period consists of $9.7 million of consulting expenses associated with systems implementation activities, $3.3 million of severance charges (primarily related to the separation of the Company's former President), $3.3 million of expenses associated with litigation, $2.7 million write-down of assets, and $4.5 million of other non-recurring expenses. The 2023 period consists of $12.5 million of expenses associated with litigation, $6.3 million of severance charges (of which $2.9 million related to the separation of the Company's former CEO), $4.1 million of lease termination costs associated with a cost management program, $3.9 million of consulting expenses associated with systems implementation activities, $0.9 million of net impairments of operating lease right-of-use assets, and $6.1 million of other non-recurring expenses.

Free Cash Flow

This press release presents AdaptHealth’s free cash flow for the three and nine months ended September 30, 2024 and 2023.

AdaptHealth defines free cash flow as net cash provided by operating activities less cash paid for purchases of equipment and other fixed assets.

The following unaudited table reconciles net cash provided by operating activities to the free cash flow measure for the three and nine months ended September 30, 2024 and 2023:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended |

| | September 30, | | September 30, |

| (in thousands) | | 2024 | | 2023 | | 2024 | | 2023 |

| | (Unaudited) |

| Net cash provided by operating activities | | $ | 144,405 | | $ | 98,833 | | $ | 391,424 | | $ | 325,400 |

| Purchases of equipment and other fixed assets | | (59,556) | | (77,086) | | (228,719) | | (248,816) |

| Free cash flow | | $ | 84,849 | | $ | 21,747 | | $ | 162,705 | | $ | 76,584 |

Contacts

AdaptHealth Corp.

Jason Clemens, CFA

Chief Financial Officer

IR@adapthealth.com

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

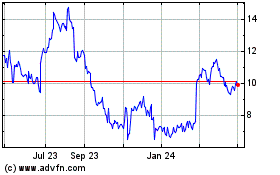

AdaptHealth (NASDAQ:AHCO)

Historical Stock Chart

From Nov 2024 to Dec 2024

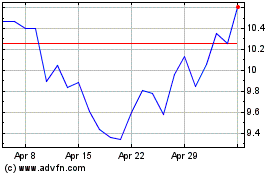

AdaptHealth (NASDAQ:AHCO)

Historical Stock Chart

From Dec 2023 to Dec 2024