Revenue Increases to $765.7 Million on 5.2%

Growth in Same Facility Revenue

Updates 2018 Financial Guidance

Acadia Healthcare Company, Inc. (NASDAQ: ACHC) today announced

financial results for the second quarter and six months ended June

30, 2018. Revenue was $765.7 million for the quarter, up 7.0% from

$715.9 million for the second quarter of 2017. Net income

attributable to Acadia stockholders for the second quarter of 2018

was $58.8 million, or $0.67 per diluted share, compared with $49.6

million, or $0.57 per diluted share, for the second quarter of

2017. Adjusted income attributable to Acadia stockholders per

diluted share (“adjusted EPS”) was $0.70 for the second quarter of

2018, a 6.1% increase from $0.66 for the second quarter of 2017,

which excludes transaction-related expenses of $2.9 million and

$9.1 million for the second quarter of 2018 and 2017, respectively,

as well as debt extinguishment costs of $0.8 million for the second

quarter last year. A reconciliation of all non-GAAP financial

results in this release appears beginning on page 7.

Joey Jacobs, Chairman and Chief Executive Officer of Acadia,

remarked, “We are pleased to report that growth in Acadia’s revenue

and adjusted EPS met our expectations for the second quarter. Our

revenue growth was primarily driven by the addition of nearly 900

beds during the 12 months ended June 30, 2018. We added 155 of

these beds during the second quarter, including 67 beds to existing

facilities in the U.S. and U.K. and an 88-bed de novo facility

through our joint-venture with Erlanger Health System. For the full

year 2018, we expect to add more than 800 beds to existing and new

facilities.”

For the second quarter of 2018, Acadia’s total same facility

revenue increased 5.2% compared with the second quarter of 2017,

including a 1.7% increase in patient days and a 3.4% increase in

revenue per patient day. Total same facility EBITDA margin declined

60 basis points to 25.7%. U.S. same facility revenue increased

5.0%, including a 1.9% increase in patient days and a 3.1% increase

in revenue per patient day. U.S. same facility EBITDA margin

declined 30 basis points to 28.1%. U.K. same facility revenue grew

5.6% for the second quarter of 2018 from the second quarter last

year, including a 1.6% increase in patient days and a 3.9% increase

in revenue per patient day. U.K. same facility EBITDA margin

declined 110 basis points to 21.3%.

Acadia today updated its financial guidance for 2018 to reflect

a lower exchange rate in the second half of the year as well as

higher interest rates. The Company now assumes an exchange rate of

$1.30 per British Pound Sterling and interest expense to be

approximately $95 million for the second half of the year. The

updated guidance is as follows:

- Revenue for 2018 in a range of $3.02

billion to $3.06 billion;

- Adjusted EBITDA for 2018 in a range of

$632 million to $639 million; and

- Adjusted earnings per diluted share for

2018 in a range of $2.52 to $2.56.

The Company’s guidance does not include the impact of any future

acquisitions or transaction-related expenses.

EBITDA is defined as net income adjusted for net income (loss)

attributable to noncontrolling interests, provision for income

taxes, net interest expense and depreciation and amortization.

Adjusted EBITDA is defined as EBITDA adjusted for equity-based

compensation expense, transaction-related expenses and debt

extinguishment costs. Adjusted income is defined as net income

adjusted for transaction-related expenses, tax reform impact, debt

extinguishment costs and income tax effect of adjustments to

income.

Acadia will hold a conference call to discuss its first quarter

financial results at 9:00 a.m. Eastern Time on Tuesday, July

31, 2018. A live webcast of the conference call will be available

at www.acadiahealthare.com in the “Investors” section of the

website. The webcast of the conference call will be available

through August 14, 2018.

Risk Factors

This news release contains forward-looking statements.

Generally, words such as “may,” “will,” “should,” “could,”

“anticipate,” “expect,” “intend,” “estimate,” “plan,” “continue,”

and “believe” or the negative of or other variation on these and

other similar expressions identify forward-looking statements.

These forward-looking statements are made only as of the date of

this news release. We do not undertake to update or revise the

forward-looking statements, whether as a result of new information,

future events or otherwise. Forward-looking statements are based on

current expectations and involve risks and uncertainties and our

future results could differ significantly from those expressed or

implied by our forward-looking statements. Factors that may cause

actual results to differ materially include, without limitation,

(i) potential difficulties operating our business in light of

political and economic instability in the U.K. and globally

relating to the U.K.’s departure from the European Union; (ii) the

impact of fluctuations in foreign exchange rates, including the

devaluation of the British Pound Sterling (GBP) relative to the

U.S. Dollar (USD); (iii) Acadia’s ability to complete acquisitions

and successfully integrate the operations of acquired facilities;

(iv) Acadia’s ability to add beds, expand services, enhance

marketing programs and improve efficiencies at its facilities; (v)

potential reductions in payments received by Acadia from government

and third-party payors; (vi) the occurrence of patient incidents,

governmental investigations and adverse regulatory actions, which

could adversely affect the price of our common stock and result in

substantial payments and incremental regulatory burdens; (vii) the

risk that Acadia may not generate sufficient cash from operations

to service its debt and meet its working capital and capital

expenditure requirements; and (viii) potential operating

difficulties, labor costs, client preferences, changes in

competition and general economic or industry conditions that may

prevent Acadia from realizing the expected benefits of its joint

venture, de novo and other business strategies. These factors and

others are more fully described in Acadia’s periodic reports and

other filings with the SEC.

About Acadia

Acadia is a provider of behavioral healthcare services. At June

30, 2018, Acadia operated a network of 585 behavioral healthcare

facilities with approximately 17,900 beds in 40 states, the United

Kingdom and Puerto Rico. Acadia provides behavioral health and

addiction services to its patients in a variety of settings,

including inpatient psychiatric hospitals, specialty treatment

facilities, residential treatment centers and outpatient

clinics.

Acadia

Healthcare Company, Inc. Condensed Consolidated Statements

of Operations (Unaudited) Three Months Ended

June 30, Six Months Ended June 30, 2018

2017 2018

2017 (In thousands, except per share amounts)

Revenue before provision for doubtful accounts $ 765,738 $

725,643 $ 1,507,979 $ 1,414,984 Provision for doubtful accounts

- (9,747 ) - (19,894 )

Revenue 765,738 715,896 1,507,979 1,395,090

Salaries, wages and benefits (including

equity-based compensation expense of $7,129, $7,436, $14,048 and

$14,832, respectively)

416,741 383,595 828,269 760,016 Professional fees 53,461 46,321

107,479 89,730 Supplies 30,133 28,639 59,497 56,348 Rents and

leases 20,236 19,435 40,524 38,406 Other operating expenses 87,282

83,122 175,513 166,833 Depreciation and amortization 39,928 35,201

79,701 68,814 Interest expense, net 45,812 43,505 91,055 86,262

Debt extinguishment costs - 810 940 810 Transaction-related

expenses 2,887 9,052 7,655

13,171 Total expenses 696,480

649,680 1,390,633 1,280,390

Income before income taxes 69,258 66,216 117,346 114,700

Provision for income taxes 10,368 16,578

7,582 30,289 Net income 58,890

49,638 109,764 84,411 Net (income) loss attributable to

noncontrolling interests (54 ) (8 ) (109 )

177 Net income attributable to Acadia Healthcare

Company, Inc. $ 58,836 $ 49,630 $ 109,655 $

84,588

Earnings per share attributable to Acadia

Healthcare Company, Inc. stockholders:

Basic $ 0.67 $ 0.57 $ 1.26 $ 0.97

Diluted $ 0.67 $ 0.57 $ 1.26 $ 0.97

Weighted-average shares outstanding: Basic 87,303 86,954

87,205 86,859 Diluted 87,467 87,080 87,351 86,997

Acadia Healthcare Company, Inc. Condensed

Consolidated Balance Sheets (Unaudited) June

30, December 31, 2018

2017 (In thousands) ASSETS

Current assets: Cash and cash equivalents $ 79,463 $ 67,290

Accounts receivable, net 329,256 296,925 Other current assets

80,503 107,335 Total current assets

489,222 471,550 Property and equipment, net 3,103,331 3,048,130

Goodwill 2,739,303 2,751,174 Intangible assets, net 91,566 87,348

Deferred tax assets 3,664 3,731 Derivative instrument assets 24,989

12,997 Other assets 51,072 49,572 Total

assets $ 6,503,147 $ 6,424,502

LIABILITIES AND EQUITY Current liabilities: Current portion

of long-term debt $ 33,264 $ 34,830 Accounts payable 130,228

102,299 Accrued salaries and benefits 102,840 99,047 Other accrued

liabilities 127,786 141,213 Total

current liabilities 394,118 377,389 Long-term debt 3,187,788

3,205,058 Deferred tax liabilities 78,340 80,333 Other liabilities

160,809 166,434 Total liabilities

3,821,055 3,829,214 Redeemable noncontrolling interests 28,791

22,417 Equity: Common stock 873 871 Additional paid-in capital

2,530,083 2,517,545 Accumulated other comprehensive loss (415,883 )

(374,118 ) Retained earnings 538,228 428,573

Total equity 2,653,301 2,572,871

Total liabilities and equity $ 6,503,147 $ 6,424,502

Acadia Healthcare Company,

Inc. Condensed Consolidated Statements of Cash Flows

(Unaudited) Six Months Ended June 30,

2018 2017 (In thousands)

Operating activities: Net income $ 109,764 $ 84,411

Adjustments to reconcile net income to net cash provided by

continuing operating activities: Depreciation and amortization

79,701 68,814 Amortization of debt issuance costs 5,124 4,845

Equity-based compensation expense 14,048 14,832 Deferred income

taxes (3,978 ) 17,096 Debt extinguishment costs 940 810 Other 1,040

6,558 Change in operating assets and liabilities: Accounts

receivable, net (26,104 ) (22,404 ) Other current assets 9,953

20,457 Other assets 2,761 1,809 Accounts payable and other accrued

liabilities 21,066 (4,893 ) Accrued salaries and benefits 4,364

(9,157 ) Other liabilities (793 ) 5,257 Net

cash provided by continuing operating activities 217,886 188,435

Net cash used in discontinued operating activities (572 )

(829 ) Net cash provided by operating activities 217,314

187,606

Investing activities: Cash paid for capital

expenditures (161,555 ) (117,521 ) Cash paid for real estate

acquisitions (8,857 ) (22,850 ) Other (3,337 ) (5,938

) Net cash used in investing activities (173,749 ) (146,309 )

Financing activities: Principal payments on long-term

debt (23,246 ) (17,275 ) Common stock withheld for minimum

statutory taxes, net (2,134 ) (3,678 ) Other (5,172 )

(2,270 ) Net cash used in financing activities (30,552 ) (23,223 )

Effect of exchange rate changes on cash (840 )

4,297 Net increase in cash and cash equivalents

12,173 22,371 Cash and cash equivalents at beginning of the period

67,290 57,063 Cash and cash equivalents

at end of the period $ 79,463 $ 79,434

Acadia Healthcare

Company, Inc. Operating Statistics (Unaudited,

Revenue in thousands) Three Months Ended June 30,

Six Months Ended June 30, 2018

2017 % Change 2018 2017

% Change Same Facility Results (a,d) Revenue $ 730,681 $

694,730 5.2% $ 1,440,285 $ 1,366,845 5.4% Patient Days 1,127,834

1,108,621 1.7% 2,226,128 2,185,539 1.9% Admissions 41,930 40,279

4.1% 82,900 80,534 2.9% Average Length of Stay (b) 26.9 27.5 -2.3%

26.9 27.1 -1.0% Revenue per Patient Day $ 648 $ 627 3.4% $ 647 $

625 3.5% EBITDA margin 25.7% 26.3% -60 bps 25.0% 25.1% -10 bps

U.S. Same Facility Results (a) Revenue $ 474,266 $ 451,805

5.0% $ 932,989 $ 884,091 5.5% Patient Days 627,400 615,951 1.9%

1,236,700 1,213,215 1.9% Admissions 39,564 37,992 4.1% 78,109

75,900 2.9% Average Length of Stay (b) 15.9 16.2 -2.2% 15.8 16.0

-0.9% Revenue per Patient Day $ 756 $ 734 3.1% $ 754 $ 729 3.5%

EBITDA margin 28.1% 28.4% -30 bps 27.2% 27.2% 0 bps U.K.

Same Facility Results (a,d) Revenue $ 256,415 $ 242,925 5.6% $

507,296 $ 482,754 5.1% Patient Days 500,434 492,670 1.6% 989,428

972,324 1.8% Admissions 2,366 2,287 3.5% 4,791 4,634 3.4% Average

Length of Stay (b) 211.5 215.4 -1.8% 206.5 209.8 -1.6% Revenue per

Patient Day $ 512 $ 493 3.9% $ 513 $ 496 3.3% EBITDA margin 21.3%

22.4% -110 bps 20.8% 21.2% -40 bps U.S. Facility

Results (c) Revenue $ 481,470 $ 461,067 4.4% $ 943,875 $ 900,965

4.8% Patient Days 635,766 624,047 1.9% 1,248,655 1,224,499 2.0%

Admissions 40,519 38,092 6.4% 79,451 76,063 4.5% Average Length of

Stay (b) 15.7 16.4 -4.2% 15.7 16.1 -2.4% Revenue per Patient Day $

757 $ 739 2.5% $ 756 $ 736 2.7% EBITDA margin 27.0% 27.9% -90 bps

26.2% 26.7% -50 bps U.K. Facility Results (c,d) Revenue $

284,268 $ 270,716 5.0% $ 564,104 $ 539,221 4.6% Patient Days

676,901 684,195 -1.1% 1,342,472 1,355,915 -1.0% Admissions 2,712

2,611 3.9% 5,474 5,313 3.0% Average Length of Stay (b) 249.6 262.0

-4.8% 245.2 255.2 -3.9% Revenue per Patient Day $ 420 $ 396 6.1% $

420 $ 398 5.7% EBITDA margin 19.1% 20.4% -130 bps 18.7% 19.5% -80

bps Total Facility Results (c,d) Revenue $ 765,738 $ 731,783

4.6% $ 1,507,979 $ 1,440,186 4.7% Patient Days 1,312,667 1,308,242

0.3% 2,591,127 2,580,414 0.4% Admissions 43,231 40,703 6.2% 84,925

81,376 4.4% Average Length of Stay (b) 30.4 32.1 -5.5% 30.5 31.7

-3.8% Revenue per Patient Day $ 583 $ 559 4.3% $ 582 $ 558 4.3%

EBITDA margin 24.1% 25.1% -100 bps 23.4% 24.0% -60 bps (a)

Results for the periods presented exclude the elderly care division

of our U.K. operations and certain closed services. (b) Average

length of stay is defined as patient days divided by admissions.

(c) Results for the periods presented exclude certain closed

services. (d) Revenue and revenue per patient day for the three and

six months ended June 30, 2017 is adjusted to reflect the foreign

currency exchange rate for the comparable periods of 2018 in order

to eliminate the effect of changes in the exchange rate. The

exchange rate used in the adjusted revenue and revenue per patient

day amounts for the three and six months ended June 30, 2017 is

1.36 and 1.38, respectively.

Acadia

Healthcare Company, Inc. Reconciliation of Net Income

Attributable to Acadia Healthcare Company, Inc. to Adjusted

EBITDA (Unaudited) Three Months Ended June

30, Six Months Ended June 30, 2018

2017 2018 2017 (in

thousands) Net income attributable to Acadia Healthcare

Company, Inc. $ 58,836 $ 49,630 $ 109,655 $ 84,588 Net income

(loss) attributable to noncontrolling interests 54 8 109 (177 )

Provision for income taxes 10,368 16,578 7,582 30,289 Interest

expense, net 45,812 43,505 91,055 86,262 Depreciation and

amortization 39,928 35,201 79,701

68,814 EBITDA 154,998 144,922 288,102 269,776

Adjustments: Equity-based compensation expense (a) 7,129 7,436

14,048 14,832 Transaction-related expenses (b) 2,887 9,052 7,655

13,171 Debt extinguishment costs (c) - 810 940

810 Adjusted EBITDA $ 165,014 $ 162,220 $ 310,745 $

298,589

See footnotes on page 9.

Acadia Healthcare Company, Inc.

Reconciliation of Adjusted Income Attributable to Acadia

Healthcare Company, Inc. to Net Income Attributable to

Acadia Healthcare Company, Inc. (Unaudited)

Three Months Ended June 30, Six Months Ended June 30,

2018 2017

2018 2017 (in thousands,

except per share amounts) Net income attributable to

Acadia Healthcare Company, Inc. $ 58,836 $ 49,630 $ 109,655 $

84,588 Adjustments to income: Transaction-related expenses

(b) 2,887 9,052 7,655 13,171 Tax reform impact (d) - - (10,472 ) -

Debt extinguishment costs (c) - 810 940 810 Income tax effect of

adjustments to income (e) (554 ) (2,268 )

(1,415 ) (1,469 ) Adjusted income attributable to Acadia

Healthcare Company, Inc. $ 61,169 $ 57,224 $ 106,363

$ 97,100 Weighted-average shares outstanding -

diluted 87,467 87,080 87,351 86,997

Adjusted income attributable to Acadia

Healthcare Company, Inc. per diluted share

$ 0.70 $ 0.66 $ 1.22 $ 1.12 See

footnotes on page 9.

Acadia Healthcare Company, Inc.

Footnotes We have included certain financial

measures in this press release, including EBITDA, Adjusted EBITDA,

and Adjusted income, which are “non-GAAP financial measures” as

defined under the rules and regulations promulgated by the SEC. We

define EBITDA as net income adjusted for net income (loss)

attributable to noncontrolling interests, provision for income

taxes, net interest expense and depreciation and amortization. We

define Adjusted EBITDA as EBITDA adjusted for equity-based

compensation expense, transaction-related expenses and debt

extinguishment costs. We define Adjusted income as net income

adjusted for transaction-related expenses, tax reform impact, debt

extinguishment costs and income tax effect of adjustments to

income. EBITDA, Adjusted EBITDA, and Adjusted income are

supplemental measures of our performance and are not required by,

or presented in accordance with, generally accepted accounting

principles in the United States (“GAAP”). EBITDA, Adjusted EBITDA,

and Adjusted income are not measures of our financial performance

under GAAP and should not be considered as alternatives to net

income or any other performance measures derived in accordance with

GAAP or as an alternative to cash flow from operating activities as

measures of our liquidity. Our measurements of EBITDA, Adjusted

EBITDA, and Adjusted income may not be comparable to similarly

titled measures of other companies. We have included information

concerning EBITDA, Adjusted EBITDA, and Adjusted income in this

press release because we believe that such information is used by

certain investors as measures of a company’s historical

performance. We believe these measures are frequently used by

securities analysts, investors and other interested parties in the

evaluation of issuers of equity securities, many of which present

EBITDA, Adjusted EBITDA, and Adjusted income when reporting their

results. Our presentation of EBITDA, Adjusted EBITDA, and Adjusted

income should not be construed as an inference that our future

results will be unaffected by unusual or nonrecurring items.

The Company is not able to provide a reconciliation of projected

Adjusted EBITDA and adjusted earnings per diluted share, where

provided, to expected results due to the unknown effect, timing and

potential significance of transaction-related expenses and the tax

effect of such expenses. (a) Represents the equity-based

compensation expense of Acadia. (b) Represents

transaction-related expenses incurred by Acadia related to

acquisitions and integration efforts. (c) Represents debt

extinguishment costs recorded in connection with the Amended and

Restated Credit Agreement, including the discount and write-off of

deferred financing costs. (d) Represents tax benefit related

to a change in the Company’s provisional amounts recorded at

December 31, 2017 related to the enactment of the Tax Cuts and Jobs

Act. (e) Represents the income tax effect of adjustments to

income based on tax rates of 15.2% and 24.8% for the three months

ended June 30, 2018 and 2017, respectively, and 15.5% and 24.6% for

the six months ended June 30, 2018 and 2017, respectively.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20180730005687/en/

Acadia Healthcare Company, Inc.Gretchen Hommrich,

615-861-6000Director, Investor Relations

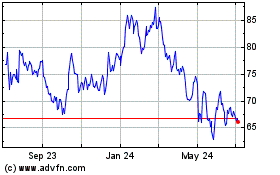

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Sep 2024 to Oct 2024

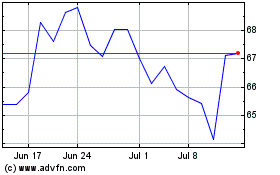

Acadia Healthcare (NASDAQ:ACHC)

Historical Stock Chart

From Oct 2023 to Oct 2024