AAON, INC. (NASDAQ-AAON), a provider of premier, configurable HVAC

solutions that bring long-term value to customers and owners, today

announced its results for the third quarter of 2022.

Net sales for the third quarter of 2022

increased 75.1% to a record $242.6 million from $138.6 million in

the third quarter of 2021. Organic volume growth and product mix

contributed approximately 26.9% to year over year growth. Volume

growth reflected the Company's strong backlog and a third straight

quarter of record production. In addition to volume, pricing

contributed 24.4% of growth and the acquisition of BasX contributed

23.8% of growth. Similar to the legacy business, BasX performed

extremely well in the quarter. BasX realized record sales and

EBITDA, while increasing its backlog 33.8% compared to the end of

the second quarter of 2022.

Gross profit margin in the quarter increased to

27.0%, the highest level since the second quarter of 2021. Higher

pricing and improved productivity offset increased costs and the

adverse effects of supply chain issues. Similar to the trend

realized within the second quarter of 2022, gross profit margin

improved sequentially throughout the third quarter.

Earnings per diluted share in the third quarter

of 2022 increased 75.9% to a record $0.51 from $0.29 in the third

quarter of 2021. The increase in earnings was primarily due to

robust volume growth and improved gross profit margin. Furthermore,

as a percent of sales, SG&A expenses, excluding BasX, were down

80 basis points from a year ago to 10.7%, the lowest level of any

quarter in over two years.

| Financial

Highlights: |

Three Months Ended September

30, |

|

% |

|

|

|

Nine Months Ended September

30, |

|

% |

| |

|

2022 |

|

|

|

2021 |

|

|

Change |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

Change |

| |

(in thousands, except share and per share data) |

|

|

|

(in thousands, except share and per share data) |

| GAAP

Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales |

$ |

242,605 |

|

|

$ |

138,571 |

|

|

75.1 |

% |

|

|

|

$ |

634,190 |

|

|

$ |

398,235 |

|

|

59.3 |

% |

| Gross profit |

|

65,591 |

|

|

|

36,019 |

|

|

82.1 |

% |

|

|

|

$ |

159,031 |

|

|

$ |

111,283 |

|

|

42.9 |

% |

|

Gross profit margin |

|

27.0 |

% |

|

|

26.0 |

% |

|

|

|

|

|

|

25.1 |

% |

|

|

27.9 |

% |

|

|

| Operating income |

$ |

36,700 |

|

|

$ |

20,137 |

|

|

82.3 |

% |

|

|

|

$ |

80,163 |

|

|

$ |

63,810 |

|

|

25.6 |

% |

|

Operating margin |

|

15.1 |

% |

|

|

14.5 |

% |

|

|

|

|

|

|

12.6 |

% |

|

|

16.0 |

% |

|

|

| Net income |

|

27,473 |

|

|

|

15,581 |

|

|

76.3 |

% |

|

|

|

$ |

61,478 |

|

|

$ |

52,572 |

|

|

16.9 |

% |

|

Earnings per diluted share |

$ |

0.51 |

|

|

$ |

0.29 |

|

|

75.9 |

% |

|

|

|

$ |

1.14 |

|

|

$ |

0.98 |

|

|

16.3 |

% |

| Diluted average shares |

|

53,958,715 |

|

|

|

53,546,513 |

|

|

0.8 |

% |

|

|

|

|

53,921,865 |

|

|

|

53,664,997 |

|

|

0.5 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-GAAP

Measures |

|

|

|

|

|

|

|

|

|

|

|

|

|

| EBITDA1 |

$ |

46,078 |

|

|

$ |

27,726 |

|

|

66.2 |

% |

|

|

|

$ |

106,082 |

|

|

$ |

86,379 |

|

|

22.8 |

% |

|

EBITDA margin1 |

|

19.0 |

% |

|

|

20.0 |

% |

|

|

|

|

|

|

16.7 |

% |

|

|

21.7 |

% |

|

|

| 1These are non-GAAP

measures. See "Use of Non-GAAP Financial Measures" below for

reconciliation to GAAP measures. |

Backlog

|

September 30, 2022 |

|

June 30, 2022 |

|

December 31, 2021 |

|

September 30, 2021 |

|

(in thousands) |

|

$ |

514,735 |

|

$ |

464,025 |

|

$ |

260,164 |

|

$ |

181,813 |

The Company finished the third quarter of 2022

with a record backlog of $514.7 million, up 183.1% from $181.8

million a year ago, and up 10.9% from $464.0 million at the end of

the second quarter of 2022. Excluding BasX's backlog, organic

backlog was up 109.6% from the prior year quarter.

Gary Fields, President and CEO, stated, “Our

performance in the third quarter was excellent. I was particularly

pleased to see a material improvement in gross profit margin as a

result of our pricing strategy gaining traction.

Furthermore, despite supply chain issues persisting, productivity

improved throughout the quarter, a reflection of how well our

operations are performing. Better productivity, along with an

increase in headcount, helped us realize a third straight quarter

of record production. Meanwhile, we continue to grow our backlog.

Bookings in the quarter were solid. Total bookings increased 36.7%

compared to the second quarter of 2022, almost all of which was

driven by volume, with a small amount related to pricing.”

Mr. Fields continued, “BasX continues to build

momentum. In the third quarter, the business realized record

revenue and EBITDA. Backlog at BasX at the end of the quarter also

finished at a record level, up 33.8% from the end of the second

quarter. New bookings in the quarter were by far a record for the

business as it benefited from a strong pipeline of projects in the

data center and semiconductor markets. Revenue synergies related to

the acquisition are being realized and we are making progress

integrating BasX production into our Longview facility. We are also

starting to recognize cost synergies, which should accelerate over

the next 12 months. Overall, we continue to be excited about the

growth opportunities that BasX is bringing to AAON."

Mr. Fields continued, "In the third quarter, we

made the decision to terminate our WH and WV series portion of the

water-source heat pump business. After careful analysis, we

determined this type of product does not allow us to meet our

profit margin targets. Additionally, upcoming new refrigerant

regulations would require a capital infusion that we determined

would not be the best use of capital. This product line generated

approximately $10.0 million of revenue in 2021 and was on track for

a similar level in 2022. We plan to accept orders through the rest

of 2022, at which time we will stop accepting new orders and will

work on building the rest of the WH/WV backlog before repurposing

personnel and equipment."

Mr. Fields concluded, “As we approach the end of

the year, we remain positive on the business. Production rates and

productivity levels continue to increase, the margin profile of the

backlog is the best that it has been all year, which suggests gross

margin will continue to improve, and order trends remain positive.

We are confident that we will finish the year on a high note in the

fourth quarter.”

As of September 30, 2022, the Company had cash

and cash equivalents of $10.7 million and total debt of $76.3

million. Rebecca Thompson, CFO, commented, “In the third quarter,

we generated $43.4 million of cash flows from operations, the

strongest quarter in at least five years. Within the quarter, we

paid down $30.0 million on our line of credit. Our balance sheet

remains strong. At the end of the third quarter, our leverage ratio

decreased to 0.65, from 1.06 at the end of the second quarter. In

the fourth quarter, we anticipate another solid quarter of cash

flows from operations, allowing us to continue to reduce our

borrowings under the line of credit while making necessary capital

investments for long-term growth.”

Conference Call The Company

will host a conference call and webcast today at 5:15 P.M. ET to

discuss the third quarter 2022 results and outlook. The conference

call will be accessible via a dial-in for those who wish to

participate in Q&A as well as a listen-only webcast. The

dial-in is 1-888-440-3307 for domestic callers or 1-646-960-0787

for international callers, both accessible with the conference ID

7249161. To access the listen-only webcast, please register at

https://events.q4inc.com/attendee/219209225.

About AAONFounded in 1988, AAON

is a world leader in HVAC solutions for commercial and industrial

indoor environments. The Company's industry-leading approach to

designing and manufacturing highly configurable equipment to meet

exact needs creates a premier ownership experience with greater

efficiency, performance and long-term value. AAON is headquartered

in Tulsa, Oklahoma, where its world-class innovation center and

testing lab allows AAON engineers to continuously push boundaries

and advance the industry. For more information, please visit

www.AAON.com.

Forward-Looking

StatementsCertain statements in this news release may be

“forward-looking statements” within the meaning of Section 27A of

the Securities Act of 1933. Statements regarding future prospects

and developments are based upon current expectations and involve

certain risks and uncertainties that could cause actual results and

developments to differ materially from the forward-looking

statements.

Contact InformationJoseph

MondilloDirector of Investor RelationsPhone: (617) 877-6346Email:

joseph.mondillo@aaon.com

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Income |

|

(Unaudited) |

| |

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

(in thousands, except share and per share data) |

| Net sales |

$ |

242,605 |

|

|

$ |

138,571 |

|

|

$ |

634,190 |

|

|

$ |

398,235 |

|

| Cost of sales |

|

177,014 |

|

|

|

102,552 |

|

|

|

475,159 |

|

|

|

286,952 |

|

| Gross profit |

|

65,591 |

|

|

|

36,019 |

|

|

|

159,031 |

|

|

|

111,283 |

|

| Selling, general and

administrative expenses |

|

28,891 |

|

|

|

15,897 |

|

|

|

78,880 |

|

|

|

47,488 |

|

| Gain on disposal of

assets |

|

— |

|

|

|

(15 |

) |

|

|

(12 |

) |

|

|

(15 |

) |

| Income from operations |

|

36,700 |

|

|

|

20,137 |

|

|

|

80,163 |

|

|

|

63,810 |

|

| Interest expense, net |

|

(954 |

) |

|

|

(10 |

) |

|

|

(1,694 |

) |

|

|

(11 |

) |

| Other income (expense),

net |

|

54 |

|

|

|

(19 |

) |

|

|

295 |

|

|

|

37 |

|

| Income before taxes |

|

35,800 |

|

|

|

20,108 |

|

|

|

78,764 |

|

|

|

63,836 |

|

| Income tax provision |

|

8,327 |

|

|

|

4,527 |

|

|

|

17,286 |

|

|

|

11,264 |

|

| Net income |

$ |

27,473 |

|

|

$ |

15,581 |

|

|

$ |

61,478 |

|

|

$ |

52,572 |

|

| Earnings per share: |

|

|

|

|

|

|

|

|

Basic |

$ |

0.52 |

|

|

$ |

0.30 |

|

|

$ |

1.16 |

|

|

$ |

1.00 |

|

|

Diluted |

$ |

0.51 |

|

|

$ |

0.29 |

|

|

$ |

1.14 |

|

|

$ |

0.98 |

|

| Cash dividends declared per

common share: |

$ |

— |

|

|

$ |

— |

|

|

$ |

0.19 |

|

|

$ |

0.19 |

|

| Weighted average shares

outstanding: |

|

|

|

|

|

|

|

|

Basic |

|

53,185,324 |

|

|

|

52,420,711 |

|

|

|

53,029,284 |

|

|

|

52,392,300 |

|

|

Diluted |

|

53,958,715 |

|

|

|

53,546,513 |

|

|

|

53,921,865 |

|

|

|

53,664,997 |

|

|

AAON, Inc. and Subsidiaries |

|

Consolidated Balance Sheets |

|

(Unaudited) |

| |

September 30, 2022 |

|

December 31, 2021 |

| Assets |

(in thousands, except share and per share data) |

| Current assets: |

|

|

|

|

Cash and cash equivalents |

$ |

10,738 |

|

|

$ |

2,859 |

|

Restricted cash |

|

530 |

|

|

|

628 |

|

Accounts receivable, net of allowance for credit losses of $682 and

$549, respectively |

|

134,073 |

|

|

|

70,780 |

|

Income tax receivable |

|

1,941 |

|

|

|

5,723 |

|

Inventories, net |

|

176,888 |

|

|

|

130,270 |

|

Contract assets |

|

9,592 |

|

|

|

5,749 |

|

Prepaid expenses and other |

|

2,302 |

|

|

|

2,071 |

| Total current assets |

|

336,064 |

|

|

|

218,080 |

| Property, plant and

equipment: |

|

|

|

|

Land |

|

8,537 |

|

|

|

5,016 |

|

Buildings |

|

166,193 |

|

|

|

135,861 |

|

Machinery and equipment |

|

336,123 |

|

|

|

318,259 |

|

Furniture and fixtures |

|

27,814 |

|

|

|

23,072 |

|

Total property, plant and equipment |

|

538,667 |

|

|

|

482,208 |

|

Less: Accumulated depreciation |

|

242,213 |

|

|

|

224,146 |

| Property, plant and equipment,

net |

|

296,454 |

|

|

|

258,062 |

| Intangible assets, net |

|

65,507 |

|

|

|

70,121 |

| Goodwill |

|

81,892 |

|

|

|

85,727 |

| Right of use assets |

|

1,684 |

|

|

|

16,974 |

| Other long-term assets |

|

4,242 |

|

|

|

1,216 |

| Total assets |

$ |

785,843 |

|

|

$ |

650,180 |

| |

|

|

|

| Liabilities and

Stockholders' Equity |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

48,613 |

|

|

$ |

29,020 |

|

Accrued liabilities |

|

61,780 |

|

|

|

50,206 |

|

Contract liabilities |

|

31,791 |

|

|

|

7,542 |

| Total current liabilities |

|

142,184 |

|

|

|

86,768 |

| Revolving credit facility,

long-term |

|

76,291 |

|

|

|

40,000 |

| Deferred tax liabilities |

|

31,430 |

|

|

|

31,993 |

| Other long-term

liabilities |

|

5,642 |

|

|

|

18,843 |

| New market tax credit

obligation |

|

6,438 |

|

|

|

6,406 |

| Commitments and

contingencies |

|

|

|

| Stockholders' equity: |

|

|

|

|

Preferred stock, $.001 par value, 5,000,000 shares authorized, no

shares issued |

|

— |

|

|

|

— |

|

Common stock, $.004 par value, 100,000,000 shares authorized,

53,214,971 and 52,527,985 issued and outstanding at

September 30, 2022 and December 31, 2021, respectively |

|

213 |

|

|

|

210 |

|

Additional paid-in capital |

|

87,949 |

|

|

|

81,654 |

|

Retained earnings |

|

435,696 |

|

|

|

384,306 |

| Total stockholders'

equity |

|

523,858 |

|

|

|

466,170 |

| Total liabilities and

stockholders' equity |

$ |

785,843 |

|

|

$ |

650,180 |

|

AAON, Inc. and Subsidiaries |

|

Consolidated Statements of Cash Flows |

|

(Unaudited) |

| |

Nine Months Ended September

30, |

|

|

|

2022 |

|

|

2021 |

|

| Operating

Activities |

(in thousands) |

|

Net income |

$ |

61,478 |

|

$ |

52,572 |

|

|

Adjustments to reconcile net income to net cash provided by

operating activities: |

|

|

|

Depreciation and amortization |

|

25,624 |

|

|

22,532 |

|

|

Amortization of debt issuance cost |

|

32 |

|

|

31 |

|

|

Amortization of right of use assets |

|

191 |

|

|

— |

|

|

Provision for credit losses on accounts receivable, net of

adjustments |

|

300 |

|

|

— |

|

|

Provision for excess and obsolete inventories |

|

1,380 |

|

|

378 |

|

|

Share-based compensation |

|

10,229 |

|

|

8,784 |

|

|

Gain on disposition of assets |

|

(12 |

) |

|

(15 |

) |

|

Foreign currency transaction loss (gain) |

|

42 |

|

|

(1 |

) |

|

Interest income on note receivable |

|

(17 |

) |

|

(19 |

) |

|

Deferred income taxes |

|

(563 |

) |

|

2,766 |

|

|

Changes in assets and liabilities: |

|

|

|

Accounts receivable |

|

(63,593 |

) |

|

(11,369 |

) |

|

Income tax receivable |

|

3,782 |

|

|

2,588 |

|

|

Inventories |

|

(47,998 |

) |

|

(22,712 |

) |

|

Contract assets |

|

(3,843 |

) |

|

— |

|

|

Prepaid expenses and other long-term assets |

|

(70 |

) |

|

937 |

|

|

Accounts payable |

|

18,616 |

|

|

16,390 |

|

|

Contract liabilities |

|

24,249 |

|

|

— |

|

|

Deferred revenue |

|

730 |

|

|

316 |

|

|

Accrued liabilities and other long-term liabilities |

|

12,857 |

|

|

1,525 |

|

|

Net cash provided by operating activities |

|

43,414 |

|

|

74,703 |

|

| Investing

Activities |

|

|

|

Capital expenditures |

|

(41,586 |

) |

|

(42,636 |

) |

|

Cash paid for building |

|

(22,000 |

) |

|

— |

|

|

Cash paid in business combination, net of cash acquired |

|

(249 |

) |

|

— |

|

|

Proceeds from sale of property, plant and equipment |

|

12 |

|

|

19 |

|

|

Principal payments from note receivable |

|

41 |

|

|

41 |

|

|

Net cash used in investing activities |

|

(63,782 |

) |

|

(42,576 |

) |

| Financing

Activities |

|

|

|

Borrowings under revolving credit facility |

|

151,103 |

|

|

— |

|

|

Payments under revolving credit facility |

|

(114,812 |

) |

|

— |

|

|

Principal payments on financing lease |

|

(115 |

) |

|

— |

|

|

Stock options exercised |

|

10,990 |

|

|

14,573 |

|

|

Repurchase of stock |

|

(7,943 |

) |

|

(15,014 |

) |

|

Employee taxes paid by withholding shares |

|

(978 |

) |

|

(1,537 |

) |

|

Cash dividends paid to stockholders |

|

(10,096 |

) |

|

(9,964 |

) |

|

Net cash provided by (used in) financing activities |

|

28,149 |

|

|

(11,942 |

) |

| Net increase in cash,

cash equivalents and restricted cash |

|

7,781 |

|

|

20,185 |

|

| Cash, cash equivalents

and restricted cash, beginning of period |

|

3,487 |

|

|

82,288 |

|

| Cash, cash equivalents

and restricted cash, end of period |

$ |

11,268 |

|

$ |

102,473 |

|

Use of Non-GAAP Financial

Measures

To supplement the Company’s consolidated

financial statements presented in accordance with generally

accepted accounting principles (“GAAP”), additional non-GAAP

financial measures are provided and reconciled in the following

tables. The Company believes that these non-GAAP financial

measures, when considered together with the GAAP financial

measures, provide information that is useful to investors in

understanding period-over-period operating results. The Company

believes that this non-GAAP financial measure enhances the ability

of investors to analyze the Company’s business trends and operating

performance as they are used by management to better understand

operating performance. Since EBITDA and EBITDA margin are non-GAAP

measures and are susceptible to varying calculations, EBITDA and

EBITDA margin, as presented, may not be directly comparable with

other similarly titled measures used by other companies.

EBITDA

EBITDA (as defined below) is presented herein

and reconciled from the GAAP measure of net income because of its

wide acceptance by the investment community as a financial

indicator of a company's ability to internally fund operations. The

Company defines EBITDA as net income, plus (1) depreciation and

amortization, (2) interest expense (income), net and (3) income tax

expense. EBITDA is not a measure of net income or cash flows as

determined by GAAP. EBITDA margin is defined as EBITDA as a

percentage of net sales.

The Company’s EBITDA measure provides additional

information which may be used to better understand the Company’s

operations. EBITDA is one of several metrics that the Company uses

as a supplemental financial measurement in the evaluation of its

business and should not be considered as an alternative to, or more

meaningful than, net income, as an indicator of operating

performance. Certain items excluded from EBITDA are significant

components in understanding and assessing a company's financial

performance. EBITDA, as used by the Company, may not be comparable

to similarly titled measures reported by other companies. The

Company believes that EBITDA is a widely followed measure of

operating performance and is one of many metrics used by the

Company’s management team and by other users of the Company’s

consolidated financial statements.

The following table provides a reconciliation of

net income (GAAP) to EBITDA (non-GAAP) and for the periods

indicated:

| |

Three Months Ended September

30, |

|

Nine Months Ended September

30, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

(in thousands) |

| Net income, a GAAP

measure |

$ |

27,473 |

|

|

$ |

15,581 |

|

|

$ |

61,478 |

|

|

$ |

52,572 |

|

|

Depreciation and amortization |

|

9,324 |

|

|

|

7,608 |

|

|

|

25,624 |

|

|

|

22,532 |

|

|

Interest expense, net |

|

954 |

|

|

|

10 |

|

|

|

1,694 |

|

|

|

11 |

|

|

Income tax expense |

|

8,327 |

|

|

|

4,527 |

|

|

|

17,286 |

|

|

|

11,264 |

|

| EBITDA, a non-GAAP

measure |

$ |

46,078 |

|

|

$ |

27,726 |

|

|

$ |

106,082 |

|

|

$ |

86,379 |

|

|

EBITDA margin |

|

19.0 |

% |

|

|

20.0 |

% |

|

|

16.7 |

% |

|

|

21.7 |

% |

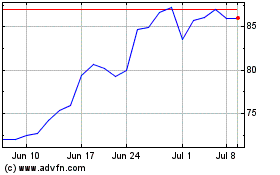

AAON (NASDAQ:AAON)

Historical Stock Chart

From Jun 2024 to Jul 2024

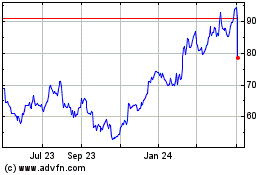

AAON (NASDAQ:AAON)

Historical Stock Chart

From Jul 2023 to Jul 2024