10x Genomics Reports Third Quarter 2019 Financial Results and Provides 2019 Revenue Guidance

November 07 2019 - 4:03PM

10x Genomics, Inc. (Nasdaq: TXG), today reported financial results

for the third quarter ended September 30, 2019.

Recent Highlights

- Revenue of $61.2 million for the third quarter of 2019,

representing a 67% increase over the third quarter of 2018

- Completed initial public offering, raising $410.8 million of

net proceeds, after underwriting discounts and commissions and

other offering expenses

“During the quarter, we had solid execution across all fronts

demonstrating the strength of our business,” said Serge Saxonov,

PhD, CEO and co-founder of 10x Genomics. “Our Chromium platform

continues to see strong momentum with increasing publications and

scientific discoveries coming out of our customers’ labs. In

September, we began taking pre-orders for our new Visium Spatial

Gene Expression Solution and are encouraged by the early interest

in this product from both new and existing customers. Following the

successful completion of our IPO, we look forward to continuing our

rapid pace of innovation to lead the transformation of biology in

the coming decades.”

Third Quarter 2019 Financial ResultsRevenue was

$61.2 million in the three months ended September 30, 2019, a 67%

increase from $36.6 million in the three months ended September 30,

2018.

Gross margin was 75% for the third quarter of 2019, as compared

to 86% in the corresponding prior year period. The decrease in

gross margin was driven by higher accrued royalties related to

ongoing litigation.

Operating expenses were $54.8 million for the third quarter of

2019, as compared to $46.3 million in the corresponding prior year

period, an increase of 18%.

Net loss was $9.6 million in the third quarter of 2019, as

compared to $15.3 million in the corresponding prior year

period.

Cash and cash equivalents were $427.4 million as of September

30, 2019. In September 2019, 10x Genomics completed an initial

public offering, raising $410.8 million net of underwriting

discounts and commissions and other offering expenses.

2019 Financial Guidance10x Genomics expects

full year 2019 revenue to be in the range of $238 million to $242

million, representing 63% to 65% growth over full year 2018

revenue.

Webcast and Conference Call Information10x

Genomics will host a conference call to discuss the third quarter

2019 financial results, business developments and outlook after

market close on November 7, 2019 at 2:00 PM Pacific Time / 5:00 PM

Eastern Time. The conference call can be accessed live over the

phone (877) 665-6515 for U.S. callers or (602) 563-8470 for

international callers (Conference ID: 5899936). A live and archived

webcast of the event will be available at

http://investors.10xGenomics.com for at least 14 days following the

event.

About 10x Genomics10x Genomics is a life

science technology company building products to interrogate,

understand and master biology to advance human health. The

company’s integrated solutions include instruments, consumables and

software for analyzing biological systems at a resolution and scale

that matches the complexity of biology. 10x

Genomics products have been adopted by researchers around the

world including 93 of the top 100 global research institutions and

90 percent of the top 20 global pharmaceutical companies, and have

been cited in over 570 research papers on discoveries ranging from

oncology to immunology and neuroscience. The company's patent

portfolio comprises more than 650 issued patents and patent

applications.

Forward Looking StatementsThis press release

contains forward-looking statements within the meaning of the

Private Securities Litigation Reform Act of 1995 as contained in

Section 27A of the Securities Act of 1933, as amended, and Section

21E of the Securities Exchange Act of 1934, as amended.

Forward-looking statements generally can be identified by the use

of forward-looking terminology such as “may,” “will,” “should,”

“expect,” “plan,” “anticipate,” “could,” “intend,” “target,”

“project” “contemplate,” “believe,” “estimate,” “predict,”

“potential” or “continue” or the negatives of these terms or

variations of them or similar terminology. These

forward-looking statements include statements regarding 10x

Genomics, Inc.’s expected financial results for the year ended

December 31, 2019, which involve risks and uncertainties that could

cause 10x Genomics, Inc.’s actual results to differ materially from

the anticipated results and expectations expressed in these

forward-looking statements. These statements are based on

management’s current expectations, forecasts, beliefs, assumptions

and information currently available to management, and actual

outcomes and results could differ materially from these statements

due to a number of factors. These and additional risks and

uncertainties that could affect 10x Genomics, Inc.’s financial and

operating results and cause actual results to differ materially

from those indicated by the forward-looking statements made in this

press release include those discussed under the captions "Risk

Factors" and "Management's Discussion and Analysis of Financial

Condition and Results of Operations" and elsewhere in the documents

10x Genomics, Inc. files with the Securities and Exchange

Commission from time to time. The forward-looking statements in

this press release are based on information available to 10x

Genomics, Inc. as of the date hereof, and 10x Genomics, Inc.

disclaims any obligation to update any forward-looking statements

provided to reflect any change in its expectations or any change in

events, conditions, or circumstances on which any such statement is

based, except as required by law. These forward-looking statements

should not be relied upon as representing 10x Genomics, Inc.’s

views as of any date subsequent to the date of this press

release.

Disclosure Information10x Genomics uses

filings with the Securities and Exchange Commission, its

website (www.10xgenomics.com), press releases, public conference

calls, public webcasts and its social media accounts as means

of disclosing material non-public information and for complying

with its disclosure obligations under Regulation FD.

ContactsInvestors:investors@10xgenomics.com

Media:media@10xgenomics.com

10x Genomics,

Inc.Condensed Consolidated Statements of

Operations and Comprehensive Loss(Unaudited)(In thousands,

except share and per share data)

|

|

Three Months Ended September 30, |

|

Nine Months Ended September 30, |

|

|

2019 |

|

|

2018 |

|

|

2019 |

|

|

2018 |

|

|

Revenue |

$ |

61,207 |

|

|

$ |

36,607 |

|

|

$ |

170,604 |

|

|

$ |

95,759 |

|

| Cost of revenue |

|

15,480 |

|

|

|

5,241 |

|

|

|

44,451 |

|

|

|

13,761 |

|

|

Gross profit |

|

45,727 |

|

|

|

31,366 |

|

|

|

126,153 |

|

|

|

81,998 |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

22,209 |

|

|

|

11,085 |

|

|

|

55,208 |

|

|

|

34,457 |

|

|

In-process research and development |

|

— |

|

|

|

16,104 |

|

|

|

— |

|

|

|

22,310 |

|

|

Selling, general and administrative |

|

32,614 |

|

|

|

19,110 |

|

|

|

92,078 |

|

|

|

61,030 |

|

|

Accrued contingent liabilities |

|

— |

|

|

|

— |

|

|

|

1,360 |

|

|

|

— |

|

|

Total operating expenses |

|

54,823 |

|

|

|

46,299 |

|

|

|

148,646 |

|

|

|

117,797 |

|

| Loss from operations |

|

(9,096 |

) |

|

|

(14,933 |

) |

|

|

(22,493 |

) |

|

|

(35,799 |

) |

| Other income (expense): |

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

481 |

|

|

|

294 |

|

|

|

986 |

|

|

|

755 |

|

|

Interest expense |

|

(708 |

) |

|

|

(659 |

) |

|

|

(2,087 |

) |

|

|

(1,721 |

) |

|

Other expenses, net |

|

(272 |

) |

|

|

(31 |

) |

|

|

(413 |

) |

|

|

(151 |

) |

|

Total other expense |

|

(499 |

) |

|

|

(396 |

) |

|

|

(1,514 |

) |

|

|

(1,117 |

) |

| Loss before provision for income

taxes |

|

(9,595 |

) |

|

|

(15,329 |

) |

|

|

(24,007 |

) |

|

|

(36,916 |

) |

| Provision for income taxes |

|

8 |

|

|

|

16 |

|

|

|

110 |

|

|

|

45 |

|

| Net loss |

$ |

(9,603 |

) |

|

$ |

(15,345 |

) |

|

$ |

(24,117 |

) |

|

$ |

(36,961 |

) |

| Other comprehensive income

(loss): |

|

|

|

|

|

|

|

|

|

|

|

|

Foreign currency translation adjustment |

|

(126 |

) |

|

|

1 |

|

|

|

(123 |

) |

|

|

17 |

|

| Comprehensive loss |

$ |

(9,729 |

) |

|

$ |

(15,344 |

) |

|

$ |

(24,240 |

) |

|

$ |

(36,944 |

) |

| Net loss per share attributable

to common stockholders, basic and diluted |

$ |

(0.33 |

) |

|

$ |

(1.13 |

) |

|

$ |

(1.21 |

) |

|

$ |

(2.80 |

) |

| Weighted-average shares of common

stock used in computing net loss per share attributable to

common |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| stockholders, basic and

diluted |

|

29,184,218 |

|

|

|

13,587,288 |

|

|

|

19,904,184 |

|

|

|

13,188,322 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

10x Genomics,

Inc.Condensed Consolidated Balance

Sheets (In thousands, except share and per share

data)

|

|

September 30,2019 |

|

December 31,2018 |

|

|

(Unaudited) |

|

|

| Assets |

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

Cash and cash equivalents |

$ |

427,436 |

|

|

$ |

65,080 |

|

|

Accounts receivable, net |

|

26,150 |

|

|

|

28,088 |

|

|

Inventory |

|

13,305 |

|

|

|

8,570 |

|

|

Prepaid expenses and other current assets |

|

7,253 |

|

|

|

4,498 |

|

|

Total current assets |

|

474,144 |

|

|

|

106,236 |

|

| Property and equipment, net |

|

46,840 |

|

|

|

11,127 |

|

| Restricted cash |

|

50,053 |

|

|

|

5,008 |

|

| Other assets |

|

1,778 |

|

|

|

1,939 |

|

|

Total assets |

$ |

572,815 |

|

|

$ |

124,310 |

|

| Liabilities,

convertible preferred stock and stockholders’ equity

(deficit) |

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

Accounts payable |

$ |

11,959 |

|

|

$ |

8,792 |

|

|

Accrued compensation and related benefits |

|

7,850 |

|

|

|

7,047 |

|

|

Accrued expenses and other current liabilities |

|

14,267 |

|

|

|

8,172 |

|

|

Term loans, current portion |

|

7,383 |

|

|

|

4,187 |

|

|

Accrued legal expenses |

|

3,695 |

|

|

|

1,769 |

|

|

Deferred revenue, current |

|

3,082 |

|

|

|

2,395 |

|

|

Total current liabilities |

|

48,236 |

|

|

|

32,362 |

|

| Term loans, noncurrent

portion |

|

22,307 |

|

|

|

25,489 |

|

| Accrued contingent

liabilities |

|

62,501 |

|

|

|

38,000 |

|

| Deferred revenue, noncurrent |

|

1,202 |

|

|

|

1,102 |

|

| Deferred rent, noncurrent |

|

16,170 |

|

|

|

3,329 |

|

| Other noncurrent liabilities |

|

951 |

|

|

|

771 |

|

|

Total liabilities |

|

151,367 |

|

|

|

101,053 |

|

| Commitments and

contingencies |

|

|

|

|

|

| Convertible preferred stock,

$0.00001 par value, no shares authorized and no shares issued and

outstanding as of September 30, 2019; 67,904,871 shares |

|

|

|

|

|

|

|

| authorized and 67,704,278

shares issued and outstanding as of December 31, 2018; aggregate

liquidation preference of $242,588 as of December 31, |

|

|

|

|

|

|

|

| 2018 |

|

— |

|

|

|

243,244 |

|

| Stockholders’ equity

(deficit): |

|

|

|

|

|

|

Preferred stock, $0.00001 par value; 100,000,000 shares

authorized, no shares issued and outstanding as of September 30,

2019 and |

|

|

|

|

|

|

|

|

December 31, 2018 |

|

— |

|

|

|

— |

|

|

Common stock, $0.00001 par value; 1,100,000,000 shares authorized

as of September 30, 2019, 96,118,804 shares issued and |

|

|

|

|

|

|

|

|

outstanding as of September 30, 2019; 190,955,000 shares

authorized as of December 31, 2018, 14,549,801 shares issued

and |

|

|

|

|

|

|

|

|

outstanding as of December 31, 2018 |

|

2 |

|

|

|

1 |

|

|

Additional paid-in capital |

|

676,839 |

|

|

|

11,165 |

|

|

Accumulated deficit |

|

(255,233 |

) |

|

|

(231,116 |

) |

|

Accumulated other comprehensive loss |

|

(160 |

) |

|

|

(37 |

) |

|

Total stockholders’ equity (deficit) |

|

421,448 |

|

|

|

(219,987 |

) |

|

Total liabilities, convertible preferred stock and stockholders’

equity (deficit) |

$ |

572,815 |

|

|

$ |

124,310 |

|

|

|

|

|

|

|

|

|

|

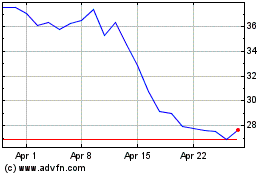

10x Genomics (NASDAQ:TXG)

Historical Stock Chart

From Jun 2024 to Jul 2024

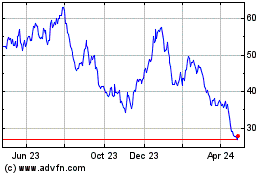

10x Genomics (NASDAQ:TXG)

Historical Stock Chart

From Jul 2023 to Jul 2024