Item 1. Reports to Stockholders.

Annual Report

November 30, 2012

Investment Adviser

Gerstein, Fisher & Associates, Inc.

565 Fifth Avenue, 27th Floor

New York, New York 10017

Phone: 800-473-1155

www.gersteinfisher.com/GFMGX

www.gersteinfisher.com/GFIGX

Table of Contents

|

LETTERS TO SHAREHOLDERS

|

3

|

|

|

|

|

EXPENSE EXAMPLES

|

7

|

|

|

|

|

INVESTMENT HIGHLIGHTS

|

9

|

|

|

|

|

SCHEDULES OF INVESTMENTS

|

13

|

|

|

|

|

STATEMENT OF ASSETS AND LIABILITIES

|

31

|

|

|

|

|

STATEMENT OF OPERATIONS

|

32

|

|

|

|

|

STATEMENTS OF CHANGES IN NET ASSETS

|

33

|

|

|

|

|

FINANCIAL HIGHLIGHTS

|

35

|

|

|

|

|

NOTES TO FINANCIAL STATEMENTS

|

37

|

|

|

|

|

REPORT OF INDEPENDENT REGISTERED

|

|

|

PUBLIC ACCOUNTING FIRM

|

46

|

|

|

|

|

BASIS FOR TRUSTEES’ APPROVAL OF

|

|

|

INVESTMENT ADVISORY AGREEMENT

|

47

|

|

|

|

|

NOTICE OF PRIVACY POLICY & PRACTICES

|

50

|

|

|

|

|

ADDITIONAL INFORMATION

|

51

|

Gerstein Fisher Multi-Factor Growth Equity Fund

Dear Fellow Shareholders,

Despite a stream of negative headlines, the US stock market (as measured by the S&P 500 Index) finished the trailing one year period ended 11/30/2012 with a powerful advance of 16.13%. The market posted strong gains early in 2012 before dropping sharply in May owing to the worsening sovereign debt crisis in Europe and slower economic growth in the US. Since June, the market has made steady gains except for a brief, sharp drop after the elections on November 6. It is important to recall the role that we envision the Gerstein Fisher Multi-Factor Growth Equity Fund playing within an investor’s overall diversified portfolio. The fund is designed to be an all-cap US growth equity portfolio with additional exposures to targeted, systematic risk factors that include small companies, value and momentum, while seeking to avoid non-systematic risks such as industry or company overexposures. While we seek to capture a larger share of the equity market’s upside, it needs to be understood that this additional return is fundamentally linked to additional risk and volatility.

As specified in fund documentation, the portfolio is as fully invested as possible in domestic equities from the all cap growth universe––as defined by the Russell 3000 Growth Index––with approximately 80% of holdings in large cap companies and the remaining 20% in small cap companies. Total fund assets as of 11/30/2012 were approximately $124.4 million.

As of 11/30/2012, the portfolio held 278 equity securities, with no individual holdings constituting more than 5% of the total portfolio. Portfolio industry and sector weightings were held as close to the benchmark as possible after the required risk factor tilts were implemented. This is a direct consequence of controlling for undesired exposures while constraining the portfolio to consist of higher-momentum, more value oriented, and smaller securities within the all cap growth universe. Any industry and sector over- and under-weights are driven by these underlying factor exposures.

During the one year ended 11/30/2012, GFMGX had a total return of 14.91% compared to 14.63% for the Russell 3000 Growth Index. Multi-Factor Performance attribution revealed that in these past 12 months (11/30/2011 to 11/30/2012), the higher exposure to more value-oriented stocks resulted in a positive contribution of 0.83% relative to the Russell 3000 Growth Index. The fund’s exposure to smaller securities detracted 0.22% and the exposure to higher momentum securities added 0.41% relative to the Russell 3000 Growth Index over the same time period. Since the fund’s inception in December 2009, we have been pleased that the fund has tracked our overall expectations. Because our process is based on a scientifically grounded approach, we believe that the Gerstein Fisher Multi-Factor Growth Equity Fund should be well positioned to deliver a positive investment experience in the US domestic growth equity space, along with exposure to often-overlooked factors within the growth universe.

Our investment approach at Gerstein Fisher is grounded in the efficiency of capital markets, rigorous academic research and sound economic logic. Our experience of over

20 years demonstrates that the ideas and principles upon which we have built our firm are sound. We look forward to writing to you again in six months, and we thank you for your continued trust and partnership.

Sincerely,

Gregg S. Fisher, CFA, CFP

®

President & Chief Investment Officer

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. Small- and medium-capitalization companies tend to have limited liquidity and greater price volatility than large-capitalization companies. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. Securities with “momentum” have recently had above average returns and may be more volatile than a broad cross-section of securities.

Diversification does not assure a profit or protect against a loss in a declining market

The Russell 3000

®

Growth Index measures the performance of the broad growth segment of the U.S. equity universe. The S&P 500

®

Index measures the performance of 500 of the largest capitalization stocks in the U.S. equity universe. Book Value is net asset value calculated as total assets minus intangible assets and liabilities. Ratio of book-to-market value is a ratio used to find the value of a company by comparing the book value of a firm to its market value.

Must be preceded or accompanied by a prospectus.

The Gerstein Fisher Multi-Factor Growth Equity Fund is distributed by Quasar Distributors, LLC.

Gerstein Fisher Multi-Factor International Growth Equity Fund

Dear Fellow Shareholders,

During the trailing one-year period ended 11/30/2012, international developed markets (as measured by the MSCI EAFE Index) rose by 13.16%, despite recessions in Europe and economic weakness in Japan.

Given the recent volatility of international equity markets in general, it is important to recall the role that we envision the Gerstein Fisher Multi-Factor International Growth Equity Fund playing within an investor’s overall globally diversified portfolio. The fund is designed to be a large-cap developed-market growth equity portfolio with additional exposures to targeted, systematic risk factors, while seeking to avoid non-systematic risks such as industry or company overexposures. While we seek to capture a larger share of the equity market’s upside, it needs to be understood that this additional return is fundamentally linked to additional risk and volatility.

As specified in fund documentation, the portfolio is as fully invested as possible in international developed equities from the large cap growth universe, as defined by the MSCI EAFE Growth Index. Total fund assets as of 11/30/2012 were approximately $67.8 million.

As of 11/30/2012, the portfolio held approximately 239 equity securities, with no individual holdings constituting more than 5% of the total portfolio. Portfolio industry and sector weightings were held as close to the benchmark as possible after the required risk factor tilts were implemented. This is a direct consequence of controlling for undesired exposures while constraining the portfolio to consist of higher-momentum, more value oriented, and smaller securities within the large cap growth universe. Any industry and sector over- and under-weights are driven by these underlying factor exposures. In addition to the risk factor tilts, another source of deviation of the portfolio from the MSCI EAFE Growth Index is due to the difference in country weightings. Our fund sets a soft cap on any single country’s exposure within the portfolio at 10%. This country cap redistributes weight from the larger countries in the index, such as Japan and the U.K., to smaller countries such as Norway and Finland.

The risk decomposition of the portfolio relative to the MSCI EAFE Growth Index was also in line with the way the fund is managed. Aside from the targeted risk factor exposures and the country caps, the other risk factors were constrained to be neutral relative to the benchmark. The three largest contributors of active risk are due to the differences in country exposures, currency exposures and risk-factor exposures. In total, over 80% of the active risk comes from these common factors and less than 20% is explained by asset selection. Again, this is a result of the quantitative approach used by the fund in creating a well-diversified portfolio that contains intentional exposures to certain risk factors and limits the allocation to any single country.

Since the inception of the fund (01/27/2012) through 11/30/2012, GFIGX had a total return of 8.20% compared to 7.62% for the MSCI EAFE Growth Index. Multi-factor model performance attribution revealed that the greatest source of return deviation relative to the benchmark, i.e., the MSCI EAFE Growth Index, was from the fund’s stated risk-factor exposures. During the same time period (01/27/2012 to 11/30/2012), the fund’s exposure to higher momentum resulted in a contribution of 0.46% relative to the benchmark index and being invested in more value-oriented stocks had a contribution of 0.04% relative to the benchmark. In the same period, the exposure of the fund to smaller securities added 0.04% relative to the benchmark.

Since the fund’s inception in January 2012, we have been pleased that the fund has tracked our overall expectations. Because our process is based on a scientifically grounded approach, we believe that the Gerstein Fisher Multi-Factor International Growth Equity Fund should be well positioned to deliver a positive investment experience in the international-developed growth equity space, along with exposure to often-overlooked factors within the growth universe.

We look forward to writing to you again in six months, and we thank you for your continued trust and partnership.

Sincerely,

Gregg S. Fisher, CFA, CFP

®

President & Chief Investment Officer

Opinions expressed are subject to change at any time, are not guaranteed and should not be considered investment advice.

Past performance does not guarantee future results.

Mutual fund investing involves risk. Principal loss is possible. The Fund invests in foreign securities, which involve greater volatility and political, economic and currency risks and differences in accounting methods. These risks are greater for emerging markets. Small- and medium-capitalization companies tend to have limited liquidity and greater price volatility than large capitalization companies. Growth stocks typically are more volatile than value stocks; however, value stocks have a lower expected growth rate in earnings and sales. Securities with “momentum” have recently had above average returns and may be more volatile than a broad cross-section of securities. Options on securities may be subject to greater fluctuations in value than an investment in the underlying securities. The investment in options is not suitable for all investors. The risks of investments in derivatives include imperfect correlation between the value of these instruments and the underlying assets; risks of default by the other party to the derivative transactions; risks that the transactions may result in losses that partially or completely offset gains in portfolio positions; and risks that the derivative transactions may not be liquid.

Diversification does not assure a profit or protect against a loss in a declining market.

MSCI EAFE Index measures the performance of international non-US developed stocks (as defined by MSCI) that comprise the top 85% of the market cap of the investable universe (as defined by MSCI). The MSCI EAFE Growth Index consists of the growth portion (growth being a measure of price relative to book/value/cash flow) of the MSCI EAFE Index. An investment cannot be made directly in an index.

Must be preceded or accompanied by a prospectus

.

The Gerstein Fisher Multi-Factor International Growth Equity Fund is distributed by Quasar Distributors, LLC.

Gerstein Fisher Funds

Expense Examples

(Unaudited)

As a shareholder of the Funds, you incur two types of costs: (1) transaction costs, including redemption fees, and (2) ongoing costs, including advisory fees and other Fund expenses. This Example is intended to help you understand your ongoing costs (in dollars) of investing in the Funds, and to compare these costs with the ongoing costs of investing in other mutual funds. The Examples are based on an investment of $1,000 invested at the beginning of the period and held for the entire period (6/1/12–11/30/12).

Actual Expenses

The first lines of the following tables provide information about actual account values and actual expenses. Although the Funds charge no sales load, you will be assessed fees for outgoing wire transfers, returned checks and stop payment orders at prevailing rates charged by U.S. Bancorp Fund Services, LLC, the Funds’ transfer agent. If you request that a redemption be made by wire transfer, currently a $15.00 fee is charged by the Funds’ transfer agent. You will be charged a redemption fee equal to 1.00% of the net amount of the redemption if you redeem your shares of the Funds within sixty days of purchase. Individual Retirement Accounts (“IRA”) will be charged a $15.00 annual maintenance fee. To the extent the Funds invest in shares of exchange-traded funds or other investment companies as part of their investment strategies, you will indirectly bear your proportionate share of any fees and expenses charged by the underlying funds in which the Funds invest in addition to the expenses of the Funds. Actual expenses of the underlying funds are expected to vary among the various underlying funds. These expenses are not included in the Example. The Example includes, but is not limited to, advisory fees, fund administration fees and accounting, custody and transfer agent fees. You may use the information in this line, together with the amount you invested, to estimate the expenses that you paid over the period. Simply divide your account value by $1,000 (for example, an $8,600 account value divided by $1,000 = 8.6), then multiply the result by the number in the first line under the heading entitled “Expenses Paid During Period” to estimate the expenses you paid on your account during this period.

Hypothetical Example for Comparison Purposes

The second lines of the following tables provide information about hypothetical account values and hypothetical expenses based on the Funds’ actual expense ratios and an assumed rate of return of 5% per year before expenses, which is not the Funds’ actual return. The hypothetical account values and expenses may not be used to estimate the actual ending account balance or expenses you paid for the period. You may use this information to compare the ongoing costs of investing in the Funds and other funds. To do so, compare this 5% hypothetical example with the 5% hypothetical examples that appear in the shareholder reports of other funds. Please note that the expenses shown in the table are meant to highlight your ongoing costs only and do not reflect any transactional costs, such as sales charges (loads), redemption fees or exchange fees. Therefore, the second line of the table is useful in comparing ongoing costs only, and will not help you determine the relative total costs of owning different funds. In addition, if these transactional costs were included, your costs would have been higher.

Gerstein Fisher Funds

Expense Examples (Continued)

(Unaudited)

Gerstein Fisher Multi-Factor Growth Equity Fund

|

|

|

|

Expenses Paid

|

|

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

June 1, 2012 -

|

|

|

June 1, 2012

|

November 30, 2012

|

November 30, 2012*

|

|

Actual

|

$1,000.00

|

$1,091.10

|

$6.06

|

|

Hypothetical (5% return

|

|

|

|

|

before expenses)

|

$1,000.00

|

$1,091.20

|

$5.86

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.16%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

|

Gerstein Fisher Multi-Factor International Growth Equity Fund

|

|

|

|

Expenses Paid

|

|

|

Beginning

|

Ending

|

During Period

|

|

|

Account Value

|

Account Value

|

June 1, 2012 -

|

|

|

June 1, 2012

|

November 30, 2012

|

November 30, 2012*

|

|

Actual

|

$1,000.00

|

$1,165.90

|

$7.31

|

|

Hypothetical (5% return

|

|

|

|

|

before expenses)

|

$1,000.00

|

$1,018.25

|

$6.81

|

|

*

|

Expenses are equal to the Fund’s annualized expense ratio of 1.35%, multiplied by the average account value over the period, multiplied by 183/366 (to reflect the one-half year period).

|

Gerstein Fisher Multi-Factor Growth Equity Fund

Investment Highlights

(Unaudited)

Under normal market conditions, at least 80% of the Fund’s net assets will be invested in equity securities. The Fund seeks to invest primarily in common stocks of domestic companies of any size. Equity securities may also include preferred stocks, exchange-traded funds (“ETFs”) that invest in equities, individual stock options and options on indices. At any one time, the combined value of options may be up to 5% of the Fund’s net assets. The Fund may invest up to 20% of its net assets in the securities of foreign issuers that are publicly traded in the United States or on foreign exchanges. Additionally, the Fund may sell shares of securities short for hedging purposes.

Allocation of Portfolio Holdings

(% of Investments)

Average Annual Total Returns as of November 30, 2012

|

|

|

Gerstein Fisher

|

|

|

Russell 3000

|

|

|

|

|

Multi-Factor

|

|

|

Growth

|

|

|

|

|

Growth Equity

|

|

|

Index

|

|

|

|

|

|

|

|

|

|

|

|

|

One Year

|

|

|

14.91

|

%

|

|

|

14.63

|

%

|

|

|

|

|

|

|

|

|

|

|

|

Since Inception (12/31/09)

|

|

|

10.87

|

%

|

|

|

11.74

|

%

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted

Continued

Gerstein Fisher Multi-Factor Growth Equity Fund

Investment Highlights (Continued)

(Unaudited)

Performance data current to the most recent month-end may be obtained by calling 800-473-1155. The Fund imposes a 1.00% redemption fee of the net amount of the redemption on shares held less than 60 days. Performance quoted does not reflect the redemption fee. If reflected, total returns would be reduced.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

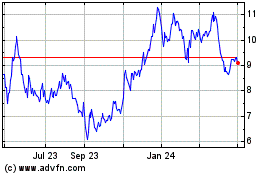

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The Russell 3000 Growth Index measures the performance of the broad growth segment of the U.S. equity universe. It includes those Russell 3000 companies with higher price-to-book ratios and higher forecasted growth values. One cannot invest directly in an index.

|

|

|

Growth of $10,000 Investment

|

|

|

|

|

|

Gerstein Fisher Multi-Factor International Growth Equity Fund

Investment Highlights

(Unaudited)

Under normal market conditions, at least 80% of the Fund’s net assets will be invested in equity securities. The Fund seeks to invest primarily in common stocks of international companies of any size, including foreign securities and securities of U.S. companies. The Fund may invest in foreign securities which may include securities of companies in emerging markets or less developed countries. Equity securities include common stocks, preferred stocks, exchange-traded funds (“ETFs”) that invest in equities, individual stock options and options on indices.

Allocation of Portfolio Holdings

(% of Investments)

Total Returns as of November 30, 2012

|

|

|

Gerstein Fisher

|

|

|

|

|

|

|

|

Multi-Factor

|

|

|

|

|

|

|

|

International

|

|

|

MSCI EAFE

|

|

|

|

|

Growth Equity

|

|

|

Growth Index

|

|

|

|

|

|

|

|

|

|

|

|

|

Since Inception (1/27/12)

|

|

|

8.20

|

%

|

|

|

7.62

|

%

|

Performance data quoted represents past performance and does not guarantee future results. The investment return and principal value of an investment will fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original cost. Current performance of the Fund may be lower or higher than the performance quoted. Performance data current to the most recent month-end may be obtained by calling

Continued

Gerstein Fisher Multi-Factor International Growth Equity Fund

Investment Highlights (Continued)

(Unaudited)

800-473-1155. The Fund imposes a 1.00% redemption fee of the net amount of the redemption on shares held less than 60 days. Performance quoted does not reflect the redemption fee. If reflected, total returns would be reduced.

Short-term performance, in particular, is not a good indication of the Fund’s future performance, and an investment should not be made based solely on historical returns.

Investment performance reflects fee waivers in effect. In the absence of such waivers, total return would be reduced.

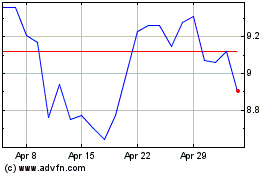

The returns shown assume reinvestment of Fund distributions and do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares. The following chart illustrates performance of a hypothetical investment made in the Fund and a broad-based securities index on the Fund’s inception date. The graph does not reflect any future performance.

The MSCI EAFE Growth Index consists of the growth portion (growth being a measure of price relative to book/value/cash flow) of the MSCI EAFE Index. One cannot invest directly in an index.

|

|

|

Growth of $10,000 Investment

|

|

|

|

|

|

Gerstein Fisher Multi-Factor Growth Equity Fund

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

COMMON STOCKS – 97.34%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Accommodation – 0.09%

|

|

|

|

|

|

|

|

Wyndham Worldwide Corp.

|

|

|

2,287

|

|

|

$

|

112,269

|

|

|

|

|

|

|

|

|

|

|

|

|

Administrative and Support Services – 0.22%

|

|

|

|

|

|

|

|

|

|

AECOM Technology Corp. (a)

|

|

|

5,387

|

|

|

|

121,692

|

|

|

Expedia, Inc.

|

|

|

1,808

|

|

|

|

111,843

|

|

|

Liquidity Services, Inc. (a)

|

|

|

1,102

|

|

|

|

45,248

|

|

|

|

|

|

|

|

|

|

278,783

|

|

|

Air Transportation – 0.45%

|

|

|

|

|

|

|

|

|

|

Alaska Air Group, Inc. (a)

|

|

|

7,454

|

|

|

|

318,658

|

|

|

SkyWest, Inc.

|

|

|

5,255

|

|

|

|

60,905

|

|

|

Spirit Airlines, Inc. (a)

|

|

|

2,001

|

|

|

|

33,577

|

|

|

United Continental Holdings, Inc. (a)

|

|

|

7,153

|

|

|

|

144,634

|

|

|

|

|

|

|

|

|

|

557,774

|

|

|

Ambulatory Health Care Services – 0.25%

|

|

|

|

|

|

|

|

|

|

Air Methods Corp. (a)

|

|

|

2,820

|

|

|

|

307,859

|

|

|

|

|

|

|

|

|

|

|

|

|

Amusement, Gambling, and Recreation Industries – 0.68%

|

|

|

|

|

|

|

|

|

|

Six Flags Entertainment Corp.

|

|

|

3,181

|

|

|

|

195,568

|

|

|

Walt Disney Co.

|

|

|

13,007

|

|

|

|

645,928

|

|

|

|

|

|

|

|

|

|

841,496

|

|

|

Animal Production and Aquaculture – 0.33%

|

|

|

|

|

|

|

|

|

|

Cal-Maine Foods, Inc.

|

|

|

8,879

|

|

|

|

408,168

|

|

|

|

|

|

|

|

|

|

|

|

|

Apparel Manufacturing – 0.94%

|

|

|

|

|

|

|

|

|

|

Carter’s, Inc. (a)

|

|

|

1,829

|

|

|

|

97,010

|

|

|

PVH Corp.

|

|

|

2,866

|

|

|

|

328,415

|

|

|

Under Armour, Inc. (a)

|

|

|

564

|

|

|

|

29,232

|

|

|

VF Corp.

|

|

|

4,416

|

|

|

|

708,812

|

|

|

|

|

|

|

|

|

|

1,163,469

|

|

|

Beverage and Tobacco Product Manufacturing – 5.65%

|

|

|

|

|

|

|

|

|

|

Altria Group, Inc.

|

|

|

7,548

|

|

|

|

255,198

|

|

|

Boston Beer Co., Inc. (a)

|

|

|

897

|

|

|

|

101,334

|

|

|

Brown-Forman Corp.

|

|

|

660

|

|

|

|

46,319

|

|

|

Coca-Cola Co.

|

|

|

30,562

|

|

|

|

1,158,911

|

|

|

Coca-Cola Enterprises, Inc.

|

|

|

8,406

|

|

|

|

262,099

|

|

|

Lorillard, Inc.

|

|

|

305

|

|

|

|

36,954

|

|

|

Monster Beverage Corp. (a)

|

|

|

9,854

|

|

|

|

512,901

|

|

|

PepsiCo, Inc.

|

|

|

12,730

|

|

|

|

893,773

|

|

|

Philip Morris International, Inc.

|

|

|

36,802

|

|

|

|

3,307,763

|

|

|

Reynolds American, Inc.

|

|

|

10,241

|

|

|

|

447,737

|

|

|

|

|

|

|

|

|

|

7,022,989

|

|

The accompanying notes are an integral part of these financial statements.

Gerstein Fisher Multi-Factor Growth Equity Fund

|

Schedule of Investments

(Continued)

|

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

Broadcasting (except Internet) – 2.25%

|

|

|

|

|

|

|

|

Comcast Corp.

|

|

|

20,305

|

|

|

$

|

754,940

|

|

|

DIRECTV (a)

|

|

|

987

|

|

|

|

49,054

|

|

|

Discovery Communications, Inc. (a)

|

|

|

8,562

|

|

|

|

517,230

|

|

|

Liberty Media Corporation – Liberty Capital (a)

|

|

|

13,405

|

|

|

|

1,474,416

|

|

|

|

|

|

|

|

|

|

2,795,640

|

|

|

Building Material and Garden

|

|

|

|

|

|

|

|

|

|

Equipment and Supplies Dealers – 2.48%

|

|

|

|

|

|

|

|

|

|

Home Depot, Inc.

|

|

|

25,892

|

|

|

|

1,684,792

|

|

|

Lumber Liquidators Holdings, Inc. (a)

|

|

|

9,997

|

|

|

|

536,639

|

|

|

Sherwin-Williams Co.

|

|

|

5,688

|

|

|

|

867,534

|

|

|

|

|

|

|

|

|

|

3,088,965

|

|

|

Chemical Manufacturing – 10.75%

|

|

|

|

|

|

|

|

|

|

Abbott Laboratories

|

|

|

25,569

|

|

|

|

1,661,985

|

|

|

Alexion Pharmaceuticals, Inc. (a)

|

|

|

15,675

|

|

|

|

1,505,114

|

|

|

CF Industries Holdings, Inc.

|

|

|

7,624

|

|

|

|

1,631,764

|

|

|

Church & Dwight Co., Inc.

|

|

|

734

|

|

|

|

39,746

|

|

|

Colgate-Palmolive Co.

|

|

|

5,036

|

|

|

|

546,406

|

|

|

E.I. du Pont de Nemours & Co.

|

|

|

579

|

|

|

|

24,978

|

|

|

Eastman Chemical Co.

|

|

|

4,158

|

|

|

|

253,014

|

|

|

Endo Health Solutions, Inc. (a)

|

|

|

906

|

|

|

|

25,966

|

|

|

Gilead Sciences, Inc. (a)

|

|

|

4,464

|

|

|

|

334,800

|

|

|

Hi-Tech Pharmacal Co., Inc. (a)

|

|

|

3,987

|

|

|

|

120,407

|

|

|

Innophos Holdings, Inc.

|

|

|

6,209

|

|

|

|

297,473

|

|

|

Johnson & Johnson

|

|

|

7,636

|

|

|

|

532,458

|

|

|

LyondellBasell Industries NV (b)

|

|

|

19,919

|

|

|

|

990,572

|

|

|

Medivation, Inc. (a)

|

|

|

36,664

|

|

|

|

1,912,027

|

|

|

Olin Corp.

|

|

|

9,574

|

|

|

|

198,469

|

|

|

PDL BioPharma, Inc.

|

|

|

29,730

|

|

|

|

234,867

|

|

|

Perrigo Co.

|

|

|

4,284

|

|

|

|

443,394

|

|

|

Questcor Pharmaceuticals, Inc.

|

|

|

15,964

|

|

|

|

414,266

|

|

|

Regeneron Pharmaceuticals, Inc. (a)

|

|

|

5,394

|

|

|

|

952,311

|

|

|

Salix Pharmaceuticals Ltd. (a)

|

|

|

773

|

|

|

|

33,123

|

|

|

Stepan Co.

|

|

|

8,589

|

|

|

|

858,471

|

|

|

The Mosaic Co.

|

|

|

494

|

|

|

|

26,706

|

|

|

Watson Pharmaceuticals, Inc. (a)

|

|

|

876

|

|

|

|

77,097

|

|

|

Westlake Chemical Corp.

|

|

|

3,544

|

|

|

|

256,621

|

|

|

|

|

|

|

|

|

|

13,372,035

|

|

|

Clothing and Clothing Accessories Stores – 1.60%

|

|

|

|

|

|

|

|

|

|

Buckle, Inc.

|

|

|

704

|

|

|

|

36,010

|

|

|

DSW, Inc.

|

|

|

505

|

|

|

|

34,355

|

|

|

Genesco, Inc. (a)

|

|

|

1,911

|

|

|

|

105,736

|

|

|

Limited Brands, Inc.

|

|

|

4,088

|

|

|

|

213,189

|

|

|

Ross Stores, Inc.

|

|

|

15,222

|

|

|

|

866,436

|

|

The accompanying notes are an integral part of these financial statements.

Gerstein Fisher Multi-Factor Growth Equity Fund

|

Schedule of Investments

(Continued)

|

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

Clothing and Clothing Accessories Stores – 1.60% (Continued)

|

|

|

|

|

|

|

|

TJX Companies, Inc.

|

|

|

16,468

|

|

|

$

|

730,191

|

|

|

|

|

|

|

|

|

|

1,985,917

|

|

|

Computer and Electronic Product Manufacturing – 13.88%

|

|

|

|

|

|

|

|

|

|

Apple, Inc.

|

|

|

9,655

|

|

|

|

5,650,878

|

|

|

Atmel Corp. (a)

|

|

|

7,982

|

|

|

|

44,619

|

|

|

Atrion Corp.

|

|

|

149

|

|

|

|

29,441

|

|

|

Cirrus Logic, Inc. (a)

|

|

|

18,618

|

|

|

|

583,116

|

|

|

Dell, Inc.

|

|

|

13,115

|

|

|

|

126,429

|

|

|

EMC Corp. (a)

|

|

|

28,987

|

|

|

|

719,457

|

|

|

FEI Co.

|

|

|

6,278

|

|

|

|

345,478

|

|

|

Fossil, Inc. (a)

|

|

|

395

|

|

|

|

34,144

|

|

|

Harris Corp.

|

|

|

9,836

|

|

|

|

463,571

|

|

|

Intel Corp.

|

|

|

24,881

|

|

|

|

486,921

|

|

|

International Business Machines Corp.

|

|

|

26,816

|

|

|

|

5,096,917

|

|

|

Loral Space & Communications, Inc.

|

|

|

2,870

|

|

|

|

244,151

|

|

|

Mettler-Toledo International, Inc. (a)

|

|

|

196

|

|

|

|

36,670

|

|

|

OSI Systems, Inc. (a)

|

|

|

4,626

|

|

|

|

283,481

|

|

|

QUALCOMM, Inc.

|

|

|

22,074

|

|

|

|

1,404,347

|

|

|

Skyworks Solutions, Inc. (a)

|

|

|

1,446

|

|

|

|

32,752

|

|

|

St. Jude Medical, Inc.

|

|

|

742

|

|

|

|

25,436

|

|

|

Stratasys, Inc. (a)

|

|

|

3,287

|

|

|

|

246,361

|

|

|

Teradata Corp. (a)

|

|

|

1,742

|

|

|

|

103,614

|

|

|

TTM Technologies, Inc. (a)

|

|

|

11,530

|

|

|

|

104,001

|

|

|

Viacom, Inc.

|

|

|

12,856

|

|

|

|

663,498

|

|

|

Western Digital Corp.

|

|

|

15,807

|

|

|

|

528,586

|

|

|

|

|

|

|

|

|

|

17,253,868

|

|

|

Couriers and Messengers – 0.02%

|

|

|

|

|

|

|

|

|

|

United Parcel Service, Inc.

|

|

|

356

|

|

|

|

26,027

|

|

|

|

|

|

|

|

|

|

|

|

|

Credit Intermediation and Related Activities – 2.68%

|

|

|

|

|

|

|

|

|

|

American Express Co.

|

|

|

5,699

|

|

|

|

318,574

|

|

|

Bank of the Ozarks, Inc.

|

|

|

8,300

|

|

|

|

263,774

|

|

|

Cash America International, Inc.

|

|

|

1,597

|

|

|

|

59,472

|

|

|

Discover Financial Services

|

|

|

11,203

|

|

|

|

466,157

|

|

|

Visa, Inc.

|

|

|

9,636

|

|

|

|

1,442,606

|

|

|

Wells Fargo & Co.

|

|

|

14,808

|

|

|

|

488,812

|

|

|

World Acceptance Corp. (a)

|

|

|

3,951

|

|

|

|

288,463

|

|

|

|

|

|

|

|

|

|

3,327,858

|

|

|

Data Processing, Hosting and Related Services – 0.62%

|

|

|

|

|

|

|

|

|

|

AOL, Inc. (a)

|

|

|

17,030

|

|

|

|

638,966

|

|

|

Automatic Data Processing, Inc.

|

|

|

1,746

|

|

|

|

99,103

|

|

|

DST Systems, Inc.

|

|

|

521

|

|

|

|

30,030

|

|

|

|

|

|

|

|

|

|

768,099

|

|

The accompanying notes are an integral part of these financial statements.

Gerstein Fisher Multi-Factor Growth Equity Fund

|

Schedule of Investments

(Continued)

|

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

Electrical Equipment, Appliance, and

|

|

|

|

|

|

|

|

Component Manufacturing – 1.08%

|

|

|

|

|

|

|

|

Cooper Industries PLC (b)

|

|

|

6,378

|

|

|

$

|

475,161

|

|

|

Emerson Electric Co.

|

|

|

606

|

|

|

|

30,439

|

|

|

Generac Holdings, Inc.

|

|

|

24,225

|

|

|

|

790,462

|

|

|

Hubbell, Inc.

|

|

|

516

|

|

|

|

43,473

|

|

|

|

|

|

|

|

|

|

1,339,535

|

|

|

Electronics and Appliance Stores – 0.15%

|

|

|

|

|

|

|

|

|

|

Conn’s, Inc. (a)

|

|

|

6,625

|

|

|

|

187,355

|

|

|

|

|

|

|

|

|

|

|

|

|

Fabricated Metal Product Manufacturing – 0.96%

|

|

|

|

|

|

|

|

|

|

Chart Industries, Inc. (a)

|

|

|

5,825

|

|

|

|

352,296

|

|

|

Sturm Ruger & Co, Inc.

|

|

|

9,130

|

|

|

|

534,927

|

|

|

Timken Co.

|

|

|

6,868

|

|

|

|

309,403

|

|

|

|

|

|

|

|

|

|

1,196,626

|

|

|

Food and Beverage Stores – 0.48%

|

|

|

|

|

|

|

|

|

|

Casey’s General Stores, Inc.

|

|

|

7,151

|

|

|

|

353,260

|

|

|

Harris Teeter Supermarkets, Inc.

|

|

|

697

|

|

|

|

26,479

|

|

|

Whole Foods Market, Inc.

|

|

|

2,334

|

|

|

|

217,902

|

|

|

|

|

|

|

|

|

|

597,641

|

|

|

Food Manufacturing – 1.72%

|

|

|

|

|

|

|

|

|

|

B & G Foods, Inc.

|

|

|

10,163

|

|

|

|

296,556

|

|

|

Bunge Ltd. (b)

|

|

|

12,122

|

|

|

|

886,846

|

|

|

Darling International, Inc. (a)

|

|

|

8,629

|

|

|

|

145,571

|

|

|

Hain Celestial Group, Inc. (a)

|

|

|

1,256

|

|

|

|

75,699

|

|

|

Ingredion, Inc.

|

|

|

8,975

|

|

|

|

582,926

|

|

|

Kraft Foods Group, Inc. (a)

|

|

|

1,138

|

|

|

|

51,460

|

|

|

Mondelez International, Inc.

|

|

|

1,050

|

|

|

|

27,185

|

|

|

Omega Protein Corp. (a)

|

|

|

12,223

|

|

|

|

76,027

|

|

|

|

|

|

|

|

|

|

2,142,270

|

|

|

Food Services and Drinking Places – 1.80%

|

|

|

|

|

|

|

|

|

|

Chipotle Mexican Grill, Inc. (a)

|

|

|

226

|

|

|

|

59,614

|

|

|

Hyatt Hotels Corp. (a)

|

|

|

17,496

|

|

|

|

638,603

|

|

|

McDonald’s Corp.

|

|

|

11,920

|

|

|

|

1,037,517

|

|

|

Starbucks Corp.

|

|

|

1,180

|

|

|

|

61,207

|

|

|

Yum! Brands, Inc.

|

|

|

6,535

|

|

|

|

438,368

|

|

|

|

|

|

|

|

|

|

2,235,309

|

|

|

Funds, Trusts, and Other Financial Vehicles – 0.29%

|

|

|

|

|

|

|

|

|

|

AMERIGROUP Corp. (a)

|

|

|

2,103

|

|

|

|

193,097

|

|

|

WellCare Health Plans, Inc. (a)

|

|

|

3,444

|

|

|

|

166,242

|

|

|

|

|

|

|

|

|

|

359,339

|

|

|

Furniture and Related Product Manufacturing – 0.37%

|

|

|

|

|

|

|

|

|

|

Patrick Industries, Inc. (a)

|

|

|

3,315

|

|

|

|

57,615

|

|

The accompanying notes are an integral part of these financial statements.

Gerstein Fisher Multi-Factor Growth Equity Fund

|

Schedule of Investments

(Continued)

|

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

Furniture and Related Product Manufacturing – 0.37% (Continued)

|

|

|

|

|

|

|

|

Select Comfort Corp. (a)

|

|

|

14,992

|

|

|

$

|

401,486

|

|

|

|

|

|

|

|

|

|

459,101

|

|

|

Gasoline Stations – 0.71%

|

|

|

|

|

|

|

|

|

|

Susser Holdings Corp. (a)

|

|

|

24,178

|

|

|

|

882,739

|

|

|

|

|

|

|

|

|

|

|

|

|

General Merchandise Stores – 4.35%

|

|

|

|

|

|

|

|

|

|

Dollar General Corp. (a)

|

|

|

24,970

|

|

|

|

1,248,500

|

|

|

Dollar Tree, Inc. (a)

|

|

|

12,906

|

|

|

|

538,696

|

|

|

Macy’s, Inc.

|

|

|

6,271

|

|

|

|

242,688

|

|

|

O’Reilly Automotive, Inc. (a)

|

|

|

3,794

|

|

|

|

356,940

|

|

|

Pricesmart, Inc.

|

|

|

397

|

|

|

|

30,775

|

|

|

Target Corp.

|

|

|

3,762

|

|

|

|

237,495

|

|

|

Tractor Supply Co.

|

|

|

1,899

|

|

|

|

170,188

|

|

|

Wal-Mart Stores, Inc.

|

|

|

35,793

|

|

|

|

2,577,812

|

|

|

|

|

|

|

|

|

|

5,403,094

|

|

|

Health and Personal Care Stores – 1.48%

|

|

|

|

|

|

|

|

|

|

CVS Caremark Corporation

|

|

|

10,581

|

|

|

|

492,122

|

|

|

Express Scripts Holding Co. (a)

|

|

|

10,163

|

|

|

|

547,278

|

|

|

McKesson Corp.

|

|

|

2,877

|

|

|

|

271,790

|

|

|

Owens & Minor, Inc.

|

|

|

7,291

|

|

|

|

199,628

|

|

|

Ulta Salon Cosmetics & Fragrance, Inc.

|

|

|

3,225

|

|

|

|

323,403

|

|

|

|

|

|

|

|

|

|

1,834,221

|

|

|

Heavy and Civil Engineering Construction – 0.29%

|

|

|

|

|

|

|

|

|

|

KBR, Inc.

|

|

|

2,855

|

|

|

|

79,369

|

|

|

MasTec, Inc. (a)

|

|

|

6,928

|

|

|

|

158,236

|

|

|

Primoris Services Corp.

|

|

|

8,294

|

|

|

|

120,097

|

|

|

|

|

|

|

|

|

|

357,702

|

|

|

Insurance Carriers and Related Activities – 4.83%

|

|

|

|

|

|

|

|

|

|

Allied World Assurance Co. Holdings AG (b)

|

|

|

37,741

|

|

|

|

3,063,438

|

|

|

Amtrust Financial Services, Inc.

|

|

|

12,347

|

|

|

|

355,841

|

|

|

Homeowners Choice, Inc.

|

|

|

30,552

|

|

|

|

635,787

|

|

|

Travelers Companies, Inc.

|

|

|

9,883

|

|

|

|

699,914

|

|

|

Validus Holdings Ltd. (b)

|

|

|

26,892

|

|

|

|

953,590

|

|

|

WellPoint, Inc.

|

|

|

5,259

|

|

|

|

293,978

|

|

|

|

|

|

|

|

|

|

6,002,548

|

|

|

Leather and Allied Product Manufacturing – 0.02%

|

|

|

|

|

|

|

|

|

|

NIKE, Inc.

|

|

|

299

|

|

|

|

29,147

|

|

|

|

|

|

|

|

|

|

|

|

|

Machinery Manufacturing – 2.55%

|

|

|

|

|

|

|

|

|

|

3D Systems Corp. (a)

|

|

|

2,184

|

|

|

|

97,647

|

|

|

Applied Materials, Inc.

|

|

|

21,678

|

|

|

|

232,605

|

|

|

Cascade Corp.

|

|

|

601

|

|

|

|

39,047

|

|

The accompanying notes are an integral part of these financial statements.

Gerstein Fisher Multi-Factor Growth Equity Fund

|

Schedule of Investments

(Continued)

|

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

Machinery Manufacturing – 2.55% (Continued)

|

|

|

|

|

|

|

|

Caterpillar, Inc.

|

|

|

1,664

|

|

|

$

|

141,839

|

|

|

Coinstar, Inc. (a)

|

|

|

4,672

|

|

|

|

219,771

|

|

|

Cummins, Inc.

|

|

|

5,390

|

|

|

|

529,082

|

|

|

Deere & Co.

|

|

|

2,936

|

|

|

|

246,770

|

|

|

Flowserve Corp.

|

|

|

2,471

|

|

|

|

342,357

|

|

|

KLA-Tencor Corp.

|

|

|

9,973

|

|

|

|

453,472

|

|

|

National Oilwell Varco, Inc.

|

|

|

3,253

|

|

|

|

222,180

|

|

|

Oil States International, Inc. (a)

|

|

|

991

|

|

|

|

70,084

|

|

|

Roper Industries, Inc.

|

|

|

5,141

|

|

|

|

573,376

|

|

|

|

|

|

|

|

|

|

3,168,230

|

|

|

Management of Companies and Enterprises – 0.43%

|

|

|

|

|

|

|

|

|

|

EchoStar Corp. (a)

|

|

|

17,235

|

|

|

|

540,490

|

|

|

|

|

|

|

|

|

|

|

|

|

Merchant Wholesalers, Durable Goods – 2.52%

|

|

|

|

|

|

|

|

|

|

Anixter International, Inc.

|

|

|

4,305

|

|

|

|

262,949

|

|

|

Arrow Electronics, Inc. (a)

|

|

|

17,635

|

|

|

|

657,080

|

|

|

Covidien PLC (b)

|

|

|

11,101

|

|

|

|

645,079

|

|

|

Dorman Products, Inc. (a)

|

|

|

15,605

|

|

|

|

533,691

|

|

|

Henry Schein, Inc. (a)

|

|

|

361

|

|

|

|

29,158

|

|

|

LKQ Corp. (a)

|

|

|

17,220

|

|

|

|

377,462

|

|

|

Tessco Technologies, Inc.

|

|

|

6,697

|

|

|

|

145,794

|

|

|

WW Grainger, Inc.

|

|

|

2,478

|

|

|

|

480,782

|

|

|

|

|

|

|

|

|

|

3,131,995

|

|

|

Merchant Wholesalers, Nondurable Goods – 0.32%

|

|

|

|

|

|

|

|

|

|

Monsanto Co.

|

|

|

328

|

|

|

|

30,042

|

|

|

Nu Skin Enterprises, Inc.

|

|

|

7,037

|

|

|

|

319,480

|

|

|

Procter & Gamble Co.

|

|

|

735

|

|

|

|

51,325

|

|

|

|

|

|

|

|

|

|

400,847

|

|

|

Mining (except Oil and Gas) – 0.01%

|

|

|

|

|

|

|

|

|

|

Cliffs Natural Resources, Inc.

|

|

|

604

|

|

|

|

17,365

|

|

|

|

|

|

|

|

|

|

|

|

|

Miscellaneous Manufacturing – 1.89%

|

|

|

|

|

|

|

|

|

|

3M Co.

|

|

|

711

|

|

|

|

64,665

|

|

|

Becton Dickinson & Co.

|

|

|

375

|

|

|

|

28,751

|

|

|

Cooper Companies, Inc.

|

|

|

2,497

|

|

|

|

237,065

|

|

|

Edwards Lifesciences Corp. (a)

|

|

|

2,017

|

|

|

|

175,015

|

|

|

Estee Lauder Companies, Inc.

|

|

|

521

|

|

|

|

30,348

|

|

|

Intuitive Surgical, Inc. (a)

|

|

|

1,826

|

|

|

|

965,955

|

|

|

NewMarket Corp.

|

|

|

3,080

|

|

|

|

817,278

|

|

|

WR Grace & Co. (a)

|

|

|

529

|

|

|

|

34,634

|

|

|

|

|

|

|

|

|

|

2,353,711

|

|

The accompanying notes are an integral part of these financial statements.

Gerstein Fisher Multi-Factor Growth Equity Fund

|

Schedule of Investments

(Continued)

|

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

Miscellaneous Store Retailers – 0.13%

|

|

|

|

|

|

|

|

1-800-Flowers.com, Inc. (a)

|

|

|

38,757

|

|

|

$

|

121,309

|

|

|

PetSmart, Inc.

|

|

|

606

|

|

|

|

42,820

|

|

|

|

|

|

|

|

|

|

164,129

|

|

|

Motion Picture and Sound Recording Industries – 0.19%

|

|

|

|

|

|

|

|

|

|

Cinemark Holdings, Inc.

|

|

|

8,730

|

|

|

|

237,456

|

|

|

|

|

|

|

|

|

|

|

|

|

Motor Vehicle and Parts Dealers – 0.11%

|

|

|

|

|

|

|

|

|

|

Advance Auto Parts, Inc.

|

|

|

388

|

|

|

|

28,382

|

|

|

America’s Car-Mart, Inc. (a)

|

|

|

2,000

|

|

|

|

73,800

|

|

|

AutoZone, Inc. (a)

|

|

|

74

|

|

|

|

28,399

|

|

|

|

|

|

|

|

|

|

130,581

|

|

|

Nonstore Retailers – 1.44%

|

|

|

|

|

|

|

|

|

|

Amazon.com, Inc. (a)

|

|

|

1,939

|

|

|

|

488,725

|

|

|

eBay, Inc. (a)

|

|

|

1,700

|

|

|

|

89,794

|

|

|

GNC Holdings, Inc.

|

|

|

32,137

|

|

|

|

1,128,973

|

|

|

Systemax, Inc. (a)

|

|

|

7,574

|

|

|

|

78,012

|

|

|

|

|

|

|

|

|

|

1,785,504

|

|

|

Oil and Gas Extraction – 0.28%

|

|

|

|

|

|

|

|

|

|

Concho Resources, Inc. (a)

|

|

|

316

|

|

|

|

25,362

|

|

|

Contango Oil & Gas Co. (a)

|

|

|

6,017

|

|

|

|

246,636

|

|

|

Halcon Resources Corp. (a)

|

|

|

8,904

|

|

|

|

55,027

|

|

|

Occidental Petroleum Corp.

|

|

|

327

|

|

|

|

24,594

|

|

|

|

|

|

|

|

|

|

351,619

|

|

|

Other Information Services – 2.59%

|

|

|

|

|

|

|

|

|

|

BGC Partners, Inc.

|

|

|

10,956

|

|

|

|

39,442

|

|

|

Google, Inc. (a)

|

|

|

4,562

|

|

|

|

3,185,964

|

|

|

|

|

|

|

|

|

|

3,225,406

|

|

|

Paper Manufacturing – 1.67%

|

|

|

|

|

|

|

|

|

|

Clearwater Paper Corp. (a)

|

|

|

11,271

|

|

|

|

448,022

|

|

|

International Paper Co.

|

|

|

5,915

|

|

|

|

219,683

|

|

|

Kimberly-Clark Corp.

|

|

|

2,178

|

|

|

|

186,698

|

|

|

Rock-Tenn Co.

|

|

|

8,964

|

|

|

|

583,019

|

|

|

Schweitzer-Mauduit International, Inc.

|

|

|

17,148

|

|

|

|

642,535

|

|

|

|

|

|

|

|

|

|

2,079,957

|

|

|

Petroleum and Coal Products Manufacturing – 2.40%

|

|

|

|

|

|

|

|

|

|

Chevron Corp.

|

|

|

16,579

|

|

|

|

1,752,235

|

|

|

CVR Energy, Inc. (a)

|

|

|

5,556

|

|

|

|

254,131

|

|

|

Exxon Mobil Corp.

|

|

|

5,053

|

|

|

|

445,371

|

|

|

HollyFrontier Corp.

|

|

|

10,911

|

|

|

|

494,596

|

|

|

Western Refining, Inc.

|

|

|

1,189

|

|

|

|

34,540

|

|

|

|

|

|

|

|

|

|

2,980,873

|

|

The accompanying notes are an integral part of these financial statements.

Gerstein Fisher Multi-Factor Growth Equity Fund

|

Schedule of Investments

(Continued)

|

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

Plastics and Rubber Products Manufacturing – 0.17%

|

|

|

|

|

|

|

|

Armstrong World Industries, Inc.

|

|

|

3,296

|

|

|

$

|

166,480

|

|

|

Jarden Corp.

|

|

|

961

|

|

|

|

50,847

|

|

|

|

|

|

|

|

|

|

217,327

|

|

|

Primary Metal Manufacturing – 0.15%

|

|

|

|

|

|

|

|

|

|

Handy & Harman Ltd. (a)

|

|

|

11,465

|

|

|

|

161,313

|

|

|

Precision Castparts Corp.

|

|

|

169

|

|

|

|

30,993

|

|

|

|

|

|

|

|

|

|

192,306

|

|

|

Professional, Scientific, and Technical Services – 4.10%

|

|

|

|

|

|

|

|

|

|

Accenture PLC (b)

|

|

|

2,481

|

|

|

|

168,510

|

|

|

Alliance Data Systems Corp. (a)

|

|

|

3,572

|

|

|

|

508,974

|

|

|

Amgen, Inc.

|

|

|

6,858

|

|

|

|

608,990

|

|

|

Biogen Idec, Inc. (a)

|

|

|

1,573

|

|

|

|

234,519

|

|

|

Booz Allen Hamilton Holdings Corp.

|

|

|

12,866

|

|

|

|

180,253

|

|

|

CACI International, Inc. (a)

|

|

|

7,703

|

|

|

|

394,008

|

|

|

Cerner Corp. (a)

|

|

|

540

|

|

|

|

41,699

|

|

|

IHS, Inc. (a)

|

|

|

398

|

|

|

|

36,672

|

|

|

Mastercard, Inc.

|

|

|

1,669

|

|

|

|

815,607

|

|

|

Mistras Group, Inc. (a)

|

|

|

5,028

|

|

|

|

109,057

|

|

|

priceline.com, Inc. (a)

|

|

|

1,838

|

|

|

|

1,218,888

|

|

|

SolarWinds, Inc. (a)

|

|

|

4,941

|

|

|

|

276,844

|

|

|

Teledyne Technologies, Inc. (a)

|

|

|

1,655

|

|

|

|

104,265

|

|

|

Towers Watson & Co.

|

|

|

4,292

|

|

|

|

226,961

|

|

|

WEX, Inc. (a)

|

|

|

2,346

|

|

|

|

168,818

|

|

|

|

|

|

|

|

|

|

5,094,065

|

|

|

Publishing Industries (except Internet) – 5.68%

|

|

|

|

|

|

|

|

|

|

Adobe Systems, Inc. (a)

|

|

|

2,986

|

|

|

|

103,345

|

|

|

Catamaran Corp. (a)(b)

|

|

|

13,898

|

|

|

|

676,694

|

|

|

Ellie Mae, Inc. (a)

|

|

|

41,232

|

|

|

|

1,023,378

|

|

|

ePlus, Inc. (a)

|

|

|

3,643

|

|

|

|

147,323

|

|

|

Microsoft Corp.

|

|

|

94,364

|

|

|

|

2,511,970

|

|

|

News Corp.

|

|

|

48,564

|

|

|

|

1,196,617

|

|

|

Oracle Corp.

|

|

|

42,407

|

|

|

|

1,361,264

|

|

|

TIBCO Software, Inc. (a)

|

|

|

1,539

|

|

|

|

38,552

|

|

|

|

|

|

|

|

|

|

7,059,143

|

|

|

Rail Transportation – 1.52%

|

|

|

|

|

|

|

|

|

|

CSX Corp.

|

|

|

10,694

|

|

|

|

211,314

|

|

|

Kansas City Southern

|

|

|

396

|

|

|

|

30,947

|

|

|

Union Pacific Corp.

|

|

|

13,449

|

|

|

|

1,651,269

|

|

|

|

|

|

|

|

|

|

1,893,530

|

|

|

Rental and Leasing Services – 0.37%

|

|

|

|

|

|

|

|

|

|

Aircastle Ltd. (b)

|

|

|

22,939

|

|

|

|

260,816

|

|

The accompanying notes are an integral part of these financial statements.

Gerstein Fisher Multi-Factor Growth Equity Fund

|

Schedule of Investments

(Continued)

|

November 30, 2012

|

|

|

Shares

|

|

|

Value

|

|

|

|

|

|

|

|

|

|

|

Rental and Leasing Services – 0.37% (Continued)

|

|

|

|

|

|

|

|

Textainer Group Holdings Ltd. (b)

|

|

|

6,611

|

|

|

$

|

199,520

|

|

|

|

|

|

|

|

|

|

460,336

|

|

|

Retailing – 0.08%

|

|

|

|

|

|

|

|

|

|

Cabela’s, Inc. (a)

|

|

|

2,041

|

|

|

|

97,499

|

|

|

|

|

|

|

|

|

|

|

|

|

Securities, Commodity Contracts, and Other

|

|

|

|

|

|

|

|

|

|

Financial Investments and Related Activities – 1.94%

|

|

|

|

|

|

|

|

|

|

BlackRock, Inc.

|

|

|

3,844

|

|

|

|

757,421

|

|

|

GAMCO Investors, Inc.

|

|

|

3,147

|

|

|

|

154,203

|

|

|

NASDAQ OMX Group, Inc.

|

|

|

9,402

|

|

|

|

227,810

|

|

|

Stifel Financial Corp. (a)

|

|

|

1,635

|

|

|

|

49,737

|

|

|

Virtus Investment Partners, Inc. (a)

|

|

|

10,641

|

|

|

|

1,222,225

|

|

|

|

|

|

|

|

|

|

2,411,396

|

|

|

Support Activities for Mining – 0.22%

|

|

|

|

|

|

|

|

|

|

Atwood Oceanics, Inc. (a)

|

|

|

3,476

|

|

|

|

159,896

|

|

|

Rowan Companies PLC (a)(b)

|

|

|

3,601

|

|

|

|

114,260

|

|

|

|

|

|

|

|

|

|

274,156

|

|

|

Support Activities for Transportation – 0.02%

|

|

|

|

|

|

|

|

|

|

Tidewater, Inc.

|

|

|

588

|

|

|

|

26,378

|

|

|

|

|

|

|

|

|

|

|

|

|

Telecommunications – 1.58%

|

|

|

|

|

|

|

|

|

|

Equinix, Inc. (a)

|

|

|

3,994

|

|

|

|

741,925

|

|

|

j2 Global, Inc.

|

|

|

5,728

|

|

|

|

173,215

|

|

|

Time Warner Cable, Inc.

|

|

|

1,310

|

|

|

|

124,306

|

|

|

Verizon Communications, Inc.

|

|

|

21,073

|

|

|

|

929,741

|

|

|

|

|

|

|

|

|

|

1,969,187

|

|

|

Transportation Equipment Manufacturing – 3.16%

|

|

|

|

|

|

|

|

|

|

Arctic Cat, Inc. (a)

|

|

|

8,944

|

|

|

|

336,563