Swiss Franc Strengthens As SNB Rate Cut Hopes Fade

June 04 2024 - 9:54AM

RTTF2

The Swiss franc appreciated against its major counterparts in

the New York session on Tuesday, as Switzerland's consumer prices

posted a steady increase in May.

The consumer price index grew 1.4 percent on yearly basis, the

same rate as seen in April.

On a monthly basis, consumer prices advanced 0.3 percent due to

several factors including rising prices for housing rentals and for

international package holidays.

Core consumer prices gained 0.2 percent on month, taking the

annual inflation to 1.2 percent in May.

The data reduced the probability of a rate cut when the Swiss

National Bank meets this month.

The franc firmed to a 1-1/2-month high of 0.9674 against the

euro, 2-1/2-month high of 0.8890 against the greenback and a 3-week

high of 1.1368 against the pound, from its early lows of 0.9781,

0.8972 and 1.1483, respectively. The franc is poised to challenge

resistance around 0.95 against the euro, 0.87 against the greenback

and 1.11 against the pound.

The franc recovered to 174.11 against the yen, from an early

5-day low of 173.21. This may be compared to a previous fresh

5-week high of 174.75. Next key resistance for the currency is seen

around the 175.00 level.

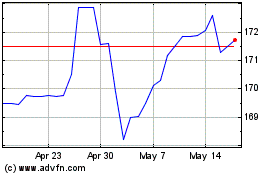

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jun 2024 to Jul 2024

CHF vs Yen (FX:CHFJPY)

Forex Chart

From Jul 2023 to Jul 2024