Commodity Currencies Slide Amid Risk Aversion

July 24 2024 - 11:11PM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Thursday amid risk aversion, following the broadly

negative cues from global markets overnight, led by steep declines

for technology stocks, which mirrored their peers on the tech-heavy

Nasdaq, after a few big-name U.S. tech firms reported disappointing

quarterly numbers. Lingering concerns over slowing growth in the

world's second largest economy, China, also kept investors

nervous.

Traders also remained cautious ahead of the release of key U.S.

GDP and inflation data later in the week, which could have a

significant impact on the outlook for interest rates.

In the Asian trading now, the Australian dollar fell to more

than a 3-month lows of 1.6574 against the euro and 99.71 against

the yen, from yesterday's closing quotes of 1.6466 and 101.26,

respectively. If the aussie extends its downtrend, it is likely to

find support around 1.67 against the euro and 98.00 against the

yen.

Against the U.S., the Canada and the New Zealand dollars, the

aussie slid to nearly a 3-month low of 0.6540, nearly a 2-1/2-month

low of 0.9039 and a 1-week low of 1.1060 from Wednesday's closing

quotes of 0.6581, 0.9084 and 1.1094, respectively. The aussie may

test support near 0.64 against the greenback, 0.88 against the

loonie and 1.08 against the kiwi.

The NZ dollar fell to nearly a 3-month low of 0.5913 against the

U.S. dollar and more than a 3-month low of 90.10 against the yen,

from Wednesday's closing quotes of 0.5930 and 91.23, respectively.

If the kiwi extends its downtrend, it is likely to find support

around 0.58 against the greenback and 89.00 against the yen.

Against the euro, the kiwi edged down to 1.8333 from yesterday's

closing value of 1.8273. On the downside, 1.84 is seen as the next

support level for the kiwi.

The Canadian dollar fell to more than a 3-month low of 1.3822

against the U.S. dollar and more than a 4-month low of 110.17

against the yen, from Wednesday's closing quotes of 1.3807 and

111.43, respectively. If the loonie extends its downtrend, it is

likely to find support around 1.39 against the greenback and 109.00

against the yen.

Against the euro, the loonie edged down to 1.4988 from

yesterday's closing value of 1.4963. The next possible downside

target for the loonie is seen around the 1.51 region.

Looking ahead, Germany's Ifo business sentiment survey data for

July, European Central Bank's euro area monetary aggregates data

for June and the Confederation of British Industry's industrial

trends survey results for July are slated for release in the

European session.

In the New York session, Canada average weekly earnings data for

May, U.S. durable goods orders for June, GDP growth rate for the

second quarter, weekly jobless claims data, U.S. core PCE price

index for the second quarter and U.S. Kansas Fed manufacturing

index for July are slated for release.

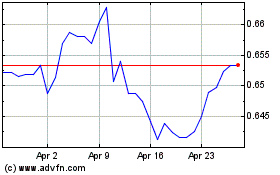

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Jun 2024 to Jul 2024

AUD vs US Dollar (FX:AUDUSD)

Forex Chart

From Jul 2023 to Jul 2024