Sustained financial performance despite macro-economic context and competitive environment nationwide

July 22 2022 - 1:00AM

Sustained financial performance despite macro-economic context and

competitive environment nationwide

Press releaseEmbargo until 22 July 2022 at

7:00 am Regulated information – Inside information

Financial information for the first semester 2022

Sustained

financial performance

despite macro-economic context and

competitive environment

nationwide

- Mobile postpaid customer base +3.5% yoy / Cable

customer base +13.9% yoy

- H1 Revenues +3.3% yoy / H1 Retail service revenues

+6.4% yoy

- H1 EBITDAal +3.5% yoy

H1 Operational

Highlights

- The

commercial performance remained positive especially in

postpaid, despite the limited growth of the market

compared with last year and a competitive environment

nationwide.

- Thanks to the

success of the Go portfolio and the effectiveness of the “Go

Extreme Special Edition” promotion, as well as the hey! Portfolio,

33k new mobile postpaid were added bringing total

subscribers to 2.8m (+3.5% yoy)

- Cable

customer base increased by 22k, with an ending base of

417k customers (+13.9% yoy) within a context of the end of the

Covid boost.

- B2C

convergent ARPO decreased by

0.6% yoy to

€73.2, mainly because of

the discounts provided in the mobile tariffs, as well as the

growing Love Duo customer base.

- Mobile only

postpaid ARPO increased

by 1.5% yoy to

€19.9 mainly explained by the increase in

customer roaming.

| Orange

Belgium: key operating figures |

|

|

|

|

|

H1 2021 |

H1 2022 |

change |

| Mobile postpaid

customer base (in ‘000) |

2 681 |

2 775 |

3.5% |

| Net adds (in

‘000) |

41 |

33 |

-19.7% |

| Mobile only

postpaid ARPO (€ per month) |

19.6 |

19.9 |

1.5% |

| Cable customer

base (in ‘000) |

366 |

417 |

13.9% |

| Net adds (in

‘000) |

41 |

22 |

-44.9% |

| B2C convergent

ARPO (€ per month) |

73.6 |

73.2 |

-0.6% |

H1 Financial

Highlights

- Revenues

reached 677.3 million

euros, increasing by

3.3%, despite the loss of Mobile Vikings

revenues as from Q2 2022. Retail service revenues continued to grow

by 6.4%, mainly thanks to higher convergent service revenues

(+13.0% yoy)

- EBITDAaL

increased by 3.5% yoy to 166.8

million euros,

mainly driven by higher retail service revenues, supported by

effective cost management despite the growing pressure linked to

the macro-economic context. Stable EBITDAaL margin at 24.6%

- eCapex grew

by 5.8% yoy to

86.0 million

euros, mainly explained by the

acceleration of the implementation of the network sharing with

Proximus and the deployment of 5G

| Orange

Belgium Group: key financial figures |

|

|

|

| |

|

|

|

|

in €m |

H1 2021 |

H1 2022 |

change |

|

Revenues |

655.9 |

677.3 |

3.3% |

| Retail service

revenues |

460.8 |

490.5 |

6.4% |

|

|

|

|

|

|

EBITDAaL |

161.2 |

166.8 |

3.5% |

| margin as % of

revenues |

24.6% |

24.6% |

6 bp |

| eCapex1 |

-81.3 |

-86.0 |

5.8% |

|

Operating cash flow2 |

79.9 |

80.8 |

1.2% |

|

|

|

|

|

| Net financial

debt |

124.4 |

65.3 |

|

- eCapex excluding licence fees. In H1 2021 Orange Belgium paid

10.9 million euros on licence fees. In H1 2022 Orange Belgium paid

10.9 million euros on licence fees.

- Operating cash flow defined as EBITDAaL – eCapex excluding

licence fees

Xavier Pichon, Chief Executive Officer,

commented:

The events in the world during the first half of

this year have had major impact on the macro-economic situation

with unprecedented inflation and rising energy costs. In addition,

we notice that the market has been slowing down with fewer market

movements in a competitive environment nationwide. Nevertheless,

Orange Belgium has been able to provide positive commercial

results, consolidating our position in mobile and improving our

market share in broadband. Proof of the company’s strong

resilience.

Following the spectrum auction in June, we were

able to obtain the maximum of key 5G spectrum available. This

spectrum will allow us to deploy a multi-gigabit 5G network with

outstanding coverage and capacity. In combination with the

switch-off of 3G and later 2G, this will allow optimum usage of the

spectrum providing the optimal services for the customer. In

addition, during the first half of this year, we already made the

5G network available to our postpaid customers and we announced the

opening of a second 5G Lab in the heart of Liège. True to our

commitment to act as an engaged and responsible operator, we opened

the Orange Digital Center in Brussels, free and open to all to

promote learning.

Antoine Chouc, Chief Financial Officer,

stated:

As last year, we have been able to deliver solid

financial results, both in revenues as well as in EBITDAaL. Despite

the loss of Mobile Vikings, our revenues have improved over the

first half of the year. The growth comes mainly from the positive

commercial performance and the review of our fixed and mobile

tariff plans.

In a context of macro-economic uncertainties

with rising inflation and increasing energy costs we have been able

to control our costs successfully. Indirect costs have grown at a

slower pace than inflation over the same period. Consequently, we

were able to increase our EBITDAaL by 3.5% compared with the same

period of last year.

We remain cautiously optimistic and confirm our

guidance for the year 2022, with low single-digit revenue growth,

EBITDAaL between 350 million euros and 370 million euros, and

eCapex between 210 million euros and 230 million euros.

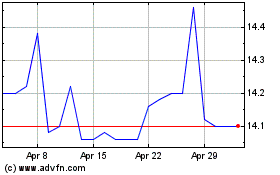

Orange Belgium (EU:OBEL)

Historical Stock Chart

From Oct 2024 to Nov 2024

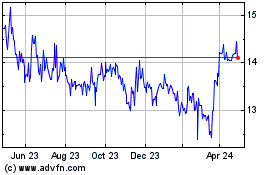

Orange Belgium (EU:OBEL)

Historical Stock Chart

From Nov 2023 to Nov 2024