Marie Brizard Wine & Spirits: 3rd quarter 2022 revenues

October 27 2022 - 12:11PM

Marie Brizard Wine & Spirits: 3rd quarter 2022 revenues

Charenton-le-Pont,

27 October 2022

3rd

quarter 2022 revenues

MBWS posts nine-month 2022 revenues of

€135.0m, up 9.8% versus 2021

- France

posts YTD growth in strategic portfolio brands, including:

- recovery in the off-trade business,

driven by the current decline in promotional pressure and supply

issues among competitors; in particular, this temporarily benefited

William Peel sales, which were up in the third quarter in a spirits

market still in decline versus 2021;

- a sharp upswing in on-trade sales

during the quarter, as 2022 is the first season unaffected by

health restrictions since 2019.

- Strong

growth in international sales, up 12.8% versus

2021 driven by all markets, including:

- growth in Europe, particularly in

the UK, and in the Bulgarian and Lithuanian domestic markets,

despite the Russia-Ukraine conflict;

- sustained performance by all

strategic brands, particularly Marie Brizard and Cognac Gautier,

primarily in South Korea and Australia;

- decline in US sales of Sobieski

vodka in a market segment that remains highly competitive.

- The inflationary

surge in raw material prices and energy costs has intensified in

the second half, forcing the Group to continue to raise its prices

with customers. This situation has prompted the Group to adopt a

prudent stance again with regard to its business over the coming

months.

NB: All revenue growth figures reported herein

are at constant exchange rates and consolidation scope, unless

otherwise stated.

Marie Brizard

Wine & Spirits (Euronext: MBWS) today

announces its unaudited revenues for the third quarter of 2022,

covering the period from 1 July to 30 September 2022, and for the

first nine months of 2022.

Nine-month 2022 revenues:

|

€m |

9M 2021 |

Like-for-like change |

Currency impact |

9M 2022 |

LFL change(excl. currency

impact) |

Reported growth (incl.

currency impact) |

|

France |

56.8 |

3.6 |

- |

60.4 |

+6.3% |

+6.3% |

|

International |

65.1 |

8.3 |

1.2 |

74.6 |

+12.8% |

+14.6% |

|

TOTAL MBWS GROUP |

121.9 |

11.9 |

1.2 |

135.0 |

+9.8% |

+10.7% |

Q3 2022 revenues

|

€m |

Q3 2021 |

Like-for-like change |

Currency impact |

Q3 2022 |

LFL change(exc. currency

impact) |

Reported growth (incl.

currency impact) |

|

France |

17.7 |

2.6 |

- |

20.3 |

+14.7% |

+14.7% |

|

International |

23.1 |

4.5 |

0.6 |

28.2 |

+19.4% |

+22.0% |

|

TOTAL MBWS GROUP |

40.8 |

7.1 |

0.6 |

48.5 |

+17.3% |

+18.9% |

Breakdown by cluster

France cluster

The France cluster posted revenues of €60.4m for

the nine months ended 30 September 2022, up 6.3% versus the

previous year. This performance reflects in particular the

continued improvement in on-trade sales in the third quarter

coupled with robust sales in the off-trade market. Consequently Q3

revenues were up 14.7% versus 2021.

Revenue growth continued for the Group’s main

brands over the first nine months of 2022, in particular Marie

Brizard, Sobieski and San José. Our brands are positioned in line

with customer needs in the current inflationary environment. In a

declining market for under-12-year blended whisky (down 7.5% for

the first nine months of 2022), William Peel maintained its sales

volumes compared to the first nine months of 2021 thanks to a

competitive positioning still bolstered by the new listing obtained

in the second half of 2021.

However, in view of the ongoing severe supply

chain disruption and sharp price rises for raw materials,

particularly in the glass industry, the Group continues to adopt

allocation measures per brand based on available volumes. Likewise,

the necessary sales policy adjustments announced previously are

being maintained and will continue in order to adapt to this

changing environment.

International cluster

The International cluster posted nine-month 2022

revenues of €74.6m, up 12.8% versus 2021 at constant exchange

rates.

Western Europe enjoyed a favourable economic

climate over the first nine months, with on-trade growth confirmed

versus 2021, still driven by Marie Brizard.

In Spain, nine-month revenues were up 12.8%

versus 2021, mainly driven by strong subcontracting business and a

sustained performance by strategic brands, primarily Marie Brizard

and William Peel.

Scandinavia posted nine-month revenues up 30.6%,

also driven by Marie Brizard sales.

The Baltic States posted nine-month revenues up

13.3%, including a slight upturn in the third quarter mainly due to

brand performance driven by a proactive pricing policy and a

buoyant bulk market.

Bulgaria confirmed its growth trend with third

quarter revenues up 18.9% across the entire brand portfolio

(spirits and wines) in both domestic and export markets.

In Poland, Gautier and Marie Brizard sales rose

sharply in the first nine months of 2022 despite a slowdown in the

third quarter.

In the United States, nine-month revenues

continued to fall short of 2021 performance, still impacted by a

highly competitive vodka market (Sobieski) and inventory adjustment

by our local distributor. Marie Brizard and Gautier continue to

grow in this market.

Brazil revenues edged up in Q3 2022, mainly

driven by local brands underpinned by a proactive pricing

policy.

In Asia Pacific, the positive trend in the first

half of 2022 was confirmed in the third quarter by sustained

performance, particularly in South Korea and Australia.

Outlook

Ongoing increases in raw material prices,

surging energy costs and continued volatility in supplier

production availability are factors we have already mentioned that

must be taken into account when assessing the level and performance

of the Group’s business activities.

If they continue, these adverse factors could

have an impact on the Group’s ability to supply all of its

customers (in France and abroad) and on potential flexibility in

consumer demand upset by sharp price rises.

Despite the level of business growth since the

start of the year, the prevailing situation obliges the Group to

continue to proactively adapt pricing policies with customers. The

Group will therefore continue to adopt a prudent stance with regard

to its business level over the coming months, usually an important

period as the year draws to a close, and perhaps also at the start

of 2023.

Financial calendar

- Q4 and full-year 2022 revenues: 16

February 2023

| Contact

Relations Investisseurs

et Actionnaires

Groupe MBWSEmilie

Drexleremilie.drexler@mbws.comTél : +33 1 43 91 62 40 |

Contact PresseImage

Sept Claire Doligez - Laurence Maurycdoligez@image7.fr –

lmaury@image7.frTél : +33 1 53 70 74 70 |

About Marie

Brizard Wine & Spirits Marie

Brizard Wine & Spirits is a wine and spirits group based in

Europe and the United States. Marie Brizard Wine & Spirits

stands out for its expertise, a combination of brands with a long

tradition and a resolutely innovative spirit. Since the birth of

the Maison Marie Brizard in 1755, the Marie Brizard Wine &

Spirits Group has developed its brands in a spirit of modernity

while respecting their origins. Marie Brizard Wine & Spirits is

committed to offering its customers bold and trusted brands full of

flavour and experiences. The Group now has a rich portfolio of

leading brands in their market segments, including William Peel,

Sobieski, Marie Brizard and Cognac Gautier. Marie Brizard Wine

& Spirits is listed on Compartment B of Euronext Paris

(FR0000060873 - MBWS) and is part of the EnterNext© PEA-PME 150

index.

- PR MBWS - Net Sales - Q3 and Sep YTD 2022 final

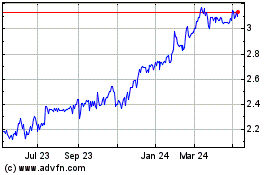

Marie Brizard Wine And S... (EU:MBWS)

Historical Stock Chart

From Oct 2024 to Nov 2024

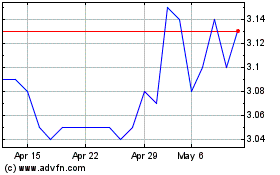

Marie Brizard Wine And S... (EU:MBWS)

Historical Stock Chart

From Nov 2023 to Nov 2024