Signify reports first quarter sales of EUR 1.8 billion, CSG of 6.4%

and an operational profitability of 10.5%

Press Release

April 29, 2022

Signify reports first quarter sales of EUR 1.8 billion,

CSG of 6.4% and an operational profitability of 10.5%

First quarter

20221

- Signify's installed base of connected light points increased

from 96 million in Q4 21 to 100 million in Q1 22

- Sales of EUR 1,788 million; nominal sales increase of 11.8% and

CSG of 6.4%

- LED-based sales represented 84% of total sales (Q1 21:

82%)

- Adj. EBITA margin of 10.5% (Q1 21: 10.8%)

- Net income of EUR 87 million (Q1 21: EUR 60 million)

- Free cash flow of EUR -189 million (Q1 21: EUR 168

million)

- Net debt/EBITDA ratio of 1.6x (Q1 21: 1.4x)

Eindhoven, the Netherlands – Signify (Euronext:

LIGHT), the world leader in lighting, today announced the company’s

first quarter 2022 results.

“Our main priority in the first quarter was to safeguard and

support our Ukrainian employees and their families to the best

extent possible. We are happy to report that all of our people are

safe, and we were proud to see the very strong engagement from our

colleagues and the Signify Foundation in supporting the people and

communities so desperately affected by the war. Investments in

Russia were stopped and all new business was paused since February

25th. We were also impacted by the return of lockdowns in China

towards the end of the quarter. Throughout these challenging

conditions, Signify continued to see strong momentum in the

professional channel in the US and in most of the other

geographies. We grew by 6.4% in the first quarter and maintained a

strong double-digit adjusted EBITA margin. Global supply chain

disruptions, which brought longer supplier lead times and higher

levels of inventory, have negatively affected our cash flow. We

expect this to positively readjust as the year progresses,” said

CEO, Eric Rondolat.

“Given the world’s growing need for sustainable, connected and

energy efficient lighting, we remain more focused than ever on our

strategic priorities. For the remainder of the year, we anticipate

a lower performance from our consumer-focused business due to

inflationary headwinds. At the same time, we still expect strong

demand for our professional business, driven by ongoing investments

in the energy transition. Moving forward, our guidance for the year

remains within reach, assuming the Chinese market and global supply

chain dynamics do not deteriorate further.”

Brighter Lives, Better World 2025

In the first quarter of the year, Signify was on track for most

of its Brighter Lives, Better World 2025 sustainability program

commitments that contribute to doubling its positive impact on the

environment and society.

- Double

the pace of the Paris Agreement:

Cumulative carbon reduction over the value chain is on track.

This is mainly due to the accelerated shift to energy efficient and

connected LED lighting, which decreases carbon emissions in the use

phase, and Signify's ongoing efforts to decarbonize its supply

chain.

- Double our Circular

revenues to 32%:

Circular revenues increased to 30%, well on track to reach the

target. This positive trend is attributable to the recent upgrade

of a family of luminaires, which are now serviceable, and to the

further expansion of the serviceable portfolio in outdoor

luminaires.

- Double our Brighter lives

revenues to 32%:

Brighter lives revenues were 27%, on track to reach the target.

The main contributions come from the consumer well-being portfolio,

as well as UV-C disinfection and emergency lighting.

- Double the percentage of

women in leadership positions to 34%:

The percentage of women in leadership positions was 26%,

slightly off track, yet Signify expects to see further progress

during the year. In Q1, Signify conducted the first all-employee

session of the Powering Inclusion Series with more than 5,000

participants across the company, and celebrated International

Women's Day with its global #BreakTheBias campaign. Signify

participated in the UN Global Compact’s Target Gender Equality

event to share its mentoring practices for improving diverse

representation in its organization.

Outlook

Following the solid performance in the first quarter, the strong

order intake and the continued momentum in the professional

segment, Signify maintains its guidance for 2022. This assumes that

the Chinese market and global supply chain dynamics do not

deteriorate further.

- Comparable sales growth in the

range of 3-6%

- Continued Adjusted EBITA margin

improvement of up to 50 bps

- Free cash flow in excess of 8% of

sales

Financial review

| |

First quarter |

| in

millions of EUR, except percentages |

2021 |

2022 |

change |

|

Comparable sales growth |

|

|

6.4% |

| Effects of currency

movements |

|

|

5.2% |

| Consolidation and other

changes |

|

|

0.2% |

| Sales |

1,599 |

1,788 |

11.8% |

| Adjusted gross margin |

637 |

684 |

7.5% |

| Adj. gross margin (as

% of sales) |

39.8 % |

38.3 % |

|

| |

|

|

|

| Adj. SG&A expenses |

-424 |

-456 |

|

| Adj. R&D expenses |

-72 |

-72 |

|

| Adj. indirect costs |

-496 |

-528 |

-6.3 % |

| Adj. indirect costs

(as % of sales) |

31.0 % |

29.5 % |

|

| |

|

|

|

| Adjusted EBITA |

172 |

187 |

8.6% |

| Adjusted EBITA

margin |

10.8% |

10.5% |

|

| Adjusted items |

-57 |

-41 |

|

| EBITA |

115 |

146 |

27.1% |

| |

|

|

|

| Income from operations

(EBIT) |

85 |

115 |

35.5% |

| Net financial

income/expense |

-10 |

-6 |

|

| Income tax expense |

-15 |

-22 |

|

| Net

income |

60 |

87 |

44.7% |

| |

|

|

|

| Free cash flow |

168 |

-189 |

|

| Basic EPS (€) |

0.47 |

0.69 |

|

|

Employees (FTE) |

37,356 |

36,884 |

|

First quarterSales increased by

11.8% to EUR 1,788 million, with a comparable sales growth of 6.4%.

Nominal sales growth included a positive currency effect of 5.2%,

mainly attributable to the appreciation of the USD, and a positive

impact from consolidation and other changes of 0.2%. LED-based

sales increased from 82% in Q1 21 to 84% in Q1 2022.

During the quarter, energy prices increased significantly.

Together with higher transportation costs, the increase in energy

costs impacted the adjusted gross margin, mainly in Conventional

Products due to its energy intensive production processes. As a

result of these cost increases, the Adjusted gross margin decreased

by 150 bps to 38.3%, yet on the back of a high comparison base in

Q1 2021. The company is implementing further price increases to

compensate for these effects.

Adjusted indirect costs as a percentage of sales decreased by

150 bps to 29.5%, driven by operating leverage and structural cost

savings.

Adjusted EBITA increased by 8.6% to EUR 187 million. The

Adjusted EBITA margin was 10.5%, remaining above 10% for the second

consecutive year. The Adjusted EBITA margin decline of 30 bps

reflects the high comparison base of the previous year, a negative

currency effect of 130 bps and higher COGS, which were partly

compensated by price increases, positive sales mix and operating

leverage.

Restructuring costs were EUR 4 million, acquisition-related

charges were EUR 7 million and incidental items were EUR 29

million, largely attributable to impairments related to Signify's

operations in Russia and Ukraine.

Net income increased by EUR 27 million to EUR 87

million, mainly reflecting higher income from operations and lower

net financial expenses, partly reduced by impairments related to

our operations in Russia and Ukraine.¹ This press release contains

certain non-IFRS financial measures and ratios, such as comparable

sales growth, EBITA, adjusted EBITA and free cash flow, and related

ratios, which are not recognized measures of financial performance

or liquidity under IFRS. For a reconciliation of these non-IFRS

financial measures to the most directly comparable IFRS financial

measures, see appendix B, Reconciliation of non-IFRS financial

measures, of this press release.

For the full and original version of the press release click

hereFor the presentation click here

Conference call and audio

webcastEric Rondolat (CEO) and Javier van Engelen (CFO)

will host a conference call for analysts and institutional

investors at 9:00 a.m. CET to discuss the first quarter 2022

results. A live audio webcast of the conference call will be

available via the Investor Relations website.

Financial calendar 2022May 17,

2022

Annual

General MeetingMay 19,

2022 Ex-dividend

dateMay 20,

2022 Dividend

record dateMay 31,

2022 Dividend

payment dateJuly 29,

2022 Second

quarter and half-year results 2022October 28,

2022 Third

quarter results 2022

For further information, please

contact:Signify Investor RelationsThelke

GerdesTel: +31 6 1801 7131E-mail: thelke.gerdes@signify.com

Signify Corporate

CommunicationsLeanne Carmody Tel: +31 6 3928 0201

E-mail: leanne.carmody@signify.com

Abigail LeveneTel: +31 6 2939 3895E-mail:

abigail.levene@signify.com

About SignifySignify (Euronext:

LIGHT) is the world leader in lighting for professionals and

consumers and lighting for the Internet of Things. Our Philips

products, Interact connected lighting systems and data-enabled

services, deliver business value and transform life in homes,

buildings and public spaces. With 2021 sales of EUR 6.9 billion, we

have approximately 37,000 employees and are present in over 70

countries. We unlock the extraordinary potential of light for

brighter lives and a better world. We achieved carbon neutrality in

2020, have been in the Dow Jones Sustainability World Index since

our IPO for five consecutive years and were named Industry Leader

in 2017, 2018 and 2019. News from Signify is located at the

Newsroom, Twitter, LinkedIn and Instagram. Information for

investors can be found on the Investor Relations page.

Important Information

Forward-Looking Statements and Risks &

UncertaintiesThis document and the related oral

presentation contain, and responses to questions following the

presentation may contain, forward-looking statements that reflect

the intentions, beliefs or current expectations and projections of

Signify N.V. (the “Company”, and together with its subsidiaries,

the “Group”), including statements regarding strategy, estimates of

sales growth and future operational results.

By their nature, these statements involve risks and

uncertainties facing the Company and its Group companies, and a

number of important factors could cause actual results or outcomes

to differ materially from those expressed in any forward-looking

statement as a result of risks and uncertainties. Such risks,

uncertainties and other important factors include but are not

limited to: adverse economic and political developments, in

particular the impacts of the Russia-Ukraine conflict, the impacts

of COVID-19, supply chain constraints, component shortages, rapid

technological change, competition in the general lighting market,

development of lighting systems and services, successful

implementation of business transformation programs, impact of

acquisitions and other transactions, reputational and adverse

effects on business due to activities in Environment, Health &

Safety, compliance risks, ability to attract and retain talented

personnel, adverse currency effects, pension liabilities, and

exposure to international tax laws. Please see “Risk Factors and

Risk Management” in Chapter 12 of the Annual Report 2021 for

discussion of material risks, uncertainties and other important

factors which may have a material adverse effect on the business,

results of operations, financial condition and prospects of the

Group. Such risks, uncertainties and other important factors should

be read in conjunction with the information included in the

Company’s Annual Report 2021.

Additional risks currently not known to the Group or that the

Group has not considered material as of the date of this document

could also prove to be important and may have a material adverse

effect on the business, results of operations, financial condition

and prospects of the Group or could cause the forward-looking

events discussed in this document not to occur. The Group

undertakes no duty to and will not necessarily update any of the

forward-looking statements in light of new information or future

events, except to the extent required by applicable law.

Market and Industry InformationAll references

to market share, market data, industry statistics and industry

forecasts in this document consist of estimates compiled by

industry professionals, competitors, organizations or analysts, of

publicly available information or of the Group’s own assessment of

its sales and markets. Rankings are based on sales unless otherwise

stated.

Non-IFRS Financial MeasuresCertain parts of

this document contain non-IFRS financial measures and ratios, such

as comparable sales growth, adjusted gross margin, EBITA, adjusted

EBITA, and free cash flow, and other related ratios, which are not

recognized measures of financial performance or liquidity under

IFRS. The non-IFRS financial measures presented are measures used

by management to monitor the underlying performance of the Group’s

business and operations and, accordingly, they have not been

audited or reviewed. Not all companies calculate non-IFRS financial

measures in the same manner or on a consistent basis and these

measures and ratios may not be comparable to measures used by other

companies under the same or similar names. A reconciliation of

these non-IFRS financial measures to the most directly comparable

IFRS financial measures is contained in this document. For further

information on non-IFRS financial measures, see “Chapter 18

Reconciliation of non-IFRS measures” in the Annual Report 2021.

PresentationAll amounts are in millions of

euros unless otherwise stated. Due to rounding, amounts may not add

up to totals provided. All reported data are unaudited. Unless

otherwise indicated, financial information has been prepared in

accordance with the accounting policies as stated in the Annual

Report 2021.

Market Abuse RegulationThis press release

contains information within the meaning of Article 7(1) of the EU

Market Abuse Regulation.

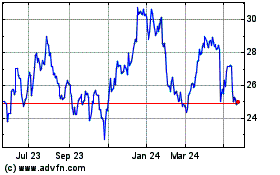

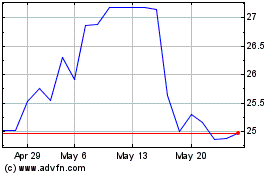

Signify NV (EU:LIGHT)

Historical Stock Chart

From Oct 2024 to Nov 2024

Signify NV (EU:LIGHT)

Historical Stock Chart

From Nov 2023 to Nov 2024