Brunel delivers accelerated EBIT growth and continued revenue

growth

Amsterdam, 28 July 2023 – Brunel International N.V. (Brunel;

BRNL), a global provider of flexible workforce solutions and

expertise, today announced its second quarter 2023 results.

Key points Q2 2023

- Revenue of EUR 328 million, up 13% (20% like-for-like)

- Gross Profit of EUR 66 million, up 11% (15% like-for-like)

- EBIT of EUR 11.0 million, up 10% (17% like-for-like)

Key points H1 2023

- Revenue of EUR 645 million, up 14% (20% like-for-like)

- Gross profit increase of 11% compared to H1 2022

- EBIT of EUR 26.8 million, up 4% (10% like-for-like)

- Earnings per share of EUR 0.32, up 167% compared to H1

2022

Jilko Andringa, CEO of Brunel

International N.V.:“I’m excited to report that since 8

quarters we have consistently shown strong growth across all

metrics, confirming our strategic positioning against the favorable

trends in our markets. We were able to achieve strong EBIT growth

despite one less working day in DACH. I am proud that all our

regions are now contributing, confirming our progress on

diversification.

I would especially like to call out the Dutch team, who further

improved their growth and outperformed the market.

We continue to see strong demand from our clients across the

globe. The energy and digital transformations create a high demand

for specialized Science, Technology, Engineering and Mathematics

talent. With our expanded capabilities in over 45 countries, we

continue to win projects and new clients in our chosen market

segments.

Following the acquisition of the biggest pure-play renewable

team Taylor Hopkinson in 2021, we achieve accelerated growth in the

renewable energy markets across all our regions. The combination of

Taylor Hopkinson’s renewable energy expertise and our global

infrastructure with 100% compliant solutions, puts us in a unique

position to service this industry globally. We are very proud to be

recognized as the global leader in renewable recruitment

solutions.

To support our continued profitable growth, we have further

rolled out our Digital/AI strategy to continue to move to market

leading SAAS-solutions. This enables us to easily add new

best-in-class IT-tools and benefit from the software and AI

developments by our leading global partners.

We will organize a Capital Markets Day in Q4 to present our

mid-term ambitions, as we are clearly ahead of the 5-year plan we

communicated in 2021.”

ESG UpdateIn April the Brunel

Foundation kicked off Autism Awareness Month as we believe that

impactful change is achieved through increased awareness.

Colleagues around the world organized events such as a webinar on

autism in the workplace, an autism awareness quiz, viewing session

and panel discussion with the documentary My journey for education

as a starting point, “AUT in the Brunel office” interviews and

walk-in coaching sessions. All with the aim to contribute to a more

inclusive workforce.

We also engaged in several cleanup activities during the

quarter, in line with the Brunel Foundation's mission to safeguard

the environment. Brunellers from various parts of Asia joined

forces with Seven Clean Seas for a beach clean-up in Phuket,

collecting 490kg of waste. In the Amsterdam headquarters colleagues

rolled up their sleeves for a lunchbreak clean up, while the Europe

and Africa team cleaned the Delft canals as part of their team

event. On top of that, the numbers in our Global Trash 'n Trace

Challenge with Litterati grew to over 440,000 pieces of litter

picked and registered in our challenge.

In June, we united for the preservation of our precious planet

by spreading awareness in an online campaign. It's crucial to

recognize the interdependencies between land and sea, as their

vitality and prosperity are inherently intertwined. We highlighted

the value of life on land and below water. We believe that raising

awareness helps to educate and mobilize individuals and foster a

shared responsibility for taking action.

GROUP PERFORMANCE

|

Brunel International (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q2 2023 |

Q2 2022 |

Δ% |

|

|

H1 2023 |

H1 2022 |

Δ% |

|

| Revenue |

327.8 |

289.1 |

13% |

a |

|

644.7 |

563.7 |

14% |

d |

| Gross Profit |

65.6 |

59.0 |

11% |

|

|

134.4 |

120.9 |

11% |

|

| Gross margin |

20.0% |

20.4% |

|

|

|

20.8% |

21.4% |

|

|

| Operating costs |

53.8 |

48.0 |

12% |

b |

|

106.2 |

93.1 |

14% |

e |

| Operating result |

11.7 |

11.0 |

6% |

|

|

28.2 |

27.8 |

2% |

|

| Earn out related share based

payments* |

0.7 |

1.0 |

-30% |

|

|

1.4 |

2.1 |

-33% |

|

| EBIT |

11.0 |

10.0 |

10% |

c |

|

26.8 |

25.7 |

4% |

f |

| EBIT % |

3.4% |

3.5% |

|

|

|

4.2% |

4.6% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

11,237 |

11,356 |

-1% |

|

|

11,118 |

11,295 |

-2% |

|

| Average indirects |

1,582 |

1,446 |

9% |

|

|

1,555 |

1,441 |

8% |

|

| Ratio direct / indirect |

7.1 |

7.9 |

|

|

|

7.1 |

7.8 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 20 % at like-for-like |

d 20 % at

like-for-like |

|

|

| b 18 % at like-for-like |

e 18 % at

like-for-like |

|

|

| c 17 % at like-for-like |

f 10 % at

like-for-like |

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions and

divestments |

|

|

|

|

|

| *Relates to the

acquisition related expenses for Taylor Hopkinson |

|

|

|

|

|

Headline performance by region Summary (amounts

in EUR million):

|

Revenue |

Q2 2023 |

Q2 2022 |

Δ% |

|

H1 2023 |

H1 2022 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

60.2 |

55.1 |

9% |

|

125.2 |

113.5 |

10% |

| The

Netherlands |

52.4 |

45.9 |

14% |

|

105.9 |

94.8 |

12% |

| Australasia |

46.1 |

39.6 |

16% |

|

89.6 |

73.6 |

22% |

| Middle East &

India |

37.7 |

34.9 |

8% |

|

75.5 |

65.8 |

15% |

| Americas |

45.1 |

35.2 |

28% |

|

89.1 |

67.7 |

32% |

| Asia |

46.0 |

37.8 |

22% |

|

90.1 |

70.8 |

27% |

| Rest of

world |

40.4 |

40.6 |

-1% |

|

69.4 |

77.6 |

-11% |

| |

|

|

|

|

|

|

|

|

Total |

327.8 |

289.1 |

13% |

|

644.7 |

563.7 |

14% |

|

EBIT |

Q2 2023 |

Q2 2022 |

Δ% |

|

H1 2023 |

H1 2022 |

Δ% |

| |

|

|

|

|

|

|

|

| DACH region |

2.9 |

3.8 |

-22% |

|

11.2 |

10.6 |

6% |

| The

Netherlands |

3.0 |

2.7 |

9% |

|

7.8 |

7.9 |

-1% |

| Australasia |

1.2 |

0.8 |

52% |

|

2.1 |

1.0 |

125% |

| Middle East &

India |

2.6 |

3.1 |

-17% |

|

5.6 |

6.2 |

-9% |

| Americas |

1.1 |

0.5 |

105% |

|

1.5 |

0.9 |

63% |

| Asia |

3.0 |

2.0 |

49% |

|

5.0 |

4.0 |

27% |

| Rest of

world |

0.9 |

0.1 |

967% |

|

0.7 |

1.1 |

-38% |

| Unallocated |

-3.7 |

-3.0 |

-22% |

|

-7.1 |

-5.9 |

-20% |

| |

|

|

|

|

|

|

|

|

Total |

11.0 |

10.0 |

10% |

|

26.8 |

25.7 |

4% |

In Q2 2023 the Group’s revenue increased by 13%

or EUR 38.7 million y-o-y. We achieved growth in revenue and EBIT

despite the increasing impact of the unfavorable development of

exchange rates. Like-for-like revenue increased by 20%. In Q2 2022,

Rest of world still included EUR 8 million in revenues from Russia,

at zero EBIT.

The gross margin decreased by 0.4 percentage

points, mainly due to a continued change in the mix between the

regions.

EBIT increased by 10% to EUR 11.0 million.

Adjusted for the impact of foreign currencies, EBIT increased by

17% or EUR 1.7 million.PERFORMANCE BY REGION

|

DACH region (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

Q2 2023 |

Q2 2022 |

Δ% |

|

|

H1 2023 |

H1 2022 |

Δ% |

| Revenue |

60.2 |

55.1 |

9% |

|

|

125.2 |

113.5 |

10% |

| Gross Profit |

18.9 |

18.4 |

3% |

|

|

43.0 |

39.5 |

9% |

| Gross margin |

31.5% |

33.5% |

|

|

|

34.3% |

34.8% |

|

| Operating costs |

16.0 |

14.6 |

10% |

|

|

31.8 |

28.9 |

10% |

| EBIT |

2.9 |

3.8 |

-22% |

|

|

11.2 |

10.6 |

6% |

| EBIT % |

4.9% |

6.8% |

|

|

|

9.0% |

9.4% |

|

| |

|

|

|

|

|

|

|

|

| Average directs |

2,103 |

2,014 |

4% |

|

|

2,094 |

1,999 |

5% |

| Average indirects |

437 |

402 |

9% |

|

|

432 |

395 |

9% |

| Ratio direct / indirect |

4.8 |

5.0 |

|

|

|

4.8 |

5.1 |

|

The DACH

region includes Germany, Switzerland, Austria and

Czech Republic. Revenue per working day in DACH increased by 11.2%,

as a result of a higher number of specialists working at our

clients, and increased rates. Gross margin adjusted for working

days is 32.5% in Q2 2023 (Q2 2022: 33.5%), and remains robust,

where this was impacted by higher illness rates in the same period

last year.

Headcount as of 30 June was 2,084 (2022:

2,033).

Working days Germany:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2023 |

65 |

60 |

65 |

61 |

251 |

|

2022 |

64 |

61 |

66 |

62 |

253 |

|

Brunel Netherlands (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

Q2 2023 |

Q2 2022 |

Δ% |

|

|

H1 2023 |

H1 2022 |

Δ% |

| Revenue |

52.4 |

45.9 |

14% |

|

|

105.9 |

94.8 |

12% |

| Gross Profit |

13.2 |

12.7 |

4% |

|

|

28.2 |

27.6 |

2% |

| Gross margin |

25.2% |

27.6% |

|

|

|

26.6% |

29.1% |

|

| Operating costs |

10.2 |

10.0 |

2% |

|

|

20.4 |

19.7 |

4% |

| EBIT |

3.0 |

2.7 |

9% |

|

|

7.8 |

7.9 |

-1% |

| EBIT % |

5.6% |

5.9% |

|

|

|

7.3% |

8.3% |

|

| |

|

|

|

|

|

|

|

|

| Average directs |

1,733 |

1,669 |

4% |

|

|

1,717 |

1,673 |

3% |

| Average indirects |

270 |

278 |

-3% |

|

|

271 |

277 |

-2% |

| Ratio direct / indirect |

6.4 |

6.0 |

|

|

|

6.3 |

6.0 |

|

In The Netherlands the revenue

growth was mainly driven by higher rates and a higher number of

specialists. The gross margin decreased with 2.4 ppt, partly as a

result of faster growth in our freelance population. We are making

progress on the indexation of rates to cover for higher

salaries.

Headcount as of 30 June was 1,748 (2022:

1,673)

Working days The Netherlands:

|

|

Q1 |

Q2 |

Q3 |

Q4 |

FY |

|

2023 |

65 |

61 |

65 |

63 |

254 |

|

2022 |

64 |

61 |

66 |

64 |

255 |

|

Australasia (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q2 2023 |

Q2 2022 |

Δ% |

|

|

H1 2023 |

H1 2022 |

Δ% |

|

| Revenue |

46.1 |

39.6 |

16% |

a |

|

89.6 |

73.6 |

22% |

d |

| Gross Profit |

5.0 |

4.0 |

26% |

|

|

9.5 |

7.0 |

36% |

|

| Gross margin |

10.8% |

10.0% |

|

|

|

10.6% |

9.6% |

|

|

| Operating costs |

3.8 |

3.2 |

19% |

b |

|

7.4 |

6.0 |

23% |

e |

| EBIT |

1.2 |

0.8 |

52% |

c |

|

2.1 |

1.0 |

125% |

f |

| EBIT % |

2.6% |

2.0% |

|

|

|

2.4% |

1.3% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,545 |

1,351 |

14% |

|

|

1,520 |

1,303 |

17% |

|

| Average indirects |

121 |

105 |

15% |

|

|

119 |

103 |

16% |

|

| Ratio direct / indirect |

12.8 |

12.9 |

|

|

|

12.8 |

12.7 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 26 % like-for-like |

d 27 % at

like-for-like |

|

|

|

|

|

| b 28 % like-for-like |

e 27 % at

like-for-like |

|

|

|

|

|

| c 63 % like-for-like |

f 133 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions and

divestments |

|

|

|

|

|

Australasia includes Australia

and Papua New Guinea.

We continue to see an increased client demand

for specialists in the conventional energy and mining markets,

resulting in a strong increase of our workforce. The revenue

increase of 16% was achieved despite the unfavourable impact from

foreign currencies and would have been 26% at constant

currencies.

The gross margin increased with 0.8 ppt, mainly

due to strong margin discipline and focus on higher value added

activities.

|

Middle East & India (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q2 2023 |

Q2 2022 |

Δ% |

|

|

H1 2023 |

H1 2022 |

Δ% |

|

| Revenue |

37.7 |

34.9 |

8% |

a |

|

75.5 |

65.8 |

15% |

d |

| Gross Profit |

5.2 |

5.5 |

-6% |

|

|

10.8 |

10.7 |

0% |

|

| Gross margin |

13.7% |

15.7% |

|

|

|

14.3% |

16.3% |

|

|

| Operating costs |

2.6 |

2.4 |

8% |

b |

|

5.2 |

4.5 |

16% |

e |

| EBIT |

2.6 |

3.1 |

-17% |

c |

|

5.6 |

6.2 |

-9% |

f |

| EBIT % |

6.9% |

9.0% |

|

|

|

7.4% |

9.4% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

2,110 |

2,205 |

-4% |

|

|

2,153 |

2,192 |

-2% |

|

| Average indirects |

164 |

133 |

23% |

|

|

162 |

132 |

23% |

|

| Ratio direct / indirect |

12.9 |

16.5 |

|

|

|

13.3 |

16.7 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 11 % like-for-like |

d 16 % at

like-for-like |

|

|

|

|

|

| b 12 % like-for-like |

e 14 % at

like-for-like |

|

|

|

|

|

| c -13 % like-for-like |

f -8 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions and

divestments |

|

|

|

|

|

Middle East & India

includes Qatar, Dubai, Kuwait, Iraq and India.

We continue to see growth in almost all

countries from new projects and project extensions in the region,

while Kuwait continues to trail. The gross margin decreased due to

change in the client mix and absence of high margin shut down

projects.

|

Americas (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q2 2023 |

Q2 2022 |

Δ% |

|

|

H1 2023 |

H1 2022 |

Δ% |

|

| Revenue |

45.1 |

35.2 |

28% |

a |

|

89.1 |

67.7 |

32% |

d |

| Gross Profit |

6.3 |

4.8 |

30% |

|

|

11.8 |

9.0 |

30% |

|

| Gross margin |

13.9% |

13.7% |

|

|

|

13.2% |

13.3% |

|

|

| Operating costs |

5.2 |

4.3 |

21% |

b |

|

10.3 |

8.1 |

27% |

e |

| EBIT |

1.1 |

0.5 |

105% |

c |

|

1.5 |

0.9 |

63% |

f |

| EBIT % |

2.4% |

1.5% |

|

|

|

1.7% |

1.4% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,056 |

906 |

17% |

|

|

1,039 |

883 |

18% |

|

| Average indirects |

156 |

121 |

29% |

|

|

153 |

118 |

30% |

|

| Ratio direct / indirect |

6.8 |

7.5 |

|

|

|

6.8 |

7.5 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 33 % like-for-like |

d 33 % at

like-for-like |

|

|

|

|

|

| b 25 % like-for-like |

e 28 % at

like-for-like |

|

|

|

|

|

| c 120 % like-for-like |

f 69 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions and

divestments |

|

|

|

|

|

The Americas includes Brazil,

Canada, USA, Guyana and Surinam. In Q2 the growth was mainly

achieved in the USA and new projects won in South America, slightly

offset by lower revenue in Canada due to the completion of big

projects in Q1. We have been able to grow our sales organisation to

support continued growth, which resulted in higher operating

costs.

|

Asia (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q2 2023 |

Q2 2022 |

Δ% |

|

|

H1 2023 |

H1 2022 |

Δ% |

|

| Revenue |

46.0 |

37.8 |

22% |

a |

|

90.1 |

70.8 |

27% |

d |

| Gross Profit |

7.6 |

5.4 |

41% |

|

|

14.3 |

10.3 |

38% |

|

| Gross margin |

16.6% |

14.4% |

|

|

|

15.9% |

14.6% |

|

|

| Operating costs |

4.6 |

3.4 |

35% |

b |

|

9.3 |

6.3 |

48% |

e |

| EBIT |

3.0 |

2.0 |

49% |

c |

|

5.0 |

4.0 |

27% |

f |

| EBIT % |

6.5% |

5.3% |

|

|

|

5.6% |

5.6% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,426 |

1,502 |

-5% |

|

|

1,442 |

1,437 |

0% |

|

| Average indirects |

153 |

127 |

20% |

|

|

150 |

131 |

14% |

|

| Ratio direct / indirect |

9.3 |

11.8 |

|

|

|

9.6 |

10.9 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 28 % like-for-like |

d 31 % at

like-for-like |

|

|

|

|

|

| b 42 % like-for-like |

e 49 % at

like-for-like |

|

|

|

|

|

| c 61 % like-for-like |

f 34 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions and

divestments |

|

|

|

|

|

Asia includes Singapore, China,

Hong Kong, South Korea, Taiwan, Japan, Indonesia, Thailand and

Malaysia. The region had another strong second quarter as it

continues to benefit from growing activity levels at the

fabrication yards for large energy projects. Operating costs

increased as a result of strategic investments to support the

future growth.

|

Rest of world (unaudited) |

| P&L

amounts in EUR million |

|

|

|

|

|

|

|

|

|

|

Q2 2023 |

Q2 2022 |

Δ% |

|

|

H1 2023 |

H1 2022 |

Δ% |

|

| Revenue |

40.4 |

40.6 |

-1% |

a |

|

69.4 |

77.6 |

-11% |

d |

| Gross Profit |

9.4 |

8.2 |

14% |

|

|

16.9 |

16.6 |

2% |

|

| Gross margin |

23.3% |

20.3% |

|

|

|

24.3% |

21.4% |

|

|

| Operating costs |

7.8 |

7.1 |

10% |

b |

|

14.8 |

13.4 |

10% |

e |

| Operating result |

1.6 |

1.1 |

40% |

|

|

2.1 |

3.2 |

-35% |

|

| Earn out related share based

payments* |

0.7 |

1.0 |

-30% |

|

|

1.4 |

2.1 |

-33% |

|

| EBIT |

0.9 |

0.1 |

967% |

c |

|

0.7 |

1.1 |

-38% |

f |

| EBIT % |

2.3% |

0.2% |

|

|

|

1.0% |

1.4% |

|

|

| |

|

|

|

|

|

|

|

|

|

| Average directs |

1,262 |

1,710 |

-26% |

|

|

1,153 |

1,808 |

-36% |

|

| Average indirects |

219 |

221 |

-1% |

|

|

205 |

226 |

-9% |

|

| Ratio direct / indirect |

5.8 |

7.7 |

|

|

|

5.6 |

8.0 |

|

|

| |

|

|

|

|

|

|

|

|

|

| a 24 % like-for-like |

d 20 % at

like-for-like |

|

|

|

|

|

| b 58 % like-for-like |

e 31 % at

like-for-like |

|

|

|

|

|

| c 9391 % like-for-like |

f 210 % at

like-for-like |

|

|

|

|

|

| Like-for-like is

measured excluding the impact of currencies, acquisitions and

divestments |

|

|

|

|

|

| *Relates to the

acquisition related expenses for Taylor Hopkinson |

|

|

|

|

|

Rest of World includes Taylor

Hopkinson, Belgium and our other energy activities in Europe. Until

June 2022, this region also included Russia which activities were

divested.

Excluding Russia and the impact of foreign

currencies, revenue increased by 24%. The growth was mainly driven

by new project wins in Europe and the strong performance of Taylor

Hopkinson’s offshore wind activities.

Tax and net profitThe effective

tax rate for the six-month period ended on 30 June 2023 is 33.3%

(2022: 47.8%). For the full year we expect an effective tax rate of

approximately 30% (2022: 35.2%). Net profit came in at EUR 15.9

million (H1 2022: EUR 6.2 million), reflecting earnings per share

of EUR 0.32 (H1 2022: EUR 0.12).

Risk profileReference is made

to our 2022 Annual Report (pages 62 – 79). Reassessment of our

earlier identifiedrisks and the potential impact on occurrence has

not resulted in required changes in our internal riskmanagement and

control systems.

Cash positionThe net cash

balance at 30 June 2023 was EUR 5.0 million and includes

EUR 16.0 million restricted cash. The decrease in net cash is

mainly the result of the dividend payment in June, seasonality in

our cash flows, and the additional working capital required to fund

the growth. We have sufficient overdraft facilities in place to

support continued growth and, as usual, will achieve a strong

positive cash flow in H2.

OutlookWe expect the current

favourable trends to continue in Q3 2023, including the

acceleration of EBIT growth.

Statement of the Board of

DirectorsThe Board of Directors of Brunel International

N.V. hereby declares that, to the best of its knowledge:

- the interim financial statements

give a true and fair view of the assets, liabilities, financial

position and result of Brunel International N.V. and the companies

jointly included in the consolidation, and

- the interim report gives a true and

fair view of the information referred to in the eighth and, insofar

as applicable, the ninth subsection of Section 5:25d of the Dutch

Act on Financial Supervision and with reference to the section on

related parties in the interim financial statements.

Amsterdam, 28 July 2023Brunel International

N.V.

Jilko Andringa (CEO)Peter de Laat (CFO)Graeme

Maude (COO)

- Press Release Q2 and interim financial statements 2023

Source: Brunel International NV

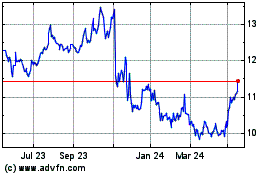

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Oct 2024 to Nov 2024

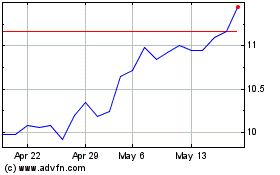

Brunel International NV (EU:BRNL)

Historical Stock Chart

From Nov 2023 to Nov 2024