Alcoa moved to conserve cash and cut capacity due to the

pandemic, while Las Vegas Sands saw its revenue cut in half.

Earlier in the day, consumer-goods makers got a boost as

stay-at-home measures prompted people to stock up.

Wednesday's earnings, at a glance:

Alcoa Corp.: The aluminum maker said it is moving to conserve

cash amid an economic downturn caused by the new coronavirus

pandemic and will curtail capacity at a smelter.

Las Vegas Sands Corp.: The casino operator reported a 51% drop

in revenue, with Las Vegas shut down in response to the coronavirus

pandemic and reopened casinos in Macau struggling to recover.

Netgear Inc.: The maker of networking products said it lost $4

million, or 14 cents a share, versus a profit of $13 million, or 39

cents a share, in the year-ago quarter. Adjusted for one-time

items, Netgear said it earned 21 cents a share, compared with 60

cents a share a year ago. The quarter was "challenging" due to

COVID-19 and the company endured "supply and demand disruptions

around the world on a rolling basis."

Kimberly-Clark Corp.: Sales at the seller of Scott and

Cottonelle toilet paper and Kleenex jumped to slightly more than $5

billion in the first quarter as consumers stockpiled paper

products.

Silgan Holdings Inc.: The company reported first-quarter profit

growth, citing higher volumes for its consumer-goods packaging

products during the Covid-19 crisis.

ACC Ltd.: The Indian cement maker's first-quarter net profit

fell 6.7% after it had to shut its plants during the government

lockdown of the nation to curb the spread of Covid-19. ACC said

cement sale volumes during the quarter fell 12%.

Akzo Nobel N.V.: The Dutch paints-and-coatings company said

revenue for the first quarter fell due to the coronavirus

pandemic's effect on end-market demand, and that the virus will

have a significant impact during the second quarter.

Amphenol Corp.: The electronics manufacturer reported lower

sales and a weaker profit for the first quarter as it navigated the

Covid-19 pandemic.

ASM Pacific Technology Ltd.: The semiconductor equipment

company's first-quarter net profit dropped 79% after incurring

HK$61.3 million (US$7.9 million) in coronavirus-pandemic-related

expenses and booking lower contributions from its industrial

printer and semiconductor solutions business.

AT&T Inc.: The telecommunications company warned that the

coronavirus crisis is clouding its financial outlook as

cash-strapped customers spend less and TV production grinds to a

halt. It withdrew the financial targets it gave investors in

November, citing the economic uncertainty caused by the recent wave

of job losses.

Baker Hughes Co.: The oilfield-services company recorded a net

loss of $10.21 billion in the first quarter as it grappled with

sharply lower oil prices and the coronavirus pandemic.

Bangkok Bank PCL: The Thai lender said its first-quarter net

profit fell 15% partly due to fair-value losses from financial

instruments, as concerns about business disruption due to the

Covid-19 pandemic weighed on markets.

Biogen Inc.: The drugmaker reported first-quarter earnings that

exceeded analysts' expectations amid an uptick in sales and the

coronavirus pandemic.

China International Travel Service Corp.: The Chinese tourism

company said it swung to a net loss in the first quarter, as a

slump in visitor numbers decimated sales at its tax-free shops.

Delta Air Lines Inc.: The airline reported its first quarterly

loss in more than five years, as the coronavirus pandemic ravaged

the travel industry.

Ericsson AB: The Swedish telecom equipment company reported

lower net profit in the first quarter, saying it felt limited

impact from the new coronavirus while cautioning the general

economic slowdown caused by the pandemic could lead some operators

to delay investment programs.

Heineken NV: The Dutch brewer reported a sharp drop in net

profit for the first quarter due to a pandemic-induced volume drop

in March and said limited benefits came from its mitigating

actions.

Nasdaq Inc.: The exchange operator noted a surge of trading

volume related to the COVID-19 pandemic and posted first-quarter

revenue that beat analysts' estimates.

Quest Diagnostics Inc.: The lab company said its profit for the

first quarter fell as testing volumes, including for Covid-19,

slumped in March.

Randstad N.V.: The Dutch recruitment company reported a 64% fall

in net profit for the first quarter of the year after booking an

impairment charge against the acquisition of Monster and on lower

revenue. Randstad said organic revenues per working day fell 3%-4%

during the quarter until the first half of March and then fell

around 30% in the second half of the month due to the escalating

Covid-19 impact.

Roche Holding AG: The Swiss pharma giant's sales rose in the

first quarter, driven by its pharamceuticals division. Roche said

global supply chains for medicines and tests remain intact in spite

of the coronavirus pandemic and market volatility had a limited

impact on its performance in the first quarter.

STMicroelectronics NV: The European chip maker saw higher

first-quarter revenue but fell short of its own target. "The

Covid-19 outbreak and subsequent containment measures by

governments around the world brought challenges in our

manufacturing operations and, especially in the last few days of

the quarter, logistics," Chief Executive Jean-Marc Chery said.

Suntec Real Estate Investment Trust: The Singapore REIT's

first-quarter net property income fell 7.2% on year as a result of

measures that were put into place to contain the spread of the

coronavirus pandemic.

Svenska Handelsbanken AB: The Swedish bank posted a 17% drop in

first-quarter net profit as it took higher credit loss provisions

and other financial adjustments in light of the coronavirus.

Telia Co. AB: The Nordic telecommunications operator reported a

38% fall in net profit for the first quarter of the year as it

booked higher costs. The pandemic-inspired economic downturn

resulted in lower advertising revenue for its TV & Media unit,

which was also affected by the suspension of live sport

broadcastings.

(END) Dow Jones Newswires

April 22, 2020 18:11 ET (22:11 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

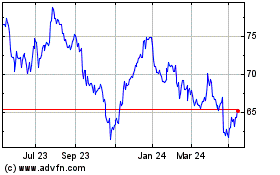

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Jan 2025 to Feb 2025

Akzo Nobel NV (EU:AKZA)

Historical Stock Chart

From Feb 2024 to Feb 2025