With Liquid Proof-Of-Stake, Tezos Hits The Winning Formula For DeFi Growth

March 28 2022 - 10:00AM

NEWSBTC

Ethereum might still be the number one blockchain for smart

contracts, but dozens of competing networks have been gaining

ground. Lots of these alternative chains have been quite vocal

about their status as an “Ethereum killer”, while others have

stayed quiet, keeping their heads down and focusing on growth

rather than media attention. One of the quiet ones to watch may

well be Tezos, an open-source and eco-friendly blockchain that

first went online four years ago and has, until recently, managed

to stay under the radar. But it has been working hard for these

last four years, building out and developing its software, quietly

attracting partners and expanding its user base with a sharp focus

on DeFi, green NFTs, GameFi and the metaverse. That hard work has

paid off. In the last year Tezos has emerged as one of the darlings

of the DeFi space. Back in the summer of 2020 Tezos was pretty much

invisible, with less than $1 million in total value locked across

all of its DeFi projects. Since then, its popularity has exploded,

reaching an all-time high of just over $217 million in TVL in

October 2021, with more than 100 dApps running on its blockchain.

Tezos can put much of its success down to the unique consensus

mechanism it employs, which is not only vastly different to the

Proof-of-Work (PoW) algorithm that underpins Bitcoin but also

unique compared to most other chains that are based on the

alternative Proof-of-Stake mechanism. Tezos relies on what’s called

a Liquid Proof-of-Stake (LPoS) consensus mechanism that not only

solves the problem of high energy consumption that afflicts Bitcoin

and its PoW algorithm but is also superior to standard PoS systems

in many ways. What is PoS? The PoS mechanism was first detailed in

a paper by the researcher Sunny King back in 2012, when the energy

problems of Bitcoin’s PoW first became apparent. Rather than using

high-powered computer hardware to solve mathematical problems, PoS

incentivizes token holders to stake their cryptocurrency to try and

validate blocks using a semi-random process. With PoS, the network

essentially votes on which validators will add the next block and

receive rewards for doing so. PoS has some big advantages over PoW.

The first and most important is that it’s less computationally

intensive, translating to lower energy costs and a cleaner

environment. The second is that it’s more decentralized. PoW

networks incentivize miners to invest in expensive computing

hardware, because the more powerful their operation is, the more

Bitcoins they can mint. Of course, that creates a big barrier to

entry, leading to mining power being concentrated in just a few

hands. On the other hand, PoS doesn’t incentivize validators to

pool their resources, meaning there are more of them. These days a

whole bunch of variations of the PoS mechanism have emerged, but

the most widespread model is the Delegated Proof-of-Stake (DPoS)

that’s employed by Cardano, Lisk, Ark, Tron, Steem and EOS, to name

a few examples. Delegated Proof-of-Stake In a DPoS architecture,

anyone in the network has the Right to Vote on the production of

new blocks on the blockchain, but there is a fixed number of

delegates. The network users determine which of those delegates

will validate the next block using a democratic voting process,

where users’ votes are weighted according to the number of tokens

staked in crypto wallets. This process of voting for delegates is

ongoing, and the network has the power to replace an ineffective or

inactive delegate with a new validator if required. This forces

delegates to behave themselves because if they don’t have the

backing of network stakeholders they won’t be chosen and won’t earn

any rewards. The approved delegates on a network will split the

production rights for new blocks among themselves evenly.

Stakeholders receive a portion of the delegate’s block production

earnings, in return for backing them, in proportion to the amount

of tokens they staked. Proponents of DPoS say this stake-weighted

voting process ensures the network remains democratic. In addition,

there’s a fairly low threshold to participate in the staking

process. Another advantage of DPoS is that it can quickly achieve a

consensus, meaning blocks are processed faster and more

transactions can be performed per second. Even so, no system is

perfect and DPoS has a number of design flaws. One of the biggest

concerns with DPoS is that it’s easy to organize an attack against

the network. Because the number of delegates is limited, there is

an inherent risk of the network falling victim to a 51% attack,

which could occur if delegates team up to form cartels. That not

only makes the network less decentralized but also less secure.

Another key problem is referred to as “the rich get richer”, and

has to do with the fact that voters’ strength is related to how

many tokens they hold. The danger is that those who own lots of

tokens – so-called “whales” – will have too great an influence over

the network. DPoS can also be at risk of user apathy. Unless a

large number of users stay engaged with the network, the system

will not work as it was intended. Liquid Proof of Stake Recognizing

the issues with DPoS, Tezos set about perfecting the system and

came up with a newer model, LPoS. The biggest difference between

LPoS and DPoS is that delegation is entirely optional for network

users. Every token holder can delegate voting rights to validators,

who are known as “bakers”, with no token lock-up period. In

addition, token holders get to maintain custody of their $XTZ

tokens when voting for a baker, providing another incentive for

them to do so. A second big difference with Tezos’ LPoS is that it

has a dynamic number of validator nodes, as opposed to the fixed

number in DPoS systems. In fact, Tezos can support up to 80,000

validators compared to the 20 to 40 that most other DPoS networks

allow. What this means is that LPoS gives users a lot of

flexibility with regard to how they participate in the network.

Individuals who hold a large number of tokens can easily become

block validators by staking their own tokens with no need for

anyone’s approval. Meanwhile, those with a smaller amount of $XTZ

can still take part by supporting a larger token holder, or by

forming coalitions with others in their position. Why Tezos Is

Winning Proponents of Tezos argue that its LPoS system creates a

more representative democracy, as it’s possible for users to change

their vote and support a different validator at any time. In other

words, everyone in the Tezos community gets to have their say in

how the network operates. If, for example, someone has made a

proposal to change the network in some way, each user in favor can

choose to back a baker that supports the upgrade, while those not

in favor can choose to support a baker that’s voting against the

change. In contrast, a voter in a DPoS network would be required to

lock up their funds for a minimum of 72 hours. Tezos has a lower

barrier of entry for users too. Because LPoS doesn’t require

massive amounts of computer hardware, users can create a new node

without any significant investment. To set up a node on Tron, the

hardware costs have been estimated at around $40,000. A second

option would be to shell out around $4,800 per month to rent the

necessary hardware on Amazon Web Services. For Tezos though, all

that’s required is a modern laptop and whatever the electricity

costs of running that machine are. Because anyone can join in,

Tezos has a far more decentralized network than its competitors.

One final benefit of Tezos is its low fees, as opposed to having no

fees. While the idea of not paying any fees sounds nice, it’s bad

for security. A famous example of this was EOS, which in 2019 fell

victim to a distributed denial-of service attack, wherein multiple

users were duped into making useless transactions. The attackers

did this to sabotage the network, increasing congestion and causing

the price of CPU time on the network to increase by more than

100,000% over the four-hour period the attack lasted. Tezos

implements a low fee structure that’s designed to avoid these kinds

of incidents. Typical transaction costs on Tezos are around $0.0004

– low enough not to bother users, but also expensive enough to make

launching DDoS attacks uneconomical. Judging by Tezos’ rising

adoption over the last couple of years, it’s clear that its unique

network architecture has struck a chord with the crypto community.

Tezos has gotten the blend just right, fusing a democratic

governance model with strong security, easy accessibility and low

fees, making it the ideal blockchain for a growing number of

decentralized apps that value the same characteristics.

Tezos (COIN:XTZUSD)

Historical Stock Chart

From Oct 2024 to Nov 2024

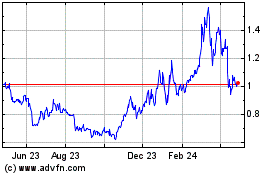

Tezos (COIN:XTZUSD)

Historical Stock Chart

From Nov 2023 to Nov 2024